Global Choline Chloride Market Outlook to 2030

Region:Global

Author(s):Shambhavi

Product Code:KROD6086

December 2024

98

About the Report

Global Choline Chloride Market Overview

- The Global Choline Chloride Market is valued at USD 550 million, driven by significant demand from various industries such as animal feed, human nutrition, and pharmaceuticals. Choline chloride plays an essential role in animal feed formulations due to its positive effects on liver health, fat metabolism, and growth performance in livestock. In addition to its use in feed, choline chloride is utilized in human nutrition for its benefits in cognitive function and fat metabolism, leading to further growth in demand. The increasing population, rising disposable incomes, and consumer preference for healthy nutrition in both human and animal sectors continue to drive market expansion.

- Countries like China and the United States dominate the choline chloride market, owing to their strong presence in the livestock industry and increasing demand for quality animal feed. China, with its large-scale poultry and livestock production, heavily relies on choline chloride to improve productivity and animal health. Meanwhile, the U.S. dominates due to its advanced pharmaceutical industry and increasing adoption of choline chloride in the human nutrition sector, driven by the growing awareness of its health benefits.

- Global animal feed safety regulations, particularly in the EU and North America, impose rigorous standards on feed additives, including choline chloride. Regulatory authorities mandate compliance with safety levels to prevent toxicity in livestock, ensuring consumer safety. Feed industry stakeholders comply with regulations to maintain quality across the supply chain.

Global Choline Chloride Market Segmentation

By Form: The choline chloride market is segmented by form into Powder and Liquid. Powder form holds the largest share in the market, contributing 61% in 2023. The dominance of powder form can be attributed to its ease of use, longer shelf life, and compatibility with various feed formulations. The powder form is highly adopted in the animal feed industry, as it is easy to blend with other feed ingredients and is effective in preventing health issues like liver enlargement and growth deformities in livestock.

By End-User: The market is further segmented by end-user into Animal Feed, Human Nutrition, Oil & Gas, and Others. The Animal Feed segment dominates the market, with a share of 47% in 2023, driven by the increasing demand for nutrient-rich feed supplements in the poultry and livestock sectors. Choline chloride is crucial in maintaining cell structure, enhancing metabolism, and improving reproductive health in animals, making it indispensable in feed formulations

Global Choline Chloride Market Competitive Landscape

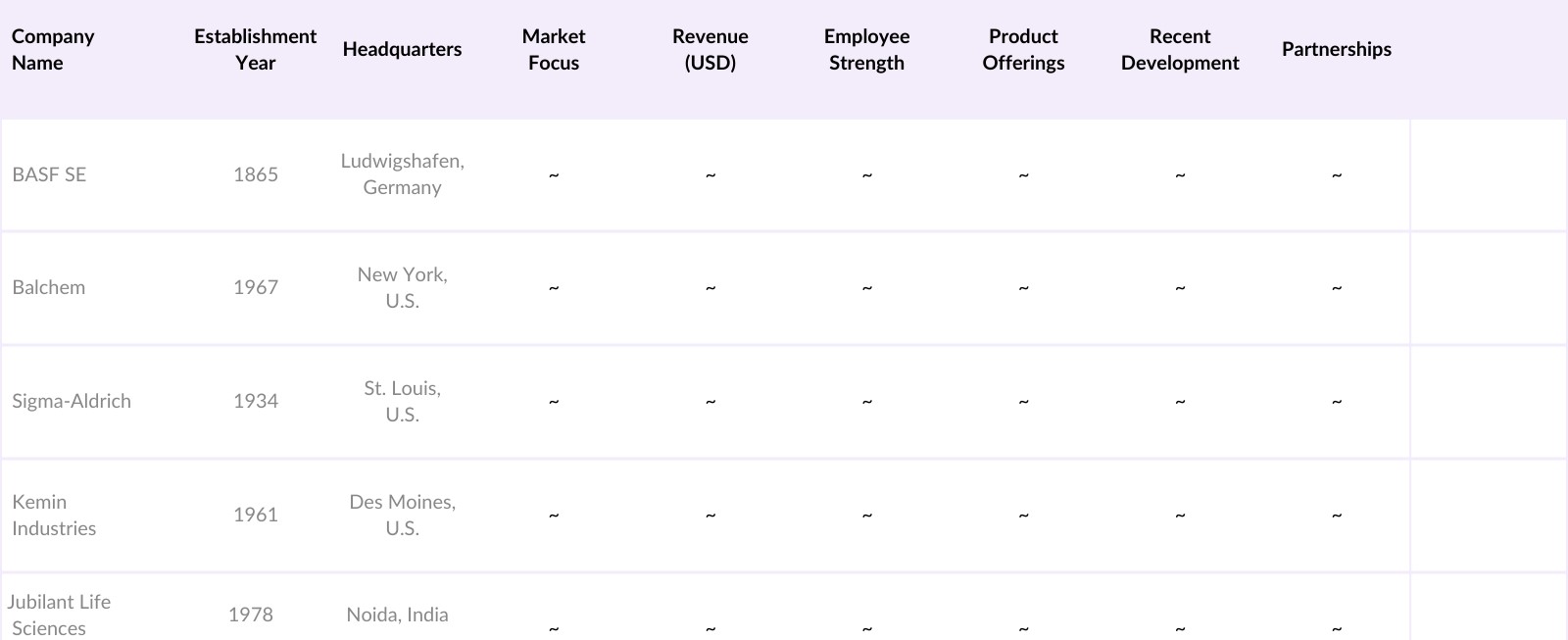

The Global Choline Chloride Market is characterized by the presence of several key players, each contributing to the market's growth through strategic partnerships, mergers, and innovations. Major players focus on product development, geographic expansion, and increasing their production capacities to meet the growing global demand. The competitive landscape features a mix of multinational and local companies, with BASF SE and Balchem standing out for their advanced production capabilities and large customer bases. Sigma-Aldrich and Kemin Industries have also established themselves as dominant forces in the market, leveraging their strong research and development arms to innovate in product formulations and expand their reach.

Global Choline Chloride Market Analysis

Growth Drivers

- Rising Demand in Animal Feed Industry: Global demand for animal feed is substantial, driven by the increasing consumption of poultry, pork, and beef, particularly in middle-income countries. As per recent industry data, the global animal feed production was approximately 1.29 billion metric tons in 2023, with Asia-Pacific as a primary consumer due to its extensive poultry and livestock farming sectors. Middle-income countries have been identified as the highest contributors to agricultural greenhouse gas emissions, mainly due to intensive livestock production, underlining the role of efficient feed additives like choline chloride in sustaining growth in this industry

- Expansion in Oil & Gas Industry: The use of choline chloride in oil and gas, particularly as a clay stabilizer, is growing alongside global energy demand. Enhanced oil recovery (EOR) techniques that incorporate choline chloride are pivotal for high-salinity formations, which are becoming more prevalent in oil extraction regions. This is crucial for regions like the Middle East and North America, where the energy sector continues to expand, requiring innovative solutions to maintain extraction efficiency and mitigate environmental impacts. Data from 2023 indicates that more than 10% of oil recovery operations in key extraction regions utilize EOR techniques employing additives like choline chloride

- Increased Use in Human Nutrition and Pharmaceutical Sectors: Choline chloride's benefits in brain health, cell membrane synthesis, and liver function have increased its application in human nutrition and pharmaceutical products. As lifestyle-related diseases become more common, demand for health supplements containing choline chloride has grown, especially in North America and Europe. Health organizations report that an estimated 35% of adults are deficient in key nutrients, including choline, suggesting a rising need for supplementation. This growing awareness in nutrition is pushing demand across global markets in pharmaceuticals and dietary supplements

Market Challenges

- High Raw Material Costs and Supply Constraints: Choline chloride production faces high raw material costs, particularly for high-purity grades, due to supply chain disruptions in chemical feedstocks. In 2024, inflationary pressures on agricultural commodities and essential raw materials like ammonium chloride have intensified production costs. These supply constraints, reported in regions with high manufacturing capacity such as Asia and North America, impact overall market stability and product affordability

- Health and Environmental Concerns of Choline Chloride Overuse: Excessive choline chloride use in animal feed and human supplements has raised health concerns, as excessive intake can lead to health issues such as vomiting, sweating, and gastrointestinal distress. Additionally, environmental regulations in regions like the EU are increasingly stringent, targeting emissions and pollutants from intensive livestock production. With animal feed production responsible for up to 25.9% of greenhouse emissions, governments and environmental organizations have stressed the need for responsible use and regulation of additives like choline chloride

Global Choline Chloride Market Future Outlook

The global choline chloride market is expected to experience robust growth in the coming years, driven by advancements in animal nutrition, increasing awareness of cholines health benefits, and the growing demand for enhanced feed additives. As consumer preferences shift toward high-quality animal products, such as meat, dairy, and eggs, the market for choline chloride will continue to expand. Additionally, the pharmaceutical industry's increasing reliance on choline chloride for liver function supplements and cognitive health products will fuel further market growth.

Market Opportunities

- Emerging Applications in Oilfield Operations: The application of choline chloride as a hydraulic fracturing additive is gaining traction. By stabilizing clay formations, it ensures prolonged oil extraction efficiency in high-salinity regions. The U.S. and Middle Eastern countries, which account for nearly half of the worlds hydraulic fracturing operations, are increasingly adopting choline-based stabilizers. This presents a significant opportunity for choline chloride providers to capture market share in oil extraction technologies

- Increased Demand in Aquaculture Feed: The growing aquaculture industry, particularly in Southeast Asia, requires nutrient-rich feeds for fish and crustaceans. As of 2023, global aquaculture production surpassed 100 million metric tons, and demand for choline-enriched feed is critical for healthy growth and sustainable yield. Governments in leading aquaculture nations like China, Vietnam, and India have also supported nutrient-optimized feeds to improve overall production efficiency.

Scope of the Report

|

Segment |

Sub-Segments |

|

Application |

Poultry Feed Swine Feed Pet Food Human Nutrition Oil & Gas Additives |

|

Form |

Liquid Powder |

|

Grade |

50% 75% 98% and Above |

|

Region |

North America Asia Pacific Europe South America Middle East & Africa |

|

End-Use Industry |

Animal Feed Pharmaceutical Personal Care Chemical Industry |

Products

Key Target Audience

Animal Feed Manufacturers

Pharmaceutical Companies

Chemical Distributors

Investors and Venture Capitalist Firms

Livestock and Poultry Farmers

Government and Regulatory Bodies (USDA, FDA)

Human Nutrition Supplement Manufacturers

Pet Food Industry Players

Companies

Players mentioned in the report

BASF SE

Balchem

Sigma-Aldrich

Kemin Industries

Jubilant Life Sciences

Eastman Chemical Company

Algry Quimica SL

Balaji Amines

Pestell Minerals & Ingredients

GWH International

Nuproxa Switzerland

SDG Products

BASF Corporation

Liaoning Bicochem

Zibo Wengfu Gene Tech Co., Ltd.

Table of Contents

1. Global Choline Chloride Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Drivers

1.4 Segmentation Overview

2. Global Choline Chloride Market Size (In USD Mn)

2.1 Historical Market Size Analysis

2.2 Current Market Dynamics and Volume Trends

2.3 Strategic Market Developments

3. Global Choline Chloride Market Analysis

3.1 Growth Drivers

3.1.1 Rising Demand in Animal Feed Industry (Poultry Feed, Swine Feed, Ruminant Feed)

3.1.2 Expansion in Oil & Gas Industry (Clay Stabilizer Use)

3.1.3 Increased Use in Human Nutrition and Pharmaceutical Sectors

3.2 Market Challenges

3.2.1 High Raw Material Costs and Supply Constraints

3.2.2 Health and Environmental Concerns of Choline Chloride Overuse

3.3 Opportunities

3.3.1 Emerging Applications in Oilfield Operations (Hydraulic Fracturing, Drilling)

3.3.2 Increased Demand in Aquaculture Feed

3.3.3 Innovation in Choline-based Supplements

3.4 Trends

3.4.1 Adoption of Higher Purity Grades (98%, 75%)

3.4.2 Shift Towards Liquid and Powder Forms in Animal Feed

3.4.3 Product Diversification in Personal Care

3.5 Government Regulation

3.5.1 Feed Safety Standards

3.5.2 Environmental Compliance for Oil & Gas Applications

3.5.3 Pharmaceutical Grade Standards

3.6 SWOT Analysis

3.7 Value Chain Analysis

3.8 Porters Five Forces Analysis

3.9 Industry Ecosystem and Collaboration Landscape

4. Global Choline Chloride Market Segmentation

4.1 By Application (In Value %)

4.1.1 Poultry Feed

4.1.2 Swine Feed

4.1.3 Pet Food

4.1.4 Human Nutrition

4.1.5 Oil & Gas Additives

4.2 By Form (In Value %)

4.2.1 Liquid

4.2.2 Powder

4.3 By Grade (In Value %)

4.3.1 50%

4.3.2 75%

4.3.3 98% and Above

4.4 By Region (In Value %)

4.4.1 North America

4.4.2 Asia Pacific

4.4.3 Europe

4.4.4 South America

4.4.5 Middle East & Africa

4.5 By End-Use Industry (In Value %)

4.5.1 Animal Feed

4.5.2 Pharmaceutical

4.5.3 Personal Care

4.5.4 Chemical Industry

5. Competitive Landscape in the Global Choline Chloride Market

5.1 Detailed Profiles of Major Players

5.1.1 Balchem Corporation

5.1.2 BASF SE

5.1.3 Eastman Chemical Company

5.1.4 GHW International

5.1.5 Kemin Industries

5.1.6 NB Group Co. Ltd.

5.1.7 Jubilant Life Sciences

5.1.8 Taminco Corporation

5.1.9 Algry Qumica S.L.

5.1.10 Balaji Amines Ltd.

5.1.11 Pestell Nutrition Inc.

5.1.12 Havay Chemicals

5.1.13 Taian Hanwei Group

5.1.14 Be-Long Corporation

5.1.15 Impextraco NV

5.2 Cross Comparison Parameters (Production Capacity, Product Portfolio, Market Presence, R&D Investment)

5.3 Market Share Analysis

5.4 Strategic Alliances and Partnerships

5.5 Key Investments and Funding

5.6 Expansion Plans

5.7 Regulatory Compliance Efforts

5.8 Innovation and New Product Launches

6. Global Choline Chloride Market Regulatory Framework

6.1 Animal Feed Regulations

6.2 Safety Standards in Pharmaceuticals

6.3 Environmental Compliance in Oil and Gas

6.4 Import-Export Regulations

6.5 Regional Regulatory Landscape

7. Future Market Outlook for Global Choline Chloride Market

7.1 Key Drivers for Future Growth

7.2 Market Size Projections

7.3 Emerging Applications and Opportunities

8. Market Analysts Recommendations

8.1 Market Entry Strategies

8.2 Product Differentiation and Positioning

8.3 White Space and Niche Opportunities

8.4 Customer and End-Use Segmentation Insights

Disclaimer Contact Us

Research Methodology

Step 1: Identification of Key Variables

This initial phase involves constructing a detailed market map of the global choline chloride market by conducting extensive desk research and utilizing both secondary and proprietary databases. The goal is to identify all critical factors influencing market dynamics, including demand, production, and regional trends.

Step 2: Market Analysis and Construction

In this phase, historical data on the production and consumption of choline chloride across various end-users such as animal feed, human nutrition, and oil & gas will be analyzed. This helps in constructing an accurate assessment of the markets penetration levels and revenue generation from various sectors.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated through expert interviews with stakeholders in the animal feed, pharmaceutical, and chemical industries. The data collected from interviews will corroborate existing statistics and provide operational insights.

Step 4: Research Synthesis and Final Output

The final output is generated by synthesizing insights gained from manufacturers, distributors, and industry experts, creating a robust and validated market forecast for choline chloride consumption across various regions and sectors.

Frequently Asked Questions

-

How big is the Global Choline Chloride Market?

The global choline chloride market is valued at USD 550 million, driven by growing demand in animal feed and human nutrition sectors. -

What are the challenges in the Global Choline Chloride Market?

Key challenges include fluctuating raw material costs, competition from alternative feed additives, and stringent regulatory frameworks in certain regions. -

Who are the major players in the Global Choline Chloride Market?

Leading players include BASF SE, Balchem, Sigma-Aldrich, and Kemin Industries, known for their expansive product portfolios and strong geographic presence. -

What are the growth drivers of the Global Choline Chloride Market?

The market is driven by increased demand for high-quality animal feed, rising awareness of cholines health benefits, and the growing pharmaceutical industry. -

Which regions dominate the Global Choline Chloride Market?

Asia Pacific, led by China, dominates the market due to high livestock production and demand for premium animal feed.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.