Global Cinema Camera Market Outlook to 2030

Region:Global

Author(s):Vijay Kumar

Product Code:KROD4629

December 2024

97

About the Report

Global Cinema Camera Market Overview

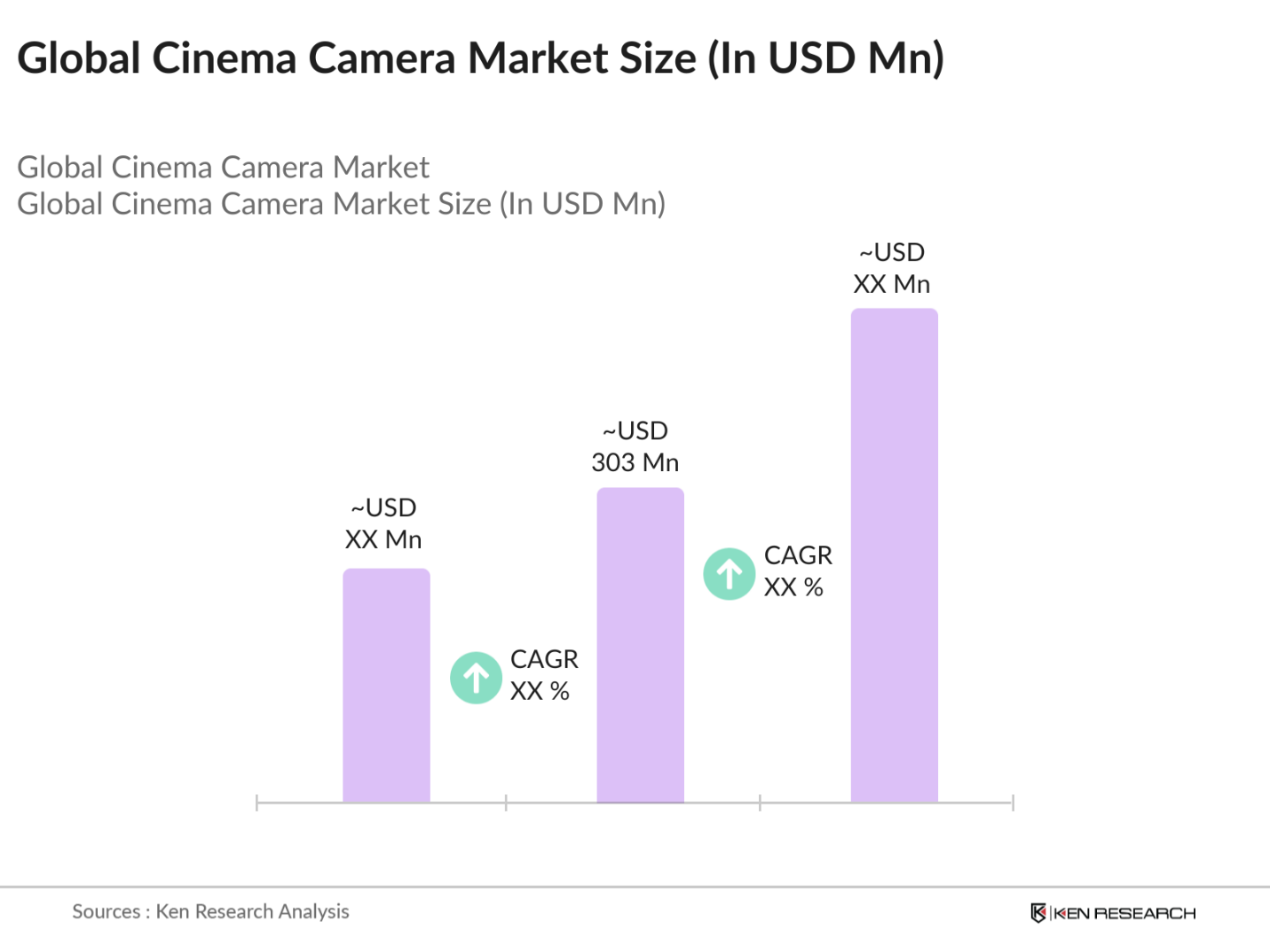

- The global cinema camera market is valued at USD 303 million, based on a five-year historical analysis. This market is primarily driven by the increasing demand for high-resolution content production, including 4K and 8K formats, particularly from the entertainment industry and independent filmmakers. Technological advancements such as AI-based image stabilization, HDR capabilities, and enhanced low-light performance are key factors fueling the adoption of cinema cameras.

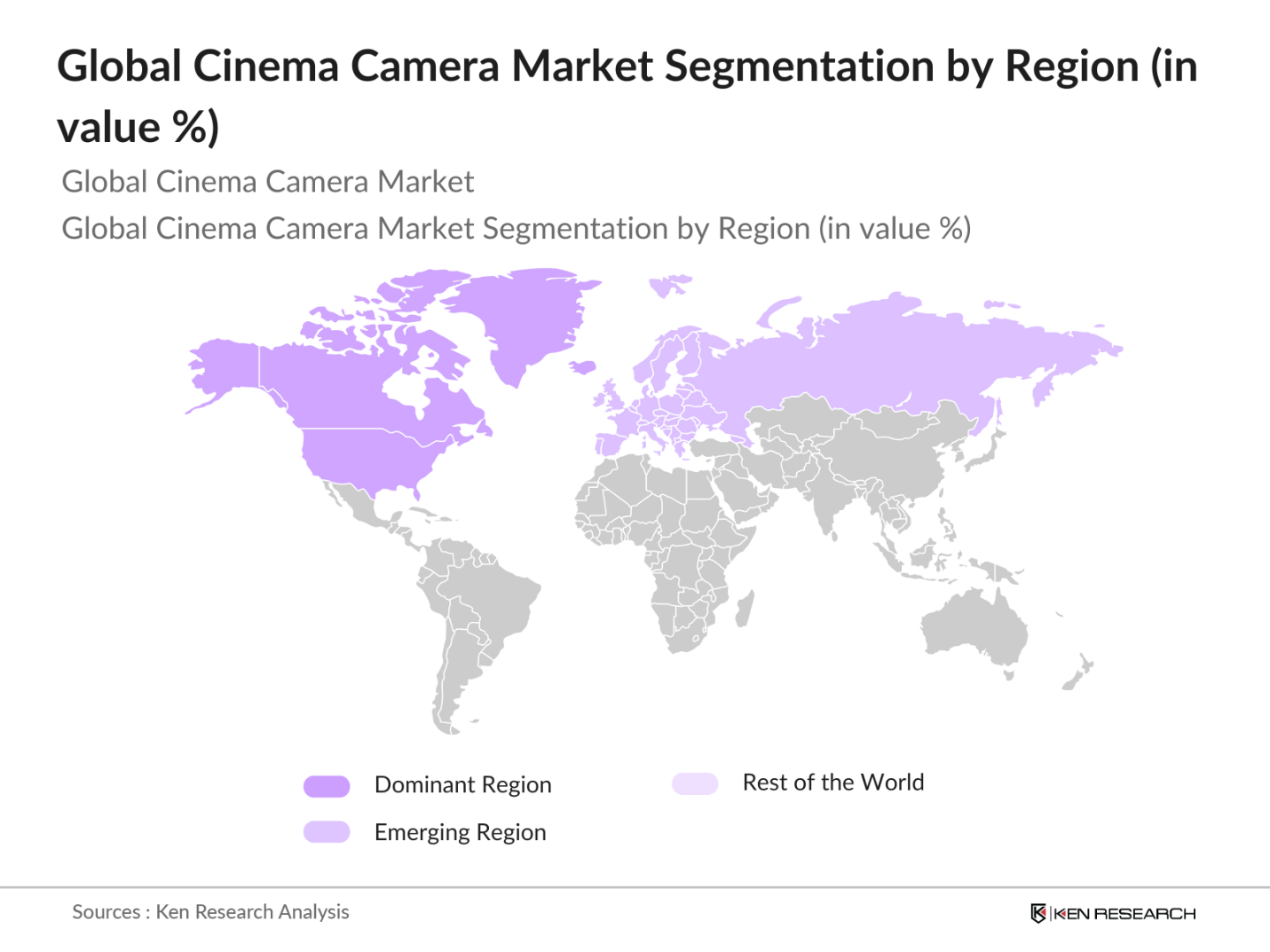

- Dominant regions in the market include North America and Europe, led by the United States and Germany, respectively. The dominance of these regions can be attributed to the presence of large production studios, significant investments in filmmaking infrastructure, and the growing trend of digital content consumption. Moreover, the well-established film industries and production houses in these regions ensure a stable demand for high-quality cinema cameras.

- Governments are focusing on strengthening intellectual property rights to protect cinematic content from piracy and illegal distribution. The U.S. introduced the CASE Act in 2023, providing independent filmmakers an affordable way to enforce copyrights. This initiative encourages creators to invest in high-quality production equipment, reducing fears of revenue loss due to copyright infringement.

Global Cinema Camera Market Segmentation

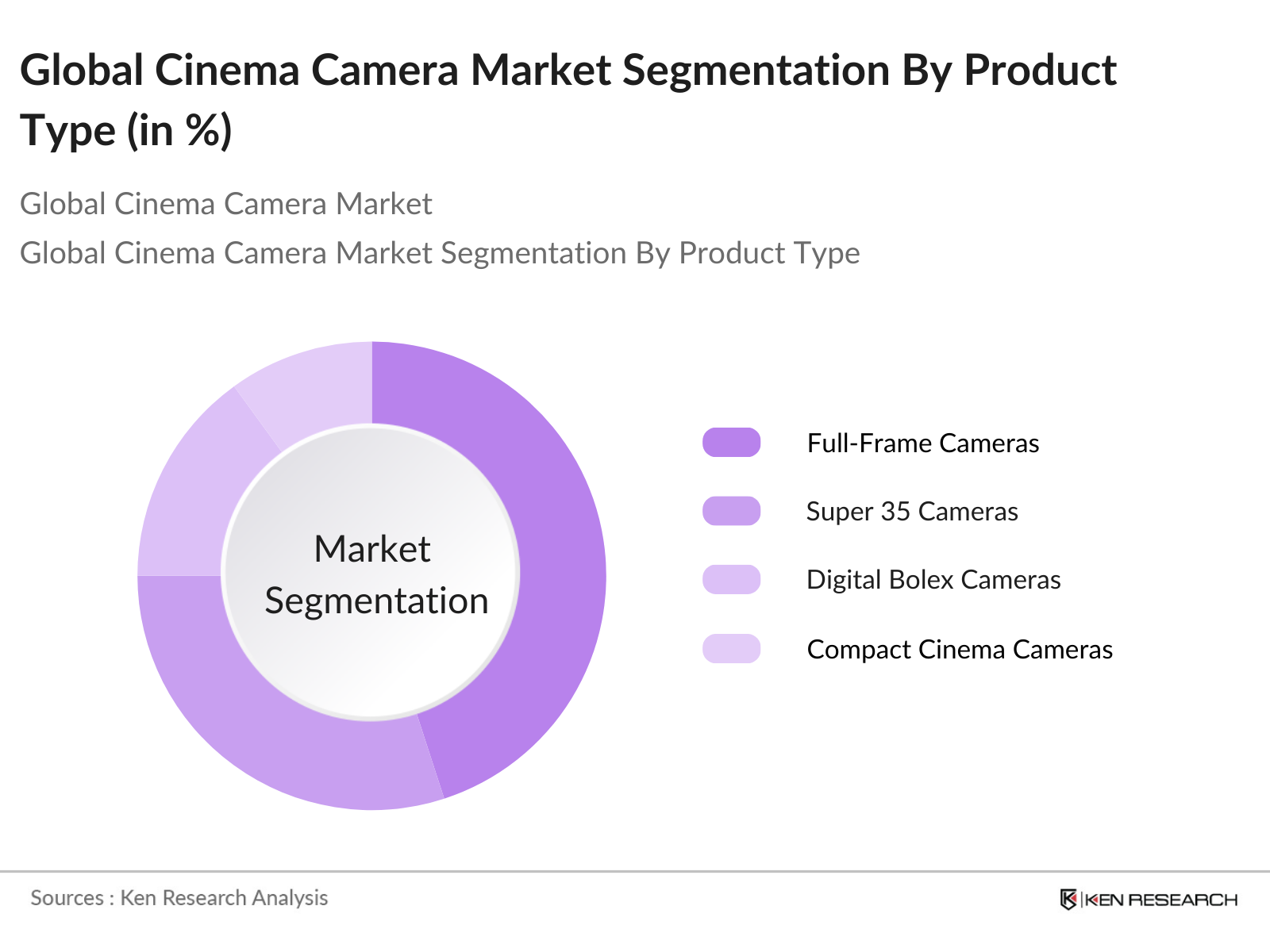

By Product Type: The global cinema camera market is segmented by product type into Full-Frame Cameras, Super 35 Cameras, Digital Bolex Cameras, and Compact Cinema Cameras. Recently, Full-Frame Cameras have dominated the market share under this segmentation due to their superior image quality and flexibility in low-light conditions. Full-frame cameras, such as those produced by Canon and Sony, are widely favored by filmmakers for feature films, commercials, and high-end content due to their dynamic range and high-resolution capabilities.

By Application: The cinema camera market is segmented by application into Feature Films, TV Series and Documentaries, Corporate Films and Advertisements, and Online Content Creation. The Feature Films segment holds the leading market share due to the continuous production of big-budget films and the demand for high-quality equipment.

By Region: The cinema camera market is geographically segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America holds the largest market share, owing to the concentration of major film production studios in the United States and Canada. Additionally, the presence of Hollywood, along with established production houses and increasing investments in content creation for streaming platforms, has solidified this region's market position.

Global Cinema Camera Market Competitive Landscape

The global cinema camera market is dominated by several key players, including established manufacturers and innovators. The competitive landscape is characterized by a mix of companies focusing on technological advancements, product launches, and strategic partnerships to enhance their market presence. The top players are constantly improving their camera technology, focusing on attributes like resolution, frame rates, and ergonomics to cater to the diverse needs of professional filmmakers and content creators.

Global Cinema Camera Industry Analysis

Growth Drivers

- Demand for High-Quality Content Creation: The increasing demand for high-quality content creation is driven by the rapid growth of the global entertainment and media industry. In 2023, the global media and entertainment market reached over $2 trillion, reflecting a significant investment in high-quality content production across films, TV, and streaming platforms. This demand has spurred innovation and development of high-end cinema cameras with enhanced resolution and features.

- Technological Advancements in Camera Equipment: Technological advancements in cinema camera equipment, such as the introduction of AI-based autofocus systems, improved image sensors, and integrated stabilization technologies, are fueling the growth of the market. The adoption of these innovations has improved filming efficiency and quality, meeting the growing need for detailed visual content in both films and commercial applications.

- Expansion of Film Production Industry Globally: The film production industry has been expanding globally, with an estimated 1,500 films produced annually in India alone, generating over $3 billion in revenue in 2023. This growth is not limited to traditional markets like the United States but is also evident in emerging markets such as Nigerias Nollywood and South Koreas film industry, which produced approximately 200 films in 2023.

Market Challenges

- High Cost of Cinema Cameras: The high cost of cinema cameras remains a significant barrier to entry, particularly for smaller production houses and independent filmmakers. Advanced cinema cameras with capabilities such as 8K recording, high dynamic range (HDR), and built-in stabilization can cost upwards of $50,000. This pricing restricts access to high-end equipment for independent creators and small studios, limiting market adoption and potentially hindering the overall growth of the cinema camera industry.

- Piracy and Distribution Issues: Piracy and distribution issues are significant concerns in the cinema industry, impacting revenue generation and reducing the overall profitability of production investments. In 2023, global losses due to piracy amounted to approximately $50 billion, affecting both small and large-scale productions. This has a trickle-down effect on the purchase and usage of high-quality equipment, as content producers may hesitate to invest heavily in production tools without ensuring adequate returns.

Global Cinema Camera Market Future Outlook

Over the next few years, the global cinema camera market is expected to demonstrate substantial growth driven by the rising adoption of advanced camera technologies such as 8K resolution, high dynamic range (HDR), and AI-assisted filming tools. The increasing demand for high-quality visual content across various platforms, including streaming services and independent films, will further boost market expansion.

Market Opportunities

- Growth of Independent Filmmaking and Content Creation: The rise of independent filmmaking and content creation is presenting new opportunities for the cinema camera market. Platforms like YouTube and Vimeo have seen a surge in content creators investing in mid-to-high-range cinema cameras to differentiate their visual content. Additionally, the number of independent films registered with the Sundance Film Festival increased by 15% in 2023, indicating a growing trend towards independent content production.

- Expansion of Streaming Platforms: Streaming platforms like Netflix, Amazon Prime, and Disney+ are expanding globally, leading to an increased demand for original content. In 2023, Netflix allocated over $17 billion for content production, a portion of which includes investment in equipment and technology upgrades. This has led to increased sales of high-end cinema cameras, as production quality becomes a key differentiator for these platforms. The growth of streaming platforms in emerging markets further contributes to the demand for advanced filming equipment.

Scope of the Report

|

By Product Type |

Full-Frame Cameras Super 35 Cameras Digital Bolex Cameras Compact Cinema Cameras |

|

By Application |

Feature Films TV Series and Documentaries Corporate Films and Advertisements Online Content Creation |

|

By Resolution |

2K Resolution 4K Resolution 8K Resolution |

|

By Sensor Type |

CMOS Sensors CCD Sensors BSI Sensors |

|

Region |

North America Europe Asia Pacific Latin America Middle East & Africa |

Products

Key Target Audience

Professional Filmmakers and Studios

Independent Content Creators

Advertising and Media Agencies

Government and Regulatory Bodies (e.g., Federal Communications Commission, Ministry of Information & Broadcasting)

Film Production Houses and Studios

Streaming Platforms (e.g., Netflix, Amazon Prime Video)

Investments and Venture Capitalist Firms

Camera Rental and Service Providers

Companies

Players Mentioned in the Report

ARRI AG

Sony Corporation

Canon Inc.

RED Digital Cinema

Panasonic Corporation

Blackmagic Design Pty Ltd.

Leica Camera AG

Fujifilm Corporation

Nikon Corporation

Hasselblad

Table of Contents

1. Global Cinema Camera Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Cinema Camera Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Cinema Camera Market Analysis

3.1. Growth Drivers

3.1.1. Demand for High-Quality Content Creation

3.1.2. Technological Advancements in Camera Equipment

3.1.3. Expansion of Film Production Industry Globally

3.2. Market Challenges

3.2.1. High Cost of Cinema Cameras

3.2.2. Piracy and Distribution Issues

3.2.3. Limited Adoption in Small and Medium-Scale Productions

3.3. Opportunities

3.3.1. Growth of Independent Filmmaking and Content Creation

3.3.2. Expansion of Streaming Platforms

3.3.3. Increased Demand for Remote Filming Solutions (e.g., Autonomous Drones)

3.4. Trends

3.4.1. Adoption of 8K and 4K Technology in Filmmaking

3.4.2. Integration of AI and Machine Learning for Post-Production

3.4.3. Use of Drones and Motion Capture in Cinematography

3.5. Government Regulations

3.5.1. Intellectual Property Rights for Cinematic Content

3.5.2. Compliance for Drone Use in Filmmaking

3.5.3. Data Protection and Privacy Laws

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Landscape Analysis

4. Global Cinema Camera Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Full-Frame Cameras

4.1.2. Super 35 Cameras

4.1.3. Digital Bolex Cameras

4.1.4. Compact Cinema Cameras

4.2. By Application (In Value %)

4.2.1. Feature Films

4.2.2. TV Series and Documentaries

4.2.3. Corporate Films and Advertisements

4.2.4. Online Content Creation

4.3. By Resolution (In Value %)

4.3.1. 2K Resolution

4.3.2. 4K Resolution

4.3.3. 8K Resolution

4.4. By Sensor Type (In Value %)

4.4.1. CMOS Sensors

4.4.2. CCD Sensors

4.4.3. BSI Sensors

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia Pacific

4.5.4. Latin America

4.5.5. Middle East & Africa

5. Global Cinema Camera Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. ARRI AG

5.1.2. Sony Corporation

5.1.3. Canon Inc.

5.1.4. RED Digital Cinema

5.1.5. Panasonic Corporation

5.1.6. Blackmagic Design Pty Ltd.

5.1.7. GoPro, Inc.

5.1.8. Leica Camera AG

5.1.9. Fujifilm Corporation

5.1.10. Hasselblad

5.1.11. Nikon Corporation

5.1.12. Phase One

5.1.13. Sigma Corporation

5.1.14. DJI Innovations

5.1.15. Zeiss AG

5.2 Cross Comparison Parameters (Product Portfolio, Innovation Index, Market Positioning, Financial Performance, Global Presence, Customer Satisfaction, Brand Equity, Sustainability Initiatives)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers And Acquisitions

5.6. Investment Analysis

5.7 Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Global Cinema Camera Market Regulatory Framework

6.1. Environmental Standards and Compliance

6.2. Certification Processes and Licensing

6.3. Standards for Camera Equipment (ISO, CIPA)

7. Global Cinema Camera Market Future Size Projections (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global Cinema Camera Market Future Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By Resolution (In Value %)

8.4. By Sensor Type (In Value %)

8.5. By Region (In Value %)

9. Global Cinema Camera Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involved mapping out the entire ecosystem of the cinema camera market, covering stakeholders like manufacturers, distributors, and end-users. Extensive desk research was conducted using a combination of secondary and proprietary databases to compile a comprehensive dataset of market variables and industry-specific parameters.

Step 2: Market Analysis and Construction

This phase focused on the collection and analysis of historical data related to market size, industry growth, and product penetration. This step included assessing product usage trends, advancements in technology, and market consolidation activities. An in-depth review of the supply chain dynamics was also performed.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were validated through expert interviews conducted with professionals from leading camera manufacturers and film studios. These discussions provided critical insights into the operational and financial aspects of the market, supporting data refinement and hypothesis validation.

Step 4: Research Synthesis and Final Output

The final stage involved synthesizing all collected data points, market metrics, and insights to create a detailed, structured, and validated report. The data was further verified using the bottom-up approach to ensure accurate market size and growth estimations.

Frequently Asked Questions

01. How big is the Global Cinema Camera Market?

The global cinema camera market is valued at USD 303 billion, based on a five-year historical analysis. This market is primarily driven by the increasing demand for high-resolution content production, including 4K and 8K formats, particularly from the entertainment industry and independent filmmakers.

02. What are the growth drivers for the Global Cinema Camera Market?

The market is primarily driven by the demand for high-resolution content, expanding film industries, and advancements in camera technology, such as AI-based tools and 8K resolution capabilities.

03. Who are the major players in the Global Cinema Camera Market?

Key players include ARRI AG, Sony Corporation, Canon Inc., RED Digital Cinema, and Panasonic Corporation. These companies dominate the market due to their strong product portfolios and continuous innovation.

04. What are the challenges in the Global Cinema Camera Market?

Challenges include the high cost of cinema cameras, limited adoption by small production houses, and issues related to intellectual property rights and piracy.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.