Global Clinical Laboratory Services Market Outlook to 2030

Region:Global

Author(s):Mukul

Product Code:KROD10411

November 2024

93

About the Report

Global Clinical Laboratory Services Market Overview

- The Global Clinical Laboratory Services Market is valued at USD 258 billion, based on a five-year historical analysis. The market is driven by increasing chronic diseases and a rise in demand for advanced diagnostic tests. Chronic conditions such as diabetes, cardiovascular diseases, and cancer have led to a higher demand for laboratory tests, further supported by advancements in testing technologies. The growth is bolstered by expanding preventive healthcare measures and widespread adoption of routine diagnostic tests, especially in aging populations, creating a steady demand for clinical laboratory services.

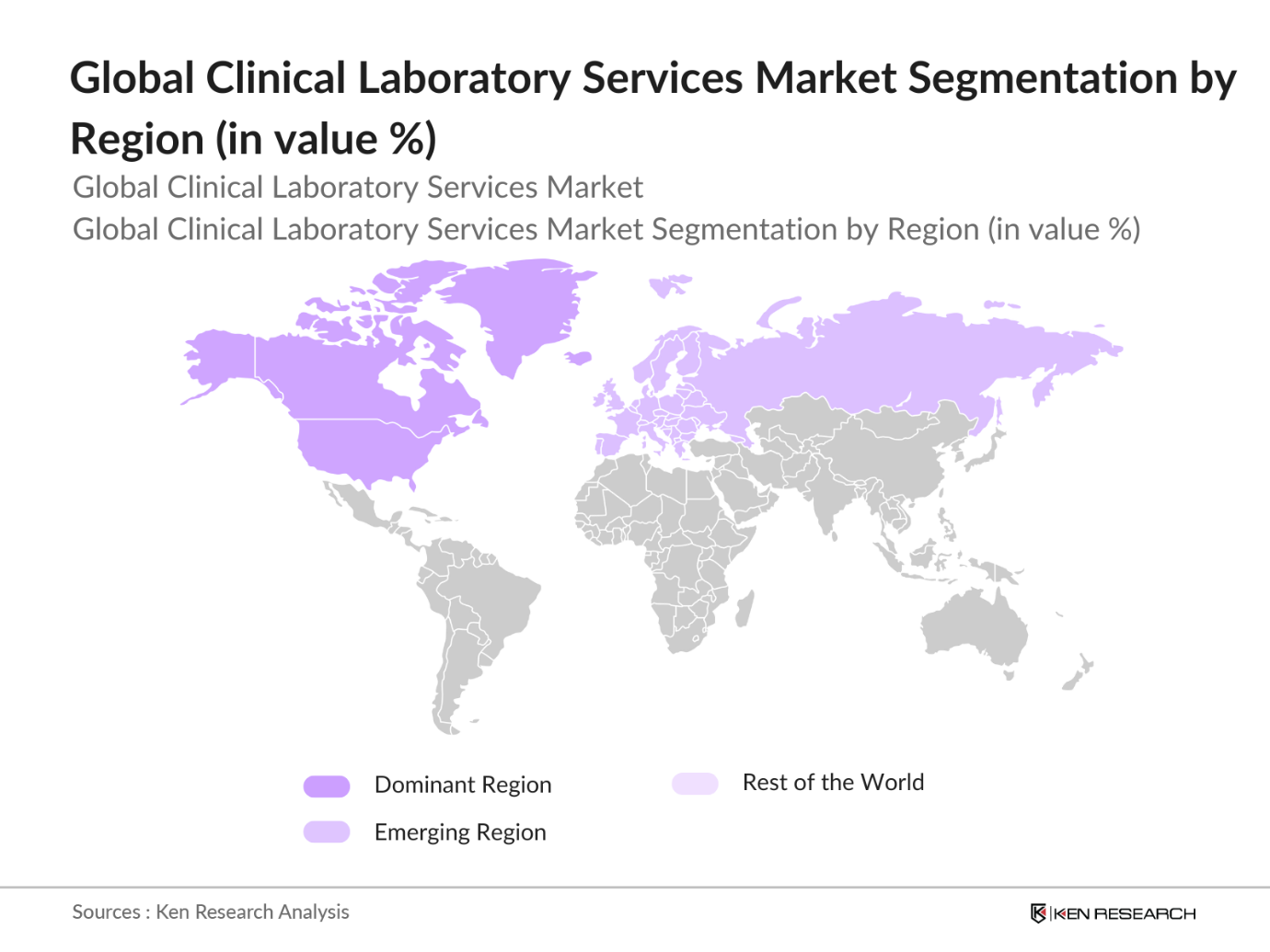

- North America and Europe dominate the Global Clinical Laboratory Services Market due to their robust healthcare infrastructure and significant investments in research and development. In North America, the presence of major healthcare companies and increasing healthcare expenditure have made the region a leader in clinical diagnostics. In Europe, the market thrives due to the adoption of advanced diagnostic technologies and favorable government initiatives to improve healthcare services. The high demand in these regions is also due to well-established laboratory networks and a significant focus on early disease detection and prevention.

- The General Data Protection Regulation (GDPR) significantly affects how clinical laboratories in the European Union manage patient data. Introduced in 2018, the regulation imposes strict guidelines on data storage and sharing to protect patient privacy. By 2023, over 80% of clinical laboratories in the EU had adopted GDPR-compliant systems to ensure that patient data is handled securely. Failure to comply with GDPR can result in hefty fines, making it crucial for diagnostic labs to invest in data protection technologies and protocols.

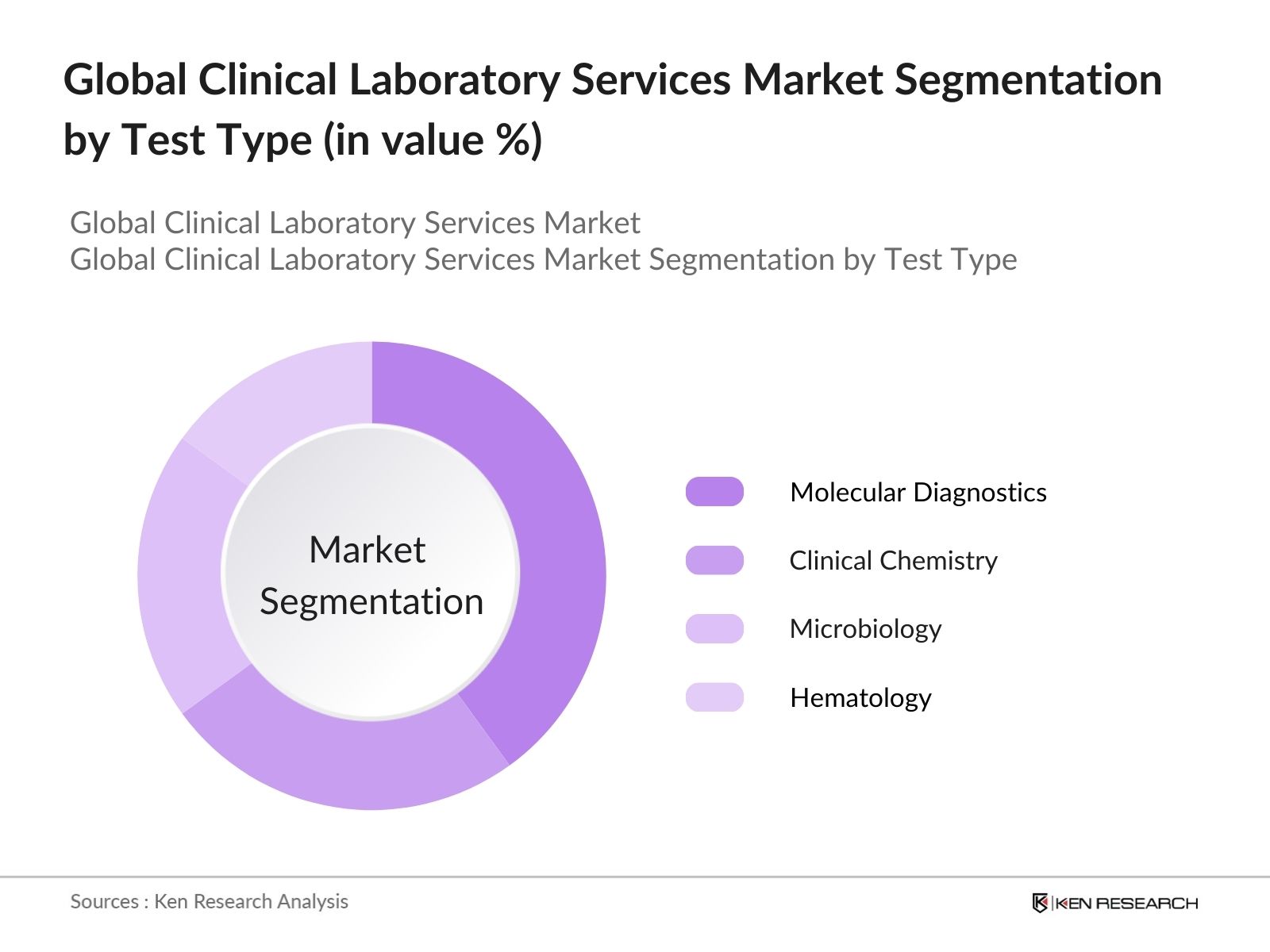

Global Clinical Laboratory Services Market Segmentation

- By Test Type: The clinical laboratory services market is segmented into clinical chemistry, hematology, microbiology, cytogenetics, and molecular diagnostics. Among these, molecular diagnostics holds the largest market share due to its pivotal role in early detection and precision medicine, particularly in cancer diagnostics and infectious diseases. Molecular diagnostics' ability to provide accurate and quick results, coupled with the increasing adoption of personalized medicine, has made it a dominant segment in the global market.

- By Region: Regionally, North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa form the primary market segments. North America leads the market, driven by high healthcare expenditure and technological innovations in diagnostics. Asia-Pacific, however, is expected to witness rapid growth due to increasing healthcare investments, rising chronic disease prevalence, and expanding healthcare infrastructure. In countries like India and China, the growing demand for diagnostic services has propelled market growth significantly.

- By Service Provider: The service provider segment is categorized into hospital-based laboratories, stand-alone laboratories, clinical research organizations (CROs), and physician office laboratories (POLs). Hospital-based laboratories dominate the market due to their extensive patient base and the integration of advanced diagnostic technologies in hospital systems. These laboratories have the infrastructure and resources to offer comprehensive diagnostic services, which makes them critical to the clinical diagnostics landscape.

Global Clinical Laboratory Services Market Competitive Landscape

The Global Clinical Laboratory Services Market is highly consolidated, with major players dominating due to their extensive networks, technological capabilities, and focus on research and development. The competitive landscape is characterized by collaborations, mergers, acquisitions, and a strong focus on innovation in diagnostic technologies. For instance, companies like Quest Diagnostics and LabCorp have been at the forefront of clinical laboratory services through their investments in molecular diagnostics and data-driven healthcare solutions.

|

Company |

Established |

Headquarters |

Revenue (USD Bn) |

No. of Employees |

Technology Focus |

Global Presence |

Partnerships |

R&D Investments |

|

Quest Diagnostics |

1967 |

Secaucus, NJ, USA |

- |

- |

- |

- |

- |

- |

|

LabCorp |

1978 |

Burlington, NC, USA |

- |

- |

- |

- |

- |

- |

|

Sonic Healthcare |

1987 |

Sydney, Australia |

- |

- |

- |

- |

- |

- |

|

Eurofins Scientific |

1987 |

Luxembourg |

- |

- |

- |

- |

- |

- |

|

Charles River Laboratories |

1947 |

Wilmington, MA, USA |

- |

- |

- |

- |

- |

- |

Global Clinical Laboratory Services Industry Analysis

Growth Drivers

- Increase in Chronic Diseases: Chronic diseases, such as diabetes and cardiovascular disorders, have surged globally, leading to an increasing demand for clinical laboratory services. According to the World Health Organization (WHO), in 2023, over 422 million people globally were diagnosed with diabetes, and this number continues to grow due to lifestyle changes and urbanization. Cardiovascular diseases also represent a significant burden, with approximately 17.9 million deaths annually, pushing the need for diagnostic testing. This increase in chronic conditions is driving demand for routine lab diagnostics, with particular emphasis on early detection and monitoring.

- Growing Aging Population: The aging global population is a major driver of clinical laboratory services, particularly in high-income countries. The United Nations reported that the global population aged 65 and over exceeded 771 million in 2022. With this demographic more susceptible to chronic and age-related diseases, the need for regular diagnostic services grows exponentially. Countries like Japan, where over 28% of the population is aged 65 and older, are experiencing a corresponding rise in demand for clinical testing services as healthcare systems cater to an aging society.

- Technological Advancements in Diagnostics: The integration of advanced diagnostic technologies is reshaping clinical laboratory services. The adoption of molecular diagnostics, next-generation sequencing, and digital pathology has revolutionized disease detection and monitoring. The introduction of portable diagnostic devices that enable high-precision results further strengthens this segment. For example, automated laboratory instruments have seen wide-scale adoption, with countries like the United States leading the charge. The deployment of these tools increased the efficiency of tests conducted and reduced human error, positioning technology as a key driver in the market.

Market Restraints

- Lack of Skilled Workforce: A shortage of skilled laboratory technicians is one of the significant challenges facing the clinical laboratory services market. According to the U.S. Bureau of Labor Statistics, as of 2023, there is a projected shortage of nearly 90,000 lab technicians in the United States alone. The demand for skilled professionals far outpaces supply, exacerbated by the complexity of emerging diagnostic technologies that require specialized training. The growing dependency on advanced diagnostic tools is intensifying the need for a well-trained workforce, placing a bottleneck on the growth of clinical lab services.

- High Cost of Diagnostic Testing: The cost associated with diagnostic testing, especially advanced molecular and genetic tests, remains high. For instance, according to Medicare data from 2023, the cost of certain advanced diagnostic tests can range from $500 to $1,500 per test, which restricts accessibility in low- and middle-income countries. Many healthcare systems struggle to integrate these costs into standard patient care, leading to unequal access across regions. Countries with lower healthcare budgets face difficulty in providing widespread access to these expensive diagnostic services, creating disparities in patient outcomes.

Global Clinical Laboratory Services Market Future Outlook

Over the next five years, the Global Clinical Laboratory Services Market is expected to witness significant growth driven by continuous advancements in molecular diagnostics, the increasing adoption of AI-based diagnostic tools, and the growing prevalence of chronic diseases. The integration of digital platforms with laboratory services will further enhance the accuracy and efficiency of diagnostics, particularly in developed regions. Additionally, the expansion of healthcare services in emerging economies will provide ample growth opportunities for global players in the market.

Market Opportunities

- Growing Demand for Point-of-Care Diagnostics: Point-of-care (POC) diagnostics are gaining traction as healthcare shifts toward patient-centric models. The World Bank reports a significant increase in demand for POC diagnostics in emerging markets such as Africa and Southeast Asia, where decentralized healthcare is more prevalent. The U.S. alone saw a surge in the use of POC testing, with over 75% of primary healthcare providers offering rapid diagnostic tests as of 2023. These devices enable faster diagnoses and reduce hospital wait times, particularly in underserved areas, making it an emerging opportunity in the market.

- Increasing Public-Private Collaborations: Public-private collaborations are on the rise, particularly in countries with growing healthcare needs. In 2023, India initiated a public-private partnership program aimed at modernizing laboratory infrastructure in collaboration with international diagnostic companies. Such initiatives are creating new growth opportunities for clinical lab services, particularly in underserved regions. Government funding combined with private expertise is accelerating the establishment of diagnostic facilities in rural areas, providing underserved populations with access to essential testing services.

Scope of the Report

|

Test Type |

Clinical Chemistry Hematology Microbiology Cytogenetics Molecular Diagnostics |

|

Service Provider |

Hospital-Based Labs Stand-Alone Labs CROs Physician Office Labs (POLs) |

|

End User |

Hospitals Diagnostic Centers Research & Academic Institutes Point-of-Care Testing |

|

Technology |

Immunoassay Clinical Chemistry Analyzers PCR NGS |

|

Region |

North America Europe Asia-Pacific Latin America Middle East & Africa |

Products

Key Target Audience

Clinical Diagnostics Companies

Healthcare Service Providers

Hospitals and Medical Institutions

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., US FDA, European Medicines Agency)

Pharmaceutical and Biotechnology Companies

Diagnostic Equipment Manufacturers

Insurance Providers and Healthcare Payers

Companies

Players Mentioned in the Report:

Quest Diagnostics

Laboratory Corporation of America Holdings (LabCorp)

Sonic Healthcare

Eurofins Scientific

Charles River Laboratories

Bio-Reference Laboratories

Unilabs

ACM Global Laboratories

NeoGenomics Laboratories

Fresenius Medical Care

ARUP Laboratories

Cerba HealthCare

Syneos Health

Covance Inc.

Synlab International GmbH

Table of Contents

1. Global Clinical Laboratory Services Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Clinical Laboratory Services Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Clinical Laboratory Services Market Analysis

3.1. Growth Drivers

3.1.1. Increase in Chronic Diseases (Market Drivers)

3.1.2. Growing Aging Population (Market Drivers)

3.1.3. Technological Advancements in Diagnostics (Market Drivers)

3.1.4. Expansion of Preventive Healthcare Services (Market Drivers)

3.2. Market Challenges

3.2.1. Lack of Skilled Workforce (Market Challenges)

3.2.2. High Cost of Diagnostic Testing (Market Challenges)

3.2.3. Regulatory and Reimbursement Issues (Market Challenges)

3.3. Opportunities

3.3.1. Growing Demand for Point-of-Care Diagnostics (Opportunities)

3.3.2. Increasing Public-Private Collaborations (Opportunities)

3.3.3. Untapped Markets in Emerging Economies (Opportunities)

3.4. Trends

3.4.1. Automation in Clinical Laboratories (Trends)

3.4.2. Integration of Artificial Intelligence (AI) in Diagnostics (Trends)

3.4.3. Rise of Home-Based Diagnostic Services (Trends)

3.5. Government Regulations

3.5.1. Healthcare Regulatory Reforms (Regulations)

3.5.2. CLIA (Clinical Laboratory Improvement Amendments) Compliance (Regulations)

3.5.3. Impact of GDPR on Data Handling in Labs (Regulations)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

4. Global Clinical Laboratory Services Market Segmentation

4.1. By Test Type (In Value %)

4.1.1. Clinical Chemistry

4.1.2. Hematology

4.1.3. Microbiology

4.1.4. Cytogenetics

4.1.5. Molecular Diagnostics

4.2. By Service Provider (In Value %)

4.2.1. Hospital-Based Laboratories

4.2.2. Stand-Alone Laboratories

4.2.3. Clinical Research Organizations (CROs)

4.2.4. Physician Office Laboratories (POLs)

4.3. By End User (In Value %)

4.3.1. Hospitals

4.3.2. Diagnostic Centers

4.3.3. Research and Academic Institutes

4.3.4. Point-of-Care Testing

4.4. By Technology (In Value %)

4.4.1. Immunoassay

4.4.2. Clinical Chemistry Analyzers

4.4.3. PCR (Polymerase Chain Reaction)

4.4.4. Next-Generation Sequencing (NGS)

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia-Pacific

4.5.4. Latin America

4.5.5. Middle East & Africa

5. Global Clinical Laboratory Services Market Competitive Analysis

5.1. Detailed Profiles of Major Competitors

5.1.1. Quest Diagnostics Incorporated

5.1.2. Laboratory Corporation of America Holdings

5.1.3. Sonic Healthcare

5.1.4. Eurofins Scientific

5.1.5. Charles River Laboratories

5.1.6. Bio-Reference Laboratories

5.1.7. Unilabs

5.1.8. ACM Global Laboratories

5.1.9. NeoGenomics Laboratories

5.1.10. Fresenius Medical Care

5.1.11. ARUP Laboratories

5.1.12. Cerba HealthCare

5.1.13. Syneos Health

5.1.14. Covance Inc.

5.1.15. Synlab International GmbH

5.2. Cross Comparison Parameters (Revenue, Market Presence, Employee Strength, Laboratory Capacity, R&D Investment, Technological Capabilities, Operational Regions, Strategic Initiatives)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital and Private Equity Funding

6. Global Clinical Laboratory Services Market Regulatory Framework

6.1. Accreditation and Certification Standards

6.2. Compliance and Regulatory Requirements

6.3. ISO Certification and International Standards

7. Global Clinical Laboratory Services Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global Clinical Laboratory Services Future Market Segmentation

8.1. By Test Type (In Value %)

8.2. By Service Provider (In Value %)

8.3. By End User (In Value %)

8.4. By Technology (In Value %)

8.5. By Region (In Value %)

9. Global Clinical Laboratory Services Market Analysts' Recommendations

9.1. Total Addressable Market (TAM), Serviceable Available Market (SAM), and Serviceable Obtainable Market (SOM) Analysis

9.2. Expansion Opportunities for Key Market Players

9.3. Customer Segment Analysis

9.4. White Space Opportunities

Research Methodology

Step 1: Identification of Key Variables

In this phase, we mapped the ecosystem of stakeholders in the Global Clinical Laboratory Services Market, identifying the key variables influencing market dynamics. This was achieved through extensive desk research using proprietary databases and secondary sources, ensuring a comprehensive understanding of the markets key drivers.

Step 2: Market Analysis and Construction

We conducted historical data analysis on the clinical laboratory market, focusing on market penetration rates, test volumes, and revenue generation across regions. The quality and reliability of the data were cross-verified against multiple databases to ensure accurate estimates.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses developed from the market data were validated through expert consultations with industry professionals. These interviews provided valuable operational insights, helping refine the market models and verify key trends and projections.

Step 4: Research Synthesis and Final Output

The final phase involved aggregating data from various diagnostic service providers and laboratories to develop an accurate analysis of market trends. This synthesis was combined with expert interviews to ensure comprehensive and validated output for the Global Clinical Laboratory Services Market.

Frequently Asked Questions

01. How big is the Global Clinical Laboratory Services Market?

The Global Clinical Laboratory Services Market was valued at USD 258 billion and is driven by the increasing prevalence of chronic diseases and advancements in diagnostic technologies.

02. What are the challenges in the Global Clinical Laboratory Services Market?

Challenges include the high cost of advanced diagnostic tests, regulatory hurdles in various regions, and a shortage of skilled professionals to operate sophisticated diagnostic equipment.

03. Who are the major players in the Global Clinical Laboratory Services Market?

Key players in the market include Quest Diagnostics, LabCorp, Sonic Healthcare, Eurofins Scientific, and Charles River Laboratories, all of which lead the industry through technological advancements and extensive market presence.

04. What are the growth drivers of the Global Clinical Laboratory Services Market?

Growth drivers include the rising demand for preventive healthcare services, increasing investments in molecular diagnostics, and the integration of AI and digital platforms in laboratory services.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.