Global Cloud Computing Market Outlook to 2030

Region:Global

Author(s):Mukul

Product Code:KROD7097

December 2024

90

About the Report

Global Cloud Computing Market Overview

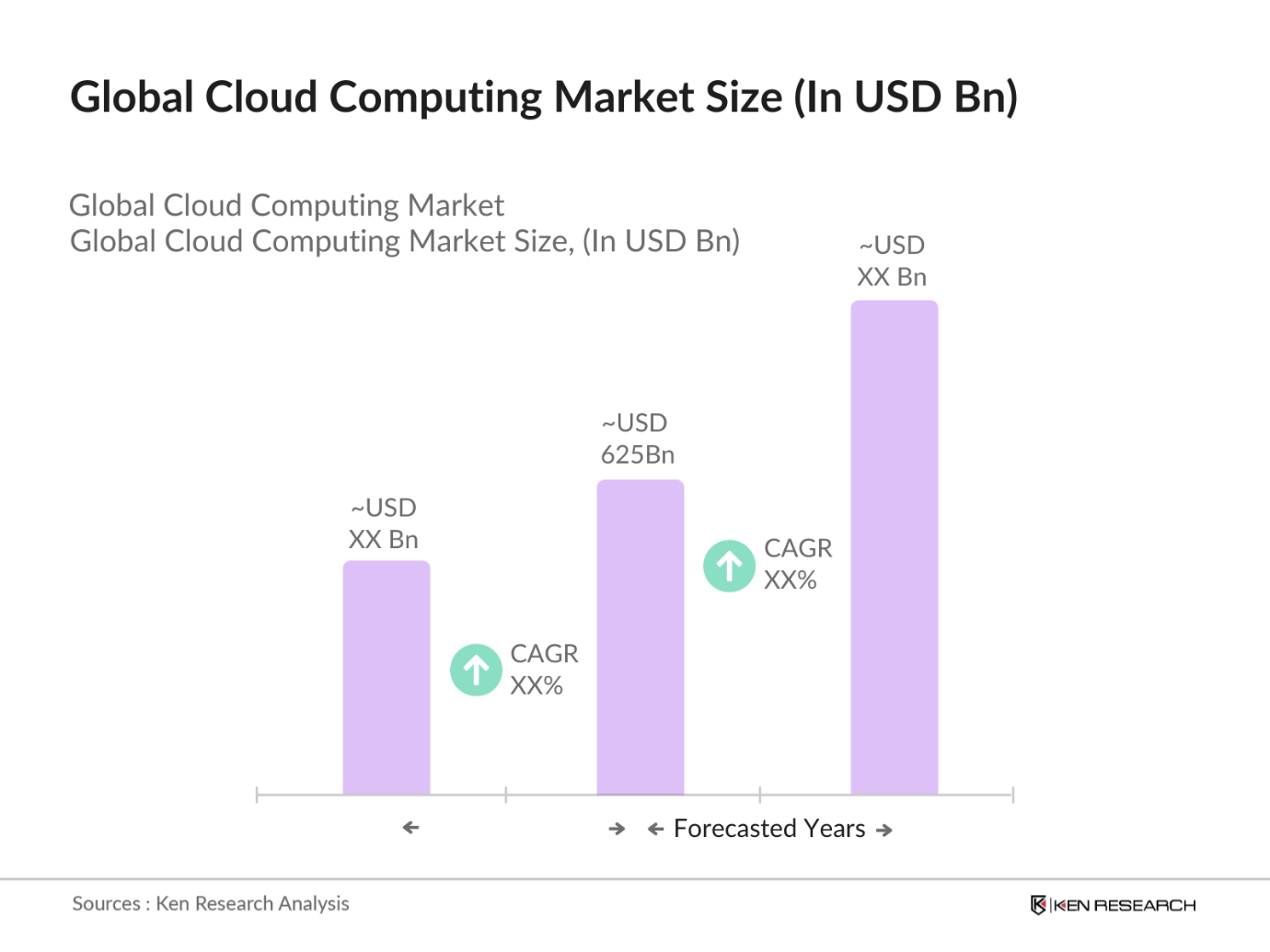

- The Global Cloud Computing Market is valued at USD 625 billion, based on a five-year historical analysis. The market is driven by the rapid adoption of digital transformation strategies across various industries, coupled with the growing demand for data storage, scalability, and cost-efficiency. Businesses are increasingly shifting their operations to the cloud to leverage its flexibility, scalability, and ability to support real-time processing and big data analytics.

- Countries such as the United States, China, and Germany dominate the global cloud computing market due to their technological advancements, large-scale IT infrastructure investments, and the presence of major cloud service providers. The U.S. leads with its highly developed IT sector, while China's rapid digital transformation and Germany's strong industrial base further reinforce their positions. These countries benefit from favorable regulatory environments and the adoption of cloud solutions by both private and public sectors.

- The integration of AI, machine learning, and IoT with cloud infrastructure is driving significant technological advancements. According to the World Economic Forum, over 40 billion IoT devices were connected to cloud platforms by 2023, creating vast opportunities for real-time data analytics and automation. In the manufacturing and logistics sectors, IoT-cloud integration has resulted in a 15% improvement in operational efficiency. AI and machine learning algorithms, meanwhile, are helping businesses optimize resource allocation and enhance customer experiences through predictive analytics.

Global Cloud Computing Market Segmentation

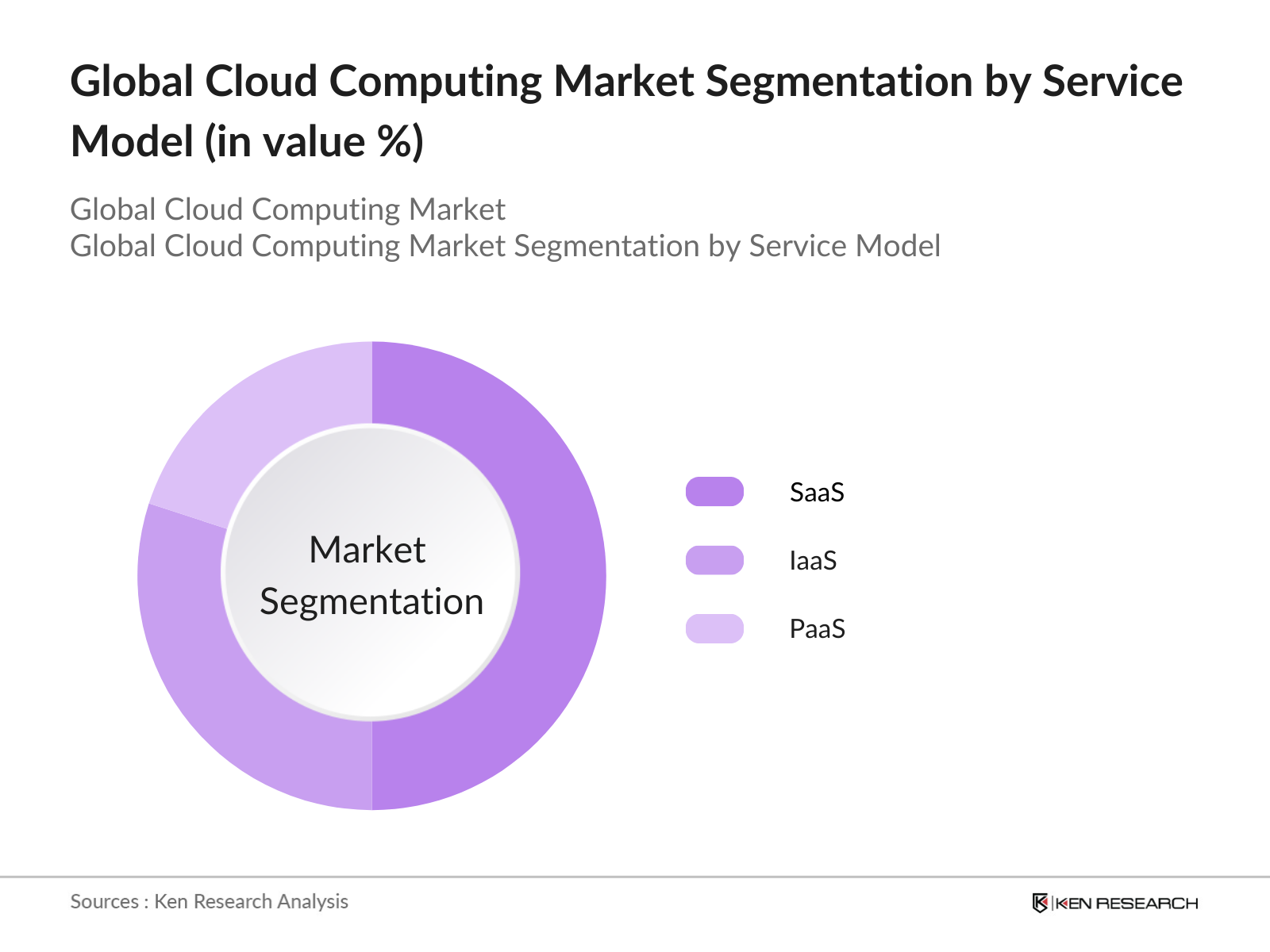

- By Service Model: The Global Cloud Computing Market is segmented by service model into Infrastructure as a Service (IaaS), Platform as a Service (PaaS), and Software as a Service (SaaS). Among these, SaaS holds the dominant share due to its widespread adoption across industries, driven by its ability to reduce costs, improve efficiency, and streamline business processes. Companies like Salesforce and Microsoft have cemented their leadership in this segment by offering robust, scalable software solutions. In contrast, IaaS and PaaS are gaining traction among businesses looking to build customized applications or manage extensive IT infrastructure needs.

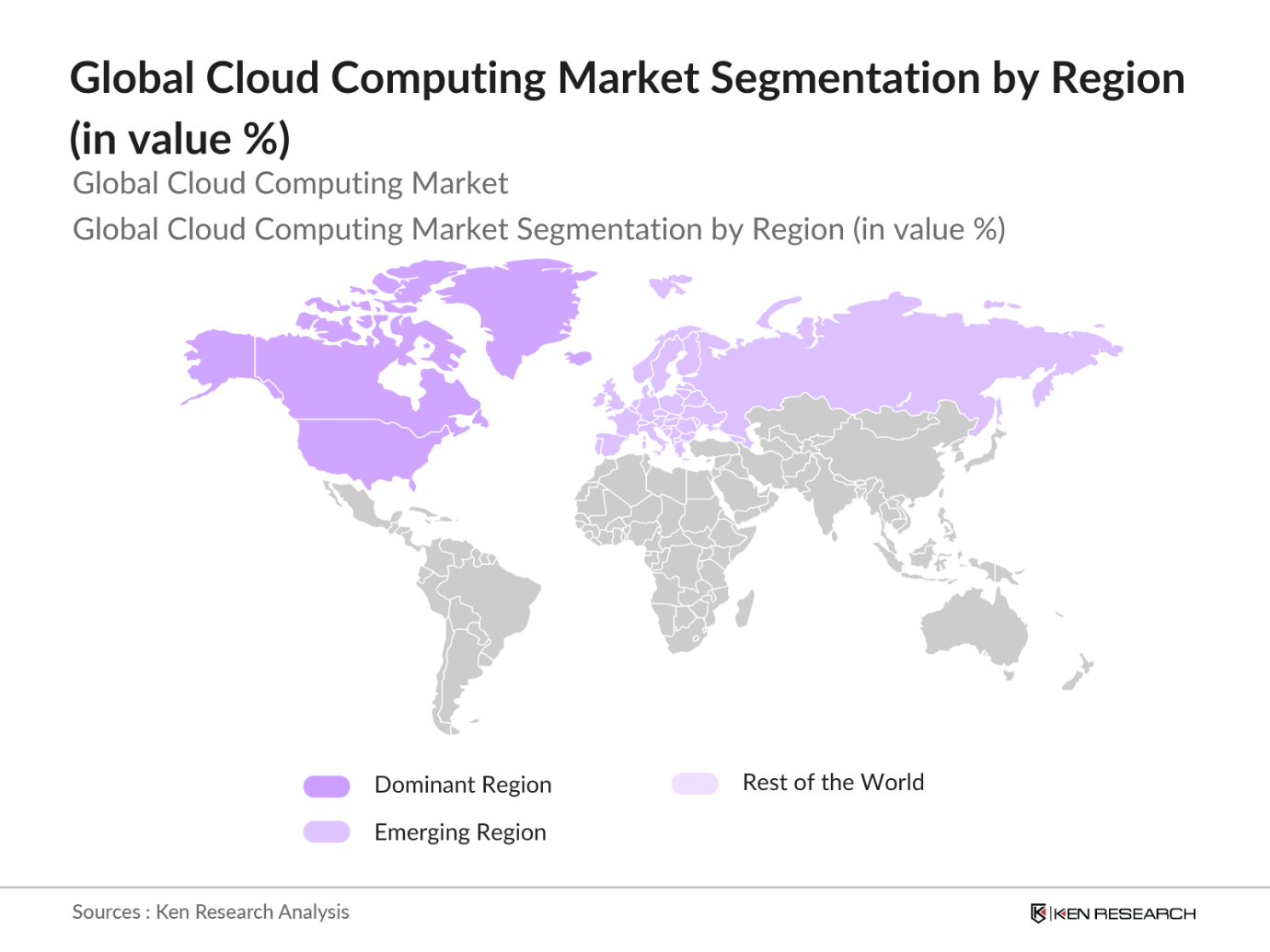

- By Region: The Global Cloud Computing Market is segmented by region into North America, Europe, Asia-Pacific, Middle East and Africa, and Latin America. North America holds the largest market share, primarily due to the strong presence of major cloud providers such as AWS, Google Cloud, and Microsoft Azure. The region's dominance is supported by high IT infrastructure investment, early adoption of cloud services, and a tech-savvy population. Asia-Pacific is also growing rapidly due to increasing cloud adoption in countries like China, Japan, and India, driven by digital transformation and government initiatives.

- By Deployment Model: The Global Cloud Computing Market is also segmented by deployment model into Public Cloud, Private Cloud, and Hybrid Cloud. Hybrid Cloud is emerging as the dominant segment, offering a blend of public and private cloud benefits, including enhanced flexibility, security, and scalability. Businesses prefer hybrid models for sensitive data storage while utilizing the public cloud for non-sensitive operations, reducing costs and improving operational efficiency. Companies like Amazon Web Services (AWS) and Microsoft Azure are leaders in providing seamless hybrid cloud solutions.

Global Cloud Computing Market Competitive Landscape

The Global Cloud Computing Market is dominated by several key players that control significant market share through innovation, strategic partnerships, and investments. These companies offer a variety of services across IaaS, PaaS, and SaaS models, enabling businesses to optimize their operations. The market is highly competitive, with players focusing on expanding their cloud offerings and improving customer service to maintain their competitive edge.

Global Cloud Computing Industry Analysis

Growth Drivers

- Digital Transformation Initiatives: Digital transformation continues to be a primary driver of cloud computing adoption, particularly as organizations increasingly seek to modernize their operations. According to the World Bank, global digital economy spending reached $13 trillion in 2022, with cloud technologies playing a crucial role in supporting these initiatives. Over 75% of businesses in high-income economies are shifting to cloud-native solutions to enhance digital services, such as remote working infrastructure and digital platforms. The World Bank also notes that economies heavily investing in digital infrastructure, like the U.S. and China, are prioritizing cloud computing to improve efficiency.

- Cloud-Native Applications Growth: Cloud-native applications are expanding rapidly as businesses focus on creating scalable, resilient, and efficient systems. The IMF highlights that 90% of businesses in developed markets utilize cloud-native services for application deployment. The number of cloud-native startups in regions such as the EU, U.S., and parts of Southeast Asia increased by 25% between 2022-2024, demonstrating a significant shift toward cloud-first strategies. With over 35,000 cloud-native applications launched globally in 2023, this trend underpins the massive demand for robust, cloud-centric infrastructure.

- Increasing Demand for Data Storage and Scalability: In 2023, global data generation surpassed 120 zettabytes, fueling the demand for scalable cloud storage solutions, as per the World Economic Forum. This demand is driven by businesses seeking efficient methods to store and manage growing data pools, particularly in the financial, healthcare, and retail sectors. In the U.S. alone, cloud storage services are expected to handle over 60 billion data transactions daily, underscoring the critical need for scalable and cost-efficient storage infrastructure. Emerging markets are also catching up, contributing to an increase in data-centric cloud investments.

Market Restraints

- Data Security and Privacy Concerns: With 40% of global cyberattacks in 2023 targeting cloud-based systems, as reported by the World Economic Forum, data security remains a top concern for cloud adopters. Businesses in industries like finance and healthcare, handling sensitive data, face significant risks due to increasingly sophisticated cyber threats. As governments implement stricter data protection laws, such as the European Unions GDPR, ensuring cloud compliance with these regulations is a priority but also a challenge, especially for multinational corporations managing data across borders.

- Regulatory Compliance Complexities: Global cloud service providers must navigate a web of complex regulatory frameworks, particularly concerning data localization. In 2023, over 70 countries, including China and India, implemented data localization laws, as per the IMF. These laws require businesses to store data locally, posing operational challenges for cloud providers who must meet these standards across multiple jurisdictions. This regulatory burden disproportionately impacts global corporations and startups alike, limiting the flexibility of deploying cross-border cloud services efficiently.

Global Cloud Computing Market Future Outlook

Over the next five years, the Global Cloud Computing Market is expected to experience substantial growth, driven by advancements in cloud technology, increasing demand for scalable IT solutions, and the growing adoption of AI, machine learning, and IoT integration within cloud platforms. The shift towards hybrid cloud models and the rising demand from emerging economies will also contribute to this growth. Furthermore, enhanced security measures and compliance frameworks will attract more businesses to adopt cloud solutions in their critical operations.

Market Opportunities

- Growing Adoption of Hybrid Cloud Models: Hybrid cloud models are increasingly popular as businesses seek a balance between public cloud scalability and private cloud security. By 2023, over 60% of global enterprises had adopted a hybrid cloud strategy, according to IMF data. This model allows organizations to manage sensitive workloads on private infrastructure while leveraging the flexibility of public cloud services for less critical tasks. The trend is most notable in sectors such as healthcare, where data protection is paramount, but scalability is still required for large datasets and AI applications.

- Expansion of Cloud Services in Emerging Markets: Emerging markets, particularly in Southeast Asia and Latin America, are becoming hotspots for cloud expansion. According to the World Bank, cloud adoption in these regions grew by 35% in 2023, as businesses seek affordable, scalable solutions to meet growing digital demands. Governments in countries like Brazil and Indonesia are offering incentives for cloud infrastructure development, creating opportunities for service providers to penetrate new markets. These initiatives are critical for enhancing digital economies in regions previously underrepresented in global cloud growth.

Scope of the Report

|

By Service Model |

Infrastructure as a Service (IaaS) |

|

By Deployment Model |

Public Cloud |

|

By Enterprise Size |

Large Enterprises |

|

By End-User Industry |

BFSI (Banking, Financial Services, and Insurance) |

|

By Region |

North America |

Products

Key Target Audience

Cloud Service Providers

Data Center Operators

IT Infrastructure Companies

Telecommunication Companies

Government and Regulatory Bodies (U.S. Federal Trade Commission, European Data Protection Board)

Investor and Venture Capitalist Firms

Large Enterprises (BFSI, Healthcare, Retail)

Managed Service Providers (MSPs)

Companies

Players Mentioned in the Report:

Amazon Web Services (AWS)

Microsoft Azure

Google Cloud

IBM Cloud

Alibaba Cloud

Oracle Cloud

Salesforce

SAP

VMware

Cisco Systems

Rackspace Technology

Tencent Cloud

HCL Technologies

Fujitsu

CenturyLink

Table of Contents

1 Global Cloud Computing Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Cloud Computing Ecosystem

1.4. Market Segmentation Overview

1.5. Cloud Adoption Trends by Region

2 Global Cloud Computing Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Key Market Developments and Milestones

2.3. Market Penetration Analysis

3 Global Cloud Computing Market Analysis

3.1. Growth Drivers

3.1.1. Digital Transformation Initiatives

3.1.2. Cloud-Native Applications Growth

3.1.3. Increasing Demand for Data Storage and Scalability

3.1.4. Multi-Cloud Adoption

3.1.5. Cost Efficiency and Flexibility of Cloud Solutions

3.2. Market Challenges

3.2.1. Data Security and Privacy Concerns

3.2.2. Regulatory Compliance Complexities

3.2.3. High Dependency on Internet Connectivity

3.2.4. Vendor Lock-in and Integration Challenges

3.3. Opportunities

3.3.1. Growing Adoption of Hybrid Cloud Models

3.3.2. Expansion of Cloud Services in Emerging Markets

3.3.3. Increased Adoption in Small and Medium Enterprises (SMEs)

3.3.4. AI, Machine Learning, and IoT Integration

3.4. Trends

3.4.1. Edge Computing and 5G Integration

3.4.2. Rise of Industry-Specific Cloud Solutions

3.4.3. Cloud Automation and DevOps

3.4.4. Increased Focus on Green Cloud Computing

3.5. Government Regulations

3.5.1. Data Localization Policies

3.5.2. Cloud Service Compliance Standards (GDPR, HIPAA)

3.5.3. Cybersecurity Frameworks

3.5.4. Government Incentives for Cloud Adoption

3.6. SWOT Analysis

3.7. Cloud Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

4 Global Cloud Computing Market Segmentation

4.1. By Service Model (In Value %)

4.1.1. Infrastructure as a Service (IaaS)

4.1.2. Platform as a Service (PaaS)

4.1.3. Software as a Service (SaaS)

4.2. By Deployment Model (In Value %)

4.2.1. Public Cloud

4.2.2. Private Cloud

4.2.3. Hybrid Cloud

4.3. By Enterprise Size (In Value %)

4.3.1. Large Enterprises

4.3.2. Small and Medium Enterprises (SMEs)

4.4. By End-User Industry (In Value %)

4.4.1. BFSI (Banking, Financial Services, and Insurance)

4.4.2. Healthcare

4.4.3. IT and Telecom

4.4.4. Retail and E-commerce

4.4.5. Government and Public Sector

4.4.6. Manufacturing

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia-Pacific

4.5.4. Middle East and Africa

4.5.5. Latin America

5 Global Cloud Computing Market Competitive Analysis

5.1. Detailed Profiles of Major Competitors

5.1.1. Amazon Web Services (AWS)

5.1.2. Microsoft Azure

5.1.3. Google Cloud

5.1.4. IBM Cloud

5.1.5. Alibaba Cloud

5.1.6. Oracle Cloud

5.1.7. Salesforce

5.1.8. SAP

5.1.9. VMware

5.1.10. Cisco

5.1.11. Rackspace Technology

5.1.12. Tencent Cloud

5.1.13. HCL Technologies

5.1.14. Fujitsu

5.1.15. CenturyLink

5.2. Cross Comparison Parameters (Revenue, Cloud Offerings, Market Share, Global Presence, Data Center Infrastructure, Client Base, Cloud Security Solutions, Strategic Partnerships)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6 Global Cloud Computing Market Regulatory Framework

6.1. Data Protection and Privacy Regulations

6.2. Compliance Requirements for Cloud Providers

6.3. Cloud Security Certifications

6.4. Legal and Contractual Considerations

7 Global Cloud Computing Future Market Size (In USD Mn)

7.1. Market Forecast and Projections

7.2. Factors Influencing Future Growth

8 Global Cloud Computing Future Market Segmentation

8.1. By Service Model (In Value %)

8.2. By Deployment Model (In Value %)

8.3. By Enterprise Size (In Value %)

8.4. By End-User Industry (In Value %)

8.5. By Region (In Value %)

9 Global Cloud Computing Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Go-to-Market Strategies

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial step involves identifying key factors influencing the Global Cloud Computing Market. Extensive research was conducted using both secondary and proprietary data sources to map the stakeholders in the market, including cloud service providers, IT companies, and end-users. The goal is to assess factors such as service model adoption rates and regional penetration levels.

Step 2: Market Analysis and Construction

In this phase, historical data related to the Global Cloud Computing Market was analyzed to determine market trends, penetration levels, and service adoption across regions. Various sources, including industry reports and government publications, were utilized to collect reliable data.

Step 3: Hypothesis Validation and Expert Consultation

To validate the market hypotheses, consultations were conducted with industry experts through interviews and surveys. These consultations provided insights into market dynamics, competition, and future trends. Feedback from cloud service providers also helped refine the market estimates.

Step 4: Research Synthesis and Final Output

The final phase involved consolidating all the data points and expert insights to provide a comprehensive market analysis. The synthesis of quantitative and qualitative data ensured a detailed, accurate, and actionable market report.

Frequently Asked Questions

01 How big is the Global Cloud Computing Market?

The Global Cloud Computing Market is valued at USD 625 billion, driven by increasing cloud adoption, the rise of digital transformation initiatives, and the growing demand for scalable IT solutions.

02 What are the challenges in the Global Cloud Computing Market?

Challenges include data security concerns, complex regulatory compliance requirements, and vendor lock-in issues. These factors impact the scalability and adoption of cloud solutions across industries.

03 Who are the major players in the Global Cloud Computing Market?

Key players include Amazon Web Services (AWS), Microsoft Azure, Google Cloud, IBM Cloud, and Alibaba Cloud. These companies dominate due to their extensive data center infrastructure, innovative cloud solutions, and global reach.

04 What are the growth drivers of the Global Cloud Computing Market?

The market is driven by the increasing need for cost-efficient, scalable IT solutions, the rising adoption of cloud-native applications, and advancements in AI, machine learning, and IoT. Hybrid cloud models are also fueling growth.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.