Global Cloud Services Market Outlook to 2030

Region:Global

Author(s):Shivani Mehra

Product Code:KROD3760

December 2024

86

About the Report

Global Cloud Services Market Overview

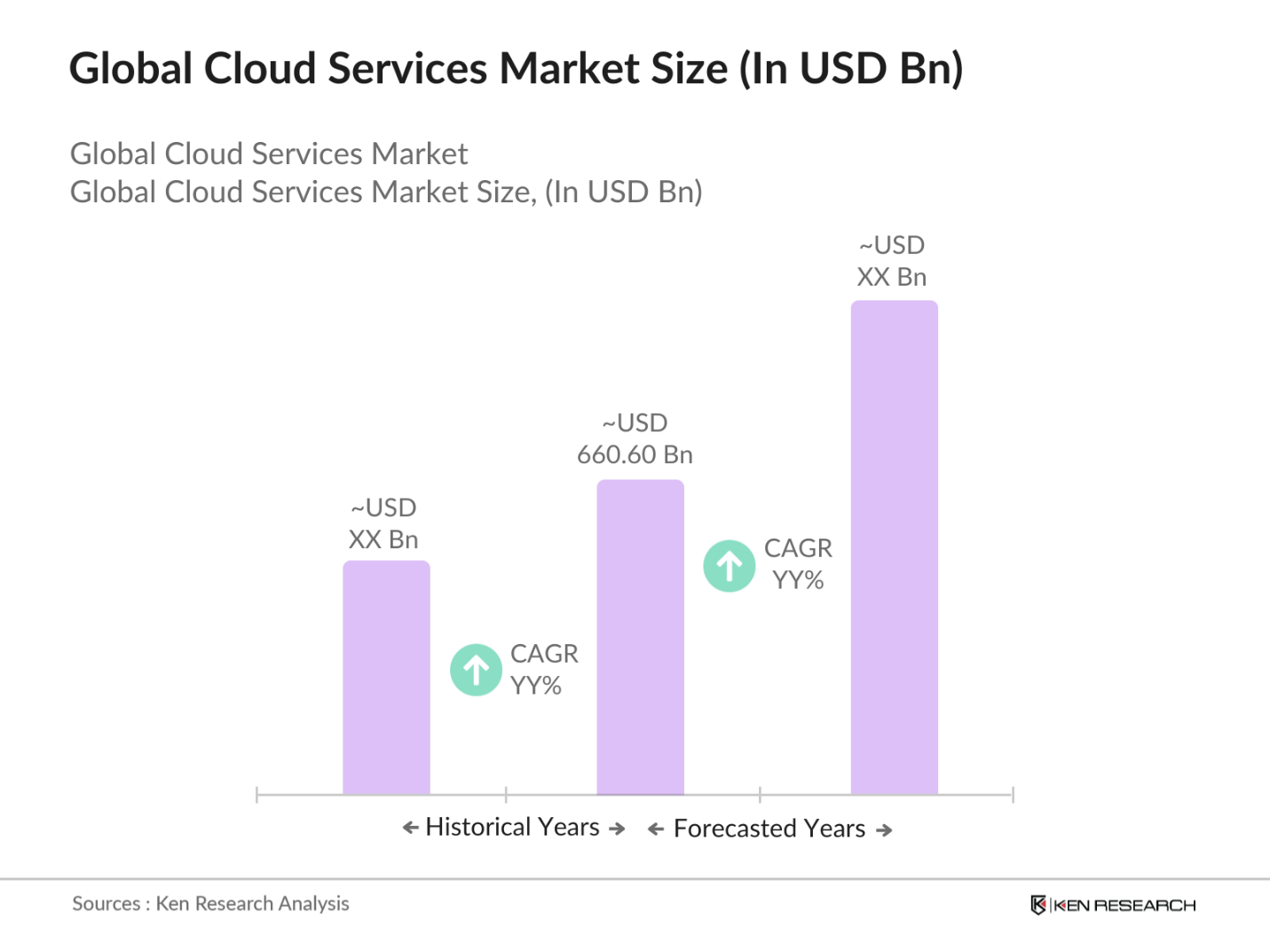

- The global cloud services market is valued at USD660.60 billion in 2023, driven by the increasing adoption of cloud-based solutions across industries such as healthcare, retail, manufacturing, and banking. The rapid growth of the cloud services market is fueled by several factors, including the growing need for flexible, scalable computing resources, the shift to remote work, and the rising demand for data storage solutions. Public cloud adoption continues to expand due to its cost-efficiency, flexibility, and ability to handle vast amounts of data.

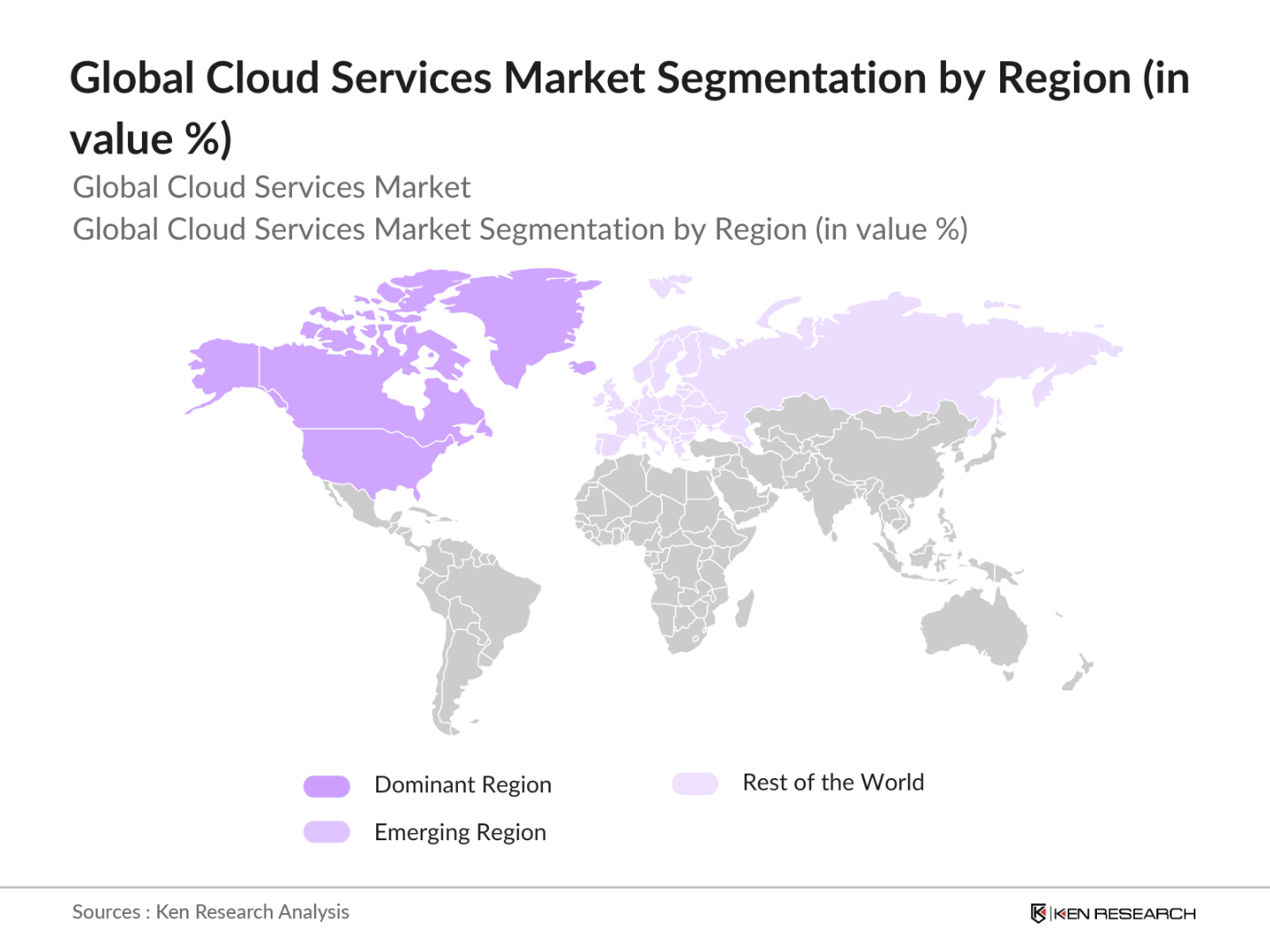

- The United States, followed by China and the United Kingdom, leads the global cloud services market. The dominance of the U.S. can be attributed to its high concentration of tech giants such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud. Additionally, the increasing demand for cloud-based solutions by enterprises and the continued expansion of cloud-based applications across sectors such as healthcare, retail, and finance contribute to the U.S.s leadership in this market. Meanwhile, China has been investing heavily in cloud infrastructure, driven by government-backed initiatives and the rise of domestic cloud providers such as Alibaba Cloud.

- Governments around the world are playing a significant role in the growth of the cloud services market. For example, the U.S. government has launched cloud-first policies, which require federal agencies to adopt cloud solutions where feasible, promoting the use of public and hybrid cloud models. Similarly, the Chinese government has launched the "Internet Plus" initiative to foster the adoption of cloud computing technologies across industries. The European Unions GDPR (General Data Protection Regulation) has also influenced the rise of cloud-based security solutions, as businesses increasingly turn to the cloud to ensure data privacy and compliance.

Global Cloud Services Market Segmentation

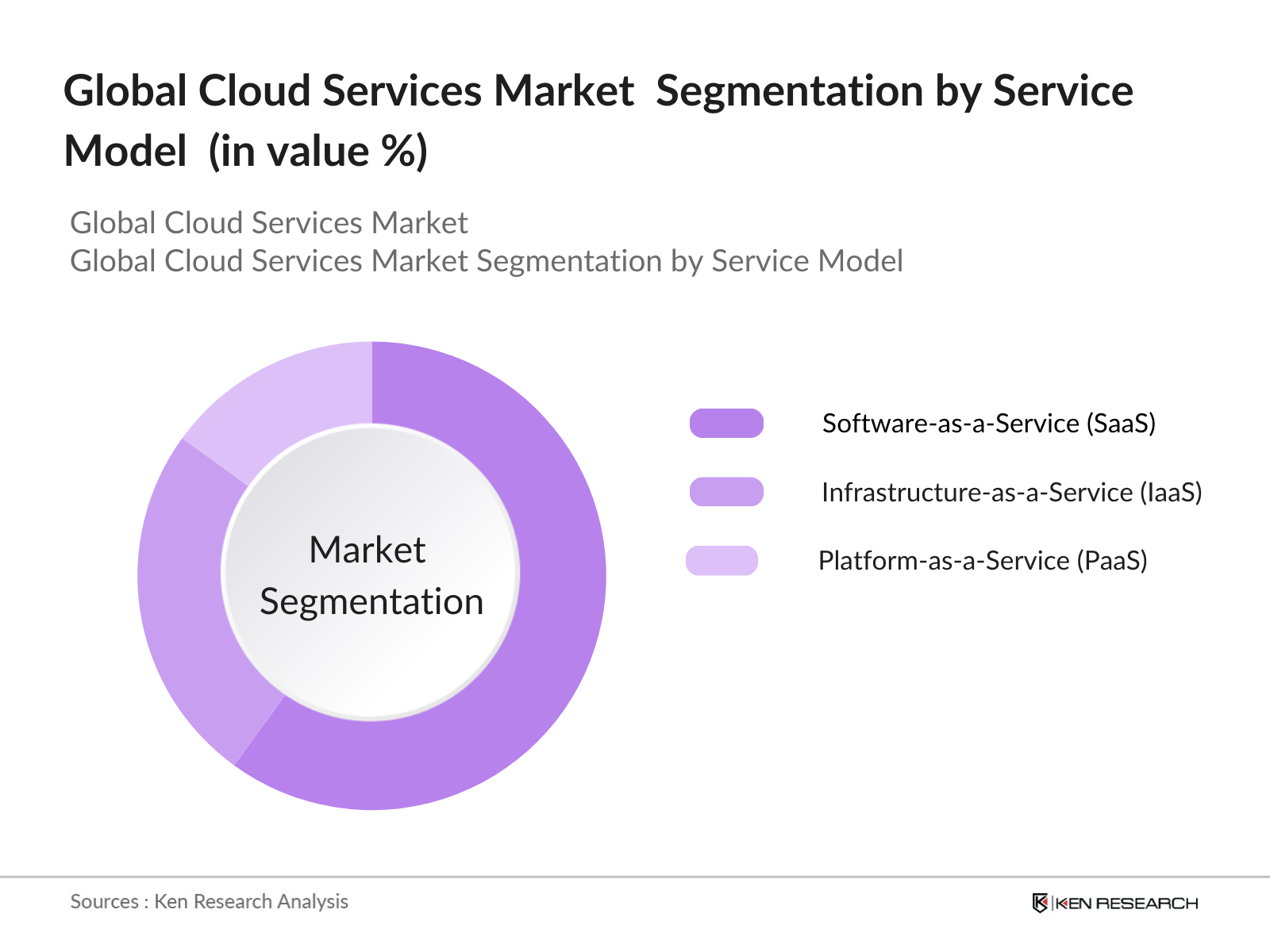

- By Service Model: The global cloud services market is segmented by service model into Infrastructure-as-a-Service (IaaS), Platform-as-a-Service (PaaS), and Software-as-a-Service (SaaS). SaaS dominates the market as businesses increasingly migrate their applications to the cloud. SaaS provides cost-effective solutions for enterprise resource planning (ERP), customer relationship management (CRM), and human resource management (HRM) systems. IaaS enables enterprises to scale their computing resources on-demand without the need to invest in physical infrastructure.

- By Region: The global cloud services market is segmented by region into North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. North America leads the market, driven by the presence of major cloud service providers and high adoption rates of cloud technology. Asia-Pacific is rapidly growing, propelled by digitalization, government initiatives, and the expansion of cloud infrastructure. Europe experiences growth due to GDPR compliance and increasing cloud adoption in key countries.

Global Cloud Services Market Competitive Landscape

The global cloud services market is highly competitive, with major players focusing on expanding their offerings through strategic partnerships, mergers and acquisitions, and technological innovations. The leading companies in the market include Amazon Web Services (AWS), Microsoft Azure, Google Cloud Platform, Alibaba Cloud, and IBM Cloud. These companies dominate the market by offering comprehensive cloud platforms that cater to a wide range of industries, including retail, manufacturing, and healthcare. In addition, they invest heavily in R&D to develop new cloud services and enhance their cloud infrastructure.

|

Company Name |

Establishment Year |

Headquarters |

Revenue (USD bn) |

|

Amazon Web Services |

2006 |

USA |

- |

|

Microsoft Azure |

2010 |

USA |

- |

|

Google Cloud Platform |

2008 |

USA |

- |

|

Alibaba Cloud |

2009 |

China |

- |

|

IBM Cloud |

2011 |

USA |

- |

Global Cloud Services Market Analysis

Global Cloud Services Market Growth Drivers:

- Increasing Adoption of Cloud-Based Solutions Across Industries:

The growing shift towards digital transformation across industries such as retail, healthcare, and finance has led to increased demand for cloud-based solutions. Businesses are leveraging cloud services to improve operational efficiency, reduce costs, and offer better customer experiences. Cloud-based applications, such as CRM, ERP, and data analytics, enable companies to gain real-time insights and make data-driven decisions. - Integration of Artificial Intelligence (AI) and Machine Learning (ML):

The integration of AI and ML into cloud services is a significant growth driver, enabling businesses to harness predictive analytics, automate workflows, and improve decision-making processes. AI-driven cloud solutions such as Amazon SageMaker, Google AI Platform, and Azure Machine Learning are helping enterprises enhance their operational efficiency and deliver personalized experiences to customers. - Growing Demand for Data Storage and Management:

As businesses generate and collect vast amounts of data, the need for scalable and secure data storage solutions continues to grow. Cloud services provide enterprises with flexible storage solutions, such as AWS S3 and Google Cloud Storage, that allow them to store, access, and analyze large datasets efficiently. The rise of big data analytics has further fueled the demand for cloud-based data management platforms.

Global Cloud Services Market Challenges:

- Data Security and Privacy Concerns:Despite the widespread adoption of cloud services, data security and privacy remain major challenges. Businesses, particularly in highly regulated industries such as finance and healthcare, are concerned about the risks associated with storing sensitive data on the cloud. Compliance with data protection regulations, such as GDPR in Europe and CCPA in the U.S., is essential for cloud providers to address these concerns.

- High Costs of Cloud Migration: While cloud services offer long-term cost savings, the initial costs of migrating from traditional on-premises infrastructure to the cloud can be high. This includes costs associated with moving legacy systems, training employees, and adapting business processes to cloud environments. For small and medium-sized enterprises (SMEs), these costs can be prohibitive, limiting their ability to fully leverage cloud solutions.

Global Cloud Services Market Future Outlook

The global cloud services market is expected to grow significantly over the next five years, driven by the increasing adoption of digital transformation strategies, the rise of hybrid work models, and the integration of AI and machine learning into cloud platforms. The Asia-Pacific region, particularly China and India, is projected to witness the fastest growth due to government initiatives and increased investments in cloud infrastructure. Furthermore, the expansion of 5G networks will enable faster and more reliable cloud access, creating new opportunities for cloud service providers. Companies are likely to invest in multi-cloud and hybrid cloud solutions to overcome vendor lock-in and improve flexibility.

Marketing Opportunities

- AI and Machine Learning Integration: The integration of artificial intelligence (AI) and machine learning (ML) into cloud platforms offers significant growth potential. Businesses are increasingly adopting AI-powered tools to automate processes, improve data analytics, and enhance customer experiences. Cloud providers can capitalize on this by offering advanced AI-driven services such as predictive analytics, intelligent automation, and personalized cloud solutions.

- Demand for Multi-Cloud and Hybrid Cloud Solutions: As businesses seek to avoid vendor lock-in and enhance operational flexibility, the demand for multi-cloud and hybrid cloud environments is growing. Cloud providers that offer seamless integration across different platforms will be well-positioned to capture this market. Additionally, businesses are prioritizing solutions that allow them to manage workloads across private and public clouds, offering cloud providers opportunities to develop innovative tools for efficient multi-cloud management.

Scope of the Report

|

By Service Model |

Software-as-a-Service (SaaS) Infrastructure-as-a-Service (IaaS) Platform-as-a-Service (PaaS |

|

By Deployment Type |

Public Cloud Private Cloud Hybrid Cloud |

|

By Organization Size |

Large Enterprises Small and Medium Enterprises (SMEs) |

|

By End-User Industry |

IT and Telecommunications BFSI Healthcare Retail and E-commerce |

|

By Region |

North-East Midwest West Coast Southern States |

Products

Key Target Audience

Cloud Service Providers

Data Storage Providers

Enterprise IT Managers

Government and Regulatory Bodies (e.g., FCC, GDPR)

Investments and Venture Capitalist Firms

Cloud Infrastructure Developers

Managed Service Providers (MSPs)

Telecommunication Companies

Companies

Players Mentioned in the report

Amazon Web Services (AWS)

Microsoft Azure

Google Cloud Platform

Alibaba Cloud

IBM Cloud

Oracle Cloud

SAP Cloud

Salesforce

Tencent Cloud

VMware Cloud

Hewlett Packard Enterprise (HPE)

Adobe Cloud

Dropbox

Rackspace Technology

Citrix Systems

Table of Contents

1. Global Cloud Services Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

1.5. Government Initiatives Supporting Cloud Services Adoption

1.6. Key Market Trends in Cloud Service Models

2. Global Cloud Services Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Cloud Services Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Adoption of Cloud-Based Solutions Across Industries

3.1.2. Shift to Remote Work and Hybrid Work Environments

3.1.3. Integration of AI and ML

3.1.4. Growing Demand for Data Storage and Management

3.2. Market Challenges

3.2.1. Data Security and Privacy Concerns

3.2.2. High Costs of Cloud Migration

3.2.3. Vendor Lock-In and Interoperability Issues

3.1. Growth Drivers

3.1.1. Increasing Adoption of Cloud-Based Solutions Across Industries

3.1.2. Shift to Remote Work and Hybrid Work Environments

3.1.3. Integration of AI and ML in Cloud Services

3.1.4. Growing Demand for Data Storage and Management Solutions

3.2. Market Challenges

3.2.1. Data Security and Privacy Concerns

3.2.2. High Costs of Cloud Migration

3.2.3. Vendor Lock-In and Interoperability Issues

3.3. Opportunities

3.3.1. Growth in Developing Markets

3.3.2. Expansion of Hybrid Cloud Models

3.3.3. Integration with 5G and Edge Computing

4. Global Cloud Services Market Segmentation

4.1. By Service Model (In Value %)

4.1.1. Software-as-a-Service (SaaS)

4.1.2. Infrastructure-as-a-Service (IaaS)

4.1.3. Platform-as-a-Service (PaaS)

4.2. By Deployment Type (In Value %)

4.2.1. Public Cloud

4.2.2. Private Cloud

4.2.3. Hybrid Cloud

4.3. By Region (In Value %)

4.3.1. North America

4.3.2. Europe

4.3.3. Asia-Pacific

4.3.4. Latin America

4.3.5. Middle East & Africa

5. Global Cloud Services Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Amazon Web Services (AWS)

5.1.2. Microsoft Azure

5.1.3. Google Cloud Platform

5.1.4. Alibaba Cloud

5.1.5. IBM Cloud

5.1.6. Oracle Cloud

5.1.7. SAP Cloud

5.1.8. Salesforce

5.1.9. Tencent Cloud

5.1.10. VMware Cloud

5.1.11. Hewlett Packard Enterprise (HPE)

5.1.12. Adobe Cloud

5.1.13. Dropbox

5.1.14. Rackspace Technology

5.1.15. Citrix Systems

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Revenue, Product Portfolio, Strategic Partnerships, R&D Investments)

6. Global Cloud Services Market Regulatory Framework

6.1. Industry Standards and Compliance (e.g., GDPR, CCPA)

6.2. Government Policies Promoting Cloud Adoption

6.3. Compliance Requirements for Cloud Security and Data Protection

7. Global Cloud Services Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Growth

8. Global Cloud Services Future Market Segmentation

8.1. By Service Model (In Value %)

8.2. By Deployment Type (In Value %)

8.3. By Region (In Value %)

9. Global Cloud Services Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Strategic Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial research phase involved identifying the key variables affecting the global cloud services market, including government regulations, data privacy laws, the rise of hybrid cloud models, and the increasing demand for cloud-based storage solutions. This phase included extensive desk research utilizing secondary sources such as industry reports, government publications, and proprietary databases.

Step 2: Market Analysis and Construction

In this phase, historical data from the cloud services market was analyzed, including trends in cloud adoption, sector-specific cloud applications, and regional cloud infrastructure growth. Using this data, market forecasts were developed based on year-on-year growth in cloud demand, infrastructure spending, and SaaS, PaaS, and IaaS growth across regions.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were validated through consultations with experts from leading cloud service providers, regulatory bodies, and technology consultants. Key stakeholders from companies like AWS, Microsoft, and Google were interviewed, providing valuable insights into market growth trajectories, customer needs, and potential challenges in cloud deployment.

Step 4: Research Synthesis and Final Output

The final output was synthesized from both primary and secondary research, including data gathered from expert interviews, cloud adoption case studies, and technological assessments. The report presents validated quantitative data on market size, growth drivers, and challenges, along with qualitative insights into future opportunities in the cloud services market.

Frequently Asked Questions

01. How big is the Global Cloud Services Market?

The global cloud services market is valued at USD 660.60 billion in 2023, driven by the increasing adoption of cloud-based solutions across industries such as healthcare, retail, and manufacturing. The market is expanding rapidly due to the rise of SaaS, IaaS, and PaaS applications.

02. What are the key challenges in the Global Cloud Services Market?

Key challenges include data security and privacy concerns, high costs of cloud migration, and vendor lock-in. These issues hinder some businesses from fully transitioning to cloud services, particularly in regulated industries such as finance and healthcare.

03. Who are the major players in the Global Cloud Services Market?

Major players in the global cloud services market include Amazon Web Services (AWS), Microsoft Azure, Google Cloud Platform, Alibaba Cloud, and IBM Cloud. These companies dominate the market due to their comprehensive product portfolios, global infrastructure, and extensive R&D investments.

04. What is driving growth in the Global Cloud Services Market?

The market is driven by the increasing adoption of digital transformation strategies, the rise of hybrid work models, and the integration of AI and machine learning into cloud platforms. Cloud services are essential for businesses seeking flexible, scalable computing resources.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.