Global Cloud TV Market Outlook to 2030

Region:Global

Author(s):Shreya Garg

Product Code:KROD1130

November 2024

91

About the Report

Global Cloud TV Market Overview

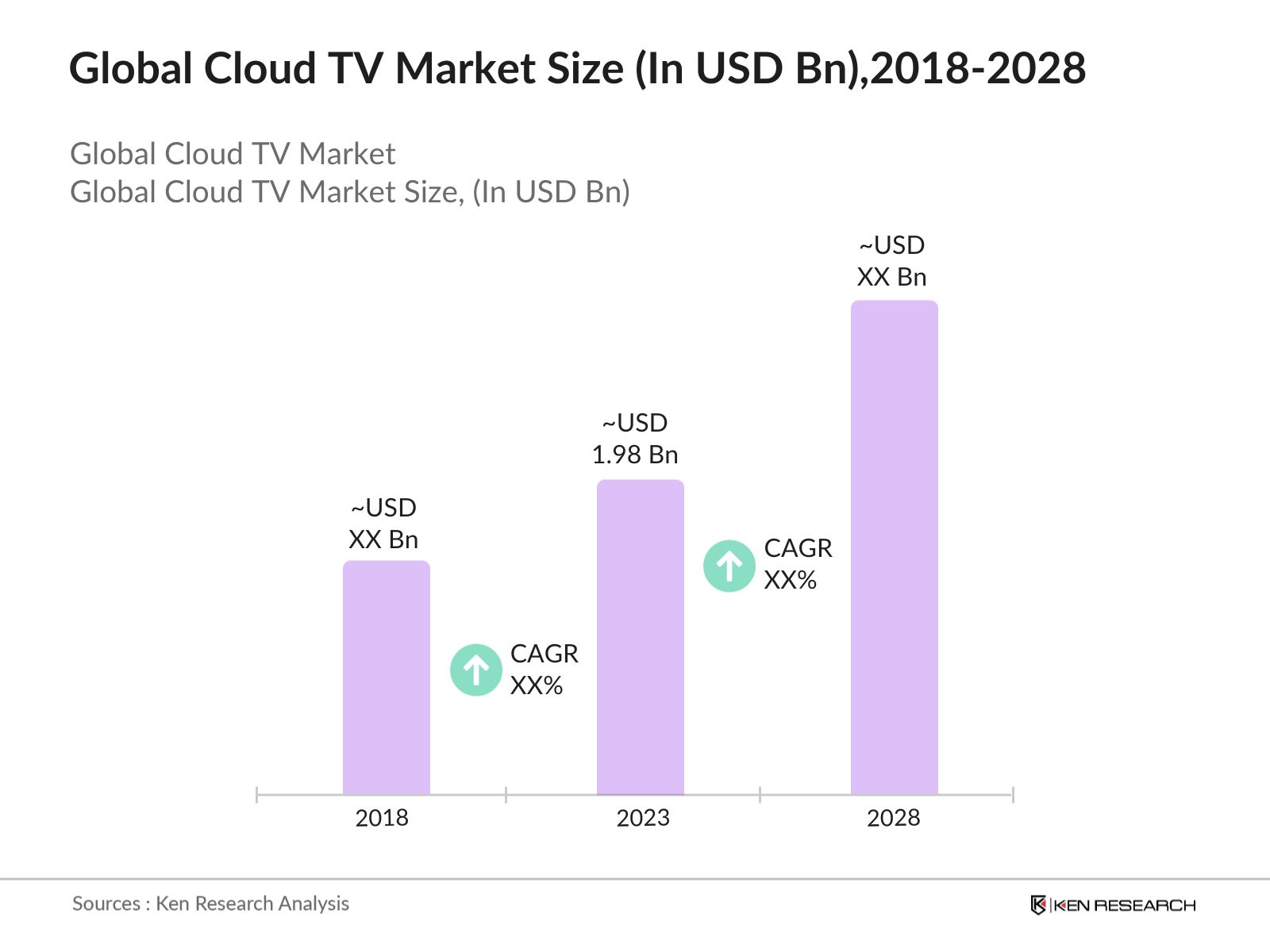

The global Cloud TV market was valued at USD 1.98 Billion in 2023, primarily driven by the growing demand for over-the-top (OTT) content and advancements in cloud computing technologies. The proliferation of smart devices, coupled with rising internet penetration, played a crucial role in accelerating the adoption of Cloud TV services. Content providers are increasingly shifting to cloud-based solutions for their scalability, cost-efficiency, and flexibility, which has further fueled the market's growth.

Several key players dominate the global Cloud TV market, leveraging cloud technologies to offer innovative solutions. Major players include Kaltura, Comcast Technology Solutions, Brightcove, Synamedia, and Ateme. These companies are continuously investing in research and development to enhance their Cloud TV platforms, offering enhanced video quality, personalization, and user experience.

In 2023, Kaltura's collaboration with Bouygues Telecom in France, where Kaltura's technology is being utilized to power a next-generation IPTV and OTT digital TV service. This partnership is expected to enhance Bouygues Telecom's offerings by migrating to a cloud-based operation, providing features like content management and improved user experiences.

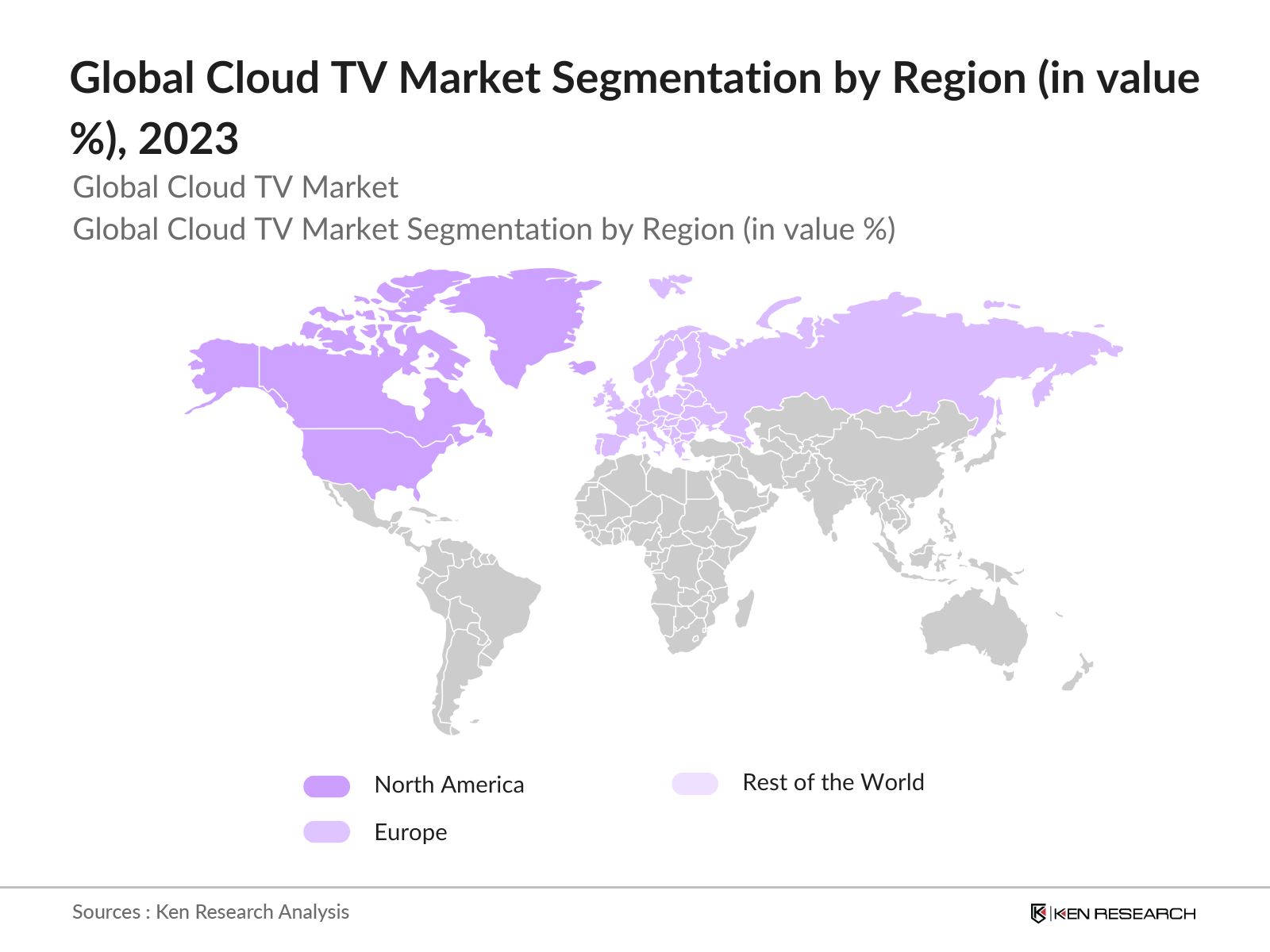

United States, dominates the global market share in 2023. This dominance is attributed to the widespread availability of high-speed internet and the strong presence of key Cloud TV players like Comcast and Kaltura. Additionally, the regions early adoption of OTT services, coupled with consumer preference for personalized content, has solidified its leadership in the market.

Global Cloud TV Market Segmentation

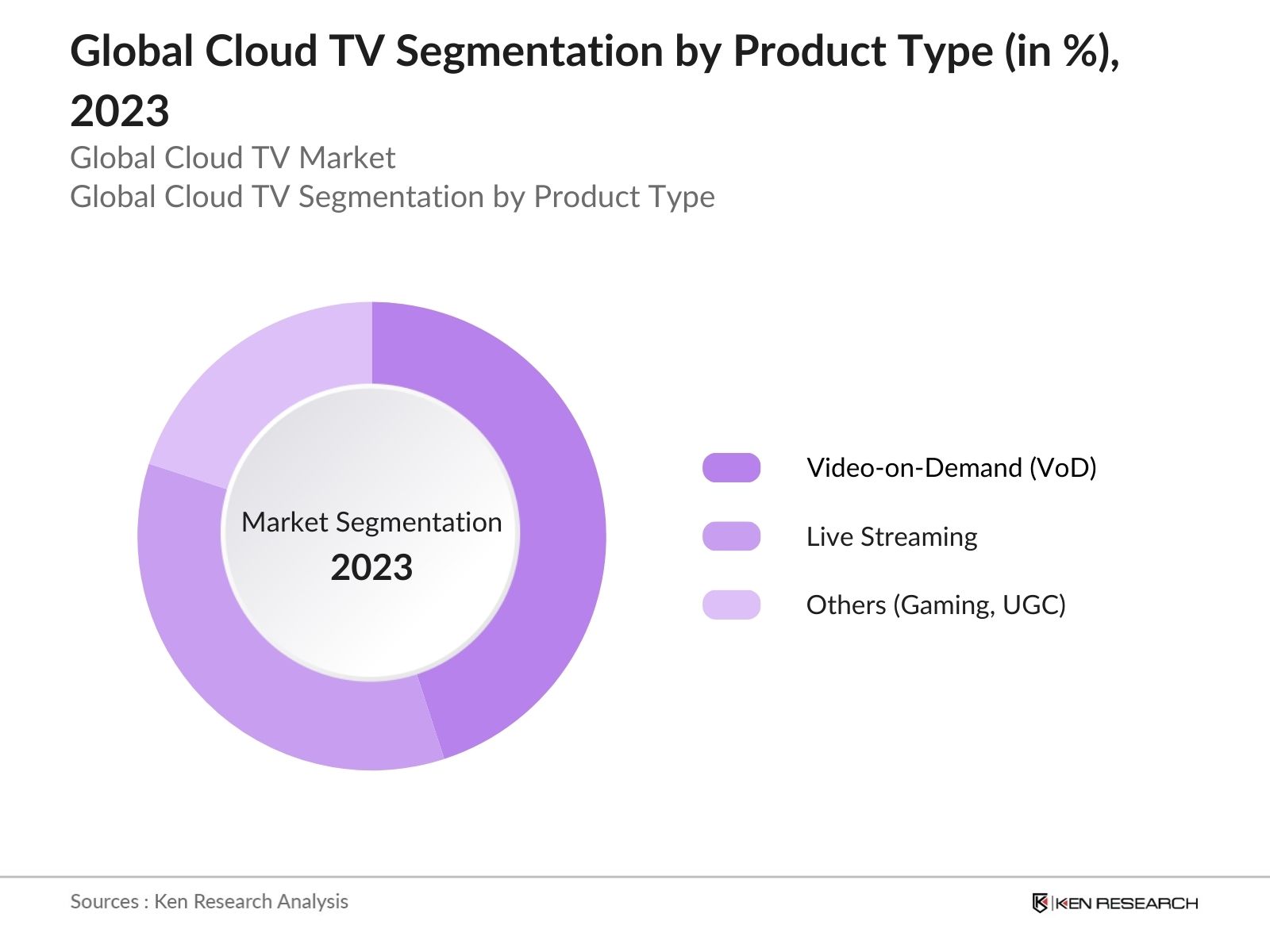

The Cloud TV market is segmented by various factors such as product type, deployment type, region etc.

By Product Type: The market is segmented by product type into live streaming, video-on-demand (VoD), and others (gaming, user-generated content). In 2023, video-on-demand held a dominant market share, primarily due to the increasing consumer demand for flexible viewing options and the growing popularity of platforms like Netflix and Amazon Prime. VoD services allow users to watch content at their convenience, making it the most preferred segment among consumers globally.

By Deployment Mode: By deployment mode, the market is segmented into public cloud, private cloud, and hybrid cloud. In 2023, the hybrid cloud segment dominated with a market share, driven by its ability to offer the scalability of the public cloud while maintaining the security and privacy of a private cloud. Hybrid cloud solutions are particularly popular among broadcasters and OTT service providers, allowing them to manage large volumes of content efficiently while adhering to data protection regulations.

By Region: The market is segmented into North America, South America, Europe, APAC, and MEA. In 2023, North America led the dominant market share, driven by high internet penetration rates and early adoption of Cloud TV solutions. The region is home to several major Cloud TV service providers, such as Comcast and Brightcove, which further contributes to its market dominance.

Global Cloud TV Market Competitive Landscape

|

Company Name |

Establishment Year |

Headquarters |

|---|---|---|

|

Kaltura |

2006 |

New York, USA |

|

Comcast Technology Solutions |

1963 |

Philadelphia, USA |

|

Brightcove |

2004 |

Boston, USA |

|

Synamedia |

2018 |

London, UK |

|

Ateme |

1991 |

Vlizy-Villacoublay, France |

- Synamedias AI-Powered Ad Targeting Technology: In early 2024, Synamedia launched an AI-powered ad-targeting technology, which allows broadcasters to personalize advertisements for individual viewers based on their viewing habits. This technology is expected to generate USD 300 million in additional revenue for Synamedias cloud TV partners by 2025, marking a significant advancement in monetizing cloud TV services.

- Brightcove Partners with Asian Broadcasters: Brightcove is actively involved in the Southeast Asian market and has partnerships with various companies, including recent collaborations with J:COM in Japan and Alibaba Cloud, Brightcove has been focusing on expanding its cloud TV solutions and enhancing its presence in the Asian market, which is experiencing significant growth in OTT services.

Global Cloud TV Industry Analysis

Growth Drivers

- Rising Demand for Streaming Services Across All Devices: The demand for streaming services, especially on multiple devices such as smartphones, tablets, and smart TVs, has surged in 2024. 1.8 billion subscriptionsto video streaming services globally, which require advanced cloud TV solutions for content delivery and scalability. The continued proliferation of smart devices is expected to bolster the demand for cloud TV services, with many telecom companies expanding their offerings to accommodate this growth.

- Expansion of High-Speed Internet Networks: The expansion of high-speed internet infrastructure globally has been a pivotal growth driver for cloud TV. By 2024, more than 4 billion people had access to high-speed broadband connections, enabling seamless access to cloud-based streaming services. Governments worldwide are pushing investments into 5G networks, expected to cover more than half of the global population by 2025, further fueling cloud TV adoption.

- Increase in Content Production for Digital Platforms: As of 2024, digital content production has reached new heights, with huge amount of video content being uploaded daily to platforms that integrate cloud TV services. Major studios and broadcasters have invested in cloud TV infrastructure to facilitate smooth content production and distribution, driving the need for enhanced scalability and real-time content delivery.

Challenges

- Data Privacy and Security Concerns: One of the main challenges faced by the Cloud TV market in 2024 is the growing concern over data privacy and security breaches. According to industry reports, over 200 million user records were compromised through cloud-based streaming platforms in the first half of 2024 alone, leading to increased scrutiny on data management and storage practices. This has resulted in additional pressure on Cloud TV providers to adopt more stringent security measures.

- Infrastructure Gaps in Emerging Markets: While broadband penetration is growing globally, many emerging markets still struggle with insufficient infrastructure. Regions like Africa and Southeast Asia remain without access to reliable high-speed internet, limiting the growth of Cloud TV services. This creates a significant barrier to expansion in these regions, particularly for providers looking to tap into these untapped markets.

Government Initiatives

- 5G Infrastructure Investment: The Federal Communications Commission (FCC) has been actively working to make additional spectrum available for 5G services and has established funds to support 5G deployment, particularly in rural areas. The FCC's 5G Fund for Rural America aims to allocate up to USD 9 billion for advanced 5G mobile wireless services in rural locations. The expansion of 5G networks is expected to enhance various services, including cloud TV and streaming, by providing faster and more reliable connectivity.

- Indias Internet Connectivity for All Initiative: Indias Ministry of Communications, in 2024, launched The BharatNet Phase III project has an estimated budget ofINR 65,000 crore. This budget is part of a largerINR 1.39 lakh croreinitiative aimed at enhancing rural connectivity across India. This initiative is expected to significantly boost cloud TV penetration in rural India, enabling a new wave of digital content consumption across the nation.

Global Cloud TV Market Future Outlook

The global Cloud TV market is projected to grow exponentially by 2028, driven by the growing demand for video streaming services, advancements in AI-powered content recommendation engines, and increased focus on delivering personalized content experiences. The rise in smart home adoption and 5G technology rollouts will further enhance streaming quality and reduce latency, fostering market growth.

Future Trends

- Expansion of AI-Powered Personalization: Over the next five years, cloud TV platforms will increasingly rely on AI-powered personalization tools to enhance user experiences. By 2028, it is projected that over 1 billion users will benefit from AI-based content recommendations, allowing service providers to offer tailored content to individual viewers and significantly improving engagement rates.

- Increased Focus on Regional Content: Localized content is expected to play a critical role in cloud TV market growth over the next five years. By 2028, regional content production will increase to over 1 million hours annually, driven by demand for culturally relevant programming. Cloud TV providers will invest heavily in partnerships with local content creators to capture this market segment effectively.

Scope of the Report

|

By Product Type |

Live Streaming Video-On-Demand (Vod) Others (Gaming, User-Generated Content) |

|

By Deployment Mode |

Public Cloud Private Cloud Hybrid Cloud |

|

By Region |

North America South America Europe APAC MEA |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Investors and VC Firms

Banks and Financial Institutions

Cloud TV Service Providers

Telecom Companies

Internet Service Providers

Smart TV Manufacturers

Media and Entertainment Companies

Digital Advertising Agencies

Government Telecommunications Authorities

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:

Kaltura

Comcast Technology Solutions

Brightcove

Synamedia

Ateme

Huawei Technologies

IBM

Amazon Web Services (AWS)

Google Cloud

Oracle

Akamai Technologies

CenturyLink

Wurl

Mediakind

Harmonic

Table of Contents

1. Global Cloud TV Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Cloud TV Market Size (in USD Bn), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Cloud TV Market Analysis

3.1. Growth Drivers

3.1.1. Demand for Streaming Services

3.1.2. Expansion of High-Speed Internet Networks

3.1.3. Shift Towards Personalized Viewing

3.1.4. Increase in Digital Content Production

3.2. Restraints

3.2.1. Data Privacy and Security Concerns

3.2.2. High Operational Costs

3.2.3. Infrastructure Gaps in Emerging Markets

3.2.4. Content Licensing Challenges

3.3. Opportunities

3.3.1. AI-Powered Content Recommendation

3.3.2. Expansion into Emerging Markets

3.3.3. Partnerships with Content Creators

3.3.4. Growth in 8K Streaming Adoption

3.4. Trends

3.4.1. Rise in Hybrid Cloud Deployments

3.4.2. Use of Machine Learning for Content Optimization

3.4.3. Integration with Smart TV Technology

3.4.4. Increasing Focus on Localized Content

3.5. Government Initiatives

3.5.1. 5G Infrastructure Investments

3.5.2. EU Digital Strategy for Cloud Adoption

3.5.3. Chinas National Digital Infrastructure Plan

3.5.4. Indias BharatNet Connectivity Initiative

3.6. SWOT Analysis

3.7. Ecosystem Stakeholders

3.8. Competitive Ecosystem

4. Global Cloud TV Market Segmentation, 2023

4.1. By Product Type (in Value %)

4.1.1. Video-on-Demand (VoD)

4.1.2. Live Streaming

4.1.3. Gaming and User-Generated Content

4.2. By Deployment Mode (in Value %)

4.2.1. Public Cloud

4.2.2. Private Cloud

4.2.3. Hybrid Cloud

4.3. By Region (in Value %)

4.3.1. North America

4.3.2. Europe

4.3.3. APAC

4.3.4. South America

4.3.5. Middle East & Africa (MEA)

5. Global Cloud TV Market Competitive Landscape

5.1. Detailed Profiles of Major Companies

5.1.1. Kaltura

5.1.2. Comcast Technology Solutions

5.1.3. Brightcove

5.1.4. Synamedia

5.1.5. Ateme

5.2. Cross-Comparison of Key Players

5.2.1. Number of Employees

5.2.2. Headquarters

5.2.3. Year of Establishment

5.2.4. Revenue

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.4.1. Mergers and Acquisitions

5.4.2. Partnerships and Collaborations

5.5. Investment Analysis

5.5.1. Venture Capital Funding

5.5.2. Government Grants

5.5.3. Private Equity Investments

6. Global Cloud TV Market Regulatory Framework

6.1. Data Privacy and Compliance

6.2. Certification Standards

6.3. Cybersecurity Regulations

7. Global Cloud TV Market Future Size (in USD Bn), 2023-2028

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global Cloud TV Market Future Segmentation, 2028

8.1. By Product Type (in Value %)

8.2. By Deployment Mode (in Value %)

8.3. By Region (in Value %)

9. Global Cloud TV Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing and Positioning Initiatives

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step:1 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step:2 Market Building:

Collating statistics on this industry over the years, penetration of marketplaces and service providers ratio to compute revenue generated for Global Cloud TV industry. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step:3 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different Cloud TV companies to validate statistics and seek operational and financial information from company representatives.

Step:4 Research output:

Our team will approach multiple Cloud TV companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from such Cloud TV companies.

Frequently Asked Questions

01 How big is Global Cloud TV Market?

The Global Cloud TV market was valued at USD 1.98 billion in 2023, driven by increasing demand for streaming services, rising internet penetration, and the growing adoption of cloud-based technologies.

02 What are the challenges in Global Cloud TV Market?

Challenges in the global Cloud TV Market include data privacy and security concerns, high operational costs, infrastructure gaps in emerging markets, and content licensing and distribution issues that limit global reach.

03 Who are the major players in the Global Cloud TV Market?

Key players in the global Cloud TV market include Kaltura, Comcast Technology Solutions, Brightcove, Synamedia, and Ateme. These companies dominate due to their innovative cloud TV solutions, strategic partnerships, and strong presence in both developed and emerging markets.

04 What are the growth drivers of Global Cloud TV Market?

The market is driven by the rising demand for streaming services across multiple devices, the expansion of high-speed internet networks globally, a shift toward personalized content viewing, and the increased production of digital content for cloud platforms.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.