Global Coffee Packaging Market Outlook to 2030

Region:Global

Author(s):Mukul

Product Code:KROD6515

December 2024

91

About the Report

Global Coffee Packaging Market Overview

- The global coffee packaging market is valued at USD 827 million, driven by increasing global demand for coffee, especially in emerging markets such as Asia-Pacific and Latin America. This surge in demand is fueled by a rise in coffee consumption, a shift towards premium and specialty coffee products, and the growing trend of on-the-go coffee, particularly in urban areas. Sustainable packaging is becoming a critical component, driven by consumer demand for eco-friendly solutions and stringent environmental regulations in major markets such as Europe and North America.

- Key countries dominating the coffee packaging market include the United States, Brazil, and Germany, driven by high consumption rates and advanced coffee supply chains. The U.S. has a strong coffee culture with significant demand for both ready-to-drink coffee and specialty brands, while Brazils dominance is attributed to its role as the worlds largest coffee producer. In Europe, Germany leads due to its robust retail market and strong emphasis on sustainability in packaging, which aligns with evolving consumer preferences.

- Flexible packaging, such as pouches and bags, is gaining traction due to its lightweight, resealable features and reduced material use. In 2023, flexible packaging accounted for 35% of the coffee packaging market in North America, reflecting a 12% increase over the previous year. Its convenience and ability to preserve product freshness make it popular among both consumers and manufacturers, further driving demand in the coffee packaging sector.

Global Coffee Packaging Market Segmentation

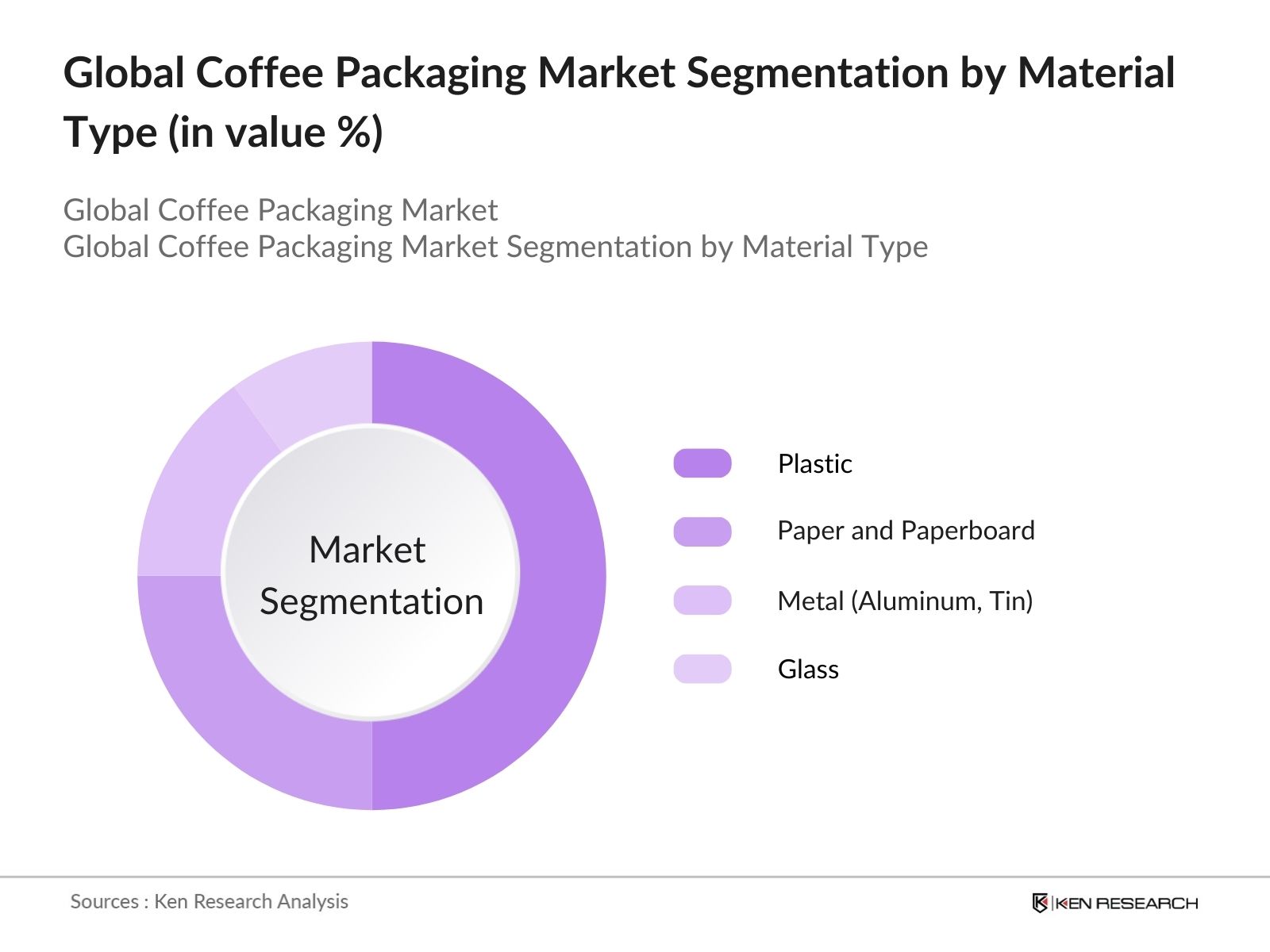

- By Material Type: The global coffee packaging market is segmented by material type into plastic, paper and paperboard, glass, metal (aluminum, tin), and biodegradable packaging. In this segment, plastic holds a dominant market share due to its cost-effectiveness and lightweight properties, making it suitable for a variety of coffee packaging formats, particularly flexible packaging. However, the increasing consumer demand for eco-friendly alternatives is driving the growth of biodegradable packaging in many regions, especially Europe, where strict regulations on plastic usage are in place.

- By Region: The market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. North America holds a dominant position in the global coffee packaging market, largely due to high consumption rates and the established coffee culture in the U.S. and Canada. Europe follows closely, driven by the demand for sustainable packaging solutions in countries like Germany and France. The Asia-Pacific region is expected to witness rapid growth due to increasing coffee consumption in countries such as China and India, where the coffee culture is still expanding.

- By Packaging Type: The market is segmented by packaging type into bags and pouches, bottles and jars, pods and capsules, cans and containers, and wrappers. Bags and pouches have the largest market share, owing to their versatility in packaging different coffee types such as ground coffee, beans, and instant coffee. This packaging format is popular due to its lightweight nature and convenience for both retail and consumer handling. Meanwhile, pods and capsules are growing rapidly, especially in North America and Europe, due to the rising demand for single-serve coffee systems.

Global Coffee Packaging Market Competitive Landscape

The global coffee packaging market is dominated by key players focusing on innovation in packaging materials, sustainability, and expanding product portfolios. Companies are increasingly investing in eco-friendly solutions like recyclable and biodegradable materials to meet growing environmental concerns and regulatory standards. The competition is characterized by both established global firms and emerging regional players that cater to niche markets.

Global Coffee Packaging Industry Analysis

Growth Drivers

- Increasing Global Coffee Consumption: Global coffee consumption continues to grow due to increased urbanization and changing lifestyles, especially in emerging economies. In 2023, global coffee consumption surpassed 170 million 60-kg bags, driven largely by growth in Asia-Pacific countries like China, where coffee demand has doubled since 2020. Data from the International Coffee Organization (ICO) shows coffee imports in these regions have risen significantly, impacting packaging demand for beans and ground coffee. Coffee production in major markets like Brazil and Vietnam also influences the global supply chain, creating robust packaging needs for exports.

- Demand for Sustainable Packaging: The demand for sustainable coffee packaging is a significant growth driver as consumers and governments push for eco-friendly solutions. According to the European Commissions Circular Economy Action Plan, packaging waste accounts for over 30% of municipal solid waste, prompting a shift toward recyclable and biodegradable packaging. In 2022, the use of recycled paper for coffee packaging increased by 15% in Europe and North America. Countries such as Germany and the Netherlands have introduced stricter regulations for packaging, incentivizing manufacturers to switch to sustainable materials.

- Rising Demand for Ready-to-Drink Coffee: The Ready-to-Drink (RTD) coffee market continues to grow, with the global market reaching sales of over 6.5 billion liters by mid-2023, as per data from Euromonitor. This surge is tied to convenience trends among younger consumers and working professionals. The increased consumption of RTD coffee significantly boosts the demand for packaging, especially in countries like the U.S., Japan, and South Korea, which are major consumers. RTD coffee requires specialized packaging solutions like aluminum cans, PET bottles, and cartons, further driving the packaging markets growth.

Market Restraints

- Regulatory Requirements on Packaging Waste: Stricter packaging waste regulations are pressuring coffee packaging manufacturers to reduce their environmental impact. In 2023, the European Union implemented its Packaging and Packaging Waste Directive, targeting a 50% reduction in packaging waste by 2025. Manufacturers face compliance costs associated with waste reduction and recycling mandates. Additionally, the U.S. has introduced state-level legislation requiring producers to bear a portion of recycling costs, increasing operational expenses for coffee packaging companies.

- Limited Adoption of Compostable Packaging Materials: Despite the growing demand for sustainable options, the adoption of compostable packaging remains limited due to high costs and lack of infrastructure. In 2023, compostable packaging materials represented less than 10% of total coffee packaging. The infrastructure needed to process compostable materials is insufficient in many key markets, like the U.S. and parts of Asia. This slow adoption presents a significant challenge for brands looking to align with sustainability trends Without incurring steep costs.

Global Coffee Packaging Market Future Outlook

Over the next five years, the global coffee packaging market is expected to witness significant growth, driven by the rising demand for specialty and premium coffee products, advancements in sustainable packaging technology, and increasing consumer awareness about eco-friendly packaging options. The adoption of smart packaging technologies, such as QR codes and NFC-enabled packaging for improved traceability and customer engagement, is expected to be a key growth driver. Additionally, the expansion of coffee consumption in emerging markets such as China, India, and Brazil will further propel market growth.

Market Opportunities

- Adoption of Biodegradable and Recyclable Packaging: Increased consumer demand for eco-friendly packaging has created opportunities for the adoption of biodegradable and recyclable materials. Governments are incentivizing this shift, with France mandating that by 2023, all single-use packaging must be compostable. Globally, companies have been investing in research and development, leading to a 22% rise in biodegradable packaging solutions for coffee products in Europe, North America, and Asia-Pacific. This presents an opportunity for packaging manufacturers to innovate and capture market share.

- Technological Advancements in Packaging Equipment; Technological advancements, such as automation in packaging machinery, are expected to improve productivity and reduce costs. In 2023, the global market for packaging automation reached $53 billion, supported by increasing demand from the coffee industry. This shift allows for faster packaging processes and improved product shelf life, particularly for premium and RTD coffee products. Advanced packaging solutions such as modified atmosphere packaging (MAP) and vacuum sealing are gaining traction in specialty coffee markets.

Scope of the Report

|

By Material Type |

Plastic Paper and Paperboard Glass Metal (Aluminum, Tin) Biodegradable Packaging |

|

By Packaging Type |

Bags and Pouches Bottles and Jars Pods and Capsules Cans and Containers Wrappers |

|

By Application |

Ground Coffee Whole Bean Coffee Instant Coffee Ready-to-Drink Coffee Single-Serve Coffee |

|

By Distribution Channel |

Supermarkets/Hypermarkets Convenience Stores Online Retailers Specialty Coffee Shops Direct Sales |

|

By Region |

North America Europe Asia-Pacific Latin America Middle East & Africa |

Products

Key Target Audience

Coffee Manufacturers

Coffee Retailers

Packaging Material Suppliers

Coffee Distributors

Packaging Equipment Manufacturers

Investor and Venture Capitalist Firms

Government and Regulatory Bodies (FDA, EU Regulatory Bodies)

Sustainability and Environmental Organizations

Companies

Players Mentioned in the Report:

Amcor Plc

Mondi Group

Berry Global, Inc.

DS Smith Plc

ProAmpac

Smurfit Kappa Group

WestRock Company

Huhtamki Oyj

Sonoco Products Company

Constantia Flexibles Group

Graham Packaging Company

Guala Closures Group

Winpak Ltd.

Crown Holdings, Inc.

Uflex Ltd.

Table of Contents

1 Global Coffee Packaging Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (CAGR, Volume, Value)

1.4. Market Segmentation Overview

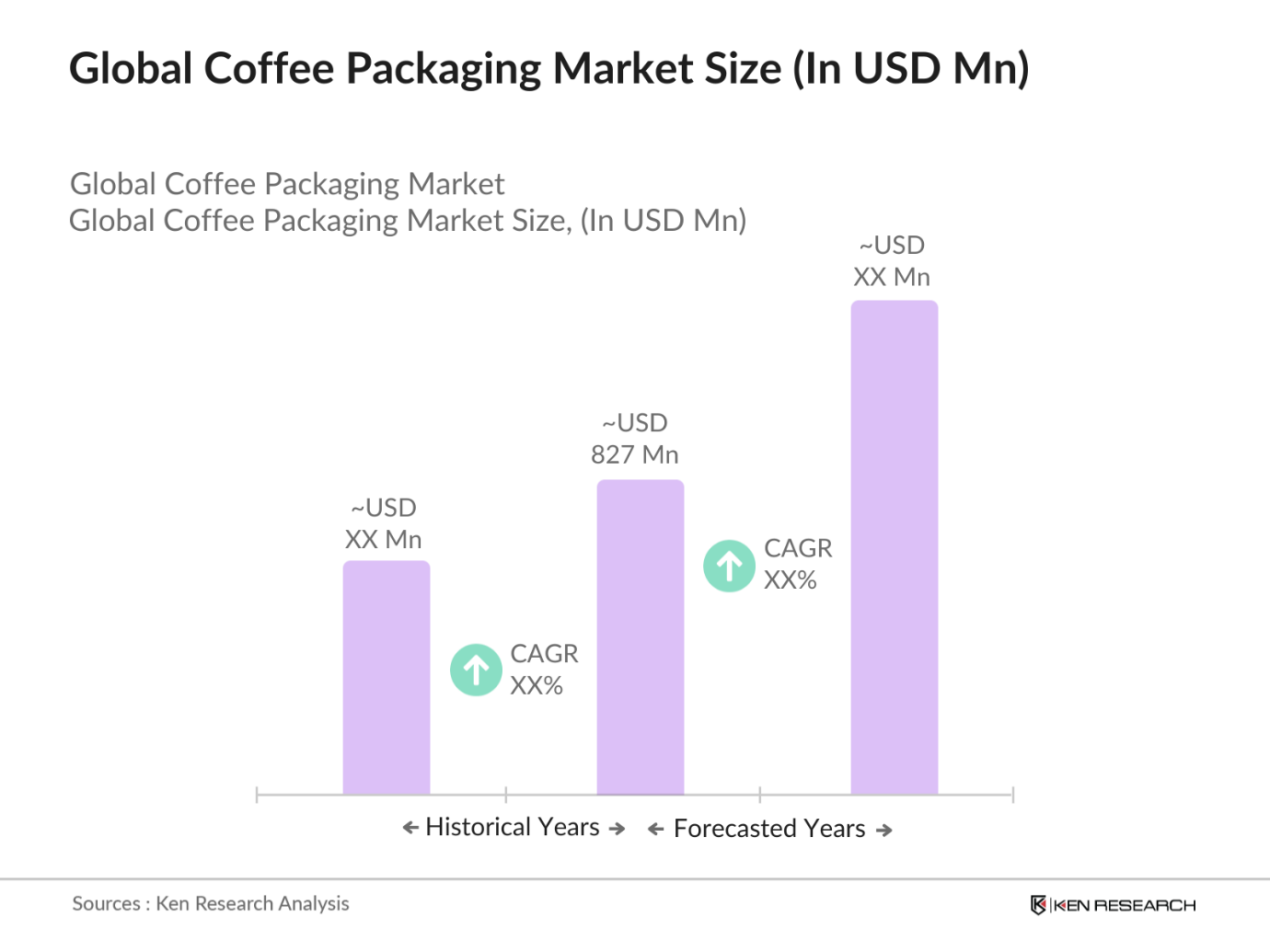

2 Global Coffee Packaging Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3 Global Coffee Packaging Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Global Coffee Consumption

3.1.2. Demand for Sustainable Packaging

3.1.3. Rising Demand for Ready-to-Drink Coffee

3.1.4. Consumer Preference for Premium Coffee Brands

3.2. Market Challenges

3.2.1. High Cost of Raw Materials

3.2.2. Regulatory Requirements on Packaging Waste

3.2.3. Limited Adoption of Compostable Packaging Materials

3.2.4. Supply Chain Disruptions

3.3. Opportunities

3.3.1. Adoption of Biodegradable and Recyclable Packaging

3.3.2. Technological Advancements in Packaging Equipment

3.3.3. Growth in Specialty Coffee and Premiumization

3.3.4. Expansion into Emerging Markets (Asia-Pacific, Latin America)

3.4. Trends

3.4.1. Eco-Friendly Packaging Solutions

3.4.2. Use of Smart Packaging Technology (NFC, QR Codes)

3.4.3. Shift Toward Lightweight Packaging

3.4.4. Increasing Demand for Flexible Packaging

3.5. Government Regulations

3.5.1. Extended Producer Responsibility (EPR) Guidelines

3.5.2. Packaging Waste Reduction Initiatives

3.5.3. Bans on Single-Use Plastic Packaging

3.5.4. Food Safety and Compliance Standards

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Raw Material Suppliers, Manufacturers, Distributors, Retailers)

3.8. Porters Five Forces

3.9. Competition Ecosystem

4 Global Coffee Packaging Market Segmentation

4.1. By Material Type (In Value %)

4.1.1. Plastic

4.1.2. Paper and Paperboard

4.1.3. Glass

4.1.4. Metal (Aluminum, Tin)

4.1.5. Biodegradable Packaging

4.2. By Packaging Type (In Value %)

4.2.1. Bags and Pouches

4.2.2. Bottles and Jars

4.2.3. Pods and Capsules

4.2.4. Cans and Containers

4.2.5. Wrappers

4.3. By Application (In Value %)

4.3.1. Ground Coffee

4.3.2. Whole Bean Coffee

4.3.3. Instant Coffee

4.3.4. Ready-to-Drink Coffee

4.3.5. Single-Serve Coffee

4.4. By Distribution Channel (In Value %)

4.4.1. Supermarkets/Hypermarkets

4.4.2. Convenience Stores

4.4.3. Online Retailers

4.4.4. Specialty Coffee Shops

4.4.5. Direct Sales

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia-Pacific

4.5.4. Latin America

4.5.5. Middle East & Africa

5 Global Coffee Packaging Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. Amcor Plc

5.1.2. Mondi Group

5.1.3. Berry Global, Inc.

5.1.4. DS Smith Plc

5.1.5. ProAmpac

5.1.6. Smurfit Kappa Group

5.1.7. WestRock Company

5.1.8. Huhtamki Oyj

5.1.9. Sonoco Products Company

5.1.10. Constantia Flexibles Group

5.1.11. Graham Packaging Company

5.1.12. Guala Closures Group

5.1.13. Winpak Ltd.

5.1.14. Crown Holdings, Inc.

5.1.15. Uflex Ltd.

5.2 Cross Comparison Parameters (No. of Employees, Headquarters, Market Share, Product Portfolio, Revenue, R&D Expenditure, Manufacturing Capabilities, Sustainability Initiatives)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Private Equity and Venture Capital Investments

6 Global Coffee Packaging Market Regulatory Framework

6.1 Environmental Standards (Material and Waste Management)

6.2 Compliance Requirements (FDA, EU Regulations)

6.3 Certification Processes (ISO Standards, Eco-Certification)

7 Global Coffee Packaging Market Future Market Size (In USD Mn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8 Global Coffee Packaging Market Future Segmentation

8.1 By Material Type (In Value %)

8.2 By Packaging Type (In Value %)

8.3 By Application (In Value %)

8.4 By Distribution Channel (In Value %)

8.5 By Region (In Value %)

9 Global Coffee Packaging Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 White Space Opportunity Analysis

9.4 Marketing and Sales Strategies

Research Methodology

Step 1: Identification of Key Variables

The research began with the identification of major stakeholders within the global coffee packaging market. This included coffee manufacturers, packaging suppliers, and environmental organizations. The goal was to define the key variables influencing market dynamics, such as material type, sustainability trends, and technological innovations.

Step 2: Market Analysis and Construction

This phase involved gathering and analyzing historical data from 2018-2023 to understand trends in packaging materials, customer preferences, and regional market performance. Data was sourced from industry reports, government databases, and proprietary datasets to ensure accuracy and comprehensiveness.

Step 3: Hypothesis Validation and Expert Consultation

Industry experts were consulted through a combination of telephone interviews and online surveys. These experts provided critical insights into the operational challenges and opportunities within the coffee packaging market, validating the research findings and shaping market hypotheses.

Step 4: Research Synthesis and Final Output

The final phase involved synthesizing all collected data and insights into a cohesive market report. This step included direct engagement with coffee packaging manufacturers and suppliers to verify key data points and refine the final market estimates, ensuring a comprehensive analysis.

Frequently Asked Questions

01 How big is the global coffee packaging market?

The global coffee packaging market is valued at USD 827 million, driven by increasing demand for specialty coffee, rising coffee consumption in emerging markets, and the growing trend of eco-friendly packaging.

02 What are the challenges in the global coffee packaging market?

Key challenges include rising raw material costs, stringent regulations on plastic packaging waste, and limited adoption of biodegradable materials. Companies also face difficulties in balancing cost-effectiveness with sustainability.

03 Who are the major players in the global coffee packaging market?

The market is dominated by key players such as Amcor Plc, Mondi Group, Berry Global, and DS Smith. These companies have a global presence and invest heavily in R&D and sustainability initiatives.

04 What are the growth drivers of the global coffee packaging market?

Growth is driven by rising coffee consumption, increasing demand for sustainable packaging solutions, and the shift towards premium and specialty coffee products, particularly in developed regions like North America and Europe.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.