Global Cold Chain Logistics Market Outlook to 2030

Region:Global

Author(s):Nishika

Product Code:KENGR036

October 2024

97

About the Report

Global Cold Chain Logistics Market Overview

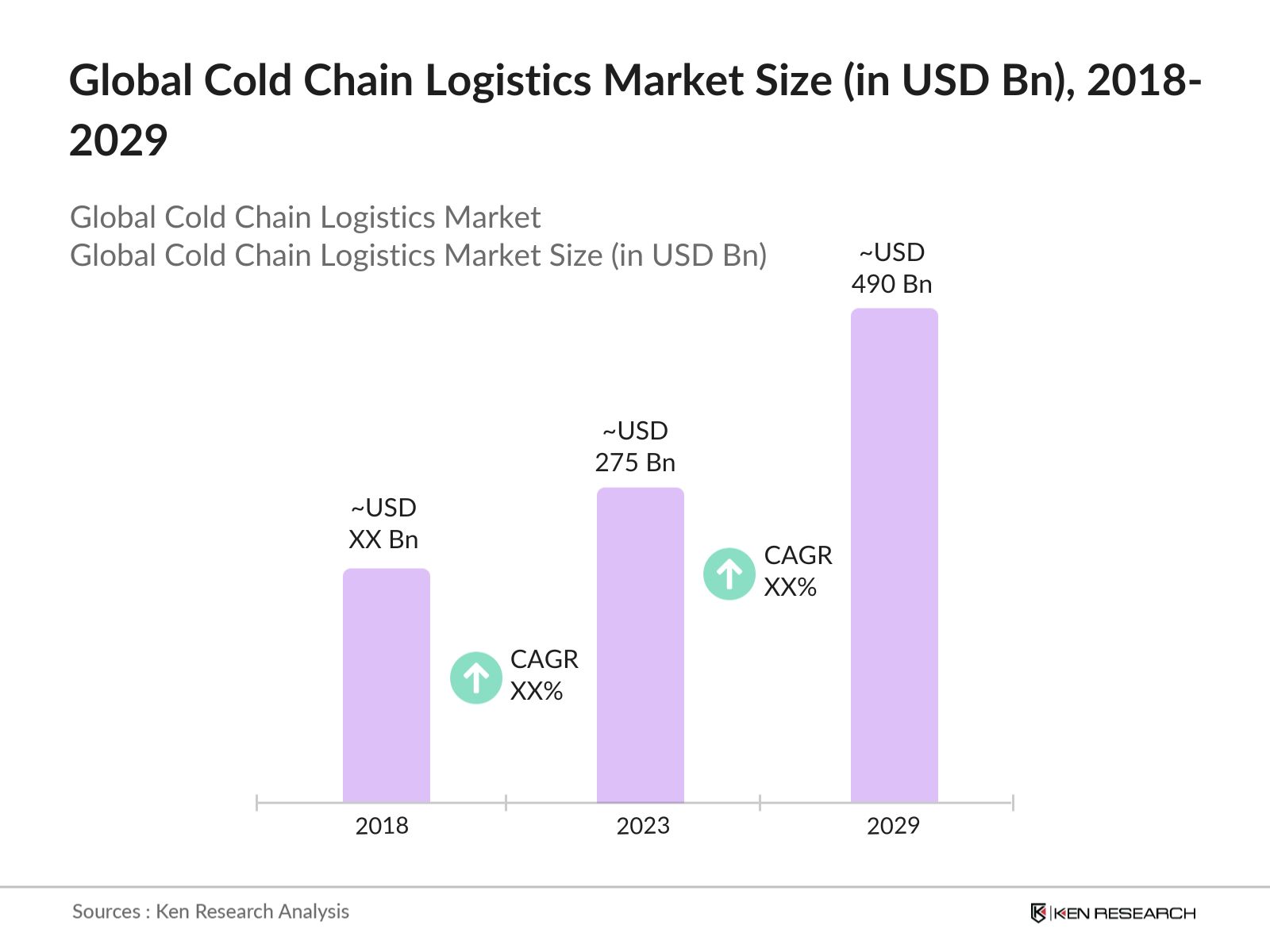

- The global Cold Chain Logistics market was valued at USD 275 Bn in 2023, is driven by increasing demand for perishable food items, pharmaceuticals, and temperature-sensitive products. The rapid growth of e-commerce and globalization of trade have also significantly contributed to the market's expansion. Efficient cold chain logistics ensure the integrity and safety of these products during transportation and storage, thereby boosting market demand.

- Key players in the market include Americold Logistics LLC, Lineage Logistics Holdings, LLC, United Parcel Service (UPS), Deutsche Post DHL Group, and Kuehne + Nagel International AG. These companies have established extensive networks and advanced cold chain solutions, making them dominant in the market. Their strategic acquisitions, expansions, and partnerships enhance their market positions, catering to the growing needs of the cold chain logistics industry globally.

- In October 2023, Americold Logistics, Inc. acquired Safeway Freezers in Vineland, NJ, for approximately $24.0 Mn. The facility offers 6.0 Mn cubic feet of storage space and 16,800 pallet positions. Additionally, the company expanded its operations in Plainville, CT, with a $161.0 Mn investment, increasing its capacity to 12.1 Mn cubic feet and 31,000 pallet positions.

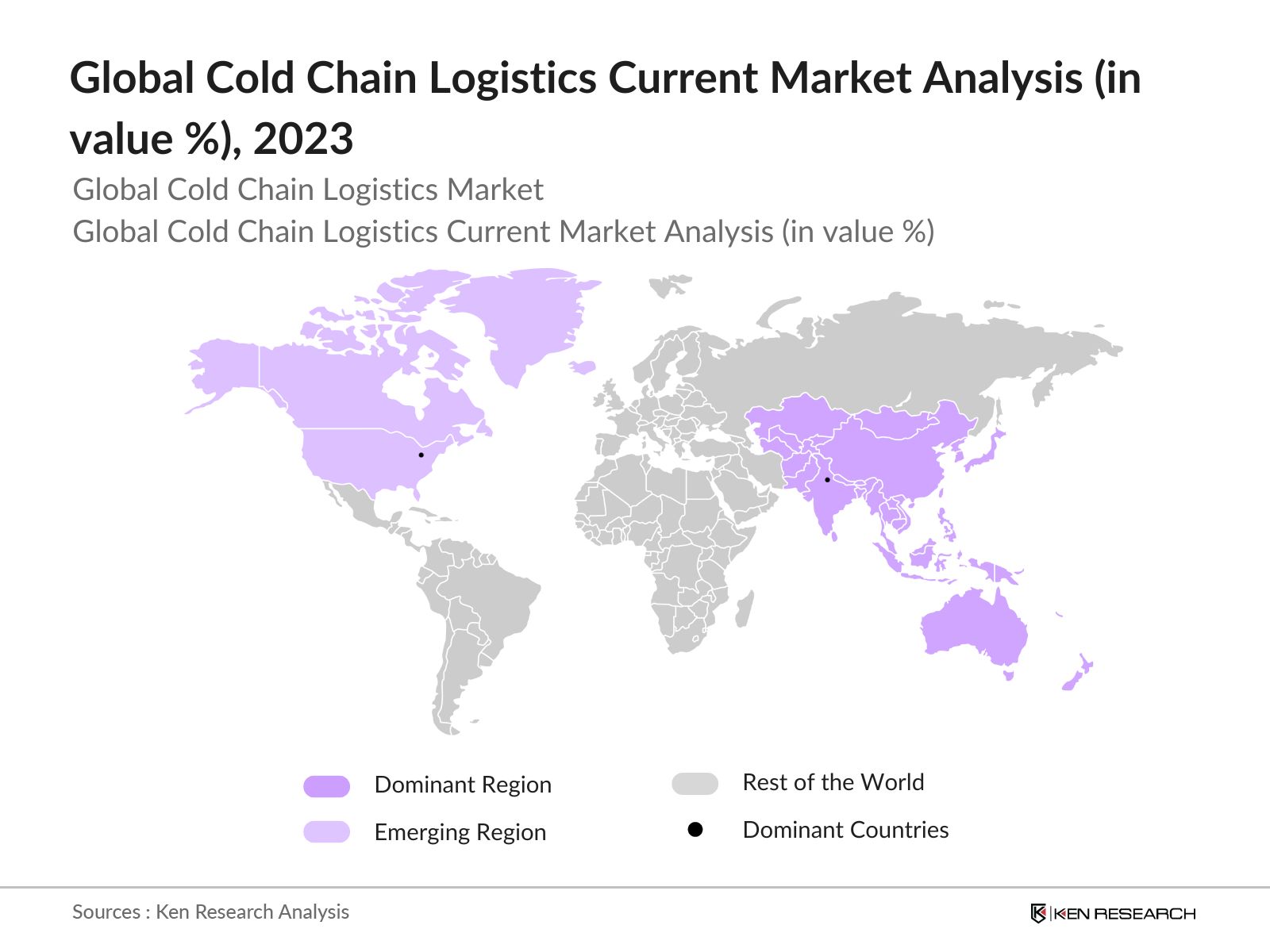

Global Cold Chain Logistics Current Market Analysis

- APAC as dominant region: The Asia-Pacific (APAC) region dominates the cold chain logistics market, driven by robust economic growth, rapid urbanization at 45% in 2023, and rising consumer demand for perishable and FMCG goods. Key factors include substantial investments in infrastructure, such as advanced cold storage facilities and efficient transportation networks. The booming e-commerce sector, projected to reach USD 4.20 trillion in 2024, and the growing preference for high-quality, fresh food products further boost the need for advanced cold chain solutions. With over 4.3 billion people and expanding middle classes in China and India, these countries are central to sector growth. Government initiatives to modernize logistics and enhance supply chain efficiency further strengthen APAC's position.

- North America as emerging region: North America is emerging as a key region in the market due to its robust infrastructure, advanced technology, and high demand for temperature-sensitive goods. The rise of e-commerce and the preference for fresh food over 95% of the population favors it along with dietary guidelines, are driving the need for efficient cold chain solutions. Regulatory advancements, including Nutritional Labeling and Sugar Reduction Regulations, are also boosting market dynamics. Significant investments in cold storage and the adoption of IoT and automation technologies are enhancing efficiency and capacity, solidifying North America's role in the global cold chain logistics sector.

- India as dominant country: India is emerging as a key player in the cold chain logistics market, driven by its vast population of over 1.4 billion and a growing urbanization rate of approximately 36% in 2024. This demographic expansion creates significant demand for temperature-sensitive goods, such as pharmaceuticals, perishable foods, and fresh produce. Government initiatives like the Pradhan Mantri Kisan Sampada Yojana (PMKSY), with a funding boost of INR 4,600 crore until March 2026, and the National Cold Chain Infrastructure Policy, are enhancing infrastructure and providing financial incentives. The adoption of advanced technologies like IoT and blockchain improves real-time monitoring and supply chain transparency.

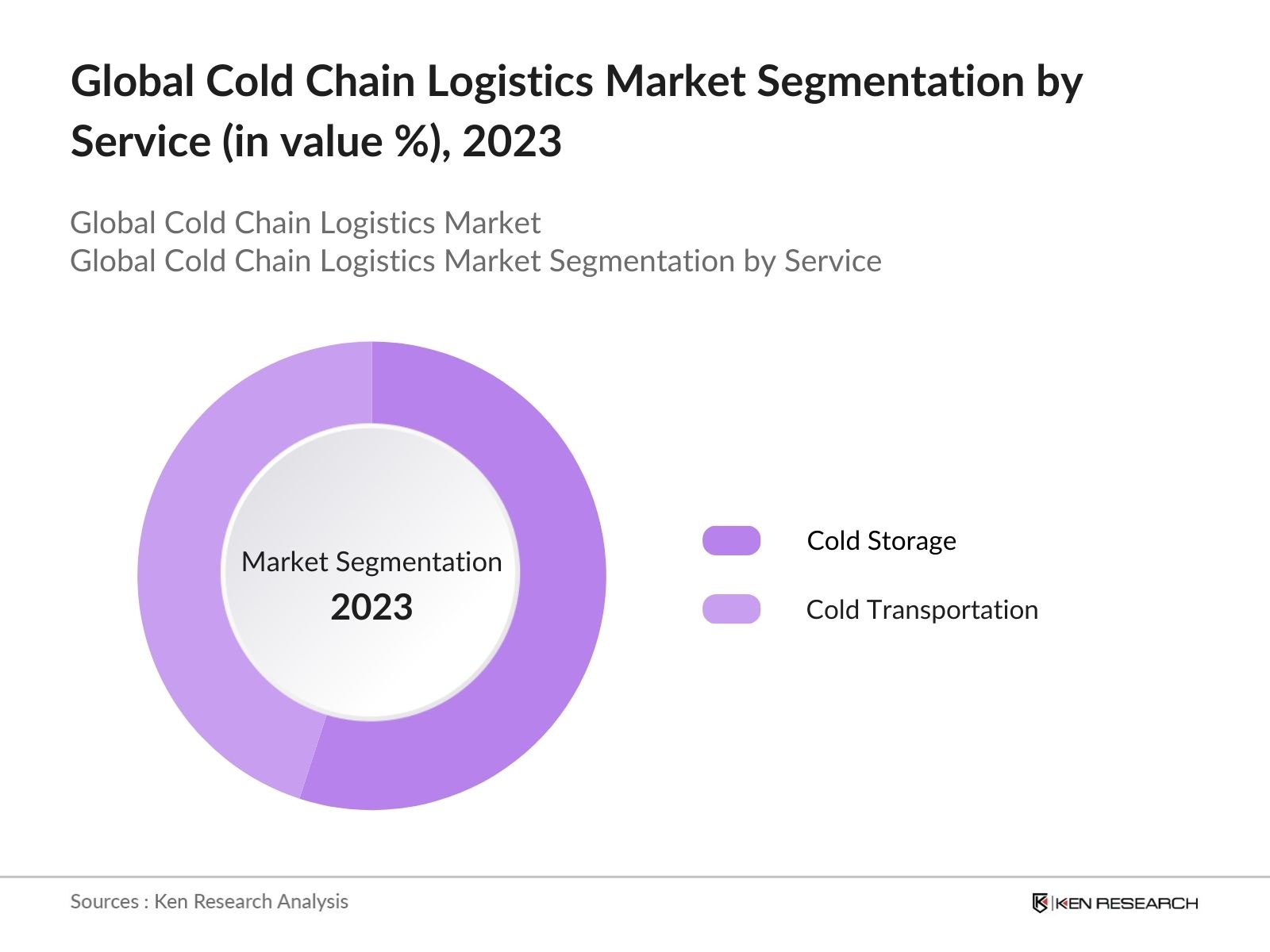

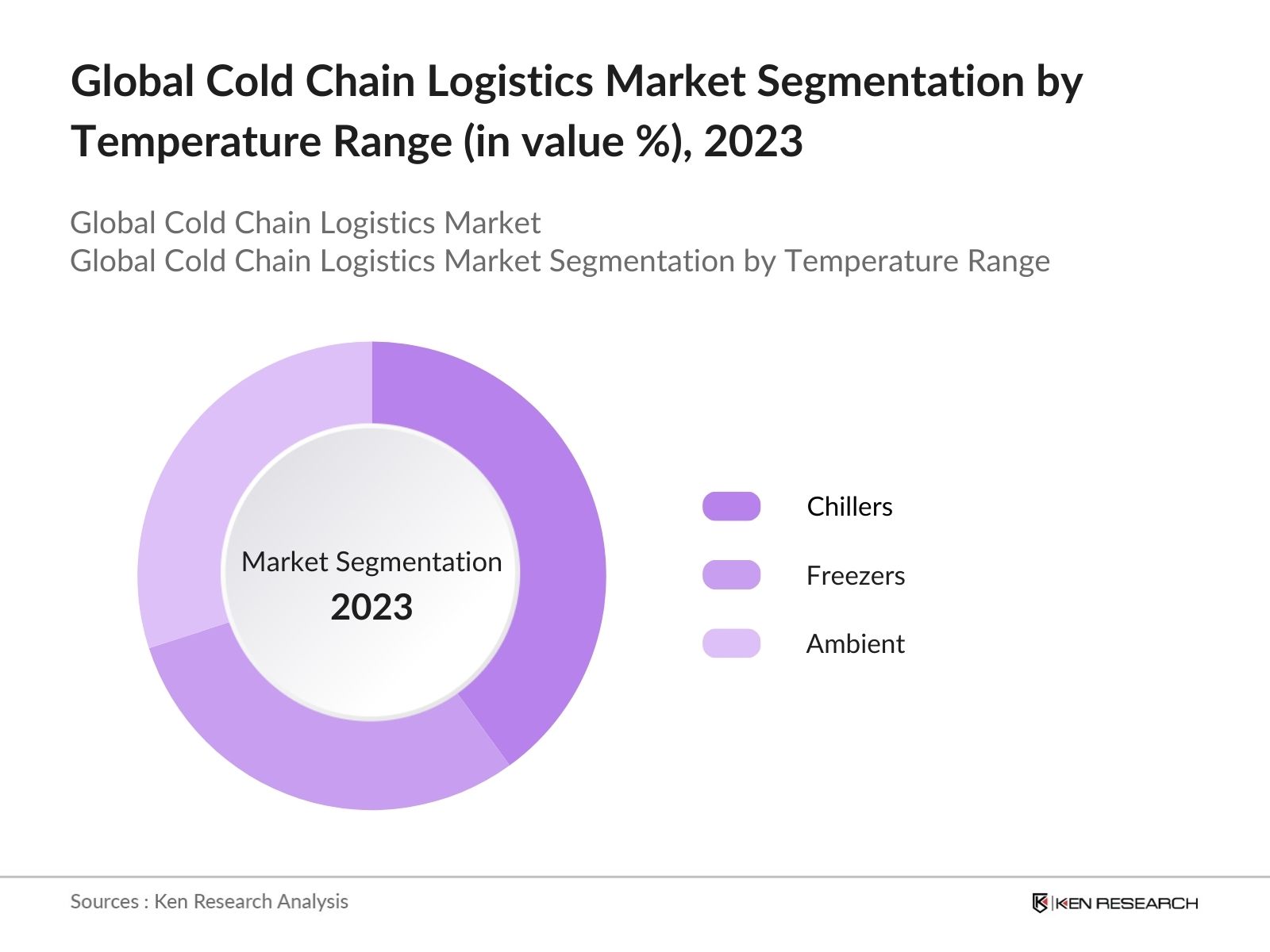

Global Cold Chain Logistics Market Segmentation

The Global Cold Chain Logistics Market can be segmented based on several factors:

By Service: Global Cold Chain Logistics market segmentation by service is divided into cold storage and cold transportation. In 2023, cold storage leads the market, driven by its critical role in preserving the quality of temperature-sensitive goods such as pharmaceuticals and perishables. The rise in demand for fresh foods and pharmaceuticals, coupled with advancements in refrigeration technology and the expansion of e-commerce, fuels the need for extensive cold storage infrastructure. These factors underscore the segments dominance and its essential role in maintaining product safety and supply chain efficiency.

By Temperature Range: In the Global Cold Chain Logistics market segmentation by temperature range is divided into chillers, freezers and ambient. In 2023, the chiller segment dominates the market, due to its crucial role in maintaining temperatures between 2C and 8C for pharmaceuticals, dairy, and perishable foods. The rise in demand for precise temperature control and regulatory compliance drives the prominence of chillers, alongside the growth of the pharmaceutical sector and increased consumption of fresh goods.

By Provider Type: Global Cold Chain Logistics market segmentation by provider type is divided into 3PL and 2PL. In 2023, Third-Party Logistics (3PL) dominates the market, thanks to their comprehensive and scalable solutions for managing storage, transportation, and distribution. Their expertise and technological capabilities in handling temperature-sensitive goods drive their leadership, as businesses increasingly seek outsourced logistics services to ensure efficiency and product integrity.

Global Cold Chain Logistics Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

Global Headcount, 2023 |

|

Lineage Logistics Holding |

2012 |

Novi, Michigan, US |

7200 |

|

Americold Logistics, Inc. |

1903 |

Atlanta, Georgia, US |

14,706 |

|

United States Cold Storage |

1889 |

Voorhees, NJ, US |

3500 |

|

New Cold Coperatief U.A. |

2012 |

Breda, Netherlands |

2000 |

|

Nichirei Logistics Group Inc. |

1942 |

Tokyo, Japan |

5600 |

|

Constellation Cold Logistics |

2019 |

London, UK |

700 |

|

Frialsa Frigorificos S.A. De C.V. |

1986 |

Tlalnepantla, Mxico |

2000 |

|

Interstate Warehousing, Inc. (Tippmann Group) |

1968 |

Fort Wayne, Indiana, US |

700-800 |

- Lineage Logistics Holding expansion and acquisition: Lineage Logistics Holding has recently made significant strides in its global operations. The company launched a new next-generation cold-storage facility in Tauranga, New Zealand, further strengthening its infrastructure. In October 2021, Lineage enhanced its network across Australia through the acquisition of Auscold Logistics. Additionally, on December 14, 2021, Lineage expanded its operations in Savannah, Georgia, significantly boosting its port-centric capabilities.

- United States Cold Storage Expansion in Tennessee: United States Cold Storage has invested $48 million to expand its facility in Covington, Tennessee. The new 315,000 square-foot facility will create 63 new jobs and support Unilever's ice cream production, demonstrating the integration between storage providers and major food manufacturers.

- Nichirei Logistics Group Inc. Merger Announcement: Nichirei Logistics Group Inc. has announced a merger with Eurofrigo B.V. and Thermotraffic Holland B.V. (Netherlands), as well as Kevin Hancock Ltd. and Norish Ltd. (UK), to create a comprehensive end-to-end logistics service provider for the food industry in Europe.

Global Cold Chain Logistics Industry Analysis

Global Cold Chain Logistics Market Growth Drivers:

- Expanding Pharmaceutical Industry: The pharmaceutical industry's reliance on temperature-sensitive products, such as vaccines and biologics, is increasing. This drives the need for sophisticated cold chain logistics to maintain the efficacy of these products throughout the supply chain. The global pharmaceutical cold chain logistics market size was valued at $16.7 billion in 2020 and is expected to reach $25.4 billion by 2027, growing at a CAGR of 6.6% during the forecast period.

- Stringent Regulations and Quality Standards: The Food and Agriculture Organization (FAO) estimates that roughly one-third of all food produced for human consumption is lost or wasted annually. This significant loss underscores the urgent need for stricter regulations, improved infrastructure, and enhanced quality standards within the cold chain industry. By addressing these issues, we can effectively reduce food loss, ensure safety, and promote sustainability in global food supply chains.

- E-commerce Growth: The rapid expansion of e-commerce, especially within the food and grocery sector, is a key market driver fueling the demand for efficient cold chain solutions. As online shopping continues to surge, the need to maintain product integrity throughout storage, transportation, and last-mile delivery has become increasingly critical. This growth is driving investments in advanced cold chain technologies and infrastructure to ensure that perishable goods reach consumers in optimal condition, thereby supporting customer satisfaction and reducing spoilage.

Global Cold Chain Logistics Market Challenges:

- Infrastructure Limitations: In certain regions, the lack of sufficient cold storage and transportation infrastructure presents major obstacles in preserving the quality of perishable goods. This inadequacy can result in increased wastage and deterioration of product integrity, impacting overall efficiency and reliability in the cold chain logistics sector.

- Cost Pressure: The cold chain logistics industry faces substantial cost pressures due to the necessity for specialized equipment, high energy consumption, and rigorous temperature control measures. These factors contribute to elevated operational expenses, which can strain profit margins for companies in this field and challenge their financial sustainability.

Global Cold Chain Logistics Market Government Initiatives:

- U.S. FDAs Food Safety Modernization Act (FSMA): In 2024, the U.S. FDA expanded the FSMA guidelines to enhance the safety of perishable goods during transportation and storage. This initiative mandates strict temperature control and regular monitoring for all cold chain logistics operations. The FSMA aims to reduce foodborne illnesses by ensuring that perishable products maintain their quality from origin to destination. This regulation has driven companies to adopt advanced cold chain technologies and practices.

- Indias National Cold Chain Development Program: The Indian government launched the National Cold Chain Development Program in 2023, aiming to strengthen the cold chain infrastructure across the country. This program includes financial incentives for building cold storage facilities, purchasing refrigerated transport vehicles, and implementing modern cold chain technologies. The initiative is expected to reduce post-harvest losses by 40%, significantly benefiting the agricultural sector and boosting the cold chain logistics market.

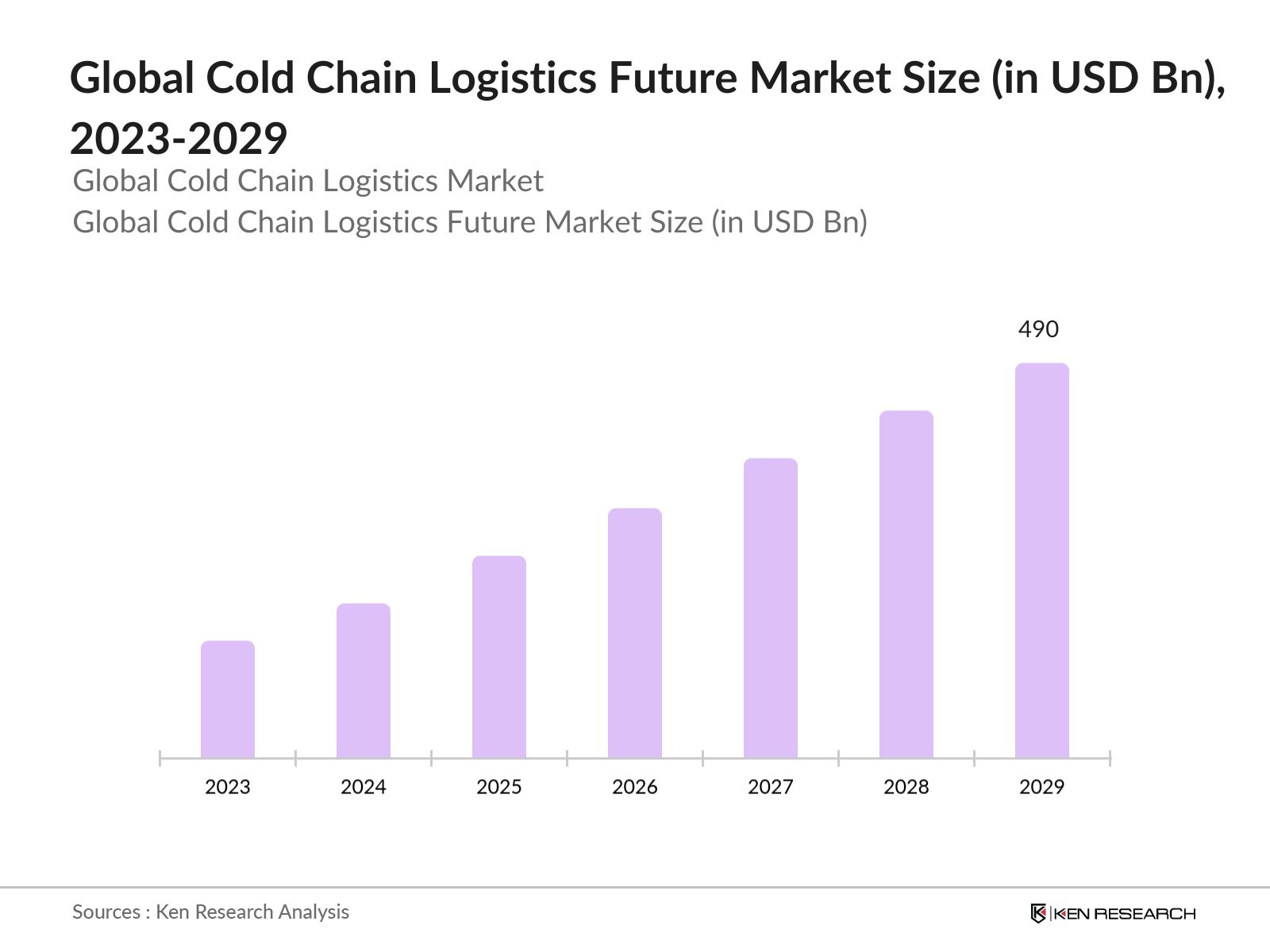

Global Cold Chain Logistics Future Market Outlook

Market is expected to reach USD 490 Bn by 2029 driven by increasing demand for temperature-sensitive products, advancements in cold chain technologies, and supportive government initiatives. By 2029, the market is expected to witness substantial investments in infrastructure development and technological innovations, enhancing the efficiency and sustainability of cold chain operations worldwide.

Future Market Trends

- Shift Towards Sustainable Practices: The cold chain industry will increasingly emphasize sustainability, with initiatives such as using eco-friendly refrigerants, energy-efficient equipment, and renewable energy sources expected to reduce the environmental impact of cold chain operations.

- Focus on Last-Mile Delivery: As e-commerce and direct-to-consumer models continue to grow, there will be a heightened focus on optimizing last-mile delivery in the cold chain. This will likely include the adoption of electric vehicles, micro-fulfillment centers, and delivery lockers to ensure timely and temperature-controlled deliveries.

Scope of the Report

|

By Region |

North America Europe APAC Latin America MEA |

|

By Service |

Cold Storage Cold Transportation |

|

By Temperature Range |

Chillers Freezers Ambient |

|

By Provider Type |

3PL 2PL |

|

By Application |

Meat and Seafood Fruits and Vegetables Dairy & Frozen Desserts Processed foods and Nutrition Pharma, Life Sciences and Chemicals Bakery & Confectionary Others |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Logistics Service Providers

Cold Chain Service Providers

E-Commerce Companies

Retail Chains

Food and Beverage Companies

Pharmaceutical Companies

Banks and Financial Institution

Investors and VCs

Regulatory Bodies (FDA, EMA and IATA)

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2029

Companies

Players Mentioned in the Report:

Lineage Logistics Holding

Americold Logistics, Inc.

United States Cold Storage

NewCold Coperatief U.A.

Nichirei Logistics Group Inc.

Constellation Cold Logistics

Frialsa Frigorificos S.A. De C.V.

Interstate Warehousing, Inc. (Tippmann Group)

FreezPak Logistics

SuperFrio Logstica Frigorificada

Vertical Cold Storage

Snowman Logistics Ltd

Table of Contents

1. Executive Summary

1.1 Global Logistics Market

1.2 Global Cold Chain Logistics Market

2. Global Overview

2.1 Overview of Global Economics

2.2 Overview of Global Logistics Industry

2.3 Global Logistics (Freight Forwarding, Warehousing, 3PL, CEP, Cold Chain and Value-Added Services) Revenue

2.4 Global Cold Chain Logistics Infrastructure

3. Global Cold Chain Logistics Market Overview

3.1 Ecosystem

3.2 Value Chain

3.3 Case Study

3.4 Taxonomy

4. Global Cold Chain Logistics Market Size (in USD Bn), 2018-2023

5. Global Cold Chain Logistics Market Segmentation (in value %), 2018-2023

5.1 By Region (North America, Europe, APAC, Latin America and MEA) in value %, 2018-2023

5.2 By Service (Cold Storage and Cold Transportation) in value%, 2018-2023

5.3 By Temperature Range (Chillers, Freezers and Ambient) in value %, 2018-2023

5.4 By Provider Type (3PL and 2PL) in value %, 2018-2023

5.5 By Application (Meat & Seafood, Fruits & Vegetables, Dairy & Frozen Desserts, Processed Foods & Nutrition, Pharma, Life Sciences & Chemicals, Bakery & Confectionary and Others) in value %, 2018-2023

6. Global Cold Chain Logistics Market Competition Landscape

6.1 Market Share Analysis

6.2 Market Heat Map Analysis

6.3 Market Cross Comparison

6.4 Comparison Matrix

6.5 Investment Landscape

7. Global Cold Chain Logistics Market Dynamics

7.1 Growth Drivers

7.2 Challenges

7.3 Trends

7.4 Case Studies

7.5 Strategic Initiatives

8. Global Cold Chain Logistics Future Market Size (in USD Bn), 2023-2029

9. Global Cold Chain Logistics Future Market Segmentation (in value %), 2023-2029

9.1 By Region (North America, Europe, APAC, Latin America and MEA) in value %, 2023-2029

9.2 By Service (Cold Storage and Cold Transportation) in value%, 2023-2029

9.3 By Temperature Range (Chillers, Freezers and Ambient) in value %, 2023-2029

9.4 By Provider Type (3PL and 2PL) in value %, 2023-2029

9.5 By Application (Meat & Seafood, Fruits & Vegetables, Dairy & Frozen Desserts, Processed Foods & Nutrition, Pharma, Life Sciences & Chemicals, Bakery & Confectionary and Others) in value %, 2023-2029

10. Analyst Recommendations

Research Methodology

Step 1: Market Hypothesis Formation and Data Collection

We initiated the research by framing a hypothesis about the global cold chain market based on an analysis of existing industry factors. We utilized both public and proprietary databases, including government reports from authorities like the FDA and the Department of Agriculture, as well as official company reports and press releases from major cold chain players.

Step 2: Market Confirmation and Trend Analysis

Our objective was to confirm key market metrics including revenues, margins, segmentations, pallet sizes, occupancy rates, and reefer truck usage. We also evaluated future projections to gain insights into current and emerging market trends. This involved validating data on market performance and assessing the impact of various factors on market dynamics.

Step 3: Revenue and Operational Analysis

We employed a bottom-top approach to calculate the revenue of major players by analyzing their share in transportation and warehousing sectors. We used proxy modeling for cold storage and transportation by estimating total pallet sizes, occupancy rates, and average pricing. Additionally, we conducted disguised interviews with managers to gather insights on operational and financial performance, ensuring the accuracy of the data shared by top management.

Frequently Asked Questions

01. How big is Global Cold Chain Logistics Market?

The global Cold Chain Logistics market was valued at USD 275 Bn in 2023, is driven by increasing demand for perishable food items, pharmaceuticals, and temperature-sensitive products. The rapid growth of e-commerce and globalization of trade have also significantly contributed to the market's expansion.

02. What are the challenges in Global Cold Chain Logistics Market?

Challenges in the global cold chain logistics market include high operational costs, regulatory compliance and safety standards, and infrastructure limitations in developing regions. These issues can hinder market growth and efficiency.

03. Who are the major players in Global Cold Chain Logistics Market?

Key players in the global cold chain logistics market include Americold Logistics LLC, Lineage Logistics Holdings LLC, United Parcel Service (UPS), Deutsche Post DHL Group, and Kuehne + Nagel International AG. These companies lead the market due to their extensive networks and advanced cold chain solutions.

04 What are the growth drivers of the Global Cold Chain Logistics Market?

The global cold chain logistics market is driven by the increasing demand for temperature-sensitive pharmaceuticals, the expansion of e-commerce and online grocery sales, and the growth in global trade of perishable goods. These factors boost the need for efficient cold chain logistics solutions.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.