Global Colocation Datacenter Market Outlook to 2030

Region:Global

Author(s):Anshika and Anurag

Product Code:KENGR014

September 2024

81

About the Report

Global Colocation Datacenter Market Overview

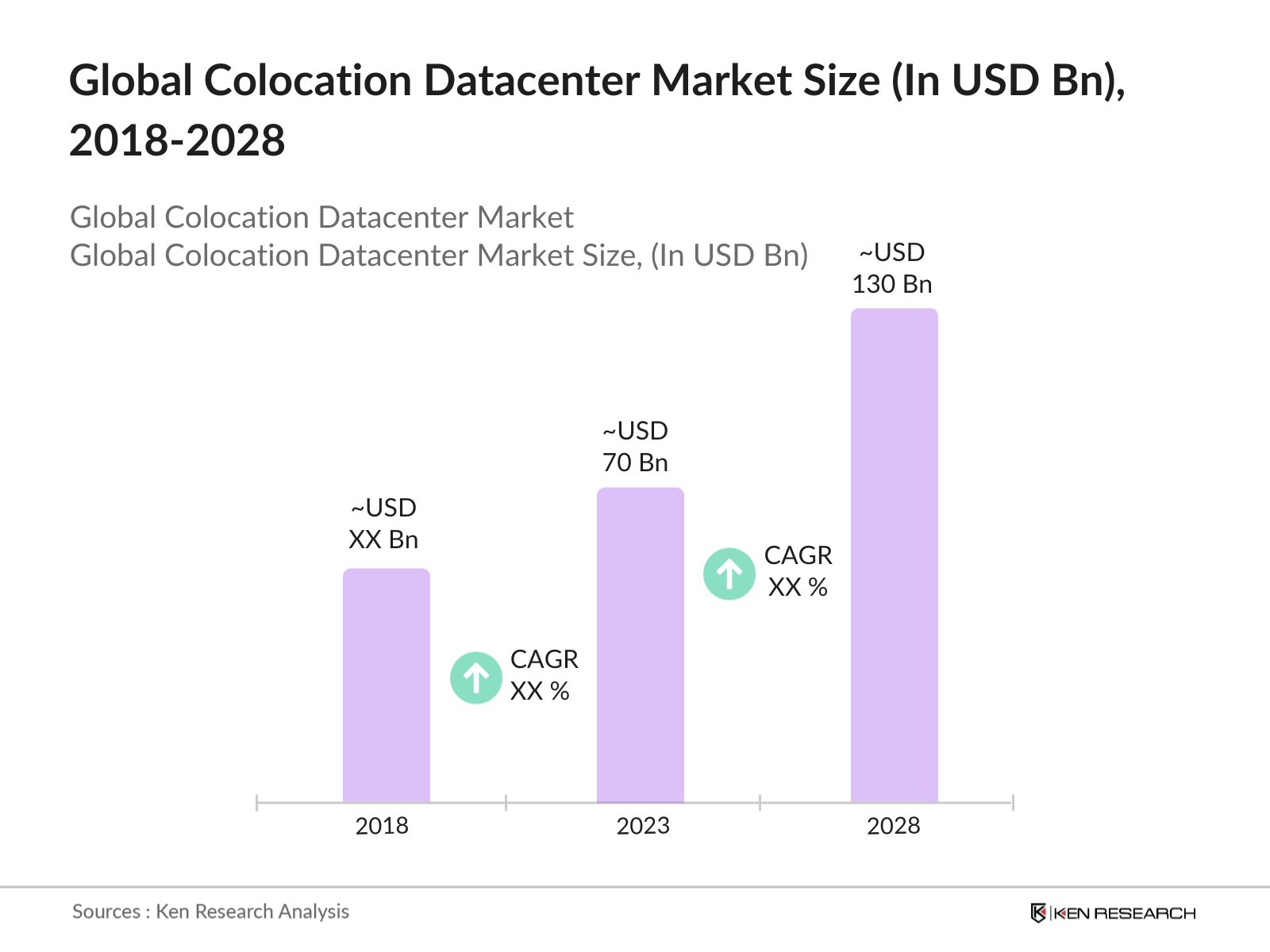

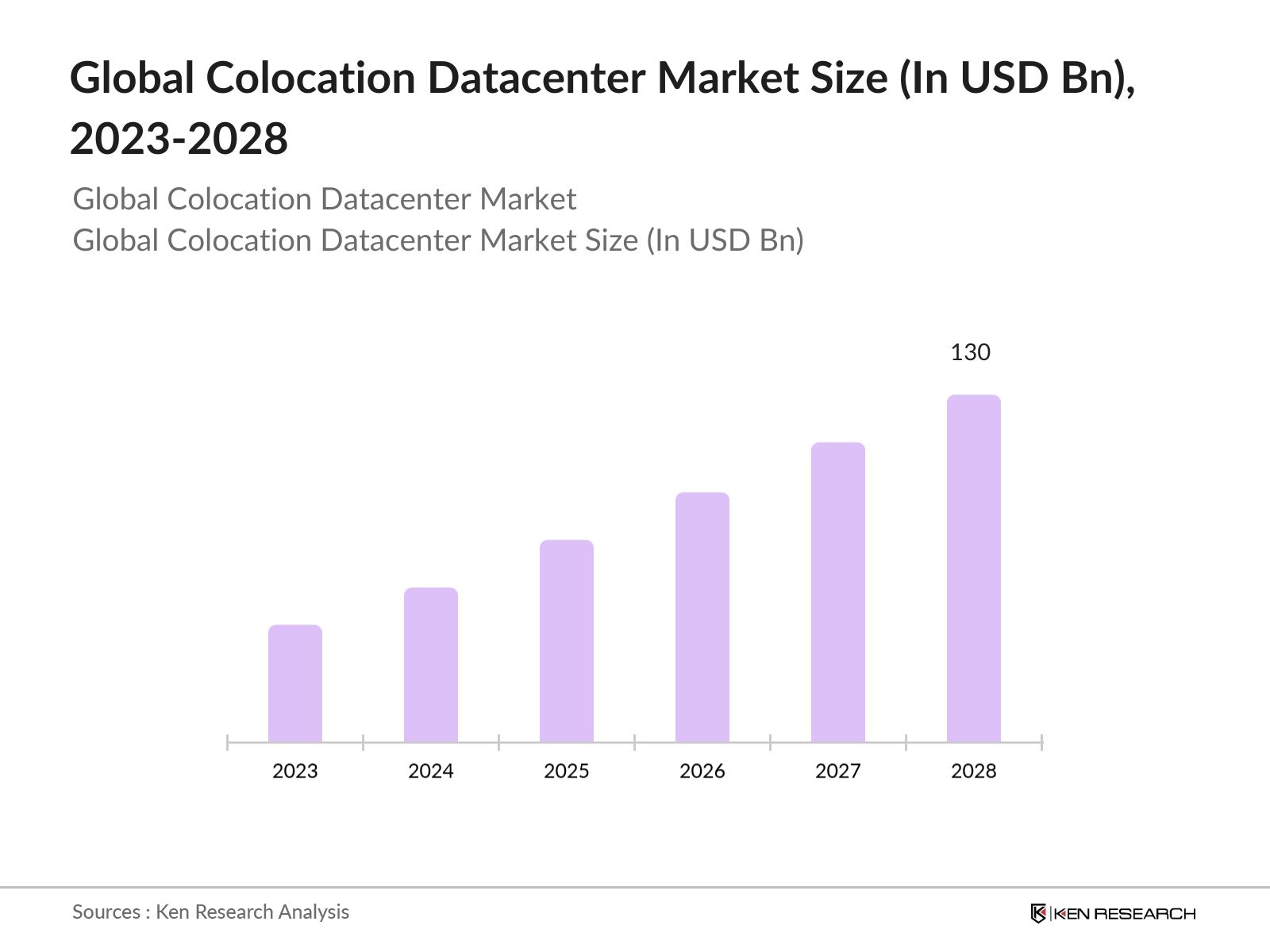

- The global colocation datacenter market was valued at USD 70 Bn in 2023 and is forecasted to reach a market size of USD 130 Bn in 2028 driven by increasing cost-effective expense reduction, growing disaster recovery and business continuity requirements, and a surge in hyperscale deployments by colocation providers.

- The market is a highly fragmented one, the top 10 participants account for the majority of the total revenues in 2023. Some of the top players in the market include Equinix Inc., Digital Realty Trust, Inc., and China Telecom Corporation Limited.

- In 2024, KDDI participated in MWC 2024, showcasing advancements in cloud-network integration and smart network interconnection. This might indicate a focus on improving their data center colocation services for these areas.

Global Colocation Datacenter Current Market Analysis

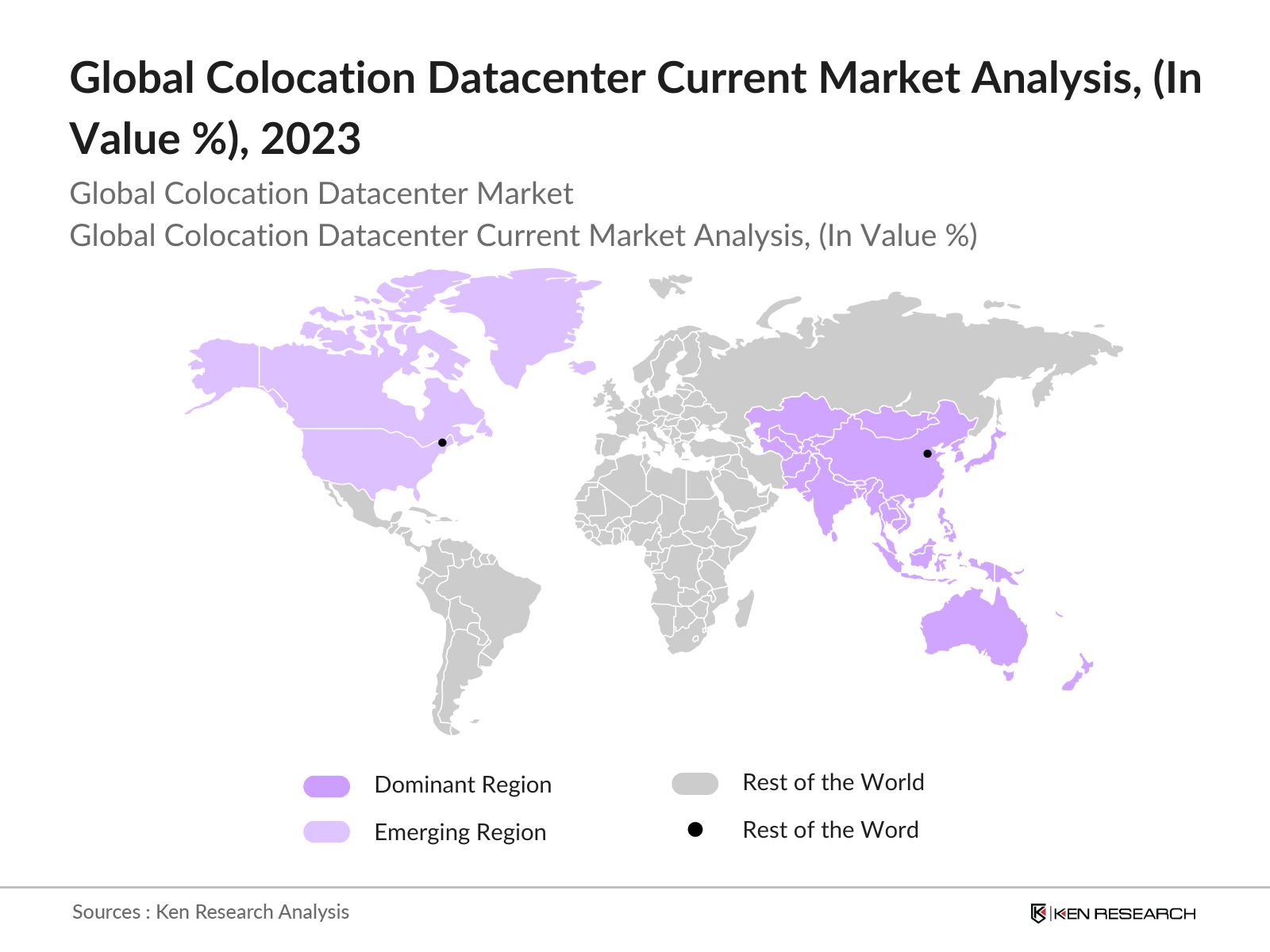

- APAC as dominant region: The APAC colocation services market was the largest market for colocation services globally in 2023. APAC is expected to become a hub for data center construction as companies in China, South Korea, Japan, and Taiwan invest to take advantage of the coming boom in data creation due to 5G technology.

- The APAC colocation services market is driven by Rapid digital transformation, growing internet penetration, and economic growth and industrialization. In Asia-Pacific, mobile broadband networks cover 96% of the population and 44% (about 1.23 billion users) actively use mobile internet services.

- North America as emerging region: North America is emerging as next promising region in the global colocation services market driven by the increased focus on digital infrastructure (mainly due to the impact of COVID-19) and technology innovations relating to 5G, IoT, and edge computing.

- The US Inflation Reduction Act, passed in August 2022, has been pivotal in stimulating infrastructure investments across North America. It is expected to unlock up to USD 3 trillion for energy-related investments over the next decade, which indirectly supports digital infrastructure.

- China as the dominant Country: China dominates the Asia-Pacific colocation service market driven by rapid digital transformation, government initiatives and policies, expanding cloud service providers, and growing e-commerce and online services. In 2022, China's digital economy reached 50.2 trillion-yuan, accounting for 41.5% of the GDP, with a year-on-year growth of 10.3%.

Global Colocation Datacenter Market Segmentation

The Global Colocation Datacenter Market can be segmented based on several factors:

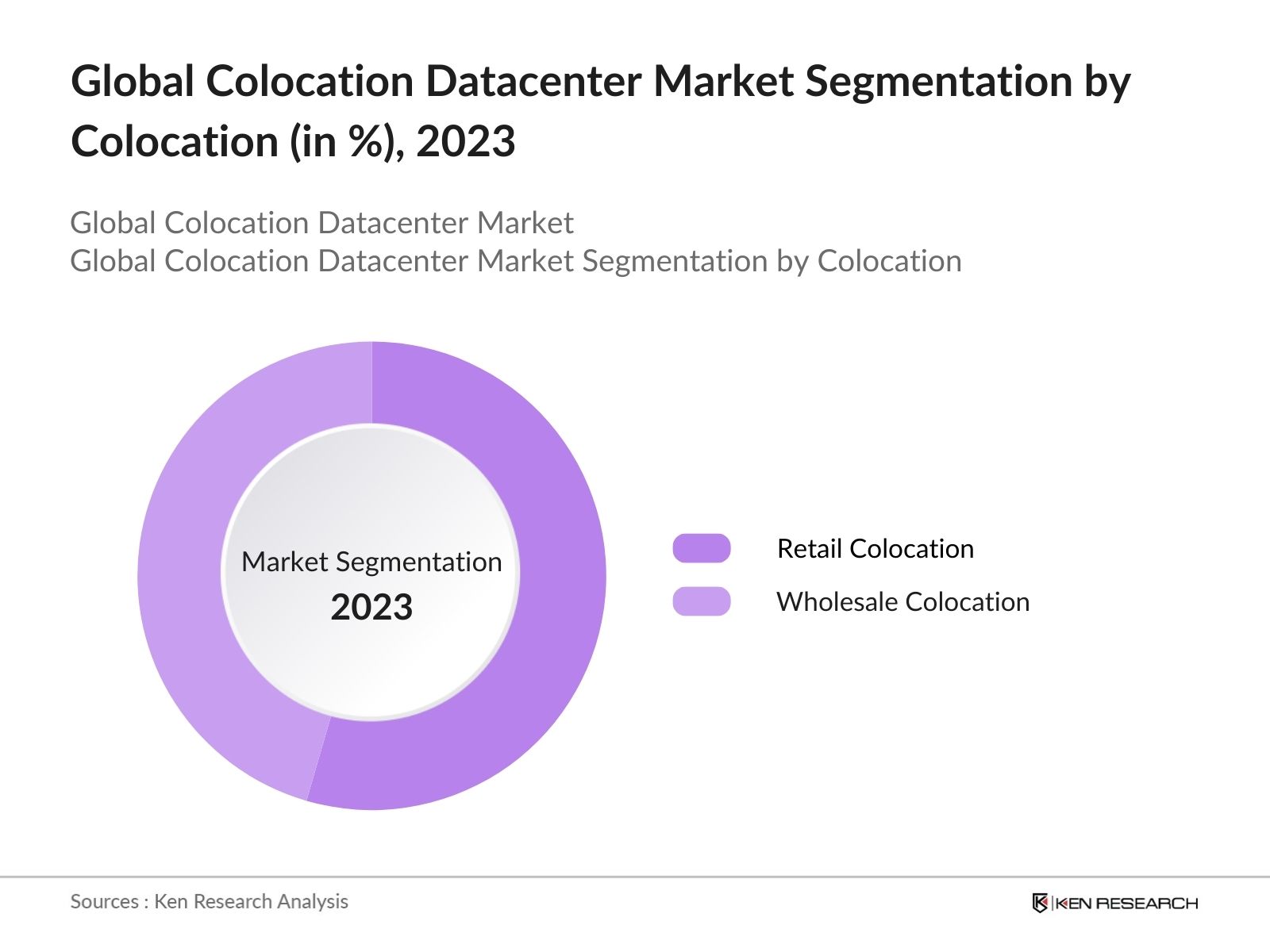

- By Colocation Type: The global colocation datacenter market segmentation by colocation type is classified into retail colocation and wholesale colocation. In 2023, Retail Colocation was dominating the market due to its flexibility and cost-effectiveness. Retail colocation services allow businesses, particularly SMEs and startups, to rent space within a shared data center, benefiting from the provider's infrastructure and services.

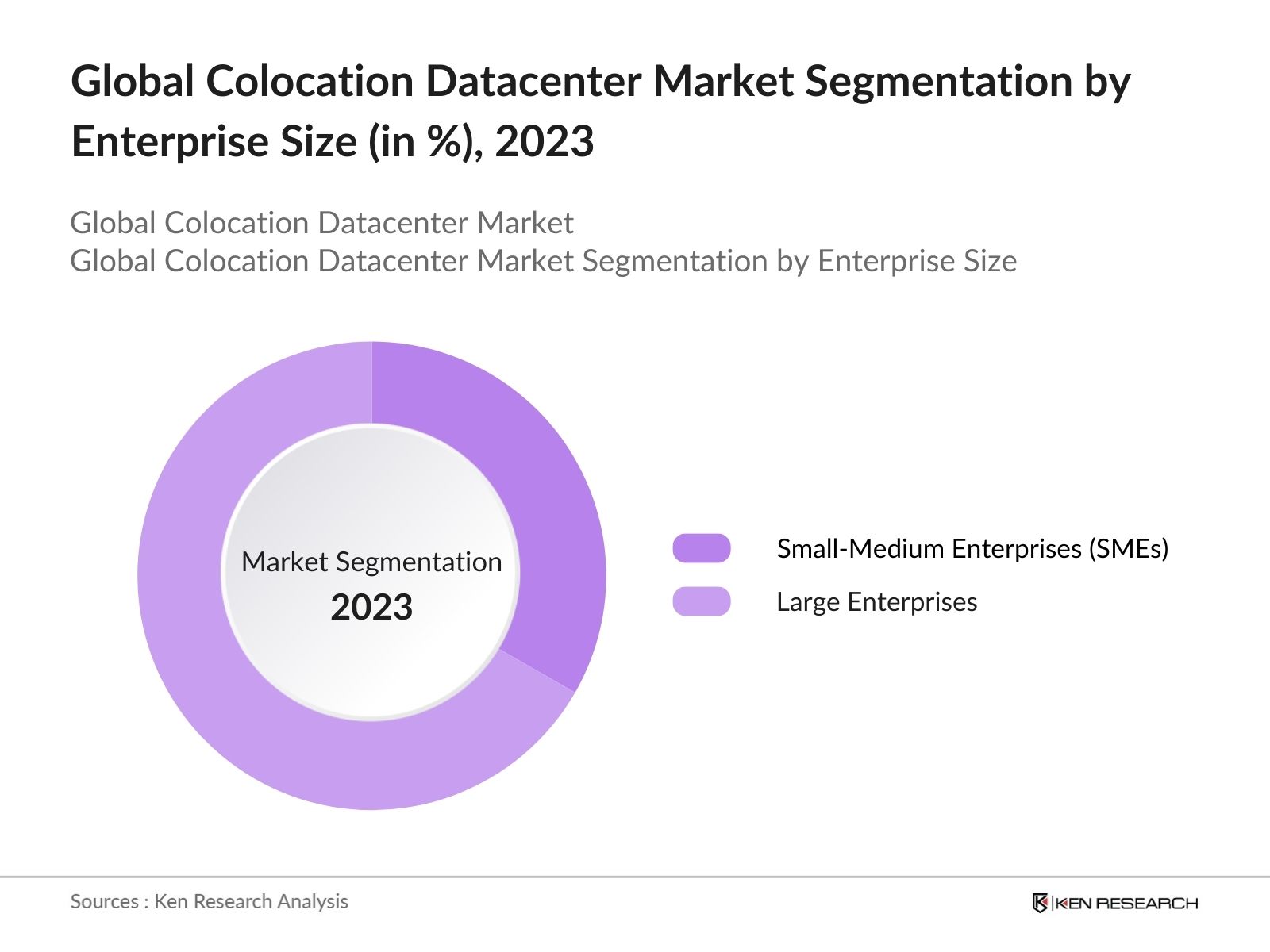

- By Enterprise Size: The global colocation data centre market segmentation by enterprise size is classified into small-medium enterprises (SMEs) and large enterprises. In 2023, the large enterprises segment dominated the market due to the rising adoption of digital technologies and the need for reliable and scalable IT infrastructure. large enterprises leverage colocation services to reduce capital expenditure on data center infrastructure while maintaining control over their hardware and software.

- By End-User: The global colocation datacenter market segmentation by end-user is classified into BFSI, IT and telecom, retail and e-commerce, government, healthcare, manufacturing, energy, and others. In 2023, IT and telecom were a prominent end-user segment due to the sector's critical need for data security, uptime, and compliance. IT and telecom end-users dominate the global colocation data center market due to their massive and growing data processing and storage needs, driven by cloud services, big data, and high traffic volumes.

Global Colocation Datacenter Market Competitive Landscape

|

Name of Company |

Headquarter |

Establishment Year/Vintage |

|

Equinix |

California, US |

1998 |

|

Digital Realty Trust, Inc |

AUSTIN, UNITED STATES |

2004 |

|

NTT Communications Corporation |

Tokyo, Japan |

1999 |

|

China Telecom Corporation |

Beijing, China |

1994 |

|

Global Switch |

London, United Kingdom |

1998 |

- Equinix: In 2022, the firm introduced innovative products like Equinix Metal to enable businesses to deploy physical infrastructure at software speed. Additionally in 2021, it Completed the acquisition of 13 data centers from BCE Inc. in Canada, adding nearly 1.2 million gross square feet of data center space.

- Digital Realty Trust, Inc: In 2023, Digital Realty Trust, Inc signed 50-year right-of-use agreement for a 2.7-acre site (MRS5) in Marseille, France, for 22MW data center. In August 2022, it closed a majority interest acquisition in Teraco for $3.5 billion, expanding into South Africa.

- NTT Communications Corporation: In 2023 , NTT Communications Corporation built a new data center campus in Hillsboro, Oregon, USA. Additionally, in 2022, TC Global Investments Americas LLC, a group company of Tokyo Century Corporation, is investing in NTT Global Data Centers' American data center business in Chicago, Illinois, a group company of NTT DATA.

Global Colocation Datacenter Industry Analysis

Global Colocation Datacenter Market Growth Drivers:

- Increasing Adoption of Cloud Services: The rapid adoption of cloud services by businesses of all sizes has significantly increased the demand for colocation data centers. Companies are shifting from traditional on-premises data centers to cloud-based solutions to improve flexibility, scalability, and cost efficiency. In 2024, over 90% of organizations are utilizing cloud services in some capacity, with 94% of enterprises with more than 1,000 employees running significant workloads in the cloud

- Technology Advancements Driving Enterprise Colocation Demand: Advancements in AI, IoT, and 5G are fueling digital transformation and increasing the need for data center services. Investments in AI, ML, Big Data, cloud, and IoT are escalating demand for colocation services, emphasizing the importance of high-density rack capabilities and tailored infrastructure designs. In 2021, 75% of enterprise applications utilized AI, up from 45% in 2020 showing exceptional growth of colocation services.

- Sustainability Drives Transformation in Data Center Operations: Sustainability remains a core priority for data centers due to environmental concerns and regulations like the EU Green Deal. With increasing reliance on cloud services, focus is on energy-efficient operations, including cooling systems and waste management. The average Power Usage Effectiveness (PUE) of data centers has improved from 2.5 in 2007 to 1.59 in 2021, reflecting increased energy efficiency.

Global Colocation Datacenter Market Challenges

- High Initial and Maintenance Cost: The initial setup and ongoing maintenance costs associated with data center colocation can be substantial. Businesses must invest in high-quality infrastructure, including servers, networking equipment, cooling systems, and security measures. Additionally, ongoing maintenance expenses, such as power, cooling, and IT support, add to the total cost of ownership.

- Location Constraints for Data Center Construction: Selecting an appropriate site for data center construction involves various critical factors. Land stability is essential to ensure the physical safety and longevity of the facility. Power availability is crucial to meet the high energy demands of data centers. Moreover, obtaining government approvals and adhering to local regulations can be time-consuming and challenging.

Global Colocation Datacenter Market Future Outlook

The Global Colocation Datacenter market is expected to reach a market size of USD 130 Bn by 2028 showing substantial growth driven by growth in demand for colocation services, expansion of edge data centers, and advancements in green data centers.

Future Market Trends

- Growth in Demand for Colocation Services: The global data center colocation market is expected to experience robust growth driven by the increasing adoption of cloud computing, the rise of IoT devices, and the proliferation of big data and artificial intelligence (AI) applications, which all require substantial data storage and processing capabilities.

- Expansion of Edge Data Centers: The edge data center market is anticipated to grow significantly. The demand for low-latency data processing and the growth of 5G networks will drive the deployment of edge data centers. These centers will be strategically located closer to end-users to reduce latency and improve performance for applications such as autonomous vehicles, smart cities, and real-time analytics.

Scope of the Report

Products

Key Target Audience:

Banks and Financial Institutions

Cloud Service Providers

Data Center Operators

Telecommunications Companies

IT and Technology Companies

Financial Services Firms (BFSI)

Retail and E-Commerce Businesses

Government and Regulatory Bodies (FCC and MIIT)

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:

Equinix

Digital Realty Trust, Inc

NTT Communications Corporation

China Telecom Corporation

Global Switch

KDDI Corporation (Telehouse)

China Unicom

Cyxtera Technologies

CyrusOne

Table of Contents

1. Executive Summary

1.1 Global Colocation Datacenter Market

2. Global Overview

2.1 Overview of Global Economics

2.2 Overview of Global Colocation Datacenter Industry

2.3 Global Datacenter Market

3. Global Colocation Datacenter Market Overview

3.1 Global Colocation Datacenter Market Ecosystem

3.2 Global Colocation Datacenter Market Value Chain

4.Global Colocation Datacenter Market Size (in USD Bn), 2018-2023

5. Global Colocation Datacenter Market Segmentation (in value %), 2018-2023

5.1 Global Colocation Datacenter Market Segmentation by Region (in value %), 2018-2023

5.2 Global Colocation Datacenter Market Segmentation by Colocation Type (in value%), 2018-2023

5.3 Global Colocation Datacenter Market Segmentation by Enterprises Size Type (in value %), 2018-2023

5.4 Global Colocation Datacenter Market Segmentation by End-User (in value %), 2018-2023

6.Global Colocation Datacenter Market Competition Landscape

6.1 Global Colocation Datacenter Market Share Analysis

6.2 Global Colocation Datacenter Market Heat Map Analysis

6.3 Global Colocation Datacenter Market Cross Comparison

6.4 Global Colocation Datacenter Market Comparison Matrix

7.Global Colocation Datacenter Market Dynamics

7.1 Global Colocation Datacenter Market Growth Drivers

7.2 Global Colocation Datacenter Market Challenges

7.3 Global Colocation Datacenter Market Trends

7.4 Global Colocation Datacenter Market Case Studies

7.5 Global Colocation Datacenter Market Strategic Initiatives

8. Global Colocation Datacenter Future Market (in value %), 2023-2028

8.1 Global Colocation Datacenter Future Market Segmentation by Region (in value %), 2023-2028

8.2 Global Colocation Datacenter Future Market Segmentation by Colocation Type (in value%), 2023-2028

8.3 Global Colocation Datacenter Future Market Segmentation by Enterprises Size Type (in value %), 2023-2028

8.4 Global Colocation Datacenter Future Market Segmentation by End-User (in value %), 2023-2028

9. Analyst Recommendations

Disclaimer

Contact Us

Research Methodology

Step 1: Comprehensive Secondary Research on the Data Center Colocation Market

Conducted extensive secondary research by reviewing company reports, industry publications, Presentations, Websites and Press Releases, News Articles, Journals, and Paid Databases and journals to understand the data center colocation market. Identified key players, market size, segmentation, trends, and regional variations.

Step 2: Expert Interviews for Market Validation and Qualitative Insights

Interviewed industry leaders (CEOs, CTOs, etc.) to gather data on market size, trends, competition, and segmentation. Interviews helped validate data collected from secondary sources and provided qualitative insights. The respondents are selected across level and functions to generate a holistic picture of the market studied. Key Contacts: Company Sales Managers , Industry Associations , Market Experts , DC Operators, Industry Aggregators, End-User Industries.

Step 3: Identification and Evaluation of Key Vendors

Identified key vendors in the data center colocation market through secondary research and expert interviews. Vendors were evaluated based on product features, company size, and past research. A final shortlist of 10 significant companies in the global market was created based on these parameters.

Step 4: Market Size Estimation for Data Center Colocation

Calculated the overall market size for data center colocation market in terms of value in USD by integrating the segment wise data across several levels.

Step 5: Regional Market Profiling and Comparative Analysis

Utilized the collected data to construct regional market profiles for each continent. Conducted a comparative analysis to discern regional variations in data center colocation market and market growth.

Step 6: Data Validation and Statistical Assessment

Conducted a rigorous validation process to ensure the accuracy and reliability of the obtained data. Employed statistical methods to assess the robustness of the findings and mitigate any potential biases in the research.

Frequently Asked Questions

01. How big is the Global Colocation Datacenter Market?

The Global Colocation Datacenter market was valued at USD 70 Bn in 2023 and is predicted to reach a market size of USD 130 Bn in 2028 driven by increasing cost-effective expense reduction, growing disaster recovery and business continuity requirements, and a surge in hyperscale deployments by colocation providers.

02. What are the challenges in the Global Colocation Datacenter Market?

Challenges in the global colocation datacenter market include high initial and maintenance costs, location constraints for data center construction, increased carbon emissions from data centers, and power outages & reliability issues, which can result in significant financial losses and operational disruptions for businesses.

03. Who are the major players in the Global Colocation Datacenter Market?

Key players in the global colocation datacenter market include Equinix, Digital Realty, NTT Communications, CyrusOne, and China Telecom. These companies dominate due to their extensive data center portfolios, global reach, and significant investment in infrastructure and technology.

04. What are the growth drivers of the Global Colocation Datacenter Market?

The global colocation datacenter market is propelled by factors such as increasing adoption of cloud services, the rise of digital transformation initiatives, growing data generation and storage needs, and the implementation of stricter regulatory and compliance requirements.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.