Global Combat Drone Market Outlook 2030

Region:Global

Author(s):Shivani Mehra

Product Code:KROD2317

November 2024

84

About the Report

Global Combat Drone Market Overview

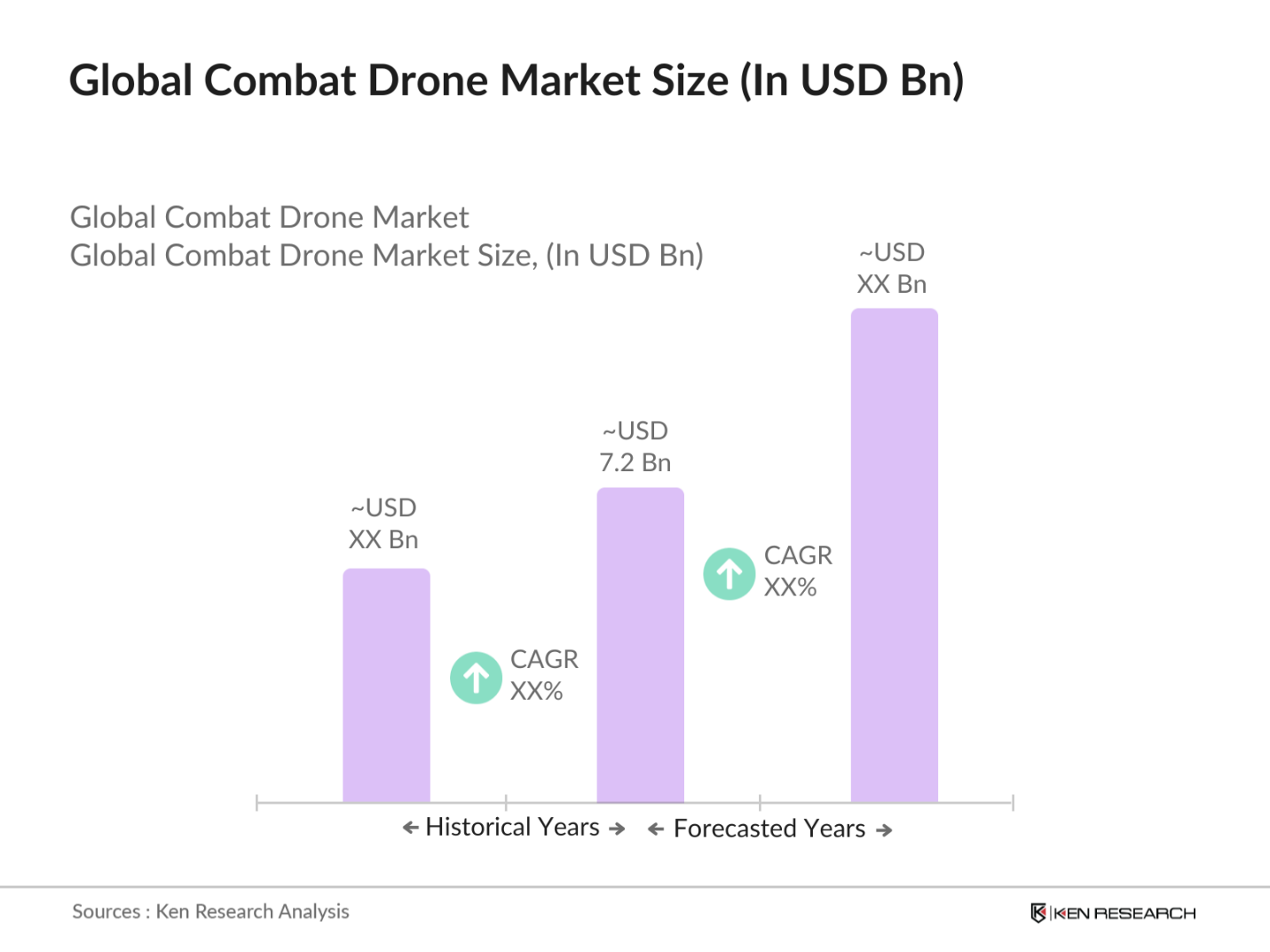

- The global combat drone market is valued at approximately USD 7.2 billion, driven primarily by increased adoption of unmanned systems for intelligence, surveillance, and reconnaissance (ISR), as well as combat missions. Advances in drone technology have enabled the development of cost-effective, versatile UAVs capable of performing complex military tasks with minimal human intervention. In particular, countries like the U.S., China, and Israel have invested heavily in enhancing the capabilities of these drones, spurred by the growing demand for precision strikes and electronic warfare solutions.

- North America, led by the U.S., dominates the global combat drone market due to its substantial defense budget and a strong focus on technological innovation. The U.S. Department of Defense has been at the forefront of UAV adoption, driven by the need for advanced ISR, combat, and stealth capabilities. Meanwhile, countries in the Asia-Pacific region, including China and India, are emerging as key players due to growing defense budgets and regional security concerns

- The European Defence Agency (EDA) launched a USD 1.4 billion program in 2023 to develop and deploy interoperable military UAVs among European Union member states. The program is part of the European Defence Fund, aimed at enhancing joint military capabilities and improving the coordination of UAV operations across borders. The initiative focuses on developing UAVs for both ISR and combat roles, as well as fostering collaboration between EU nations and defense contractors. This program is expected to strengthen Europes defense infrastructure by leveraging UAV technology for collective defense efforts.

Global Combat Drone Market Segmentation

By Platform: The global combat drone market is segmented by platform into small drones, tactical drones, and strategic drones. Tactical drones hold a dominant market share due to their versatility in battlefield operations, combining portability and advanced ISR capabilities. These drones are favored by military forces for precision strikes in hostile environments, offering low operational costs and high maneuverability.

By Region: The global combat drone market is segmented by region into North America, Europe, Asia-Pacific, Middle East & Africa, and Latin America. North America dominates the market due to its well-established defense infrastructure and significant investment in UAV R&D. Europe follows closely with growing adoption of advanced UAV technologies for military purposes.

|

|

|---|

Global Combat Drone Market Competitive Landscape

The global combat drone market is characterized by the presence of both established defense contractors and emerging technology firms. The market is dominated by key players with a strong emphasis on technological innovation and strategic partnerships. These players are increasingly collaborating with government entities to advance drone technology and meet the evolving needs of modern warfare

|

Company |

Establishment Year |

Headquarters |

Product Range |

Revenue (USD Billion) |

Key Technologies |

Strategic Focus |

Recent Innovations |

|

Northrop Grumman |

1939 |

Virginia, USA |

|||||

|

General Atomics Aeronautical |

1993 |

California, USA |

|||||

|

Raytheon Technologies |

1922 |

Massachusetts, USA |

|||||

|

Israel Aerospace Industries |

1953 |

Lod, Israel |

|||||

|

AeroVironment Inc. |

1971 |

California, USA |

Global Combat Drone Market Analysis

Global Combat Drone Market Growth Drivers

- Rising Demand for Unmanned Systems: The demand for unmanned aerial vehicles (UAVs) for combat missions and intelligence, surveillance, and reconnaissance (ISR) has significantly increased due to ongoing global military conflicts and security threats. According to data from the World Bank, global defense expenditure reached USD 2.24 trillion in 2023, with a substantial portion allocated to UAV procurement. In the United States, the Department of Defense allocated over USD 5.6 billion for unmanned systems in 2024, reflecting the growing reliance on UAVs for ISR missions. Additionally, countries like China and Russia are ramping up UAV investments for combat operations to enhance their defense capabilities.

- Increasing Adoption in Asymmetric Warfare: Asymmetric warfare strategies, particularly in the Middle East and North Africa, have driven increased adoption of UAVs for surveillance, targeting, and counter-terrorism operations. The U.S. Army deployed over 11,000 unmanned aircraft for counter-insurgency missions by 2023, with similar trends seen in regions like Yemen and Syria, where non-state actors use UAVs for intelligence gathering. This growing reliance is backed by government data, such as the U.S. Department of Defense, which highlights UAVs as essential tools in low-intensity conflict zones due to their flexibility and cost-effectiveness compared to traditional manned systems.

- Technological Advancements in UAV Payloads and Autonomy: Technological advancements in UAV payloads, including better sensors, improved communication systems, and autonomous capabilities, have revolutionized military UAV applications. The U.S. Air Force has invested over USD 3.2 billion in developing next-gen autonomous drones capable of performing ISR tasks without human intervention. Furthermore, the increasing integration of artificial intelligence (AI) for real-time data analysis has made UAVs more effective for intelligence missions. Chinas Ministry of National Defense also reports substantial investments in AI-powered drones, with plans to enhance UAV payload capabilities for multi-role operations.

Global Combat Drone Market Challenges

- Bandwidth and Control Limitations: UAVs rely heavily on satellite-based communication systems, which often face bandwidth constraints during military operations. A report from the U.S. Government Accountability Office (GAO) in 2023 highlighted that approximately 70% of military UAV missions experience operational inefficiencies due to limited satellite bandwidth. This limits the control, responsiveness, and effectiveness of UAVs during combat and surveillance operations. The U.S. military is working on dedicated satellite systems, but these remain costly and complex, with full implementation expected in several years. The bandwidth challenge is particularly critical for large-scale UAV deployments in regions like the Middle East.

- Regulatory Challenges in Military UAV Operations: Government-imposed airspace regulations significantly limit UAV deployment. For instance, the FAA in the U.S. imposed strict airspace corridors for UAV operations, restricting their mobility. These regulations, aimed at ensuring air safety, slow down the deployment of military UAVs for training and active missions. In Europe, countries like Germany and France have similar restrictions, while developing countries in Asia-Pacific face delays in formulating comprehensive regulatory frameworks for UAVs. As UAV technology continues to advance, these regulations present a significant bottleneck, limiting the speed at which new drones can be deployed for military purposes.

Global Combat Drone Market Future Outlook

Over the next five years, the global combat drone market is expected to exhibit robust growth, driven by increased military investments in autonomous systems, continued advancements in AI and drone swarming technology, and the rising demand for cost-effective combat solutions. Key defense players are likely to expand their product portfolios to meet the demand for diverse applications, ranging from ISR and combat missions to border security operations. This market expansion will be particularly pronounced in regions such as the Asia-Pacific, where defense budgets are on the rise and nations seek to modernize their military capabilities

Market Opportunities:

- Drone Swarming Technology: Drone swarming, where multiple UAVs operate as a coordinated group to achieve mission objectives, is a key emerging trend in military applications. The U.S. Army successfully tested its drone swarming capabilities in 2023, with over 100 drones participating in a coordinated strike. This technology allows militaries to overwhelm enemy defenses with a cost-effective solution, enhancing mission success rates. China and Russia have also demonstrated advancements in drone swarming, with Chinas People's Liberation Army (PLA) executing similar swarm tactics for ISR missions in contested airspaces.

- Manned-Unmanned Teaming (MUM-T): Manned-Unmanned Teaming (MUM-T) is gaining traction in military operations, where manned aircraft collaborate with UAVs to enhance mission flexibility and effectiveness. The U.S. Air Force invested USD 1.6 billion in 2023 for MUM-T technologies, allowing UAVs to act as force multipliers in combat scenarios. This integration reduces the risk to human pilots while improving ISR and strike capabilities. European countries are also exploring MUM-T applications, with Germanys Luftwaffe conducting trials using manned fighter jets in conjunction with UAVs for real-time data sharing and target acquisition.

Scope of the Report

|

By Platform |

Small Tactical Strategic |

|

By Application |

Lethal Stealth Loitering Munition Target |

|

By Application |

Medical Imaging AR/VR Advertising and Marketing Engineering and Design |

|

By Type |

Fixed-wing Rotary-wing Hybrid |

|

By Region |

North America Europe Asia-Pacific MEA Latin America |

Products

Key Target Audience

Defense Ministries and Departments (e.g., U.S. Department of Defense)

Drone Manufacturers

Technology Providers (AI and Autonomy)

ISR and Combat Technology Providers

Government and Regulatory Bodies (e.g., Federal Aviation Administration)

Investments and Venture Capital Firms

Armed Forces and Special Operations Units

Drone Software and Systems Integrators

Companies

Players Mention in the Report

Northrop Grumman

General Atomics Aeronautical Systems

Raytheon Technologies

Israel Aerospace Industries Ltd.

AeroVironment Inc.

Boeing

Elbit Systems

Lockheed Martin

Leonardo S.p.A.

Teledyne FLIR LLC

Airbus

BAE Systems

Kratos Defense & Security Solutions

SZ DJI Technology Co., Ltd.

Saab AB

Table of Contents

01. Global Combat Drone Market Overview

1.1. Definition and Scope

1.2. Market Dynamics

1.3. Evolution of Combat Drone Technology

1.4. Combat Drone Ecosystem

1.5. Technological Advancements Driving Market Growth

02. Global Combat Drone Market Size (in USD Billion)

2.1. Historical Market Size Analysis

2.2. Key Milestones and Growth Trajectories

2.3. Market Forecast and Projections

03. Global Combat Drone Market Analysis and Dynamics

3.1. Growth Drivers

3.1.1. Rising Demand for Unmanned Systems (Combat Missions, ISR)

3.1.2. Increasing Adoption in Asymmetric Warfare

3.1.3. Technological Advancements in UAV Payloads and Autonomy

3.2. Market Restraints

3.2.1. Bandwidth and Control Limitations

3.2.2. Regulatory Challenges in Military UAV Operations

3.2.3. Concerns over UAV Vulnerability to Electronic Jamming

3.3. Opportunities

3.3.1. Integration of AI and Machine Learning for Autonomous Drones

3.3.2. Rising Government Initiatives and International Collaborations

3.3.3. Expansion in Emerging Markets (Middle East, Asia-Pacific)

3.4. Trends

3.4.1. Drone Swarming Technology

3.4.2. Manned-Unmanned Teaming (MUM-T)

3.4.3. Development of Hypersonic Drones

3.5. Government Regulations and Initiatives (Combat Drone-specific Regulation)

3.5.1. Regulatory Framework by Region (North America, Europe, Asia-Pacific)

3.5.2. Defense Budget Allocations

3.5.3. National Drone Strategy and Innovation Programs

04. Global Combat Drone Market Segmentation

4.1. By Platform (in Value %)

4.1.1. Small Drones

4.1.2. Tactical Drones

4.1.3. Strategic Drones

4.2. By Application (in Value %)

4.2.1. Lethal Drones

4.2.2. Stealth Drones

4.2.3. Loitering Munition (Expendable, Recoverable)

4.2.4. Target Drones

4.3. By Type (in Value %)

4.3.1. Fixed-wing

4.3.2. Rotary-wing

4.3.3. Hybrid

4.4. By Launch Mode (in Value %)

4.4.1. Air-Launched Effect

4.4.2. Vertical Take-off and Landing

4.4.3. Automatic Take-off and Landing

4.4.4. Catapult Launcher

4.5. By Region (in Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia-Pacific

4.5.4. Middle East & Africa

4.5.5. Latin America

05. Global Combat Drone Market Competitive Landscape

5.1. Detailed Profiles of Major Competitors

5.1.1. Northrop Grumman Corporation

5.1.2. General Atomics Aeronautical Systems

5.1.3. Raytheon Technologies Corporation

5.1.4. Israel Aerospace Industries Ltd.

5.1.5. AeroVironment, Inc.

5.1.6. Lockheed Martin Corporation

5.1.7. Boeing

5.1.8. Teledyne FLIR LLC

5.1.9. Elbit Systems

5.1.10. Airbus

5.1.11. BAE Systems

5.1.12. SZ DJI Technology Co., Ltd.

5.1.13. Leonardo S.p.A.

5.1.14. Kratos Defense & Security Solutions, Inc.

5.1.15. Saab AB

5.2. Cross Comparison Parameters (Headquarters, No. of Employees, Revenue, Specialization)

5.3. Market Share Analysis

5.4. Recent Developments in Combat Drone Technologies

5.5. Strategic Partnerships and Collaborations

5.6. Mergers & Acquisitions in the Combat Drone Sector

06. Global Combat Drone Market Regulatory Framework

6.1. Regional Compliance and Certification (Combat Drone Certifications)

6.2. Export Control Regulations

6.3. Compliance with International Drone Warfare Protocols

07. Global Combat Drone Market Future Market Size (in USD Billion)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Growth

08. Global Combat Drone Market Future Market Segmentation

8.1. By Platform (in Value %)

8.2. By Application (in Value %)

8.3. By Type (in Value %)

8.4. By Launch Mode (in Value %)

8.5. By Region (in Value %)

09. Global Combat Drone Market Analyst Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Investment and Strategic Recommendations

9.3. White Space Opportunity Analysis

9.4. Marketing Initiatives for Market Expansion

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The initial step involves identifying critical variables affecting the global combat drone market. This is accomplished by examining major stakeholders, including defense ministries, drone manufacturers, and technology providers, through an extensive review of secondary and proprietary sources.

Step 2: Market Analysis and Construction

During this phase, historical market data is analyzed to understand growth patterns and technological advancements in the combat drone sector. Factors such as military spending, drone usage in conflict zones, and technological innovations in autonomy are evaluated.

Step 3: Hypothesis Validation and Expert Consultation

Insights gained from industry experts, including drone manufacturers and defense contractors, are used to validate the market assumptions. Interviews conducted with defense analysts and military officials provide key operational insights into market trends.

Step 4: Research Synthesis and Final Output

The final stage synthesizes data from both primary and secondary research to produce a comprehensive analysis of the combat drone market. This includes market size forecasts, segmentation analysis, and detailed competitive insights.

Frequently Asked Questions

01. How big is the global combat drone market?

The global combat drone market is valued at USD 7.2 billion, driven by advancements in UAV technology and increased military spending on ISR and combat missions.

02. What are the key drivers for the combat drone market?

Key drivers include rising demand for UAVs in asymmetric warfare, advancements in AI and autonomy, and increased defense spending by key nations such as the U.S. and China.

03. Who are the major players in the global combat drone market?

Major players include Northrop Grumman, General Atomics Aeronautical Systems, Raytheon Technologies, Israel Aerospace Industries, and AeroVironment, among others.

04. What challenges does the combat drone market face?

Challenges include regulatory restrictions on UAV use in combat, limited bandwidth for drone control, and the risk of UAVs being vulnerable to electronic jamming.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.