Global Combat Drones Market Outlook to 2030

Region:Global

Author(s):Vijay Kumar

Product Code:KROD1108

December 2024

98

About the Report

Global Combat Drones Market Overview

- The global combat drones market reached a valuation of USD 7 billion in 2023, driven by increased defense spending, advancements in unmanned aerial vehicle (UAV) technologies, and the growing need for intelligence, surveillance, and reconnaissance (ISR) capabilities. This market expansion is further supported by rising geopolitical tensions and the integration of artificial intelligence in combat drone systems, enhancing their operational efficiency and autonomous capabilities.

- Major players in the global combat drones market include General Atomics Aeronautical Systems, Northrop Grumman Corporation, Lockheed Martin Corporation, Boeing Defense, Space & Security, and Israel Aerospace Industries. These companies have strengthened their market positions through significant investments in research and development, innovative UAV designs, and strategic partnerships with defense ministries and organizations globally. Their focus on enhancing drone capabilities with AI and stealth technologies has enabled them to maintain a competitive edge.

- In 2023, Northrop Grumman Corporation expanded its product portfolio by introducing the MQ-28A Ghost Bat, an advanced combat drone designed for collaborative operations with manned aircraft. This new drone features enhanced autonomous capabilities and stealth technology, gaining significant traction in North America and Europe. Additionally, Lockheed Martin introduced a new range of tactical drones targeting specialized military applications, highlighting the increasing demand for versatile and cost-effective UAV solutions.

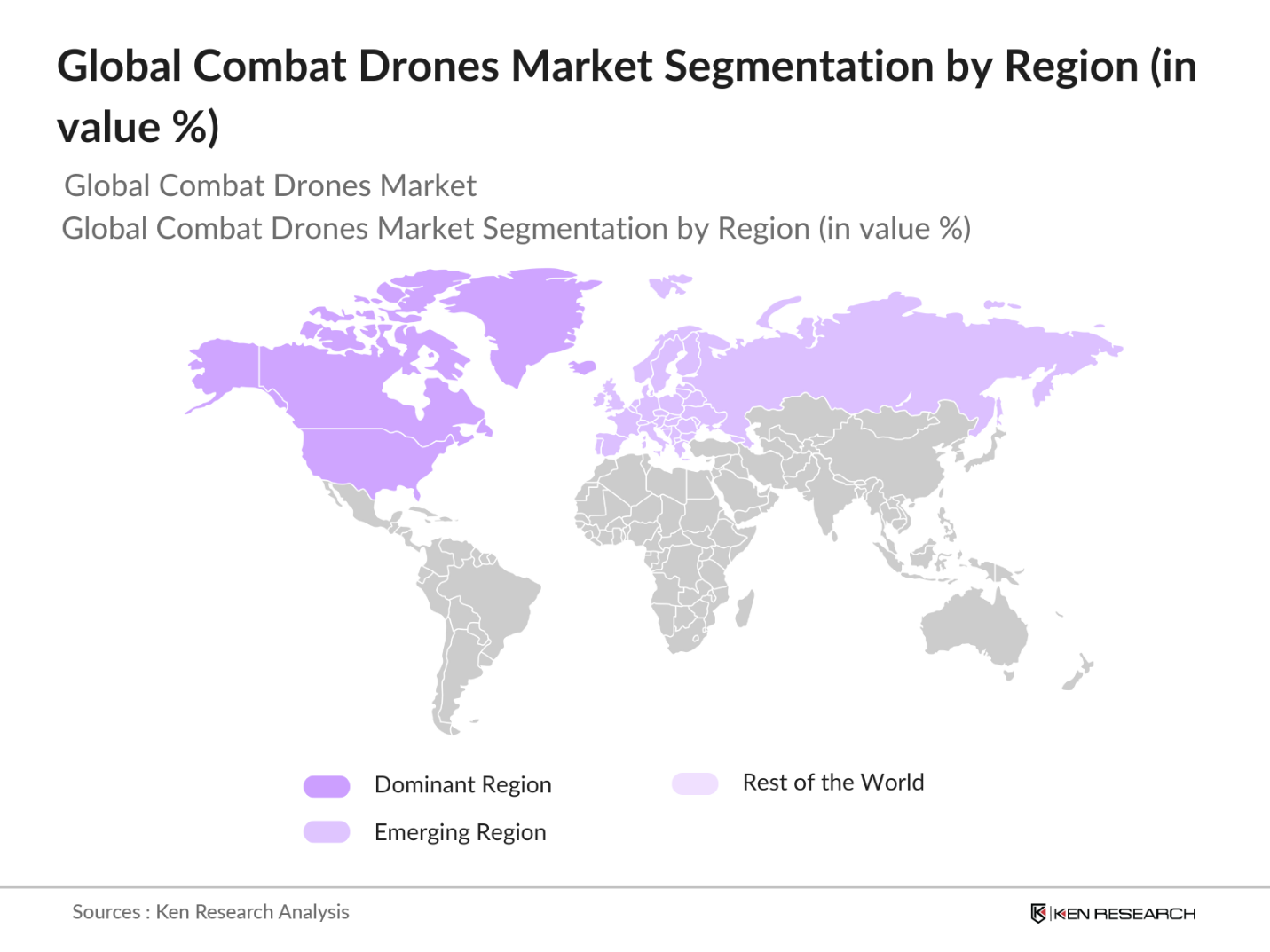

- North America dominates the global combat drones market, primarily due to substantial defense budgets and a strong focus on technological innovation. The region's leadership position is bolstered by the presence of major defense contractors and ongoing government initiatives aimed at enhancing UAV capabilities for military operations. Initiatives like the U.S. Department of Defense's Skyborg program are driving the development and deployment of advanced combat drones across various military branches.

Global Combat Drones Market Segmentation

The Global Combat Drones Market can be segmented based on Drone Type, Application, and Region.

By Drone Type: The market is segmented by drone type into MALE (Medium Altitude Long Endurance) Drones, HALE (High Altitude Long Endurance) Drones, and Tactical Drones. In 2023, MALE drones held the dominant market share due to their extensive use in ISR missions and capability to operate for extended periods. The increasing demand for these drones in military operations, owing to their endurance and versatility, has reinforced the dominance of this segment.

By Application: The market is further segmented by application into Combat Operations, Surveillance and Reconnaissance, and Border Patrol and Security. The Combat Operations segment accounted for the largest market share in 2023, driven by the high demand for precision strike capabilities in military engagements. Countries are increasingly deploying combat drones for targeted strikes and close air support missions, making them a vital component of modern warfare strategies.

By Region: The market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East and Africa (MEA). North America dominated the market in 2023, driven by the high concentration of key players, advanced technological infrastructure, and significant defense expenditures. The demand for combat drones in North America is particularly strong in the United States, where defense agencies are investing heavily in UAV technologies to maintain air superiority and enhance ISR capabilities.

Global Combat Drones Market Competitive Landscape

|

Company Name |

Headquarters |

Establishment Year |

|

General Atomics Aeronautical Systems |

San Diego, USA |

1993 |

|

Northrop Grumman Corporation |

Falls Church, USA |

1939 |

|

Lockheed Martin Corporation |

Bethesda, USA |

1995 |

|

Boeing Defense, Space & Security |

Arlington, USA |

1916 |

|

Israel Aerospace Industries |

Tel Aviv, Israel |

1953 |

- Israel Aerospace Industries: In 2024, Israel Aerospace Industries announced a strategic partnership with the Indian Ministry of Defence to develop a new line of combat drones tailored to the specific requirements of the Indian Armed Forces. This collaboration is expected to strengthen IAIs presence in the Asia-Pacific market and enhance India's indigenous UAV capabilities.

- General Atomics Aeronautical Systems: expanded its portfolio in February 2024 by introducing the Mojave STOL drone, designed for rapid deployment in challenging environments. This new model supports vertical take-off and landing, making it suitable for operations in remote or makeshift airstrips, thereby enhancing the operational flexibility of military forces.

Global Combat Drones Market Analysis

Market Growth Drivers

- Increased Defense Budgets Globally: In 2024, global defense spending is projected to reach $2.3 trillion, with a significant portion allocated to modernizing military assets, including combat drones. The United States, for instance, has planned a defense budget exceeding $800 billion for 2024, with a substantial focus on acquiring advanced UAVs for intelligence, surveillance, and reconnaissance (ISR) missions. Similarly, countries like China and India are increasing their defense expenditures, focusing on enhancing UAV capabilities to strengthen their military prowess and achieve strategic advantages.

- Technological Advancements in Drone Capabilities: The development of drones equipped with AI and machine learning capabilities is a key driver in the market. In 2024, $1 billion has been invested in R&D for enhancing autonomous operations of combat drones. This includes improving target recognition, autonomous navigation, and real-time data processing capabilities, making drones more efficient and effective in combat scenarios. Advanced sensor technologies and stealth features are also being integrated, with companies like Northrop Grumman and Lockheed Martin leading these technological innovations.

- Geopolitical Tensions and Security Concerns: Heightened geopolitical tensions, particularly in regions such as the Middle East and Asia-Pacific, have led to increased demand for combat drones. In 2024, defense analysts reported over 150 cross-border drone incidents, highlighting the growing reliance on UAVs for surveillance and defensive operations. Countries are procuring drones to safeguard their borders and enhance their situational awareness, reflecting a strategic shift towards using unmanned systems to counter threats without risking human lives.

Global Combat Drones Market Challenges

- Regulatory Hurdles and Airspace Management: The integration of combat drones into national airspace systems is hindered by stringent regulations and airspace management challenges. Many countries are still developing frameworks to safely incorporate UAVs into civilian and military airspaces, limiting their widespread use.

- High Costs and Resource Requirements: The development, deployment, and maintenance of advanced combat drones involve substantial costs and resources. The high expense associated with these systems, including R&D, manufacturing, and operational costs, poses a challenge for market growth, particularly for countries with limited defense budgets.

Global Combat Drones Market Government Initiatives

- Skyborg Program (USA): The U.S. Department of Defense has been advancing its Skyborg program, aimed at developing autonomous combat drones that can operate alongside manned aircraft. With a funding boost to over $400 million in 2024, this initiative focuses on integrating AI technologies into UAVs to enhance their operational capabilities, reduce human intervention, and improve mission outcomes in complex environments.

- Geopolitical Tensions and Security Concerns: Heightened geopolitical tensions, particularly in regions such as the Middle East and Asia-Pacific, have led to increased demand for combat drones. In 2024, defense analysts reported over 150 cross-border drone incidents, highlighting the growing reliance on UAVs for surveillance and defensive operations. Countries are procuring drones to safeguard their borders and enhance their situational awareness, reflecting a strategic shift towards using unmanned systems to counter threats without risking human lives.

Global Combat Drones Market Future Market Outlook

The Global Combat Drones Market is poised for significant growth, driven by advancements in UAV technologies, increased defense spending, and the growing need for ISR capabilities in military operations.

Future Market Trends

- Integration of AI and Autonomous Systems: By 2028, the combat drones market will see a significant shift towards fully autonomous systems, with AI playing a crucial role in mission planning, target recognition, and real-time decision-making. The integration of advanced AI algorithms will enable drones to operate with minimal human intervention, enhancing their effectiveness in complex combat scenarios.

- Expansion of Multi-Domain Operations: The market is expected to expand into multi-domain operations, where drones will be used across air, land, and sea environments. This trend will be driven by the need for versatile and flexible UAV systems that can support various military missions, from aerial reconnaissance to maritime surveillance and ground attack operations.

Scope of the Report

|

By Drone |

MALE (Medium Altitude Long Endurance) Drones HALE (High Altitude Long Endurance) Drones Tactical Drones |

|

By End-User |

Military Intelligence Agencies Homeland Security |

|

By Region |

North America Europe APAC Latin America MEA |

|

By Application |

Combat Operations Surveillance and Reconnaissance Border Patrol and Security |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Defense Ministries

Intelligence Agencies

Homeland Security Departments

Military Contractors

Defense Research Organizations

Investments and Venture Capitalist Firms

Aerospace and Defense Manufacturers

Government and Regulatory Bodies

Technology Integrators

Time Period Captured in the Report

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report

General Atomics Aeronautical Systems

Northrop Grumman Corporation

Lockheed Martin Corporation

Boeing Defense, Space & Security

Israel Aerospace Industries

Elbit Systems Ltd.

AeroVironment, Inc.

Textron Inc.

Leonardo S.p.A.

BAE Systems

Table of Contents

1. Global Combat Drones Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Combat Drones Market Size (in USD Billion), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Combat Drones Market Analysis

3.1. Growth Drivers

3.1.1. Increased Global Defense Spending

3.1.2. Advancements in Drone Technology

3.1.3. Growing Geopolitical Tensions

3.1.4. Expansion of ISR Capabilities

3.2. Restraints

3.2.1. High Costs and Resource Requirements

3.2.2. Regulatory Hurdles and Airspace Management

3.2.3. Cybersecurity Threats

3.3. Opportunities

3.3.1. Technological Innovations in UAV Systems

3.3.2. Increased Focus on Autonomous Operations

3.3.3. Expansion into Emerging Markets

3.4. Trends

3.4.1. Integration of AI in Drone Systems

3.4.2. Use of Swarming Technologies

3.4.3. Growing Adoption of Multi-Domain Operations

3.5. Government Regulations

3.5.1. U.S. Skyborg Program

3.5.2. European Defence Fund (EDF) Initiative

3.5.3. India's Indigenous Drone Development Policies

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Competition Ecosystem

4. Global Combat Drones Market Segmentation, 2023

4.1. By Drone Type (in Value %)

4.1.1. MALE (Medium Altitude Long Endurance) Drones

4.1.2. HALE (High Altitude Long Endurance) Drones

4.1.3. Tactical Drones

4.2. By Application (in Value %)

4.2.1. Combat Operations

4.2.2. Surveillance and Reconnaissance

4.2.3. Border Patrol and Security

4.3. By End-User (in Value %)

4.3.1. Military

4.3.2. Intelligence Agencies

4.3.3. Homeland Security

4.4. By Region (in Value %)

4.4.1. North America

4.4.2. Europe

4.4.3. Asia-Pacific

4.4.4. Latin America

4.4.5. Middle East and Africa (MEA)

5. Global Combat Drones Market Cross Comparison

5.1. Detailed Profiles of Major Companies

5.1.1. General Atomics Aeronautical Systems

5.1.2. Northrop Grumman Corporation

5.1.3. Lockheed Martin Corporation

5.1.4. Boeing Defense, Space & Security

5.1.5. Israel Aerospace Industries

5.1.6. Elbit Systems Ltd.

5.1.7. AeroVironment, Inc.

5.1.8. Textron Inc.

5.1.9. Leonardo S.p.A.

5.1.10. BAE Systems

5.1.11. Thales Group

5.1.12. Saab AB

5.1.13. Dassault Aviation

5.1.14. Turkish Aerospace Industries

5.1.15. China Aerospace Science and Technology Corporation

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

6. Global Combat Drones Market Competitive Landscape

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

6.4. Investment Analysis

6.4.1. Venture Capital Funding

6.4.2. Government Grants

6.4.3. Private Equity Investments

7. Global Combat Drones Market Regulatory Framework

7.1. Environmental and Airspace Regulations

7.2. Compliance Requirements

7.3. Certification Processes

8. Global Combat Drones Future Market Size (in USD Billion), 2023-2028

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

9. Global Combat Drones Market Future Segmentation, 2028

9.1. By Drone Type (in Value %)

9.2. By Application (in Value %)

9.3. By End-User (in Value %)

9.4. By Region (in Value %)

10. Global Combat Drones Market Analysts Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Marketing Initiatives

10.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identifying Key Variables

Creating an ecosystem for all major entities within the market and referencing a combination of secondary and proprietary databases to conduct desk research. This step involves gathering industry-level information, identifying market trends, and understanding the competitive landscape to ensure a comprehensive analysis.

Step 2: Market Building

Collating statistics on the market over the years, analyzing market penetration across various segments, and evaluating the performance of key market players. This includes reviewing production capacities, market shares, and sales data to accurately compute the revenue generated within the global combat drones market. Quality checks are conducted to ensure the accuracy and reliability of the data points shared.

Step 3: Validating and Finalizing

Developing market hypotheses and conducting Computer Assisted Telephone Interviews (CATIs) with industry experts and stakeholders from leading companies in the combat drones market. These interviews are crucial for validating the collected data, refining market forecasts, and obtaining operational and financial insights directly from industry representatives.

Step 4: Research Output

Engaging with multiple key players in the combat drones industry to understand the dynamics of product segments, customer needs, sales patterns, and market challenges. This step involves using a bottom-up approach to validate the data, ensuring that the final statistics and insights accurately reflect market conditions and support strategic decision-making.

Frequently Asked Questions

1. How big is the Global Combat Drones Market?

The global combat drones market reached a valuation of USD 7 billion in 2023, driven by increased defense spending, advancements in unmanned aerial vehicle (UAV) technologies, and the growing need for intelligence, surveillance, and reconnaissance (ISR) capabilities.

2. What are the challenges in the Global Combat Drones Market?

Challenges in the global combat drones market include regulatory hurdles, high development and maintenance costs, and cybersecurity threats. These factors complicate the integration of drones into national airspaces and expose them to potential vulnerabilities.

3. Who are the major players in the Global Combat Drones Market?

Key players in the global combat drones market include General Atomics Aeronautical Systems, Northrop Grumman Corporation, Lockheed Martin Corporation, Boeing Defense, Space & Security, and Israel Aerospace Industries. These companies lead the market through innovation and strategic partnerships.

4. What are the growth drivers of the Global Combat Drones Market?

The market is driven by increased global defense spending, advancements in drone technology, and growing geopolitical tensions. These factors contribute to the rising demand for combat drones across various military applications.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.