Global Commodity Plastic Market Outlook to 2030

Region:Global

Author(s):Rohit and Nishika

Product Code:KENGR002

October 2024

95

About the Report

Global Commodity Plastics Market Overview

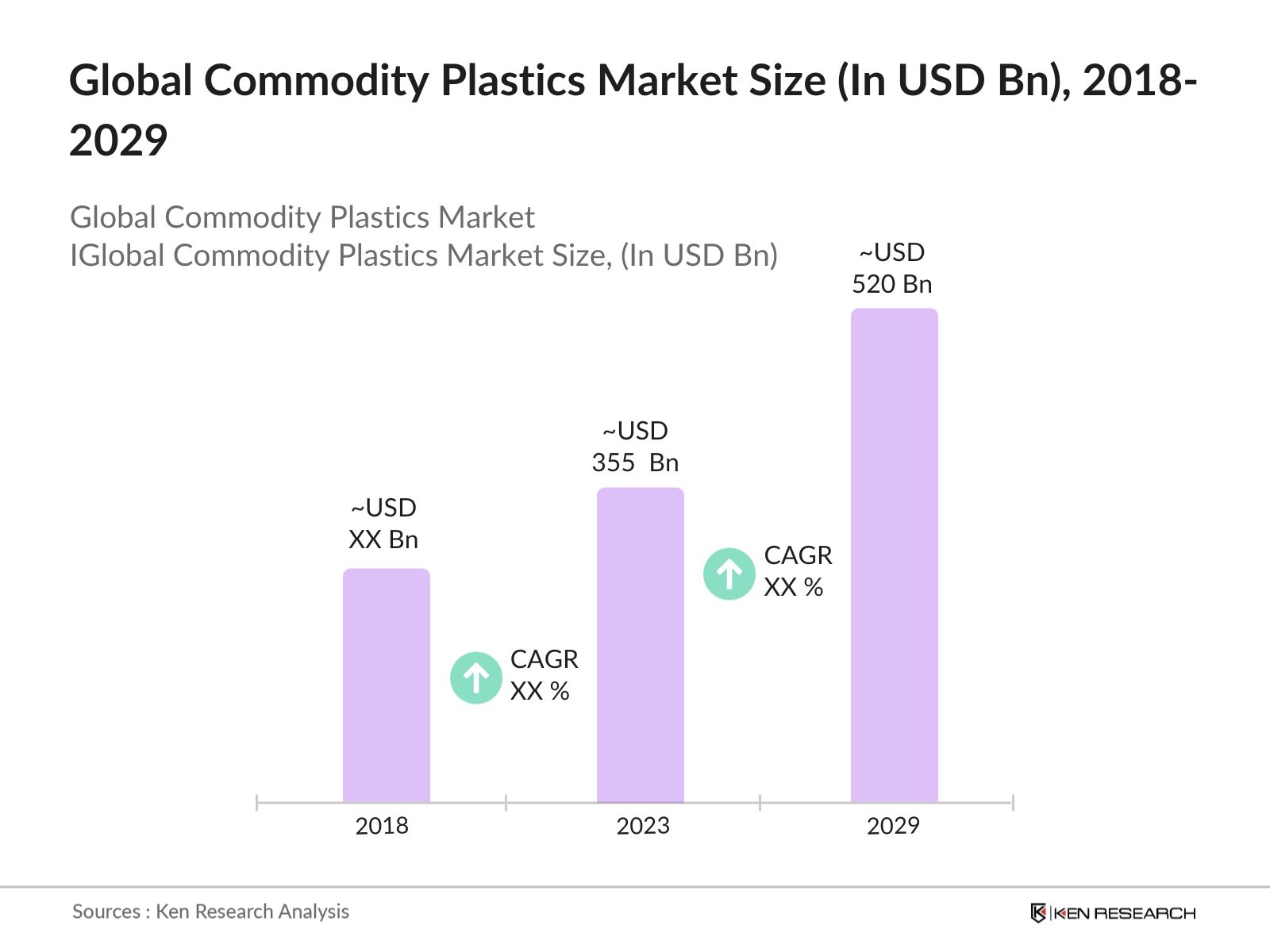

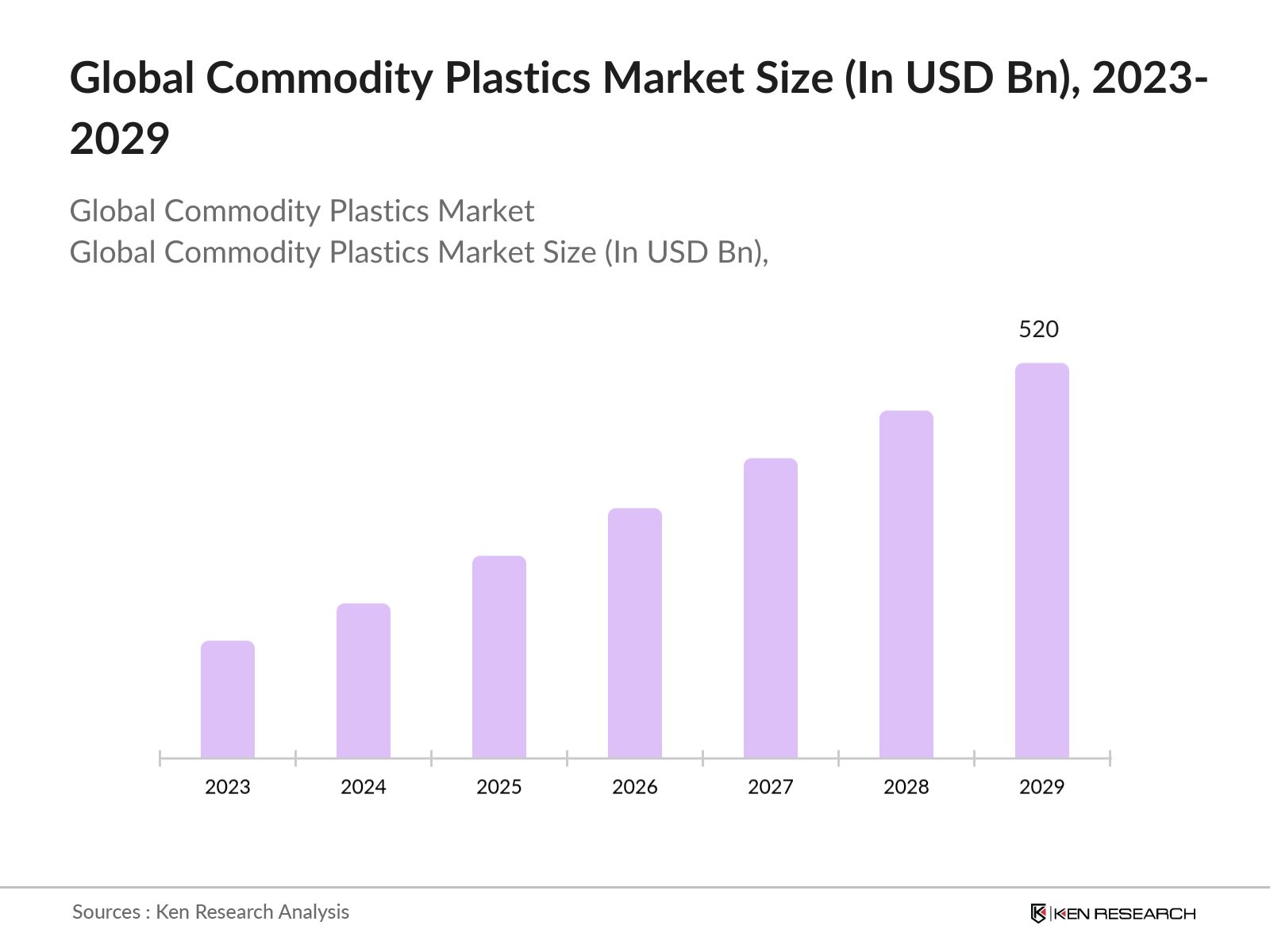

- The global Commodity Plastics market was valued at USD 355 Bn in 2023 anticipated to reach a market size of USD 520 Bn in 2029 driven by its sheer size, rapid urbanization, and robust industrialization.

- The market is fragmented due to the presence of numerous players with relatively small market shares. China Petroleum & Chemical Corporation (Sinopec Group), LyondellBasell Industries N.V., SABIC, and The DOW Chemical Company are some of the key players in the market.

- In May 2023, China Petroleum & Chemical Corporation signed a key terms agreement with KazMunayGaz, the national operator of the oil and gas industry of Kazakhstan, for developing a polyethylene project in the Atyrau Region in Xi'an, China.

Global Commodity Plastics Current Market Analysis

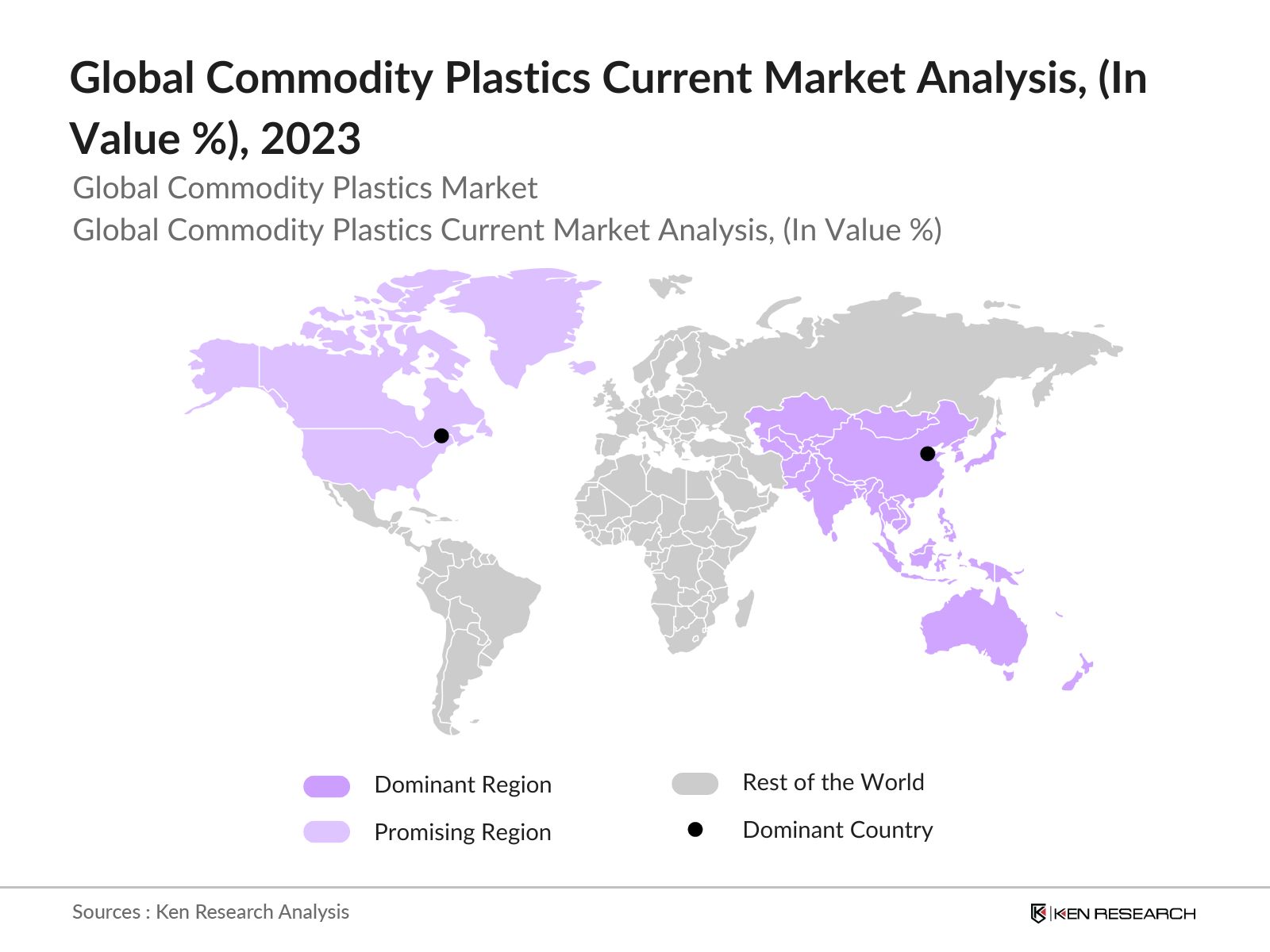

- APAC as the Most Dominant Region: Asia Pacific stands as the largest market for commodity plastics globally, driven by its sheer size, rapid urbanization, and robust industrialization. In 2023, 54% of the global urban population, more than 2.2 billion people, live in Asia. With a burgeoning population and expanding middle class, the region exhibits substantial demand across multiple sectors including packaging, construction, automotive, and electronics. Additionally, in Q1 2024, total investment volumes in the Asia-Pacific real estate market reached USD 30.5 billion, marking a 13% increase year-over-year.

- North America as emerging region: North America emerges as the fastest-growing market for commodity plastics, fueled by technological innovation, stringent quality standards, and a strong focus on sustainability. The region's advanced manufacturing capabilities and R&D investments contribute to continuous improvements in plastic production efficiency and material performance. Between 2020 and 2023, the manufacturing industry in the U.S. received USD 1.47 trillion in investments from USA-based investors.

- China as the Dominant Country: China commands a commanding presence in the Asia-Pacific commodity plastics market, maintaining a dominant market share that consistently exceeds other countries in the region. This leadership is driven by China's large population, robust industrial infrastructure, and extensive manufacturing capabilities. In 2022, the Chinese government announced an investment of USD1 trillion in infrastructure megaprojects aimed at boosting construction and related activities.

Global Commodity Plastics Market Segmentation

The Global Commodity Plastics Market can be segmented based on several factors:

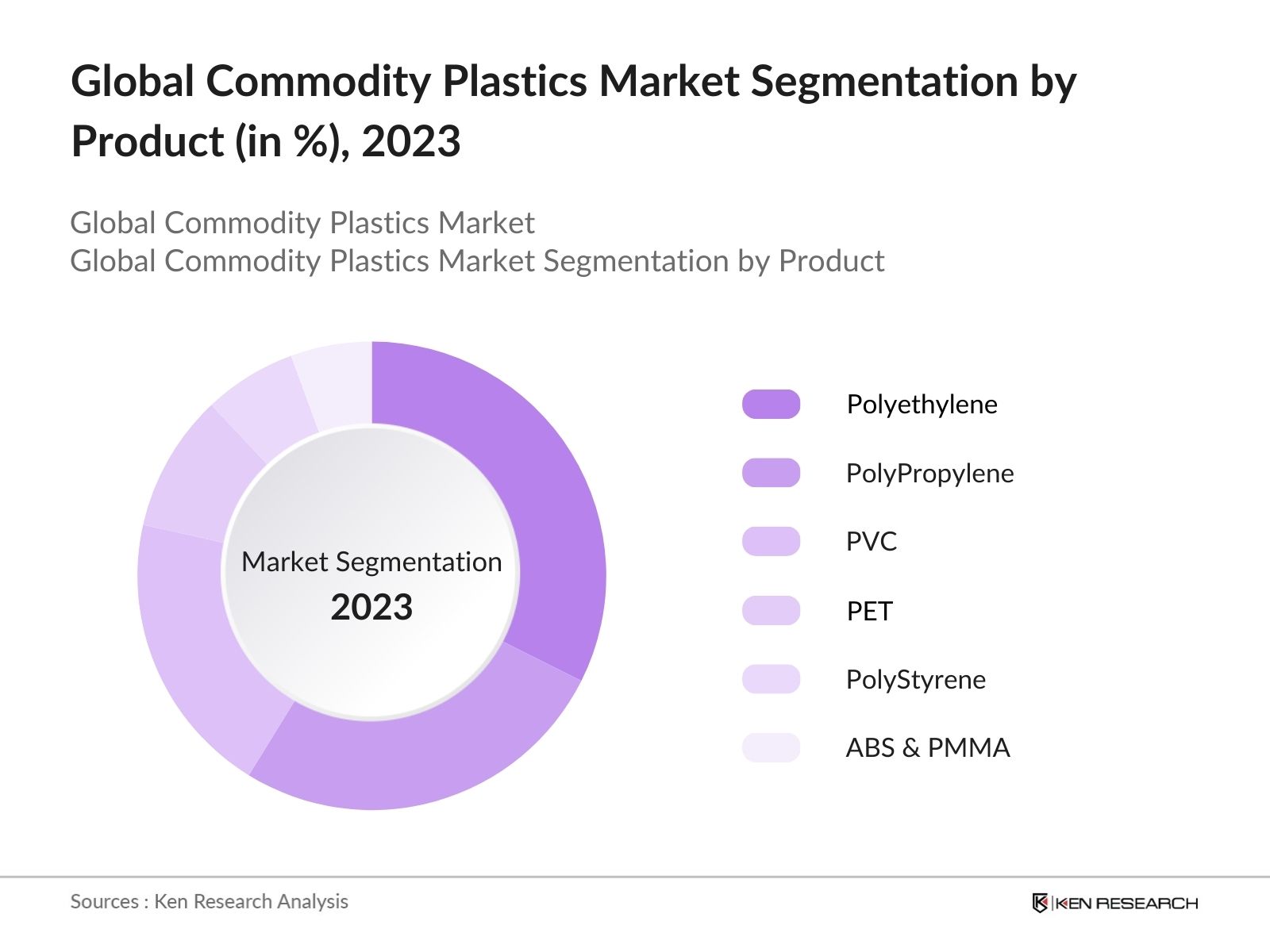

By Product: The global commodity plastics market segmentation by product type is classified into polyethylene, polypropylene, PVC, PET, polystyrene, and ABS & PMMA. In 2023, polyethylene (PE) was the dominant segment in commodity plastics due to several key factors. Firstly, PE is widely used across diverse industries such as packaging, construction, and consumer goods due to its versatility, durability, and cost-effectiveness.

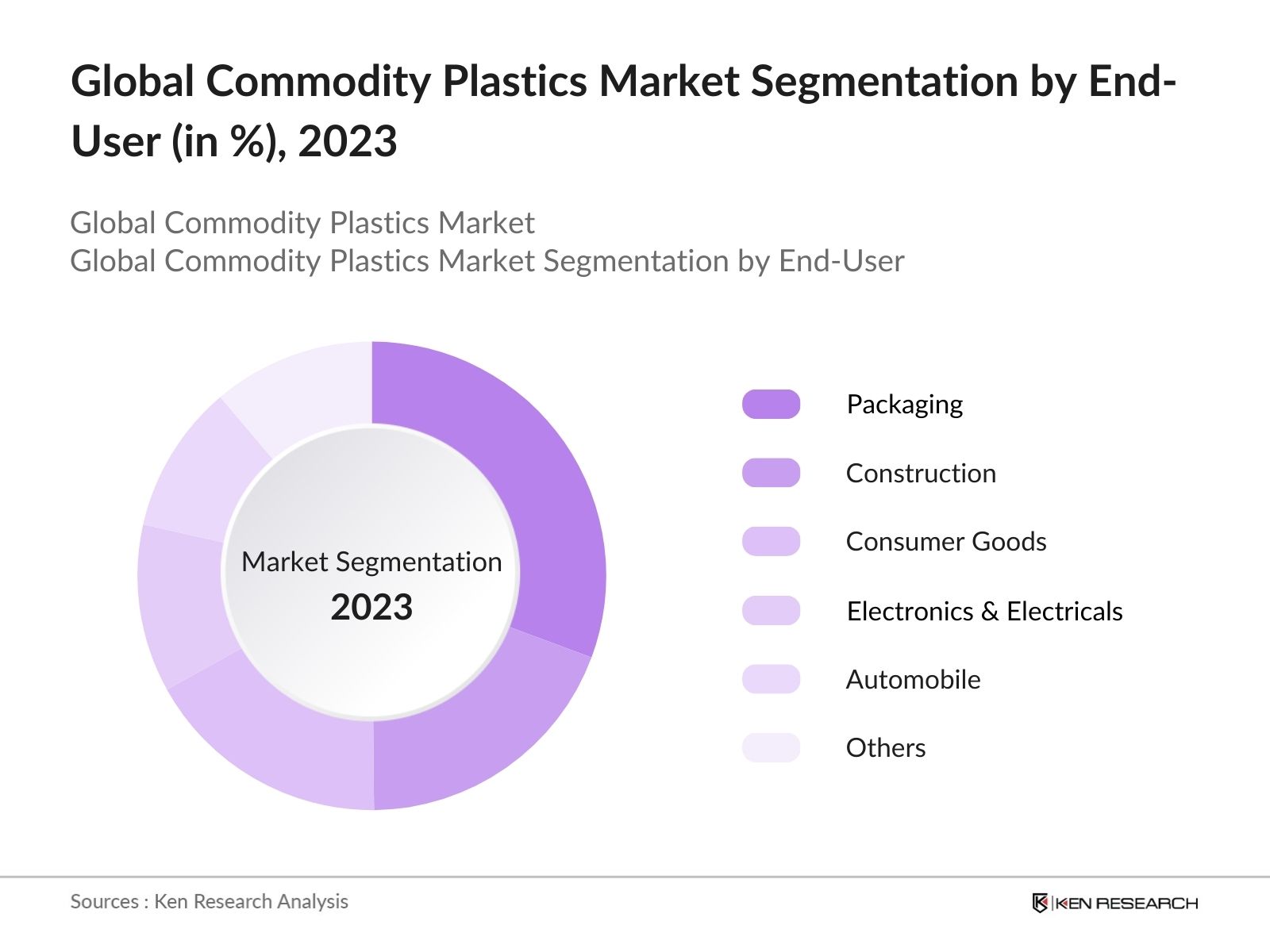

By End-User: The global commodity plastics market segmentation by end-user is divided into packaging, construction, consumer goods, electronics & electricals, automobile, medical & pharmaceuticals, and others. In 2023, the packaging segment dominated the market due to the exponential growth of e-commerce and the increasing consumer preference for convenient and sustainable packaging solutions.

Global Commodity Plastics Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

Geographical Presence |

R&D Expense'23 (USD Bn) |

|

China Petroleum & Chemical Corporation (Sinopec Group) |

2000 |

Beijing, China |

23 |

1.92 |

|

LyondellBasell Industries N.V. |

1985 |

Houston, Texas, USA |

32 |

0.1 |

|

SABIC |

1976 |

Riyadh, Saudi Arabia |

45 |

0.5 |

|

Exxon Mobil |

1999 |

USA |

45 |

0.9 |

|

The DOW Chemical Company |

1897 |

Midland, Michigan, USA |

160 |

0.82 |

|

Ineos |

1998 |

London, UK |

29 |

0.04 |

|

Formosa Plastics Corporation |

1954 |

USA |

USA only |

0.1 |

|

Sumitomo Chemical Co. Ltd. |

1913 |

Tokyo, Japan |

55 |

1.24 |

- LyondellBasell Industries N.V.: In January 2024, LYB launched Petrothene T3XL7420: A revolutionary polymer compound for optimized manufacturing. In November 2022- LyondellBasell and Audi create first automotive plastic parts from mixed automotive plastic waste. This advanced polymer features enhanced durability and flexibility, enabling more efficient production processes and reducing material waste in industrial applications

- SABIC: In November 2023, SABIC in association with CJ CHEILJEDANG launched World-First ready-to-Eat Rice packaging Bowls made with 25% Renewable PP. This innovative collaboration marks a significant milestone in automotive sustainability, demonstrating the potential for recycling and repurposing waste materials into high-quality, functional components for vehicles.

- ExxonMobil: In September 2023- ExxonMobil invested $2 Bn to expand chemical production at the Baytown plant. Additionally, In December 2022- ExxonMobil doubled PP production at Baton Rouge Plant. This substantial investment aims to increase production capacity and enhance technological capabilities, positioning ExxonMobil to meet growing global demand for high-performance chemicals and support long-term growth in the industry.

Global Commodity Plastics Industry Analysis

Global Commodity Plastics Market Growth Drivers:

- Technological Advancements in Polymer Chemistry: Innovations in polymer chemistry and processing technologies have led to improved properties of commodity plastics, such as enhanced strength, heat resistance, and recyclability. These advancements have expanded their applicability and competitiveness in the market. In 2023, Worldwide production of fossil-based polymers exceeds 360 million metric tons annually, with an impressive growth rate of 8.4% per year.

- Cost Effectiveness & Versatility: Commodity plastics are preferred for their cost-effectiveness and versatility in various applications. They can be easily moulded, shaped, and extruded, making them suitable for a wide range of industrial and consumer applications. In 2022, global plastic production reached 400.3 million metric tons, marking a 1.6% increase from the previous year.

- Shift towards Lightweight & Fuel-Efficient Vehicles: In the automotive sector, there is a global trend towards lightweight materials to improve fuel efficiency and reduce emissions. In 2023, global sales of lightweight materials vehicles reached 13 million units. Commodity plastics play a crucial role in achieving these objectives, thereby driving their demand in automotive manufacturing.

Global Commodity Plastics Market Challenges:

- Competitive Market Dynamics: The commodity plastics market is highly competitive, with numerous global and regional players vying for market share. Price competition, technological advancements, and innovations in material properties pose challenges and opportunities for existing and new market entrants.

- Price Votality: Commodity plastics are susceptible to price fluctuations due to changes in raw material costs (like crude oil and natural gas), global supply chain disruptions, and geopolitical factors. Managing these price variations can be challenging for manufacturers and consumers alike.

Global Commodity Plastics Market Future Outlook

The Global commodity plastics market is expected to reach a market size of USD 520 Bn by 2029 showing substantial growth driven by shifting consumer preferences, regulatory changes, and sustainability initiatives.

Future Market Trends

- Sustainability and Circular Economy: Increasing environmental awareness and stringent regulations are pushing manufacturers towards sustainable practices. The development of bio-based and biodegradable plastics will gain momentum. Enhanced recycling technologies and initiatives to improve plastic waste management will become more prevalent.

- Growth in E-commerce and Packaging: The rapid expansion of e-commerce will continue to drive the demand for efficient and lightweight packaging solutions. Plastics will remain a preferred material due to their versatility, durability, and cost-effectiveness. Innovations in smart packaging, which includes features like freshness indicators and anti-counterfeit measures, will further boost the use of plastics in the packaging industry.

Scope of the Report

|

By Region |

North America Europe APAC Latin America MEA |

|

By Product Type |

Polyethylene Poly Propylene PVC PET Poly Styrene ABS & PMMA |

|

By End-User Type |

Packaging Construction Consumer Goods Electronics & Electricals Automobile Medical & pharmaceuticals Others |

Companies

Players mentioned in the Report:

- China Petroleum & Chemical Corporation (Sinopec Group)

- LyondellBasell Industries N.V.

- SABIC

- Exxon Mobil

- The DOW Chemical Company

- Ineos

- Formosa Plastics Corporation

- Sumitomo Chemical Co. Ltd.

- BASF SE

- LG Chem

Table of Contents

1. Executive Summary

1.1 Global Commodity Plastics Market

2. Global Overview

2.1 Overview of Global Economics

2.2 Overview of Global Commodity Plastics Industry

2.3 Global Plastics Market

3. Global Commodity Plastics Market Overview

3.1 Global Commodity Plastics Market Ecosystem

3.2 Global Commodity Plastics Market Value Chain

4. Global Commodity Plastics Market Size (in USD Bn), 2018-2023

5. Global Commodity Plastics Market (in value %), 2018-2023

5.1 Global Commodity Plastics Market Segmentation by Region (in value %), 2018-2023

5.2 Global Commodity Plastics Market Segmentation by Product Type (in value%), 2018-2023

5.3 Global Commodity Plastics Market Segmentation by End-User Type (in value %), 2018-2023

6. Global Commodity Plastics Market Competition Landscape

6.1 Global Commodity Plastics Market Share Analysis

6.2 Global Commodity Plastics Market Heat Map Analysis

6.3 Global Commodity Plastics Market Cross Comparison

6.4 Global Commodity Plastics Market Comparison Matrix

7. Global Commodity Plastics Market Dynamics

7.1 Global Commodity Plastics Market Growth Drivers

7.2 Global Commodity Plastics Market Challenges

7.3 Global Commodity Plastics Market Trends

7.4 Global Commodity Plastics Market Case Studies

7.5 Global Commodity Plastics Market Strategic Initiatives

8. Global Commodity Plastics Future Market Size (in value %), 2023-2028

8.1 Global Commodity Plastics Future Market Segmentation by Region (in value %), 2023-2028

8.2 Global Commodity Plastics Future Market Segmentation by Product Type (in value%), 2023-2028

8.3 Global Commodity Plastics Future Market Segmentation by End-User Type (in value %), 2023-2028

9. Analyst Recommendations

10. Research Methodology

10.1 Market Definitions and Assumptions

10.2 Abbreviations

10.3 Market Sizing Approach

10.4 Consolidated Research Approach

10.5 Understanding Market Potential Through In-Depth Industry Interviews

10.6 Primary Research Approach

10.7 Limitations and Future Conclusion

Disclaimer

Contact Us

Research Methodology

Step 1: Secondary Resources:

Objective- Identify players, revenue and product offerings of key players to calculate the market size. Government Reports- United States Environmental Protection Agency, European Chemicals Agency, World Trade organization. Official Company Reports and Press Releases - Annual reports, investor presentations, and press releases from major Commodity Plastics Manufacturers for Product Offerings, Financial Performance & Market Strategies. Public and Proprietary Database –American Chemistry Council,F&S, Euro monitor, Statista, McKinsey for Market Sizing, Industry Analysis & Forecasts.

Step 2: Validate via Trade Desk Interviews

Objective- Confirm market revenue, margins, segmentations, Distribution, and future projections to gauge insights in the current market trends.

Step 3: Proxy Modelling & Outcomes

Bottom-Top Approach- Calculating Revenue of Major Players by analyzing their sales and pricing for different products. Disguised interviews with multiple managers to get their viewpoint on their operational and financial performance. This approach has supported our team to validate the information that was shared by their top management to ensure data accuracy

Frequently Asked Questions

01 How big is the Global Commodity Plastics Market?

The global commodity plastics market, valued at USD 355 Bn in 2023 driven by the increasing demand across various industries, including packaging, automotive, and construction.

02 What are the challenges in the Global Commodity Plastics Market?

Challenges in the global commodity plastics market include environmental concerns regarding plastic waste, stringent regulatory frameworks, volatility in raw material prices, and competition from alternative materials.

03 Who are the major players in the Global Commodity Plastics Market?

Key players in the global commodity plastics market include BASF SE, Dow Chemical Company, ExxonMobil, SABIC, and LG Chem. These companies dominate due to their extensive product portfolios, global reach, and significant investment in research and development.

04 What are the growth drivers of Global Commodity Plastics Market?

The global commodity plastics market is propelled by factors such as the growth in the packaging industry, increasing use in automotive manufacturing for lightweight vehicles, rapid urbanization and construction activities, and technological advancements in plastic production.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.