Global Competitive Intelligence Software Market Outlook to 2030

Region:Global

Author(s):Abhinav kumar

Product Code:KROD8095

November 2024

93

About the Report

Global Competitive Intelligence Software Market Overview

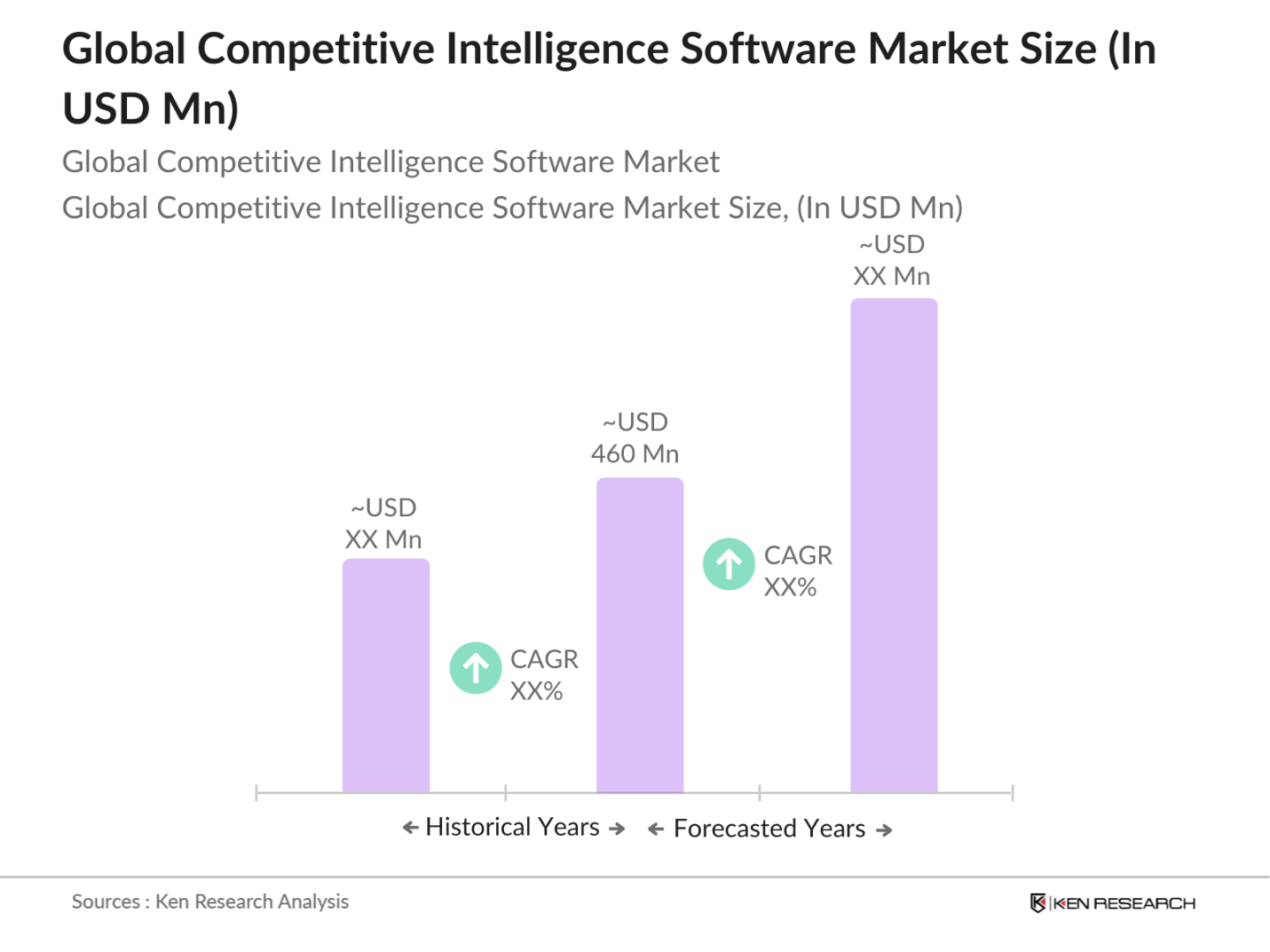

- The Global Competitive Intelligence (CI) Software market is valued at USD 460 million, driven by the increasing importance of market analytics in competitive positioning and decision-making among organizations. This growth is fueled by demand for comprehensive CI tools that leverage data analytics, AI, and machine learning for real-time competitive insights. Businesses increasingly use CI software for predictive insights, improving customer relationship management, and refining product strategies, a trend supported by the global surge in data-driven decision-making.

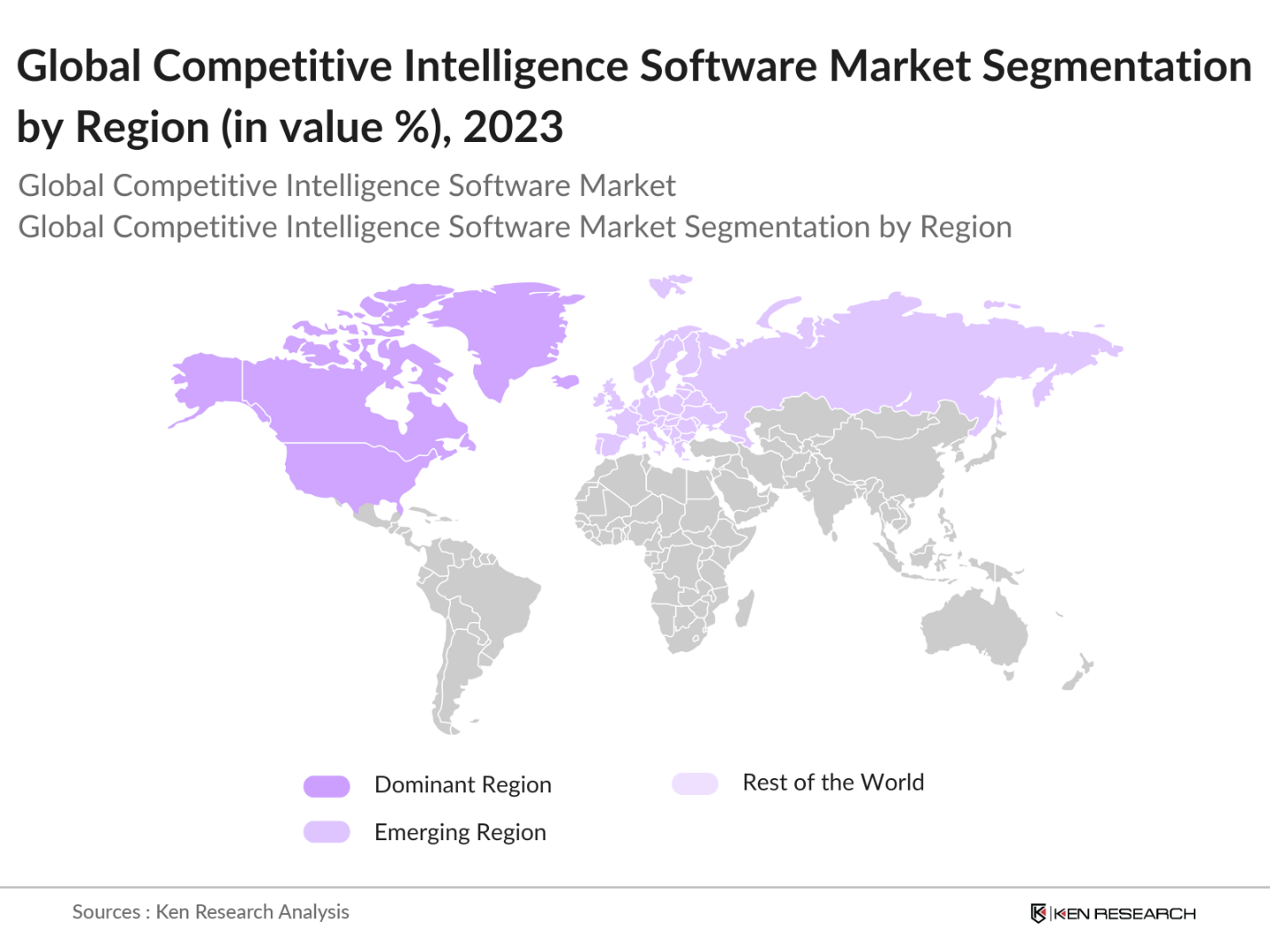

- The market sees significant contributions from North America, Europe, and parts of Asia-Pacific due to their established technological infrastructure and high adoption rates of CI solutions among enterprises. North Americas dominance stems from its large base of technology-driven industries, while Europe benefits from stringent market competition regulations and demand for intelligence tools. In the Asia-Pacific region, growing digitalization and the rise of e-commerce contribute to higher adoption rates in countries like Japan and India.

- Strict data protection regulations like GDPR and CCPA impact CI software, necessitating compliance to safeguard sensitive data. By 2024, fines under GDPR reached 1.6 billion across the EU, affecting companies with inadequate data security measures. CI software vendors are under pressure to ensure compliance frameworks are robust, especially since over 60% of companies utilizing CI tools are based in regulated regions. This emphasis on privacy underlines CI software's need to integrate stringent data protection capabilities.

Global Competitive Intelligence Software Market Segmentation

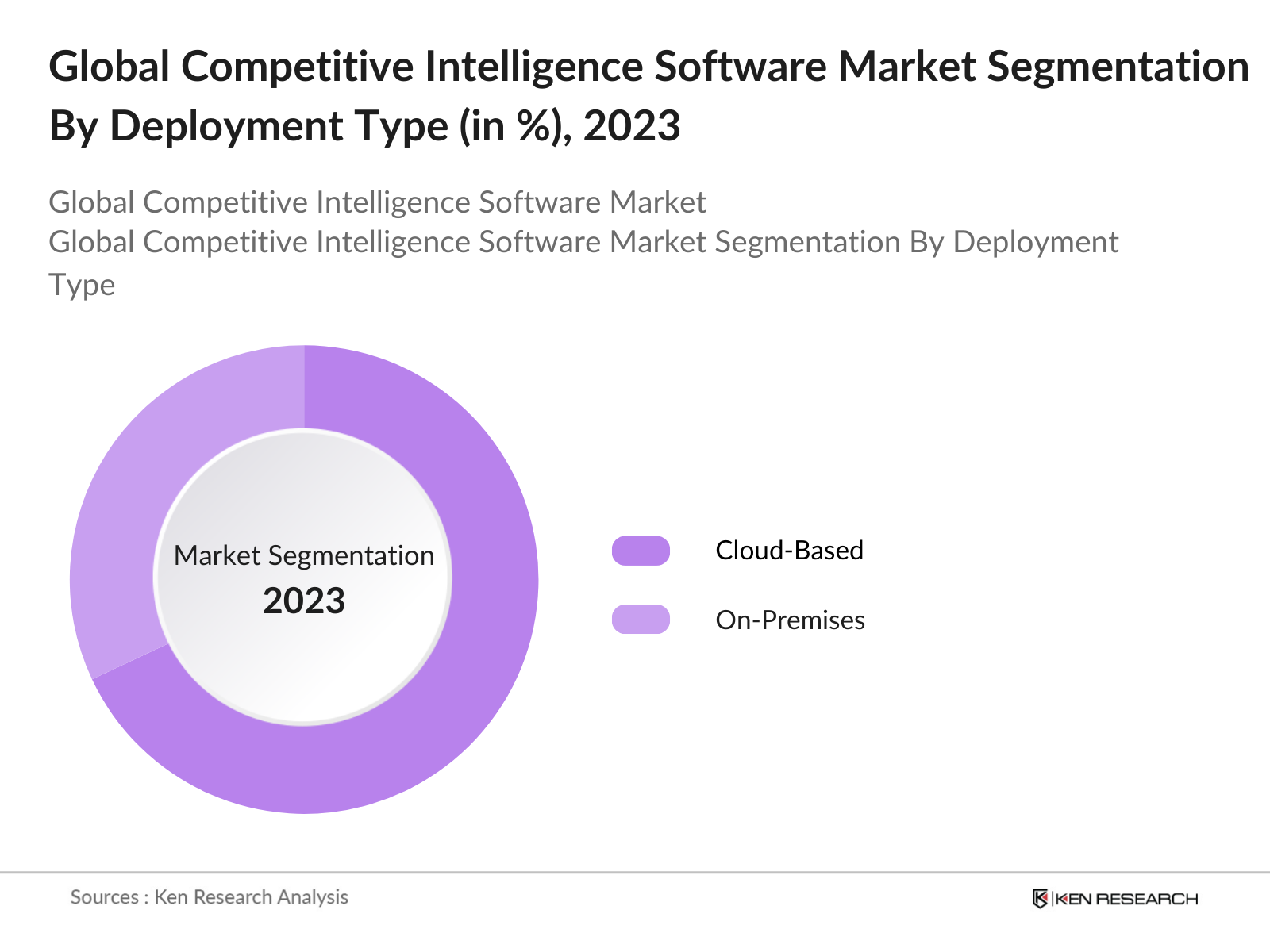

By Deployment Type: The CI software market is segmented by deployment type into Cloud-Based and On-Premises solutions. Cloud-Based solutions hold a dominant market share due to their scalability, ease of integration, and low upfront costs, which appeal to both SMEs and large enterprises. The growing preference for cloud-based CI platforms is also driven by real-time data access and seamless updates, crucial for businesses requiring on-the-go intelligence capabilities.

By Region: The market is segmented by region into North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. North America leads the regional segmentation due to its well-established tech ecosystem and rapid adoption of CI software in industries such as finance and technology. Europe follows closely, supported by strong regulatory standards that encourage competitive intelligence and data transparency.

By End-User: Competitive intelligence software is widely used across industries, with segmentation by end-user types including Small and Medium Enterprises (SMEs) and Large Enterprises. Large Enterprises have the dominant share, attributed to their significant budgets and higher data management needs, which CI software effectively meets through features like predictive analytics and automation, offering critical insights into competitor strategies.

Global Competitive Intelligence Software Market Competitive Landscape

The Global Competitive Intelligence Software market is dominated by established players who have developed sophisticated, data-driven CI platforms with extensive functionalities. Key companies include both pure CI software providers and larger corporations with CI functionalities embedded within broader analytics solutions. The competitive landscape highlights how key players are distinguished by their data integration capabilities, industry specializations, and the provision of predictive insights. This differentiation supports their stronghold across various industries, emphasizing tailored CI solutions for enhanced strategic planning.

Global Competitive Intelligence Software Industry Analysis

Growth Drivers

- Increasing Demand for Market Analytics: The demand for market analytics continues to grow as businesses rely on data-driven decisions for competitive advantage. In 2024, global businesses generated over 64 zettabytes of data, influenced by digitization trends and an increasing shift towards real-time insights in competitive intelligence (CI) software. The shift toward advanced analytics is evident as organizations globally adopt CI solutions to analyze vast datasets effectively. With this growth, the employment in data analysis roles has also increased to 3.1 million jobs worldwide, a figure projected to stabilize as digital adoption progresses across industries.

- Rise of Digital Business Models: As digital business models reshape traditional structures, the reliance on competitive intelligence (CI) software intensifies. In 2024, digitalization impacted over 70% of Fortune 500 companies globally, driven by demand for enhanced operational efficiency and strategic planning. With industries worldwide adopting digital-first approaches, CI tools offer pivotal insights, leading to their increased integration. Additionally, with digital businesses contributing around 45% of global GDP in 2024, CI software adoption grows as companies strive to stay competitive within this rapidly evolving landscape.

- Adoption of AI and Machine Learning in CI Tools: Artificial Intelligence (AI) and Machine Learning (ML) are now crucial in competitive intelligence, enabling firms to predict market trends, assess competitor moves, and refine strategies. The global AI software market size reached $94 billion in 2024, with 80% of this growth driven by business and data analytics. Furthermore, AI adoption in business processes grew by 30% year-over-year, indicating CIs focus on automation. Governments, like the EU, have invested nearly 1 billion in AI research to support its integration across sectors, making CI tools essential for analyzing AI-driven data efficiently.

Market Challenges

- Data Privacy Concerns: With growing emphasis on data security, data privacy regulations pose challenges for CI software vendors. In 2024, there were over 1,800 data breaches in the U.S. alone, exposing sensitive information and emphasizing the need for compliance. Regulatory standards, including the GDPR and CCPA, affect CI software functionality and data accessibility, compelling firms to implement compliance frameworks. Furthermore, non-compliance costs globally exceeded $4 billion, intensifying challenges for firms reliant on competitor data analysis. This context illustrates the need for CI software to adapt to increasingly stringent privacy laws.

- Limited Skilled Professionals in CI Domain: Despite CIs rapid expansion, the scarcity of skilled professionals in competitive intelligence remains a major challenge. According to the U.S. Bureau of Labor Statistics, data analytics and intelligence roles outpace supply, with a 2024 talent gap of 500,000 unfilled roles globally. Many organizations struggle to find professionals skilled in CI software tools and analysis, impacting growth and limiting strategic benefits. Additionally, education systems have yet to align with industry demands, as only 15% of recent graduates enter CI-related roles, highlighting an urgent need for workforce development.

Global Competitive Intelligence Software Market Future Outlook

Over the next five years, the Competitive Intelligence Software market is projected to grow significantly, driven by increasing demand for predictive analytics, data integration with CRM systems, and advancements in machine learning. Organizations worldwide are investing in CI solutions to refine their competitive strategies and make informed decisions using real-time insights. Cloud-based platforms are expected to gain more traction, particularly among SMEs, due to their affordability and scalability.

Opportunities

- Integration with Business Intelligence Tools: Competitive intelligence software increasingly integrates with business intelligence (BI) tools, enhancing data accessibility. In 2024, 55% of companies utilizing CI software reported increased operational efficiency through BI integration, as such integration streamlines decision-making. The global BI market, valued at $30 billion, highlights growing demand for solutions that unify BI and CI for comprehensive analysis. With integration becoming a standard, BI-supported CI software is anticipated to aid firms in making informed decisions, promoting the importance of CI solutions across industries.

- Expansion in Emerging Markets: Emerging markets present vast growth opportunities for CI software, particularly with rising digital adoption across the Asia-Pacific and Latin American regions. In 2024, 65% of companies in these regions prioritized digital transformation, supported by government incentives and investment in tech infrastructure, notably in China, where digital economy investments exceeded $2.6 trillion. CI software providers can benefit by catering to businesses in these regions that require competitive insights to navigate growing markets and digital competition.

Scope of the Report

|

By Deployment Type |

Cloud-Based On-Premises |

|

By End-User |

Small and Medium Enterprises Large Enterprises |

|

By Application |

Market Research and Analysis Product Intelligence, Competitor Tracking Sales and Marketing Intelligence |

|

By Industry Vertical |

IT and Telecommunications Healthcare Financial Services Retail and E-commerce Manufacturing |

|

By Region |

North America Europe Asia-Pacific Latin America Middle East & Africa |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Business Strategy Companies

Product Development Industries

Digital Transformation Companies

Marketing Intelligence Industries

Competitive Strategy Companies

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Federal Trade Commission, European Commission)

Technology Integrators and Platform Development Companies

Companies

Players Mentioned in the Report

Crayon

Digimind

Klue

Cipher Systems

AlphaSense

Contify

Kompyte

M-Brain

Similarweb

Brandwatch

Table of Contents

1. Global Competitive Intelligence Software Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Competitive Intelligence Ecosystem

1.4 Market Segmentation Overview

2. Global Competitive Intelligence Software Market Size (in USD)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Global Competitive Intelligence Software Market Analysis

3.1 Growth Drivers

3.1.1 Increasing Demand for Market Analytics

3.1.2 Rise of Digital Business Models

3.1.3 Adoption of AI and Machine Learning in CI Tools

3.1.4 Expansion of Competitive Benchmarking

3.2 Market Challenges

3.2.1 Data Privacy Concerns

3.2.2 Limited Skilled Professionals in CI Domain

3.2.3 High Subscription and Maintenance Costs

3.3 Opportunities

3.3.1 Integration with Business Intelligence Tools

3.3.2 Expansion in Emerging Markets

3.3.3 Automation and Real-time Insights in CI Software

3.4 Trends

3.4.1 Shift Towards Cloud-Based Solutions

3.4.2 Use of Predictive Analytics for Competitive Forecasting

3.4.3 CI Software Integration with CRM Systems

3.5 Regulatory Environment

3.5.1 Data Protection Compliance (GDPR, CCPA)

3.5.2 Industry-Specific Data Standards

3.5.3 Cybersecurity Standards for CI Tools

3.6 Competitive Intelligence in Business Strategy

3.6.1 Role in Product Development

3.6.2 Enhancing Market Positioning

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

4. Global Competitive Intelligence Software Market Segmentation

4.1 By Deployment Type (in Value %)

4.1.1 Cloud-Based

4.1.2 On-Premises

4.2 By End-User (in Value %)

4.2.1 Small and Medium Enterprises (SMEs)

4.2.2 Large Enterprises

4.3 By Application (in Value %)

4.3.1 Market Research and Analysis

4.3.2 Product Intelligence

4.3.3 Competitor Tracking

4.3.4 Sales and Marketing Intelligence

4.4 By Industry Vertical (in Value %)

4.4.1 IT and Telecommunications

4.4.2 Healthcare

4.4.3 Financial Services

4.4.4 Retail and E-commerce

4.4.5 Manufacturing

4.5 By Region (in Value %)

4.5.1 North America

4.5.2 Europe

4.5.3 Asia-Pacific

4.5.4 Latin America

4.5.5 Middle East & Africa

5. Global Competitive Intelligence Software Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Crayon

5.1.2 Digimind

5.1.3 Klue

5.1.4 Cipher Systems

5.1.5 Contify

5.1.6 Kompyte

5.1.7 M-Brain

5.1.8 AlphaSense

5.1.9 Rival IQ

5.1.10 Wide Narrow

5.1.11 Similarweb

5.1.12 Brandwatch

5.1.13 Meltwater

5.1.14 Fuld & Company

5.1.15 Intelligence2day

5.2 Cross Comparison Parameters (Platform Features, Data Integration, Real-Time Analytics, Predictive Insights, User Interface, Compliance Support, Customer Support, Industry Specialization)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Innovation and Product Development

5.8 Partner Ecosystem and Alliances

6. Global Competitive Intelligence Software Market Regulatory Framework

6.1 Compliance with Data Protection Regulations

6.2 Intellectual Property Management in CI Tools

6.3 Data Standardization and Interoperability

7. Global Competitive Intelligence Software Future Market Size (in USD)

7.1 Market Size Projections

7.2 Key Factors Driving Future Growth

8. Global Competitive Intelligence Software Future Market Segmentation

8.1 By Deployment Type (in Value %)

8.2 By End-User (in Value %)

8.3 By Application (in Value %)

8.4 By Industry Vertical (in Value %)

8.5 By Region (in Value %)

9. Global Competitive Intelligence Software Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Segmentation Insights

9.3 Competitive Positioning Strategies

9.4 Growth Opportunities and White Spaces

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

This initial phase involves constructing a detailed CI software ecosystem map, identifying major industry stakeholders, and defining crucial market dynamics. In-depth desk research supports the establishment of key variables through secondary and proprietary databases.

Step 2: Market Analysis and Construction

This phase includes gathering and analyzing historical CI software market data to assess revenue generation patterns, competitive dynamics, and data security needs. A robust analysis is conducted to ensure accuracy in market forecasts.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and validated through expert interviews, utilizing computer-assisted telephone interviews (CATI) with industry experts. These insights provide direct input into operational and financial parameters essential for market data accuracy.

Step 4: Research Synthesis and Final Output

This step synthesizes data from major CI software providers and consolidates insights across CI segments, delivering a comprehensive and verified analysis. The synthesis ensures a fully validated market overview for CI software.

Frequently Asked Questions

1. How big is the Global Competitive Intelligence Software Market?

The market was valued at USD 460 million, with its growth driven by rising demand for data-driven decision-making and strategic competitive positioning.

2. What are the main challenges in the Global Competitive Intelligence Software Market?

Challenges include data privacy issues, high software costs, and a scarcity of skilled professionals, impacting software adoption rates across industries.

3. Who are the major players in the Global Competitive Intelligence Software Market?

Key players include Crayon, Digimind, Klue, and AlphaSense, known for their extensive features in real-time analytics and predictive insights.

4. What drives the growth of the Global Competitive Intelligence Software Market?

The market growth is fueled by the adoption of AI and machine learning in CI tools, increasing use of data analytics, and demand for real-time competitive intelligence.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.