Global Computer-Aided Detection (CAD) Market Outlook to 2030

Region:Global

Author(s):Mukul

Product Code:KROD4280

December 2024

83

About the Report

Global Computer-Aided Detection (CAD) Market Overview

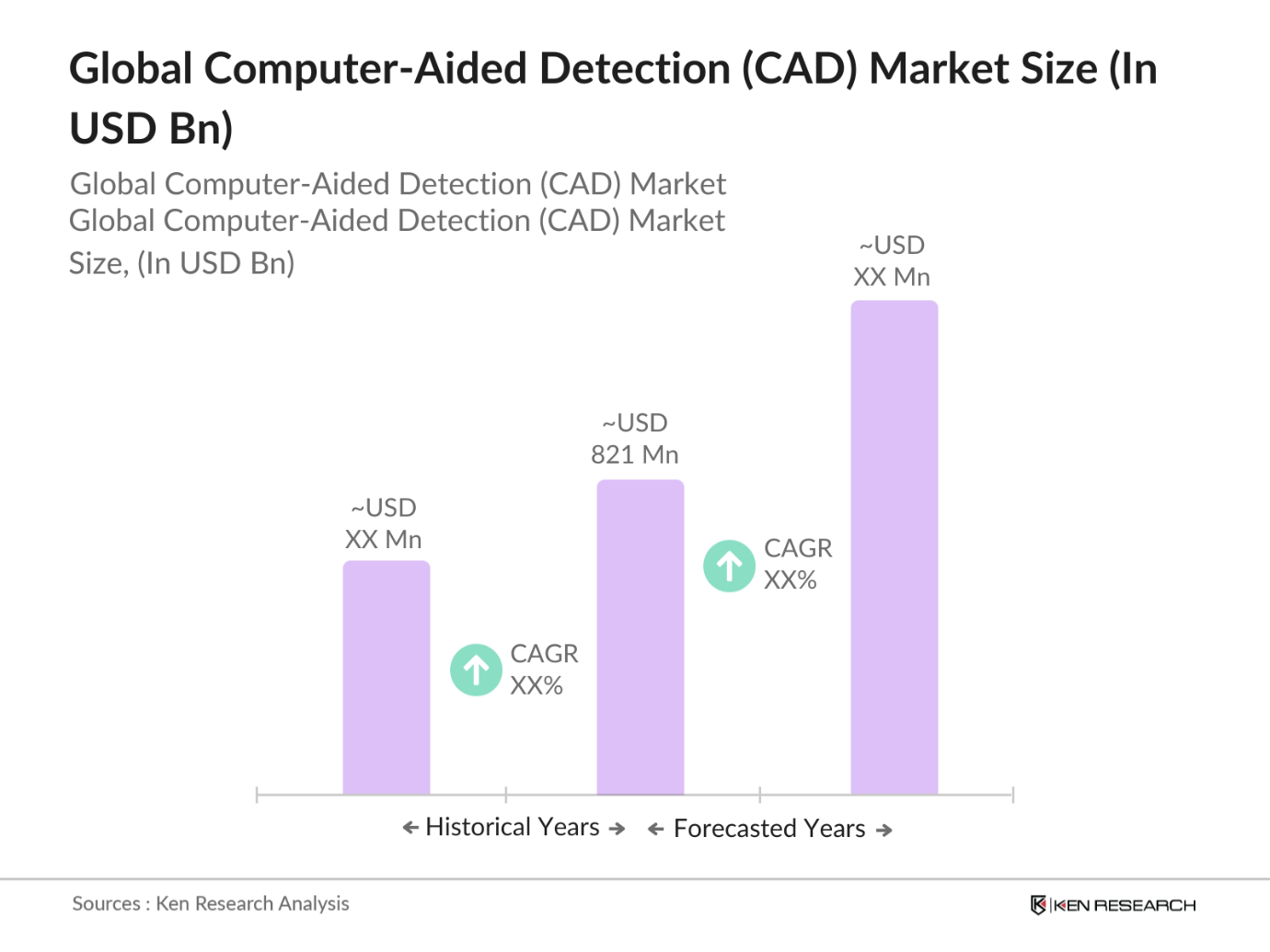

- The Global Computer-Aided Detection (CAD) Market is valued at USD 821 million, driven primarily by technological advancements, including machine learning and AI integration, which enhance diagnostic accuracy across various medical applications. This expansion is further fueled by government initiatives promoting digitized healthcare solutions and the rising demand for early diagnosis and intervention, especially in oncology and cardiovascular conditions. Based on an extensive analysis of historical data, this market continues to see steady growth due to advancements in radiology tools and regulatory support aimed at improving diagnostic accuracy.

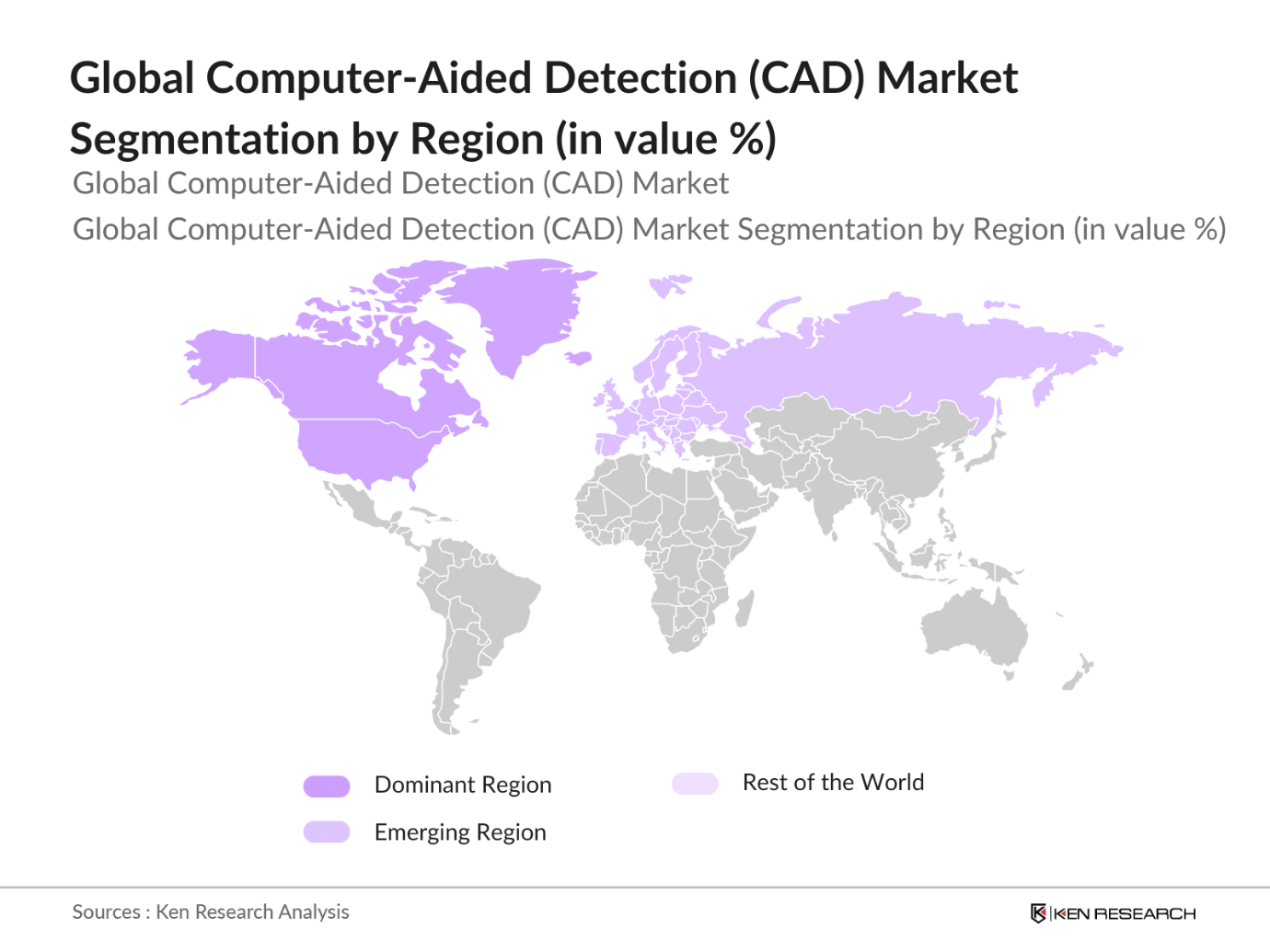

- North America, particularly the United States, leads the CAD market due to high investments in healthcare infrastructure, robust adoption of AI-powered diagnostic tools, and significant R&D activities. Europe follows, with countries like Germany and the UK investing heavily in healthcare innovations and regulatory support to improve diagnostics. Asia-Pacific, led by Japan and China, is witnessing rapid growth due to a rising awareness of advanced diagnostic tools and growing investments in healthcare infrastructure.

- International certifications like ISO and IEC have set global benchmarks for CAD system quality. In 2024, the International Organization for Standardization (ISO) certified 500 new CAD devices, ensuring their reliability for global healthcare providers. These certifications assure users of CADs compliance with international safety standards, supporting consistent performance across diverse healthcare environments. Such certifications build confidence in CAD systems, facilitating broader adoption worldwide

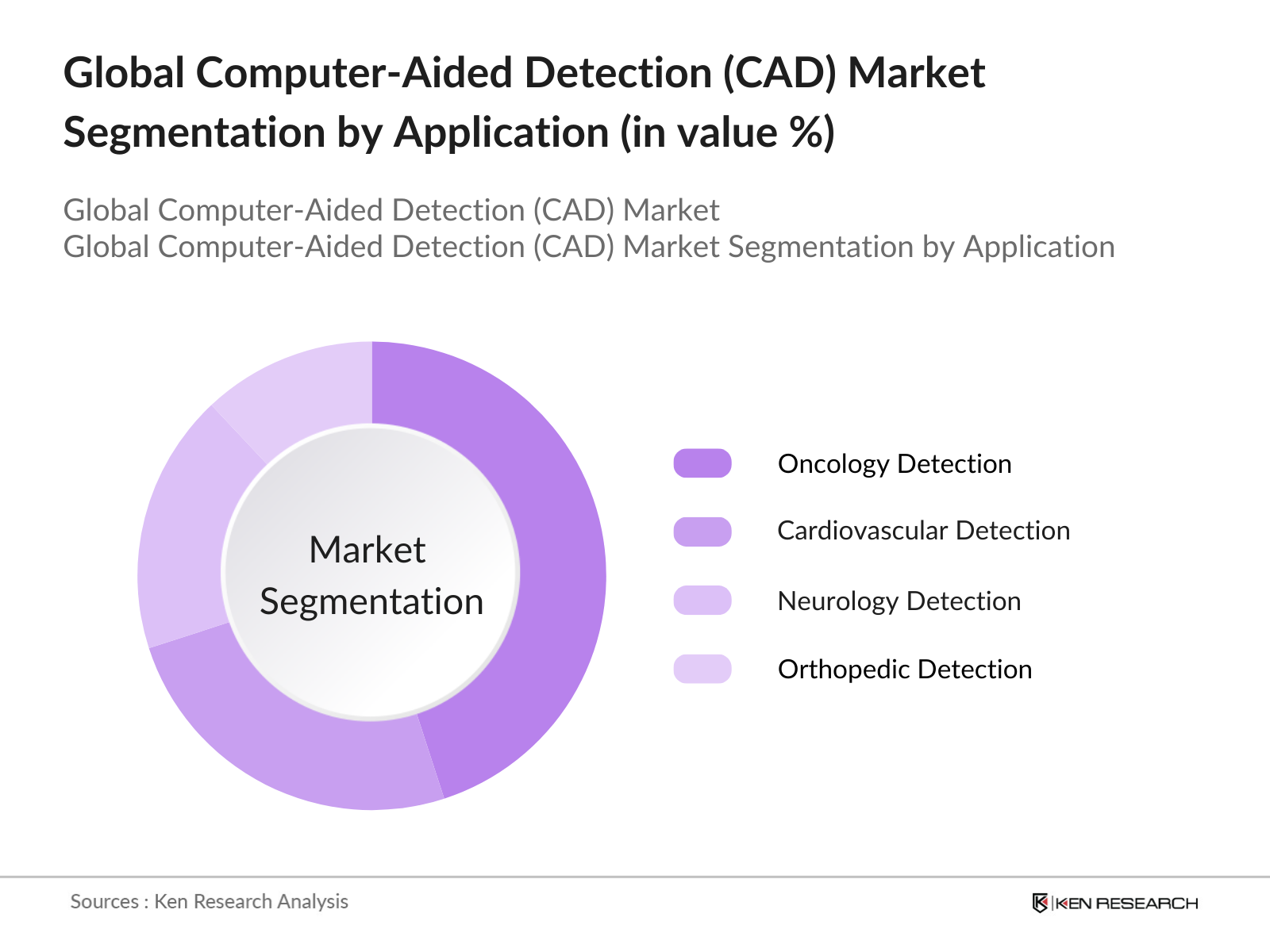

Global Computer-Aided Detection (CAD) Market Segmentation

- By Application: The CAD market is segmented by application into oncology detection, cardiovascular detection, neurology detection, orthopedic detection, and others. Oncology detection holds a dominant position due to the high prevalence of cancer cases and the critical importance of early and precise detection. CAD systems are instrumental in identifying subtle indicators in imaging, aiding in more accurate diagnoses, which enhances treatment outcomes and patient care.

- By Region: The regional segmentation includes North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. North America holds the largest share due to its well-established healthcare sector, followed by Europe, where regulatory backing and increasing healthcare expenditure drive market growth. Asia-Pacific is experiencing rapid expansion, especially in Japan and China, due to rising healthcare investments and increasing awareness of early diagnosis.

- By Imaging Modality: The market is divided by imaging modality into mammography, magnetic resonance imaging (MRI), computed tomography (CT), ultrasound, and others. Mammography dominates due to its extensive use in breast cancer detection, which represents a significant application of CAD technologies. The demand for mammography CAD systems is high because they provide critical assistance in detecting early-stage breast cancer, enhancing treatment success rates.

Global Computer-Aided Detection (CAD) Market Competitive Landscape

The CAD market is characterized by a concentration of key players focused on AI and imaging solutions. Major players include iCAD Inc., Hologic, Inc., GE Healthcare, Siemens Healthineers, and Philips Healthcare. These companies hold significant market influence through their investments in R&D and partnerships to expand product capabilities and improve detection accuracy.

Global Computer-Aided Detection (CAD) Industry Analysis

Growth Drivers

- Advancements in AI and Machine Learning Integration: The integration of artificial intelligence (AI) and machine learning (ML) has revolutionized CAD technology by enhancing automation and accuracy. As of 2024, AI adoption across healthcare is bolstered by government investments, with AI in healthcare valued significantly due to the efficiencies it brings in early detection and imaging. In Europe, the European Commission has earmarked over EUR 2 billion for AI-related healthcare improvements, aiming to reduce diagnostic times by 30% in CAD systems. This funding directly supports CAD in sectors like radiology, where AI advancements drive precision in imaging and diagnosis.

- Increasing Adoption in Healthcare and Radiology: Healthcare's expanding reliance on CAD is highlighted by increasing diagnostic volumes, with an estimated 50 million MRI scans conducted globally, signaling a rising demand for CAD tools in diagnostics. Countries like Japan have led this growth, implementing CAD-based imaging extensively in their hospitals, with over 60% of Japanese hospitals leveraging CAD for accurate radiological assessments. Government support, such as Japan's Ministry of Health's funding for CAD tech in diagnostics, further accelerates its integration in radiology.

- Rising Demand for Early Diagnosis and Treatment Planning: The global emphasis on early disease detection has heightened CADs relevance, especially in oncology. In 2024, World Health Organization (WHO) data reports a 15% increase in early cancer screening programs across Europe, driven by CAD-based solutions in early-stage detection. France and Germany lead these efforts, investing in CAD-enhanced MRI and CT scanning tools as part of national cancer screening programs. This trend aligns with the WHOs aim of reducing mortality rates through early diagnosis supported by CAD technology.

Market Restraints

- High Implementation Costs: Despite its advantages, CAD systems come with high upfront and operational costs. Installation costs for CAD systems in U.S. hospitals range between $200,000 to $500,000, a substantial investment that limits adoption in smaller healthcare facilities. A 2023 study by the Centers for Medicare & Medicaid Services (CMS) found that 70% of U.S. hospitals hesitate to invest in CAD solutions primarily due to financial constraints. This barrier remains especially significant in emerging economies where healthcare budgets are comparatively limited.

- Lack of Skilled Personnel in Emerging Markets: Emerging markets face challenges in implementing CAD due to a lack of skilled personnel. In 2024, a report from Indias Ministry of Health revealed that only 30% of radiology technicians in tier-2 and tier-3 cities possess the training required to operate CAD systems. Similarly, African nations report a shortfall of over 100,000 skilled healthcare professionals proficient in digital diagnostics, which hinders the effective adoption of CAD tools. This gap emphasizes the need for workforce development to support CADs expansion.

Global Computer-Aided Detection (CAD) Market Future Outlook

Over the next five years, the CAD market is expected to experience robust growth, driven by continuous innovations in AI and machine learning, rising healthcare expenditures, and expanding applications in disease diagnostics. This growth trajectory is reinforced by an increasing focus on improving the accuracy of CAD systems in oncology and cardiovascular applications, supported by governmental policies encouraging the adoption of advanced healthcare technologies.

Market Opportunities

- Expanding Applications Beyond Radiology: CAD applications are expanding beyond radiology, finding uses in fields like cardiology and dermatology. In 2024, reports indicate a significant increase in CAD use in cardiology, particularly for detecting heart abnormalities through echocardiograms. In India, CAD systems are being implemented across 150 cardiology departments nationwide as part of government efforts to improve cardiovascular disease management. These applications beyond traditional radiology settings suggest a broader, untapped potential for CAD tools across medical specialties

- Integration with Electronic Health Records (EHR): CAD systems increasingly integrate with electronic health records (EHR), which streamlines diagnosis and treatment. In 2024, the U.S. Department of Veterans Affairs reported a 20% increase in diagnosis efficiency following CAD-EHR integration across its hospitals. This integration facilitates more comprehensive patient data analysis, significantly reducing diagnosis times and enabling personalized treatment plans. Such integration is gaining traction globally, with Australia mandating CAD-EHR compatibility standards in all public hospitals this year.

Scope of the Report

|

By Application |

Oncology Detection |

|

By Imaging Modality |

Mammography |

|

By End User |

Hospitals |

|

By Component |

Software |

|

By Region |

North America |

Products

Key Target Audience

Healthcare Providers

Medical Imaging Equipment Manufacturers

Research & Development Institutions

Academic & Research Institutes

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (FDA, EMA)

Healthcare IT Solutions Providers

AI and ML Startups Focused on Diagnostics

Companies

Players Mentioned in the Report:

iCAD Inc.

Hologic, Inc.

GE Healthcare

Siemens Healthineers

Philips Healthcare

Agfa-Gevaert N.V.

Hitachi Medical Systems

Toshiba Medical Systems Corporation

Canon Medical Systems

Fujifilm Medical Systems

Zebra Medical Vision

Thermo Fisher Scientific

Lunit Inc.

McKesson Corporation

Riverain Technologies

Table of Contents

1 Global Computer-Aided Detection (CAD) Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2 Global CAD Market Size (In USD Million)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Developments and Milestones

3 Global CAD Market Analysis

3.1. Growth Drivers

3.1.1. Advancements in AI and Machine Learning Integration

3.1.2. Increasing Adoption in Healthcare and Radiology

3.1.3. Rising Demand for Early Diagnosis and Treatment Planning

3.1.4. Government Initiatives Supporting Healthcare Digitization

3.2. Market Challenges

3.2.1. High Implementation Costs

3.2.2. Lack of Skilled Personnel in Emerging Markets

3.2.3. Concerns Over Diagnostic Accuracy

3.3. Opportunities

3.3.1. Expanding Applications Beyond Radiology

3.3.2. Integration with Electronic Health Records (EHR)

3.3.3. Collaboration with Research Institutions for Enhanced Capabilities

3.4. Trends

3.4.1. Use of Deep Learning in Pattern Recognition

3.4.2. Remote Access and Cloud-Based CAD Systems

3.4.3. Integration with 3D Imaging for Enhanced Detection

3.5. Government Regulations

3.5.1. FDA Guidelines and Approvals

3.5.2. Data Privacy Laws (HIPAA, GDPR)

3.5.3. International Standards and Certifications (ISO, IEC)

3.6. SWOT Analysis

3.7. Value Chain Analysis

3.8. Porters Five Forces

3.9. Competitive Ecosystem

4 Global CAD Market Segmentation

4.1. By Application (In Value %)

4.1.1. Oncology Detection

4.1.2. Cardiovascular Detection

4.1.3. Neurology Detection

4.1.4. Orthopedic Detection

4.1.5. Others

4.2. By Imaging Modality (In Value %)

4.2.1. Mammography

4.2.2. Magnetic Resonance Imaging (MRI)

4.2.3. Computed Tomography (CT)

4.2.4. Ultrasound

4.2.5. Others

4.3. By End User (In Value %)

4.3.1. Hospitals

4.3.2. Diagnostic Centers

4.3.3. Research Institutes

4.3.4. Specialty Clinics

4.3.5. Others

4.4. By Component (In Value %)

4.4.1. Software

4.4.2. Services

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia-Pacific

4.5.4. Latin America

4.5.5. Middle East & Africa

5 Global CAD Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. iCAD Inc.

5.1.2. Hologic, Inc.

5.1.3. GE Healthcare

5.1.4. Siemens Healthineers

5.1.5. Philips Healthcare

5.1.6. Agfa-Gevaert N.V.

5.1.7. Hitachi Medical Systems

5.1.8. Toshiba Medical Systems Corporation

5.1.9. Canon Medical Systems

5.1.10. Fujifilm Medical Systems

5.1.11. Zebra Medical Vision

5.1.12. Thermo Fisher Scientific

5.1.13. Lunit Inc.

5.1.14. McKesson Corporation

5.1.15. Riverain Technologies

5.2. Cross Comparison Parameters (Revenue, Headquarters, Inception Year, Employees, R&D Expenditure, Technology Partnerships, Installed Base, Regional Presence)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6 Global CAD Market Regulatory Framework

6.1. Regulatory Approvals for CAD Devices

6.2. Compliance Standards (ISO, CE Marking)

6.3. Data Protection and Privacy Regulations (HIPAA, GDPR)

6.4. Certification Requirements for Diagnostic Use

7 Global CAD Future Market Size (In USD Million)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8 Global CAD Market Analysts Recommendations

8.1. TAM/SAM/SOM Analysis

8.2. White Space Opportunity Analysis

8.3. Customer Cohort Analysis

8.4. Recommended Strategic Investments

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

This initial phase involves mapping out the CAD ecosystem, identifying core stakeholders, and gathering industry-level information through extensive desk research and proprietary databases. This ensures comprehensive coverage of variables impacting the CAD market.

Step 2: Market Analysis and Construction

In this phase, historical data is compiled and analyzed, focusing on CAD market penetration, competitive landscape, and revenue generation by major players. Service quality metrics are also evaluated to verify data reliability.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are constructed based on initial findings and validated through expert consultations, including interviews with industry practitioners, providing insights into operational dynamics and financial trends in the CAD market.

Step 4: Research Synthesis and Final Output

The final synthesis involves engaging with key CAD manufacturers to gain insights into product performance, consumer preferences, and market demand. This step ensures data validation and accuracy in the final analysis of the CAD market.

Frequently Asked Questions

01 How big is the Global CAD Market?

The Global CAD Market is valued at USD 821 million, driven by technological advancements in diagnostic accuracy, rising healthcare expenditures, and government initiatives supporting digitized healthcare.

02 What are the key challenges in the CAD Market?

Challenges in the CAD market include high implementation costs, the need for skilled personnel, and concerns over diagnostic accuracy, particularly in emerging economies where healthcare infrastructure is still developing.

03 Who are the major players in the CAD Market?

Major players in the CAD market include iCAD Inc., Hologic, Inc., GE Healthcare, Siemens Healthineers, and Philips Healthcare, each contributing through innovation in AI and imaging technologies.

04 What factors are driving the CAD Market?

The CAD market is propelled by advancements in AI and machine learning, increasing applications in oncology and neurology, and regulatory support that encourages early diagnosis and treatment precision.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.