Global Computer Monitor Market Outlook to 2030

Region:Global

Author(s):Sanjana Verma

Product Code:KROD1082

December 2024

90

About the Report

Global Computer Monitor Market Overview

- The global computer monitor market, valued at USD 33 billion, is driven by advancements in display technology, increasing demand for high-definition screens, and the growing trend of work-from-home setups. The demand for gaming monitors has surged, especially with the rise of esports, while professionals require monitors with precise color accuracy and high resolution.

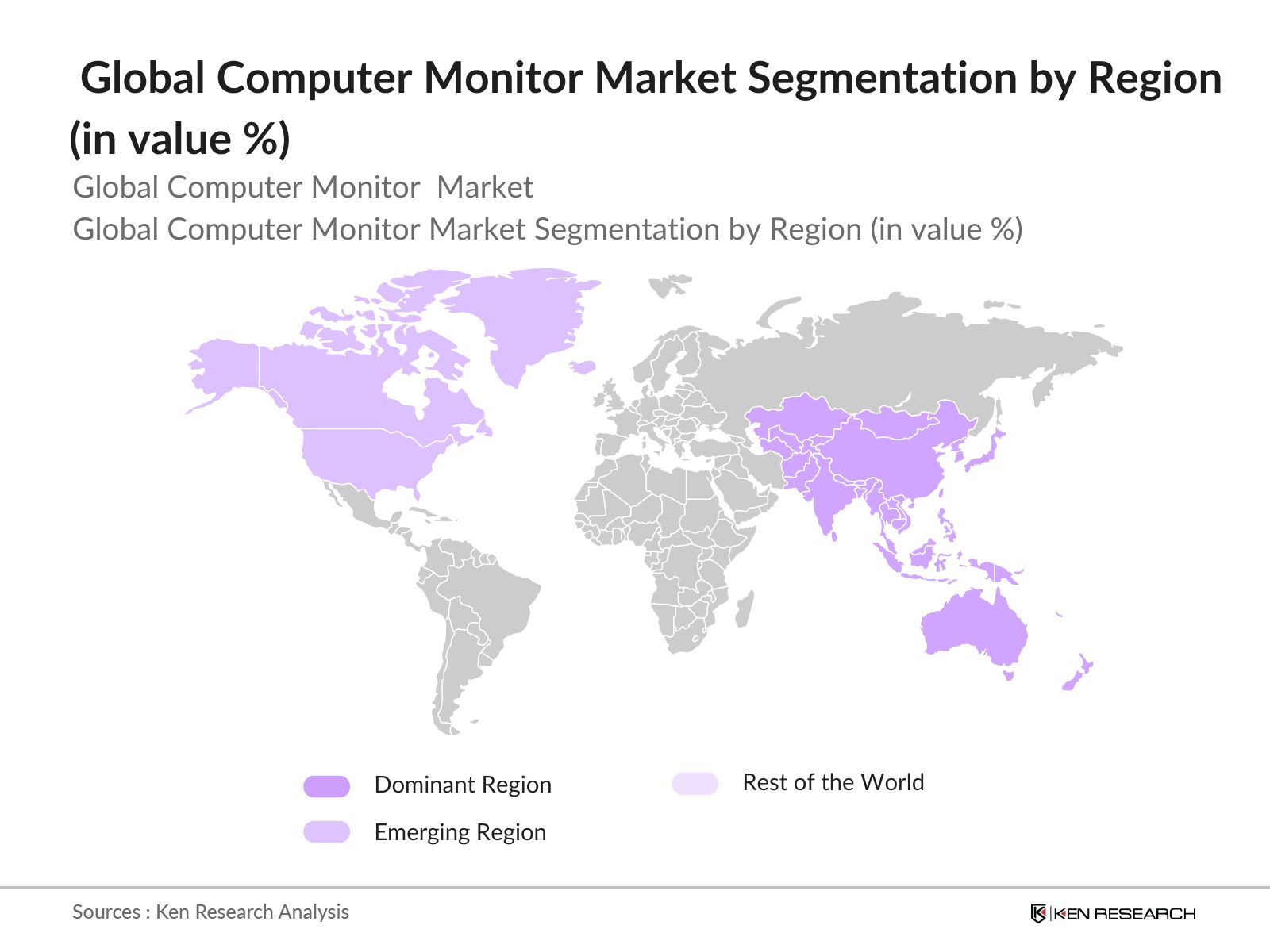

- The market is dominated by key regions such as North America, Europe, and Asia-Pacific. In North America, the dominance is largely due to the robust gaming industry, technological infrastructure, and the presence of major manufacturers. Asia-Pacific has emerged as a significant player due to the high demand for consumer electronics, rising disposable incomes, and the growing IT sector in countries like China, Japan, and South Korea.

- Governments worldwide are implementing stricter energy efficiency standards for electronics, including monitors. In the U.S., the Department of Energy introduced new guidelines in 2023, requiring all monitors sold to consume no more than 15 watts of power in standby mode. These regulations have led to innovations in energy-saving technologies across the monitor industry.

Global Computer Monitor Market Segmentation

By Screen Type: The global computer monitor market is segmented by screen type into flat monitors and curved monitors. Flat monitors dominate the market, especially in the corporate and commercial sectors, due to their wide usage in offices and home settings. Flat monitors are typically more affordable and widely available, making them accessible to a broader range of consumers. On the other hand, curved monitors are gaining popularity in gaming and immersive viewing experiences, but the market share is still smaller compared to flat screens.

By Region: The global computer monitor market is divided regionally into North America, Europe, Asia-Pacific, and Rest of the World. Asia-Pacific leads the market, driven by consumer demand for gaming and professional monitors, particularly in China and South Korea, which are significant hubs for electronics manufacturing. North America holds a substantial share, largely fueled by the gaming industry and professional usage, with significant contributions from the United States. Europe maintains a stable market share, focusing on energy efficiency and technological advancements in display technologies.

By Display Technology: The global computer monitor market is also segmented by display technology into LCD, LED, and OLED monitors. LED monitors currently dominate the market due to their energy efficiency, affordability, and superior performance compared to traditional LCD screens. The rise of OLED technology is notable due to its higher contrast ratios, faster response times, and better color accuracy, especially in premium segments, but the cost factor keeps its market share lower.

Global Computer Monitor Market Competitive Landscape

The global computer monitor market is dominated by a few major players who have established strong brand loyalty, product portfolios, and innovation capabilities. Companies like Dell, Samsung, and LG have created a strong foothold in both premium and budget segments, leveraging their global distribution networks and diverse product offerings. The competitive landscape is characterized by continuous innovation, with players investing heavily in R&D to improve resolution, refresh rates, and display technologies.

|

Company |

Year of Establishment |

Headquarters |

Product Range |

R&D Investment |

Global Market Reach |

Sustainability Initiatives |

Gaming Monitors Portfolio |

OLED Technology |

Manufacturing Plants |

|

Dell Technologies |

1984 |

USA |

- |

- |

- |

- |

- |

- |

- |

|

Samsung Electronics |

1938 |

South Korea |

- |

- |

- |

- |

- |

- |

- |

|

LG Electronics |

1958 |

South Korea |

- |

- |

- |

- |

- |

- |

- |

|

HP Inc. |

1939 |

USA |

- |

- |

- |

- |

- |

- |

- |

|

AsusTek Computer |

1989 |

Taiwan |

- |

- |

- |

- |

- |

- |

- |

Global Computer Monitor Market Analysis

Growth Drivers

- Technological Advancements: The continuous evolution in display technologies, such as OLED and QLED, is enhancing user experience across the globe. As of 2024, around 50% of all new monitors sold in developed regions, such as the US and Europe, utilize these cutting-edge technologies, enabling higher brightness levels, faster response times, and wider color ranges. According to the International Energy Agency (IEA), global electricity consumption by consumer electronics, including monitors, stands at approximately 750 terawatt-hours annually, showing the high demand for advanced, energy-efficient models.

- Increasing Demand for Gaming Monitors: Gaming monitors have seen a surge in popularity, driven by the global gaming industry's revenue, which reached $203 billion in 2024, according to the World Bank. Monitors with high refresh rates (144Hz and above) are becoming essential for competitive gaming. In the U.S. alone, 35 million gaming monitors were sold in 2023, a rise due to the increasing popularity of Esports and streaming. Gaming hardware demand, supported by advanced monitor sales, adds significantly to the sector's contribution to GDP.

- Enhanced Multimedia Experience with Higher Resolutions: High-definition content streaming and multimedia creation are major contributors to the demand for 4K and even 8K monitors. By 2024, the global video streaming market size reached $85 billion, with platforms like YouTube and Netflix driving consumer demand for monitors with higher resolutions to improve visual quality. High-resolution monitors are increasingly becoming a consumer necessity, aligning with the growing digital content economy supported by high-speed internet and digital infrastructure investments across key markets.

Challenges

- Supply Chain Disruptions: Supply chain disruptions, exacerbated by the COVID-19 pandemic, continue to affect the availability of key components like semiconductors. In 2023, global semiconductor production was reduced by 15% due to geopolitical tensions, particularly between China and Taiwan. According to the IMF, this shortage is likely to persist into 2024, causing further delays in monitor production and shipping, especially for high-end models that require specialized chips.

- Price Volatility in Electronic Components: Fluctuations in the prices of electronic components, particularly semiconductors and display panels, continue to challenge manufacturers. Major semiconductor manufacturers, including Taiwan Semiconductor Manufacturing Company (TSMC) and Intel, announced price increases starting in 2023. These increases were driven by ongoing supply chain issues and rising costs of raw materials. This price volatility directly affects the pricing strategies of computer monitor manufacturers, who must navigate cost increases without severely impacting consumer prices.

Global Computer Monitor Market Future Outlook

Global computer monitor market is expected to witness significant growth driven by technological advancements, rising demand for high-definition gaming monitors, and the increasing adoption of multi-monitor setups among professionals. The integration of AI and IoT in display technology is anticipated to revolutionize the user experience, making monitors smarter and more responsive to user needs. Moreover, energy-efficient monitors that comply with stringent environmental regulations will likely gain more traction in the commercial and industrial sectors.

Future Market Opportunities

- Expansion in Emerging Markets: Emerging markets, particularly in Asia and Africa, present significant opportunities for growth in the computer monitor sector. According to World Bank data, GDP growth in regions such as Southeast Asia and Sub-Saharan Africa will reach 3.4% in 2024, increasing consumer spending power. The demand for computer monitors in these regions is expected to grow due to rising internet penetration, the expansion of digital infrastructure, and the increasing availability of affordable devices.

- Rising Demand for Curved and Ultrawide Monitors: Curved and ultrawide monitors are increasingly popular, especially among gamers and professionals working in creative industries. In 2023, 15 million units of curved and ultrawide monitors were sold globally, reflecting a growing preference for enhanced viewing experiences. South Korea, a major producer of display technologies, accounted for 45% of global exports in this segment, according to WTO figures. As businesses increasingly adopt these monitors for productivity gains, the demand is expected to remain strong throughout 2024.

Scope of the Report

|

Screen Type |

Flat Monitors Curved Monitors |

|

Display Technology |

LCD Monitors LED Monitors OLED Monitors |

|

Resolution |

Full HD (1080p) Quad HD (1440p) 4K Ultra HD 8K Ultra HD |

|

Size |

Below 24 inches 24-32 inches Above 32 inches |

|

Connectivity |

HDMI DisplayPort USB-C Thunderbolt |

Products

Key Target Audience

Monitor Manufacturers

Gaming Industry Firms

IT and Software Companies

Professional Creative Agencies

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (such as FCC and Energy Star)

Retail and E-commerce Platforms

Companies

Players Mentioned in the Report

Dell Technologies

Samsung Electronics

LG Electronics

HP Inc.

AsusTek Computer Inc.

Acer Inc.

BenQ Corporation

ViewSonic Corporation

Lenovo Group Limited

AOC International

Table of Contents

Global Computer Monitor Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

Global Computer Monitor Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

Global Computer Monitor Market Analysis

3.1. Growth Drivers

3.1.1. Technological Advancements

3.1.2. Increasing Demand for Gaming Monitors

3.1.3. Rising Popularity of Work-From-Home Setup

3.1.4. Enhanced Multimedia Experience with Higher Resolutions

3.2. Market Challenges

3.2.1. Supply Chain Disruptions

3.2.2. Price Volatility in Electronic Components

3.2.3. High Competition in Low-Cost Monitors

3.2.4. Environmental Concerns and Sustainability Issues

3.3. Opportunities

3.3.1. Expansion in Emerging Markets

3.3.2. Rising Demand for Curved and Ultrawide Monitors

3.3.3. Growth of Esports and Streaming Culture

3.3.4. Corporate Partnerships for Professional Monitors

3.4. Trends

3.4.1. Integration of AI and IoT in Display Technologies

3.4.2. Increased Adoption of Energy-Efficient Monitors

3.4.3. Development of Portable and Compact Monitors

3.4.4. Focus on Gaming Monitors with High Refresh Rates

3.5. Government Regulation

3.5.1. Energy Efficiency Standards

3.5.2. Import/Export Tariffs on Electronics

3.5.3. Environmental Regulations for E-Waste Disposal

3.5.4. National Digital Infrastructure Initiatives

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

Global Computer Monitor Market Segmentation

4.1. By Screen Type (In Value %)

4.1.1. Flat Monitors

4.1.2. Curved Monitors

4.2. By Display Technology (In Value %)

4.2.1. LCD Monitors

4.2.2. LED Monitors

4.2.3. OLED Monitors

4.3. By Resolution (In Value %)

4.3.1. Full HD (1080p)

4.3.2. Quad HD (1440p)

4.3.3. 4K Ultra HD

4.3.4. 8K Ultra HD

4.4. By Size (In Value %)

4.4.1. Below 24 Inches

4.4.2. 24-32 Inches

4.4.3. Above 32 Inches

4.5. By Connectivity (In Value %)

4.5.1. HDMI

4.5.2. DisplayPort

4.5.3. USB-C

4.5.4. Thunderbolt

Global Computer Monitor Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Dell Technologies

5.1.2. Samsung Electronics

5.1.3. LG Electronics

5.1.4. HP Inc.

5.1.5. AsusTek Computer Inc.

5.1.6. Acer Inc.

5.1.7. AOC International

5.1.8. BenQ Corporation

5.1.9. ViewSonic Corporation

5.1.10. Lenovo Group Limited

5.2. Cross Comparison Parameters

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Private Equity Investments

Global Computer Monitor Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. E-Waste Management Policies

6.4. Import/Export Regulations on Electronics

Global Computer Monitor Market Future Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

Global Computer Monitor Future Market Segmentation

8.1. By Screen Type (In Value %)

8.2. By Display Technology (In Value %)

8.3. By Resolution (In Value %)

8.4. By Size (In Value %)

8.5. By Connectivity (In Value %)

Global Computer Monitor Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial step involved mapping the key variables and stakeholders in the global computer monitor market. A combination of secondary research through industry reports, financial data, and product line analysis was used to gather insights. The goal was to identify the crucial factors influencing market performance, such as technological developments, consumer trends, and competitive strategies.

Step 2: Market Analysis and Construction

A comprehensive analysis of historical data was conducted to understand market penetration, the volume of monitors sold, and revenue patterns. This involved evaluating industry performance metrics such as sales volume, product pricing trends, and key product categories, ensuring a deep understanding of the market's growth trajectory.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses developed from secondary research were validated through consultations with industry experts, including manufacturers, distributors, and gaming industry specialists. These discussions provided critical insights into market developments and future trends, such as the demand for gaming-specific monitors and eco-friendly alternatives.

Step 4: Research Synthesis and Final Output

The final phase focused on synthesizing all collected data to provide an accurate and validated representation of the global computer monitor market. This involved a bottom-up approach, combining both primary and secondary data sources to ensure the reliability and depth of the final analysis.

Frequently Asked Questions

01 How big is the global computer monitor market?

The global computer monitor market was valued at USD 33 billion in 2023, driven by technological advancements, gaming trends, and rising demand for high-definition displays.

02 What are the challenges in the global computer monitor market?

Challenges in the global computer monitor market include supply chain disruptions due to chip shortages, price volatility in electronic components, and growing environmental concerns regarding e-waste.

03 Who are the major players in the global computer monitor market?

Key players in the global computer monitor market include Dell Technologies, Samsung Electronics, LG Electronics, HP Inc., and AsusTek Computer Inc., dominating through innovation, strong distribution, and product portfolios.

04 What are the growth drivers of the global computer monitor market?

The global computer monitor market is driven by technological advancements in OLED and 4K displays, the rise of esports and gaming, and increased demand for professional monitors in sectors such as design, engineering, and media.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.