Global Condiments Market Outlook 2030

Region:Global

Author(s):Shivani Mehra

Product Code:KROD11359

November 2024

87

About the Report

Global Condiments Market Overview

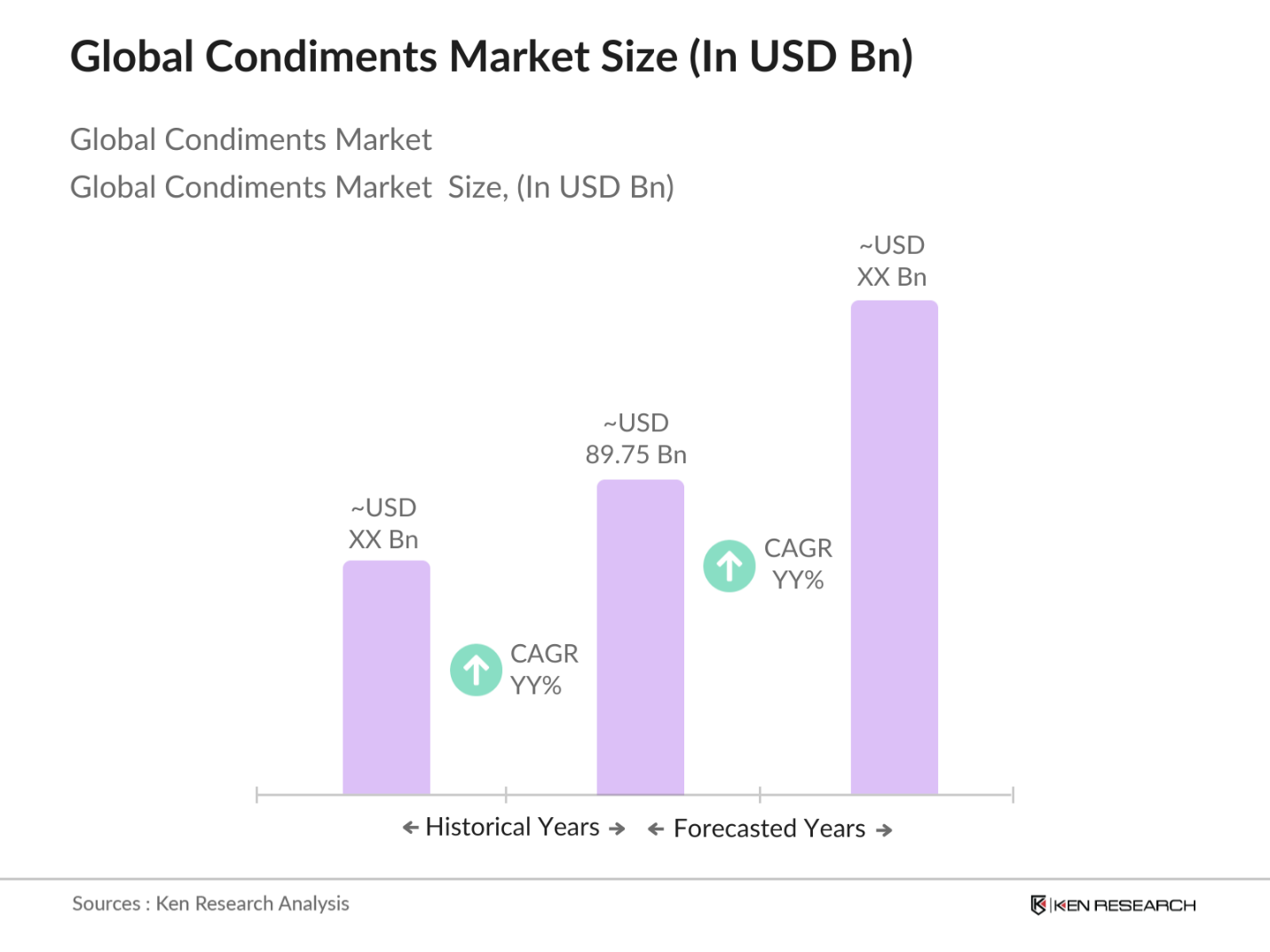

- The global condiments market is valued at USD 89.75 billion, driven by increasing consumer demand for diverse and flavorful food items. This growth is further fueled by the expanding range of condiment options, including organic, vegan, and gluten-free products, alongside rising health consciousness. The use of condiments is bolstered by the trend of convenience foods, growing fast-food consumption, and increasing innovation in product packaging, such as eco-friendly solutions.

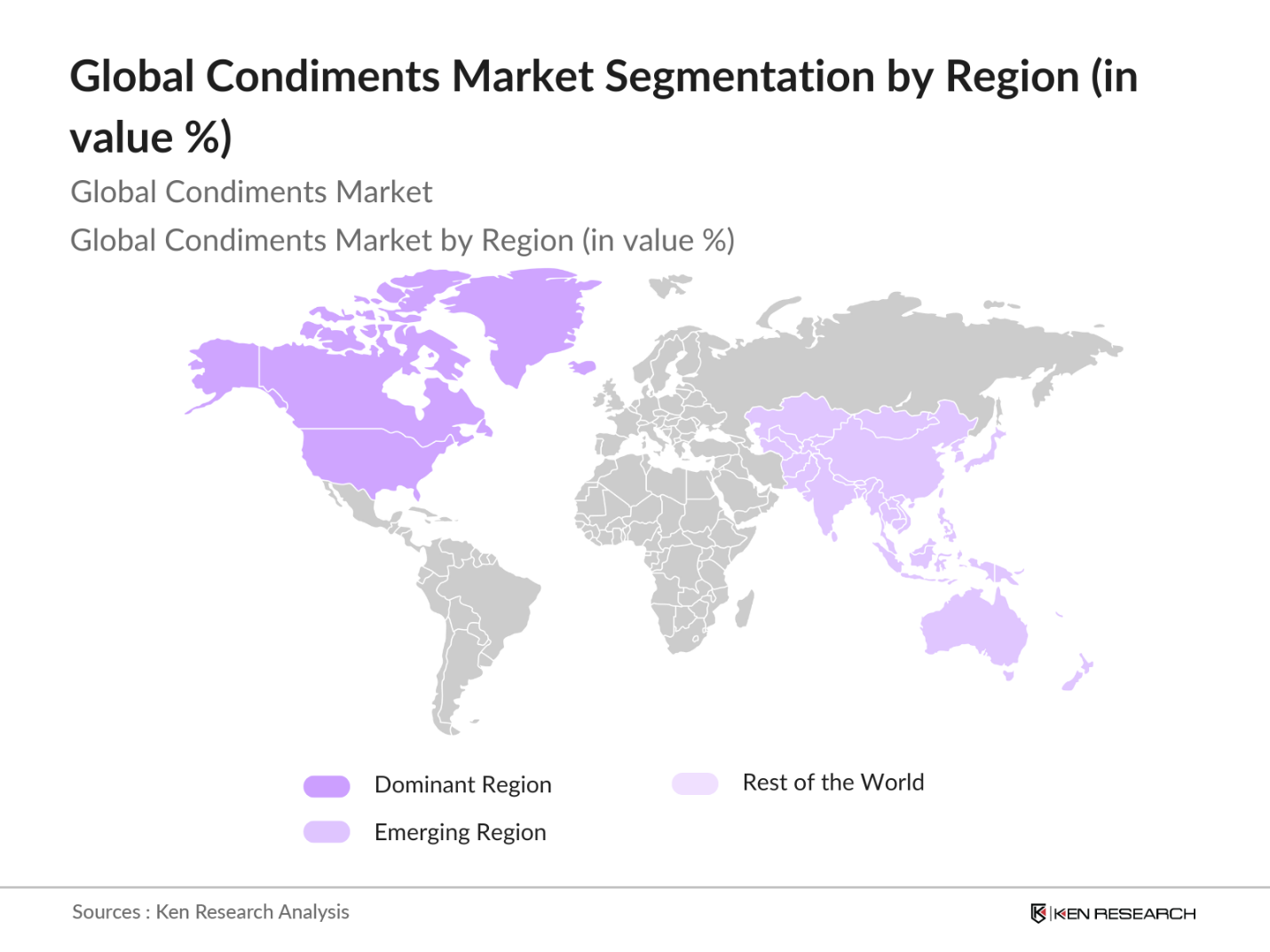

- Countries like the United States, China, and Japan dominate the global condiments market due to their long-standing culinary cultures that incorporate sauces, dressings, and marinades. The U.S. leads because of its vibrant foodservice industry and consumer demand for ready-to-use products. In Asia-Pacific, China and Japan have strong cultural preferences for traditional condiments like soy sauce and miso, and growing consumer trends for international flavors and packaged convenience products.

- Governments across the globe are encouraging the adoption of sustainable packaging practices in the food industry, including the condiments sector. In 2023, the European Union implemented the "European Green Deal," which includes strict regulations on single-use plastics and promotes the use of biodegradable and recyclable materials. This initiative supports condiment manufacturers in transitioning to eco-friendly packaging solutions.

Global Condiments Market Segmentation

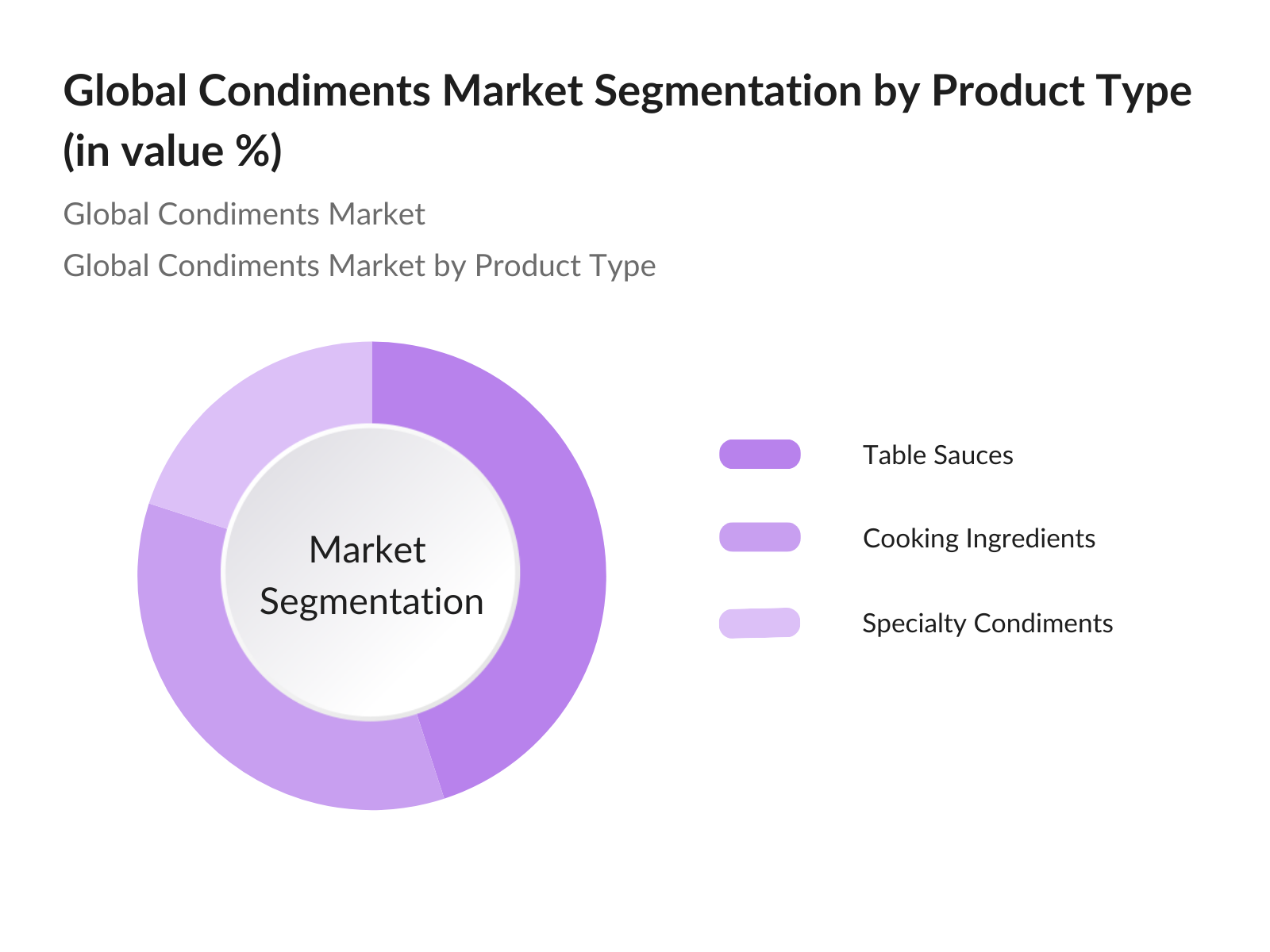

By Product Type: The global condiments market is segmented by product type into table sauces, cooking ingredients, and specialty condiments. Among these, table saucessuch as ketchup, mustard, and soy saucehold a dominant position. The established popularity of these sauces in both households and the foodservice sector contributes to their significant market share. In particular, ketchup remains highly popular in North America, while soy sauce continues to dominate in the Asia-Pacific region due to its integration into traditional cuisines.

By Region: The global condiments market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. North America leads due to a combination of high consumer demand for ready-to-use products and fast-food consumption. However, the Asia-Pacific region is seeing the highest growth due to increasing culinary experimentation and the growing presence of international cuisine in major countries like China and India.

Global Condiments Market Competitive Landscape

The global condiments market is dominated by both international giants and local producers. The key players in the market are continuously innovating, acquiring smaller firms, and expanding their product lines to meet the evolving consumer demand for healthier, organic, and eco-friendly condiments. These firms also lead in terms of research and development, focusing on sustainable practices and packaging.

|

Company Name |

Establishment Year |

Headquarters |

Product Range |

R&D Investments |

Sustainability Initiatives |

Distribution Network |

Strategic Partnerships |

|

Unilever Group |

1929 |

U.K. |

Table sauces |

- |

- |

- |

- |

|

The Kraft Heinz Company |

2015 |

U.S. |

Ketchup, sauces |

- |

- |

- |

- |

|

McCormick & Co., Inc. |

1889 |

U.S. |

Seasonings |

- |

- |

- |

- |

|

Nestl S.A. |

1866 |

Switzerland |

Sauces, pastes |

- |

- |

- |

- |

|

Conagra Brands Inc. |

1919 |

U.S. |

Condiments |

- |

- |

- |

- |

Global Condiments Market Analysis

Market Growth Drivers

- Increasing Consumer Preference for Flavored and Spiced Food Items: The rising demand for flavored and spiced food items is driving the condiments market. Consumers are increasingly seeking condiments that offer bold, diverse, and exotic flavors, such as sriracha, peri-peri, and chipotle sauces. This shift in preference is fueled by the global trend toward more adventurous and multicultural dining experiences, both at home and in restaurants. As the popularity of international cuisines continues to grow, condiments that enhance the flavor profiles of these foods are becoming essential kitchen staples, contributing to the expanding market.

- Rising Veganism and Demand for Organic Condiments: The rise in veganism has directly influenced the demand for organic condiments. In 2023, the United States Department of Agriculture (USDA) reported a 7% increase in organic farm production across the U.S., with a notable shift toward organic and plant-based food categories, including condiments. Globally, vegan food products, including condiments, are witnessing robust demand, with over 79 million people identifying as vegan worldwide, particularly in regions like Europe and North America.

- Innovations in Packaging (PET Bottles, Glass Jars): The global packaging industry has shifted toward more sustainable options, with demand for eco-friendly materials rising. By 2023, PET plastic bottles accounted for over 40 million metric tons of global plastic packaging, largely driven by the food and beverage sector, according to the European Bioplastics Association. Glass jars, favored for their recyclability, are also becoming popular for premium condiment brands. Packaging innovations are critical in reducing waste and meeting consumer demand for convenience.

Market Challenges:

- Product Recalls and Regulatory Compliance: Stringent food safety regulations pose a challenge for condiment manufacturers. In 2023, the U.S. Food and Drug Administration (FDA) issued more than 300 food recall notices, impacting various food categories, including condiments. This increased regulatory scrutiny, particularly for allergen control and ingredient labeling, has forced manufacturers to invest more in quality control measures and compliance, driving up operational costs.

- Price Pressure from Retailers: Condiment manufacturers are facing increased pressure from large retailers like Walmart and Carrefour, who are leveraging their buying power to negotiate lower prices. In 2023, retail trade revenue grew by 4%, but profit margins for manufacturers narrowed due to these pricing pressures, according to the World Trade Organization (WTO). Retailers focus on offering budget-friendly products, while maintaining quality, challenges the profitability of condiment producers.

Global Condiments Market Future Outlook

Over the next five years, the global condiments market is expected to grow significantly, driven by increased consumer demand for convenient, ready-to-use products and the expanding influence of global cuisines. The market will also see a rise in the popularity of health-oriented and eco-friendly condiments, as consumers become more conscious of product ingredients and packaging. Companies are likely to invest heavily in research and development, focusing on creating new flavors, organic options, and sustainable packaging to capture this growing demand.

Market Opportunities:

- Rise of Online Distribution Channels: The shift toward e-commerce is transforming the condiment market. In 2023, global online food sales surpassed $100 billion, with a significant portion attributed to condiments and sauces, according to the World Trade Organization (WTO). Online platforms like Amazon and Alibaba reported a 15% increase in sales of pantry staples, including condiments, as consumers shifted to online shopping for convenience. This trend is expected to drive further digital transformation in food retail.

- Adoption of Sustainable and Eco-friendly Packaging: Sustainable packaging has become a key trend in the condiment market. Food companies are increasingly adopting recycled materials in their packaging to reduce environmental impact. Major brands are transitioning to eco-friendly alternatives such as bioplastics and recyclable glass to meet the growing consumer demand for environmentally responsible products. This shift toward sustainable packaging not only helps reduce waste but also aligns with corporate social responsibility goals.

Scope of the Report

|

By Product Type |

Table Sauces Cooking Ingredients Specialty Condiments |

|

By Packaging Type |

PET Bottles Glass Jars Pouches/Sachets |

|

By Distribution Channel |

Supermarkets/Hypermarkets Convenience Stores Online Retail Foodservice |

|

By Application |

Residential Foodservice |

|

By Region |

North America Europe Asia-Pacific Latin America Middle East & Africa |

Products

Key Target Audience

Condiment Manufacturers

Retailers and Supermarkets

Foodservice Industry

Packaging Manufacturers

Government and Regulatory Bodies (e.g., FDA, EFSA)

Investments and Venture Capitalist Firms

Organic and Specialty Food Providers

Importers and Exporters of Food Products

Companies

Players Mention in the Report

Unilever Group

The Kraft Heinz Company

McCormick & Company, Inc.

Nestl S.A.

Conagra Brands Inc.

Del Monte Foods, Inc.

Kewpie Corporation

Hormel Foods Corporation

Dabur India Ltd.

General Mills, Inc.

ADF Foods Ltd.

Halcyon Proteins Pty Ltd.

NutriAsia Inc.

Dr. August Oetker KG

Three Threes Condiments Pty Ltd.

Table of Contents

01. Global Condiments Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Drivers

1.4. Market Segmentation Overview

02. Global Condiments Market Size (USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Developments and Market Milestones

03. Global Condiments Market Dynamics

3.1. Growth Drivers

3.1.1. Increasing Consumer Preference for Flavored and Spiced Food Items

3.1.2. Rising Veganism and Demand for Organic Condiments

3.1.3. Innovations in Packaging (PET Bottles, Glass Jars)

3.1.4. Increasing Demand from Foodservice Industry (Convenient Pre-packaged Options)

3.2. Market Challenges

3.2.1. Product Recalls and Regulatory Compliance

3.2.2. Price Pressure from Retailers

3.2.3. Changing Consumer Preferences (Toward Clean Label and Gluten-Free Products)

3.3. Opportunities

3.3.1. Expansion into Emerging Markets (Asia-Pacific, Middle East)

3.3.2. Strategic Partnerships and Acquisitions (Mergers in the Industry)

3.3.3. Product Line Expansion (Private Labels, Ethnic and International Cuisines)

3.4. Trends

3.4.1. Rise of Online Distribution Channels

3.4.2. Adoption of Sustainable and Eco-friendly Packaging

3.4.3. Increasing Focus on Health-Conscious Consumers (Functional and Organic Condiments)

3.5. Government Regulations

3.5.1. Food Safety Standards and Certifications

3.5.2. Import and Export Regulations for Condiments

04. Global Condiments Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Table Sauces (Ketchup, Soy Sauce, Hot Sauce, Mustard)

4.1.2. Cooking Ingredients (Marinades, Seasoning Mixes, Pastes)

4.1.3. Specialty Condiments (Vegan, Gluten-Free, Organic Options)

4.2. By Packaging Type (In Value %)

4.2.1. PET Bottles

4.2.2. Glass Jars

4.2.3. Pouches and Sachets

4.3. By Distribution Channel (In Value %)

4.3.1. Supermarkets/Hypermarkets

4.3.2. Convenience Stores

4.3.3. Online Retail

4.3.4. Foodservice

4.4. By Application (In Value %)

4.4.1. Residential

4.4.2. Foodservice Industry

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia-Pacific

4.5.4. Latin America

4.5.5. Middle East & Africa

05. Global Condiments Market Competitive Landscape

5.1. Detailed Profiles of Major Companies

5.1.1. Unilever Group

5.1.2. The Kraft Heinz Company

5.1.3. McCormick & Company

5.1.4. Nestl S.A.

5.1.5. Conagra Brands, Inc.

5.1.6. Del Monte Foods, Inc.

5.1.7. Kewpie Corporation

5.1.8. Dabur India Ltd.

5.1.9. Hormel Foods Corporation

5.1.10. Halcyon Proteins Pty Ltd.

5.1.11. General Mills, Inc.

5.1.12. ADF Foods Ltd.

5.1.13. Three Threes Condiments Pty Ltd.

5.1.14. NutriAsia Inc.

5.1.15. Dr. August Oetker KG

5.2. Cross-Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue, R&D Investments, Global Reach, Distribution Network, Sustainability Initiatives)

5.3. Market Share Analysis

5.4. Strategic Initiatives (Partnerships, Acquisitions)

5.5. Venture Capital and Funding

5.6. Innovation and R&D Developments

06. Global Condiments Market Regulatory Framework

6.1. Food Safety Certifications (ISO, HACCP)

6.2. Environmental Regulations for Packaging

6.3. Import/Export Regulations

07. Global Condiments Future Market Size (In USD Bn)

7.1. Future Projections

7.2. Factors Driving Future Growth

08. Global Condiments Market Analyst Recommendations

8.1. TAM/SAM/SOM Analysis

8.2. Customer Cohort and Preferences Analysis

8.3. Strategic Growth Recommendations

8.4. Untapped Opportunities

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The initial phase involved constructing a comprehensive market map for the global condiments market, identifying all stakeholders such as manufacturers, distributors, and retailers. This was conducted using extensive desk research and proprietary databases to gather reliable industry-level data.

Step 2: Market Analysis and Construction

In this phase, historical data from 2018 to 2023 was collected to assess the markets performance. The analysis included evaluating product category penetration, sales growth, and revenue generation trends.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were validated through interviews with industry experts and manufacturers from different regions, providing critical insights into the operational and financial aspects of the market.

Step 4: Research Synthesis and Final Output

Finally, direct consultations with key industry players provided detailed insights into consumer preferences, distribution networks, and future trends, ensuring a validated and comprehensive market report.

Frequently Asked Questions

01. How big is the global condiments market?

The global condiments market is valued at USD 89.75 billion, driven by the rising popularity of flavorful and convenient food products

02. What are the challenges in the global condiments market?

Key challenges include product recalls due to safety regulations, pricing pressure from retailers, and changing consumer preferences towards organic and clean-label products.

03. Who are the major players in the global condiments market?

Major players include Unilever Group, The Kraft Heinz Company, McCormick & Company, and Nestl S.A., which dominate through innovation, strategic acquisitions, and a global presence

04. What are the growth drivers of the global condiments market?

Growth is primarily driven by increasing consumer demand for international flavors, convenience products, and health-conscious condiments like organic and gluten-free options

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.