Region:Global

Author(s):Geetanshi

Product Code:KRAC0026

Pages:98

Published On:August 2025

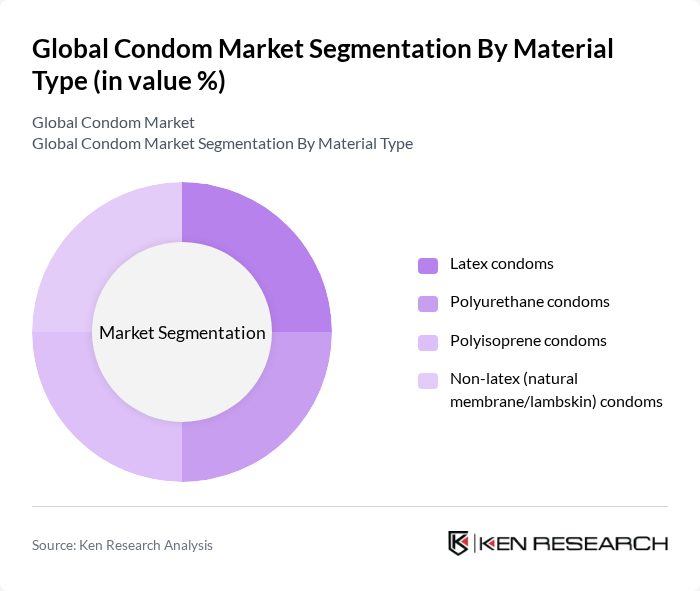

By Material Type:The material type segmentation includes various subsegments such as latex condoms, polyurethane condoms, polyisoprene condoms, and non-latex (natural membrane/lambskin) condoms. Among these, latex condoms dominate the market due to their widespread availability, cost-effectiveness, and high elasticity, making them the preferred choice for consumers. Polyisoprene condoms are gaining traction as a suitable alternative for those with latex allergies, while non-latex options cater to a niche market focused on natural materials and sensitivity. Recent trends also show increasing demand for sustainable and vegan-certified condom materials .

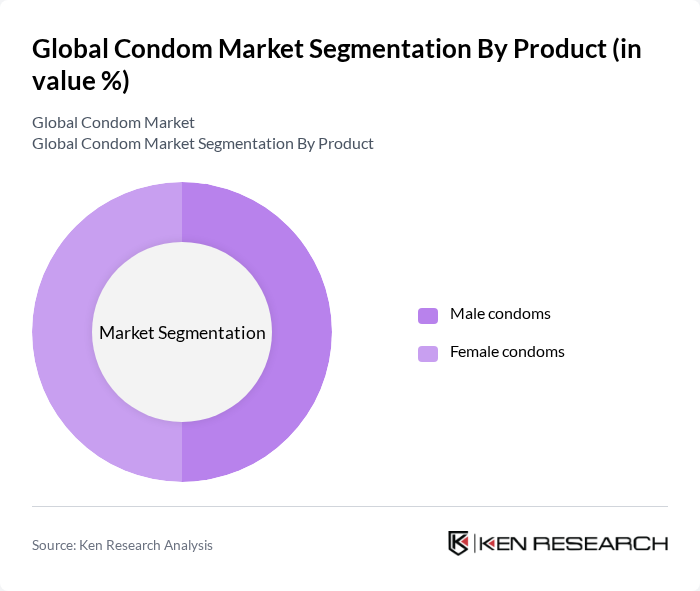

By Product:The product segmentation consists of male condoms and female condoms. Male condoms dominate the market, accounting for the majority of sales due to their established use and effectiveness in preventing pregnancy and STIs. Female condoms, while less popular, are gaining attention as they empower women to take control of their sexual health. The increasing awareness of female sexual health and the need for contraceptive options are driving growth in this segment. The rise in government and NGO-led initiatives to promote female condoms is also contributing to segment expansion .

The Global Condom Market is characterized by a dynamic mix of regional and international players. Leading participants such as Reckitt Benckiser Group plc (Durex), Church & Dwight Co., Inc. (Trojan), LifeStyles Healthcare Pte Ltd, Okamoto Industries, Inc., Karex Berhad, Cupid Limited, TTK Protective Devices Ltd., HLL Lifecare Limited (Moods), Fuji Latex Co., Ltd., Mankind Pharma Ltd. (Manforce), RRT Medcon, Glyde Health, Sagami Rubber Industries Co., Ltd., RFSU AB, Thai Nippon Rubber Industry Plc (ONE Condoms) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the condom market appears promising, driven by ongoing innovations and changing consumer preferences. As awareness of sexually transmitted infections (STIs) continues to rise, the demand for effective protection is expected to grow. Additionally, the integration of technology in product development, such as smart condoms, is likely to attract tech-savvy consumers. Companies that adapt to these trends and focus on sustainability will likely capture a larger market share in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Material Type | Latex condoms Polyurethane condoms Polyisoprene condoms Non-latex (natural membrane/lambskin) condoms |

| By Product | Male condoms Female condoms |

| By End-User | Individuals (Men) Individuals (Women) Institutional (Government, NGOs, Health Organizations) |

| By Distribution Channel | Pharmacies/Drug Stores Supermarkets/Hypermarkets E-commerce/Online Retail Mass Merchandisers Convenience Stores |

| By Region | North America Europe Asia Pacific Middle East & Africa South America |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sales of Condoms | 100 | Store Managers, Sales Representatives |

| Healthcare Provider Insights | 80 | Doctors, Nurses, Sexual Health Counselors |

| Consumer Preferences Survey | 150 | Adults aged 18-45, Diverse Demographics |

| Market Trends Analysis | 70 | Market Analysts, Industry Experts |

| Distribution Channel Feedback | 60 | Wholesalers, Distributors, Retail Buyers |

The global condom market is valued at approximately USD 12.7 billion, driven by increasing awareness of sexual health, rising demand for contraceptives, and innovative product offerings. This market is expected to continue growing as consumer preferences evolve.