Global Connected Cars Market Outlook to 2030

Region:Global

Author(s):Abhinav kumar

Product Code:KROD1231

December 2024

89

About the Report

Global Connected Cars Market Overview

- The Global Connected Cars Market was valued at USD 12 billion in 2023. This market is primarily driven by the increasing integration of advanced driver assistance systems (ADAS), the deployment of 5G networks, and the rising consumer demand for in-car connectivity and enhanced safety features.

- Major players in the global connected cars market include General Motors, BMW, Tesla, Ford Motor Company, and Volkswagen. These companies are at the forefront of innovation, focusing on the development of sophisticated connected car solutions that enhance vehicle safety, improve user experience, and support autonomous driving capabilities

- In 2023, Tesla launched its new Full Self-Driving (FSD) beta version, In August 2024, Tesla confirmed the rollout of FSD v12.5 for Hardware 3 (HW3) cars in the 2024.26.15 update .This market is primarily driven by the increasing integration of advanced driver assistance systems (ADAS), the deployment of 5G networks, and the rising consumer demand for in-car connectivity and enhanced safety features.

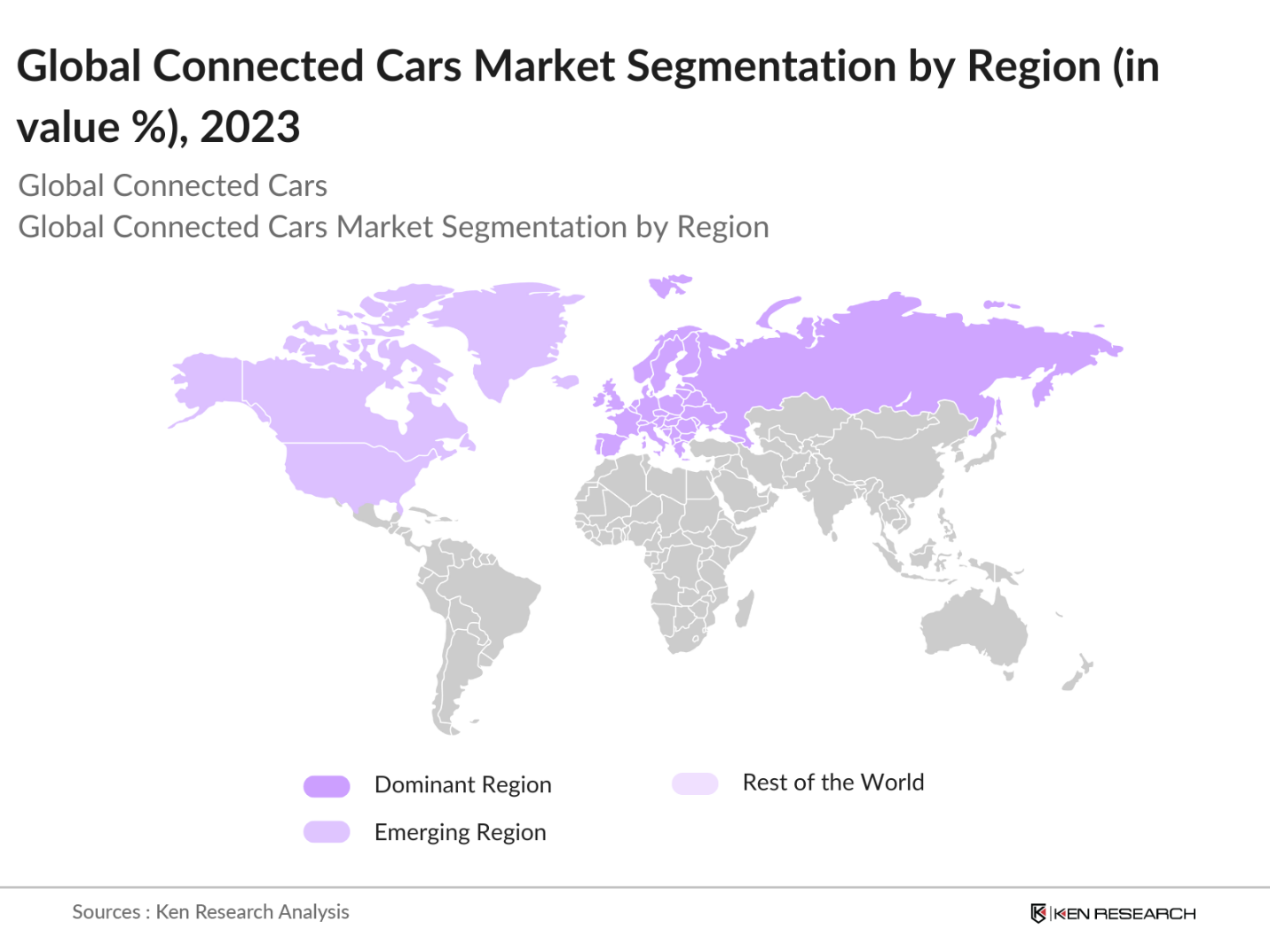

- The Asia-Pacific region dominated the global connected cars market due to rapid adoption of advanced automotive technologies, significant investments by regional automotive manufacturers, and supportive government policies.

Global Connected Cars Market Segmentation

The global connected cars market is segmented by connectivity type, service type, and region.

By Region: The global connected cars market is segmented into North America, Europe, Asia-Pacific (APAC), Middle East & Africa (MEA), and Latin America. In 2023, Asia-Pacific led the market, driven by the rapid adoption of advanced automotive technologies and significant investments in connected vehicle infrastructure.

By Connectivity Type: The market is segmented into embedded, tethered, and integrated connectivity solutions. In 2023, embedded connectivity solutions held the highest market share due to their reliability and secure data transmission capabilities, which are critical for applications like emergency services and vehicle diagnostics.

By Service Type: The market is segmented into safety & security, driver assistance, infotainment, and others. In 2023, safety & security services accounted for the largest market share, driven by the increasing demand for real-time monitoring and emergency response capabilities in vehicles.

Global Connected Cars Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

|

General Motors |

1908 |

Detroit, Michigan, USA |

|

BMW |

1916 |

Munich, Germany |

|

Tesla |

2003 |

Palo Alto, California, USA |

|

Ford Motor Company |

1903 |

Dearborn, Michigan, USA |

|

Volkswagen |

1937 |

Wolfsburg, Germany |

- General Motors: In 2023, General Motors announced a $2 billion investment to accelerate the development of its connected car technology.The investment will be used to expand the company's OnStar platform, which provides safety, security, and vehicle diagnostics services.

- BMW: In 2023, BMW announced a strategic investment of USD 1.6 billion aimed at enhancing its connected car technologies. This investment is part of BMW's broader strategy to integrate advanced digital features into its vehicles, focusing on improving user experience and safety.

Global Connected Cars Market Analysis

Global Connected Cars Market Growth Drivers:

- Increased Investment in 5G Infrastructure: The expansion of 5G networks is a critical driver for the connected car market, facilitating faster data transmission and improved connectivity. In 2024, the Federal Communications Commission (FCC) in the United States has allocated $9 billion for the deployment of 5G infrastructure, which is expected to enhance vehicle-to-everything (V2X) communication capabilities.

- Government Mandates for Vehicle Safety Technologies: The U.S. Department of Transportation has mandated that all new vehicles must be equipped with vehicle-to-vehicle (V2V) communication technology by 2025. This initiative aims to reduce traffic accidents and fatalities, driving the demand for connected car technologies that enhance safety features and improve overall vehicle performance.

- Rising Demand for Enhanced In-Car Experiences: According to a survey by the National Automobile Dealers Association, 70% of consumers expressed a desire for vehicles that offer seamless connectivity with personal devices. This demand is driving automakers to invest in advanced infotainment systems and connectivity solutions, thereby propelling the growth of the connected car market.

Global Connected Cars Market Challenges:

- Cybersecurity Risks: As vehicles become more connected, they are increasingly vulnerable to cyber-attacks. In 2024, there were multiple incidents of vehicle hacking, highlighting the need for cybersecurity measures to protect sensitive data and ensure vehicle safety. The increasing complexity of vehicle software and the growing connectivity of vehicles to external networks pose significant challenges

- Lack of Standardization: The absence of standardized connectivity protocols complicates the integration of different systems and hinders the deployment of universal vehicle-to-everything (V2X) communication. This lack of standardization poses a challenge to the scalability of connected car technologies.

Global Connected Cars Market Government Initiatives

- EU General Safety Regulation 2022: The GSR is a significant step forward in the EU's efforts to improve road safety and reduce emissions. In 2022, by mandating the adoption of connected car technologies, the regulation is expected to save over 25,000 lives and prevent at least 140,000 serious injuries by 2038.Additionally, the increased use of connected car technologies is expected to reduce road accidents by 30%

- China's 2024 New Energy Vehicle (NEV) Development Plan: In 2024, Energy Vehicle (NEV) Development Plan, announced by the Ministry of Industry and Information Technology, includes an investment in research and development for smart vehicle technologies. This initiative focuses on advancing connectivity and autonomous driving, aiming to position China as a global leader in smart vehicle innovation by 2025.

Global Connected Cars Market Future Market Outlook

The Global Connected Cars Market is expected to grow substantially over the coming years, driven by advancements in connectivity technologies, increasing demand for enhanced in-car experiences, and supportive government initiatives.

Global Connected Cars Market Future Market Trends

- Expansion of Autonomous Driving Capabilities:

By 2028, it is anticipated that a significant number of new vehicles will be equipped with advanced autonomous driving capabilities. Ongoing investments from automotive manufacturers and technology companies will drive the development of these technologies, enhancing vehicle safety and efficiency. - Rise of Subscription-Based Models and In-Car Commerce:

Subscription-based models and in-car commerce are projected to grow significantly by 2028, driven by consumer demand for flexible and personalized services. Automotive manufacturers and technology providers are expected to offer a wide range of subscription services, enhancing the overall driving experience.

Scope of the Report

|

By Connectivity Type |

Embedded Tethered Integrated |

|

By Service Type |

Safety & Security Driver Assistance Infotainment |

|

By Vehicle Type |

Passenger Vehicles Commercial Vehicles Electric Vehicles (EVs) |

|

By End-Use Industry |

Automotive OEMs Fleet Management Insurance Companies |

|

By Region |

North America Europe Asia-Pacific (APAC) Middle East & Africa (MEA) Latin America |

Products

Key Target Audience

Automotive Manufacturers

Technology Providers

Telecommunications Companies

Fleet Management Companies

Insurance Companies

Investors and Venture Capitalist Firms

Time Period Captured in the Report

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report

General Motors

BMW

Tesla

Ford Motor Company

Volkswagen

Toyota Motor Corporation

Hyundai Motor Company

Honda Motor Co., Ltd.

Volvo Car Corporation

Nissan Motor Co., Ltd.

Fiat Chrysler Automobiles (FCA)

Jaguar Land Rover

PSA Peugeot Citron

Audi AG

Daimler AG

Table of Contents

1. Global Connected Cars Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Connected Cars Market Size (in USD Bn), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Connected Cars Market Analysis

3.1. Growth Drivers

3.1.1. Increased Integration of Advanced Driver Assistance Systems (ADAS)

3.1.2. Expansion of 5G Networks

3.1.3. Rising Investments by Automotive OEMs

3.1.4. Growing Consumer Demand for Enhanced In-Car Experiences

3.2. Restraints

3.2.1. Cybersecurity Risks

3.2.2. High Costs of Connectivity Technologies

3.2.3. Lack of Standardization

3.3. Opportunities

3.3.1. Technological Advancements in Vehicle Connectivity

3.3.2. Expansion in Emerging Markets

3.3.3. Increasing Demand for Autonomous Vehicles

3.4. Trends

3.4.1. Adoption of Over-the-Air (OTA) Updates

3.4.2. Integration with Smart City Projects

3.4.3. Rise of Subscription-Based Models and In-Car Commerce

3.5. Government Regulation

3.5.1. EU General Safety Regulation 2024

3.5.2. Chinas 2024 New Energy Vehicle (NEV) Development Plan

3.5.3. U.S. Vehicle-to-Vehicle (V2V) Communication Mandates

3.5.4. Public-Private Partnerships in Connected Vehicle Infrastructure

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Competition Ecosystem

4. Global Connected Cars Market Segmentation, 2023

4.1. By Connectivity Type (in Value %)

4.1.1. Embedded

4.1.2. Tethered

4.1.3. Integrated

4.2. By Service Type (in Value %)

4.2.1. Safety & Security

4.2.2. Driver Assistance

4.2.3. Infotainment

4.2.4. Others

4.3. By Vehicle Type (in Value %)

4.3.1. Passenger Vehicles

4.3.2. Commercial Vehicles

4.3.3. Electric Vehicles (EVs)

4.4. By End-Use Industry (in Value %)

4.4.1. Automotive OEMs

4.4.2. Fleet Management

4.4.3. Insurance Companies

4.4.4. Others

4.5. By Region (in Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia-Pacific (APAC)

4.5.4. Middle East & Africa (MEA)

4.5.5. Latin America

5. Global Connected Cars Market Cross Comparison

5.1. Detailed Profiles of Major Companies

5.1.1. General Motors

5.1.2. BMW

5.1.3. Tesla

5.1.4. Ford Motor Company

5.1.5. Volkswagen

5.1.6. Toyota Motor Corporation

5.1.7. Hyundai Motor Company

5.1.8. Honda Motor Co., Ltd.

5.1.9. Volvo Car Corporation

5.1.10. Nissan Motor Co., Ltd.

5.1.11. Fiat Chrysler Automobiles (FCA)

5.1.12. Jaguar Land Rover

5.1.13. PSA Peugeot Citron

5.1.14. Audi AG

5.1.15. Daimler AG

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

6. Global Connected Cars Market Competitive Landscape

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

6.4. Investment Analysis

6.4.1. Venture Capital Funding

6.4.2. Government Grants

6.4.3. Private Equity Investments

7. Global Connected Cars Market Regulatory Framework

7.1. Data Protection Standards

7.2. Compliance Requirements

7.3. Certification Processes

8. Global Connected Cars Market Future Market Size (in USD Bn), 2023-2028

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

9. Global Connected Cars Market Future Market Segmentation, 2028

9.1. By Connectivity Type (in Value %)

9.2. By Service Type (in Value %)

9.3. By Vehicle Type (in Value %)

9.4. By End-Use Industry (in Value %)

9.5. By Region (in Value %)

10. Global Connected Cars Market Analysts Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Marketing Initiatives

10.4. White Space Opportunity Analysis

Research Methodology

Step: 1 Identifying Key Variables

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around the Market to collate Market-level information.

Step: 2 Market Building

Collating statistics on the Global Connected Cars Market over the years, and analyzing the penetration of Marketplaces as well as the ratio of service providers to compute the revenue generated for the market. We will also review service quality statistics to understand the revenue generated which can ensure accuracy behind the data points shared.

Step: 3 Validating and Finalizing

Building Market hypotheses and conducting CATIs with Market experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step: 4 Research Output

Our team will approach multiple Connected Cars companies to understand the nature of service segments, consumer preferences, and other parameters. This supports validating statistics derived through a bottom-to-top approach from these Connected Cars companies, ensuring accuracy and reliability in the report.

Frequently Asked Questions

01 How big is the Global Connected Cars Market?

The Global Connected Cars Market was valued at USD 12 billion in 2023. This market is primarily driven by the increasing integration of advanced driver assistance systems (ADAS), the deployment of 5G networks, and the rising consumer demand for in-car connectivity and enhanced safety features.

02 Who are the major players in the Global Connected Cars Market?

Major players in the global connected cars market include General Motors, BMW, Tesla, Ford Motor Company, and Volkswagen, all of which lead in developing innovative connected car solutions and technologies.

03 What are the growth drivers of the Global Connected Cars Market?

The growth drivers in the global connected cars market include the increasing integration of ADAS, the expansion of 5G networks, and significant investments by automotive manufacturers in developing connectivity technologies.

04 What are the challenges in the Global Connected Cars Market?

Challenges in the global connected cars market include cybersecurity risks, high costs of advanced connectivity features, and the lack of standardization across different connectivity platforms.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.