Global Connected Ship Market Outlook 2030

Region:Global

Author(s):Shivani Mehra

Product Code:KROD3764

December 2024

96

About the Report

Global Connected Ship Market Overview

- The Global Connected Ship Market is valued at USD 6.22 billion, primarily driven by increasing demand for real-time data analytics, fuel-efficient operations, and technological advancements in the maritime industry. The integration of IoT (Internet of Things), AI (Artificial Intelligence), and cloud computing in shipping operations has streamlined fleet management, enhanced ship-to-shore communication, and improved operational efficiency. These technologies, coupled with regulatory requirements to reduce emissions, are contributing significantly to market growth.

- Regions such as North America and Europe dominate the connected ship market. North America's dominance stems from its advanced technological infrastructure, large fleet size, and early adoption of digitalization in shipping. Europe, particularly nations like Norway and the UK, leads due to their stringent environmental regulations and significant investments in maritime digitalization. These regions are investing heavily in smart ports, cybersecurity frameworks, and autonomous ship developments, further solidifying their leadership in the global market.

- The U.S. Maritime Administration (MARAD) has increased its funding for maritime innovation under the Port Infrastructure Development Program (PIDP). In 2023, MARAD awarded $703 million to enhance port efficiency and environmental sustainability, including digital infrastructure projects aimed at integrating connected ship technologies. The funding supports advancements in port-to-ship communication systems, which enable real-time data exchange between vessels and shore-based operators. MARAD’s initiatives also promote cybersecurity frameworks, ensuring that connected ship systems remain protected from cyber threats.

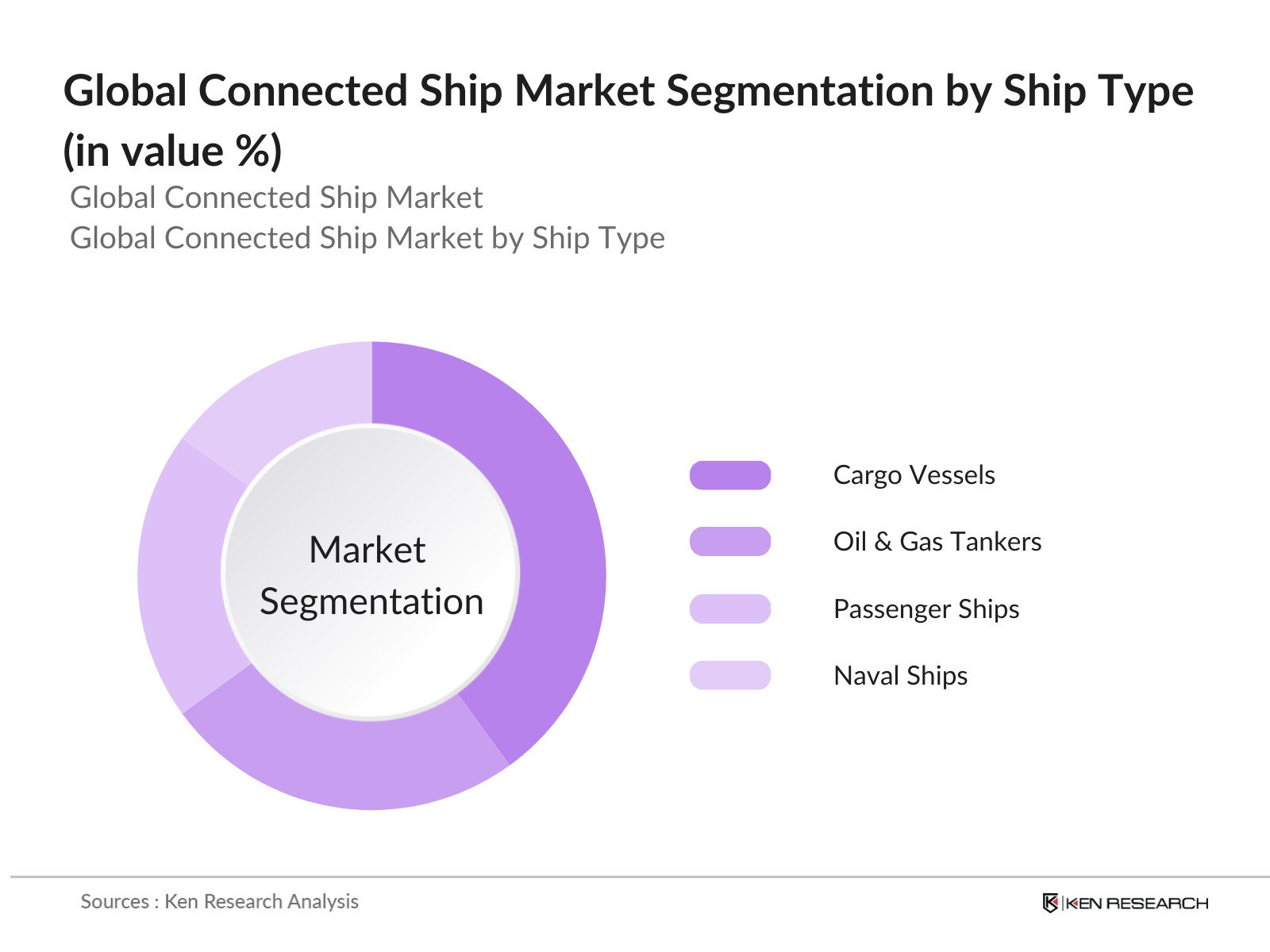

Global Connected Ship Market Segmentation

- By Ship Type: The global connected ship market is segmented by ship type into cargo vessels, tankers, passenger ships, and defense/naval ships. Cargo vessels currently dominate the market due to the significant global maritime trade volume and the need for efficient fleet management systems. The large volume of goods transported by sea necessitates sophisticated connected systems for real-time tracking and fuel optimization, giving cargo vessels a higher market share.

- By Region: The global connected ship market is segmented into North America, Europe, Asia Pacific, Middle East, and Africa. Europe is the leading region, driven by its proactive adoption of digitalization, government-backed maritime policies, and focus on environmental sustainability. The region’s strong regulatory framework, including compliance with the IMO (International Maritime Organization) emission norms, positions it at the forefront of the connected ship market.

Global Connected Ship Market Competitive Landscape

The connected ship market is dominated by major players that leverage technological advancements, mergers and acquisitions, and strategic partnerships to maintain market presence. The competitive landscape is shaped by companies focusing on cybersecurity, AI, and data analytics for maritime applications.

|

Company Name |

Established |

Headquarters |

R&D Expenditure |

Employees |

Revenue (USD) |

Regional Presence |

Strategic Initiatives |

Key Technologies |

|

Wärtsilä Corporation |

1834 |

Finland |

- |

- |

- |

- |

- |

- |

|

Kongsberg Gruppen ASA |

1814 |

Norway |

- |

- |

- |

- |

- |

- |

|

Rolls-Royce Holdings PLC |

1904 |

UK |

- |

- |

- |

- |

- |

- |

|

Siemens AG |

1847 |

Germany |

- |

- |

- |

- |

- |

- |

|

Northrop Grumman Corporation |

1939 |

USA |

- |

- |

- |

- |

- |

- |

Global Connected Ship Market Analysis

Market Growth Drivers

- Maritime Digitization: Maritime digitization is accelerating as the global shipping industry integrates advanced technologies like AI and IoT. According to the United Nations Conference on Trade and Development (UNCTAD), the maritime sector handled over 11 billion tons of goods in 2022, driving the need for digitization. By 2024, maritime shipping is expected to increase its cargo volume to over 12 billion tons. The digitization process is enabling better tracking, route optimization, and efficient communication systems, fostering seamless operations globally. This technological shift is also reducing fuel consumption, resulting in lower emissions.

- Integration of AI and IoT: AI and IoT are transforming the connected ship market, allowing for predictive maintenance, enhanced navigation, and fuel savings. According to the World Bank, the adoption of AI in the shipping industry has enabled operators to track and predict equipment failures more effectively, reducing maintenance costs and downtime. IoT integration enhances real-time monitoring, allowing fleet operators to respond to environmental and technical challenges more efficiently. This technological advancement is driving operational improvements in shipping fleets, significantly improving safety, performance, and reducing emissions.

- Rising Demand for Real-Time Data Analytics: Real-time data analytics are increasingly in demand for optimizing routes, reducing fuel consumption, and enhancing cargo tracking. The shipping industry now handles billions of tons of global trade annually, according to the International Chamber of Shipping (ICS), and leveraging data analytics is vital to ensuring efficient operations. By 2023, data analytics in shipping have contributed to reducing operational costs and improving supply chain management efficiency. These analytics offer vital insights into fleet performance, contributing to smoother global trade and optimized vessel utilization.

Market Opportunities:

- Government Funding and Initiatives for Maritime Technology: Governments around the world are increasing their investment in maritime technology. In 2023, the European Union allocated €5 billion towards the development of smart shipping technologies, while China’s “Belt and Road Initiative” invested $1.5 billion in smart ports. These initiatives are accelerating the deployment of connected ship solutions by funding innovations such as autonomous ships and smart port infrastructure, opening new growth opportunities in the market.

- Development of Digital Twins in Shipping: Digital twins, which create virtual models of ships for real-time monitoring and predictive maintenance, are becoming more prevalent. The Global Maritime Forum reports that, as of 2023, over 150 vessels are equipped with digital twin technology. This advancement allows for real-time analysis of ship performance, reducing downtime and enhancing safety. The development of digital twins is expected to further optimize fleet management and improve operational efficiency in the shipping industry.

Global Connected Ship Market Future Outlook

Over the next five years, the Global Connected Ship Market is expected to exhibit substantial growth, driven by continuous advancements in smart technologies, autonomous shipping, and cybersecurity measures. The increasing emphasis on reducing operational costs and enhancing safety through real-time data analytics and predictive maintenance will further accelerate market growth. As global trade continues to expand, the need for efficient and secure maritime operations will be paramount, fostering innovation in fleet management and communication systems.

Market Opportunities:

- Increasing Use of Big Data for Fleet Management: Big data is being utilized to streamline fleet management, reducing costs and improving operational efficiency. According to McKinsey's 2023 shipping report, the adoption of big data analytics has allowed fleets to optimize fuel use, which has saved up to 8 million tons of fuel annually. The use of big data is also enhancing decision-making and minimizing disruptions in the supply chain, ensuring smoother operations for global shipping companies.

- Remote Monitoring and Predictive Maintenance: Remote monitoring and predictive maintenance are becoming vital components of modern fleet management. The International Chamber of Shipping estimates that by 2023, nearly 10,000 ships globally are equipped with remote monitoring systems. These systems allow operators to detect potential malfunctions before they occur, reducing downtime and enhancing the overall operational efficiency of ships. Predictive maintenance not only lowers operational costs by addressing issues proactively but also improves vessel safety and extends the lifespan of ship equipment by ensuring timely interventions before critical failures occur.

Scope of the Report

|

By Ship Type |

Cargo Vessels Oil and Gas Tankers Passenger Ships Naval Ships |

|

By Solution Type |

Fleet Operations Management Monitoring and Maintenance Systems Communication Systems Security Systems |

|

By Technology |

IoT AI Blockchain |

|

By End-User |

Commercial Shipping Defense Naval Operations |

|

By Region |

North America Europe Asia-Pacific Latin America Middle East & Africa |

Products

Key Target Audience

Shipbuilding Companies

Fleet Management Operators

Maritime Technology Providers

Government and Regulatory Bodies (International Maritime Organization, European Maritime Safety Agency)

Defense and Naval Agencies

Shipping Line Owners

Investments and Venture Capitalist Firms

Port Authorities

Companies

Players Mentioned in the report

Wrtsil Corporation

Kongsberg Gruppen ASA

Rolls-Royce Holdings PLC

Northrop Grumman Corporation

General Electric Company

Siemens AG

ABB Ltd.

Cisco Systems, Inc.

Furuno Electric Co., Ltd.

Raytheon Technologies Corporation

Thales Group

Honeywell International Inc.

Schneider Electric SE

IBM Corporation

BAE Systems PLC

Table of Contents

1. Global Connected Ship Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Connected Ship Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Connected Ship Market Analysis

3.1. Growth Drivers (Technological Advancements, Fleet Management Optimization)

3.1.1. Maritime Digitization

3.1.2. Increased Focus on Operational Efficiency

3.1.3. Integration of AI and IoT

3.1.4. Rising Demand for Real-Time Data Analytics

3.2. Market Challenges (Cybersecurity Concerns, Regulatory Compliance)

3.2.1. High Initial Investment Costs

3.2.2. Lack of Skilled Personnel for Digitalization

3.2.3. Technical Integration with Legacy Systems

3.3. Opportunities (Expansion of Smart Ports, Green Shipping Initiatives)

3.3.1. Government Funding and Initiatives for Maritime Technology

3.3.2. Growth in Autonomous Vessels

3.3.3. Development of Digital Twins in Shipping

3.4. Trends (Blockchain for Supply Chain Visibility, AI for Predictive Maintenance)

3.4.1. Increasing Use of Big Data for Fleet Management

3.4.2. Remote Monitoring and Predictive Maintenance

3.4.3. Enhanced Connectivity via 5G Networks

3.5. Government Regulations (IMO 2020, Emission Control Regulations)

3.5.1. International Maritime Organization (IMO) Compliance

3.5.2. EU Emission Regulations and Standards

3.5.3. Adoption of Cybersecurity Frameworks

3.5.4. Standardization of Maritime Data Sharing

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Ship Operators, Technology Providers, Regulators)

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. Global Connected Ship Market Segmentation

4.1. By Ship Type (In Value %) (Cargo, Tankers, Passenger Ships, Defense)

4.1.1. Cargo Vessels

4.1.2. Oil and Gas Tankers

4.1.3. Passenger Ships

4.1.4. Naval Ships

4.2. By Solution Type (In Value %) (Fleet Management, Vessel Traffic Management, Maritime Security)

4.2.1. Fleet Operations Management

4.2.2. Monitoring and Maintenance Systems

4.2.3. Communication Systems

4.2.4. Security Systems

4.3. By Technology (In Value %) (IoT, AI, Blockchain)

4.3.1. Internet of Things (IoT)

4.3.2. Artificial Intelligence (AI)

4.3.3. Blockchain Technology

4.4. By Application (In Value %) (Commercial, Defense)

4.4.1. Commercial Shipping

4.4.2. Defense and Naval Operations

4.5. By Region (In Value %) (North America, Europe, Asia Pacific, Middle East, Africa)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia Pacific

4.5.4. Middle East

4.5.5. Africa

5. Global Connected Ship Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Wrtsil Corporation

5.1.2. Kongsberg Gruppen ASA

5.1.3. Rolls-Royce Holdings PLC

5.1.4. Northrop Grumman Corporation

5.1.5. General Electric Company

5.1.6. Siemens AG

5.1.7. ABB Ltd.

5.1.8. Cisco Systems, Inc.

5.1.9. Furuno Electric Co., Ltd.

5.1.10. Raytheon Technologies Corporation

5.1.11. Thales Group

5.1.12. Honeywell International Inc.

5.1.13. Schneider Electric SE

5.1.14. IBM Corporation

5.1.15. BAE Systems PLC

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue, R&D Expenditure, Market Share, Regional Presence, Strategic Alliances)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Global Connected Ship Market Regulatory Framework

6.1. Maritime Data Regulations

6.2. Compliance with Cybersecurity Standards

6.3. Certification Processes for Smart Ship Systems

7. Global Connected Ship Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global Connected Ship Future Market Segmentation

8.1. By Ship Type (In Value %)

8.2. By Solution Type (In Value %)

8.3. By Technology (In Value %)

8.4. By Application (In Value %)

8.5. By Region (In Value %)

9. Global Connected Ship Market Analysts' Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders in the global connected ship market. Extensive desk research, coupled with proprietary databases, is utilized to identify and define the critical variables influencing market dynamics.

Step 2: Market Analysis and Construction

In this step, we compile and analyze historical data on market penetration and revenue generation. The data collected is used to assess fleet digitalization rates and technological adoption across shipping operators, ensuring the accuracy of market estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and validated through consultations with industry experts via computer-assisted telephone interviews (CATIs). These consultations provide insights into technological trends, operational challenges, and investment patterns.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with key maritime players to acquire insights on product segments, sales performance, and customer feedback. These insights are used to verify and enhance the bottom-up approach, ensuring a comprehensive and accurate analysis of the market.

Frequently Asked Questions

01. How big is the Global Connected Ship Market?

The Global Connected Ship Market is valued at USD 6.22 billion, driven by advancements in maritime technology and increasing demand for efficient fleet management systems.

02. What are the challenges in the Global Connected Ship Market?

Challenges include high initial costs, cybersecurity concerns, and integration issues with legacy systems. Moreover, the lack of skilled workforce to manage advanced connected systems is a growing challenge.

03. Who are the major players in the Global Connected Ship Market?

Key players include Wrtsil Corporation, Kongsberg Gruppen ASA, Rolls-Royce Holdings PLC, Northrop Grumman Corporation, and Siemens AG, which lead the market due to their technological capabilities and strong market presence.

04. What are the growth drivers of the Global Connected Ship Market?

Growth drivers include the integration of AI and IoT technologies in ship management, government regulations to reduce emissions, and the increasing demand for real-time data analytics to optimize maritime operations.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.