Region:Global

Author(s):Geetanshi

Product Code:KRAA0031

Pages:86

Published On:August 2025

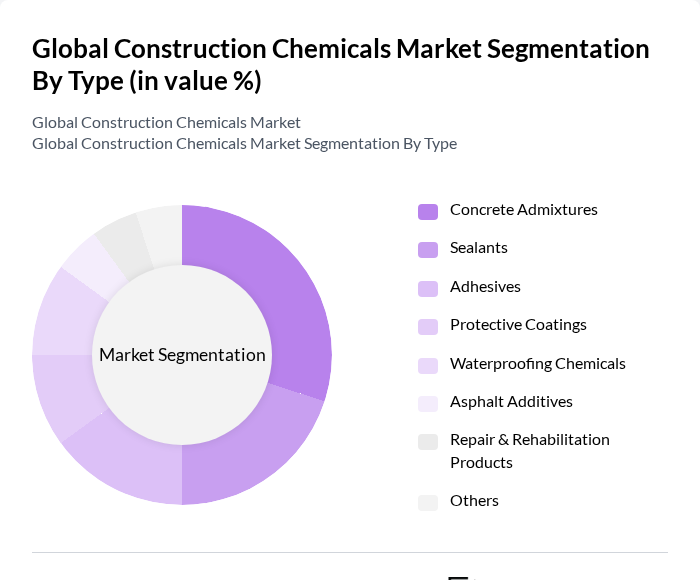

By Type:The market is segmented into various types of construction chemicals, including Concrete Admixtures, Sealants, Adhesives, Protective Coatings, Waterproofing Chemicals, Asphalt Additives, Repair & Rehabilitation Products, and Others. Among these, Concrete Admixtures are the most dominant due to their essential role in enhancing the properties of concrete, which is a fundamental material in construction. The increasing focus on high-performance concrete, the adoption of low-carbon admixtures, and the growing trend of green building practices are driving the demand for these products.

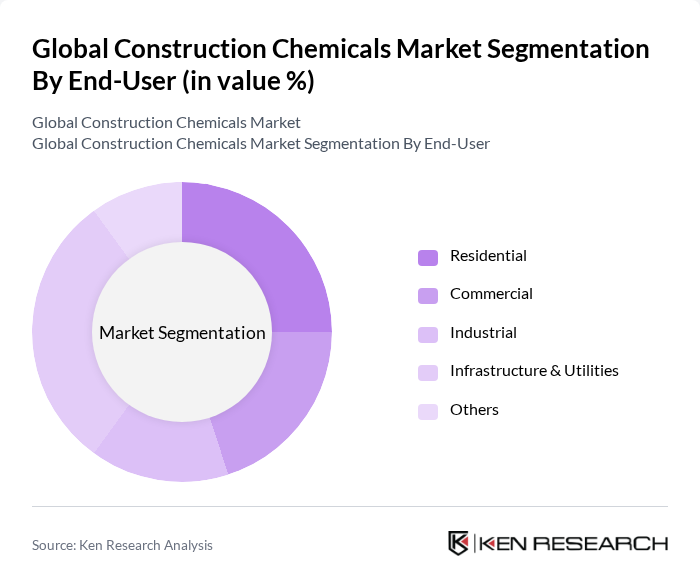

By End-User:The end-user segmentation includes Residential, Commercial, Industrial, Infrastructure & Utilities, and Others. The Infrastructure & Utilities segment is the leading end-user category, driven by significant government investments in public infrastructure projects and the increasing need for durable and sustainable construction solutions. The growing urban population and the need for improved transportation networks further fuel the demand for construction chemicals in this segment.

The Global Construction Chemicals Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Sika AG, Dow Inc., Saint-Gobain S.A., GCP Applied Technologies Inc., RPM International Inc., Huntsman Corporation, Fosroc International Limited, Mapei S.p.A., Ardex Group, Bostik (Arkema Group), Pidilite Industries Ltd., CEMEX S.A.B. de C.V., KÖSTER BAUCHEMIE AG, CHRYSO Group (Saint-Gobain Construction Chemicals) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the construction chemicals market appears promising, driven by technological advancements and a shift towards sustainable practices. Innovations in smart construction technologies, such as Building Information Modeling (BIM), are expected to enhance project efficiency and reduce waste. Additionally, the increasing focus on lifecycle costing will encourage the adoption of high-performance materials that offer long-term savings. As governments and organizations prioritize sustainability, the market is likely to witness a surge in demand for eco-friendly construction solutions.

| Segment | Sub-Segments |

|---|---|

| By Type | Concrete Admixtures Sealants Adhesives Protective Coatings Waterproofing Chemicals Asphalt Additives Repair & Rehabilitation Products Others |

| By End-User | Residential Commercial Industrial Infrastructure & Utilities Others |

| By Application | Infrastructure (Roads, Bridges, Tunnels) Residential Buildings Commercial Buildings Industrial Facilities Water & Wastewater Management Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Product Formulation | Water-Based Solvent-Based Powder-Based Others |

| By Performance Characteristics | High-Performance Standard Performance Specialty Products Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Concrete Admixtures Usage | 60 | Project Managers, Site Engineers |

| Sealants and Adhesives in Construction | 50 | Procurement Officers, Product Managers |

| Coatings and Surface Treatments | 40 | Quality Control Managers, Application Specialists |

| Construction Chemical Distribution | 40 | Supply Chain Managers, Distributors |

| Regulatory Compliance in Chemical Usage | 40 | Compliance Officers, Environmental Managers |

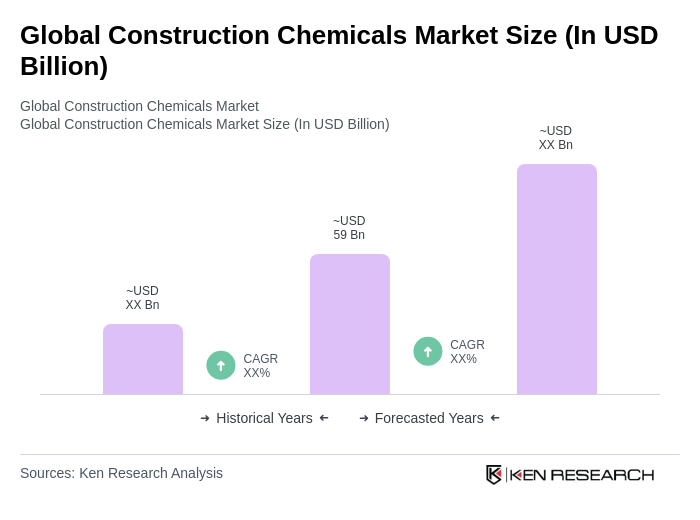

The Global Construction Chemicals Market is valued at approximately USD 59 billion, reflecting a significant growth driven by increasing construction activities, urbanization, and the demand for sustainable building materials.