Global Construction Market Outlook to 2030

Region:Global

Author(s):Mukul

Product Code:KROD10103

December 2024

96

About the Report

Global Construction Market Overview

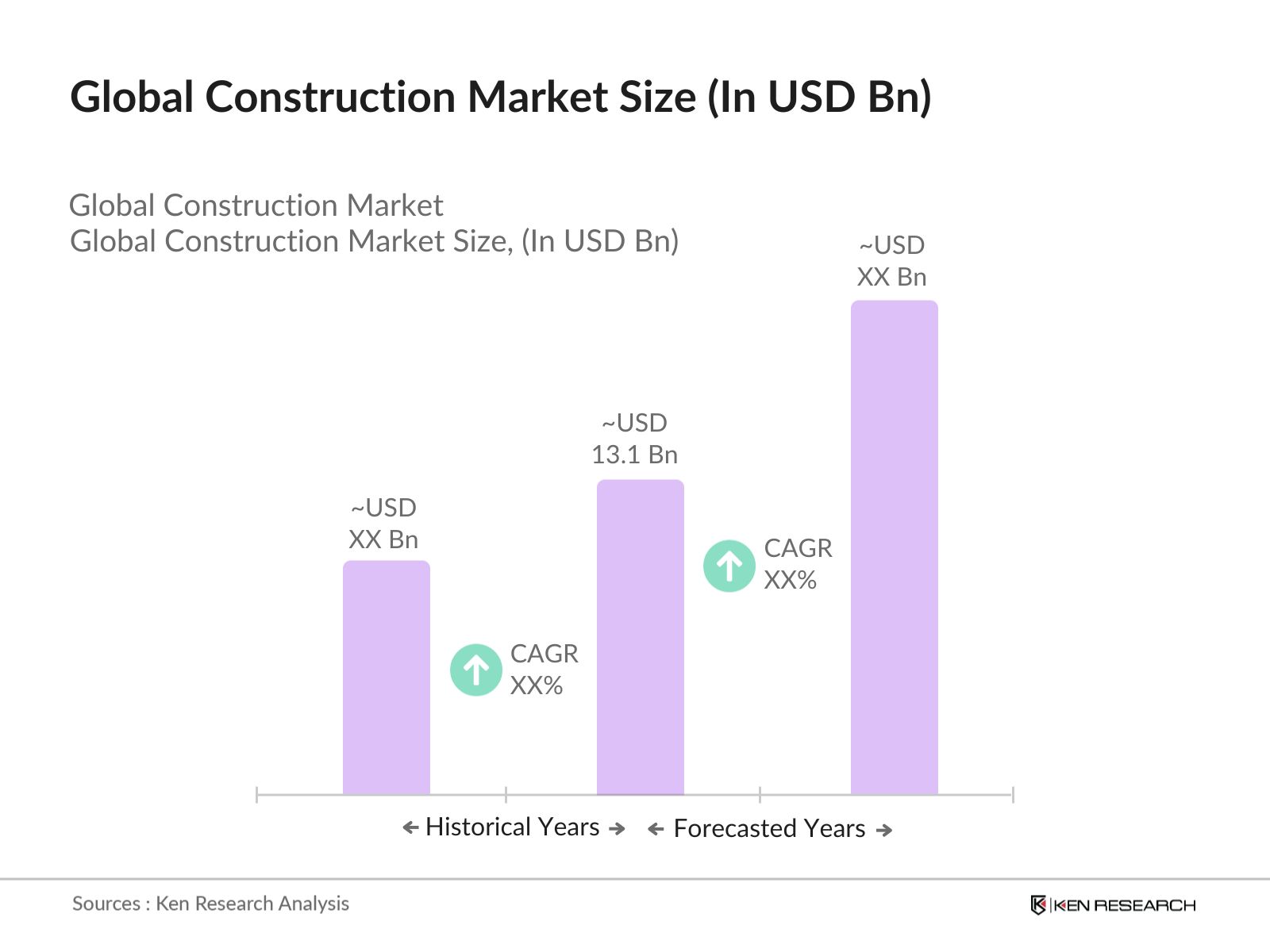

- The global construction market is valued at USD 13.1 billion, driven by robust infrastructure development, increasing urbanization, and technological advancements. The sector has seen continuous investment from both public and private sectors, particularly in megaprojects such as smart cities, renewable energy installations, and large-scale residential developments. Growing demand for eco-friendly and energy-efficient buildings has also played a crucial role in boosting the construction markets value, reflecting a shift towards sustainability.

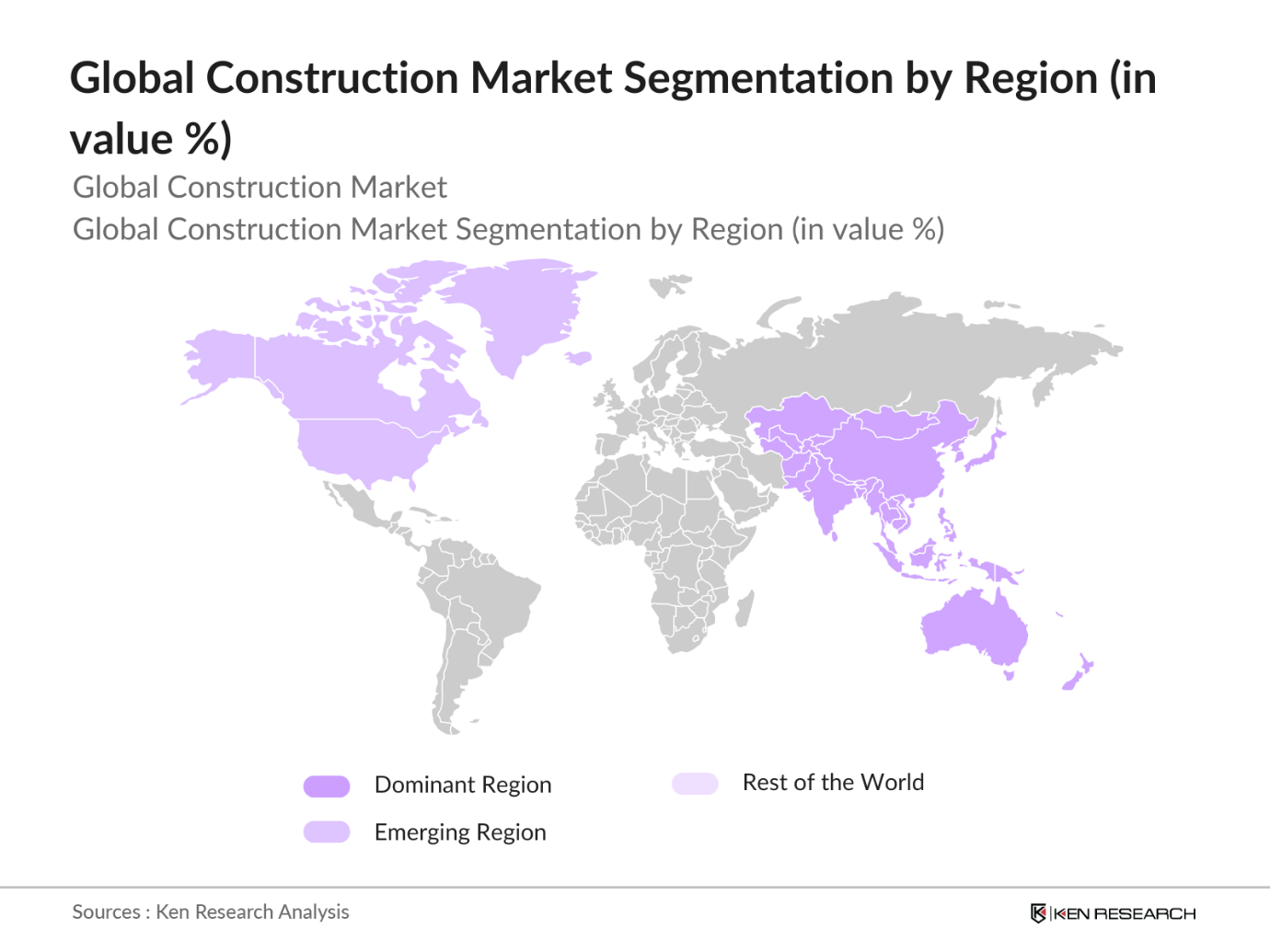

- In terms of geographical dominance, regions like North America, Europe, and Asia-Pacific lead the market, with cities such as New York, Shanghai, and London standing out due to their thriving construction activities. These cities have experienced rapid growth due to strong government support for infrastructure projects, urban expansion, and the presence of large multinational construction firms, further cementing their leadership positions in the global construction landscape.

- Governments worldwide are imposing stricter building and safety codes to ensure construction quality and public safety. The International Building Code (IBC) has been adopted by over 90 countries, including the U.S., to enforce uniform safety standards. In 2024, the U.S. strengthened its building codes to address climate risks like floods and wildfires, further influencing global construction practices. These codes ensure that new constructions are resilient to natural disasters, while also incorporating modern safety standards.

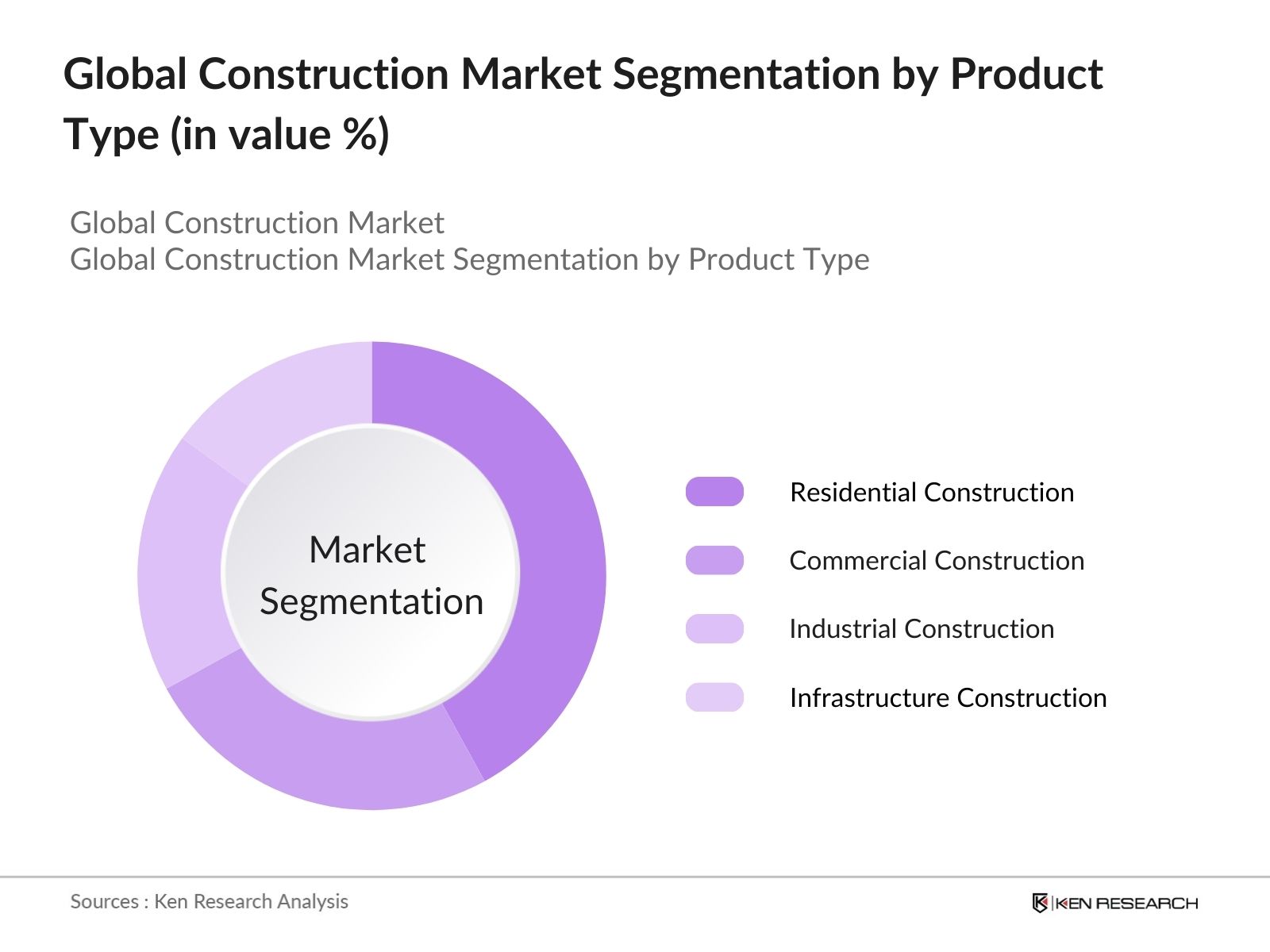

Global Construction Market Segmentation

- By Project Type: The global construction market is segmented by project type into residential, commercial, industrial, infrastructure, and institutional construction. Residential construction dominates the market due to the increasing demand for affordable and luxury housing solutions, particularly in densely populated regions such as Asia-Pacific and North America. Rapid urbanization and the growth of middle-class populations in countries like China and India have spurred the expansion of the residential construction segment. Affordable housing initiatives and investments in smart home technologies further drive this segment.

- By Material Type: The construction market includes concrete, steel, wood, composite materials, and others. Concrete holds the dominant market share in this segment due to its widespread use in various construction types. The material's strength, versatility, and cost-effectiveness make it the preferred choice for large-scale projects such as high-rise buildings and infrastructure developments. Furthermore, advancements in green concrete, which offer reduced environmental impact, are increasingly attracting attention in sustainable construction initiatives.

- By Region: The global construction market is segmented by region into North America, Europe, Asia-Pacific, Middle East & Africa, and Latin America. Asia-Pacific dominates this market due to its rapid urbanization, population growth, and government investments in large-scale infrastructure projects. Countries like China and India are spearheading construction growth, especially in residential and infrastructure development. In China, government policies supporting the Belt and Road Initiative further fuel construction activity. Meanwhile, in India, urban housing and commercial projects are driving demand across the construction sector.

Global Construction Market Competitive Landscape

The global construction market is highly competitive, with key players focusing on technological advancements, strategic partnerships, and sustainability initiatives to maintain their market positions. Major companies are also investing heavily in green construction technologies and modular building methods to cater to changing market demands.

|

Company |

Establishment Year |

Headquarters |

Revenue (USD bn) |

No. of Employees |

R&D Investment |

Technological Integration |

Sustainability Initiatives |

Global Presence |

|

Bechtel Corporation |

1898 |

San Francisco, USA |

- |

- |

- |

- |

- |

- |

|

VINCI SA |

1899 |

Rueil-Malmaison, France |

- |

- |

- |

- |

- |

- |

|

China State Construction Eng. |

1957 |

Beijing, China |

- |

- |

- |

- |

- |

- |

|

Skanska AB |

1887 |

Stockholm, Sweden |

- |

- |

- |

- |

- |

- |

|

Larsen & Toubro |

1938 |

Mumbai, India |

- |

- |

- |

- |

- |

- |

Global Construction Industry Analysis

Growth Drivers

- Infrastructure Development: The global construction market is heavily influenced by infrastructure development, especially in rapidly urbanizing regions. By 2024, global population growth is expected to surpass 8 billion, driving demand for housing and urban infrastructure. Countries like India are projected to invest over $1 trillion in infrastructure by 2025, focusing on transportation, water, and energy systems, while the US has allocated $550 billion to its infrastructure plan under the Bipartisan Infrastructure Law. Such initiatives are creating a surge in the construction of roads, bridges, airports, and public facilities.

- Technological Advancements: Technological advancements in construction, including modular construction and AI integration, are transforming the industry. AI's application in predictive maintenance and autonomous equipment is expected to reduce project delays by 30%. Modular construction, which minimizes on-site labor, saw rapid growth, with companies using prefabrication techniques seeing up to 50% faster project completion. In 2022, the global demand for automated construction technology reached significant heights, with an increasing number of firms adopting robotics and AI to counter rising labor shortages.

- Sustainability and Green Building Practices: Sustainability is a major focus within the construction market, driven by stringent environmental regulations and global commitments like the Paris Agreement. As of 2024, green buildings account for nearly 15% of new commercial constructions worldwide, a number bolstered by government incentives. For instance, the European Unions Green Deal aims to ensure that by 2025, all new buildings will have net-zero emissions. Additionally, over $100 billion has been earmarked for energy-efficient retrofitting of existing structures in the US and Europe.

Market Restraints

- Raw Material Price Volatility: The construction market faces ongoing challenges due to fluctuations in raw material prices. Since 2022, prices of essential construction materials like steel and cement have increased significantly due to global supply chain disruptions and energy costs. For example, the average price of steel rose by nearly 20% in 2023, with similar increases in the cost of cement and timber. These price hikes are putting pressure on contractors to either absorb costs or pass them on to clients, creating significant risks in long-term projects.

- Labor Shortages: Labor shortages continue to be a significant challenge for the construction industry, particularly in advanced economies. In 2024, the U.S. construction sector reported a shortage of nearly 300,000 skilled workers, with European countries facing similar issues. Aging populations and fewer younger workers entering the industry have exacerbated the situation. In the UK alone, it is estimated that 10% of the construction workforce will retire by 2025, worsening labor constraints. These shortages are leading to project delays and increased labor costs globally.

Global Construction Market Future Outlook

Over the next five years, the global construction market is expected to show significant growth, driven by continuous investments in infrastructure, the expansion of smart cities, and the rising demand for sustainable building practices. Governments worldwide are investing in green building projects to meet international sustainability standards, further promoting growth in the market. Additionally, technological advancements in 3D printing, modular construction, and building information modeling (BIM) are expected to streamline construction processes and reduce costs, leading to increased market efficiency and expansion.

Market Opportunities

- Rise of Smart Cities: The development of smart cities is opening vast opportunities in the global construction market. By 2024, over 300 smart city projects are underway globally, with significant investments in integrating IoT and AI into urban infrastructure. Smart cities like Singapore, Dubai, and Barcelona are leading the way, with governments allocating billions toward sustainable, tech-driven urbanization. In Singapore alone, $3.5 billion is being invested into smart infrastructure, including intelligent transportation systems and energy-efficient buildings.

- Growing Demand for Renovation and Retrofitting: Renovation and retrofitting of older buildings present a significant growth area for the construction market. In Europe, governments are pushing renovation efforts to meet green targets, with the EU pledging $300 billion toward energy-efficient retrofitting by 2025. Retrofitting existing structures to meet sustainability standards is also a key driver in North America, with the U.S. investing over $50 billion in renovation projects in 2023. This trend is gaining traction globally as both private developers and governments focus on reducing energy consumption in older buildings.

Scope of the Report

|

By Project Type |

Residential Commercial Industrial Infrastructure Institutional |

|

By Material Type |

Concrete Steel Wood Composite Materials Others |

|

By Construction Method |

Traditional Modular Prefabricated 3D Printing |

|

By End-User |

Government Private Sector Public-Private Partnerships |

|

By Region |

North America Europe Asia-Pacific Middle East & Africa Latin America |

Products

Key Target Audience

Government and Regulatory Bodies (e.g., U.S. Department of Transportation, European Commission)

Real Estate Developers

General Contractors and Subcontractors

Building Material Manufacturers

Urban Planning Agencies

Investment and Venture Capitalist Firms

Private Equity Firms

Infrastructure Investment Funds

Companies

Players Mentioned in the Report

Bechtel Corporation

VINCI SA

China State Construction Engineering Corp

Skanska AB

Larsen & Toubro

Fluor Corporation

Kiewit Corporation

Hochtief AG

Balfour Beatty

Laing O'Rourke

Hyundai Engineering & Construction

Tutor Perini Corporation

Bouygues Construction

Shimizu Corporation

PCL Construction

Table of Contents

1. Global Construction Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Construction Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Construction Market Analysis

3.1. Growth Drivers

3.1.1. Infrastructure Development (Increased Government Investment, Urbanization, Population Growth)

3.1.2. Technological Advancements (Modular Construction, AI, and Automation in Construction)

3.1.3. Sustainability and Green Building Practices

3.1.4. Public and Private Sector Collaboration

3.2. Market Challenges

3.2.1. Raw Material Price Volatility

3.2.2. Labor Shortages

3.2.3. Regulatory and Environmental Restrictions

3.3. Opportunities

3.3.1. Rise of Smart Cities (Urban Infrastructure Development, IoT Integration)

3.3.2. Growing Demand for Renovation and Retrofitting

3.3.3. Expansion into Emerging Markets (Asia-Pacific, Africa)

3.4. Trends

3.4.1. Adoption of BIM (Building Information Modelling)

3.4.2. Increasing Use of Drones and Robotics

3.4.3. Growth of Off-Site and Prefabricated Construction

3.5. Government Regulation

3.5.1. Building and Safety Codes

3.5.2. Tax Incentives for Green Construction

3.5.3. Infrastructure Investment Programs

3.5.4. Certification and Compliance Requirements

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Contractors, Architects, Material Suppliers, etc.)

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. Global Construction Market Segmentation

4.1. By Project Type (In Value %)

4.1.1. Residential Construction

4.1.2. Commercial Construction

4.1.3. Industrial Construction

4.1.4. Infrastructure Construction

4.1.5. Institutional Construction

4.2. By Material Type (In Value %)

4.2.1. Concrete

4.2.2. Steel

4.2.3. Wood

4.2.4. Composite Materials

4.2.5. Others

4.3. By Construction Method (In Value %)

4.3.1. Traditional Construction

4.3.2. Modular Construction

4.3.3. Prefabricated Construction

4.3.4. 3D Printing Construction

4.4. By End-User (In Value %)

4.4.1. Government

4.4.2. Private Sector

4.4.3. Public-Private Partnerships (PPP)

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia-Pacific

4.5.4. Middle East & Africa

4.5.5. Latin America

5. Global Construction Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. Bechtel Corporation

5.1.2. VINCI SA

5.1.3. China State Construction Engineering Corp

5.1.4. Larsen & Toubro

5.1.5. Skanska AB

5.1.6. Fluor Corporation

5.1.7. Kiewit Corporation

5.1.8. Hochtief AG

5.1.9. Balfour Beatty

5.1.10. Laing O'Rourke

5.1.11. Hyundai Engineering & Construction

5.1.12. Tutor Perini Corporation

5.1.13. Bouygues Construction

5.1.14. Shimizu Corporation

5.1.15. PCL Construction

5.2 Cross Comparison Parameters (Headquarters, Revenue, No. of Employees, Market Share, Regional Presence, R&D Investment, Technology Adoption, Sustainability Initiatives)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.6.1. Venture Capital and Private Equity Investments

5.6.2. Government Infrastructure Grants

5.7. Industry Collaborations and Partnerships

6. Global Construction Market Regulatory Framework

6.1. Construction and Safety Standards

6.2. Environmental and Energy-Efficiency Regulations

6.3. Building Codes Compliance

6.4. LEED and Other Certifications

7. Global Construction Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global Construction Market Future Segmentation

8.1. By Project Type (In Value %)

8.2. By Material Type (In Value %)

8.3. By Construction Method (In Value %)

8.4. By End-User (In Value %)

8.5. By Region (In Value %)

9. Global Construction Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Growth and Penetration Strategy

9.3. Market Entry Strategy

9.4. Marketing Initiatives and White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

In this phase, the research identifies key stakeholders in the global construction market by conducting desk research and mapping out the ecosystem. This step focuses on sourcing data from secondary and proprietary databases, allowing us to establish a foundational understanding of the critical variables shaping market dynamics.

Step 2: Market Analysis and Construction

We compile and evaluate historical data, focusing on market trends, revenue streams, and the penetration rates of construction services globally. This phase ensures the collection of reliable data, including construction costs and service quality statistics, to formulate accurate market estimates.

Step 3: Hypothesis Validation and Expert Consultation

In this step, hypotheses are developed based on market trends and are validated through expert consultations with construction industry professionals. These interviews provide deep insights into the operational and financial aspects of construction activities, which help in fine-tuning the market projections.

Step 4: Research Synthesis and Final Output

The final step involves synthesizing the gathered data with inputs from multiple construction stakeholders. This results in a well-rounded market analysis, incorporating insights into material usage, construction methodologies, and consumer preferences. The final report ensures comprehensive and validated market insights.

Frequently Asked Questions

01. How big is the global construction market?

The global construction market is valued at USD 13.1 billion, driven by infrastructure development, urbanization, and increasing demand for sustainable and energy-efficient buildings.

02. What are the challenges in the global construction market?

Challenges include fluctuating raw material prices, labor shortages, and increasing regulatory and environmental constraints. Companies also face rising demands for sustainable construction practices, which require additional investments.

03. Who are the major players in the global construction market?

Key players include Bechtel Corporation, VINCI SA, China State Construction Engineering Corp, Larsen & Toubro, and Skanska AB, which dominate due to their extensive global portfolios and technological integration.

04. What are the growth drivers of the global construction market?

The growth is driven by technological advancements in modular construction, rising urbanization, increasing government investment in infrastructure, and the shift towards green and sustainable building practices.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.