Global Consumer Appliances Market Outlook to 2030

Region:Global

Author(s):Mukul

Product Code:KROD4252

November 2024

92

About the Report

Global Consumer Appliances Market Overview

- The global consumer appliances market is valued at USD 437 billion, primarily driven by the rise in household incomes, urbanization, and the increasing integration of smart technology into everyday appliances. The market benefits from growing consumer demand for energy-efficient and eco-friendly products, with governments worldwide incentivizing eco-conscious products to meet sustainability goals. This shift to eco-friendly appliances significantly impacts market growth, creating an upward trajectory.

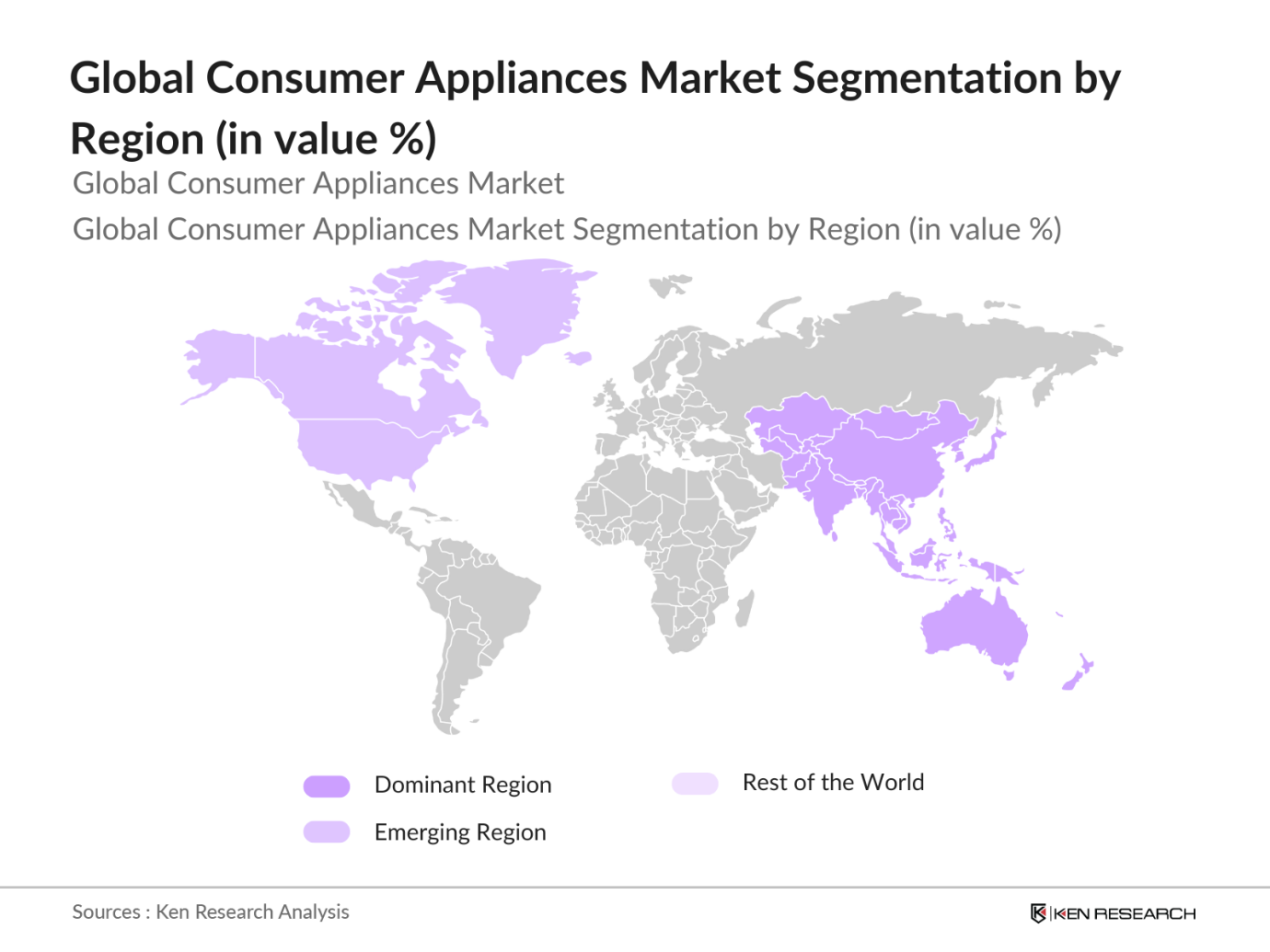

- North America, Europe, and Asia-Pacific lead the global consumer appliances market due to advanced infrastructure, high disposable incomes, and rapid adoption of innovative technologies. North America, in particular, stands out for its strong inclination toward smart home devices, while Asia-Pacific leads in terms of consumer base and high production capabilities, especially in countries like China and Japan, which serve as manufacturing hubs for leading brands.

- Consumer appliances must meet specific safety and quality certifications to be market-compliant. The International Electrotechnical Commission requires appliances to meet safety standards that cover electrical, mechanical, and radiation risks. For instance, in 2024, over 90% of appliances sold in North America comply with these certifications, ensuring consumer protection and product reliability. Compliance with safety and quality standards remains a priority for manufacturers, reinforcing consumer trust in the market.

Global Consumer Appliances Market Segmentation

- By Product Type: The consumer appliances market is segmented by product type into refrigerators, washing machines, air conditioners, cooking appliances, and vacuum cleaners. Refrigerators dominate this segment due to their universal need in households and commercial establishments. The increasing preference for energy-efficient and smart refrigerators is further boosting their demand, especially in regions with rising temperatures and urban centers where perishable goods are a staple.

- By Region: The regional segmentation includes North America, Europe, Asia-Pacific, Middle East & Africa, and Latin America. Asia-Pacific leads the market, driven by its large consumer base and manufacturing facilities. With China and India as significant markets, the region benefits from robust demand and cost-effective production capabilities. The increasing urbanization and disposable incomes in these regions drive the adoption of consumer appliances, contributing to Asia-Pacifics leadership.

- By Distribution Channel: The market is segmented by distribution channel into online retail, offline retail, and brand outlets. Online retail holds a dominant market share, reflecting the global shift to e-commerce and consumer preference for convenient, home-based shopping. The growth of online marketplaces such as Amazon and regional e-commerce giants in Asia further strengthens this channel's dominance.

Global Consumer Appliances Market Competitive Landscape

The global consumer appliances market is consolidated with major players dominating due to strong brand presence and product innovation. Key players employ strategies like product differentiation, sustainability initiatives, and extensive distribution networks to maintain competitive advantages.

Global Consumer Appliances Industry Analysis

Growth Drivers

- Rising Disposable Income (GDP per capita): Increasing disposable incomes across global markets, with GDP per capita rising significantly in emerging regions, drives demand for consumer appliances. According to the World Bank, GDP per capita in countries like India increased from approximately $2,100 in 2022 to $2,250 in 2024, reflecting improved purchasing power for consumer goods. Similarly, the U.S. saw GDP per capita rise to nearly $76,000 in 2024, signaling high disposable income conducive to appliance spending. This upward income trend directly correlates with consumer investment in durable appliances, a sector benefiting from increased household spending on essential and luxury goods.

- Increasing Demand for Energy-Efficient Appliances: With energy efficiency becoming a priority, consumer demand for energy-saving appliances has surged. According to the International Energy Agency, global electricity consumption per household has declined by 5% from 2022 to 2024, indicating a shift to energy-efficient appliances. The U.S. Department of Energy reports that replacing conventional appliances with efficient models saves households around 250 kWh annually. This trend is supported by government policies in various countries, promoting energy conservation by offering incentives for energy-efficient appliance adoption, stimulating the global consumer appliance market.

- Urbanization and Changing Consumer Preferences: Rapid urbanization fuels appliance demand as urban households often seek modern amenities. In 2024, approximately 58% of the worlds population lives in urban areas, according to United Nations data, and urban households tend to have a higher concentration of appliances. Countries such as China report urbanization rates near 65%, with consumers there increasingly demanding appliances that suit compact living spaces. Changing consumer preferences toward convenience and digital integration also drive demand for advanced appliances, solidifying the role of urbanization in boosting this market.

Market Restraints

- High Replacement Costs: Consumer reluctance to frequently replace costly appliances poses a challenge in the market. Data from the U.S. Bureau of Labor Statistics reveals that household appliance prices have risen by 2-3% from 2022 to 2024, making upgrades more financially demanding. High-end smart appliances, in particular, are expensive to replace, leading to extended appliance life cycles that slow market growth. This resistance to replacement limits consumer turnover, impacting the continuous growth of new product demand in the sector.

- Environmental Concerns and Regulations: Environmental regulations governing appliance manufacturing and disposal are increasingly stringent. The European Unions eco-design directives, for instance, restrict emissions and promote sustainable production, impacting appliance makers. Furthermore, the World Bank highlights that emissions from waste appliances constitute nearly 2% of global waste emissions. Regulations that impose recycling or waste management standards add production costs and compliance challenges for manufacturers, placing significant pressure on companies to innovate sustainably within tight regulatory frameworks.

Global Consumer Appliances Market Future Outlook

The global consumer appliances market is anticipated to experience steady growth as demand continues for advanced, sustainable, and smart home products. Factors such as increased adoption of IoT-enabled devices, a shift toward eco-friendly appliances, and advancements in energy efficiency standards are expected to shape market dynamics positively. Moreover, regional expansion in emerging markets across Asia and Latin America will create additional growth opportunities for consumer appliances.

Market Opportunities

- Growth in Smart Home Ecosystem (IoT Integration): The global consumer appliance market benefits from the rapid expansion of smart home ecosystems. The World Bank reports that, in 2024, over 700 million households are connected to smart devices, with IoT appliances leading this growth. Governments in regions like North America and Europe promote smart home systems to enhance energy efficiency, indirectly fueling demand for compatible appliances. The adoption of IoT-enabled appliances presents an immense opportunity for the market as homes become increasingly interconnected.

- Expansion in Emerging Markets: Emerging economies like Brazil, India, and Southeast Asia are experiencing increased consumer spending on appliances due to rising incomes and urbanization. In India, for instance, household consumption expenditure rose from $1.5 trillion in 2022 to $1.7 trillion in 2024, as per World Bank data. This growth creates opportunities for appliance manufacturers, particularly those offering affordable options tailored to local preferences. Expansion into these markets presents a vast opportunity, especially with populations that are new to appliance ownership.

Scope of the Report

|

Product Type |

Refrigerators, Washing Machines, Air Conditioners, Cooking Appliances, Vacuum Cleaners |

|

Distribution Channel |

Online Retail, Offline Retail, Brand Outlets |

|

Technology Type |

Conventional, Smart/Connected Appliances |

|

End-User |

Residential, Commercial |

|

Region |

North America, Europe, Asia-Pacific, Middle East & Africa, Latin America |

Products

Key Target Audience

Consumer Electronics Manufacturers

Retail Chains and E-Commerce Platforms

Component Suppliers

Technology and IoT Solution Providers

Government and Regulatory Bodies (U.S. Environmental Protection Agency, EU Energy Labelling)

Investor and Venture Capitalist Firms

Research & Development Institutes

Energy Efficiency Certification Bodies

Companies

Players Mentioned in the Report:

LG Electronics

Samsung Electronics

Whirlpool Corporation

Panasonic Corporation

Electrolux AB

Haier Group

Bosch Siemens Hausgerte

Midea Group

Sharp Corporation

Hitachi Ltd.

Arelik A..

Daikin Industries

Gree Electric Appliances Inc.

Hisense Group

Xiaomi Corporation

Table of Contents

1. Global Consumer Appliances Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Dynamics

1.4. Market Segmentation Overview

2. Global Consumer Appliances Market Size (in USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Market Milestones and Key Developments

3. Global Consumer Appliances Market Analysis

3.1. Growth Drivers

- 3.1.1. Rising Disposable Income (GDP per capita)

- 3.1.2. Increasing Demand for Energy-Efficient Appliances

- 3.1.3. Urbanization and Changing Consumer Preferences

- 3.1.4. Smart Technology Integration

3.2. Market Challenges

- 3.2.1. High Replacement Costs

- 3.2.2. Environmental Concerns and Regulations

- 3.2.3. Supply Chain Disruptions

3.3. Opportunities

- 3.3.1. Growth in Smart Home Ecosystem (IoT Integration)

- 3.3.2. Expansion in Emerging Markets

- 3.3.3. Advancements in Energy-Efficient Technologies

3.4. Trends

- 3.4.1. Connected Appliances

- 3.4.2. Preference for Compact and Multifunctional Appliances

- 3.4.3. Increased Demand for Sustainable Products

3.5. Regulatory Landscape

- 3.5.1. Energy Efficiency Standards (Government Standards)

- 3.5.2. Compliance with Environmental Policies

- 3.5.3. Safety and Quality Certifications

3.6. SWOT Analysis

3.7. Porters Five Forces Analysis

3.8. Consumer Behavior Insights

3.9. Competitive Ecosystem

4. Global Consumer Appliances Market Segmentation

4.1. By Product Type (in Value %)

- 4.1.1. Refrigerators

- 4.1.2. Washing Machines

- 4.1.3. Air Conditioners

- 4.1.4. Cooking Appliances

- 4.1.5. Vacuum Cleaners

4.2. By Distribution Channel (in Value %)

- 4.2.1. Online Retail

- 4.2.2. Offline Retail

- 4.2.3. Brand Outlets

4.3. By Technology Type (in Value %)

- 4.3.1. Conventional

- 4.3.2. Smart/Connected Appliances

4.4. By End-User (in Value %)

- 4.4.1. Residential

- 4.4.2. Commercial

4.5. By Region (in Value %)

- 4.5.1. North America

- 4.5.2. Europe

- 4.5.3. Asia-Pacific

- 4.5.4. Middle East & Africa

- 4.5.5. Latin America

5. Global Consumer Appliances Market Competitive Landscape

5.1. Detailed Profiles of Major Companies

- 5.1.1. LG Electronics

- 5.1.2. Samsung Electronics

- 5.1.3. Whirlpool Corporation

- 5.1.4. Panasonic Corporation

- 5.1.5. Electrolux AB

- 5.1.6. Haier Group

- 5.1.7. Bosch Siemens Hausgerte

- 5.1.8. Midea Group

- 5.1.9. Sharp Corporation

- 5.1.10. Hitachi Ltd.

- 5.1.11. Arelik A..

- 5.1.12. Daikin Industries

- 5.1.13. Gree Electric Appliances Inc.

- 5.1.14. Hisense Group

- 5.1.15. Xiaomi Corporation

5.2. Cross-Comparison Parameters (Product Range, Market Presence, Revenue, Product Innovation, Sustainability Initiatives, Customer Base, Manufacturing Facilities, R&D Investments)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers & Acquisitions

5.6. Investment Analysis

5.7. Venture Capital & Private Equity Investments

6. Global Consumer Appliances Market Regulatory Framework

6.1. International Energy Standards

6.2. Compliance and Certification Processes

6.3. Environmental Safety Regulations

7. Global Consumer Appliances Future Market Size (in USD Mn)

7.1. Market Growth Projections

7.2. Key Drivers Shaping Future Growth

8. Global Consumer Appliances Future Market Segmentation

8.1. By Product Type (in Value %)

8.2. By Distribution Channel (in Value %)

8.3. By Technology Type (in Value %)

8.4. By End-User (in Value %)

8.5. By Region (in Value %)

9. Global Consumer Appliances Market Analysts Recommendations

9.1. Market Entry Strategies

9.2. White Space Opportunities

9.3. Product Innovation Pathways

9.4. Targeted Marketing Strategies

Research Methodology

Step 1: Identification of Key Variables

The first stage involves a comprehensive analysis of the global consumer appliances market ecosystem, incorporating all stakeholders and economic influencers. This data is sourced from a combination of proprietary databases, industry reports, and market-specific publications to identify key market drivers and barriers.

Step 2: Market Analysis and Data Aggregation

Historical market data is aggregated from primary and secondary sources, including government publications and verified reports, to construct a baseline for revenue and growth analysis. This data serves to verify market trends, the dominance of product segments, and distribution trends.

Step 3: Hypothesis Validation with Expert Consultations

Experts from leading consumer appliance firms and industry analysts are consulted to validate preliminary findings. This process includes in-depth interviews focusing on consumer preferences, market challenges, and technological advancements, which refine the market data further.

Step 4: Synthesis and Final Analysis

In this stage, data from multiple sources are consolidated to provide a final, validated report. The findings from expert consultations and historical data analysis are synthesized to offer comprehensive insights, covering market dynamics, segmentation, competitive landscape, and forecasted growth.

Frequently Asked Questions

01. How big is the global consumer appliances market?

The global consumer appliances market is valued at USD 437 billion, driven by increasing consumer demand for smart and energy-efficient appliances, primarily due to urbanization and rising disposable incomes.

02. What are the challenges in the global consumer appliances market?

Challenges include high replacement costs, environmental regulatory compliance, and supply chain disruptions, which affect product availability and cost efficiency in the market.

03. Who are the major players in the global consumer appliances market?

Major players in the market include LG Electronics, Samsung Electronics, Whirlpool Corporation, Panasonic Corporation, and Electrolux AB, with each holding a strong market presence due to extensive product portfolios and brand loyalty.

04. What drives growth in the global consumer appliances market?

The market's growth is driven by the adoption of smart home technology, increasing awareness of energy efficiency, and government incentives promoting eco-friendly appliances.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.