Global Consumer Electronics Market Outlook 2030

Region:Global

Author(s):Shivani Mehra

Product Code:KROD3578

December 2024

81

About the Report

Global Consumer Electronics Market Overview

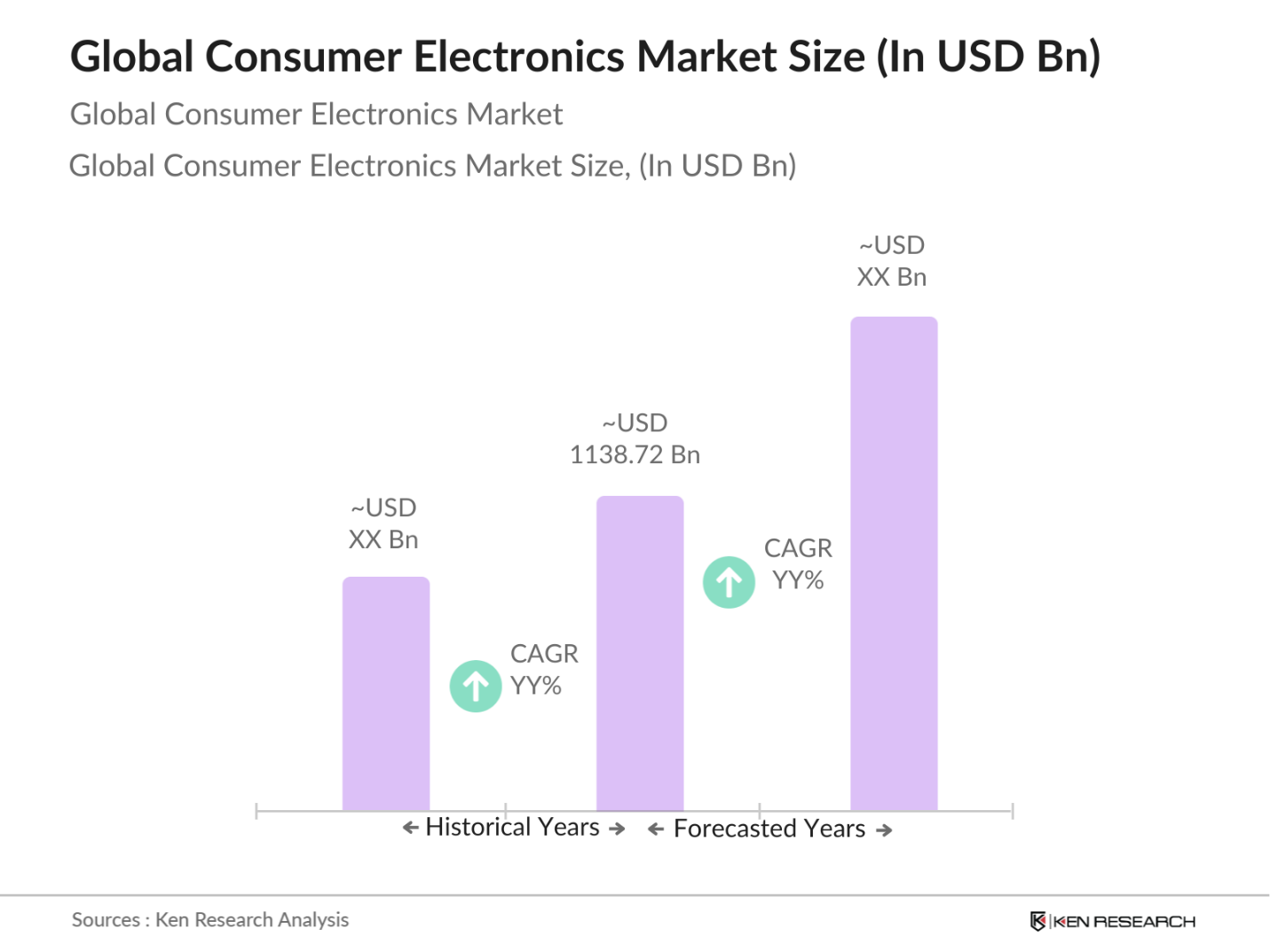

- The global consumer electronics market is valued at USD 1138.72 billion, driven by increased disposable income, advancements in smart technology, and the proliferation of e-commerce, which has expanded access to a broad range of products. Strong demand for wearables, home automation devices, and IoT-enabled gadgets continues to fuel market expansion. As the digital lifestyle becomes more mainstream, demand for products like smartphones, laptops, and smart home devices has surged, reflecting sustained market growth and consumer preference for multifunctional, high-tech devices.

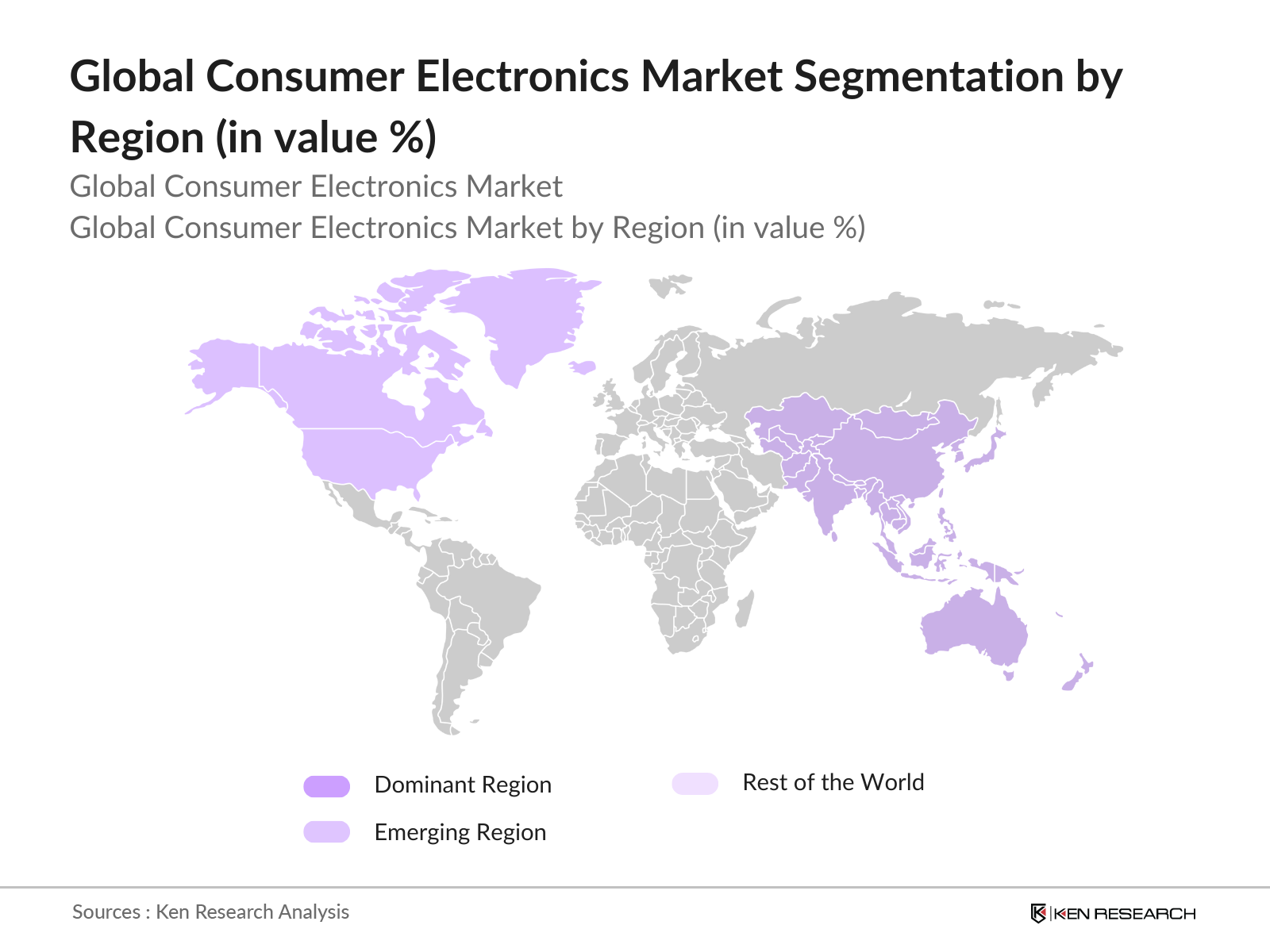

- Key regions dominating the global consumer electronics market include North America and Asia-Pacific, particularly due to the presence of leading technology hubs and high consumer demand for innovation. North Americas established technological infrastructure and high spending capacity position it as a top market. In Asia-Pacific, countries like China, South Korea, and Japan drive market dominance due to significant manufacturing capacities, favorable government policies for tech innovation, and a rapidly growing consumer base in these regions.

- The U.S. government introduced the CHIPS and Science Act, providing over USD 52 billion in funding to bolster domestic semiconductor manufacturing. This initiative aims to reduce dependency on foreign-made chips, helping alleviate supply chain disruptions for consumer electronics and ensuring a stable supply of critical components. The act also provides tax incentives for companies establishing chip manufacturing facilities within the U.S., which supports the consumer electronics industry by creating a more resilient domestic supply chain.

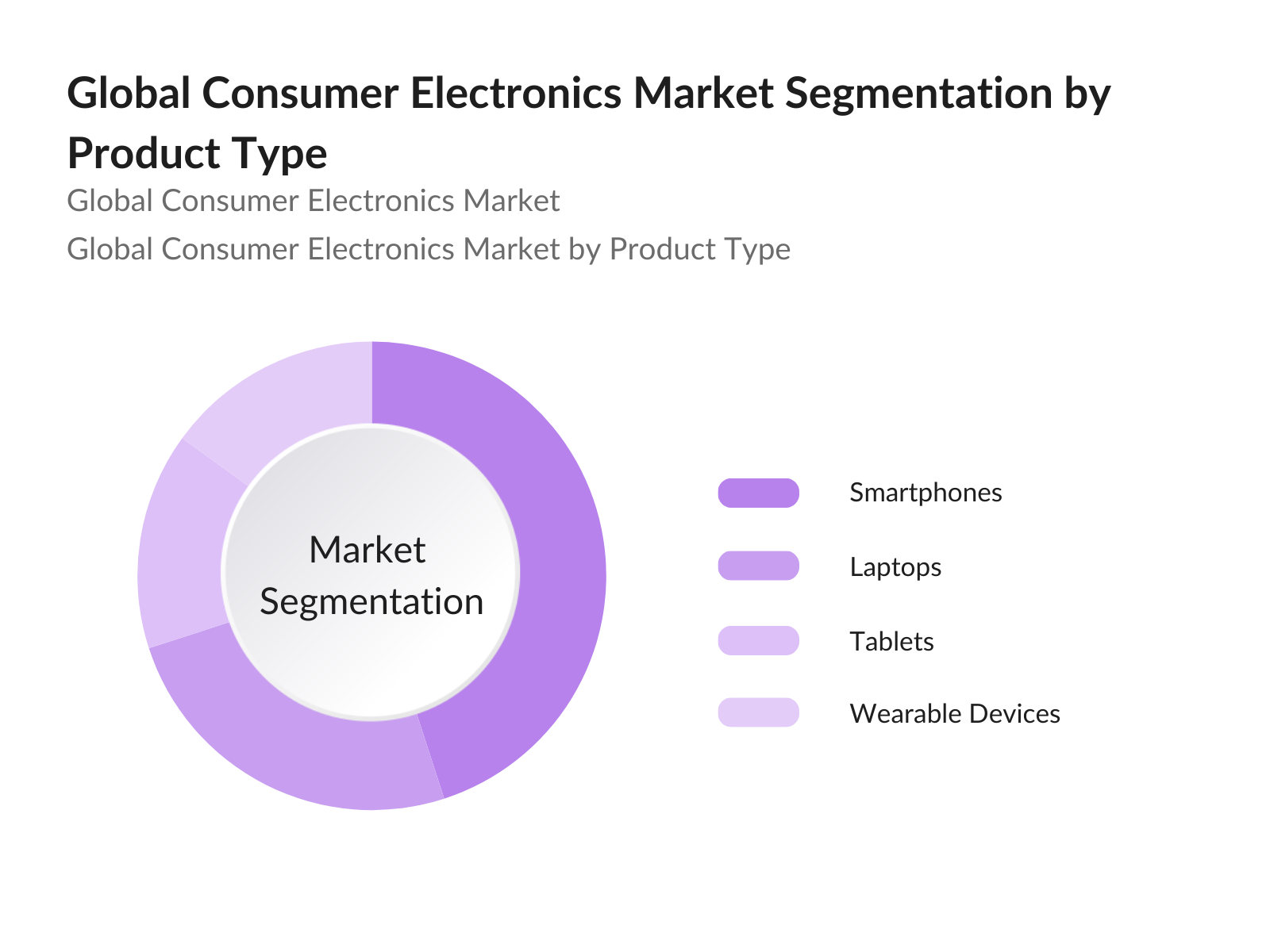

Global Consumer Electronics Market Segmentation

- By Product Type: The global consumer electronics market is segmented by product type into smartphones, laptops, tablets, and wearable devices. Recently, smartphones have held a dominant market share in this segment due to their central role in daily life and work, with constant innovations in battery life, camera technology, and processing speeds driving demand. High penetration in developing economies and regular upgrades in developed markets sustain this trend, making smartphones a leading category.

- By Region: The market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. Asia-Pacific is the most dominant region, largely driven by Chinas extensive manufacturing base, South Koreas innovation in display technology, and Japans advances in imaging sensors and smart technology. The regions economic growth and expanding middle class with increasing purchasing power further reinforce its leading market position.

Global Consumer Electronics Market Competitive Landscape

The consumer electronics market features major global players, each vying to maintain a competitive edge through continuous innovation, product diversification, and strategic partnerships.

|

Company |

Establishment Year |

Headquarters |

Revenue (USD Bn) |

Market Share (%) |

R&D Spend (USD Bn) |

Product Portfolio |

Global Presence |

Brand Reputation |

Innovation Index |

|

Samsung Electronics |

1969 |

South Korea |

- | - | - | - | - | - | - |

|

Apple Inc. |

1976 |

USA |

- | - | - | - | - | - | - |

|

Sony Corporation |

1946 |

Japan |

- | - | - | - | - | - | - |

|

LG Electronics |

1958 |

South Korea |

- | - | - | - | - | - | - |

|

Huawei Technologies |

1987 |

China |

- | - | - | - | - | - | - |

Global Consumer Electronics Market Analysis

Market Growth Drivers

- Technological Advancements (5G Integration, IoT-Enabled Devices): The adoption of 5G technology has enabled faster data transmission speeds, which has been instrumental in the growth of smart consumer devices. In 2023, approximately 1.5 billion IoT-enabled devices were in active use globally, enhancing applications in wearable devices, smart home solutions, and connected appliances. According to the GSMA, 5G connections are expected to surpass 1 billion by the end of 2024, largely in consumer electronics. IoT applications further boosted electronic device demand, with 80 million smart appliances projected to be sold globally in 2023.

- Evolving Consumer Preferences (Eco-Friendly, Smart Devices): Consumers globally are increasingly inclined toward eco-friendly devices due to regulatory initiatives and heightened environmental awareness. In the EU, sales of eco-friendly electronic devices reached over 60 million units in 2023, a significant increase from 50 million in 2022. This shift is supported by rising adoption of smart and energy-efficient appliances that meet EU energy standards. North America mirrors this trend, with continued growth in demand for sustainable electronics expected in 2023 as consumers prioritize environmentally conscious choices in their purchases.

- Rising Disposable Income (Impact on Consumer Demand): Increasing disposable income, particularly in emerging economies like India and Southeast Asia, is boosting demand for consumer electronics. In India, per capita income reached USD 2,600 in 2023, marking a notable rise from the previous year, which has contributed to heightened consumer interest in electronic gadgets like smartphones and laptops. The IMF reports a continued rise in household income across Southeast Asia in 2023, where consumer electronics now represent a substantial portion of household expenditures, further fueling demand in these regions.

Market Challenges:

- Regulatory Compliance (Environmental Standards): Adhering to stringent environmental regulations presents challenges for manufacturers in the consumer electronics industry. The European Unions Waste Electrical & Electronic Equipment (WEEE) directive, updated in 2023, mandates that manufacturers recycle a significant portion of electronics produced, increasing compliance costs for companies. Countries like Japan have also enacted stricter standards aimed at reducing electronic waste, which impacts global supply chains and requires adjustments in production practices.

- Supply Chain Disruptions (Chip Shortages, Logistics): Global supply chains, especially in semiconductor production, have encountered significant disruptions due to geopolitical tensions and natural disasters. In 2023, chip shortages led to production delays for over 100 million electronic devices, severely affecting Asia-based manufacturers. The World Bank notes that supply chain issues have lengthened global shipping times, impacting timely deliveries and raising costs. Logistics challenges, including port delays, have further exacerbated the situation, with the electronics sector projected to face a financial impact of USD 50 billion in 2023 due to these ongoing disruptions.

Global Consumer Electronics Market Future Outlook

Over the next five years, the global consumer electronics market is poised to witness substantial growth, driven by increased consumer demand for connected and smart devices, ongoing innovations in display and processor technology, and the rise of artificial intelligence and IoT integration across various product categories. The expansion of 5G networks and the growth of cloud-connected devices will further stimulate the market, enabling the development of more sophisticated and interconnected consumer electronics.

Market Opportunities:

- AI and Machine Learning Integration: AI and machine learning are revolutionizing consumer electronics, with applications in everything from personal assistants to predictive maintenance in smart appliances. In 2023, approximately 40 million AI-integrated devices were sold globally, spanning categories like smartphones and home security. By improving user experience through personalized recommendations and enhanced functionality, AI integration has become a key selling point in consumer electronics. Companies continue to invest heavily in AI research, which is expected to yield more innovative applications in 2023.

- Miniaturization of Devices (Wearables, Portables): Advances in semiconductor technology have enabled the miniaturization of electronic devices, leading to a surge in wearable and portable device sales. In 2023, wearable technology, including fitness trackers and smartwatches, saw shipments of over 200 million units globally. This trend has been further boosted by increased consumer interest in health monitoring and mobile connectivity. Smaller, lighter components have also enabled more compact designs, appealing to consumers' growing preference for convenience and functionality.

Scope of the Report

|

By Product Type |

Smartphones Laptops and Tablets Wearable Devices Smart Home Devices Audio and Video Equipment |

|

By Component |

Processors Memory Displays Batteries Sensors |

|

By Connectivity |

Wi-Fi Bluetooth 5G NFC |

|

By End-User |

Residential Commercial |

|

By Region |

North America Europe Asia Pacific Latin America Middle East & Africa |

Products

Key Target Audience

Consumer Electronics Manufacturers

Distributors and Suppliers

Government and Regulatory Bodies (e.g., Federal Communications Commission, CE Marking Authorities)

Retail Chains and E-commerce Platforms

Technology Solution Providers

Product Development and R&D Firms

Investments and Venture Capital Firms

Raw Material Suppliers (e.g., Semiconductor Manufacturers)

Companies

Players Mentioned in the report

Samsung Electronics

Apple Inc.

Sony Corporation

LG Electronics

Huawei Technologies

Xiaomi Corporation

Panasonic Corporation

Microsoft Corporation

HP Inc.

Lenovo Group Limited

Google LLC

Dell Technologies

OnePlus Technology

Amazon.com, Inc.

Bosch

Table of Contents

1. Global Consumer Electronics Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate (Industry CAGR, Demand Growth)

1.4 Market Segmentation Overview

2. Global Consumer Electronics Market Size (In USD Bn)

2.1 Historical Market Size (Value in USD Bn)

2.2 Year-On-Year Growth Analysis (Growth Rate by Product Type and Region)

2.3 Key Market Developments and Milestones

3. Global Consumer Electronics Market Analysis

3.1 Growth Drivers

3.1.1 Technological Advancements (5G Integration, IoT-Enabled Devices)

3.1.2 Rising Disposable Income (Impact on Consumer Demand)

3.1.3 Evolving Consumer Preferences (Eco-Friendly, Smart Devices)

3.1.4 Expanding E-commerce Penetration (Online Sales Growth)

3.2 Market Challenges

3.2.1 Regulatory Compliance (Environmental Standards)

3.2.2 Supply Chain Disruptions (Chip Shortages, Logistics)

3.2.3 Counterfeit Products (Impact on Brand Image)

3.3 Opportunities

3.3.1 Growth in Emerging Markets (Asia-Pacific, Latin America)

3.3.2 Product Customization (Personalized Consumer Devices)

3.3.3 Expansion of Smart Home Ecosystems

3.4 Trends

3.4.1 AI and Machine Learning Integration

3.4.2 Miniaturization of Devices (Wearables, Portables)

3.4.3 Increased Adoption of AR/VR in Consumer Electronics

3.5 Regulatory Environment

3.5.1 Government Standards (Safety, Environmental Compliance)

3.5.2 Import Tariffs and Trade Policies

3.5.3 International Certifications (RoHS, CE Marking)

3.6 SWOT Analysis

3.7 Industry Ecosystem Analysis

3.8 Porters Five Forces Analysis

3.9 Competitive Landscape Overview

4. Global Consumer Electronics Market Segmentation

4.1 By Product Type (In Value %)

4.1.1 Smartphones

4.1.2 Laptops and Tablets

4.1.3 Wearable Devices

4.1.4 Smart Home Devices

4.1.5 Audio and Video Equipment

4.2 By Component (In Value %)

4.2.1 Processors

4.2.2 Memory

4.2.3 Displays

4.2.4 Batteries

4.2.5 Sensors

4.3 By Connectivity (In Value %)

4.3.1 Wi-Fi

4.3.2 Bluetooth

4.3.3 5G

4.3.4 NFC

4.4 By End-User (In Value %)

4.4.1 Residential

4.4.2 Commercial

4.5 By Region (In Value %)

4.5.1 North America

4.5.2 Europe

4.5.3 Asia Pacific

4.5.4 Latin America

4.5.5 Middle East & Africa

5. Global Consumer Electronics Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Samsung Electronics

5.1.2 Apple Inc.

5.1.3 Sony Corporation

5.1.4 LG Electronics

5.1.5 Panasonic Corporation

5.1.6 Xiaomi Corporation

5.1.7 Huawei Technologies

5.1.8 HP Inc.

5.1.9 Dell Technologies

5.1.10 Microsoft Corporation

5.1.11 Lenovo Group Limited

5.1.12 OnePlus Technology

5.1.13 Google LLC

5.1.14 Amazon.com, Inc.

5.1.15 Bosch

5.2 Cross Comparison Parameters (No. of Employees, Headquarters, Revenue, R&D Expenditure, Product Portfolio Diversity, Market Presence, Revenue by Product Type, Innovation Index)

5.3 Market Share Analysis (Based on Revenue, By Region, By Product Type)

5.4 Strategic Initiatives (Product Innovations, New Launches, Sustainability Initiatives)

5.5 Mergers and Acquisitions

5.6 Investment Analysis (VC Funding, Private Equity Investments)

5.7 Strategic Partnerships and Collaborations

6. Global Consumer Electronics Market Regulatory Framework

6.1 Environmental Compliance Standards

6.2 Safety and Quality Standards (UL, ISO Certifications)

6.3 Import-Export Regulations

6.4 Industry Certifications (Energy Star, EPEAT)

7. Global Consumer Electronics Market Future Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Influencing Future Market Growth

8. Global Consumer Electronics Market Future Segmentation

8.1 By Product Type (In Value %)

8.2 By Component (In Value %)

8.3 By Connectivity (In Value %)

8.4 By End-User (In Value %)

8.5 By Region (In Value %)

9. Global Consumer Electronics Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Segmentation Analysis

9.3 Product Innovation and Development Roadmap

9.4 Market Entry Strategy

9.5 White Space Analysis and Opportunity Mapping

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

In this initial step, we create a comprehensive ecosystem map, including all major stakeholders in the global consumer electronics market. Through thorough desk research and proprietary databases, we gather extensive industry information, identifying critical factors that shape market trends.

Step 2: Market Analysis and Construction

This phase involves compiling historical data for the consumer electronics market, analyzing market penetration, product lifecycle stages, and revenue generation. Additionally, we evaluate sales statistics and quality metrics to validate data reliability.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses regarding market drivers and challenges are developed and validated through consultations with industry experts. These insights are gathered via CATI (Computer-Assisted Telephone Interviewing) with professionals across prominent consumer electronics companies.

Step 4: Research Synthesis and Final Output

In the final step, we engage with multiple consumer electronics manufacturers for detailed data on segment performance and market dynamics. These interactions reinforce our bottom-up approach, ensuring an accurate and validated analysis of the global consumer electronics market.

Frequently Asked Questions

01. How big is the global consumer electronics market?

The global consumer electronics market is valued at USD 1138.72 billion, driven by the rise of digital lifestyles, increased consumer demand for smart devices, and advancements in connectivity.

02. What are the challenges in the global consumer electronics market?

Challenges in this market include high competition, regulatory compliance requirements, and supply chain disruptions, such as semiconductor shortages, impacting product availability and pricing.

03. Who are the major players in the global consumer electronics market?

Key players include Samsung, Apple, Sony, LG, and Huawei, who dominate the market through robust R&D investments, diverse product portfolios, and extensive global reach.

04. What are the growth drivers of the global consumer electronics market?

The market is propelled by increasing demand for smart homes, wearable devices, and advancements in AI and IoT, which enhance product functionality and connectivity.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.