Global Consumer Packaged Goods (CPG) Market Outlook to 2030

Region:Global

Author(s):Vijay Kumar

Product Code:KROD4111

December 2024

90

About the Report

Global Consumer Packaged Goods (CPG) Market Overview

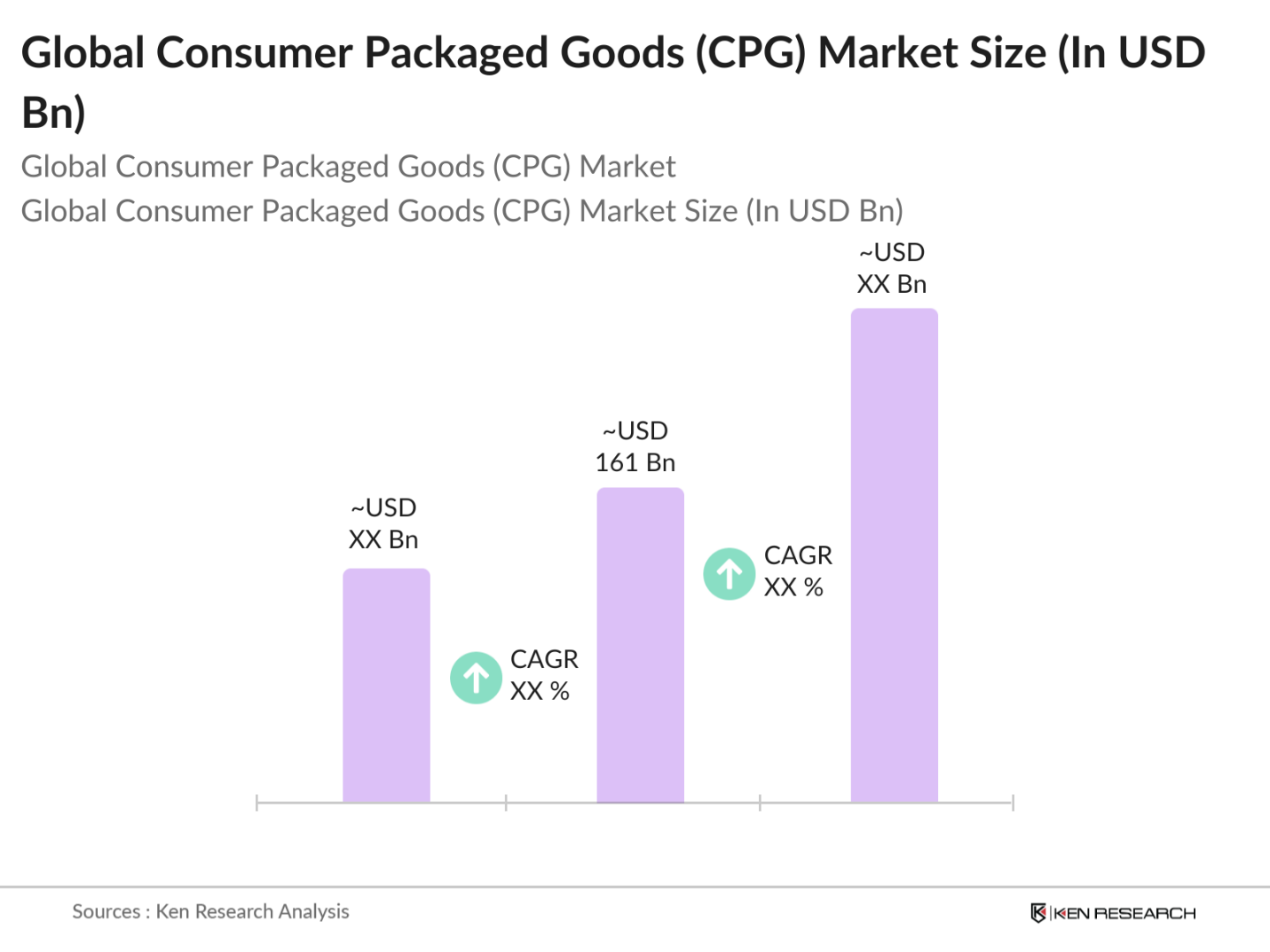

- The Global Consumer Packaged Goods (CPG) market is valued at USD 161 billion, based on a five-year historical analysis. The market is driven by factors such as rising disposable incomes, evolving consumer preferences for convenience, and the increasing penetration of digital retail channels. North America holds a leading position due to its advanced retail infrastructure, high consumer spending, and the presence of key industry players who continuously innovate in sustainable and premium product offerings.

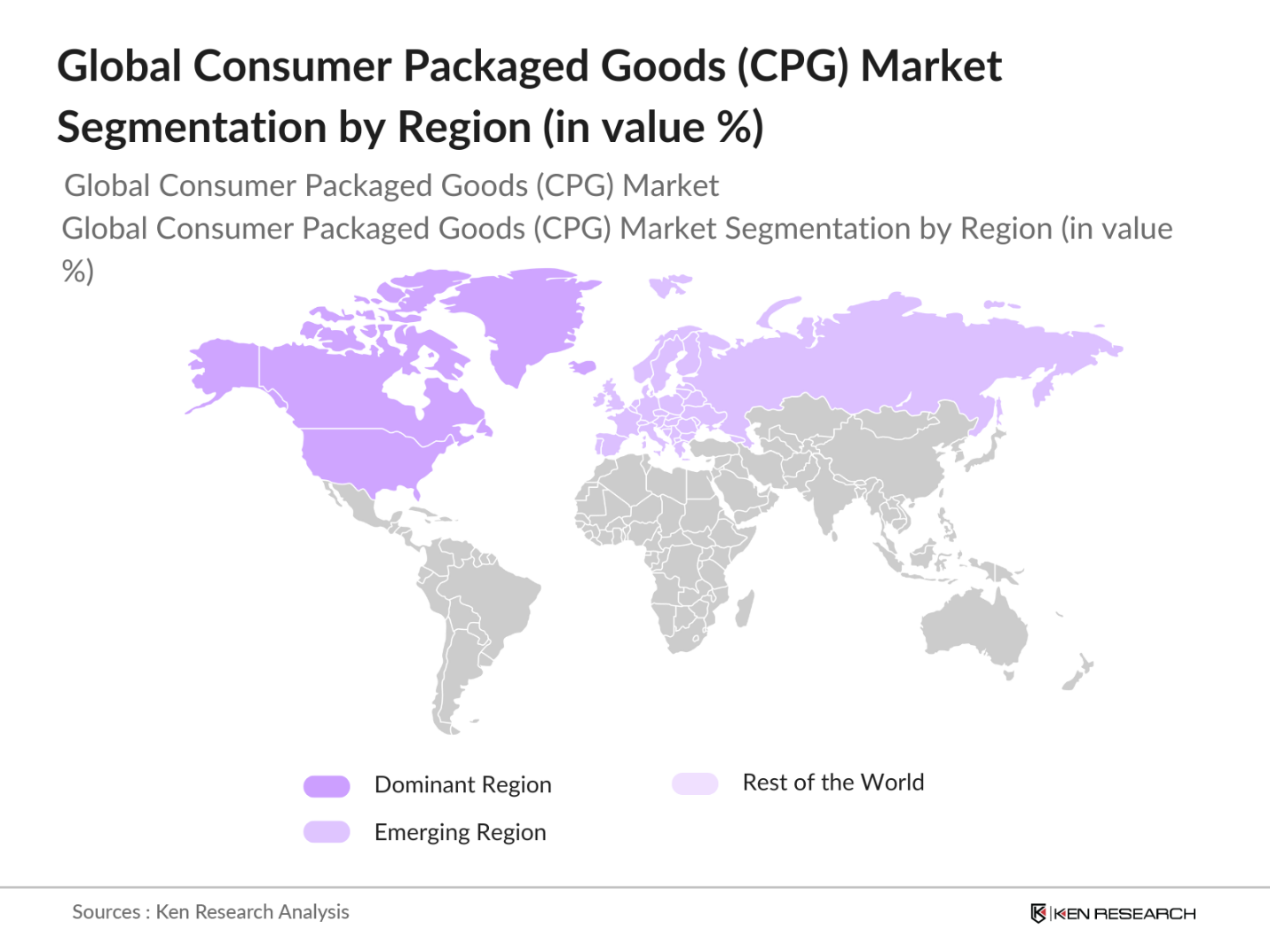

- Regions such as North America, Europe, and Asia-Pacific dominate the Global Consumer Packaged Goods (CPG) market due to distinct regional factors that drive growth and consumer demand. North America, led by the United States, is a key market because of its advanced retail infrastructure, high disposable incomes, and a strong focus on innovation and sustainability. The regions adoption of digital channels and e-commerce platforms also contributes significantly to market dominance.

- Global food safety regulations are tightening, particularly in advanced economies, resulting in higher compliance costs for Consumer-Packaged Goods (CPG) companies. These enhanced standards focus on improving food quality and safety, which is expected to significantly influence market dynamics and operational strategies throughout 2024, as firms adjust to meet these stringent requirements.

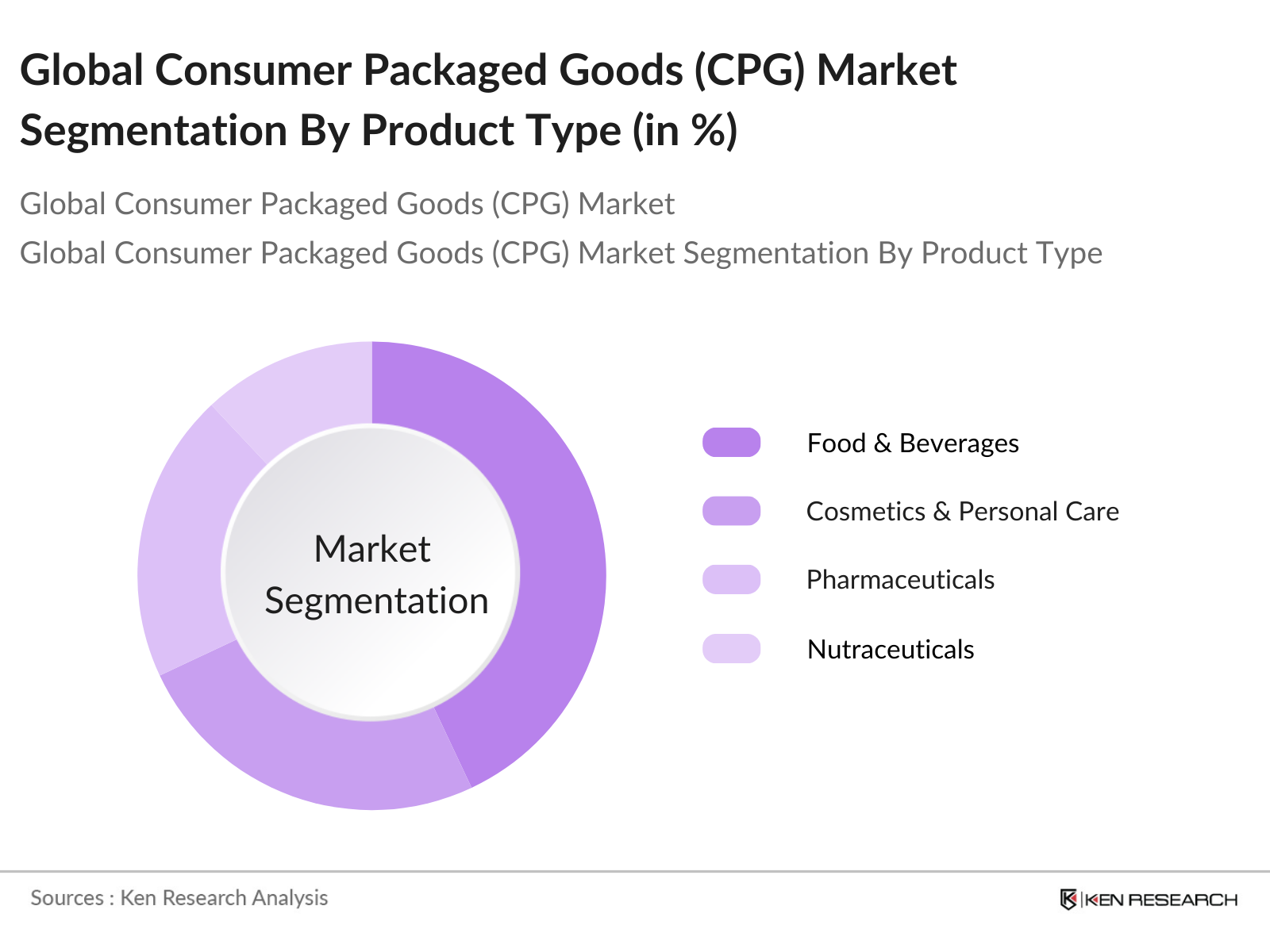

Global Consumer Packaged Goods (CPG) Market Segmentation

By Product Type: The market is segmented by product type into food & beverages, cosmetics & personal care, pharmaceuticals, nutraceuticals, and others. Recently, the food & beverages segment has maintained a dominant position in the market. This is primarily attributed to the essential nature of food products and their frequent consumption. Within this segment, beverages such as carbonated drinks and packaged foods are leading due to convenience and widespread availability. Innovations in healthy and organic food options are also boosting this segments growth.

By Distribution Channel: The distribution channels for the CPG market are divided into offline and online segments. The offline channel, which includes supermarkets, hypermarkets, and convenience stores, currently holds the dominant share due to consumer preference for in-store shopping and the tactile experience it provides.

By Region: The market is regionally segmented into North America, Europe, Asia-Pacific, and the Rest of the World. North America dominates the market, primarily driven by the U.S., where high disposable income and a preference for premium products fuel growth. Europe, with key countries like Germany, France, and the UK, holds a significant share due to the strong presence of major players and increasing focus on sustainability. Asia-Pacific, led by China, Japan, and India, shows immense potential due to its large consumer base and rising middle class.

Global Consumer Packaged Goods (CPG) Market Competitive Landscape

The Global CPG market is highly competitive, with several key players operating across different product segments. Major companies include Procter & Gamble, Unilever, Nestl SA, and PepsiCo. These firms hold significant market shares due to their established brands, extensive distribution networks, and continuous product innovations. Additionally, companies are focusing on sustainability and environmentally friendly packaging solutions to cater to evolving consumer preferences.

Global Consumer Packaged Goods (CPG) Industry Analysis

Growth Drivers

- Digital Transformation: The Consumer-Packaged Goods (CPG) sector is rapidly embracing digital transformation to enhance operational efficiency and customer engagement. The sector's adoption of cloud-based solutions and AI-driven analytics is increasing significantly, with major companies integrating technology to streamline logistics and optimize supply chains. For instance, global e-commerce trade is expected to grow at approximately 3.7% annually from 2024 onwards, as reported by the IMF, aligning with GDP growth projections.

- Changing Consumer Preferences: Consumer preferences are evolving, influenced by higher disposable incomes and a focus on health and wellness. With GDP per capita reaching new highs in various emerging markets, there is a noticeable shift towards premium products and personalized offerings. The World Bank notes that average household consumption expenditures in advanced economies have risen by about 1.8% in 2024, driven by increased demand for organic and health-focused products.

- Increasing E-commerce Penetration: The penetration of e-commerce in the CPG market has accelerated due to changing consumer habits post-pandemic. According to the IMF, global trade recovery in 2024 is expected to drive e-commerce growth, with trade volume in goods and services set to increase to 3.7%, compared to 2.0% in 2023. This growth is supported by improvements in digital infrastructure and a broader adoption of online retail platforms.

Market Challenges

- Supply Chain Disruptions: The global supply chain has faced significant disruptions due to geopolitical tensions and the aftermath of the COVID-19 pandemic. As per the IMF, global trade-to-GDP ratio is expected to remain stable in 2024 despite these disruptions, but higher costs of imported goods and prolonged delivery times continue to pose challenges. Companies must navigate these disruptions by diversifying supply sources and investing in supply chain resilience.

- Regulatory Compliance: Regulatory compliance remains a critical issue for CPG companies, especially concerning environmental regulations and food safety standards. With increased scrutiny from governments on product safety and sustainability, companies are incurring higher compliance costs. The IMF projects that regulatory tightening, especially in advanced economies, could further impact profit margins in 2024 as businesses adapt to new standards.

Global Consumer Packaged Goods (CPG) Market Future Outlook

Over the next five years, the Global Consumer Packaged Goods (CPG) market is expected to witness consistent growth due to the increasing adoption of digital and e-commerce strategies, sustainable product innovations, and a shift toward premium and personalized offerings. The market will continue to evolve with companies investing in R&D and supply chain efficiency, enhancing their ability to respond to dynamic consumer demands. Furthermore, rising middle-class populations in emerging economies like China and India will contribute significantly to market expansion.

Market Opportunities

- Innovation in Product Packaging: There is a growing demand for innovative and sustainable packaging solutions in the CPG sector. With over 4.5 million metric tons of plastic packaging waste generated annually by the industry, there is a push for biodegradable and recyclable materials. Companies adopting sustainable packaging solutions are better positioned to meet consumer expectations and regulatory requirements.

- Growth in Emerging Markets: Emerging markets in Asia, Africa, and Latin America are experiencing robust economic growth, providing new opportunities for CPG companies. The IMF projects a GDP growth of 5.4% in emerging and developing Asia in 2024, indicating strong consumer demand potential. This growth is fueled by rising incomes and urbanization, which drive higher consumption of packaged goods.

Scope of the Report

|

By Product Type |

Food and Beverages |

|

By Distribution Channel |

Supermarkets and Hypermarkets |

|

By Packaging Type |

Rigid Packaging |

|

By Consumer Demographics |

Age Group |

|

By Region |

North America |

Products

Key Target Audience

Consumer Goods Manufacturers

Retailers and Distributors

E-commerce Platforms

Supply Chain & Logistics Companies

Government and Regulatory Bodies (e.g., FDA, USDA, European Food Safety Authority)

Investment and Venture Capitalist Firms

Food & Beverage Processing Companies

Packaging Solutions Providers

Companies

Players Mentioned in the Report

Procter & Gamble

Unilever

Nestl SA

PepsiCo

LVMH Mot Hennessy Louis Vuitton

Imperial Brands PLC

Anheuser-Busch InBev

JBS S.A.

Nike, Inc.

Tyson Foods

Table of Contents

1. Global Consumer Packaged Goods (CPG) Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Dynamics

1.4. Market Segmentation Overview

2. Global CPG Market Size (in USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Market Development and Milestones

2.4. Market Size by Key Regions (North America, Europe, Asia-Pacific, Latin America, MEA)

3. Global CPG Market Analysis

3.1. Growth Drivers

3.1.1. Digital Transformation

3.1.2. Changing Consumer Preferences

3.1.3. Increasing E-commerce Penetration

3.1.4. Expansion of Omni-channel Retailing

3.2. Market Challenges

3.2.1. Supply Chain Disruptions

3.2.2. Regulatory Compliance

3.2.3. Intensified Competition

3.3. Opportunities

3.3.1. Innovation in Product Packaging

3.3.2. Growth in Emerging Markets

3.3.3. Sustainable and Eco-friendly Products

3.4. Trends

3.4.1. Personalization and Customization

3.4.2. Adoption of Data Analytics and AI

3.4.3. Health and Wellness Products

3.4.4. Direct-to-Consumer (DTC) Models

3.5. Government Regulations

3.5.1. Food and Safety Standards

3.5.2. Environmental Regulations

3.5.3. Advertising and Labelling Guidelines

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Value Chain Analysis

3.10. Pricing Analysis (Price Sensitivity, Raw Material Cost Analysis)

4. Global CPG Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Food and Beverages

4.1.2. Personal Care Products

4.1.3. Household Care Products

4.1.4. Over-the-Counter Drugs

4.1.5. Pet Care Products

4.2. By Distribution Channel (In Value %)

4.2.1. Supermarkets and Hypermarkets

4.2.2. Convenience Stores

4.2.3. Online Retail

4.2.4. Specialty Stores

4.3. By Packaging Type (In Value %)

4.3.1. Rigid Packaging

4.3.2. Flexible Packaging

4.3.3. Paperboard Packaging

4.3.4. Biodegradable Packaging

4.4. By Consumer Demographics (In Value %)

4.4.1. Age Group

4.4.2. Income Level

4.4.3. Lifestyle Preferences

4.4.4. Urban vs. Rural Consumers

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia-Pacific

4.5.4. Latin America

4.5.5. Middle East and Africa (MEA)

5. Global CPG Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Procter & Gamble Co.

5.1.2. Unilever PLC

5.1.3. Nestle S.A.

5.1.4. PepsiCo, Inc.

5.1.5. The Coca-Cola Company

5.1.6. Johnson & Johnson

5.1.7. Kimberly-Clark Corporation

5.1.8. Colgate-Palmolive Company

5.1.9. L'Oral S.A.

5.1.10. General Mills, Inc.

5.1.11. Reckitt Benckiser Group PLC

5.1.12. Mondelez International, Inc.

5.1.13. Kellogg Company

5.1.14. Danone S.A.

5.1.15. The Kraft Heinz Company

5.2. Cross Comparison Parameters

5.2.1. Revenue

5.2.2. Market Share

5.2.3. Innovation Score

5.2.4. Sustainability Initiatives

5.2.5. Brand Equity

5.2.6. R&D Expenditure

5.2.7. Product Portfolio

5.2.8. Geographic Presence

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Global CPG Market Regulatory Framework

6.1. Environmental Standards and Sustainability Regulations

6.2. Compliance Requirements (FDA, USDA, EU Standards)

6.3. Packaging and Labelling Laws

7. Global CPG Future Market Size (in USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global CPG Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Distribution Channel (In Value %)

8.3. By Packaging Type (In Value %)

8.4. By Consumer Demographics (In Value %)

8.5. By Region (In Value %)

9. Global CPG Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives and Strategies

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 2: Market Analysis and Construction

Historical data pertaining to the Global CPG market is compiled and analyzed. This includes assessing market penetration rates, product category performance, and geographic distribution to generate reliable market revenue estimates. In addition, an evaluation of consumer preference shifts and the effectiveness of different sales channels is conducted to ensure an accurate portrayal of the market landscape.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses are developed based on initial market insights and then validated through expert consultations. This includes conducting interviews with industry leaders and specialists from top CPG companies via computer-assisted telephone interviews (CATIs). These interviews provide in-depth operational and financial insights, helping to refine and corroborate the market data.

Step 4: Research Synthesis and Final Output

The final phase integrates insights gathered from primary and secondary research into a comprehensive report. Key findings are cross-verified with industry experts and stakeholders to ensure a robust, accurate, and validated analysis of the CPG market. This step involves synthesizing data from industry players, aligning it with competitive positioning, and producing a detailed and actionable report that reflects the performance and outlook of the CPG market.

Frequently Asked Questions

01. How big is the Global CPG Market?

The Global Consumer Packaged Goods (CPG) market is valued at USD 161 billion, based on a five-year historical analysis. The market is driven by factors such as rising disposable incomes, evolving consumer preferences for convenience, and the increasing penetration of digital retail channels.

02. What are the challenges in the Global CPG Market?

The CPG market faces challenges like supply chain disruptions, fluctuating raw material prices, and stringent regulatory compliance requirements. These factors pose significant hurdles for manufacturers, impacting profit margins and operational efficiency.

03. Who are the major players in the Global CPG Market?

Major players in the CPG market include Procter & Gamble, Unilever, Nestl SA, PepsiCo, and LVMH Mot Hennessy Louis Vuitton. These companies lead the market with their strong brand equity, extensive distribution networks, and continuous product innovation strategies.

04. What are the growth drivers of the Global CPG Market?

Key growth drivers include the rising demand for premium and personalized products, increased penetration of digital retail channels, and innovations in sustainable packaging solutions. The ongoing digital transformation is also enabling better engagement with consumers.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.