Global Contact Lens Market Outlook 2030

Region:Global

Author(s):Sonika Bharadwaj

Product Code:KENGR053

November 2024

81

About the Report

Global Contact Lens Market Outlook 2028

Global Contact Lens Market Overview

- The global contact lens market is valued at USD 15.4 billion, based on a five-year historical analysis. This market has witnessed steady growth, driven primarily by the increasing prevalence of vision disorders such as myopia, hyperopia, and astigmatism. The rising adoption of disposable and multifocal contact lenses further boosts demand. Factors such as technological advancements in material science, comfort improvement, and aesthetic appeal of colored lenses contribute significantly to the growth of the contact lens market.

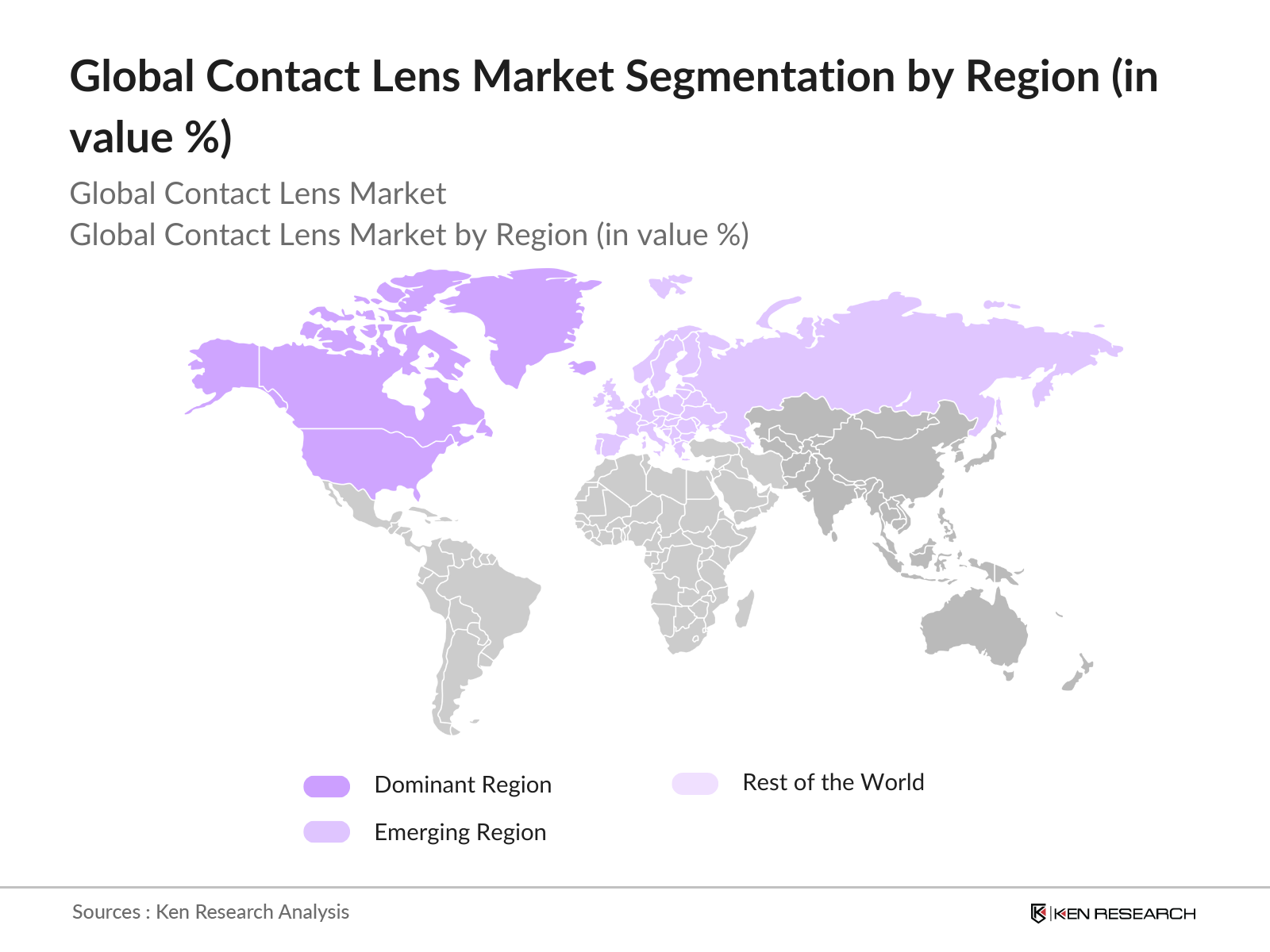

- The dominant regions in the contact lens market include North America, particularly the United States, and the Asia-Pacific region. The dominance of the U.S. is attributed to high disposable incomes, greater awareness about eye health, and a significant number of individuals requiring vision correction. Meanwhile, the Asia-Pacific region, with countries like Japan and South Korea, leads due to increasing urbanization, large populations, and high myopia rates among younger demographics.

- The U.S. Food and Drug Administration (FDA) regulates the contact lens market to ensure safety and efficacy. As of 2024, there have been over 500 approved contact lens models in the U.S., ranging from daily disposables to advanced smart lenses. The FDAs stringent regulations require that all lenses meet specific safety standards before they can be sold. Manufacturers looking to introduce new products must undergo rigorous testing to receive FDA clearance, ensuring consumer protection and maintaining high market standards.

Global Contact Lens Market Segmentation

By Product Type: The contact lens market is segmented by product type into soft contact lenses, gas-permeable lenses, and hybrid contact lenses. Recently, soft contact lenses have a dominant market share within this segment due to their widespread use for daily wear and comfort. These lenses are typically made of hydrogels or silicone hydrogels, offering enhanced oxygen permeability. Their convenience, particularly with the rising demand for disposable and daily-wear options, has driven this segments popularity.

By Region: The contact lens market is segmented by region into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. North America continues to dominate the global market, led by the United States. The strong healthcare infrastructure and high purchasing power in this region contribute to its leading position. In contrast, Asia-Pacific is emerging rapidly due to the growing aging population and a high prevalence of myopia in countries like China and Japan.

Global Contact Lens Market Competitive Landscape

The global contact lens market is dominated by a few major players that have established strong brand loyalty, advanced research and development capabilities, and extensive distribution networks. The competition is marked by technological advancements in lens materials and increased mergers and acquisitions.

|

Company Name |

Establishment Year |

Headquarters |

Product Portfolio |

Market Share |

Technological Capabilities |

Regulatory Compliance |

Distribution Network |

Strategic Partnerships |

R&D Investments |

|

Johnson & Johnson Vision |

1959 |

Jacksonville, USA |

Contact Lenses |

- |

- |

- |

- |

- |

- |

|

Alcon (Novartis) |

1945 |

Geneva, Switzerland |

Contact Lenses |

- |

- |

- |

- |

- |

- |

|

CooperVision |

1980 |

Pleasanton, USA |

Contact Lenses |

- |

- |

- |

- |

- |

- |

|

Bausch + Lomb |

1853 |

Rochester, USA |

Eye Health Products |

- |

- |

- |

- |

- |

- |

|

Hoya Corporation |

1941 |

Tokyo, Japan |

Optical Lenses |

- |

- |

- |

- |

- |

- |

Global Contact Lens Market Analysis

Market Growth Drivers

- Rising Myopia Cases: The prevalence of myopia has become a global public health issue, particularly in densely populated regions like East Asia. In China alone, nearly 600 million people suffer from myopia, according to the World Health Organization (WHO). This condition is expected to impact more individuals as urbanization accelerates and children spend more time indoors, increasing the demand for corrective lenses such as contact lenses. The World Bank reports a rapid rise in urban population, adding pressure to visual health services, driving the demand for corrective eye care solutions like contact lenses.

- Growing Demand for Aesthetic Contact Lenses: The demand for aesthetic contact lenses, particularly among younger demographics, has seen a rise, driven by beauty trends and cosmetic enhancement products. In countries like South Korea, colored and decorative lenses are becoming fashion staples, with the market expanding significantly in regions such as Southeast Asia. The United Nations' demographic statistics highlight a large population of 18-30-year-olds in this region, with nearly 200 million individuals, contributing to the growing market for aesthetic contact lenses. The cultural shift towards beauty enhancement in these regions further supports the demand.

- Increasing Prevalence of Digital Eye Strain: With the rise of digital devices, including smartphones, computers, and tablets, digital eye strain has become a growing issue, contributing to the increasing demand for contact lenses. According to a report by the World Health Organization (WHO), more than 1 billion people globally suffer from eye strain due to prolonged screen exposure. This surge in screen usage has particularly affected working professionals and students, who spend over 8-10 hours daily on digital devices. The trend is fueling demand for contact lenses designed to alleviate eye strain symptoms, further boosting the contact lens market.

Market Challenges:

- High Cost of Specialty Contact Lenses: The cost of specialty contact lenses, such as toric or multifocal lenses, remains a challenge, particularly in regions with lower income levels. A report from the International Monetary Fund (IMF) notes that the global average income per capita in 2024 is approximately $12,000, making the high prices of such lenses prohibitive for many consumers. Specialty lenses can cost between $200-$500 annually, depending on prescription and usage frequency. These costs deter broader market adoption in developing economies, where income levels remain a significant constraint.

- Complications Associated with Prolonged Use: Prolonged use of contact lenses can lead to complications, including dry eyes, corneal ulcers, and infections. The U.S. Centers for Disease Control and Prevention (CDC) reports that 1 in 500 contact lens users experience serious eye infections annually. Such complications create hesitancy among potential users and increase the necessity for frequent eye care consultations, raising overall healthcare costs. The World Bank also indicates that healthcare expenditure in emerging markets is rising at a slow pace, limiting access to timely treatments for contact lens-related complications.

Global Contact Lens Market Future Outlook

Over the next five years, the global contact lens market is expected to show substantial growth driven by the increasing prevalence of vision impairment and the rising preference for non-invasive solutions. Continuous advancements in materials, growing interest in smart contact lenses, and the introduction of daily disposables are projected to boost demand further. Additionally, the expansion of e-commerce channels for the sale of contact lenses will provide consumers with greater accessibility and convenience, fueling market growth.

Market Opportunities:

- Advancements in Smart Contact Lens Technology: Smart contact lenses, which can monitor health conditions such as glucose levels for diabetics, represent a significant growth opportunity. According to the U.S. Food and Drug Administration (FDA), several smart lens prototypes are in development, with some expected to hit the market soon. In 2023, Google and Novartis collaborated on a glucose-monitoring lens project that is anticipated to impact millions of diabetic patients worldwide. With over 422 million people suffering from diabetes globally, according to the World Health Organization, smart lenses could revolutionize both healthcare and the contact lens market.

- Expansion into Emerging Markets: Emerging markets offer immense potential for contact lens manufacturers, particularly in regions where eye care infrastructure is expanding. Countries like India and Brazil are witnessing a rise in vision correction procedures, thanks to increasing healthcare investments. In India, the government allocated nearly $15 billion towards healthcare in 2023, a significant portion of which is directed at eye care programs. This investment is expected to open up opportunities for international contact lens companies to enter and expand in these regions, offering advanced lens solutions.

Scope of the Report

|

By Product Type |

Soft Contact Lenses Gas Permeable Lenses Hybrid Lenses |

|

By Material Type |

Hydrogel Silicone Hydrogel |

|

By Wear Type |

Daily Wear Extended Wear Disposable Lenses |

|

By Application |

Corrective Cosmetic Therapeutic |

|

By Region |

North-East Midwest West Coast Southern States |

Products

Key Target Audience

Contact Lens Manufacturers

Ophthalmologists and Optometrists

Optical Retail Chains

Pharmaceutical Companies

Online Retailers and E-commerce Platforms

Hospitals and Eye Care Clinics

Government and Regulatory Bodies (e.g., FDA, CE)

Investment and Venture Capitalist Firms

Companies

Players Mention in the Report

Johnson & Johnson Vision

Alcon (Novartis)

CooperVision

Bausch + Lomb

Hoya Corporation

Carl Zeiss Meditec AG

EssilorLuxottica

Contamac

Menicon

X-Cel Specialty Contacts

SynergEyes

SEED Co., Ltd.

Visioneering Technologies, Inc.

UltraVision CLPL

Art Optical Contact Lens, Inc.

Table of Contents

01. Global Contact Lens Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

02. Global Contact Lens Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

03. Global Contact Lens Market Analysis

3.1. Growth Drivers

3.1.1. Rising Myopia Cases

3.1.2. Increased Adoption of Disposable Contact Lenses

3.1.3. Growing Demand for Aesthetic Contact Lenses

3.2. Market Challenges

3.2.1. High Cost of Specialty Contact Lenses

3.2.2. Complications Associated with Prolonged Use

3.2.3. Lack of Awareness in Emerging Markets

3.3. Opportunities

3.3.1. Advancements in Smart Contact Lens Technology

3.3.2. Increasing Popularity of Daily Disposables

3.3.3. Expansion into Emerging Markets

3.4. Trends

3.4.1. Rising Demand for Multifocal Lenses

3.4.2. Growing Availability of Custom Fit Lenses

3.4.3. Technological Integration in Contact Lenses (e.g., sensors)

3.5. Government Regulations

3.5.1. FDA Approvals and Standards

3.5.2. CE Marking for Contact Lenses

3.5.3. Country-specific Safety Regulations

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

04. Global Contact Lens Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Soft Contact Lenses

4.1.2. Gas Permeable (GP) Lenses

4.1.3. Hybrid Contact Lenses

4.2. By Material Type (In Value %)

4.2.1. Hydrogel Lenses

4.2.2. Silicone Hydrogel Lenses

4.3. By Wear Type (In Value %)

4.3.1. Daily Wear

4.3.2. Extended Wear

4.3.3. Disposable Lenses

4.4. By Application (In Value %)

4.4.1. Corrective Lenses

4.4.2. Cosmetic Lenses

4.4.3. Therapeutic Lenses

4.5. By Distribution Channel (In Value %)

4.5.1. Optical Stores

4.5.2. Online Retailers

4.5.3. Hospital & Clinics

05. Global Contact Lens Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Johnson & Johnson Vision Care

5.1.2. Alcon (Novartis)

5.1.3. CooperVision

5.1.4. Bausch + Lomb

5.1.5. Carl Zeiss Meditec AG

5.1.6. Hoya Corporation

5.1.7. EssilorLuxottica

5.1.8. Contamac

5.1.9. Menicon

5.1.10. X-Cel Specialty Contacts

5.1.11. SynergEyes

5.1.12. SEED Co., Ltd.

5.1.13. Visioneering Technologies, Inc.

5.1.14. UltraVision CLPL

5.1.15. Art Optical Contact Lens, Inc.

5.2. Cross Comparison Parameters (Product Portfolio, Manufacturing Location, Market Share, Technological Capabilities, Key Partnerships, Regulatory Compliance, Production Capacity, Pricing Strategy)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers And Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

06. Global Contact Lens Market Regulatory Framework

6.1. Global Safety and Quality Standards

6.2. Compliance and Certification Requirements

6.3. Country-Specific Licensing Processes

07. Global Contact Lens Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

08. Global Contact Lens Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Material Type (In Value %)

8.3. By Wear Type (In Value %)

8.4. By Application (In Value %)

8.5. By Distribution Channel (In Value %)

09. Global Contact Lens Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The first step involves mapping the major stakeholders within the global contact lens market. This phase is supported by in-depth desk research, using a combination of primary and secondary sources to gather comprehensive market information. The goal is to identify and assess key variables that influence market trends, such as product innovations and consumer behavior.

Step 2: Market Analysis and Construction

In this phase, historical data related to the contact lens market is compiled and analyzed. Factors such as market penetration, the number of consumers opting for specialty lenses, and revenue generation metrics are examined. Data reliability is ensured by cross-verifying market statistics with independent third-party sources.

Step 3: Hypothesis Validation and Expert Consultation

Through consultations with industry experts, hypotheses are refined, offering valuable insights on market dynamics. Interviews with key opinion leaders, including executives from top contact lens manufacturers, help validate data points and provide a clear picture of the markets trajectory.

Step 4: Research Synthesis and Final Output

The final stage integrates findings from expert consultations, desk research, and proprietary databases. This step involves the creation of a cohesive market narrative, presenting actionable insights for stakeholders. The final report reflects a holistic view of the global contact lens market, offering an in-depth understanding of its future growth potential.

Frequently Asked Questions

01. How big is the Global Contact Lens Market?

The global contact lens market is valued at USD 15.4 billion, primarily driven by increased vision correction requirements and aesthetic usage among consumers worldwide.

02. What are the major challenges in the Global Contact Lens Market?

Challenges include the high cost of specialty lenses, the risk of eye infections from improper use, and the availability of alternative vision correction options such as laser surgeries.

03. Who are the major players in the Global Contact Lens Market?

Key players in the market include Johnson & Johnson Vision, Alcon (Novartis), CooperVision, Bausch + Lomb, and Hoya Corporation. These companies have a strong global presence due to their extensive product portfolios and advanced technological capabilities.

04. What are the growth drivers of the Global Contact Lens Market?

Growth drivers include the increasing prevalence of myopia, advancements in material technology such as silicone hydrogels, and the rising popularity of daily disposable lenses for convenience and hygiene.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.