Global Crawler Camera System Market Outlook to 2030

Region:Global

Author(s):Shreya

Product Code:KROD1074

October 2024

82

About the Report

Global Crawler Camera System Market Overview

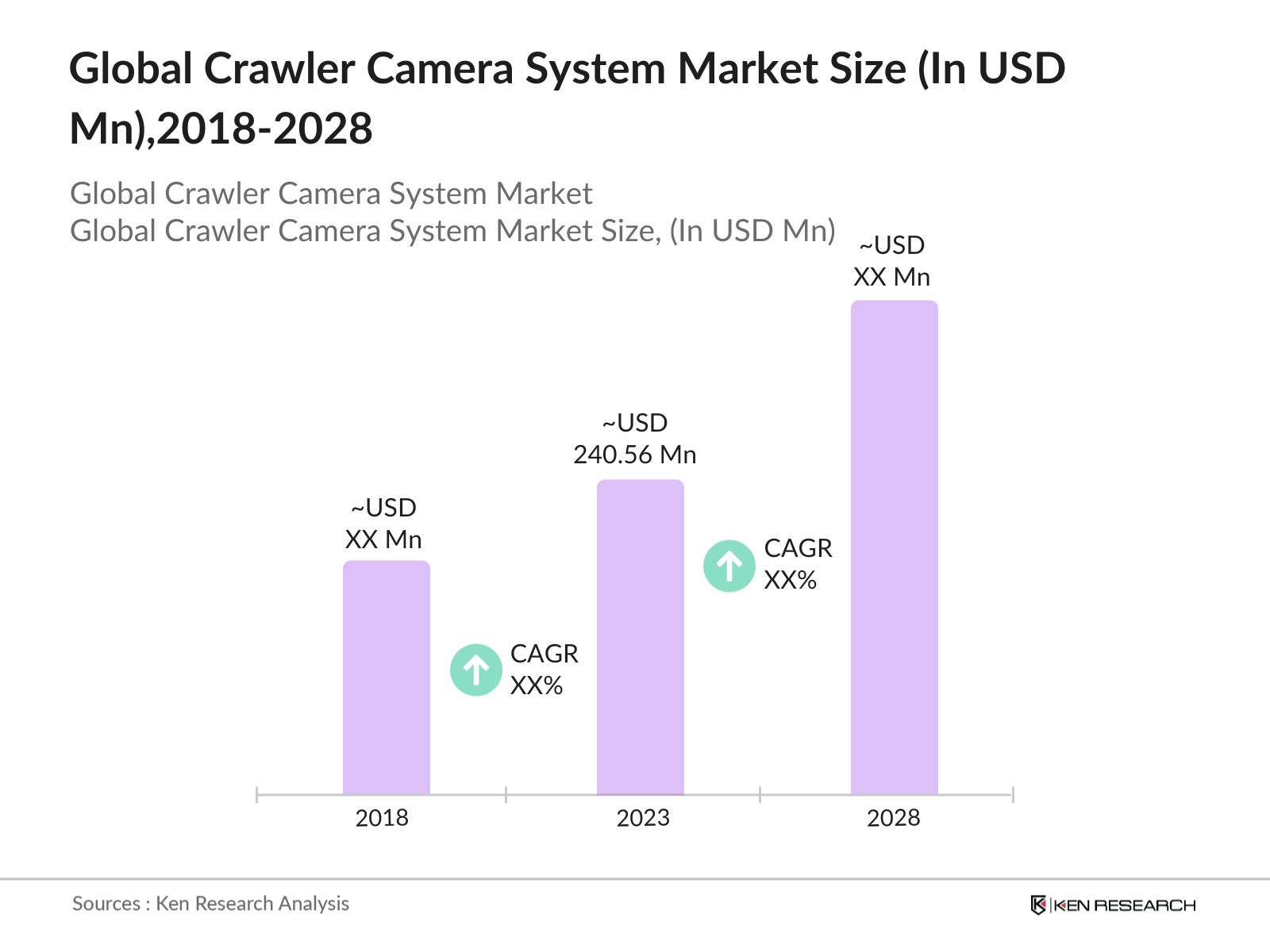

The global crawler camera system market was valued at USD 240.56 million in 2023. The growth is primarily driven by the rising adoption of these systems in sectors like wastewater treatment, industrial inspection, and public safety. The need for precise and non-invasive inspection techniques has fueled demand, particularly in infrastructure development and maintenance.

The crawler camera system market is dominated by key players like IPEK International, Mini-Cam, Envirosight LLC, and CUES Inc., which hold substantial market shares due to their strong product portfolios and continuous innovation. These companies have a strong presence across North America and Europe, where the demand for advanced inspection systems is the highest.

In 2024, Mini-Cam announced its expansion into the Asia-Pacific region, establishing a new manufacturing facility in Singapore. The expansion aims to cater to the growing demand for crawler camera systems in the region, particularly in rapidly developing markets like India and Southeast Asia. The new facility is expected to increase Mini-Cam’s production capacity and market reach.

Houston, Texas is a dominant city in the crawler camera system market in 2023. Houston's dominance is driven by its extensive oil and gas infrastructure, which requires regular inspection and maintenance. The city is a hub for energy production, and the high concentration of pipelines and industrial facilities in and around Houston creates a significant demand for advanced crawler camera systems.

Global Crawler Camera System Market Segmentation

The global crawler camera system market is segmented by various factors such as product type, region, end user industry etc.

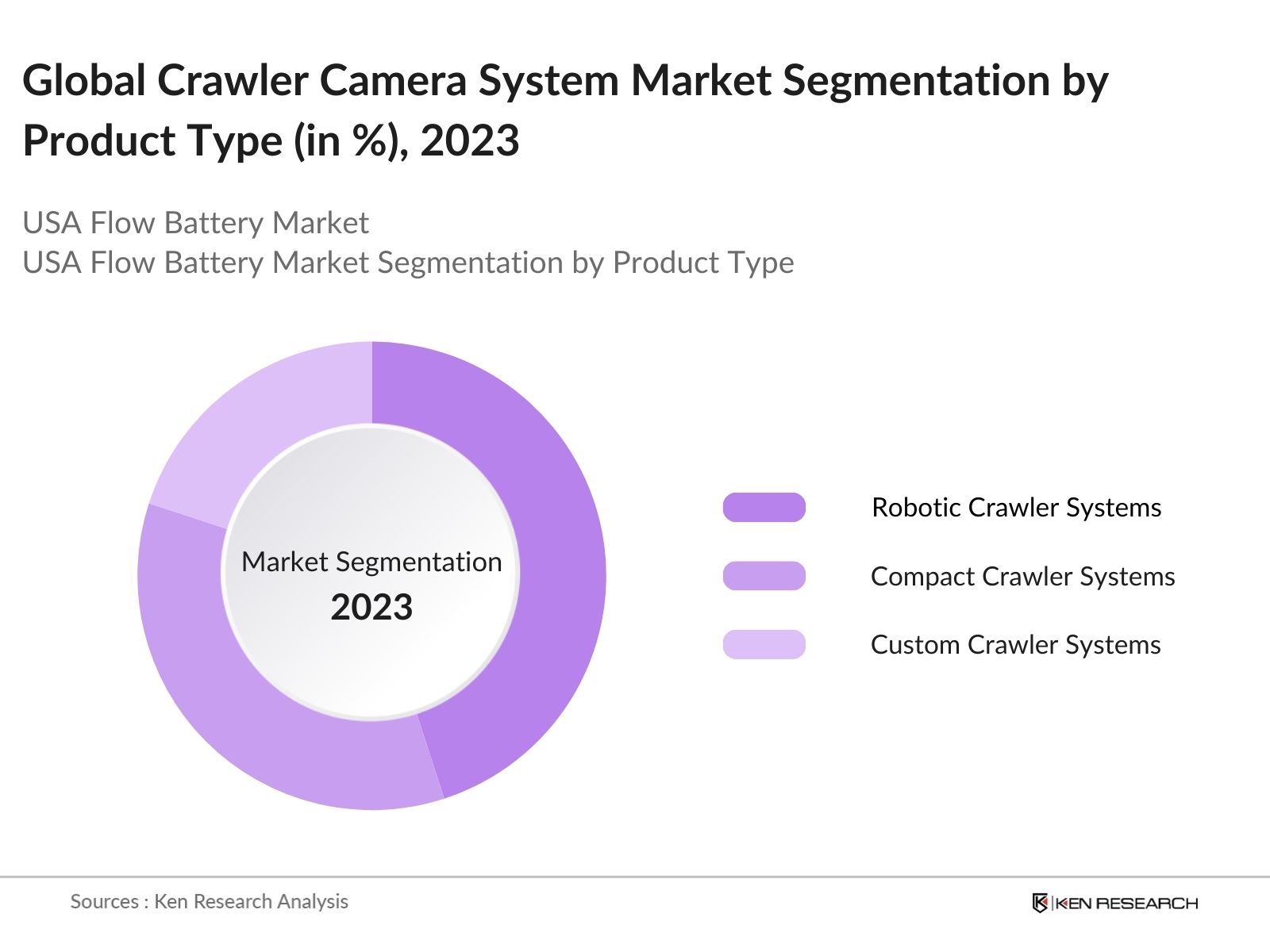

By Product Type: The global crawler camera system market is segmented by product type into robotic crawler systems, compact crawler systems, and custom crawler systems. In 2023, robotic crawler systems held a dominant market share. The dominance is due to their versatility and ability to navigate complex and confined spaces, which are common in industrial and municipal applications. The increasing integration of AI and automation features into these systems has also driven their popularity.

By Region: The regional segmentation of the market includes North America, Europe, Asia-Pacific, and Rest of the World. In 2023, North America dominated the global crawler camera system market share. The region's dominance is driven by the high demand for advanced inspection systems, significant government investments in infrastructure maintenance, and the presence of key market players.

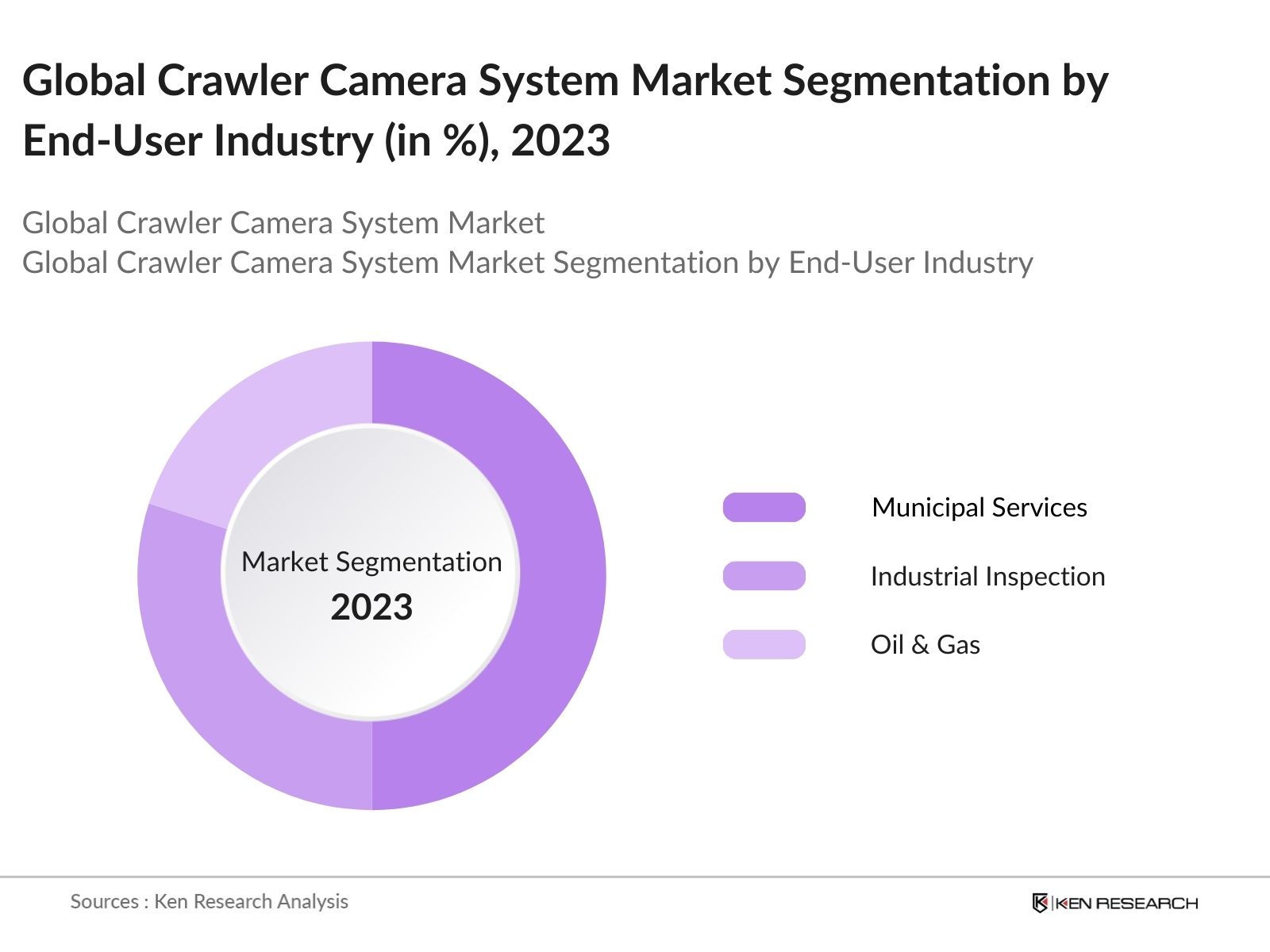

By End-User Industry: The market is also segmented by end-user industry into municipal services, industrial inspection, and oil & gas. Municipal services dominated the market in 2023 with a market share. The high share is due to the extensive use of crawler camera systems for inspecting and maintaining sewage systems, stormwater drains, and other public infrastructure. The growing urbanization and the aging infrastructure in many cities are key drivers of this segment.

Global Crawler Camera System Market Competitive Landscape

|

Company Name |

Establishment Year |

Headquarters |

|

IPEK International |

1989 |

Germany |

|

Mini-Cam |

1991 |

United Kingdom |

|

Envirosight LLC |

2001 |

United States |

|

CUES Inc. |

1966 |

United States |

|

Rausch Electronics |

1983 |

Germany |

Envirosight’s New Cutting-Edge Radar Sensors: In 2021, Envirosight introduced new cutting-edge radar sensors for their crawler camera systems. These advanced sensors enhance the capabilities of their inspection equipment, allowing for more accurate and reliable data collection during pipeline and infrastructure inspections. Envirosight is continuously working on improving the performance, durability, and user-friendliness of their crawler camera systems.

CUES Inc.’s Acquisition of a Local Competitor: SPX Corporation has completed the acquisition of CUES Inc. The acquisition deal was finalized on June 7, 2018, with SPX purchasing CUES for $189 million, which involved merging a subsidiary of SPX with CUES' parent company, ELXSI Corporation. This transaction was aimed at strengthening SPX's position in the pipeline inspection equipment market and enhancing CUES's capabilities.

Global Crawler Camera System Industry Analysis

Growth Drivers

- Infrastructure Development and Aging Systems: The global crawler camera system market is primarily driven by the increasing need for infrastructure maintenance and inspection of aging systems. This has resulted in a significant demand for advanced systems, particularly in the United States, where the government has allocated substantial funding to upgrade and inspect critical infrastructure.

- Growing Adoption in the Oil and Gas Industry: In 2024, it is anticipated that over 5,000 kilometers of new pipelines will be laid worldwide, necessitating regular inspection and maintenance to ensure safety and compliance with regulations. The oil and gas industry has increasingly adopted crawler camera systems for non-destructive testing and inspection of pipelines and other critical infrastructure.

- Increased Focus on Public Safety and Security: The rising concerns over public safety and security have led to the adoption of crawler camera systems for surveillance and inspection purposes in critical infrastructure and public spaces. The global spending on public safety infrastructure exceeded $200 billion, with an important portion directed towards the deployment of advanced surveillance and inspection systems.

Challenges

- Lack of Skilled Operators: The operation of crawler camera systems requires specialized skills and training, which are not readily available in many regions. This shortage is particularly acute in emerging markets, where the demand for these systems is growing but the availability of skilled labor is limited. The lack of skilled operators not only hinders the adoption of these systems but also affects the efficiency.

- Technological Limitations in Harsh Environments: While crawler camera systems are designed to operate in various environments, they face limitations when deployed in extremely harsh conditions such as high-temperature industrial sites or deep underwater inspections. The crawler camera systems experienced operational failures due to harsh environmental conditions, resulting in costly repairs and downtime.

Government Initiatives

- India’s Smart Cities Mission: The Indian government, under its Smart Cities Mission, as of July 3, 2024, the government has released ?46,585 crore, and the mission has completed 7,188 projects amounting to ?1.44 lakh crore, with 830 projects still in advanced stages of completion. The funding is expected to significantly increase the demand for crawler camera systems in the country.

- China’s Urban Infrastructure Modernization Plan: In 2024, China launched its Urban Infrastructure Modernization Plan with a budget of ¥500 billion aimed at upgrading the country’s urban infrastructure, including pipelines and wastewater systems. The plan includes provisions for the adoption of advanced inspection technologies to ensure the safety and efficiency of urban infrastructure. The initiative is expected to drive the growth of this market in China over the next five years.

Global Crawler Camera System Market Future Outlook

The crawler camera system market is projected to grow exponentially by 2028. The future growth will be driven by the increasing application of these systems in emerging markets and the integration of AI and machine learning technologies to enhance system capabilities. Additionally, the expansion of smart cities and infrastructure projects worldwide will contribute to the market’s upward trajectory.

Future Trends

- Integration of AI and Machine Learning: Over the next five years, the integration of AI and machine learning technologies into crawler camera systems is expected to revolutionize the market. This trend is expected to enhance the efficiency and accuracy of inspections, leading to increased adoption across various industries, particularly in oil and gas and wastewater management.

- Adoption of Autonomous Inspection Systems: The future of the crawler camera system market will see the adoption of fully autonomous inspection systems, capable of operating without human intervention. By 2028, it is estimated that autonomous systems will make up to one-fourth of the global market, driven by advancements in robotics and AI. These systems are expected to be particularly useful in hazardous environments where human intervention is risky.

Scope of the Report

|

By Product Type |

Robotic Crawler Systems Compact Crawler Systems Custom Crawler System |

|

By Application |

Electric Vehicles (EVs) Consumer Electronics Industrial Applications Energy Storage Systems (ESS) |

|

By Region |

North South East West |

Products

Key Target Audience – Organizations and Entities Who Can Benefit by Subscribing This Report:

- Municipal Services

- Industrial Inspection Companies

- Oil & Gas Companies

- Construction Companies

- Pipeline Inspection Companies

- Urban Planning Authorities

- Defense and Military Agencies

- Banking and Financial Institutions

- Investors and VC Firms

- U.S. Department of Transportation

- Environmental Protection Agency (EPA)

Time Period Captured in the Report:

- Historical Period: 2018-2023

- Base Year: 2023

- Forecast Period: 2023-2028

Companies

- IPEK International

- Mini-Cam

- Envirosight LLC

- CUES Inc.

- Rausch Electronics

- Hathorn Corporation

- Insight Vision

- Subsite Electronics

- Aries Industries

- RapidView LLC

- Vivotek Inc.

- Camtronics BV

- Viewtech Borescopes

- JWC Environmental

- Fiberscope.net

Table of Contents

1.Global Crawler Camera System Market Overview

1.1.Definition and Scope

1.2.Market Taxonomy

1.3.Market Growth Rate

1.4.Market Segmentation Overview

2.Global Crawler Camera System Market Size (in USD Mn), 2018-2023

2.1.Historical Market Size

2.2.Year-on-Year Growth Analysis

2.3.Key Market Developments and Milestones

3.Global Crawler Camera System Market Analysis

3.1.Growth Drivers

3.1.1.Infrastructure Development and Aging Systems

3.1.2.Growing Adoption in Oil and Gas Industry

3.1.3.Government Funding for Water and Wastewater Management

3.1.4.Increased Focus on Public Safety and Security

3.2.Restraints

3.2.1.High Cost of Advanced Systems

3.2.2.Lack of Skilled Operators

3.2.3.Regulatory Challenges and Compliance

3.2.4.Technological Limitations in Harsh Environments

3.3.Opportunities

3.3.1.Expansion into Emerging Markets

3.3.2.Integration of AI and Machine Learning

3.3.3.Adoption of Autonomous Inspection Systems

3.3.4.Public-Private Partnerships for Infrastructure Development

3.4.Trends

3.4.1.Increasing Adoption in Smart City Projects

3.4.2.Development of Next-Generation Inspection Systems

3.4.3.Focus on Environmental Sustainability

3.4.4.Expansion of AI-driven Analytics in Inspection Systems

3.5.Government Regulation

3.5.1.U.S. Infrastructure Investment and Jobs Act

3.5.2.EU’s Clean Water Directive

3.5.3.India’s Smart Cities Mission

3.5.4.China’s Urban Infrastructure Modernization Plan

3.6.SWOT Analysis

3.7.Stakeholder Ecosystem

3.8.Competitive Ecosystem

4.Global Crawler Camera System Market Segmentation, 2023

4.1.By Product Type (in Value %)

4.1.1.Robotic Crawler Systems

4.1.2.Compact Crawler Systems

4.1.3.Custom Crawler Systems

4.2.By End-User Industry (in Value %)

4.2.1.Municipal Services

4.2.2.Industrial Inspection

4.2.3.Oil & Gas

4.3.By Region (in Value %)

4.3.1.North America

4.3.2.Europe

4.3.3.Asia-Pacific

4.3.4.Rest of the World

5.Global Crawler Camera System Market Cross Comparison

5.1.Detailed Profiles of Major Companies

5.1.1.IPEK International

5.1.2.Mini-Cam

5.1.3.Envirosight LLC

5.1.4.CUES Inc.

5.1.5.Rausch Electronics

5.2.Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

6.Global Crawler Camera System Market Competitive Landscape

6.1.Market Share Analysis

6.2.Strategic Initiatives

6.3.Mergers and Acquisitions

6.4.Investment Analysis

6.4.1.Venture Capital Funding

6.4.2.Government Grants

6.4.3.Private Equity Investments

7.Global Crawler Camera System Market Regulatory Framework

7.1.Industry Standards and Compliance

7.2.Certification Processes

7.3.Environmental Regulations

8.Global Crawler Camera System Future Market Size (in USD Mn), 2023-2028

8.1.Future Market Size Projections

8.2.Key Factors Driving Future Market Growth

9.Global Crawler Camera System Future Market Segmentation, 2028

9.1.By Product Type (in Value %)

9.2.By End-User Industry (in Value %)

9.3.By Region (in Value %)

10.Global Crawler Camera System Market Analysts’ Recommendations

10.1.TAM/SAM/SOM Analysis

10.2.Customer Cohort Analysis

10.3.Marketing Initiatives

10.4.White Space Opportunity Analysis

11.Disclaimer

12.Contact Us

Research Methodology

Step: 1 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step: 2 Market Building:

Collating statistics on global crawler camera system market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for global crawler camera system market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step: 3 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step: 4 Research Output:

Our team will approach crawler camera system suppliers and distributors companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from crawler camera system manufacturers.

Frequently Asked Questions

1.How big is the Global Crawler Camera System Market?

The global crawler camera system market was valued at USD 210.56 million in 2023. The growth is primarily driven by the rising adoption of these systems in sectors like wastewater treatment, industrial inspection, and public safety. The need for precise and non-invasive inspection techniques has fueled demand, particularly in infrastructure development and maintenance.

2.What are the challenges in the Global Crawler Camera System Market?

Challenges in the global crawler camera system market include the high cost of advanced systems, the lack of skilled operators, regulatory compliance issues, and technological limitations in harsh environments. These challenges hinder market penetration, especially in cost-sensitive and developing regions.

3.Who are the major players in the Global Crawler Camera System Market?

Major players in the global crawler camera system market include IPEK International, Mini-Cam, Envirosight LLC, CUES Inc., and Rausch Electronics. These companies lead the market due to their strong product portfolios, continuous innovation, and extensive distribution networks across key regions.

4.What are the growth drivers of the Global Crawler Camera System Market?

The global crawler camera system market is driven by the increasing need for infrastructure inspection and maintenance, growing adoption in the oil and gas industry, government funding for water and wastewater management, and the heightened focus on public safety and security. These factors contribute to the market's robust growth.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.