Global Cross-Border Payments Market Outlook to 2030

Region:Global

Author(s):Vijay Kumar

Product Code:KROD2287

November 2024

97

About the Report

Global Cross-Border Payments Market Overview

- The global cross-border payments market is valued at USD 185 billion, based on a five-year historical analysis. This substantial valuation is driven by the rapid expansion of international trade, the proliferation of e-commerce platforms, and the increasing need for efficient remittance services. Advancements in financial technologies and the growing adoption of digital payment solutions have further propelled the market's growth.

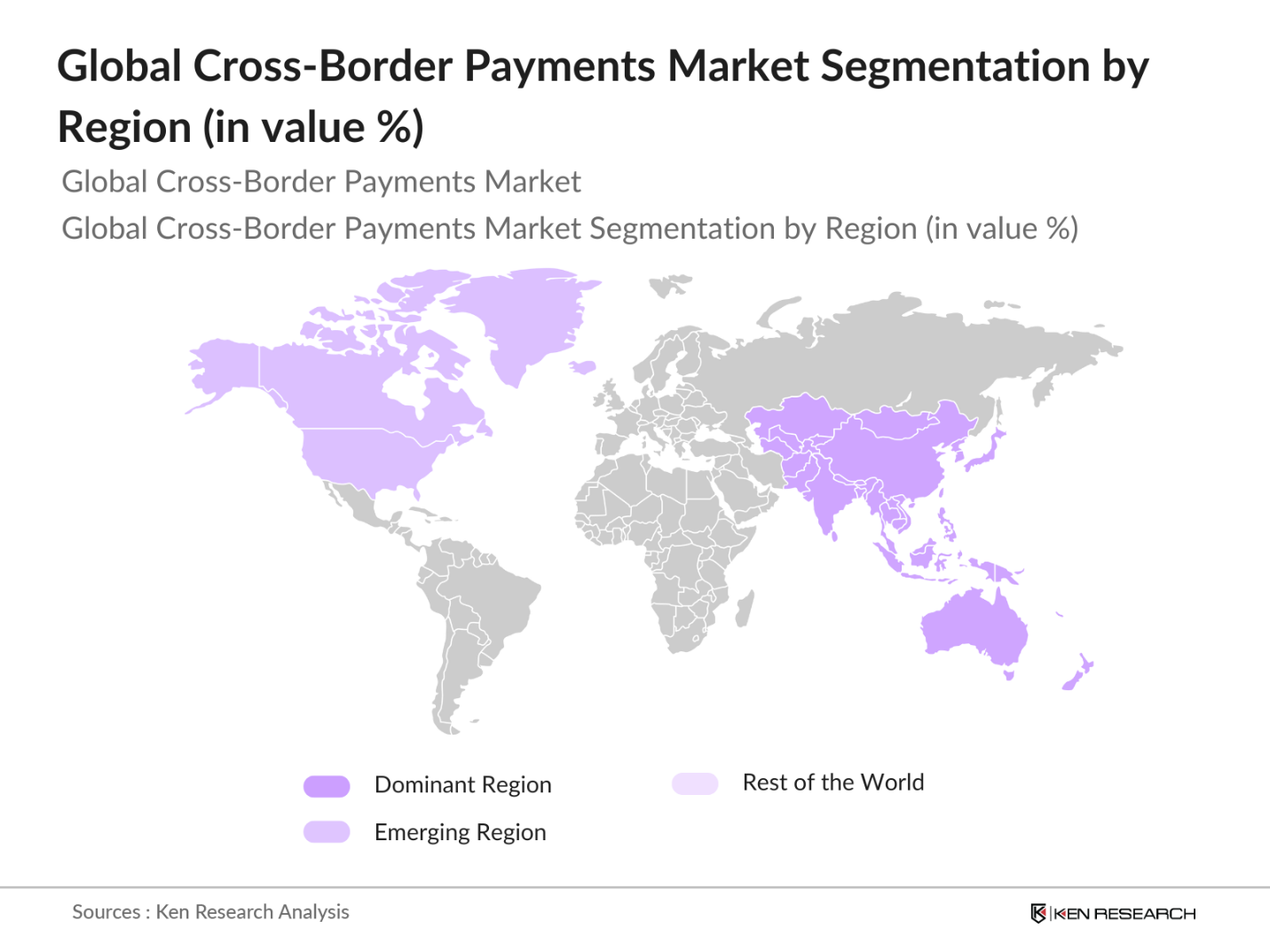

- Regions such as North America, Europe, and Asia-Pacific dominate the cross-border payments market. North America's dominance is attributed to its robust financial infrastructure and high volume of international trade. Europe benefits from the European Union's integrated financial systems, facilitating seamless cross-border transactions. Asia-Pacific's prominence is due to the rapid economic growth of countries like China and India, coupled with significant increases in cross-border e-commerce activities.

- In 2023, global AML regulations were strengthened, impacting cross-border payment systems worldwide. The Financial Action Task Force (FATF) reported that 180 countries now actively enforce AML measures to prevent money laundering through international transactions. These stringent AML policies require robust transaction monitoring and reporting, leading to increased compliance costs for payment providers. However, these measures are essential for ensuring transparency and security within the cross-border payments market.

Global Cross-Border Payments Market Segmentation

By Transaction Type: The market is segmented by transaction type into Business to Business (B2B), Customer to Business (C2B), Business to Customer (B2C), and Customer to Customer (C2C). B2B transactions hold a dominant market share due to the extensive volume of international trade between corporations. The necessity for businesses to engage in cross-border transactions for importing and exporting goods and services significantly contributes to this segment's prominence.

By Channel: The market is further segmented by channel into Bank Transfers, Money Transfer Operators, Card Payments, and Digital Wallets. Bank Transfers lead this segment, primarily because traditional banking institutions have long-established networks and trust among consumers and businesses for handling international transactions. Their ability to manage large transaction volumes securely makes them a preferred choice for cross-border payments.

By Region: Geographically, the market is divided into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. Asia-Pacific holds a significant market share, driven by the rapid economic development of countries like China and India, along with a surge in cross-border e-commerce activities. The region's increasing internet penetration and digital payment adoption further bolster its dominance in the cross-border payments market.

Global Cross-Border Payments Market Competitive Landscape

The global cross-border payments market is characterized by the presence of several key players who contribute to its dynamic nature. These companies leverage technological advancements and strategic partnerships to enhance their service offerings and expand their market reach.

Global Cross-Border Payments Industry Analysis

Growth Drivers

- Expansion of Global Trade: In 2023, global merchandise trade reached a value of $25 trillion, reflecting a significant increase from $22 trillion in 2021. This growth has been propelled by the resurgence of international supply chains and heightened demand for goods and services across borders. The World Trade Organization (WTO) reported that trade volumes expanded by 2.7% in 2023, underscoring the robust recovery of global commerce. This surge in trade activities has directly influenced the cross-border payments market, necessitating efficient and secure payment solutions to facilitate international transactions.

- Rise in E-commerce Transactions: The global e-commerce sector has experienced remarkable growth, with sales reaching $5.5 trillion in 2023, up from $4.9 trillion in 2021. This expansion is largely attributed to increased internet penetration and consumer preference for online shopping. Notably, cross-border e-commerce accounted for 22% of total e-commerce sales in 2023, highlighting the growing trend of consumers purchasing from international retailers. This shift has amplified the demand for seamless cross-border payment solutions to support international consumer transactions.

- Advancements in Financial Technologies: The financial technology sector has seen significant advancements, with over 1,000 fintech startups emerging globally between 2022 and 2024. These innovations have introduced new payment platforms and solutions, enhancing the efficiency and security of cross-border transactions. The adoption of blockchain technology, for instance, has enabled real-time settlement of international payments, reducing transaction times from several days to mere seconds. Such technological progress has been instrumental in addressing traditional challenges associated with cross-border payments.

Market Challenges

- Regulatory Compliance Complexities: Navigating the complex regulatory landscape remains a significant challenge for cross-border payment providers. In 2023, over 200 regulatory changes were enacted globally, affecting international payment operations. These include stringent Anti-Money Laundering (AML) and Know Your Customer (KYC) requirements, which vary across jurisdictions. Compliance with these diverse regulations necessitates substantial investment in legal expertise and technology, increasing operational costs and potentially delaying transaction processing times.

- Currency Exchange Rate Volatility: The foreign exchange market has experienced notable volatility, with major currencies fluctuating significantly. For instance, the Euro depreciated from 1.20 USD in early 2022 to 1.05 USD by mid-2023. Such volatility introduces uncertainty in cross-border transactions, affecting the final settlement amounts and complicating financial planning for businesses and individuals engaged in international trade. This unpredictability necessitates the implementation of hedging strategies, which can be costly and complex.

Global Cross-Border Payments Market Future Outlook

Over the next five years, the global cross-border payments market is expected to exhibit significant growth, driven by continuous advancements in financial technologies, increasing globalization of trade, and the rising adoption of digital payment platforms. The integration of blockchain technology and real-time payment systems is anticipated to enhance transaction efficiency and security, further propelling market expansion. Additionally, the growing demand for seamless and cost-effective international payment solutions among businesses and consumers is likely to contribute to the market's upward trajectory.

Market Opportunities

- Integration of Blockchain Technology: Blockchain technology offers a decentralized ledger system that enhances transparency and security in cross-border payments. In 2023, over 60% of major financial institutions explored blockchain solutions for international transactions. The adoption of blockchain can reduce transaction times from several days to minutes and lower costs by eliminating intermediaries. For example, the use of blockchain in remittances has the potential to save up to $20 billion annually in fees. This presents a significant opportunity for the cross-border payments market to enhance efficiency and customer satisfaction.

- Growth in Emerging Markets: Emerging markets have shown substantial economic growth, with countries like India and Brazil experiencing GDP increases of 6.8% and 2.9% respectively in 2023. This economic expansion has led to increased cross-border trade and investment. For instance, India's merchandise exports reached $400 billion in 2023, up from $375 billion in 2022. The rising economic activities in these regions present opportunities for cross-border payment providers to tap into new customer bases and expand their services.

Scope of the Report

|

Transaction Type |

Business to Business (B2B) |

|

Channel |

Bank Transfers |

|

Enterprise Size |

Large Enterprises |

|

End-User |

Individuals |

|

Region |

North America |

Products

Key Target Audience

Financial Institutions

Payment Service Providers

E-commerce Platforms

Multinational Corporations

Small and Medium-sized Enterprises (SMEs)

Government and Regulatory Bodies (e.g., Financial Conduct Authority, European Central Bank)

Investment and Venture Capitalist Firms

Technology Solution Providers

Companies

Players Mentioned in the Report

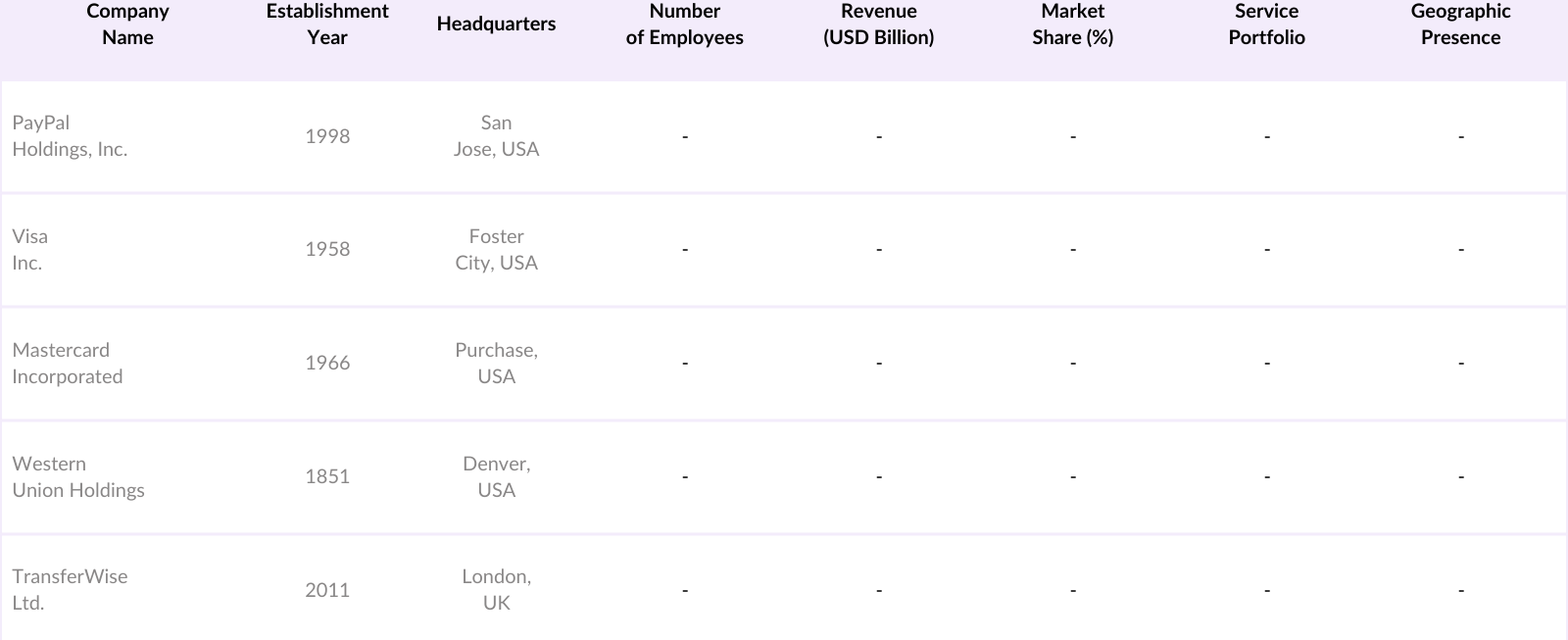

PayPal Holdings, Inc.

Visa Inc.

Mastercard Incorporated

Western Union Holdings, Inc.

TransferWise Ltd.

Ripple Labs Inc.

Payoneer Inc.

WorldRemit Ltd.

Square, Inc.

Stripe, Inc.

Table of Contents

1. Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Market Size (USD Billion)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Market Analysis

3.1 Growth Drivers

3.1.1 Expansion of Global Trade

3.1.2 Rise in E-commerce Transactions

3.1.3 Advancements in Financial Technologies

3.1.4 Increase in International Remittances

3.2 Market Challenges

3.2.1 Regulatory Compliance Complexities

3.2.2 Currency Exchange Rate Volatility

3.2.3 High Transaction Costs

3.3 Opportunities

3.3.1 Integration of Blockchain Technology

3.3.2 Growth in Emerging Markets

3.3.3 Development of Real-Time Payment Systems

3.4 Trends

3.4.1 Adoption of Digital Wallets

3.4.2 Collaboration Between Banks and Fintech Firms

3.4.3 Implementation of Artificial Intelligence in Fraud Detection

3.5 Government Regulations

3.5.1 Anti-Money Laundering (AML) Policies

3.5.2 Know Your Customer (KYC) Requirements

3.5.3 Data Protection and Privacy Laws

3.5.4 Cross-Border Payment Initiatives by Central Banks

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competitive Landscape

4. Market Segmentation

4.1 By Transaction Type (Value %)

4.1.1 Business to Business (B2B)

4.1.2 Customer to Business (C2B)

4.1.3 Business to Customer (B2C)

4.1.4 Customer to Customer (C2C)

4.2 By Channel (Value %)

4.2.1 Bank Transfers

4.2.2 Money Transfer Operators

4.2.3 Card Payments

4.2.4 Digital Wallets

4.3 By Enterprise Size (Value %)

4.3.1 Large Enterprises

4.3.2 Small and Medium-sized Enterprises (SMEs)

4.4 By End-User (Value %)

4.4.1 Individuals

4.4.2 Businesses

4.5 By Region (Value %)

4.5.1 North America

4.5.2 Europe

4.5.3 Asia-Pacific

4.5.4 Latin America

4.5.5 Middle East & Africa

5. Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 PayPal Holdings, Inc.

5.1.2 Visa Inc.

5.1.3 Mastercard Incorporated

5.1.4 Western Union Holdings, Inc.

5.1.5 TransferWise Ltd.

5.1.6 Ripple Labs Inc.

5.1.7 Payoneer Inc.

5.1.8 WorldRemit Ltd.

5.1.9 Square, Inc.

5.1.10 Stripe, Inc.

5.1.11 Ant Financial Services Group

5.1.12 Tencent Holdings Ltd.

5.1.13 Adyen N.V.

5.1.14 FIS (Fidelity National Information Services, Inc.)

5.1.15 Euronet Worldwide, Inc.

5.2 Cross-Comparison Parameters (Number of Employees, Headquarters, Inception Year, Revenue, Market Share, Service Portfolio, Geographic Presence, Strategic Initiatives)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. Regulatory Framework

6.1 International Payment Standards

6.2 Compliance Requirements

6.3 Certification Processes

7. Future Market Size (USD Billion)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Future Market Segmentation

8.1 By Transaction Type (Value %)

8.2 By Channel (Value %)

8.3 By Enterprise Size (Value %)

8.4 By End-User (Value %)

8.5 By Region (Value %)

9. Market Analysts Recommendations

9.1 Total Addressable Market (TAM), Serviceable Available Market (SAM), and Serviceable Obtainable Market (SOM) Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the global cross-border payments market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the global cross-border payments market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics is conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations provide valuable operational and financial insights directly from industry practitioners, which are instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple cross-border payment providers and fintech firms to acquire detailed insights into product segments, service performance, customer preferences, and other pertinent factors. This interaction verifies and complements statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the global cross-border payments market.

Frequently Asked Questions

1. How big is the global cross-border payments market?

The global cross-border payments market is valued at USD 185 billion, based on a five-year historical analysis. This substantial valuation is driven by the rapid expansion of international trade, the proliferation of e-commerce platforms, and the increasing need for efficient remittance services.

2. What are the challenges in the global cross-border payments market?

Challenges include high transaction fees, currency exchange volatility, regulatory compliance complexities, and cybersecurity risks that can impact cross-border transactions.

3. Who are the major players in the global cross-border payments market?

Key players in the market include PayPal, Visa, Mastercard, Western Union, and TransferWise. These companies dominate due to their global presence, established trust, and technological innovations in payment solutions.

4. What are the growth drivers of the global cross-border payments market?

Growth is driven by increased globalization, the rise of cross-border e-commerce, technological advancements in payment processing, and the growing demand for efficient remittance solutions.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.