Global Crown Cap Market Outlook to 2030

Region:Global

Author(s):Paribhasha Tiwari

Product Code:KROD9959

November 2024

99

About the Report

Global Crown Cap Market Overview

- The global crown cap market is valued at USD 1.73 billion, driven primarily by the demand for crown caps in the beverage industry. The market is influenced by a combination of factors including rising global consumption of bottled beverages and beer. A five-year historical analysis shows that crown caps, specifically made from steel and aluminum, are in high demand due to their cost-efficiency and wide applicability in mass production across food and beverage sectors. Beverage manufacturers are the key end-users of crown caps, significantly contributing to the market's stability.

- Countries like the USA, Germany, and China dominate the crown cap market due to their established manufacturing industries and high consumption rates of bottled beverages. The USA and Germany are global leaders in the beverage sector, housing some of the largest breweries and beverage companies that extensively utilize crown caps for packaging. China's dominance stems from its large-scale manufacturing capabilities and export market, alongside the rising domestic consumption of carbonated drinks and beer.

- Governments across Europe are introducing subsidies for eco-friendly packaging solutions. For instance, the EU's 2024 Green Packaging Initiative offers financial incentives for companies that adopt recyclable and sustainable crown cap solutions, particularly for the beverage industry.

Global Crown Cap Market Segmentation

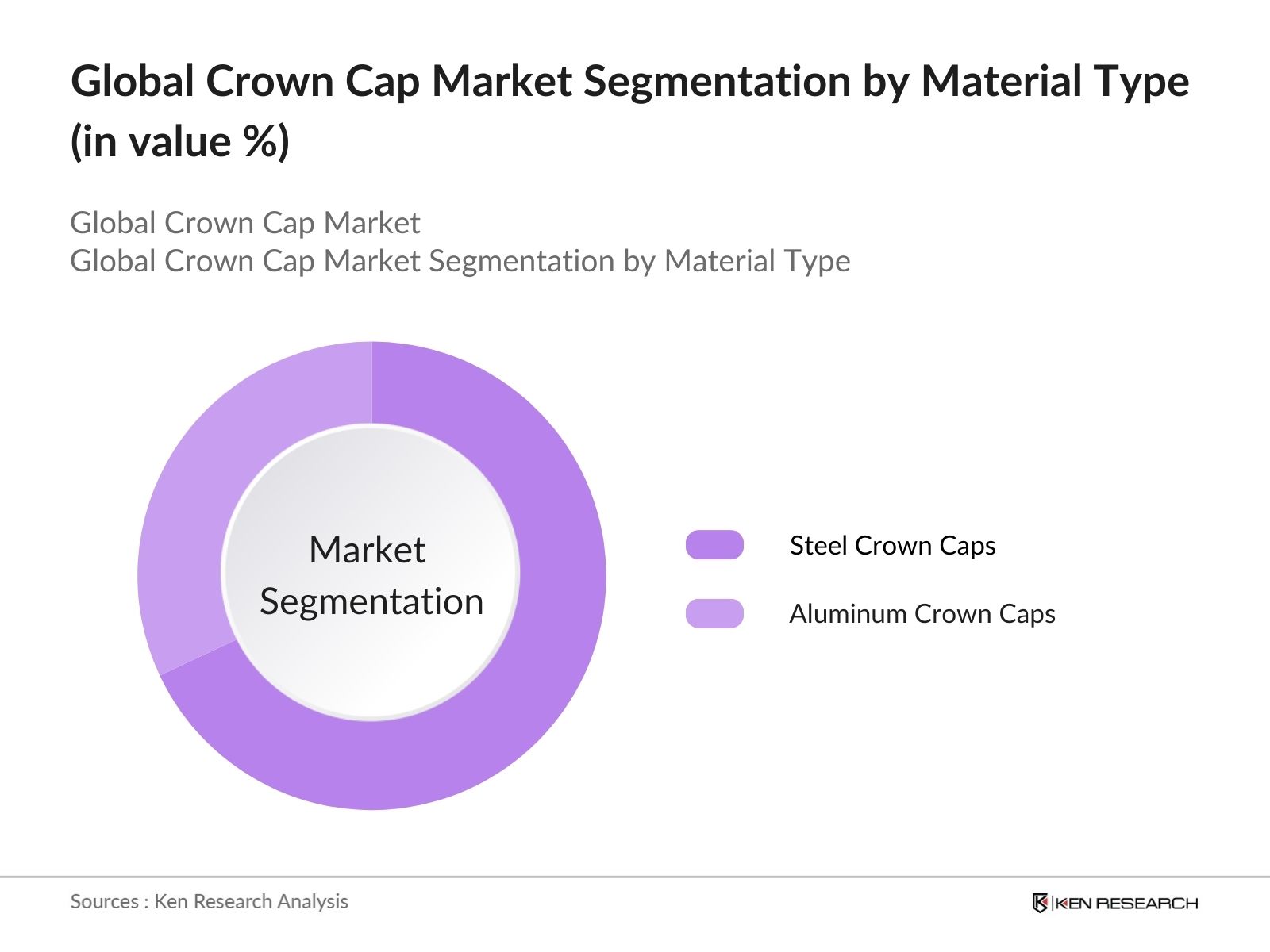

By Material Type: The global crown cap market is segmented by material type into aluminum and steel crown caps. Steel crown caps dominate this segment due to their higher durability and cost-effectiveness in large-scale production. The beverage industry, particularly beer manufacturers, prefers steel crown caps due to their ability to withstand pressure and provide better sealing, ensuring product freshness over time. Aluminum, while lighter and more flexible, is more commonly used in premium products, offering a sleek finish but accounting for a smaller market share compared to steel.

By Region: Geographically, the global crown cap market is segmented into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America. North America, particularly the USA, leads the market due to the presence of large-scale breweries and beverage manufacturers. Europe, with Germany as a key player, follows closely, driven by its strong beer culture and high consumption of bottled beverages. In Asia Pacific, China is emerging as a significant player, with increasing domestic production and export demand.

By End-Use Industry: The market is further segmented by end-use industries, primarily into food & beverages, pharmaceuticals, and household products. The beverage industry holds the largest market share, driven by the extensive use of crown caps in carbonated drinks, bottled water, and beer packaging. Crown caps offer a secure sealing solution, ensuring product integrity and longer shelf life, making them the preferred closure system in the beverage industry. The pharmaceutical industry represents a smaller segment, using crown caps for specific liquid medications that require tamper-evident packaging.

Global Crown Cap Market Competitive Landscape

The global crown cap market is dominated by key players that have a strong presence across regions and industries. Companies such as Crown Holdings, Amcor Limited, and Silgan Holdings lead due to their technological integration in packaging solutions, strong regional focus, and continuous investments in sustainability initiatives. These companies focus on innovating materials and manufacturing processes to reduce environmental impacts and cater to the growing demand for eco-friendly packaging solutions.

Global Crowm Cap Market Analysis

Growth Drivers

- Increasing Demand in the Beverage Industry: The global beverage industry, particularly in the bottled water and carbonated drinks segments, is driving the demand for crown caps. For example, the production of bottled beverages in 2023 was estimated at 540 billion liters, particularly in urbanized markets across the USA and Europe. In cities like New York and Paris, urban consumption rates of bottled beverages continue to rise, creating sustained demand for crown caps in these regions. Data from global beverage associations in 2024 highlight that the industrys growth is expected to see consistent increases, with further urban penetration fueling crown cap usage.

- Growing Packaging Innovations: Innovative packaging in the food and beverage industry is pushing the demand for specialized crown caps. Eco-friendly packaging initiatives, such as the use of recyclable steel and aluminum crown caps, are becoming increasingly popular due to government policies in major economies. For instance, the EU has introduced stricter regulations on eco-friendly packaging in 2024, requiring packaging companies to reduce the use of non-recyclable materials. This has led to a surge in demand for innovative crown caps that align with sustainability goals.

- Rising Consumption in Emerging Markets: Countries like India and Brazil are seeing significant consumption increases in beverages and pharmaceuticals, driven by a young population and growing middle class. The population in India exceeded 1.4 billion in 2024, with a corresponding rise in consumption of packaged goods requiring crown caps. Additionally, government-backed programs aimed at reducing poverty and increasing urban access to packaged goods are fueling market penetration, increasing demand for crown caps as packaging solutions.

Market Challenges

- Volatility in Raw Material Prices: The cost of raw materials such as steel and aluminum, crucial for crown cap production, has been highly volatile in recent years. In 2024, the global price of aluminum rose to $2,500 per metric ton, driven by geopolitical tensions and supply chain disruptions. This volatility makes it challenging for manufacturers to maintain consistent production costs and pricing, particularly for crown caps made from these materials. Steel, another key material, saw price fluctuations reaching $3,400 per metric ton in certain markets.

- Stringent Regulatory Requirements: Packaging safety standards are becoming stricter, especially in the food and beverage industry. The US Food and Drug Administration (FDA) introduced new packaging safety standards in 2024, requiring crown caps to meet stringent recycling and contamination prevention measures. Meeting these regulatory requirements increases production costs and complicates the manufacturing process, as companies must adapt their materials and production lines to comply with these ever-evolving standards.

Global Crown Cap Market Future Outlook

Over the next five years, the global crown cap market is expected to witness stable growth driven by continuous demand from the beverage industry, especially in emerging markets like China and India. Increasing urbanization, rising disposable incomes, and the growing preference for bottled beverages are expected to further propel the market. Additionally, the shift towards more sustainable packaging solutions, including recyclable materials, will open new opportunities for manufacturers, particularly those investing in eco-friendly cap innovations.

Market Opportunities

- Expansion into Emerging Markets: Emerging markets in Southeast Asia and Africa are becoming prime regions for the crown cap market. India, with over 1.4 billion people and an expanding beverage industry, presents a lucrative opportunity for market entry. Trade agreements, such as the Regional Comprehensive Economic Partnership (RCEP) in Asia, are lowering trade barriers, making it easier for manufacturers to enter these markets. Investment in local manufacturing units in these regions could help crown cap producers reduce logistical costs while tapping into these high-growth areas.

- Growth in Craft Beverage Industry: The craft beverage sector, including beer and artisanal drinks, is experiencing a boom, particularly in North America and Europe. In the USA alone, the number of craft breweries surpassed 9,500 in 2023, with many favoring crown caps for their packaging needs. The growing trend of premiumization in beverages and increasing consumer demand for unique packaging further drives the demand for high-quality, customizable crown caps.

Scope of the Report

|

By Material Type |

Aluminum Steel |

|

By End-Use Industry |

Food & Beverages Pharmaceuticals Household Products |

|

By Cap Size |

Standard Size (26mm) Large Size (29mm) |

|

By Manufacturing Process |

Single-Stage Process Multi-Stage Process |

|

By Region |

North America Europe Asia Pacific Middle East & Africa Latin America |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Beverage Manufacturers (AB InBev, Heineken)

Pharmaceutical Packaging Companies

Crown Cap Manufacturers

Packaging Material Suppliers

Government and Regulatory Bodies (FDA, EFSA)

Food & Beverage Industry Associations

Environmental Sustainability Bodies

Companies

Players Mentioned in The Report:

Crown Holdings, Inc.

Amcor Limited

Silgan Holdings Inc.

Guala Closures Group

Bericap GmbH

Nippon Closures Co., Ltd.

TOKK Company Ltd.

United Caps Luxembourg S.A.

Astir Vitogiannis S.A.

Alpha Packaging

Table of Contents

1. Global Crown Cap Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (Compound Annual Growth Rate Analysis, Growth Stages)

1.4. Market Segmentation Overview

2. Global Crown Cap Market Size (In USD Bn)

2.1. Historical Market Size (Past Growth Trends, Value in USD)

2.2. Year-On-Year Growth Analysis (Quarterly Growth, Value Percentage)

2.3. Key Market Developments and Milestones (Strategic Developments, Technological Advancements)

3. Global Crown Cap Market Analysis

3.1. Growth Drivers (Market Demand Drivers in Food & Beverage, Pharmaceuticals, etc.)

3.1.1. Increasing Demand in Beverage Industry (Bottled Beverage Production Data, Urban Consumption Data)

3.1.2. Growing Packaging Innovations (Eco-Friendly Packaging Initiatives, Industry-Specific Packaging Requirements)

3.1.3. Rising Consumption in Emerging Markets (Regional Data on Market Penetration, Population Growth Metrics)

3.1.4. Government Mandates on Sustainable Packaging (Plastic Reduction Policies, Waste Management Data)

3.2. Market Challenges (Production and Supply Chain Barriers, Raw Material Fluctuation)

3.2.1. Volatility in Raw Material Prices (Steel, Aluminum Price Data)

3.2.2. Stringent Regulatory Requirements (Packaging Safety Standards, Recycling Obligations)

3.2.3. Environmental Impact Concerns (Sustainability Metrics, Emission Reduction Goals)

3.3. Opportunities (Strategic Opportunities for Manufacturers, Investment Opportunities)

3.3.1. Expansion into Emerging Markets (Market Entry Strategies, Trade Agreement Analysis)

3.3.2. Growth in Craft Beverage Industry (Growth Metrics in Craft Breweries, Regional Beverage Trends)

3.3.3. Technological Innovations (Automation in Crown Cap Production, Advanced Materials)

3.4. Trends (Evolving Industry Trends)

3.4.1. Shift Towards Lightweight Crown Caps (Environmental Benefits, Production Metrics)

3.4.2. Integration of Smart Packaging Technologies (NFC-Enabled Crown Caps, Traceability Features)

3.4.3. Increase in Demand for Customizable Caps (Branding Preferences, Customer Preferences)

3.5. Government Regulation (Impact of Policies and Regulations)

3.5.1. Packaging Recycling Directives (EU Packaging and Waste Directive, Country-Specific Regulations)

3.5.2. Beverage Packaging Standards (FDA, EFSA, and Other Region-Specific Standards)

3.5.3. Import-Export Regulations (Tariff Data, Trade Barriers)

3.6. SWOT Analysis (Strengths, Weaknesses, Opportunities, and Threats)

3.7. Stakeholder Ecosystem (Industry Value Chain Analysis, Key Stakeholders)

3.8. Porters Five Forces (Competitive Rivalry, Supplier Power, etc.)

3.9. Competition Ecosystem (Industry Landscape Analysis, Competitive Metrics)

4. Global Crown Cap Market Segmentation

4.1. By Material Type (In Value %)

4.1.1. Aluminum Crown Caps

4.1.2. Steel Crown Caps

4.2. By End-Use Industry (In Value %)

4.2.1. Food & Beverages

4.2.2. Pharmaceuticals

4.2.3. Household Products

4.3. By Cap Size (In Value %)

4.3.1. Standard Size Crown Caps (26mm)

4.3.2. Large Size Crown Caps (29mm)

4.4. By Manufacturing Process (In Value %)

4.4.1. Single-Stage Process

4.4.2. Multi-Stage Process

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia Pacific

4.5.4. Middle East & Africa

4.5.5. Latin America

5. Global Crown Cap Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Crown Holdings, Inc.

5.1.2. Amcor Limited

5.1.3. O.Berk Company, LLC

5.1.4. Guala Closures Group

5.1.5. Pelliconi & C. SPA

5.1.6. Nippon Closures Co., Ltd.

5.1.7. Silgan Holdings Inc.

5.1.8. TOKK Company Ltd.

5.1.9. Astir Vitogiannis S.A.

5.1.10. United Caps Luxembourg S.A.

5.1.11. Bericap GmbH

5.1.12. Global Closure Systems

5.1.13. Zhongshan Huayi Plastics Co., Ltd.

5.1.14. Alpha Packaging

5.1.15. Tecnocap S.p.A.

5.2. Cross Comparison Parameters (No. of Employees, Revenue, Manufacturing Capacity, Production Sites, Global Presence, Product Portfolio, Strategic Partnerships, Inception Year)

5.3. Market Share Analysis (Percentage of Market Captured by Major Players)

5.4. Strategic Initiatives (Expansion Plans, Collaborations, and Partnerships)

5.5. Mergers and Acquisitions (Recent M&A Activity in the Sector)

5.6. Investment Analysis (Key Investments in Manufacturing and R&D)

5.7. Venture Capital Funding (Notable Venture-Backed Startups)

5.8. Government Grants (Funding Support from Governments)

5.9. Private Equity Investments (PE Activity in the Crown Cap Industry)

6. Global Crown Cap Market Regulatory Framework

6.1. Material Compliance Standards (FDA, EU Standards)

6.2. Recycling and Sustainability Requirements (Circular Economy Targets, Government Recycling Programs)

6.3. Certification Processes (ISO Certification, GMP Standards)

7. Global Crown Cap Future Market Size (In USD Bn)

7.1. Future Market Size Projections (Forecast Growth, Key Drivers)

7.2. Key Factors Driving Future Market Growth (Emerging Applications, Advancements in Manufacturing)

8. Global Crown Cap Future Market Segmentation

8.1. By Material Type (In Value %)

8.2. By End-Use Industry (In Value %)

8.3. By Cap Size (In Value %)

8.4. By Manufacturing Process (In Value %)

8.5. By Region (In Value %)

9. Global Crown Cap Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis (Major Consumer Segments)

9.3. Marketing Initiatives (Brand Positioning Strategies)

9.4. White Space Opportunity Analysis (Untapped Markets and Segments)

Research Methodology

Step 1: Identification of Key Variables

The research process began by mapping the entire crown cap market ecosystem, identifying all major stakeholders, including manufacturers, suppliers, and regulatory bodies. This phase involved detailed desk research to gather industry-level data and market drivers.

Step 2: Market Analysis and Construction

The second step involved collecting and analyzing historical data on market trends, industry consumption patterns, and the performance of key players. This step also included an assessment of market penetration and technological advancements in the crown cap production process.

Step 3: Hypothesis Validation and Expert Consultation

After constructing the initial market model, hypotheses regarding the future market trajectory were developed. These were validated through interviews with industry experts, crown cap manufacturers, and packaging industry professionals to gain practical insights.

Step 4: Research Synthesis and Final Output

The final phase of the research involved synthesizing all gathered data, integrating inputs from primary and secondary research, and validating the market size estimates through direct engagement with manufacturers and industry stakeholders.

Frequently Asked Questions

01. How big is the Global Crown Cap Market?

The global crown cap market is valued at USD 1.73 billion, driven by the extensive use of crown caps in the beverage industry, particularly for beer and carbonated drinks.

02. What are the challenges in the Global Crown Cap Market?

Challenges in the crown cap market include fluctuating raw material prices, especially for steel and aluminum, and stringent environmental regulations requiring sustainable packaging solutions.

03. Who are the major players in the Global Crown Cap Market?

Key players in the crown cap market include Crown Holdings, Amcor Limited, Silgan Holdings, Guala Closures Group, and Bericap GmbH, which dominate through extensive production capabilities and global distribution networks.

04. What are the growth drivers of the Global Crown Cap Market?

The crown cap market is driven by the increasing demand for bottled beverages, advancements in cap manufacturing technologies, and the global push for sustainable packaging solutions.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.