Global Cryptocurrency Exchange Platform Market Outlook to 2030

Region:Global

Author(s):Mukul

Product Code:KROD6697

November 2024

87

About the Report

Global Cryptocurrency Exchange Platform Market Overview

The global cryptocurrency exchange platform market is valued at USD 45.3 billion based on historical data and is primarily driven by the rapid adoption of cryptocurrencies in both institutional and retail sectors. The rising demand for secure and fast trading platforms that allow seamless transactions has been a key factor behind the markets growth. Governments in several countries are also introducing regulatory frameworks to legitimize cryptocurrency trading, providing more security to traders and increasing platform adoption.

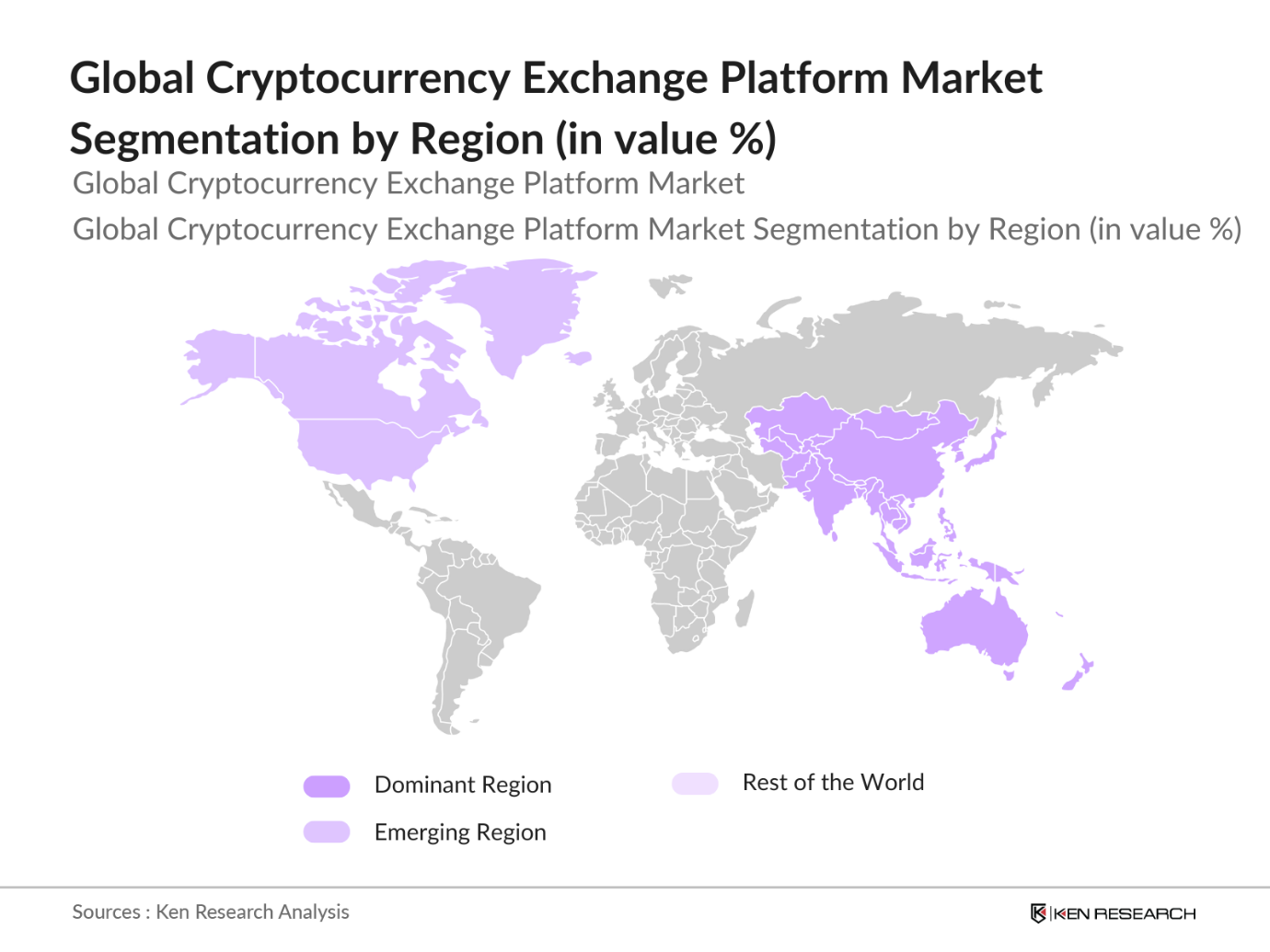

- Countries like the United States, South Korea, and Japan dominate the cryptocurrency exchange platform market. The dominance of these countries is attributed to high internet penetration, technological advancements, and favorable regulations around cryptocurrency trading. The US, for example, is home to leading exchanges such as Coinbase and Kraken, while Japan and South Korea have both legalized and regulated cryptocurrency exchanges, ensuring market transparency and security.

- Several countries are exploring or developing Central Bank Digital Currencies (CBDCs) as an official digital alternative to traditional currencies. By 2024, over 100 countries were actively researching or piloting CBDCs, including Chinas Digital Yuan and the European Unions Digital Euro. These initiatives may eventually be integrated into cryptocurrency exchanges, providing additional liquidity and security for users. Collaboration between exchanges and central banks is expected to enhance the overall ecosystem.

Global Cryptocurrency Exchange Platform Market Segmentation

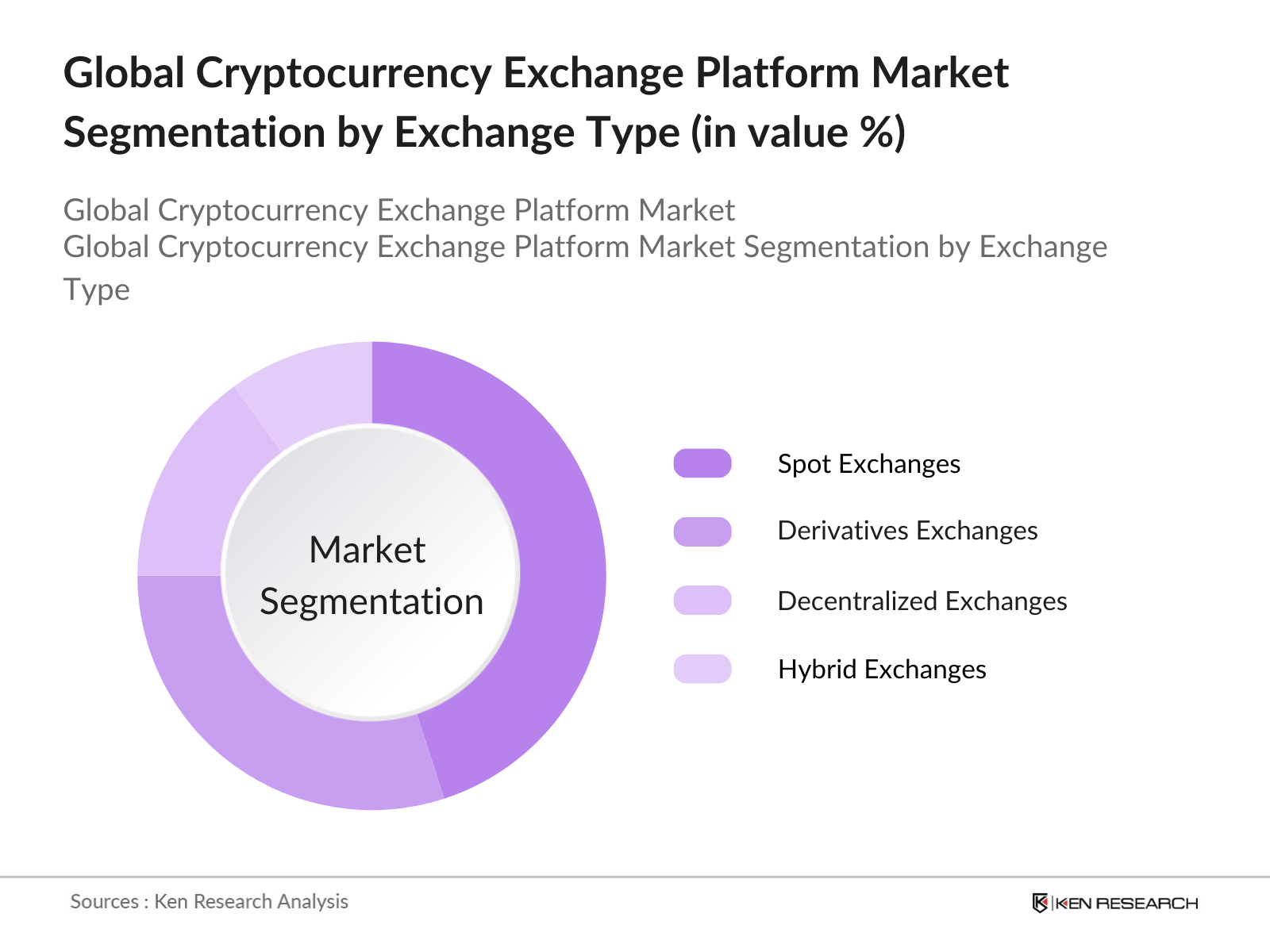

- By Exchange Type: The cryptocurrency exchange platform market is segmented by exchange type into spot exchanges, derivatives exchanges, decentralized exchanges, and hybrid exchanges. Currently, spot exchanges dominate the market, primarily due to their simplicity and the ability to trade various cryptocurrencies directly without needing complex financial instruments. Platforms like Binance and Coinbase have attracted large numbers of both retail and institutional users by offering a wide range of cryptocurrencies and a user-friendly interface.

- By Region: Regionally, the market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. Asia-Pacific has the highest market share, driven by countries like South Korea and Japan where cryptocurrency trading is regulated and enjoys widespread adoption. These countries have also fostered a culture of technological innovation, enabling cryptocurrency exchanges to develop faster and attract large user bases.

- By Transaction Type: The market is segmented by transaction type into fiat-to-crypto, crypto-to-crypto, and peer-to-peer (P2P) transactions. Fiat-to-crypto transactions hold a larger market share due to the increasing participation of first-time cryptocurrency buyers entering the market via fiat currency. These users typically use platforms like Coinbase, which have integrated banking systems, making the onboarding process easier and more secure.

Global Cryptocurrency Exchange Platform Market Competitive Landscape

The cryptocurrency exchange platform market is highly competitive, with a mix of global and regional players. The competitive landscape includes both centralized and decentralized platforms, each striving to enhance user experience through security, liquidity, and innovative features. Key players dominate due to strong user bases, extensive cryptocurrency offerings, and cutting-edge security protocols.

Global Cryptocurrency Exchange Platform Industry Analysis

Growth Drivers

- Institutional Investment Growth: The rise in institutional investment in cryptocurrency has been a significant driver for exchange platforms. For example, institutional crypto custody services have seen a sharp increase, with global custodians managing over $200 billion in digital assets as of 2024. Central banks, such as the European Central Bank, have acknowledged the increasing integration of digital assets into institutional portfolios, with over 15% of institutional investors including crypto in their portfolios, showing a tangible shift toward cryptocurrency acceptance. This institutional participation ensures liquidity and long-term stability for exchanges.

- Increasing Retail Participation: Retail participation in the cryptocurrency market continues to grow, with platforms such as Binance and Coinbase reporting over 150 million users globally in 2024. This increase in retail user base has been driven by easier access to cryptocurrencies through mobile applications, as well as governments facilitating digital payments, especially in emerging markets. Retail activity accounts for approximately 60% of total exchange volumes, showcasing the importance of individual users in this sector. Countries such as India and Brazil have seen a substantial surge in retail crypto transactions.

- Global Regulatory Approvals: Cryptocurrency exchange platforms have benefited from regulatory approvals in key jurisdictions. In 2023, the European Union passed the MiCA (Markets in Crypto-Assets) regulation, which provides a legal framework for crypto operations within the EU. This has facilitated the growth of platforms as they now operate within a clear legal environment. Additionally, Japan, South Korea, and Australia have implemented similar frameworks, providing increased security and consumer protection. These frameworks allow exchanges to expand services confidently across borders.

Market Restraints

- Regulatory Uncertainty (Licensing, Compliance Issues): While some regions have clear regulatory frameworks, others are still grappling with policy formulation. For example, the U.S. Securities and Exchange Commission (SEC) continues to investigate whether cryptocurrencies fall under securities law, leaving uncertainty for U.S.-based platforms. The global lack of standard licensing procedures creates a fragmented market, with exchanges often facing penalties or shutdowns due to compliance issues. Over 200 exchanges globally faced regulatory action in 2023 due to non-compliance, stalling their growth.

- Cybersecurity Threats (Hacks, Data Breaches): Cybersecurity remains a significant challenge for cryptocurrency exchanges. In 2023 alone, hackers stole over $3 billion from exchanges, with the largest breach occurring on a South Korean exchange, costing $600 million. These breaches undermine user trust, especially in countries with weaker cybersecurity infrastructure. Despite efforts to implement stronger multi-factor authentication and cold storage solutions, sophisticated hacking tools continue to target platform vulnerabilities.

Global Cryptocurrency Exchange Platform Market Future Outlook

Over the next five years, the global cryptocurrency exchange platform market is expected to experience significant growth, driven by increasing institutional investments, advancements in blockchain technology, and broader adoption of decentralized finance (DeFi) applications. Governments are expected to continue refining their regulatory frameworks, providing greater market transparency, and further driving user confidence in the platforms.

Market Opportunities

- Integration of Blockchain Technology: Blockchain technology offers exchanges the opportunity to enhance security, transparency, and efficiency. In 2024, more than 70% of major cryptocurrency exchanges reported integrating blockchain features to verify transaction history and improve audit trails. This reduces the risk of fraud and enhances regulatory compliance. Governments like Singapores Monetary Authority actively support blockchain integration through funding and partnerships with tech firms, signaling a promising future for crypto platforms.

- Expansion into Emerging Markets (Africa, Southeast Asia): Emerging markets in Africa and Southeast Asia present significant growth opportunities for cryptocurrency exchanges. According to the World Bank, in 2024, around 40% of adults in these regions remain unbanked, creating a massive potential user base for crypto solutions. Countries like Nigeria and Vietnam have already seen widespread crypto adoption, with remittance and mobile payments sectors leading the way. Blockchain technology and crypto exchanges offer solutions for cross-border payments and financial inclusion, reducing the reliance on traditional banking infrastructure.

Scope of the Report

|

By Exchange Type |

Spot Exchanges |

|

Derivatives Exchanges |

|

|

Decentralized Exchanges |

|

|

Hybrid Exchanges |

|

|

By Application |

Institutional Trading |

|

Retail Trading |

|

|

Staking and Yield Farming |

|

|

Payment Processing |

|

|

By Transaction Type |

Fiat-to-Crypto |

|

Crypto-to-Crypto |

|

|

Peer-to-Peer (P2P) |

|

|

By Currency Type |

Bitcoin |

|

Ethereum |

|

|

Stablecoins |

|

|

Altcoins |

|

|

By Region |

North America |

|

Europe |

|

|

Asia-Pacific |

|

|

Latin America |

|

|

Middle East & Africa |

Products

Key Target Audience

Institutional Investors and Venture Capital Firms

Cryptocurrency Developers and Blockchain Innovators

Payment Processing Companies

Government and Regulatory Bodies (e.g., Financial Crimes Enforcement Network, European Central Bank)

Financial Institutions and Banks

Cryptocurrency Miners

Technology Providers (Security, Data Analytics)

E-commerce and Payment Gateway Providers

Companies

Players Mentioned in the Report:

Binance

Coinbase

Kraken

Huobi Global

OKX

Gemini

Bitfinex

Bitstamp

Bittrex

Bybit

KuCoin

FTX

Crypto.com

Gate.io

Liquid

Table of Contents

1. Global Cryptocurrency Exchange Platform Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy (Spot Exchange, Derivative Exchange, Decentralized Exchange, Hybrid Exchange)

1.3. Market Growth Rate (Year-on-Year Trading Volume Growth, Adoption Rate)

1.4. Market Segmentation Overview

2. Global Cryptocurrency Exchange Platform Market Size (In USD Mn)

2.1. Historical Market Size (Trading Volume, Active Users)

2.2. Year-On-Year Growth Analysis (Transaction Count, Exchange Revenue)

2.3. Key Market Developments and Milestones (New Exchange Listings, Technological Upgrades)

3. Global Cryptocurrency Exchange Platform Market Analysis

3.1. Growth Drivers

3.1.1. Institutional Investment Growth

3.1.2. Increasing Retail Participation

3.1.3. Global Regulatory Approvals

3.1.4. Cross-border Payment Solutions

3.2. Market Challenges

3.2.1. Regulatory Uncertainty (Licensing, Compliance Issues)

3.2.2. Cybersecurity Threats (Hacks, Data Breaches)

3.2.3. Volatile Transaction Fees (Fee Structure Variability)

3.3. Opportunities

3.3.1. Integration of Blockchain Technology

3.3.2. Expansion into Emerging Markets (Africa, Southeast Asia)

3.3.3. Cross-chain Compatibility (Interoperability Solutions)

3.4. Trends

3.4.1. Rise of Decentralized Finance (DeFi)

3.4.2. Stablecoin Adoption (Market Liquidity)

3.4.3. Non-Fungible Tokens (NFTs) Integration

3.5. Government Regulation

3.5.1. Crypto Exchange Licensing (Country-specific Licenses)

3.5.2. Anti-Money Laundering (AML) and Know Your Customer (KYC) Policies

3.5.3. Taxation Guidelines for Cryptocurrency Transactions

3.5.4. Central Bank Digital Currencies (CBDCs) Collaboration

3.6. SWOT Analysis

3.7. Stake Ecosystem (Investors, Developers, Traders, Regulatory Bodies)

3.8. Porters Five Forces (Entry Barriers, Supplier Power, Buyer Power, Substitutes, Industry Rivalry)

3.9. Competition Ecosystem

4. Global Cryptocurrency Exchange Platform Market Segmentation

4.1. By Exchange Type (In Value %)

4.1.1. Spot Exchanges

4.1.2. Derivatives Exchanges

4.1.3. Decentralized Exchanges

4.1.4. Hybrid Exchanges

4.2. By Application (In Value %)

4.2.1. Institutional Trading

4.2.2. Retail Trading

4.2.3. Staking and Yield Farming

4.2.4. Payment Processing

4.3. By Transaction Type (In Value %)

4.3.1. Fiat-to-Crypto

4.3.2. Crypto-to-Crypto

4.3.3. Peer-to-Peer (P2P)

4.4. By Currency Type (In Value %)

4.4.1. Bitcoin

4.4.2. Ethereum

4.4.3. Stablecoins

4.4.4. Altcoins

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia-Pacific

4.5.4. Latin America

4.5.5. Middle East & Africa

5. Global Cryptocurrency Exchange Platform Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Binance

5.1.2. Coinbase

5.1.3. Kraken

5.1.4. Bitfinex

5.1.5. Huobi Global

5.1.6. OKX

5.1.7. Gemini

5.1.8. KuCoin

5.1.9. FTX

5.1.10. Bitstamp

5.1.11. Bittrex

5.1.12. Bybit

5.1.13. Crypto.com

5.1.14. Gate.io

5.1.15. Liquid

5.2. Cross Comparison Parameters (User Base, Volume, Fees, Security Measures, Insurance Coverage, Liquidity, Geographical Reach, Listed Tokens)

5.3. Market Share Analysis (Volume, Revenue, User Base)

5.4. Strategic Initiatives (Product Launches, Collaborations)

5.5. Mergers And Acquisitions (Recent M&A Activities)

5.6. Investment Analysis (Recent Fundraising Rounds)

5.7. Venture Capital Funding (Key Investors, Funding Totals)

5.8. Government Grants (Support for Innovation)

5.9. Private Equity Investments (Major PE Investors)

6. Global Cryptocurrency Exchange Platform Market Regulatory Framework

6.1. Licensing and Compliance Requirements

6.2. Security and Custody Standards

6.3. AML/KYC Compliance Requirements

6.4. International Cryptocurrency Regulations (FATF, MiCA)

7. Global Cryptocurrency Exchange Platform Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth (Adoption of DeFi, CBDCs Impact)

8. Global Cryptocurrency Exchange Platform Future Market Segmentation

8.1. By Exchange Type (In Value %)

8.2. By Application (In Value %)

8.3. By Transaction Type (In Value %)

8.4. By Currency Type (In Value %)

8.5. By Region (In Value %)

9. Global Cryptocurrency Exchange Platform Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. User Behavior Analysis (HODL vs. Active Trading)

9.3. Marketing Initiatives (User Acquisition Strategies)

9.4. Emerging White Space Opportunities

Research Methodology

Step 1: Identification of Key Variables

In this step, an ecosystem map was developed to encompass all major stakeholders within the global cryptocurrency exchange platform market. This involved desk research using secondary databases and proprietary resources to define the key market drivers, constraints, and influencing variables.

Step 2: Market Analysis and Construction

Historical data on cryptocurrency exchanges, trading volumes, and user adoption was collected to understand the penetration and performance of the market. Various sources were utilized to cross-validate transaction volumes and exchange revenues.

Step 3: Hypothesis Validation and Expert Consultation

Through telephone interviews with industry experts, including exchange operators and cryptocurrency developers, initial hypotheses regarding market growth and challenges were confirmed. Insights gathered from these discussions were critical for refining the research findings.

Step 4: Research Synthesis and Final Output

Direct engagement with cryptocurrency exchanges helped refine market statistics and projections. Data derived from primary and secondary sources was synthesized to ensure the final report reflected an accurate and comprehensive analysis of the market landscape.

Frequently Asked Questions

01. How big is the global cryptocurrency exchange platform market?

The global cryptocurrency exchange platform market is valued at USD 45.3 billion, driven by increasing institutional and retail investment in digital currencies.

02. What are the challenges in the global cryptocurrency exchange platform market?

Challenges include regulatory uncertainty, cybersecurity risks, and volatile transaction fees. Regulatory changes and compliance requirements are complex, and exchanges need to continuously invest in security to prevent hacks.

03. Who are the major players in the global cryptocurrency exchange platform market?

Key players include Binance, Coinbase, Kraken, Huobi Global, and OKX. These companies dominate due to their large user bases, extensive cryptocurrency listings, and strong liquidity.

04. What are the growth drivers of the global cryptocurrency exchange platform market?

The market is driven by increasing institutional investments, the rise of decentralized finance (DeFi), and advancements in blockchain technology. Governments' gradual regulatory approval is also contributing to market growth.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.