Global CubeSat Market Outlook to 2030

Region:Global

Author(s):Shreya Garg

Product Code:KROD5602

December 2024

100

About the Report

Global CubeSat Market Overview

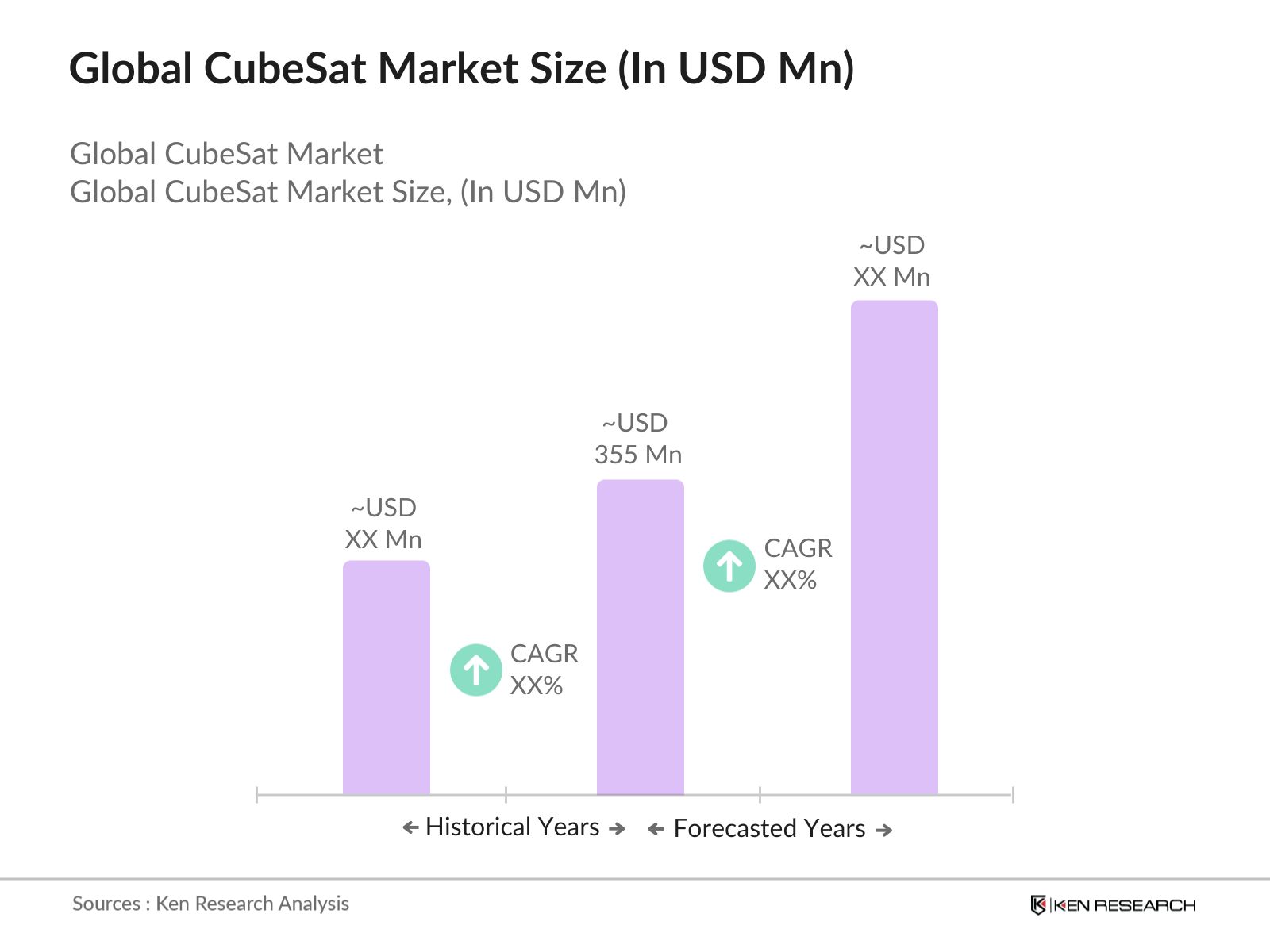

- The global CubeSat market has seen steady growth, reaching a valuation of USD 355 million. This growth is driven by technological advancements in miniaturization, cost-effective launch services, and increasing applications in Earth observation, communication, and scientific research. Governments and private enterprises are increasingly using CubeSats due to their affordability and versatility, expanding market demand across various sectors like agriculture, defense, and environmental monitoring. CubeSats offer quicker development cycles and lower deployment costs, making them an attractive alternative to traditional large-scale satellite systems.

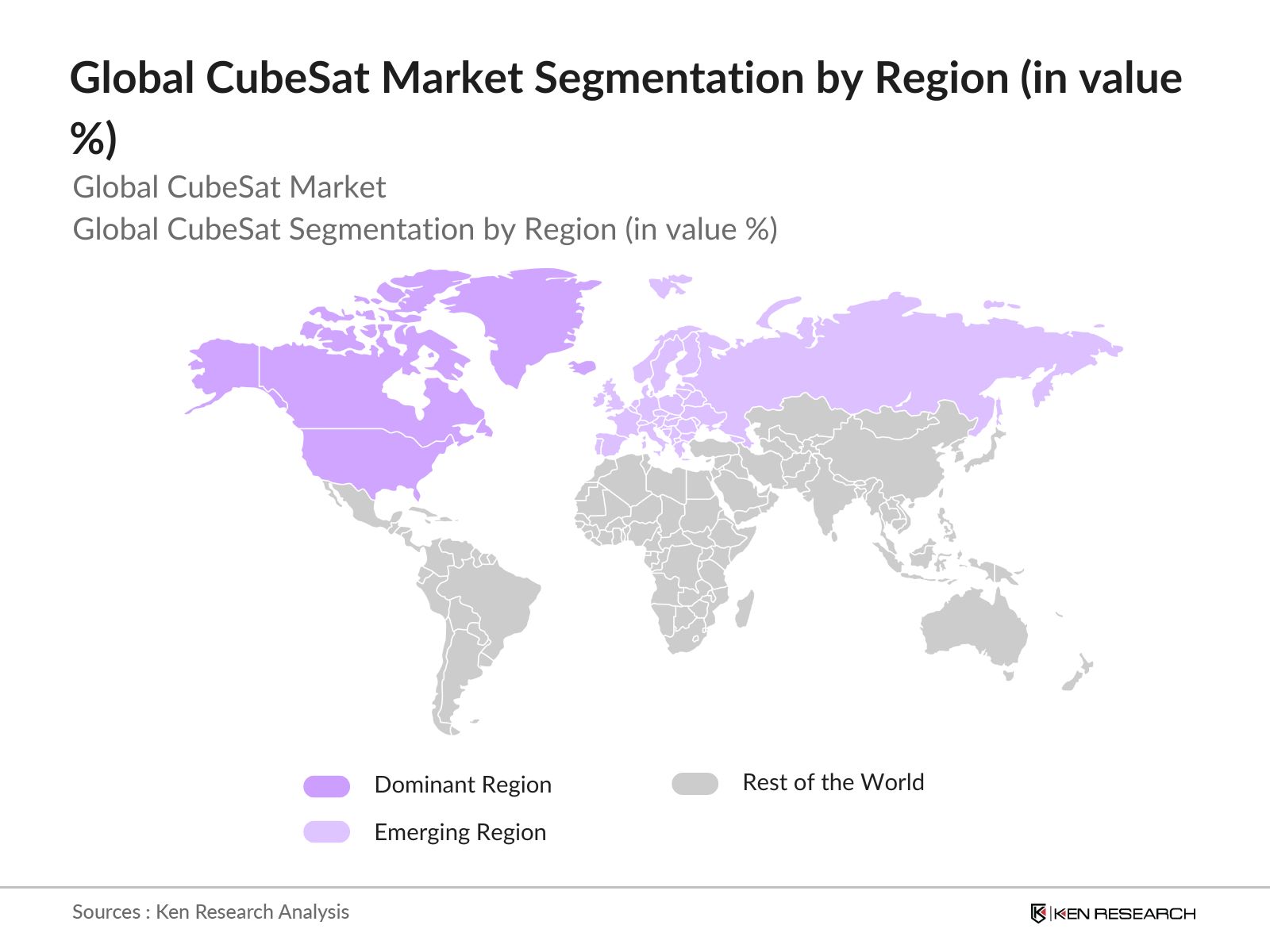

- The global CubeSat market is dominated by countries with advanced space programs, including the United States, China, and European nations like the UK and Germany. The dominance of these regions is attributed to strong governmental support, well-established space agencies like NASA and ESA, and a thriving ecosystem of private aerospace companies. The United States leads the market due to its large number of commercial satellite launches, driven by private companies like SpaceX and Blue Origin. Europes dominance is supported by their investments in satellite constellations for Earth observation and telecommunication.

- In 2024, NASA has continued to support small satellite missions through its CubeSat Launch Initiative (CSLI), providing academic institutions and non-profit organizations with access to space. Over 60 CubeSats were launched through the initiative this year, allowing new entrants into the space market to contribute to a variety of research and communication missions. This initiative is critical to fostering innovation and ensuring that small players have opportunities to launch CubeSats without incurring high costs.

Global CubeSat Market Segmentation

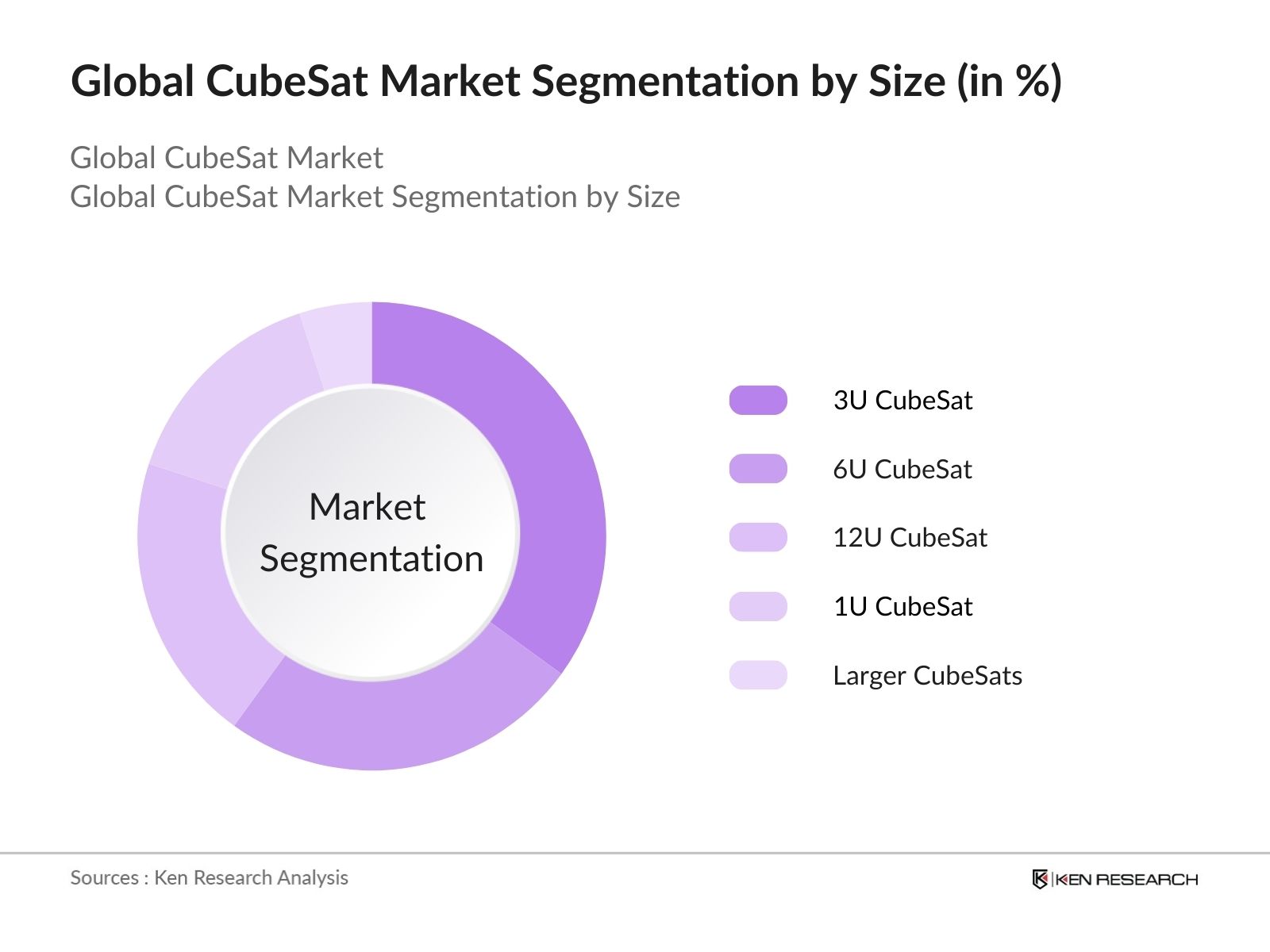

By Size: The CubeSat market is segmented by size into 1U, 3U, 6U, 12U, and larger CubeSats. The 3U CubeSat dominates the market, owing to its optimal balance between size, weight, and payload capacity, making it the most preferred size for a wide range of applications, from remote sensing to scientific research. It offers enhanced capability for both commercial and academic users without the need for high launch costs associated with larger satellites.

By Region: The CubeSat market is geographically segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. North America dominates the market due to its advanced infrastructure, substantial government funding, and the presence of major aerospace companies. Europe is the second-largest region, driven by collaborative projects under the European Space Agency and the increased focus on CubeSat technology for scientific and defense purposes.

By Application: The CubeSat market is segmented by application into Earth observation, communication, scientific research, and technology demonstration. Earth observation dominates the market due to the increasing demand for environmental monitoring, agricultural assessment, and disaster management. CubeSats provide low-cost, high-resolution imaging solutions, enabling governments and commercial players to access real-time data for efficient decision-making.

Global CubeSat Market Competitive Landscape

The global CubeSat market is moderately consolidated, with key players dominating through innovation, strategic partnerships, and government collaborations. The market is led by companies such as Planet Labs, GomSpace, and Spire Global, which focus on providing end-to-end CubeSat solutions, from manufacturing to deployment and data analytics. These companies have a strong foothold due to their established networks, technological expertise, and access to government contracts.

|

Company |

Year Established |

Headquarters |

No. of Satellites Launched |

Revenue |

Employees |

Service Range |

Key Partnerships |

|

Planet Labs Inc. |

2010 |

San Francisco, USA |

450 |

$100M |

500 |

Earth Observation |

NASA |

|

Tyvak Nano-Satellite Systems |

2011 |

Irvine, USA |

120 |

$80M |

300 |

SmallSat Launches |

SpaceX |

|

GomSpace |

2007 |

Aalborg, Denmark |

200 |

$90M |

400 |

Telecommunications |

ESA |

|

Spire Global, Inc. |

2012 |

San Francisco, USA |

150 |

$75M |

250 |

Weather Data |

NOAA |

|

AAC Clyde Space |

2005 |

Glasgow, UK |

170 |

$70M |

300 |

Space Missions |

UK Space Agency |

Global CubeSat Market Analysis

Growth Drivers

- Increasing Demand for Earth Observation Satellites: The rising demand for real-time monitoring of climate, agriculture, and disaster management has driven the use of CubeSats for Earth observation purposes. In 2024, governments and commercial entities are deploying CubeSats to monitor environmental changes and manage resource allocation. For instance, NASA has expanded its CubeSat program for Earth observation by launching missions like the IceCube satellite, which monitors atmospheric conditions. According to government data, the number of CubeSats deployed for Earth observation in 2024 increased by over 60 units globally, showing the growing reliance on these small satellites for monitoring purposes.

- Growing Adoption of CubeSats in Commercial Sectors: Commercial sectors, such as telecommunications and data services, are increasing their adoption of CubeSats to provide cost-effective solutions for data collection and transmission. In 2024, CubeSat missions for commercial purposes reached 120 globally, driven by the need for satellite-based internet services and precision agriculture. Companies in sectors like telecommunications have launched CubeSats to serve rural and hard-to-reach areas, expanding the digital connectivity footprint. The U.S. Department of Commerce reports that commercial CubeSat usage is accelerating rapidly due to its affordability and efficiency, enabling businesses to access space more cost-effectively.

- Government Support and Space Programs: Governments worldwide, particularly in countries like the U.S., Japan, and India, have ramped up CubeSat deployments as part of their national space programs. In 2024, NASA alone increased its funding for CubeSat-related missions by $30 million, supporting research and development of CubeSat technologies for Earth science and space exploration. Moreover, the Indian Space Research Organisation (ISRO) has deployed over 50 CubeSats to support various governmental research and defense initiatives. This increased backing from national space programs illustrates the strategic importance of CubeSats in governmental research and defense efforts.

Market Challenges

- Launch Bottlenecks and Delays: One of the major challenges in the CubeSat market in 2024 is the shortage of launch windows and the frequent delays faced by CubeSat missions. SpaceX and Rocket Lab, two key providers of CubeSat launches, reported multiple delays in scheduled launches in the first half of the year, leading to backlogs of CubeSats waiting for deployment. Approximately 70 CubeSat missions were delayed in 2024 due to launch congestion, causing significant operational and financial setbacks for companies relying on CubeSat technology for time-sensitive data collection and services.

- Limited Payload Capacity: CubeSats are constrained by their size, typically ranging from 1U to 12U, which limits their payload capacity. In 2024, the average CubeSat could carry a payload of 10 kg, which restricts the type of instruments and the range of tasks they can perform. This limitation hinders the CubeSats ability to handle large-scale scientific experiments or heavier observation equipment, forcing organizations to look for alternative solutions for more complex missions. Government programs like NASAs SmallSat initiative are actively researching ways to increase payload efficiency, but capacity remains a challenge.

Global CubeSat Market Future Outlook

Over the next five years, the global CubeSat market is poised for significant growth driven by increasing investments in satellite constellations, the rising demand for real-time Earth observation data, and advancements in space technology. Governments and private players are expected to expand CubeSat missions to include deep space exploration, 5G connectivity support, and Internet of Things (IoT) applications. The miniaturization of satellite components and the development of low-cost launch services will continue to lower entry barriers, fostering innovation in various sectors like communication, environmental monitoring, and defense.

Future Market Opportunities

- Collaborations with National Space Agencies: In 2024, CubeSat manufacturers are increasingly collaborating with national space agencies to enhance the technological capabilities and reach of CubeSats. NASAs CubeSat Launch Initiative, for example, has provided numerous small businesses and research institutions with funding and launch opportunities. In the current year, over 50 CubeSats were launched under NASAs program, many of which were developed by private companies working in partnership with the space agency. Such collaborations enable more sophisticated CubeSat missions, opening up opportunities for deeper space exploration and enhanced Earth observation capabilities.

- Growing Role in Internet of Things (IoT) and 5G Networks: The demand for low-latency communication solutions is driving CubeSat adoption in the IoT and 5G sectors in 2024. Satellite-based IoT networks have become essential for industries like agriculture, logistics, and asset tracking in remote areas. By the end of 2024, there are expected to be over 1,000 CubeSats in orbit supporting IoT communication services globally. These CubeSats offer affordable and efficient solutions to expand 5G networks, particularly in rural areas, and are set to play a vital role in connecting underserved populations.

Scope of the Report

|

Size |

1U CubeSat 3U CubeSat 6U CubeSat 12U CubeSat Larger CubeSats |

|

Application |

Earth Observation Communications Scientific Research, Technology Demonstration |

|

End User |

Government and Military Commercial Enterprises Academic Institutions |

|

Orbit Type |

Low Earth Orbit (LEO) Medium Earth Orbit (MEO) Geostationary Orbit (GEO) |

|

Region |

North America Europe Asia-Pacific Latin America Middle East & Africa |

Products

Key Target Audience

Aerospace and Defense Companies

Satellite Manufacturers

Telecommunication Service Providers

Government and Regulatory Bodies (NASA, ESA, ITU)

Venture Capital Firms and Investors

Environmental Monitoring Organizations

Agriculture Technology Firms

Space Research Institutions

Companies

Major Players

Planet Labs Inc.

Tyvak Nano-Satellite Systems

GomSpace

Spire Global, Inc.

AAC Clyde Space

Innovative Solutions in Space (ISISpace)

EnduroSat

Surrey Satellite Technology Ltd. (SSTL)

Blue Canyon Technologies

NanoAvionics

Table of Contents

Global CubeSat Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Evolution of CubeSat Technology

1.4. Key Market Drivers and Restraints

1.5. Market Segmentation Overview

Global CubeSat Market Size (In USD Bn)

2.1. Historical Market Size (In Value and Volume)

2.2. Year-On-Year Growth Analysis

2.3. Key Market Milestones and Events

Global CubeSat Market Analysis

3.1. Growth Drivers (Advancements in Miniaturization, Low Launch Costs, Demand for Earth Observation)

3.1.1. Increasing Demand for Earth Observation Satellites

3.1.2. Growing Adoption of CubeSats in Commercial Sectors

3.1.3. Government Support and Space Programs

3.1.4. Technological Advancements in Miniaturization

3.2. Market Challenges (Launch Delays, Regulatory Hurdles, Data Processing Limitations)

3.2.1. Launch Bottlenecks and Delays

3.2.2. Limited Payload Capacity

3.2.3. Regulatory Compliance for CubeSat Operations

3.2.4. High Dependency on Ground Infrastructure

3.3. Opportunities (Partnerships with Space Agencies, Expansion in IoT and 5G, New Launch Systems)

3.3.1. Collaborations with National Space Agencies

3.3.2. Growing Role in Internet of Things (IoT) and 5G Networks

3.3.3. Emergence of Affordable Launch Platforms

3.3.4. Expansion into Deep Space Exploration

3.4. Trends (Small Satellite Constellations, Increasing CubeSat Launches)

3.4.1. Rising Deployment of CubeSat Constellations

3.4.2. Increased Use of CubeSats for Academic Research

3.4.3. Proliferation of Launch Services for CubeSats

3.4.4. Advancements in CubeSat Propulsion Systems

3.5. Government Regulation (Licensing, Frequency Allocation, Debris Mitigation Policies)

3.5.1. International Licensing and Compliance for CubeSat Launch

3.5.2. Space Debris Mitigation Policies

3.5.3. Frequency Spectrum Allocation for CubeSats

3.5.4. Government Grants and Funding Initiatives

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

Global CubeSat Market Segmentation

4.1. By Size (In Value and Volume %)

4.1.1. 1U CubeSat

4.1.2. 3U CubeSat

4.1.3. 6U CubeSat

4.1.4. 12U CubeSat

4.1.5. Larger CubeSats

4.2. By Application (In Value and Volume %)

4.2.1. Earth Observation and Remote Sensing

4.2.2. Communications

4.2.3. Scientific Research

4.2.4. Technology Demonstration

4.3. By End User (In Value and Volume %)

4.3.1. Government and Military

4.3.2. Commercial Enterprises

4.3.3. Academic and Research Institutions

4.4. By Orbit Type (In Value and Volume %)

4.4.1. Low Earth Orbit (LEO)

4.4.2. Medium Earth Orbit (MEO)

4.4.3. Geostationary Orbit (GEO)

4.5. By Region (In Value and Volume %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia-Pacific

4.5.4. Latin America

4.5.5. Middle East and Africa

Global CubeSat Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Planet Labs Inc.

5.1.2. Tyvak Nano-Satellite Systems, Inc.

5.1.3. Pumpkin Inc.

5.1.4. NanoAvionics

5.1.5. GomSpace

5.1.6. Surrey Satellite Technology Ltd. (SSTL)

5.1.7. Clyde Space

5.1.8. AAC Clyde Space

5.1.9. EnduroSat

5.1.10. Innovative Solutions in Space (ISISpace)

5.1.11. Alen Space

5.1.12. SpaceQuest Ltd.

5.1.13. Spire Global, Inc.

5.1.14. Blue Canyon Technologies

5.1.15. Exolaunch

5.2. Cross Comparison Parameters (No. of Satellites Launched, Employees, HQ Location, Revenue)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

Global CubeSat Market Regulatory Framework

6.1. International CubeSat Launch Regulations

6.2. Compliance for Frequency Spectrum Usage

6.3. Space Debris Mitigation Standards

6.4. Certification Processes for CubeSat Missions

Global CubeSat Market Future Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Drivers for Future Market Growth

Global CubeSat Future Market Segmentation

8.1. By Size (In Value %)

8.2. By Application (In Value %)

8.3. By End User (In Value %)

8.4. By Orbit Type (In Value %)

8.5. By Region (In Value %)

Global CubeSat Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Go-To-Market Strategy

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The research began with identifying key variables impacting the global CubeSat market, including launch costs, government initiatives, and the availability of space infrastructure. Extensive desk research from proprietary databases and secondary sources helped define the critical market parameters.

Step 2: Market Analysis and Construction

Data was collected from historical sources, including market reports and satellite launch records. This was further validated by assessing revenue data, CubeSat deployment rates, and industry-specific drivers like government investments and private partnerships.

Step 3: Hypothesis Validation and Expert Consultation

Primary research involved discussions with experts from CubeSat manufacturing companies and space agencies. These consultations offered operational insights and validated the assumptions derived from secondary data.

Step 4: Research Synthesis and Final Output

The final synthesis combined primary and secondary research, producing a detailed market analysis backed by reliable data. This included CubeSat market trends, challenges, opportunities, and recommendations for industry stakeholders.

Frequently Asked Questions

01. How big is the Global CubeSat Market?

The global CubeSat market is valued at USD 355 million, driven by rising demand for affordable satellite systems in sectors like Earth observation, communication, and scientific research.

02. What are the challenges in the Global CubeSat Market?

Challenges in the global CubeSat market include launch delays, regulatory hurdles, and the limited payload capacity of small satellites, which can affect their operational scope.

03. Who are the major players in the Global CubeSat Market?

Major players in the CubeSat market include Planet Labs Inc., Tyvak Nano-Satellite Systems, GomSpace, Spire Global, and AAC Clyde Space, who lead through technological innovation and strong government partnerships.

04. What are the growth drivers of the Global CubeSat Market?

The CubeSat market is propelled by advancements in miniaturization, low-cost launch services, and increasing government investments in satellite constellations for Earth observation and telecommunications.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.