Global Dairy Market Outlook to 2030

Region:Global

Author(s):Mukul

Product Code:KROD10944

November 2024

84

About the Report

Global Dairy Market Overview

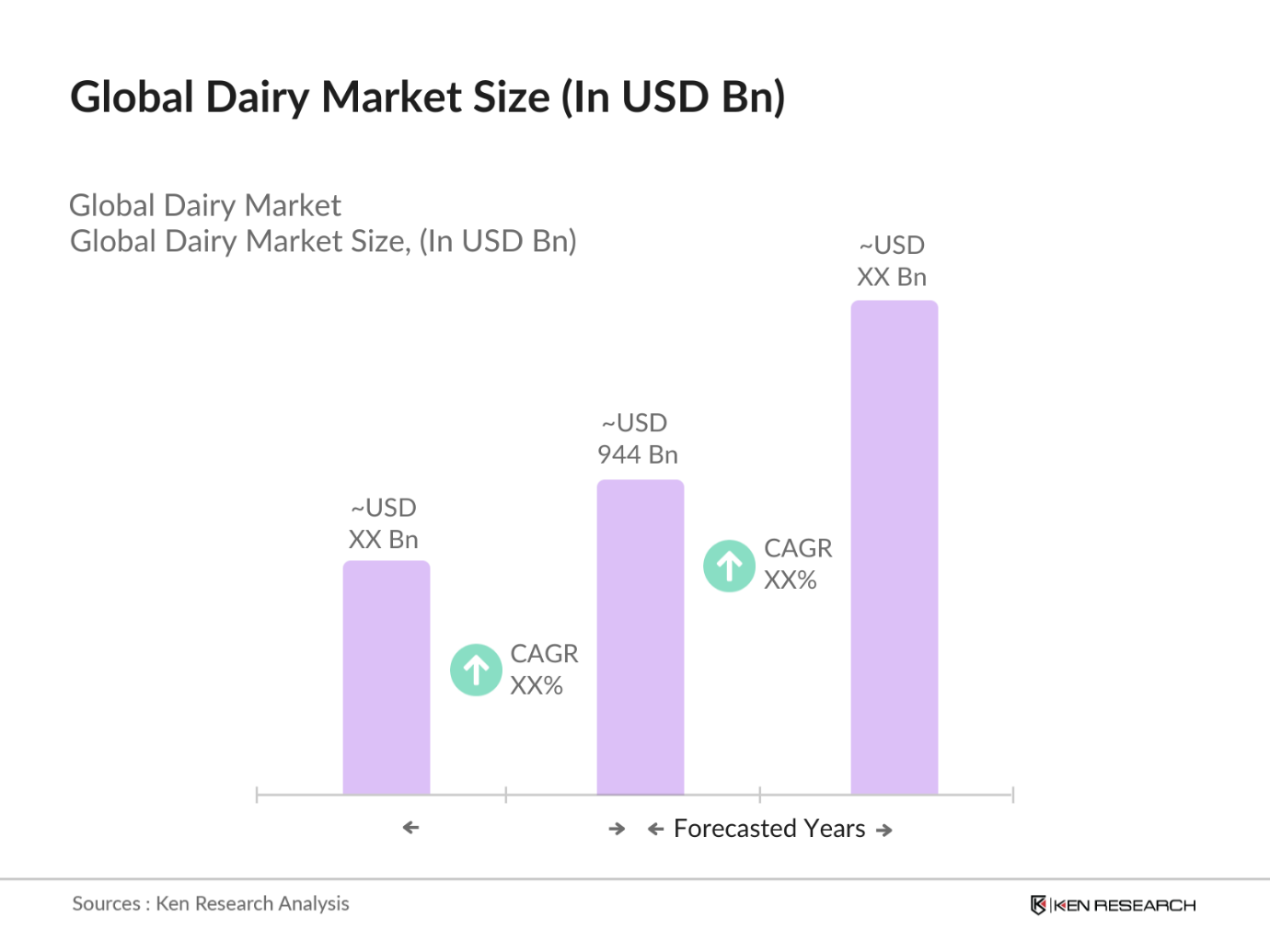

- The global dairy market is valued at USD 944 billion, driven by a significant demand for milk, cheese, yogurt, and other dairy products across the globe. The dairy industrys growth has been fueled by factors such as increasing population, rising income levels, and shifting dietary preferences toward higher consumption of protein-rich foods. With urbanization and the expansion of organized retail chains, the dairy market is projected to sustain its momentum. Continuous investments in advanced processing techniques have also contributed to enhancing production efficiency and ensuring product quality.

- Countries such as India, the United States, and China dominate the global dairy market, owing to their substantial dairy production capabilities and vast consumer bases. In India, the worlds largest milk producer, the market thrives due to the large rural population engaged in dairy farming and government initiatives supporting the dairy sector. In contrast, the United States leads in terms of technological advancements in dairy processing, which enhances efficiency and scale. Chinas dominance stems from the rapidly increasing demand for dairy products due to urbanization and growing health awareness among its population.

- Functional dairy products, such as probiotic yogurts and omega-3 enriched milk, are gaining popularity among health-conscious consumers. The FAO reports that in 2023, over 35 million tons of probiotic yogurt were consumed globally, with significant demand in North America and Europe. Omega-3 enriched milk is also becoming more mainstream due to its heart-health benefits. These products cater to the growing wellness trend, offering dairy manufacturers an opportunity to tap into premium product segments that command higher profit margins.

Global Dairy Market Segmentation

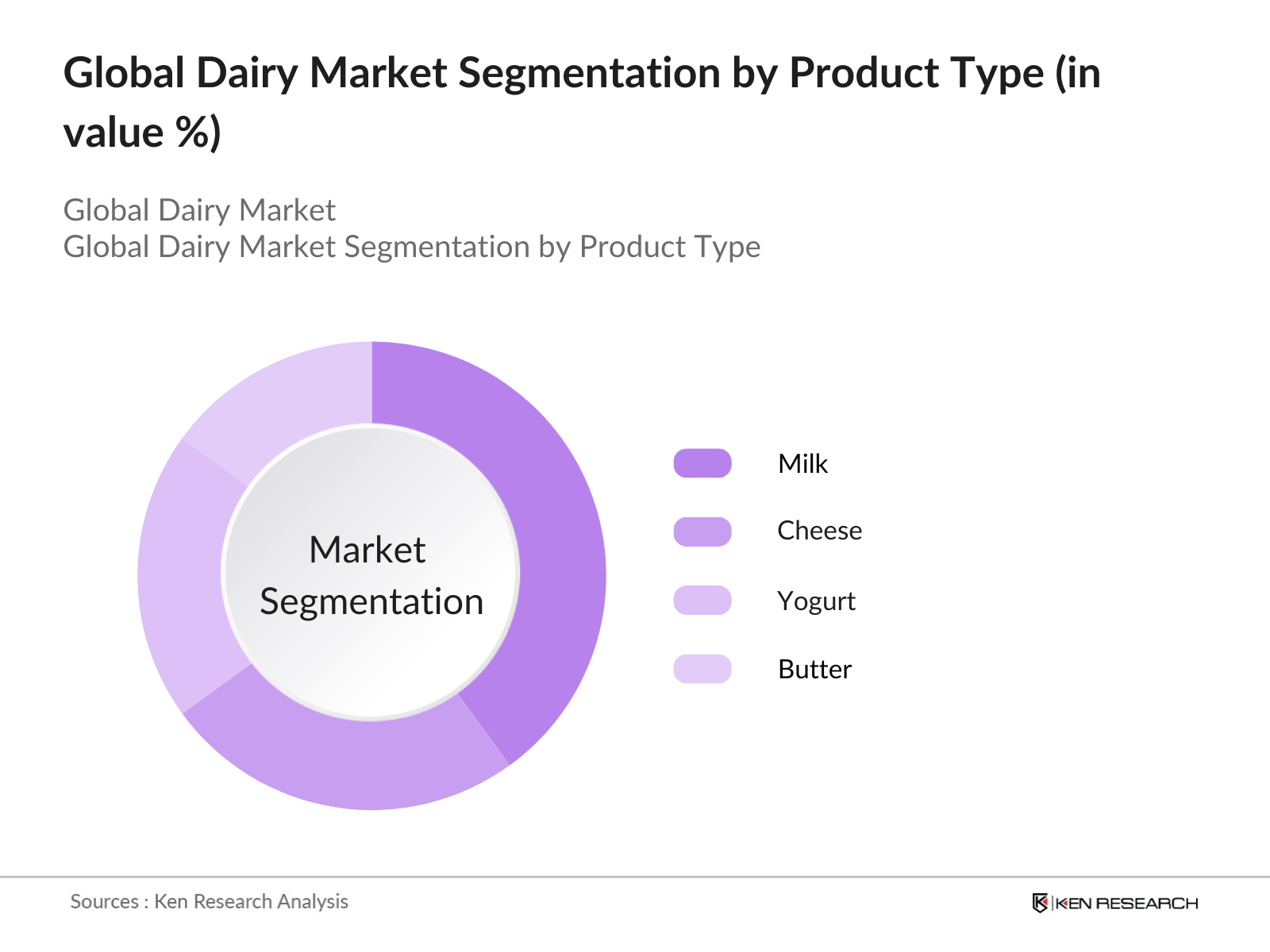

- By Product Type: The global dairy market is segmented by product type into milk, cheese, yogurt, and butter. Among these, milk holds the dominant market share due to its staple status in the diet across various regions. Additionally, milks versatile nature, serving as a key ingredient in numerous dairy products such as butter, cheese, and yogurt, further strengthens its leading position in the dairy market. The consistent demand for milk is supported by a growing population and rising health awareness regarding its nutritional value, particularly its rich calcium and protein content.

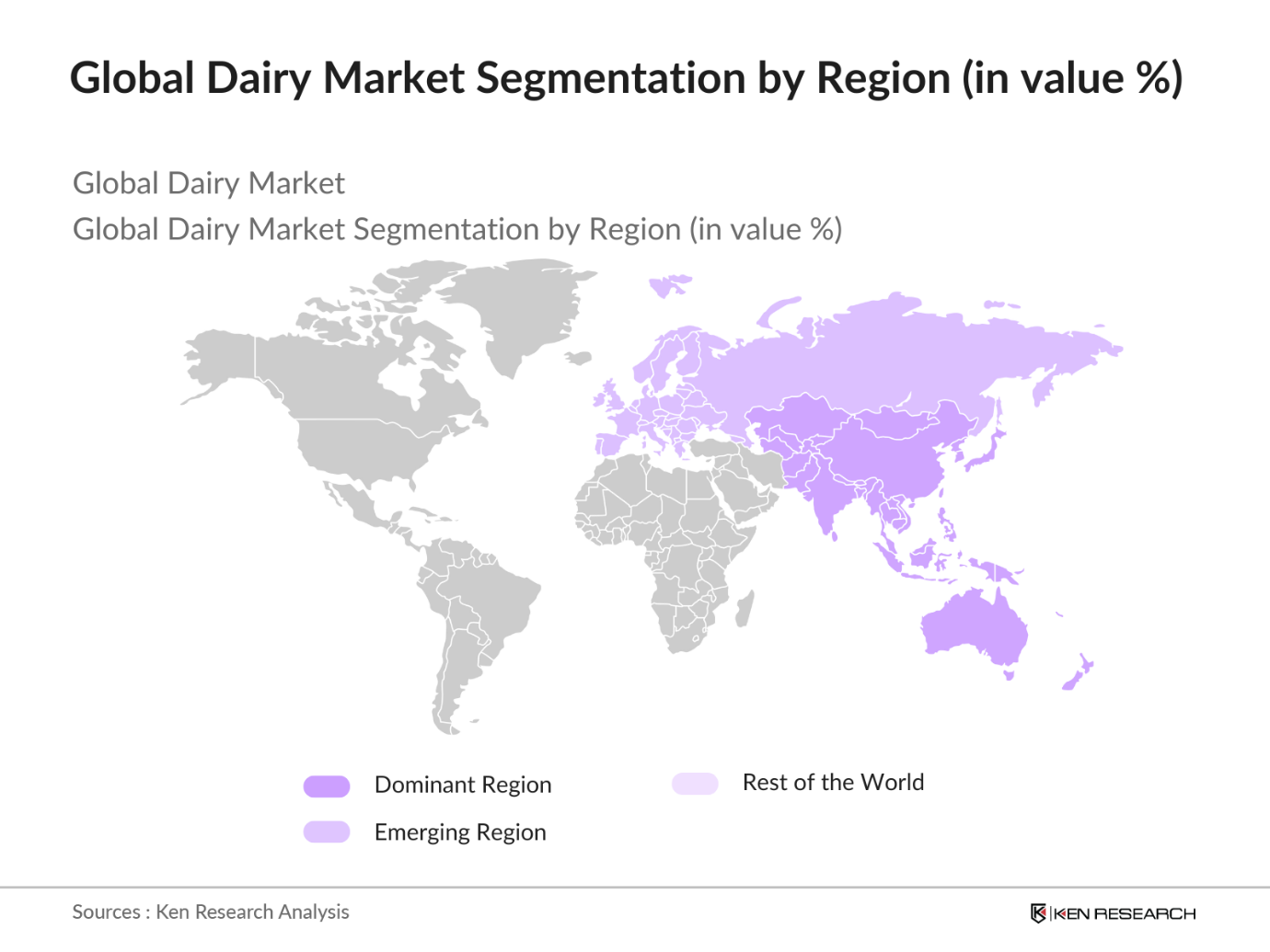

- By Region: Regionally, the dairy market is divided into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. Asia-Pacific holds the largest market share, largely driven by India and China. Indias dominance is linked to its vast production capacity and the central role of milk in its dietary culture. The market in Europe, led by countries like Germany and France, is known for its strong cheese and butter production. North Americas dairy market, particularly the United States, benefits from its highly industrialized dairy farms and innovations in dairy processing technologies.

- By Source: The market is segmented by source into cow milk, buffalo milk, goat milk, and plant-based alternatives. Cow milk dominates the market share due to its wide availability and significant consumer preference, particularly in countries such as the United States, India, and Europe. The dominance of cow milk can also be attributed to the development of an organized dairy sector that ensures a steady supply of high-quality cow milk products. However, plant-based alternatives like almond and soy milk are gaining traction due to the increasing demand for dairy-free and lactose-free products, especially in Western markets.

Global Dairy Market Competitive Landscape

The global dairy market is dominated by both multinational giants and regional players. Large corporations like Nestl and Danone hold significant influence due to their extensive product portfolios and strong distribution networks. The competitive landscape is also shaped by mergers, acquisitions, and partnerships, which enable companies to expand their geographical presence and enter emerging markets.

Global Dairy Industry Analysis

Growth Drivers

- Increasing Consumption of Dairy Products (Per Capita Dairy Consumption): Global per capita dairy consumption has seen significant growth in recent years, driven by higher demand in both developed and emerging economies. According to the Food and Agriculture Organization (FAO), global dairy consumption reached 114.7 kg per person annually in 2022. Countries like India, with a per capita consumption of over 200 kg per year, are key contributors to this growth, while Chinas consumption has grown to 45 kg per capita. In high-income nations, such as the United States, consumption hovers around 105 kg per person. Rising incomes and urbanization further support increased consumption.

- Growing Population and Urbanization: Global population growth and urbanization are driving dairy consumption. The world population surpassed 8 billion in late 2022, with urban areas accounting for more than 56% of the total population, according to the World Bank. Urban consumers typically have more access to processed and packaged dairy products, leading to increased demand. In regions like Sub-Saharan Africa, the population is expected to reach over 1.4 billion in 2024, with urbanization rates at 40%. This demographic shift creates new opportunities for dairy producers to cater to urban markets with diversified product offerings.

- Health Benefits and Nutritional Value: The growing awareness of dairy products' health benefits, particularly their calcium and protein content, has been a major factor boosting global consumption. The FAO reports that dairy products provide 13% of the global dietary protein supply, a critical component for both bone health and muscle repair. On average, 100 grams of milk contains 3.3 grams of protein and 125 milligrams of calcium. This makes dairy a key nutritional component, especially in growing populations in developing countries, where deficiencies in calcium and protein are prevalent, driving up consumption of dairy products for nutritional supplementation.

Market Restraints

- Fluctuating Raw Milk Prices: Raw milk prices have been volatile, primarily driven by supply chain disruptions, feed costs, and weather conditions. The United States Department of Agriculture (USDA) reported that in 2023, raw milk prices ranged from $18 to $24 per hundredweight in key markets like the U.S. and the EU. Weather-induced supply shortages in major dairy-producing regions, such as droughts in the U.S. Midwest and Australia, have caused erratic pricing. Additionally, increasing costs for cattle feed, which rose 17% in 2022 due to global supply chain issues, further exacerbates price fluctuations.

- High Operational Costs: Operational costs in dairy farming and processing remain high due to rising energy prices and labor costs. In 2022, energy costs in Europe surged by over 20%, according to Eurostat, severely impacting dairy production as energy is crucial for refrigeration, pasteurization, and processing. Labor shortages in regions like the U.S. and Europe, exacerbated by the COVID-19 pandemic, have pushed wage rates higher, with average hourly wages for dairy farm workers increasing by 10% in 2023. These rising costs pressure producers to adopt more automation and energy-efficient technologies.

Global Dairy Market Future Outlook

The global dairy market is expected to witness significant growth over the next five years, driven by rising consumer demand for high-quality dairy products, advancements in dairy processing technology, and an increased focus on sustainability. Companies are likely to continue investing in organic and plant-based alternatives to meet the evolving dietary preferences of consumers. The market will also see growth in fortified dairy products, such as those enriched with probiotics and omega-3 fatty acids, catering to health-conscious consumers. Emerging markets, particularly in Asia and Africa, will play a crucial role in future growth, as increasing disposable incomes and urbanization drive demand for dairy products.

Market Opportunities

- Increasing Demand for Plant-Based Alternatives: The demand for plant-based dairy alternatives is rising rapidly, driven by health-conscious consumers and those with lactose intolerance. According to the FAO, around 70 million people globally are lactose intolerant, creating a substantial market for alternatives like almond, soy, and oat milk. While these products account for about 10% of global dairy sales, their market share is expected to grow due to the increasing focus on sustainable and ethical food production. In the U.S. alone, plant-based milk consumption has reached 1.2 billion liters in 2023.

- Expansion into Emerging Markets: Emerging markets in Asia, Africa, and Latin America offer substantial opportunities for dairy expansion due to growing populations and increasing disposable incomes. According to the World Bank, Africas middle class is expected to grow by 100 million by 2025, fueling demand for packaged dairy products. In Southeast Asia, dairy consumption has surged, with Vietnam, Thailand, and Indonesia reporting annual milk consumption levels of 20 to 50 liters per capita in 2023, compared to less than 10 liters a decade ago. These markets provide a ripe opportunity for dairy producers to introduce value-added products.

Scope of the Report

|

By Product Type |

Milk, Cheese, Butter, Yogurt, Other Dairy |

|

By Source |

Cow Milk, Buffalo Milk, Goat Milk, Plant-Based Dairy |

|

By Application |

Food & Beverages, Nutraceuticals, Infant Formula, Animal Feed |

|

By Distribution Channel |

Supermarkets and Hypermarkets, Convenience Stores, Specialty Stores, Online Retail |

|

By Region |

North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

Products

Key Target Audience

Dairy Producers

Dairy Processors

Dairy Ingredient Suppliers

Retailers and Distributors

Food & Beverage Manufacturers

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (USDA, FSSAI, European Food Safety Authority)

Packaging and Logistics Companies

Companies

Players Mentioned in the Report:

Nestl S.A.

Danone S.A.

Fonterra Co-operative Group

Arla Foods

Lactalis Group

Dairy Farmers of America

Yili Group

Saputo Inc.

Dean Foods

FrieslandCampina

Unilever (Dairy Segment)

Parmalat S.p.A.

Sodiaal

Amul (Gujarat Co-operative Milk Marketing Federation)

Mengniu Dairy

Table of Contents

1. Global Dairy Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (CAGR, growth momentum)

1.4. Market Segmentation Overview (By Product, By Source, By Application, By Distribution Channel, By Region)

2. Global Dairy Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Dairy Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Consumption of Dairy Products (per capita dairy consumption)

3.1.2. Growing Population and Urbanization

3.1.3. Health Benefits and Nutritional Value (calcium, protein)

3.1.4. Innovations in Dairy Processing Technologies

3.2. Market Challenges

3.2.1. Fluctuating Raw Milk Prices

3.2.2. High Operational Costs

3.2.3. Environmental Concerns (carbon footprint, water usage)

3.2.4. Regulatory Compliance (food safety regulations, quality standards)

3.3. Opportunities

3.3.1. Increasing Demand for Plant-Based Alternatives

3.3.2. Expansion into Emerging Markets

3.3.3. Innovative Packaging Solutions

3.4. Trends

3.4.1. Growth in Functional Dairy Products (probiotics, omega-3)

3.4.2. Rising Popularity of Organic and Grass-Fed Dairy

3.4.3. Technological Innovations in Dairy Farming (robotic milking systems)

3.5. Government Regulations

3.5.1. Dairy Safety and Quality Standards

3.5.2. Sustainability Goals and Carbon Neutral Initiatives

3.5.3. Subsidies and Support for Dairy Farmers

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Dairy farmers, processors, distributors)

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem (Market competition dynamics)

4. Global Dairy Market Segmentation

4.1. By Product Type (In Value %) 4.1.1. Milk (liquid milk, flavored milk)

4.1.2. Cheese (processed, natural)

4.1.3. Butter and Ghee

4.1.4. Yogurt (traditional, Greek, flavored)

4.1.5. Other Dairy Products (cream, condensed milk)

4.2. By Source (In Value %) 4.2.1. Cow Milk

4.2.2. Buffalo Milk

4.2.3. Goat Milk

4.2.4. Sheep Milk

4.2.5. Plant-Based Dairy (soy, almond, oat, coconut)

4.3. By Application (In Value %) 4.3.1. Food & Beverages (snacks, bakery)

4.3.2. Nutraceuticals (fortified dairy)

4.3.3. Infant Formula

4.3.4. Animal Feed

4.4. By Distribution Channel (In Value %) 4.4.1. Supermarkets and Hypermarkets

4.4.2. Convenience Stores

4.4.3. Specialty Stores

4.4.4. Online Retail

4.5. By Region (In Value %) 4.5.1. North America

4.5.2. Europe

4.5.3. Asia-Pacific

4.5.4. Latin America

4.5.5. Middle East & Africa

5. Global Dairy Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. Nestl S.A.

5.1.2. Danone S.A.

5.1.3. Fonterra Co-operative Group

5.1.4. Arla Foods

5.1.5. Lactalis Group

5.1.6. Dairy Farmers of America

5.1.7. Yili Group

5.1.8. Saputo Inc.

5.1.9. Dean Foods

5.1.10. FrieslandCampina

5.1.11. Unilever (Dairy segment)

5.1.12. Parmalat S.p.A.

5.1.13. Sodiaal

5.1.14. Amul (Gujarat Co-operative Milk Marketing Federation)

5.1.15. Mengniu Dairy

5.2 Cross Comparison Parameters

5.2.1. No. of Employees

5.2.2. Headquarters Location

5.2.3. Inception Year

5.2.4. Revenue

5.2.5. Dairy Production Capacity (liters)

5.2.6. Sustainability Initiatives

5.2.7. Product Innovation Focus

5.2.8. R&D Investment

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers And Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. Global Dairy Market Regulatory Framework

6.1. Food Safety Standards (Codex Alimentarius, FSSAI, FDA)

6.2. Compliance Requirements (HACCP, GMP)

6.3. Certification Processes (ISO 22000, Organic Certification)

7. Global Dairy Market Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global Dairy Market Future Segmentation

8.1. By Product Type (In Value %)

8.2. By Source (In Value %)

8.3. By Application (In Value %)

8.4. By Distribution Channel (In Value %)

8.5. By Region (In Value %)

9. Global Dairy Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis (Total Addressable Market/Serviceable Available Market/Serviceable Obtainable Market)

9.2. Customer Cohort Analysis (Segment behavior, buying preferences)

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the global dairy market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the global dairy market. This includes assessing market penetration, the ratio of dairy producers to service providers, and the resultant revenue generation. Furthermore, an evaluation of dairy product quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple dairy manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the global dairy market.

Frequently Asked Questions

01. How big is the Global Dairy Market?

The global dairy market is valued at USD 944 billion, driven by a growing demand for dairy products and an increase in urbanization across major regions like Asia-Pacific and Europe.

02. What are the challenges in the Global Dairy Market?

Challenges in the dairy market include fluctuating raw milk prices, high operational costs, and increasing environmental concerns, particularly with regard to the carbon footprint associated with dairy farming.

03. Who are the major players in the Global Dairy Market?

Key players include Nestl, Danone, Fonterra, Arla Foods, and Lactalis Group, all of which have significant production capacities and extensive distribution networks across the globe.

04. What are the growth drivers of the Global Dairy Market?

The market is driven by increasing global demand for high-protein foods, the rise in disposable income in emerging markets, and innovations in dairy processing and packaging technologies.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.