Global Dairy Protein Market Outlook to 2030

Region:Global

Author(s):Sanjna

Product Code:KROD9971

November 2024

83

About the Report

Global Dairy Protein Market Overview

- The global dairy protein market is valued at USD 13 billion, driven by the increasing global demand for high-protein diets, functional foods, and nutraceuticals. The market's growth is fueled by technological advancements in dairy processing, rising health consciousness, and the growing consumer preference for natural and organic protein sources. The fitness and wellness industry significantly contribute to demand, with whey protein and casein being the most sought-after products.

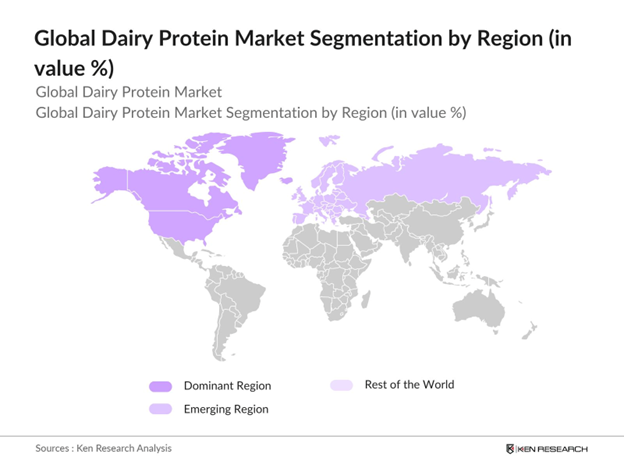

- North America and Europe dominate the dairy protein market due to their well-established dairy industries, high disposable incomes, and robust distribution networks. These regions are also home to leading dairy protein manufacturers and benefit from strong regulatory frameworks supporting high-quality standards in dairy protein production.

- Regulatory frameworks, such as the National Air Quality Monitoring Program (NAQMP), indirectly affect dairy protein production. NAQMP initiatives mandate sustainable practices for large-scale farming, a major raw material source for dairy proteins. For example, in 2023, the U.S. Environmental Protection Agency (EPA) reported a 9% decrease in ammonia emissions from dairy farms due to compliance with air quality standards. This regulatory push ensures environmentally sustainable practices while maintaining the quality of raw dairy inputs.

Global Dairy Protein Market Segmentation

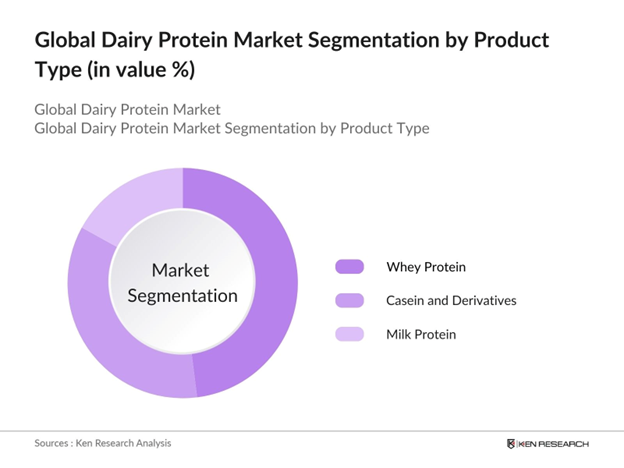

By Product Type: The dairy protein market is segmented by product type into whey protein, casein and derivatives, and milk protein concentrates. Whey protein holds a dominant market share due to its superior digestibility, complete amino acid profile, and wide application in sports nutrition and functional foods. Its versatility in formulating beverages, powders, and bars has further cemented its position in the market.

By Region: The dairy protein market is segmented by region into North America, Europe, Asia-Pacific, and Rest of the World. North America leads the market due to high consumer awareness, widespread availability of dairy-based products, and the presence of major manufacturers. The region also benefits from extensive R&D activities and strong demand for functional foods.

By Application: The dairy protein market is segmented by application into food and beverages, dietary supplements, and personal care. The food and beverages segment dominates, driven by the rising demand for protein-enriched products like yogurts, bakery items, and ready-to-drink beverages. Innovations in dairy protein formulations have also enabled the integration of these proteins into various convenience foods.

Global Dairy Protein Market Competitive Landscape

The dairy protein market is dominated by both global and regional players who focus on expanding product portfolios, improving quality standards, and investing in innovative solutions.

Global Dairy Protein Market Analysis

Growth Drivers

- Rising Consumer Awareness About Health and Nutrition: In recent years, there has been a significant increase in consumer awareness regarding health and nutrition. For instance, the World Health Organization (WHO) reported that in 2022, approximately 1.9 billion adults worldwide were overweight, with over 650 million classified as obese. This alarming statistic has led to a surge in demand for healthier food options, including dairy proteins known for their high nutritional value. Additionally, the Food and Agriculture Organization (FAO) noted that global milk production reached 930 million tonnes in 2022, reflecting the growing consumption of dairy products as part of a balanced diet.

- Expansion of the Fitness and Wellness Industry: The global fitness and wellness industry has experienced substantial growth, contributing to increased consumption of dairy protein products. According to the International Health, Racquet & Sportsclub Association (IHRSA), the global health club industry generated revenues of $96.7 billion in 2022, with over 210,000 clubs serving 184 million members. This expansion has led to a higher demand for protein supplements, including dairy-based options, as individuals seek to enhance muscle recovery and overall health.

- Innovation in Food Technology: Advancements in food technology have enabled the development of innovative dairy protein products that cater to diverse consumer preferences. The U.S. Food and Drug Administration (FDA) approved 55 new food products in 2023, many of which incorporated dairy proteins in novel forms such as ready-to-drink shakes, protein bars, and lactose-free options. These innovations have made dairy proteins more accessible and appealing to a broader audience, driving market growth.

Challenges

- High Initial Costs: The production of dairy protein products involves significant initial investments in technology and infrastructure. According to the U.S. Department of Agriculture (USDA), establishing a medium-sized dairy processing plant can require capital expenditures ranging from $2 million to $5 million, depending on capacity and technology. These high costs can be a barrier for new entrants and may limit the expansion of existing producers.

- Technical Challenges: Producing high-quality dairy protein products requires advanced technical expertise. The National Dairy Council (NDC) highlights that maintaining protein stability, solubility, and flavor during processing can be challenging. For example, achieving the desired texture in protein-enriched yogurts necessitates precise control over processing parameters, which can be technically demanding and may require specialized equipment.

Global Dairy Protein Market Future Outlook

The global dairy protein market is expected to experience significant growth over the coming years, driven by rising consumer awareness about the health benefits of dairy protein, ongoing product innovation, and expanding applications in new markets. The increasing preference for plant-based alternatives may lead to diversification within the sector, creating a balanced competitive landscape.

Market Opportunities

- Technological Advancements: Emerging technologies present opportunities for enhancing dairy protein production. The adoption of membrane filtration techniques, such as microfiltration and ultrafiltration, has improved protein isolation processes, resulting in higher purity products. The European Food Safety Authority (EFSA) approved several new processing aids in 2023 that facilitate these advanced filtration methods, enabling producers to develop innovative dairy protein products with improved functional properties.

- International Collaborations: Collaborations between dairy producers and international research institutions can drive innovation and market expansion. In 2023, the Global Dairy Platform, in partnership with the Food and Agriculture Organization (FAO), launched initiatives aimed at improving sustainability and nutritional quality in dairy production. Such collaborations can lead to the development of new products and open access to emerging markets, fostering growth in the dairy protein sector.

Scope of the Report

|

Segment |

Sub-Segments |

|

Product Type |

Indoor Air Quality Monitors |

|

Application |

Residential |

|

Technology |

Continuous Monitoring |

|

Pollutant Type |

Particulate Matter (PM2.5, PM10) |

|

Region |

Java |

Products

Key Target Audience

Food and Beverage Manufacturers

Nutraceutical Companies

Fitness and Sports Nutrition Brands

Research and Development Institutes

Retail and E-commerce Companies

Packaging and Processing Companies

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., FDA, EFSA)

Companies

Players Mentioned in the Report

Glanbia plc

Arla Foods Ingredients Group

Fonterra Co-operative Group

FrieslandCampina

Kerry Group

Saputo Inc.

Hilmar Cheese Company

Lactalis Ingredients

Agropur Cooperative

Milk Specialties Global

Table of Contents

1. Global Dairy Protein Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Dairy Protein Market Size (In USD Million)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Dairy Protein Market Analysis

3.1. Growth Drivers

3.1.1. Rising Consumer Awareness About Health and Nutrition

3.1.2. Expansion of the Fitness and Wellness Industry

3.1.3. Innovation in Food Technology

3.1.4. Increasing Disposable Income and Urbanization

3.2. Market Challenges

3.2.1. High Initial Costs

3.2.2. Technical Challenges

3.2.3. Lack of Skilled Workforce

3.3. Opportunities

3.3.1. Technological Advancements

3.3.2. International Collaborations

3.3.3. Expansion into Rural Areas

3.4. Trends

3.4.1. Adoption of IoT

3.4.2. Integration with Smart City Projects

3.4.3. Increased Use of Mobile Monitoring Units

3.5. Government Regulation

3.5.1. National Air Quality Monitoring Program

3.5.2. Emission Reduction Targets

3.5.3. Clean Air Initiative

3.5.4. Public-Private Partnerships

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. Global Dairy Protein Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Indoor Air Quality Monitors

4.1.2. Outdoor Air Quality Monitors

4.2. By Application (In Value %)

4.2.1. Residential

4.2.2. Commercial

4.2.3. Industrial

4.3. By Technology (In Value %)

4.3.1. Continuous Monitoring

4.3.2. Intermittent Monitoring

4.4. By Pollutant Type (In Value %)

4.4.1. Particulate Matter (PM2.5, PM10)

4.4.2. Gaseous Pollutants (NO2, SO2, CO, O3)

4.5. By Region (In Value %)

4.5.1. Java

4.5.2. Sumatra

4.5.3. Kalimantan

4.5.4. Sulawesi

4.5.5. Papua

5. Global Dairy Protein Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Thermo Fisher Scientific

5.1.2. Siemens AG

5.1.3. Horiba Ltd.

5.1.4. Teledyne Technologies Incorporated

5.1.5. 3M Company

5.1.6. Aeroqual

5.1.7. Honeywell International Inc.

5.1.8. Emerson Electric Co.

5.1.9. TSI Incorporated

5.1.10. Testo SE & Co. KGaA

5.1.11. PerkinElmer Inc.

5.1.12. Agilent Technologies Inc.

5.1.13. Acoem Group

5.1.14. Environnement S.A

5.1.15. Ecotech Pty Ltd.

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Global Dairy Protein Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. Global Dairy Protein Market Future Size (In USD Million)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global Dairy Protein Market Future Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By Technology (In Value %)

8.4. By Pollutant Type (In Value %)

8.5. By Region (In Value %)

9. Global Dairy Protein Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

10. Disclaimer

11. Contact Us

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves identifying major stakeholders in the dairy protein market, supported by detailed desk research. Proprietary databases and secondary research are utilized to gather comprehensive industry information, defining critical market variables.

Step 2: Market Analysis and Construction

This phase compiles historical market data, including consumption patterns, pricing trends, and revenue generation. Detailed analysis ensures reliable and accurate insights into market performance.

Step 3: Hypothesis Validation and Expert Consultation

Industry hypotheses are validated through consultations with dairy protein manufacturers, industry experts, and nutritionists, ensuring the refinement of data through direct operational insights.

Step 4: Research Synthesis and Final Output

The final phase integrates primary and secondary data to ensure a well-rounded market analysis. Data verification from stakeholders strengthens the credibility of the report.

Frequently Asked Questions

01. How big is the global dairy protein market?

The global dairy protein market is valued at USD 13 billion, supported by rising demand for functional foods, dietary supplements, and high-protein diets.

02. What are the challenges in the dairy protein market?

Challenges in global dairy protein market include fluctuating raw material prices, high production costs, and growing competition from plant-based protein alternatives.

03. Who are the major players in the dairy protein market?

Key players in global dairy protein market include Glanbia plc, Arla Foods Ingredients Group, Fonterra Co-operative Group, FrieslandCampina, and Kerry Group, recognized for their robust supply chains and innovative product offerings.

04. What drives the growth of the dairy protein market?

Growth in global dairy protein market is driven by increasing consumer health consciousness, advancements in dairy processing, and expanding applications in food, beverages, and personal care.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.