Global Data and Analytics Software Market Outlook to 2030

Region:Global

Author(s):Abhinav kumar

Product Code:KROD2043

December 2024

86

About the Report

Global Data and Analytics Software Market Overview

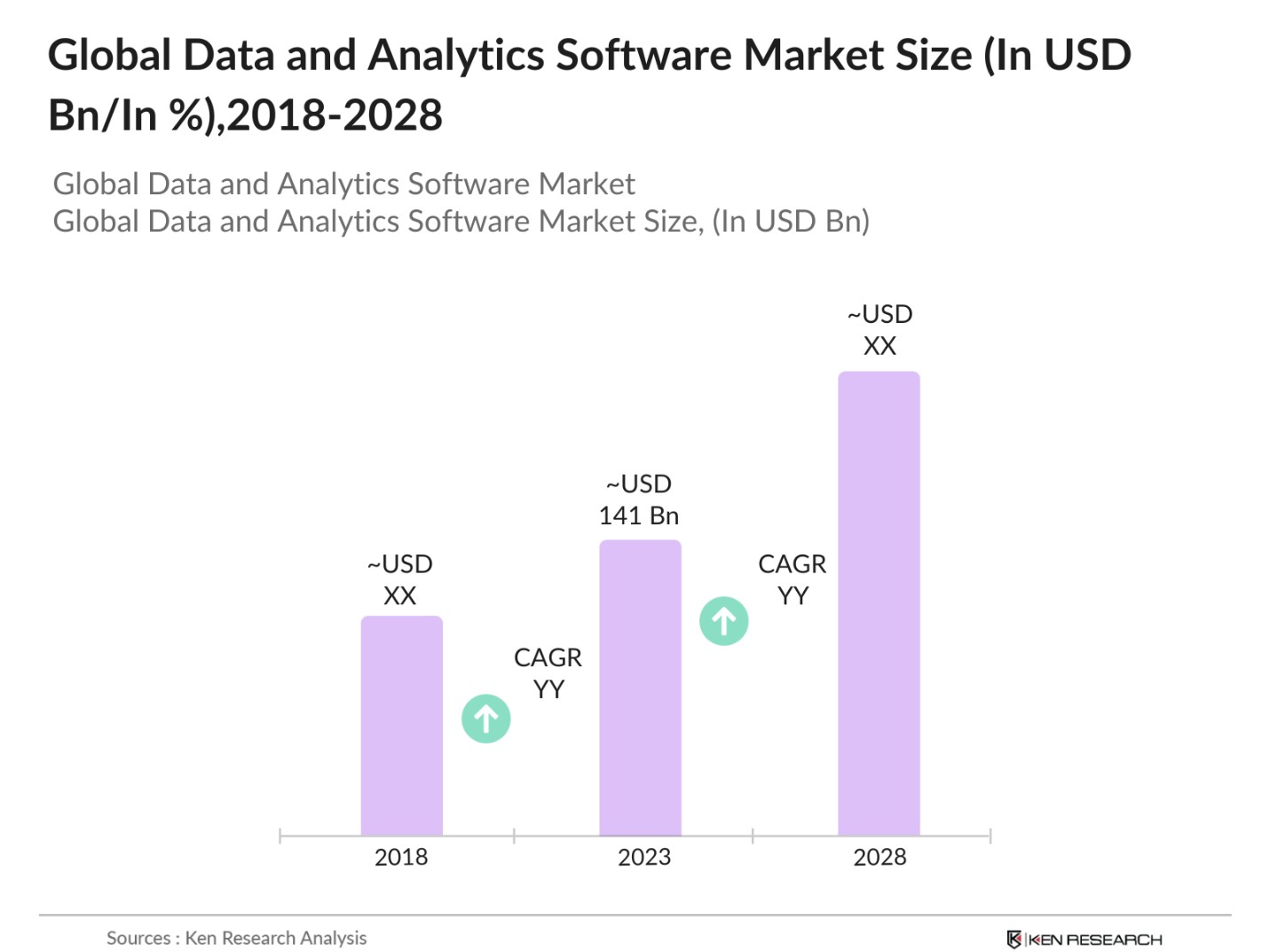

- The Global Data and Analytics Software Market was valued at USD 141 billion in 2023. This market growth is driven by the increasing demand for real-time data analytics, the shift towards cloud-based data platforms, and the integration of AI and machine learning in business intelligence processes.

- Major players in the global data and analytics software market include IBM Corporation, Microsoft Corporation, Oracle Corporation, SAP SE, and SAS Institute Inc. These companies lead the development of advanced analytics platforms, focusing on enhancing AI-driven data processing, predictive analytics, and cloud-based solutions to meet the growing need for data management and analysis.

- In 2023, Oracle Corporation expanded its Oracle Analytics Cloud platform by adding machine learning-driven analytics features that enable companies to derive predictive insights in real-time. This expansion is aimed at increasing the accessibility of data analytics for both large enterprises and SMEs, thereby boosting the market's growth.

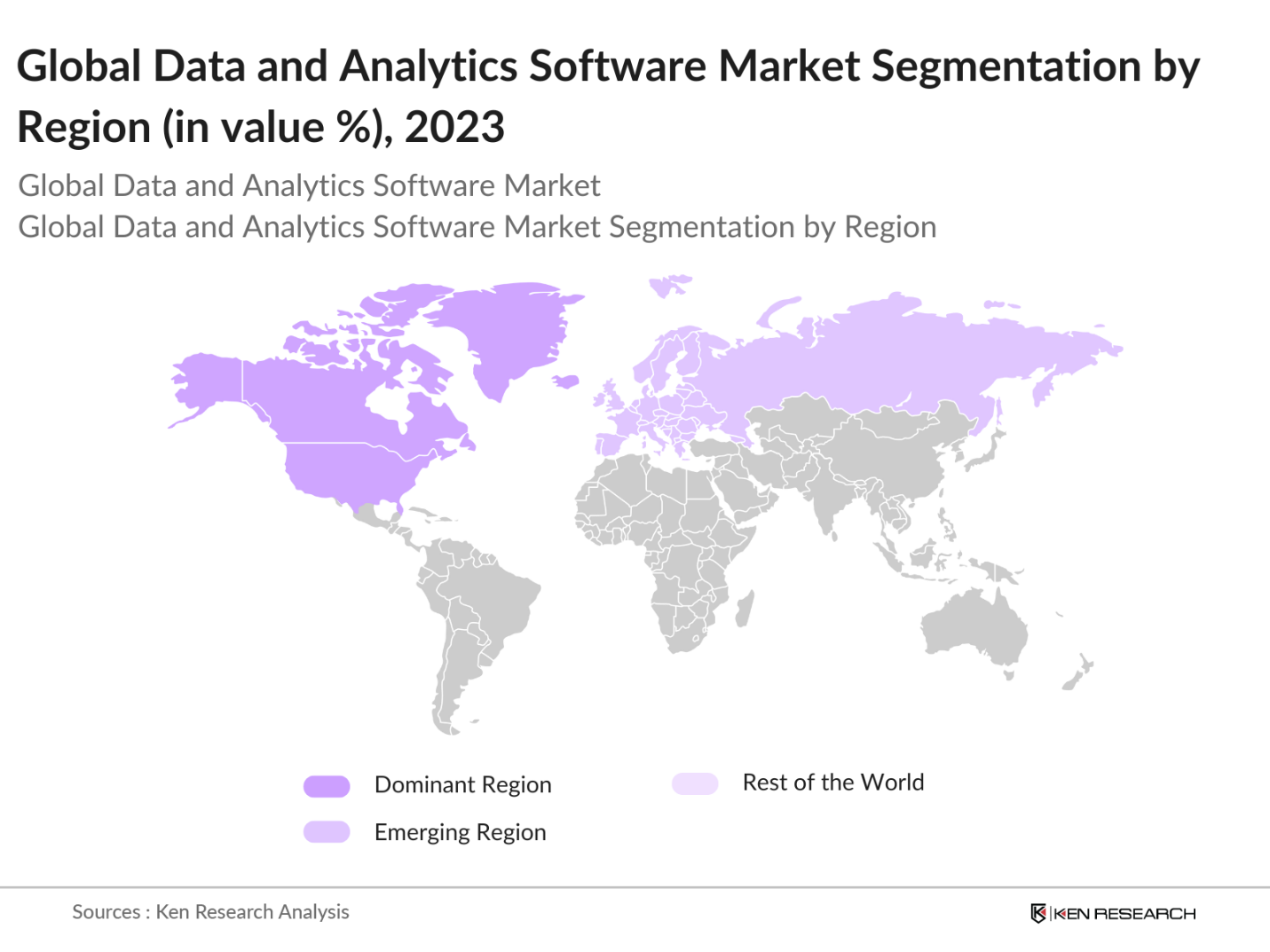

- North America dominated the global data and analytics software market in 2023, primarily due to its advanced IT infrastructure, early adoption of AI and cloud computing technologies, and the presence of major market players. The region also benefits from strong investments in digital transformation initiatives across industries.

Global Data and Analytics Software Market Segmentation

The global data and analytics software market is segmented by region, component, and deployment mode.

By Region: The global data and analytics software market is segmented into North America, Europe, Asia-Pacific (APAC), Middle East & Africa (MEA), and Latin America. In 2023, North America led the market due to its early adoption of advanced analytics solutions and robust cloud infrastructure. APAC, particularly China and India, is expected to experience significant growth due to rising investments in digital transformation.

By Component: The market is segmented into software and services. In 2023, the software segment held the highest market share, driven by the growing demand for advanced analytics platforms that provide real-time insights and predictive analytics. Businesses prefer comprehensive software solutions that centralize data management and streamline analytics processes.

By Deployment Mode: The market is segmented into cloud-based and on-premise solutions. In 2023, the cloud-based segment dominated the market due to the increasing need for scalable, cost-efficient data analytics platforms that offer flexibility and remote access. Enterprises are moving towards cloud solutions to improve data accessibility and processing power.

Global Data and Analytics Software Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

|

IBM Corporation |

1911 |

Armonk, New York, USA |

|

Microsoft Corporation |

1975 |

Redmond, Washington, USA |

|

Oracle Corporation |

1977 |

Austin, Texas, USA |

|

SAP SE |

1972 |

Walldorf, Germany |

|

SAS Institute Inc. |

1976 |

Cary, North Carolina, USA |

- IBM Corporation: In its 2023 annual report, IBM reported revenues of $61.9 billion, reflecting a 3% increase at constant currency. The company noted a growing demand for its watsonx platform, which is integral to its AI and data strategies. This platform has reportedly doubled its book of business in generative AI from Q3 to Q4 of 2023

- Microsoft Corporation: In 2024, Microsoft expanded its Azure Data Factory capabilities to support more complex data integration processes, aimed at improving analytics for SMEs and large enterprises. This update allows users to process larger data sets more efficiently, further boosting Microsofts presence in the data analytics market.

Global Data and Analytics Software Market Analysis

Global Data and Analytics Software Market Growth Drivers:

- Rising Demand for Real-time Data Analytics Solutions: In 2023, businesses increasingly require real-time data analytics to enhance decision-making and operational efficiency. Sectors like finance, healthcare, and retail have invested in data analytics platforms to process and analyze vast volumes of data. For instance, in 2023, the healthcare sector alone saw an influx in analytics investments, aimed at improving patient outcomes through predictive analysis.

- Cloud Migration and Adoption of AI-Powered Analytics: A significant driver for the market is the migration of enterprise data to the cloud, paired with the adoption of AI-powered analytics tools. In 2023, enterprises globally spent over $21 billion on cloud-based analytics platforms, enhancing data accessibility and processing power. Large enterprises, such as Microsoft and Oracle, have invested heavily in expanding their AI-powered analytics offerings, fueling demand.

- Government Initiatives Supporting Digital Transformation: Government initiatives, such as the U.S. Federal Data Strategy and the European Digital Agenda, have encouraged the adoption of data analytics tools to improve operational efficiency and public services. These initiatives are expected to positively impact the global data and analytics software market.

Global Data and Analytics Software Market Challenges:

- Data Privacy and Security Concerns: As businesses increasingly rely on cloud-based platforms, concerns over data privacy and security have risen. Compliance with stringent regulations such as the GDPR in Europe is a major challenge for market players, adding to operational costs.

- Shortage of Skilled Data Professionals: The demand for skilled data professionals continues to outpace supply, creating a talent gap in the market. This shortage limits the ability of enterprises to fully leverage advanced analytics tools, particularly in emerging markets.

Global Data and Analytics Software Market Government Initiatives:

- European Union's Digital Europe Programme (2023): The EU launched its Digital Europe Programme in 2023, with a budget of 7.5 billion aimed at supporting digital transformation, including advanced data analytics. This initiative is designed to enhance data accessibility, cybersecurity, and cloud computing adoption across the region. It aims to create a robust digital ecosystem by building capacities in data analytics.

- Indias National Data and Analytics Policy (2023): India introduced its National Data and Analytics Policy in 2023, which is a government initiative aimed at leveraging data for public welfare. With an investment, the policy focuses on the use of data analytics for improving governance, healthcare, and education services. The policy's emphasis on big data solutions and cloud-based analytics presents significant growth opportunities for the software market.

Global Data and Analytics Software Market Future Market Outlook

The global data and analytics software market is expected to witness substantial growth through 2028, driven by advancements in AI and machine learning, increased demand for cloud-based analytics platforms, and the growing need for real-time data processing across industries.

Future Market Trends

- AI Integration in Data Analytics Platforms: By 2028, the integration of AI and machine learning into data analytics platforms will become increasingly common. AI-driven analytics solutions will enable businesses to automate decision-making processes and extract valuable insights from large data sets.

- Expansion in Emerging Markets: By 2028, the adoption of data analytics solutions in emerging markets, particularly in APAC and Latin America, is expected to grow significantly. Governments in these regions are investing in digital infrastructure, which will drive demand for data analytics tools.

Scope of the Report

|

By Component |

Software services |

|

By Deployment Mode |

Cloud-Based On-Premise |

|

By Organization Size |

Large Enterprises Small Enterprises |

|

By End-Use Industry |

BFSI IT & Telecom Healthcare Retail Manufacturing |

|

By Region |

North India South India West India East India |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing to This Report:

Large Enterprises

Small and Medium-Sized Enterprises (SMEs)

Data Analytics Industries

Cloud Service Companies

IT Infrastructure Companies

Healthcare Companies

Investments and Venture Capitalist Firms

E-commerce Companies

Government and regulatory bodies (EDPB, FSB)

Time Period Captured in the Report

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report

IBM Corporation

Microsoft Corporation

Oracle Corporation

SAP SE

SAS Institute Inc.

Amazon Web Services (AWS)

Teradata Corporation

Alteryx Inc.

Tableau Software (Salesforce)

MicroStrategy Inc.

Table of Contents

1. Global Data and Analytics Software Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Data and Analytics Software Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Data and Analytics Software Market Analysis

3.1. Growth Drivers

3.1.1. Rising Demand for Real-time Data Analytics Solutions

3.1.2. Cloud Migration and Adoption of AI-Powered Analytics

3.1.3. Government Initiatives Supporting Digital Transformation

3.2. Market Challenges

3.2.1. Data Privacy and Security Concerns

3.2.2. Shortage of Skilled Data Professionals

3.2.3. Integration with Legacy Systems

3.3. Opportunities

3.3.1. Expansion into Emerging Markets

3.3.2. Technological Advancements in Predictive Analytics

3.3.3. Increased Focus on Cloud-based Data Solutions

3.4. Trends

3.4.1. AI Integration in Data Analytics Platforms

3.4.2. Rise of Edge Computing in Analytics

3.4.3. Expansion of Data Analytics in SMEs

3.5. Government Regulation

3.5.1. GDPR Compliance and Data Privacy Regulations

3.5.2. National Data and Analytics Policies

3.5.3. Cybersecurity Standards

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porter’s Five Forces Analysis

3.9. Competition Ecosystem

4. Global Data and Analytics Software Market Segmentation

4.1. By Component (In Value %)

4.1.1. Software

4.1.2. Services

4.2. By Deployment Mode (In Value %)

4.2.1. Cloud-Based

4.2.2. On-Premise

4.3. By Organization Size (In Value %)

4.3.1. Large Enterprises

4.3.2. SMEs

4.4. By End-Use Industry (In Value %)

4.4.1. BFSI

4.4.2. IT & Telecom

4.4.3. Healthcare

4.4.4. Retail

4.4.5. Manufacturing

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia-Pacific

4.5.4. Middle East & Africa

4.5.5. Latin America

5. Global Data and Analytics Software Market Competitive Analysis

5.1. Detailed Profiles of Major Companies (Headquarters, Inception Year, Revenue, AI-powered Platforms)

5.1.1. IBM Corporation

5.1.2. Microsoft Corporation

5.1.3. Oracle Corporation

5.1.4. SAP SE

5.1.5. SAS Institute Inc.

5.1.6. Amazon Web Services (AWS)

5.1.7. Teradata Corporation

5.1.8. Alteryx Inc.

5.1.9. Tableau Software (Salesforce)

5.1.10. MicroStrategy Inc.

5.1.11. TIBCO Software Inc.

5.1.12. Informatica LLC

5.1.13. Splunk Inc.

5.1.14. QlikTech International AB

5.1.15. Zoho Analytics

5.2. Cross Comparison Parameters (Revenue, Headquarters, AI Integration, Cloud Solutions, Real-time Data Processing, Market Share, Service Offerings, Global Presence)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.4.1. Mergers & Acquisitions

5.4.2. Partnerships & Collaborations

5.5. Investment Analysis

5.6. Venture Capital Funding

5.7. Government Grants

5.8. Private Equity Investments

6. Global Data and Analytics Software Market Regulatory Framework

6.1. Data Privacy and Security Regulations

6.2. Compliance Requirements for Cloud-Based Solutions

6.3. Certification Processes for AI-Driven Platforms

7. Global Data and Analytics Software Market Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global Data and Analytics Software Market Future Segmentation

8.1. By Component (In Value %)

8.2. By Deployment Mode (In Value %)

8.3. By Organization Size (In Value %)

8.4. By End-Use Industry (In Value %)

8.5. By Region (In Value %)

9. Global Data and Analytics Software Market Analysts' Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step: 1 Identifying Key Variables

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around the Market to collate Market-level information.

Step: 2 Market Building

Collating statistics on the global data and analytics software market over the years, and analyzing the penetration of Marketplaces as well as the ratio of service providers to compute the revenue generated for the market. We will also review service quality statistics to understand the revenue generated which can ensure accuracy behind the data points shared.

Step: 3 Validating and Finalizing

Building Market hypotheses and conducting CATIs with Market experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step: 4 Research Output

Our team will approach multiple data and analytics software companies to understand the nature of service segments, consumer preferences, and other parameters. This supports validating statistics derived through a bottom-to-top approach from these data and analytics software companies, ensuring accuracy and reliability in the report.

Frequently Asked Questions

01. How big is the Global Data and Analytics Software Market?

The global data and analytics software market was valued at $141 billion in 2023. The market is driven by increased digital transformation, cloud migration, and the growing demand for real-time data analytics across various industries, including healthcare, finance, and retail.

02. What are the challenges in the Global Data and Analytics Software Market?

Challenges in the global data and analytics software market include data privacy concerns, the shortage of skilled data professionals, and integration issues with legacy systems. Additionally, stringent regulatory requirements in regions like the EU add to compliance costs for enterprises.

03. Who are the major players in the Global Data and Analytics Software Market?

Major players in the global data and analytics software market include IBM Corporation, Microsoft Corporation, Oracle Corporation, SAP SE, and SAS Institute Inc. These companies dominate the market with their comprehensive platforms, cloud solutions, and AI-powered analytics tools.

04. What are the growth drivers of the Global Data and Analytics Software Market?

Key growth drivers include the increasing adoption of AI-powered analytics, the rising demand for cloud-based solutions, and government initiatives promoting digital transformation. The healthcare, finance, and retail sectors are significant contributors to the markets expansion.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.