Global Data Center and Cloud Services Market Outlook to 2030

Region:Global

Author(s):Geetanshi

Product Code:KROD-008

June 2025

96

About the Report

Global Data Center and Cloud Services Market Overview

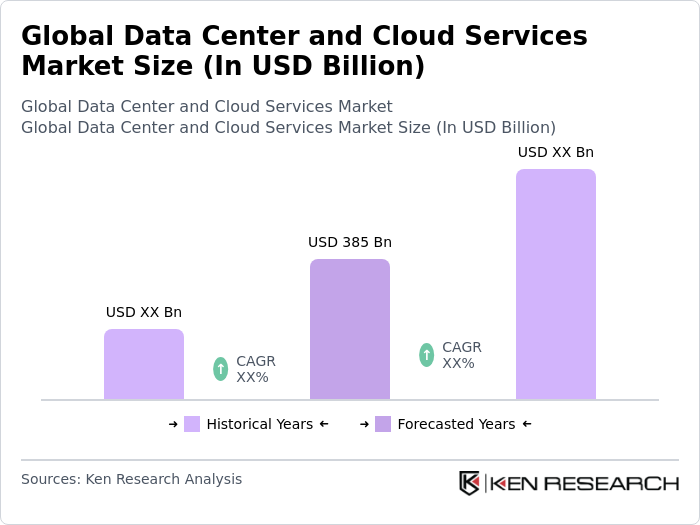

- The Global Data Center and Cloud Services Market was valued at USD 385 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing demand for cloud computing services, the rise of big data analytics, and the need for scalable IT infrastructure. The market has seen a significant shift towards hybrid and multi-cloud environments, which has further fueled investment in data center capabilities.

- Key players in this market include the United States, China, and Germany. The United States dominates due to its advanced technological infrastructure, a high concentration of hyperscale data centers, and a robust cloud services ecosystem. China follows closely, driven by its rapid digital transformation and government support for technology initiatives. Germany is a leader in Europe, benefiting from stringent data protection regulations and a strong industrial base.

- In 2023, the European Union implemented the Digital Services Act, which aims to create a safer digital space and establish clear responsibilities for online platforms. This regulation impacts the data center and cloud services market by enforcing stricter compliance requirements for data handling and user privacy, thereby influencing operational practices and service offerings across the industry.

Global Data Center and Cloud Services Market Segmentation

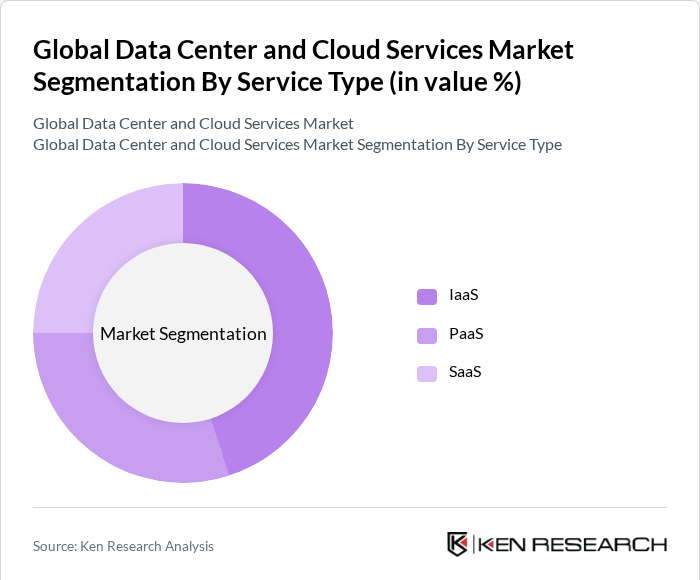

By Service Type: The service type segmentation includes Infrastructure as a Service (IaaS), Platform as a Service (PaaS), and Software as a Service (SaaS). Among these, IaaS is dominating the market due to its flexibility and cost-effectiveness, allowing businesses to scale their IT resources according to demand. The growing trend of remote work and the need for robust disaster recovery solutions have further accelerated the adoption of IaaS. Companies are increasingly opting for IaaS to reduce capital expenditures and enhance operational efficiency.

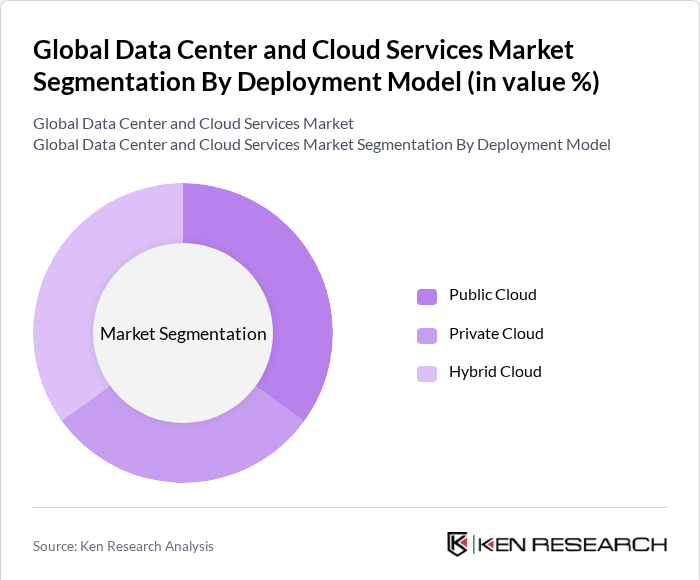

By Deployment Model: The deployment model segmentation includes Public Cloud, Private Cloud, and Hybrid Cloud. The Hybrid Cloud segment is leading the market as organizations seek to combine the benefits of both public and private clouds. This model allows for greater flexibility, enabling businesses to manage sensitive data in private environments while leveraging the scalability of public cloud services. The increasing need for data security and compliance is driving the preference for hybrid solutions among enterprises.

Global Data Center and Cloud Services Market Competitive Landscape

The Global Data Center and Cloud Services Market is characterized by intense competition among key players such as Amazon Web Services, Microsoft Azure, Google Cloud, IBM Cloud, and Alibaba Cloud. These companies are continuously innovating and expanding their service offerings to capture a larger market share. The market is also witnessing a trend towards consolidation, with larger firms acquiring smaller players to enhance their technological capabilities and service portfolios.

Global Data Center and Cloud Services Market Industry Analysis

Growth Drivers

- Increasing Demand for Scalable IT Infrastructure: The global data center industry is experiencing rapid expansion, with capacity projected to grow at an annual rate of 15% through 2025, though supply still struggles to meet demand. Data centers consumed 7.4 gigawatts of power in 2023, a 55% increase from 2022, reflecting escalating operational scale and energy needs. Preleasing rates for new data center space are expected to exceed 90% in 2025, indicating strong market absorption and limited vacancy.

- Rising Adoption of Cloud-Based Solutions: The rapid expansion of cloud services is driving significant increases in data center energy consumption, with U.S. data centers using 176 terawatt-hours (TWh) of electricity in 2023—accounting for 4.4% of the nation’s total electricity use. This marks a substantial rise from 76 TWh in 2018, reflecting growing demand from industries such as healthcare and finance leveraging cloud technologies for improved agility and service delivery. AI workloads have been a major contributor, with GPU-accelerated server energy use jumping from under 2 TWh in 2017 to over 40 TWh in 2023.

- Growing Need for Data Storage and Management: As digital transformation accelerates, organizations are generating and managing unprecedented volumes of data, with global data creation expected to exceed 175 zettabytes by 2025. This explosive growth drives a critical demand for advanced data storage and management solutions that ensure efficient accessibility, security, and scalability. Enterprises increasingly rely on cloud-based platforms and hybrid storage architectures to handle diverse data types and workloads, enabling real-time analytics and improved decision-making.

Market Challenges

- High Initial Investment Costs: One of the primary challenges facing the data center and cloud services market is the high initial investment required for infrastructure development. Building a data center demands substantial capital, which can act as a barrier for small to medium-sized enterprises. In addition, operational costs such as maintenance, energy consumption, and staffing further strain IT budgets, making it difficult for organizations to justify large-scale investments.

- Data Security and Privacy Concerns: Data security remains a significant challenge, with cyber threats becoming increasingly sophisticated. Organizations are at risk of substantial financial and reputational losses from data breaches. Compliance with regulations such as GDPR and HIPAA adds to the complexity, as companies must invest in robust cybersecurity frameworks to safeguard sensitive information. These concerns can deter businesses from fully adopting cloud solutions, thereby affecting market growth.

Global Data Center and Cloud Services Market Future Outlook

The future of the data center and cloud services market appears promising, driven by technological advancements and evolving consumer needs. As organizations increasingly adopt hybrid and multi-cloud strategies, the demand for integrated solutions will rise. Furthermore, the expansion of 5G technology is expected to enhance cloud service capabilities, enabling faster data processing and improved connectivity. This trend will likely lead to increased investments in data centers, fostering innovation and competition within the industry.

Market Opportunities

- Expansion of 5G Technology: The rollout of 5G technology is rapidly advancing, with global 5G population coverage expected to reach approximately 55% by the end of 2024. Outside mainland China, coverage was around 40% at the end of 2023 and is projected to rise to about 80% by 2029. Regions like North America and India lead with mid-band 5G coverage exceeding 85%, while Latin America and parts of Africa lag behind with less than 10% coverage.

- Focus on Sustainability: Increasing emphasis on sustainability is driving data centers to adopt energy-efficient technologies such as advanced cooling systems, renewable energy integration, and innovative infrastructure designs. These green data centers reduce energy consumption and water usage, significantly lessening their ecological footprint and contributing to climate change mitigation.

Scope of the Report

| By Service Type |

Infrastructure as a Service (IaaS) Platform as a Service (PaaS) Software as a Service (SaaS) |

| By Deployment Model |

Public Cloud Private Cloud Hybrid Cloud |

| By End-User Industry |

IT and Telecommunications Banking, Financial Services, and Insurance (BFSI) Healthcare Retail Government |

| By Geography |

North America Europe Asia-Pacific Latin America Middle East and Africa |

| By Data Center Type |

Enterprise Data Centers Colocation Data Centers Hyperscale Data Centers |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Federal Communications Commission, National Institute of Standards and Technology)

Telecommunications Service Providers

Data Center Operators

Cloud Service Providers

Energy Providers and Utility Companies

Real Estate Investment Trusts (REITs) specializing in data centers

Technology Infrastructure Companies

Companies

Players Mentioned in the Report:

Amazon Web Services

Microsoft Azure

Google Cloud

IBM Cloud

Alibaba Cloud

Oracle Cloud Infrastructure

DigitalOcean

Vultr

Linode

Rackspace Cloud

Table of Contents

1. Global Data Center and Cloud Services Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Data Center and Cloud Services Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Data Center and Cloud Services Market Analysis

3.1. Growth Drivers

3.1.1. Increasing demand for scalable and flexible IT infrastructure

3.1.2. Rising adoption of cloud-based solutions across various industries

3.1.3. Growing need for data storage and management due to digital transformation

3.2. Market Challenges

3.2.1. High initial investment and operational costs

3.2.2. Data security and privacy concerns

3.2.3. Rapid technological changes leading to obsolescence

3.3. Opportunities

3.3.1. Expansion of 5G technology enhancing cloud service capabilities

3.3.2. Increasing focus on sustainability and green data centers

3.3.3. Growth of edge computing creating new service demands

3.4. Trends

3.4.1. Shift towards hybrid and multi-cloud strategies

3.4.2. Increased automation and AI integration in data center operations

3.4.3. Enhanced focus on cybersecurity measures and compliance

3.5. Government Regulation

3.5.1. Data protection regulations impacting cloud service operations

3.5.2. Environmental regulations promoting energy-efficient data centers

3.5.3. Compliance requirements for financial and healthcare sectors

3.5.4. International standards influencing global data center operations

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porter’s Five Forces

3.9. Competition Ecosystem

4. Global Data Center and Cloud Services Market Segmentation

5. Global Data Center and Cloud Services Market Segmentation

5.1. By Service Type

5.1.1 Infrastructure as a Service (IaaS)

5.1.2 Platform as a Service (PaaS)

5.1.3 Software as a Service (SaaS)

5.2. By Deployment Model

5.2.1 Public Cloud

5.2.2 Private Cloud

5.2.3 Hybrid Cloud

5.3. By End-User Industry

5.3.1 IT and Telecommunications

5.3.2 Banking, Financial Services, and Insurance (BFSI)

5.3.3 Healthcare

5.3.4 Retail

5.3.5 Government

5.4. By Geography

5.4.1 North America

5.4.2 Europe

5.4.3 Asia-Pacific

5.4.4 Latin America

5.4.5 Middle East and Africa

5.5. By Data Center Type

5.5.1 Enterprise Data Centers

5.5.2 Colocation Data Centers

5.5.3 Hyperscale Data Centers

6. Global Data Center and Cloud Services Market Competitive Analysis

6.1. Detailed Profiles of Major Companies

Amazon Web Services, Microsoft Azure, Google Cloud, IBM Cloud, Alibaba Cloud, Oracle Cloud Infrastructure, DigitalOcean, Vultr, Linode, Rackspace Cloud

6.2. Cross Comparison Parameters

6.2.1. Market Share Analysis

6.2.2. Revenue Growth Rate

6.2.3. Customer Satisfaction Index

6.2.4. Service Availability and Uptime

6.2.5. Pricing Models Comparison

6.2.6. Innovation Index

6.2.7. Geographic Reach and Expansion

6.2.8. Partnership and Collaboration Strategies

7. Global Data Center and Cloud Services Market Regulatory Framework

7.1. Environmental Standards

7.2. Compliance Requirements

7.3. Certification Processes

8. Global Data Center and Cloud Services Market Future Market Size (In USD Bn)

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

9. Global Data Center and Cloud Services Market Future Market Segmentation

9.1. By Service Type

9.1.1 Infrastructure as a Service (IaaS)

9.1.2 Platform as a Service (PaaS)

9.1.3 Software as a Service (SaaS)

9.2. By Deployment Model

9.2.1 Public Cloud

9.2.2 Private Cloud

9.2.3 Hybrid Cloud

9.3. By End-User Industry

9.3.1 IT and Telecommunications

9.3.2 Banking, Financial Services, and Insurance (BFSI)

9.3.3 Healthcare

9.3.4 Retail

9.3.5 Government

9.4. By Geography

9.4.1 North America

9.4.2 Europe

9.4.3 Asia-Pacific

9.4.4 Latin America

9.4.5 Middle East and Africa

9.5. By Data Center Type

9.5.1 Enterprise Data Centers

9.5.2 Colocation Data Centers

9.5.3 Hyperscale Data Centers

10. Global Data Center and Cloud Services Market Analysts’ Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Marketing Initiatives

10.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Global Data Center and Cloud Services Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the Global Data Center and Cloud Services Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the Global Data Center and Cloud Services Market.

Frequently Asked Questions

01. How big is the Global Data Center and Cloud Services Market?

The Global Data Center and Cloud Services Market is valued at USD 385 billion, driven by factors such as increasing demand, technological advancements, and supportive government initiatives.

02. What are the key challenges in the Global Data Center and Cloud Services Market?

Key challenges in the Global Data Center and Cloud Services Market include intense competition, regulatory complexities, and infrastructure limitations affecting market dynamics.

03. Who are the major players in the Global Data Center and Cloud Services Market?

Major players in the Global Data Center and Cloud Services Market include Amazon Web Services, Microsoft Azure, Google Cloud, IBM Cloud, Alibaba Cloud, among others.

04. What are the growth drivers for the Global Data Center and Cloud Services Market?

The primary growth drivers for the Global Data Center and Cloud Services Market are increasing consumer demand, favorable policies, innovation, and substantial investment inflows.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.