Global Delivery Robots Market Outlook to 2030

Region:Global

Author(s):Naman Rohilla

Product Code:KROD7991

December 2024

97

About the Report

Global Delivery Robots Market Overview

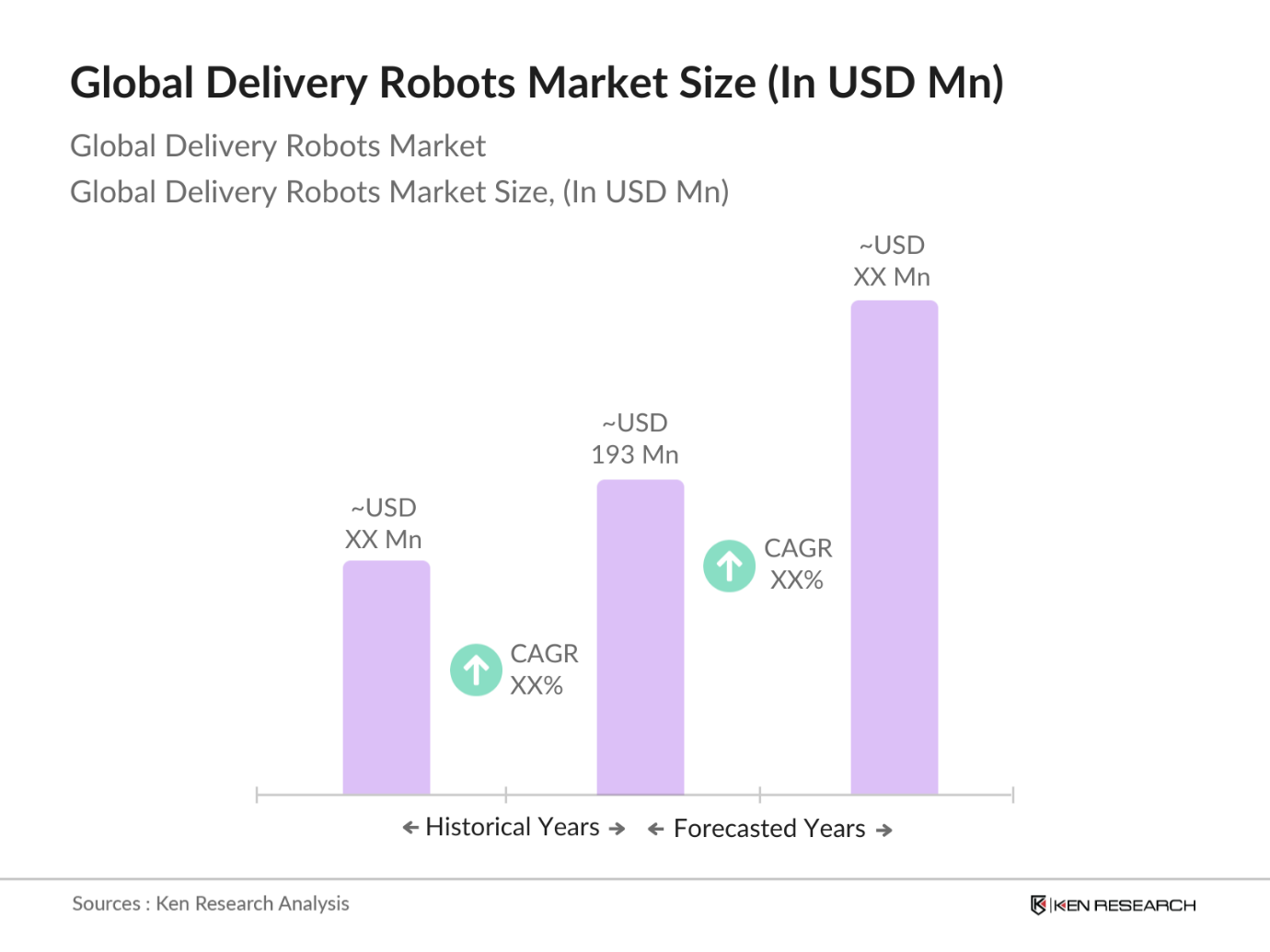

- The Global Delivery Robots Market is valued at USD 193 million based on a five-year historical analysis. The market is driven by the surge in e-commerce and last-mile delivery services, particularly in densely populated urban areas. Companies like Amazon, Walmart, and logistics providers are adopting these autonomous solutions to optimize operations, reduce labor costs, and enhance customer satisfaction. Additionally, technological advancements in AI and machine learning further support the market's growth by improving robots' navigation, decision-making, and interaction with their environment.

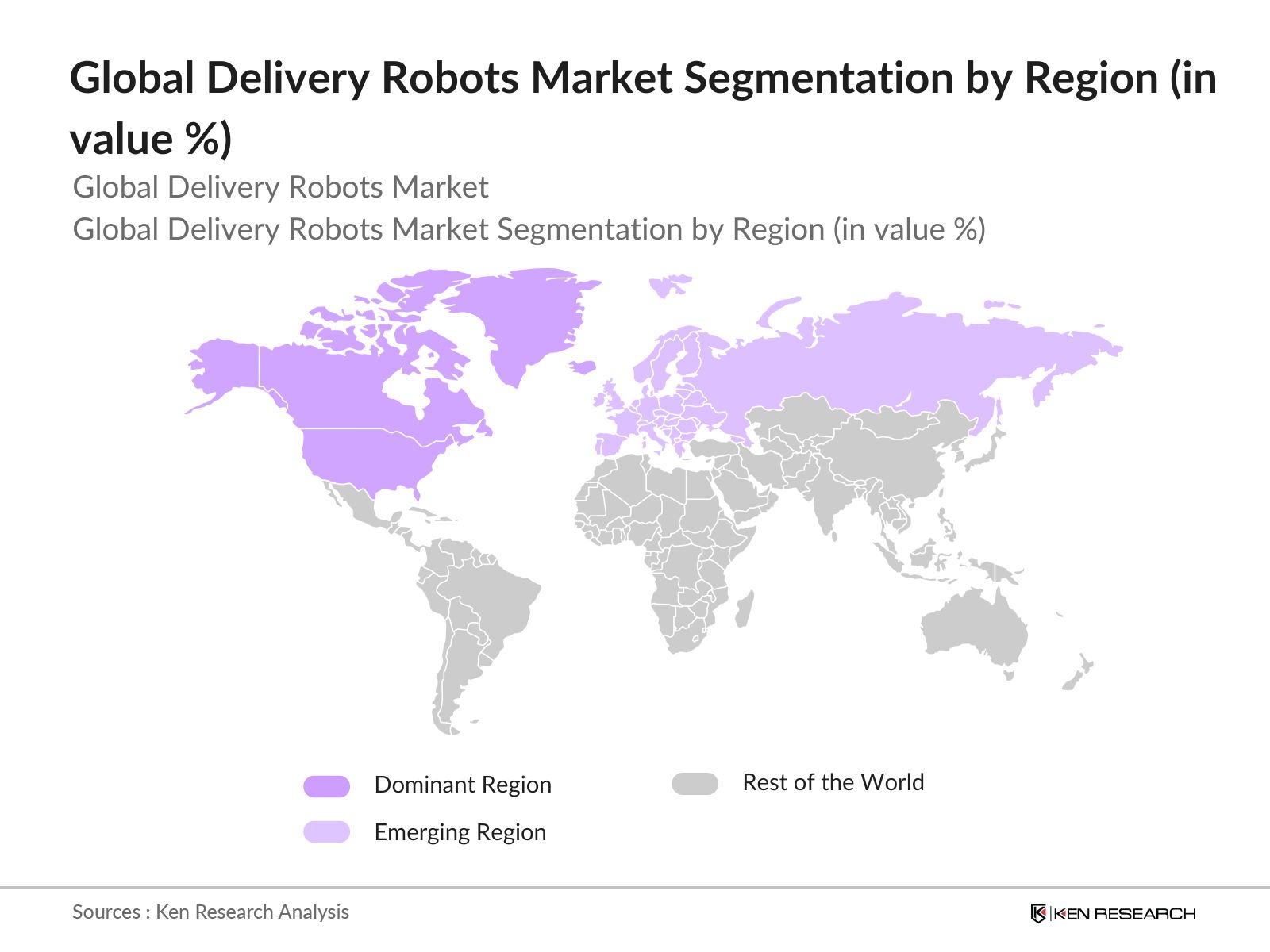

- The dominant countries in this market include the United States, China, and Japan. The dominance of these nations is attributed to their advanced technology infrastructure, strong e-commerce presence, and government initiatives to promote smart city solutions. For example, the U.S. has been a pioneer in testing and deploying autonomous delivery solutions, while China leads in the rapid adoption of delivery drones and robots due to its massive e-commerce industry. Japans technological edge and innovations in robotics also contribute to its significant market presence.

- Government guidelines for autonomous vehicles are crucial for the adoption of delivery robots. In 2024, 40 countries had formalized autonomous vehicle regulations, providing a legal framework for the safe operation of delivery robots. The European Union, for example, has introduced stringent safety protocols that require real-time monitoring of autonomous deliveries to ensure compliance with traffic laws. These guidelines are vital for the large-scale adoption of delivery robots, helping mitigate risks and ensuring safety on public roads.

Global Delivery Robots Market Segmentation

- By Application: The delivery robots market is segmented by application into e-commerce, healthcare, hospitality, retail, and postal services. The e-commerce segment is the largest, driven by the explosion in online shopping and the need for efficient last-mile delivery solutions. Companies like Amazon and Alibaba are heavily investing in autonomous delivery robots to handle the growing volume of orders, improve delivery times, and reduce operational costs, which makes this segment the leader in the market.

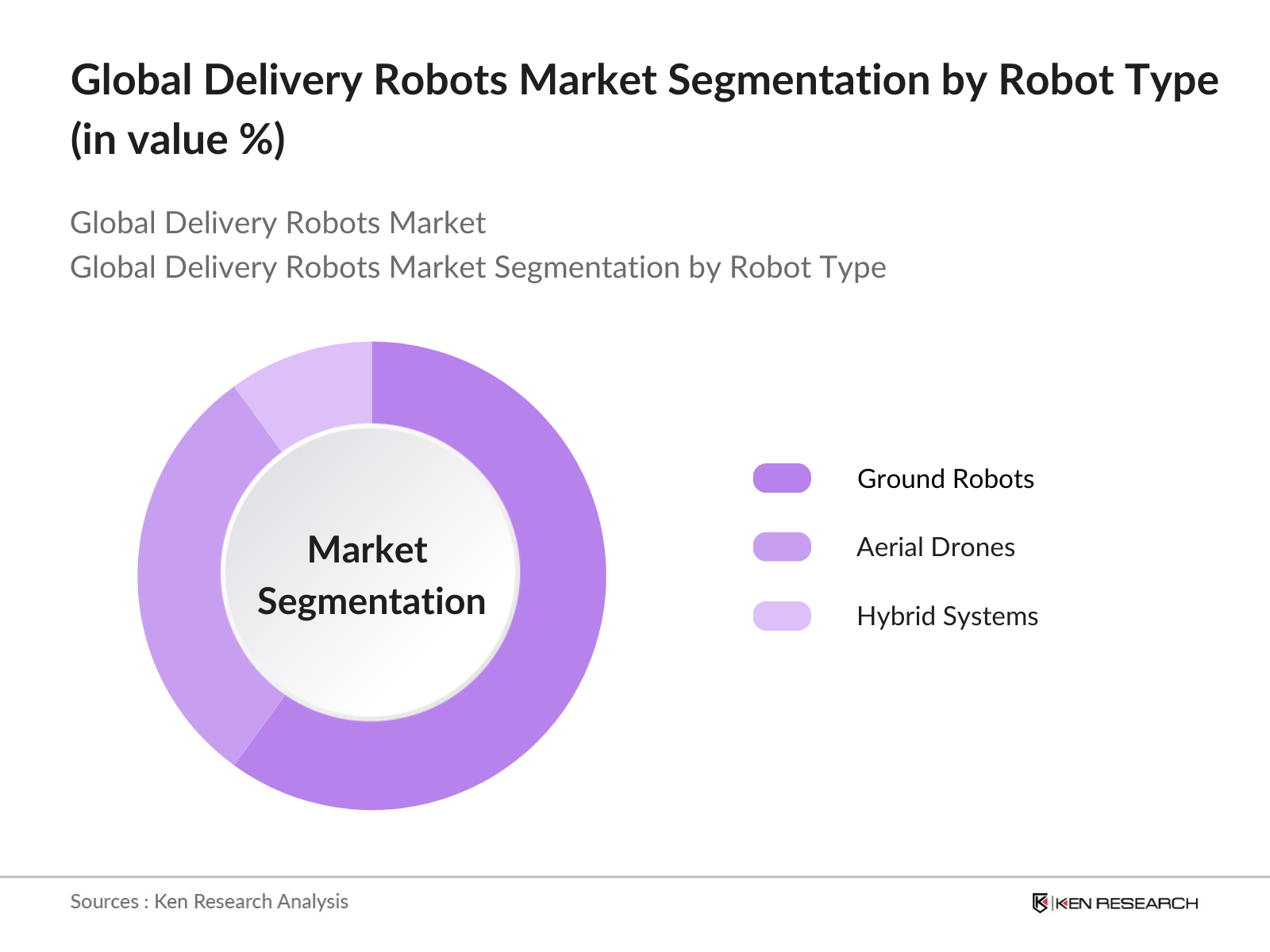

- By Robot Type: The Global Delivery Robots market is segmented by robot type into ground robots, aerial drones, and hybrid systems. Ground robots hold a dominant share of the market as they are widely used for last-mile deliveries in urban areas, particularly by logistics companies such as FedEx and Amazon. These robots are effective in navigating sidewalks and streets and have gained regulatory approvals in many regions. Their ability to carry heavier payloads compared to aerial drones also contributes to their larger market share.

- By Region: The Global Delivery Robots Market is geographically segmented into North America, Europe, APAC, MEA, and Latin America. North America holds the largest market share due to its advanced infrastructure for testing and deploying autonomous robots, regulatory approvals, and the presence of major players such as Starship Technologies and Amazon Robotics. Additionally, North American consumers are highly responsive to innovations in the delivery sector, boosting market penetration in this region.

Global Delivery Robots Market Competitive Landscape

The Global Delivery Robots Market is dominated by a few key players that lead the industry with technological advancements, strategic partnerships, and large-scale deployments. These companies are focusing on expanding their market presence through R&D investments, collaborations with logistics providers, and scaling their operations across different regions.

Global Delivery Robots Market Analysis

Global Delivery Robots Market Growth Drivers

- E-commerce Expansion: The rapid expansion of e-commerce has driven significant demand for delivery robots as companies seek more efficient last-mile delivery solutions. In 2024, global e-commerce revenues are estimated to surpass USD 5 trillion, driven by countries like the U.S., China, and India, where e-commerce penetration continues to grow. In the U.S. alone, retail e-commerce sales exceeded USD 1.3 trillion, with logistics companies increasingly investing in autonomous delivery solutions to manage growing volumes. The integration of delivery robots is expected to enhance the efficiency of urban logistics, reducing delivery times and operational costs.

- Cost Optimization in Logistics: The logistics industry is increasingly turning to automation to reduce labor and operational costs. Delivery robots, with their ability to operate continuously, offer cost-efficient alternatives to human labor. In 2024, labor costs in the logistics sector saw a rise of approximately USD 15 per hour in developed markets, leading businesses to adopt automation. The use of autonomous robots can result in up to 40% reduction in last-mile delivery costs for companies, ensuring long-term operational savings. This cost optimization is particularly relevant in regions with high labor costs such as North America and Europe.

- Advancements in AI and Autonomous Navigation: AI and autonomous navigation technologies have seen substantial advancements, leading to better real-time decision-making and route optimization in delivery robots. In 2024, the global AI market reached USD 380 billion, significantly boosting the capabilities of robotics. These technological advancements enable robots to navigate complex urban environments, avoid obstacles, and improve delivery efficiency. The development of sensors and machine learning algorithms has made it possible for robots to handle unforeseen challenges, significantly reducing delivery times by as much as 20% in highly congested urban areas.

Global Delivery Robots Market Challenges

- High Deployment Costs: Despite the potential for long-term savings, the initial deployment costs for delivery robots remain a significant barrier. These costs, which can exceed USD 100,000 per unit depending on the level of automation and integration, pose challenges for small and medium-sized businesses. The costs include robot manufacturing, AI integration, maintenance, and software upgrades. The lack of financial incentives from governments for autonomous technologies further exacerbates the issue, making adoption slower in cost-sensitive markets.

- Regulatory Frameworks: The regulatory environment for autonomous delivery robots remains complex, with varying legislation across regions. In 2024, over 40 countries had implemented or were drafting regulations specific to autonomous robots. However, inconsistent safety standards, vehicle classification, and urban mobility policies create roadblocks for global deployment. For instance, the U.S. has different state-level regulations for autonomous vehicles, affecting the scalability of robot delivery services. Companies must navigate these regulations, increasing operational complexity and costs.

Global Delivery Robots Market Future Outlook

Over the next five years, the Global Delivery Robots Market is expected to grow substantially, driven by increased demand for last-mile delivery solutions, technological advancements in AI, and the need for contactless delivery in post-pandemic scenarios. The integration of 5G technology is anticipated to enhance the robots navigation and communication capabilities, making autonomous delivery even more efficient. Furthermore, partnerships between robotics companies and logistics firms will play a critical role in scaling operations globally, particularly in emerging markets.

Global Delivery Robots Market Opportunities

- Growth in Autonomous Fleet Solutions: The integration of autonomous fleet solutions presents a key growth opportunity for the delivery robots market. As of 2024, the number of autonomous vehicle deployments globally reached 150,000, including delivery robots, driven by rising investments in logistics automation. Large e-commerce and logistics companies are exploring fleet solutions that combine delivery drones and robots to optimize last-mile operations. This shift towards autonomous fleets is creating new partnership opportunities between technology firms and logistics providers, enabling faster and more efficient deliveries in urban areas.

- Emerging Markets Adoption: Emerging markets represent a significant opportunity for the growth of delivery robots, with regions such as Southeast Asia and Africa showing increased adoption. In 2024, over 20 emerging economies were identified as key growth areas for autonomous technology, driven by rapid urbanization and e-commerce expansion. Indonesia, for example, saw a 15% increase in e-commerce deliveries, prompting the introduction of delivery robots in metropolitan areas. These markets are expected to lead in adopting autonomous technologies as local governments push for smart infrastructure development.

Scope of the Report

|

Robot Type |

Ground Robots Aerial Drones Hybrid Systems |

|

Application |

E-commerce Healthcare Hospitality Retail Postal Services |

|

Technology |

Autonomous Navigation Systems Sensor and Camera Integration AI and Machine Learning Algorithms |

|

Payload Capacity |

Less than 10 Kg 10-50 Kg Above 50 Kg |

|

Region |

North America Europe APAC MEA Latin America |

Products

Key Target Audience

Delivery Logistics Providers

E-commerce Companies

Healthcare Providers

Retail Chains

Banks and Financial Institutions

Robotics Manufacturers

Autonomous Technology Developers

Government and Regulatory Bodies (U.S. Department of Transportation, European Union Mobility and Transport)

Investor and Venture Capitalist Firms

Companies

Players Mentioned in the Report

Starship Technologies

Amazon Robotics

Nuro

Kiwibot

Alibaba Robotics

Boston Dynamics

Postmates (Serve Robotics)

Robby Technologies

FedEx SameDay Bot

TeleRetail

Table of Contents

1. Global Delivery Robots Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Delivery Robots Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Delivery Robots Market Analysis

3.1. Growth Drivers (e.g., demand for last-mile delivery automation, labor cost reduction, increasing e-commerce penetration)

3.1.1. E-commerce Expansion

3.1.2. Cost Optimization in Logistics

3.1.3. Advancements in AI and Autonomous Navigation

3.1.4. Government Support for Smart Cities

3.2. Market Challenges (e.g., high upfront costs, regulatory hurdles, technological limitations)

3.2.1. High Deployment Costs

3.2.2. Regulatory Frameworks

3.2.3. Infrastructure Gaps

3.3. Opportunities (e.g., integration with AI, expanding into new industries, partnerships)

3.3.1. Growth in Autonomous Fleet Solutions

3.3.2. Emerging Markets Adoption

3.3.3. Technological Advancements in Sensor Fusion

3.4. Trends (e.g., adoption of 5G, advancements in autonomous driving algorithms, collaborative robotics)

3.4.1. Integration with 5G Networks

3.4.2. AI-driven Real-Time Data Analytics

3.4.3. Collaboration Between Robotics and Logistics Companies

3.5. Government Regulations (e.g., autonomous vehicle legislation, safety standards, urban mobility policies)

3.5.1. Autonomous Vehicle Guidelines

3.5.2. Safety Protocols for Public Roads

3.5.3. Smart City Infrastructure Programs

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (logistics providers, technology companies, urban planners)

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. Global Delivery Robots Market Segmentation

4.1. By Robot Type (In Value %)

4.1.1. Ground Robots

4.1.2. Aerial Drones

4.1.3. Hybrid Systems

4.2. By Application (In Value %)

4.2.1. E-commerce

4.2.2. Healthcare

4.2.3. Hospitality

4.2.4. Retail

4.2.5. Postal Services

4.3. By Technology (In Value %)

4.3.1. Autonomous Navigation Systems

4.3.2. Sensor and Camera Integration

4.3.3. AI and Machine Learning Algorithms

4.4. By Payload Capacity (In Value %)

4.4.1. Less than 10 Kg

4.4.2. 10-50 Kg

4.4.3. Above 50 Kg

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. APAC

4.5.4. MEA

4.5.5. Latin America

5. Global Delivery Robots Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Starship Technologies

5.1.2. Amazon Robotics

5.1.3. Boston Dynamics

5.1.4. Nuro

5.1.5. Kiwibot

5.1.6. Robby Technologies

5.1.7. FedEx SameDay Bot

5.1.8. Eliport

5.1.9. TeleRetail

5.1.10. Dispatch

5.1.11. Savioke

5.1.12. Marble

5.1.13. Alibaba Robotics

5.1.14. Segway Robotics

5.1.15. Postmates (Serve Robotics)

5.2. Cross Comparison Parameters (No. of Patents, Market Reach, R&D Expenditure, Revenue, Technological Expertise, Partnerships, Product Range, Innovation Index)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Global Delivery Robots Market Regulatory Framework

6.1. Autonomous Vehicle Legislation

6.2. Urban Mobility Policies

6.3. Compliance with Safety Standards

6.4. Cross-Border Regulations

7. Global Delivery Robots Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global Delivery Robots Future Market Segmentation

8.1. By Robot Type (In Value %)

8.2. By Application (In Value %)

8.3. By Technology (In Value %)

8.4. By Payload Capacity (In Value %)

8.5. By Region (In Value %)

9. Global Delivery Robots Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The first step involved mapping out the entire delivery robots ecosystem, identifying all relevant stakeholders such as manufacturers, logistics providers, and regulatory bodies. Key variables like robot types, application areas, and technological advancements were analyzed through secondary research using proprietary and external databases.

Step 2: Market Analysis and Construction

During this phase, historical data on the delivery robots market was gathered to assess market penetration, growth trends, and regional deployments. Market share and adoption rates of different robot types were calculated, taking into account data from industry reports and public filings.

Step 3: Hypothesis Validation and Expert Consultation

The market hypotheses were validated by conducting CATI interviews with industry experts from leading robotics companies and logistics providers. These interviews provided insights into the operational challenges, strategic initiatives, and future growth opportunities for delivery robots.

Step 4: Research Synthesis and Final Output

The final phase involved synthesizing data from multiple sources and verifying it through interactions with robotics and logistics companies. The insights gained were then used to create a comprehensive and reliable analysis of the delivery robots market.

Frequently Asked Questions

01. How big is the Global Delivery Robots Market?

The Global Delivery Robots Market is valued at USD 193 million, driven by the increasing demand for automated delivery solutions in sectors such as e-commerce, healthcare, and retail.

02. What are the challenges in the Global Delivery Robots Market?

The market faces challenges such as high initial deployment costs, regulatory hurdles related to autonomous operations, and technological limitations in robot navigation and decision-making.

03. Who are the major players in the Global Delivery Robots Market?

Key players include Starship Technologies, Amazon Robotics, Nuro, Alibaba Robotics, and Kiwibot. These companies dominate the market due to their technological leadership, strategic partnerships, and large-scale deployments.

04. What are the growth drivers of the Global Delivery Robots Market?

The growth of this market is propelled by advancements in AI and autonomous technology, increasing e-commerce demand, and the need for contactless delivery solutions in the post-pandemic world.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.