Global Dental Impression Systems Market Outlook to 2030

Region:Global

Author(s):Vijay Kumar

Product Code:KROD6145

December 2024

90

About the Report

Global Dental Impression Systems Market Overview

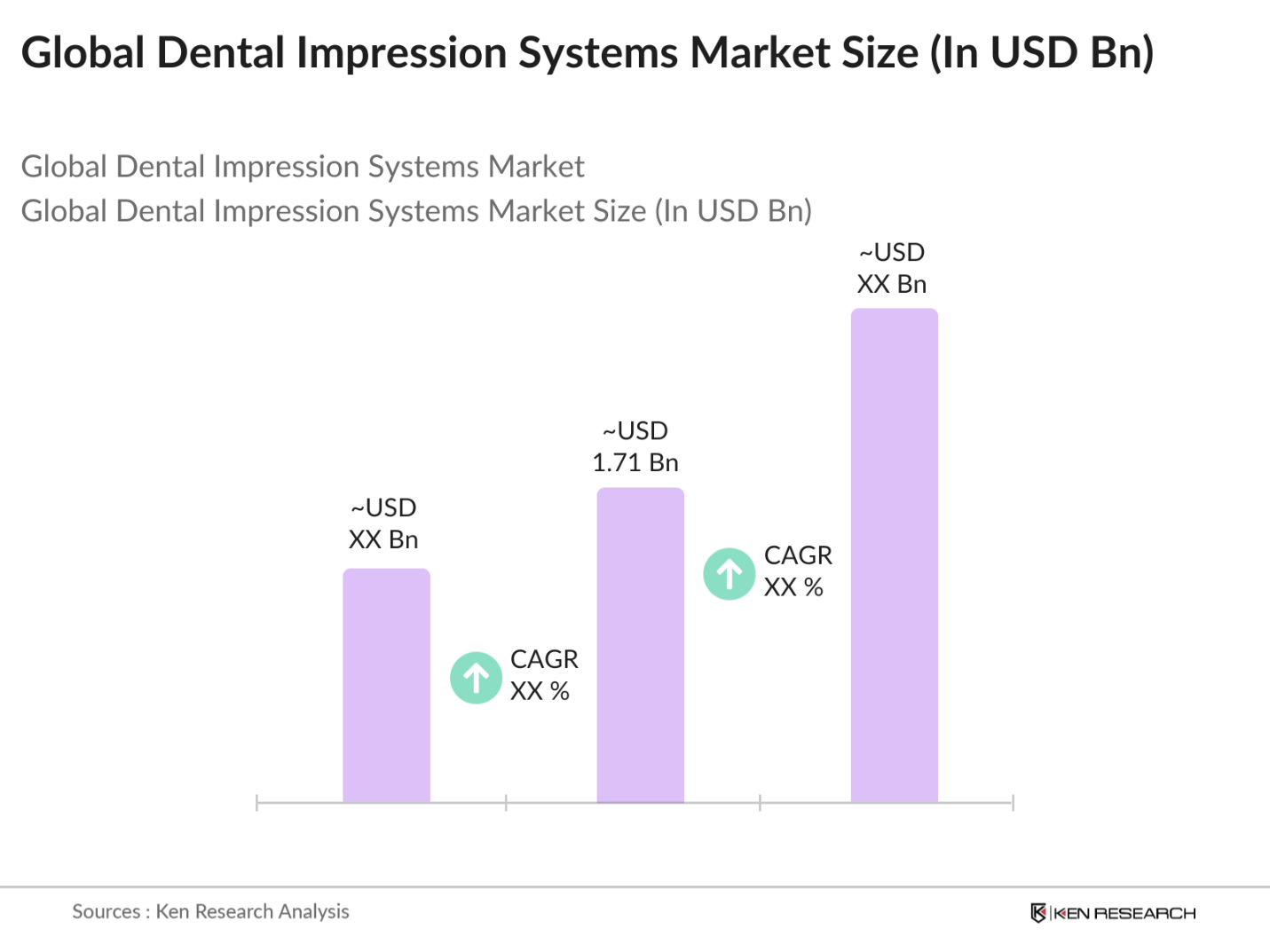

- The global dental impression systems market is valued at USD 1.71 billion, according to a detailed five-year historical analysis. The market's growth is driven by advancements in dental technology, particularly the widespread adoption of digital impression systems, which offer superior accuracy and patient comfort. The increasing demand for aesthetic and restorative dentistry, coupled with a rise in orthodontic procedures, is also contributing to the market's expansion. Notably, the aging population and heightened awareness of dental care further fuel demand.

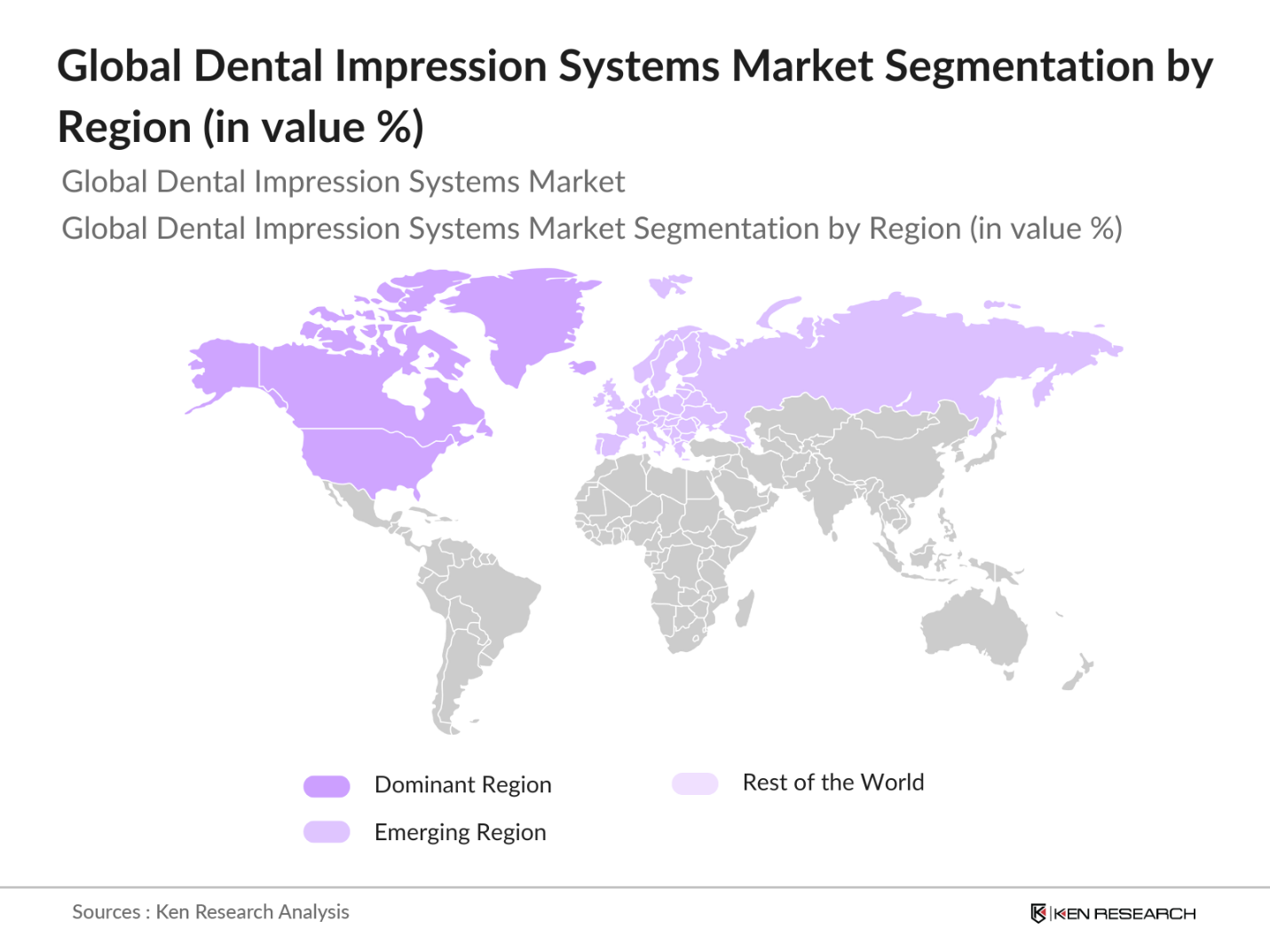

- Dominant regions in the dental impression systems market include North America and Europe. North America's dominance stems from its highly developed healthcare infrastructure, advanced technology adoption, and a higher prevalence of dental disorders requiring restorative and cosmetic dentistry. Europe is also a significant player, benefiting from strong public health initiatives, an aging population, and the presence of key industry players. Asia Pacific is rapidly catching up due to rising healthcare expenditure and an increasing middle-class population seeking advanced dental care solutions.

- In the U.S., the Food and Drug Administration (FDA) regulates the approval of dental impression systems. As of 2023, any new dental impression product entering the market must pass rigorous FDA assessments for safety and efficacy. This regulatory oversight is particularly critical for digital impression systems, which must meet higher standards due to their technological complexity. The FDA's focus on product quality and patient safety has led to an increase in the time and cost required for new systems to enter the market.

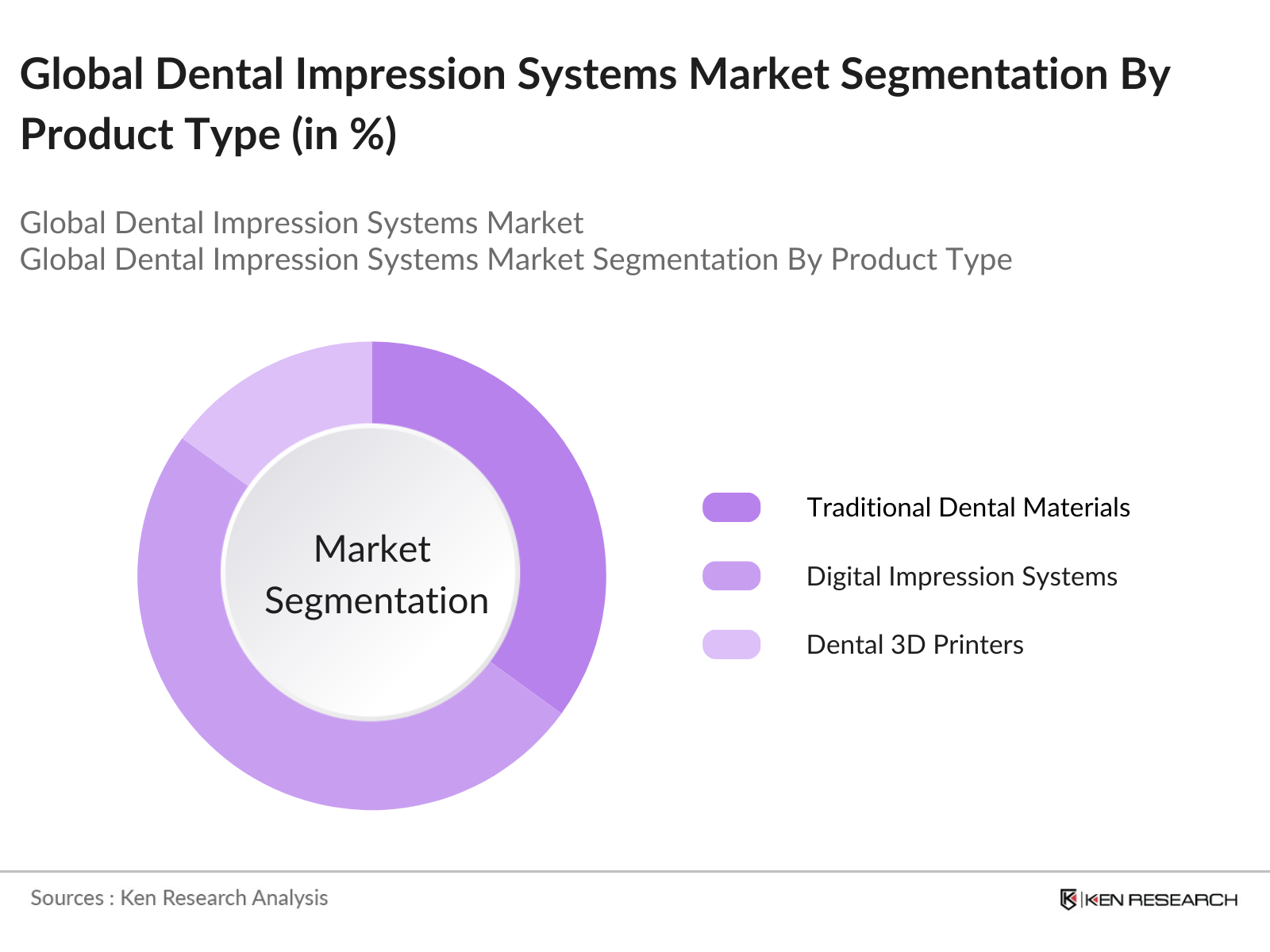

Global Dental Impression Systems Market Segmentation

By Product Type: The market is segmented by product type into traditional dental impression materials, digital impression systems, and dental 3D printers. Among these, digital impression systems hold a dominant market share. This is due to the precision they offer compared to traditional methods, as well as their ability to reduce the time needed for creating dental restorations.

By Application: The market is also segmented by application into restorative dentistry, orthodontics, implantology, and aesthetic dentistry. Restorative dentistry has emerged as the leading sub-segment, driven by the rising number of dental restoration procedures such as crowns, bridges, and veneers. With the increasing focus on aesthetics and the demand for long-lasting dental solutions, restorative dentistry procedures are growing at a rapid pace.

By Region: The market is regionally segmented into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. North America holds the largest share of the market, largely due to the high adoption of digital technology, favorable reimbursement policies, and a well-established healthcare infrastructure. In Europe, Germany and the UK lead due to their strong public dental care systems and a higher aging population.

Global Dental Impression Systems Market Competitive Landscape

The global dental impression systems market is highly competitive, with major players constantly innovating to maintain their market position. This market is dominated by a few key companies, including Dentsply Sirona, 3M, and Henry Schein, which have a global reach and well-established product portfolios. These companies are known for their strong R&D capabilities and frequent product launches aimed at improving dental care procedures.

Global Dental Impression Systems Industry Analysis

Growth Drivers

- Rise in Dental Procedures (Number of Implants, Orthodontic Treatments): The global rise in dental procedures, particularly implants and orthodontic treatments, is driving demand for dental impression systems. According to the World Health Organization (WHO), over 3.5 billion people worldwide suffer from oral diseases, which are contributing to a significant increase in dental interventions, particularly in developed nations. In the U.S., approximately 2 million dental implants are performed annually as of 2023, a number that continues to rise as oral health becomes a higher priority.

- Growing Aging Population (Dental Care Demand): The global aging population is another significant driver of the dental impression systems market. By 2023, nearly 1 billion people globally are over the age of 60, according to the United Nations. As this demographic expands, there is an increasing demand for dental care, including implants, dentures, and restorative procedures. Countries like Japan, where 28.7% of the population is over 65, are witnessing a surge in demand for specialized dental services, driving the need for efficient impression systems to cater to this market segment.

- Technological Advancements (3D Printing, Digital Scanning): Technological advancements in dental impression systems, such as the integration of 3D printing and digital scanning, are reshaping the industry. The application of 3D printing in dental clinics has reduced procedure time by enabling in-house production of dental implants and crowns. Digital scanning technology, which eliminates the need for traditional impression molds, has also gained traction, with more than 60% of U.S. dental clinics adopting digital workflows by 2023.

Market Challenges

- High Cost of Advanced Systems: The cost of adopting advanced dental impression systems remains a significant barrier for many small and medium-sized dental clinics. According to the International Federation of Dentists (FDI), digital impression systems can cost upwards of $40,000, which represents a substantial investment for many practitioners. This challenge is particularly pronounced in emerging markets, where dental practices may lack the capital to adopt these technologies, slowing their adoption rates.

- Regulatory Hurdles (FDA, CE Marking): Navigating regulatory requirements is another challenge for dental impression system manufacturers. In the U.S., the Food and Drug Administration (FDA) mandates stringent approval processes for medical devices, including dental impression systems. Similarly, in Europe, manufacturers must comply with the EU Medical Device Regulation (MDR), which has raised the bar for product safety and efficacy.

Global Dental Impression Systems Market Future Outlook

Over the next five years, the global dental impression systems market is expected to experience significant growth driven by advancements in 3D printing technology, digital scanning solutions, and the increasing adoption of CAD/CAM systems in dental practices. Emerging markets, particularly in Asia Pacific and Latin America, will also play a crucial role in expanding the global footprint of major manufacturers.

Market Opportunities

- Emerging Markets (APAC, LATAM): Emerging markets in Asia-Pacific (APAC) and Latin America (LATAM) present significant growth opportunities for dental impression system manufacturers. According to the World Bank, healthcare expenditure in APAC countries like India and China has been rising, with China spending over $500 billion on healthcare as of 2023. These regions also report a growing middle class, which is driving demand for high-quality dental care.

- Increased Adoption of Digital Workflow in Dental Clinics: The growing adoption of digital workflows in dental clinics, especially in developed regions, is creating opportunities for dental impression systems. In 2023, over 70% of dental clinics in Europe have adopted digital solutions to streamline processes such as patient records, billing, and impressions, according to the European Federation of Periodontology.

Scope of the Report

|

Product Type |

Traditional Dental Impression Materials Digital Impression Systems Dental 3D Printers |

|

Application |

Restorative Dentistry Orthodontics Implantology Aesthetic Dentistry |

|

Technology |

Digital Scanning Traditional Molding Techniques |

|

End User |

Dental Clinics Dental Laboratories Hospitals |

|

Region |

North America Europe Asia Pacific Latin America Middle East & Africa |

Products

Key Target Audience

Dental Clinics

Dental Laboratories

Dental Material Manufacturers

Dental Equipment Manufacturers

Hospitals and Healthcare Institutions

Investment and Venture Capitalist Firms

Government and Regulatory Bodies (FDA, EU MDR)

Private Dental Practice Owners

Companies

Players Mentioned in the Report

Dentsply Sirona

3M

Henry Schein

Ivoclar Vivadent

Align Technology

Zimmer Biomet

KaVo Kerr

GC Corporation

3Shape

COLTENE Holding

Table of Contents

1. Global Dental Impression Systems Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Dental Impression Systems Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Dental Impression Systems Market Analysis

3.1. Growth Drivers

3.1.1. Rise in Dental Procedures (Number of Implants, Orthodontic Treatments)

3.1.2. Growing Aging Population (Dental Care Demand)

3.1.3. Technological Advancements (3D Printing, Digital Scanning)

3.1.4. Increased Aesthetic Dentistry Awareness

3.2. Market Challenges

3.2.1. High Cost of Advanced Systems

3.2.2. Regulatory Hurdles (FDA, CE Marking)

3.2.3. Lack of Trained Professionals for Digital Impressions

3.3. Opportunities

3.3.1. Emerging Markets (APAC, LATAM)

3.3.2. Increased Adoption of Digital Workflow in Dental Clinics

3.3.3. Expanding Product Offerings by Manufacturers (Portable Scanners)

3.4. Trends

3.4.1. Shift from Traditional to Digital Impressions

3.4.2. Integration of CAD/CAM Technology

3.4.3. Growth of Chairside Solutions (One-Day Dental Restorations)

3.5. Regulatory Landscape

3.5.1. EU Medical Device Regulation (MDR)

3.5.2. FDA Approvals

3.5.3. ISO Certification

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.7.1. Dental Clinics

3.7.2. Laboratories

3.7.3. Manufacturers

3.8. Porters Five Forces

3.8.1. Bargaining Power of Suppliers

3.8.2. Bargaining Power of Buyers

3.8.3. Threat of New Entrants

3.8.4. Threat of Substitutes

3.8.5. Competitive Rivalry

3.9. Competition Ecosystem

4. Global Dental Impression Systems Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Traditional Dental Impression Materials (Alginate, Silicone)

4.1.2. Digital Impression Systems (Intraoral Scanners, Impression Software)

4.1.3. Dental 3D Printers

4.2. By Application (In Value %)

4.2.1. Restorative Dentistry (Crowns, Bridges, Veneers)

4.2.2. Orthodontics

4.2.3. Implantology

4.2.4. Aesthetic Dentistry

4.3. By Technology (In Value %)

4.3.1. Digital Scanning (Optical, Laser)

4.3.2. Traditional Molding Techniques

4.4. By End User (In Value %)

4.4.1. Dental Clinics

4.4.2. Dental Laboratories

4.4.3. Hospitals

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia Pacific

4.5.4. Latin America

4.5.5. Middle East & Africa

5. Global Dental Impression Systems Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. Dentsply Sirona

5.1.2. 3M

5.1.3. Henry Schein

5.1.4. Ivoclar Vivadent

5.1.5. Align Technology

5.1.6. Zimmer Biomet

5.1.7. Danaher Corporation

5.1.8. Mitsui Chemicals

5.1.9. KaVo Kerr

5.1.10. GC Corporation

5.1.11. 3Shape

5.1.12. COLTENE Holding

5.1.13. Straumann Group

5.1.14. Zirkonzahn

5.1.15. Carestream Dental

5.2 Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue, Product Portfolio, Geographic Reach, Market Share, Technology Used)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers And Acquisitions

5.6. Investment Analysis

5.7 Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Global Dental Impression Systems Market Regulatory Framework

6.1. Medical Device Classification (Class I, Class II)

6.2. Compliance Requirements

6.3. Certification Processes

7. Global Dental Impression Systems Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global Dental Impression Systems Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By Technology (In Value %)

8.4. By End User (In Value %)

8.5. By Region (In Value %)

9. Global Dental Impression Systems Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map of all major stakeholders within the global dental impression systems market. This process is backed by desk research, where secondary data from proprietary and publicly available databases is used to gather essential market intelligence. The goal is to identify the critical variables that drive market dynamics, including demand trends, technology adoption, and competitive intensity.

Step 2: Market Analysis and Construction

In this step, historical data is compiled and analyzed to understand the markets evolution. We assess factors such as the adoption rate of digital technologies, service provider-to-market ratio, and consumer preference for specific dental impression techniques. Revenue estimates are calculated based on market penetration and price points, ensuring accuracy in revenue projections.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed based on initial research and validated through expert consultations. These consultations involve interviews with dental professionals, manufacturers, and industry experts, providing real-world insights that refine our market estimates. The validation process ensures that the market data reflects the actual situation on the ground.

Step 4: Research Synthesis and Final Output

The final step consolidates the findings from earlier phases, with a focus on dental product segmentation, market trends, and emerging technologies. This synthesis of data, coupled with insights from primary research, ensures that the final output provides a comprehensive and actionable analysis of the global dental impression systems market.

Frequently Asked Questions

01. How big is the global dental impression systems market?

The global dental impression systems market is valued at USD 1.71 billion, according to a detailed five-year historical analysis. The market's growth is driven by advancements in dental technology, particularly the widespread adoption of digital impression systems, which offer superior accuracy and patient comfort.

02. What are the challenges in the dental impression systems market?

Key challenges include the high cost of advanced systems, regulatory hurdles in major markets, and the lack of trained professionals for operating digital impression systems.

03. Who are the major players in the dental impression systems market?

Key players include Dentsply Sirona, 3M, Henry Schein, Ivoclar Vivadent, and Align Technology. These companies lead due to their innovation in digital technology and extensive distribution networks.

04. What are the growth drivers of the dental impression systems market?

Growth is driven by advancements in 3D printing, increased dental procedures, and the rise in demand for minimally invasive aesthetic dentistry.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.