Global Diamond Market Outlook to 2029

Region:Global

Author(s):Dev

Product Code:KROD-065

June 2025

90

About the Report

Global Diamond Market Overview

- The Global Diamond Market was valued at USD 101 billion, based on a five-year historical analysis. This growth is primarily driven by increasing consumer demand for luxury goods, particularly in emerging markets, alongside a resurgence in the bridal jewelry segment. The market has also seen a rise in synthetic diamonds, which are gaining acceptance among consumers for their ethical and environmental benefits.

- Key players in this market include countries like India, Belgium, and the United States. India dominates due to its extensive diamond cutting and polishing industry, while Belgium is known for its trading and distribution networks. The United States remains a significant market due to high consumer spending on luxury items, particularly in the jewelry sector.

- In 2024–2025, the U.S. implemented regulations requiring diamond importers to certify their diamonds are conflict-free and disclose the country of origin. This initiative enhances transparency and sustainability in the diamond supply chain, specifically targeting the exclusion of Russian diamonds to uphold ethical sourcing standards.

Global Diamond Market Segmentation

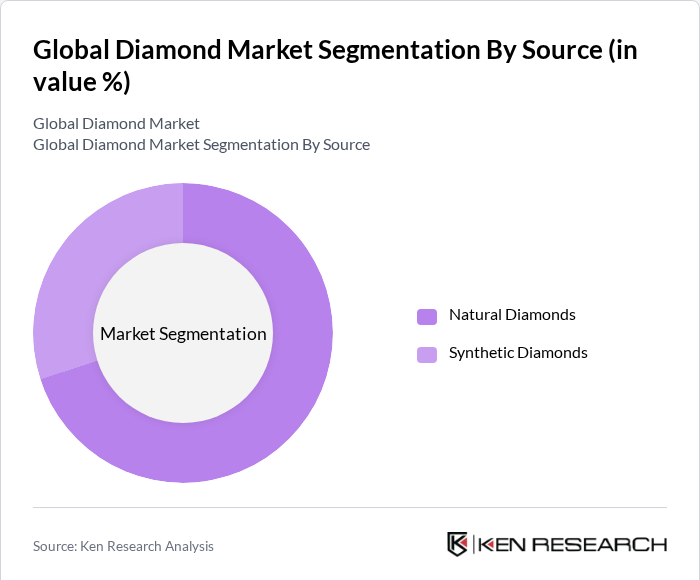

By Source: The diamond market is primarily segmented into natural and synthetic diamonds. Natural diamonds continue to dominate the market due to their traditional appeal and perceived value. However, synthetic diamonds are gaining traction, particularly among younger consumers who prioritize ethical sourcing and affordability. The increasing acceptance of lab-grown diamonds is reshaping consumer preferences, leading to a gradual shift in market dynamics.

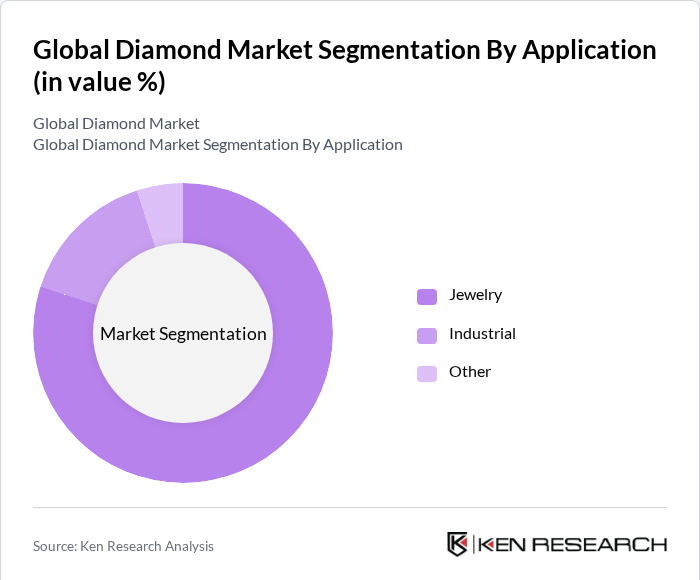

By Application: The diamond market is segmented into jewelry, industrial, and other applications. The jewelry segment holds the largest share, driven by consumer demand for engagement rings and luxury items. The industrial segment, while smaller, is significant due to the use of diamonds in cutting, grinding, and drilling applications. The growing trend of personalized jewelry is also contributing to the expansion of the jewelry segment.

Global Diamond Market Competitive Landscape

The Global Diamond Market is characterized by a mix of established players and emerging companies. Major companies such as De Beers, Alrosa, and Rio Tinto dominate the market, leveraging their extensive mining operations and brand recognition. The competitive dynamics are influenced by factors such as ethical sourcing, technological advancements in diamond production, and changing consumer preferences towards synthetic diamonds.

Global Diamond Market Industry Analysis

Growth Drivers

- Increasing Demand for Luxury Goods: The luxury goods market is driven by a growing affluent population and rising demand in Asia-Pacific, where luxury spending continues to outpace other regions. Consumers increasingly seek high-value items like diamonds for personal use and gifting, supported by a shift toward digital engagement and personalized shopping experiences. Luxury brands are also leveraging AI and live-shopping to enhance customer interaction, while sustainability and exclusivity remain key factors influencing purchasing decisions.

- Rising Disposable Incomes in Emerging Markets: Emerging markets, especially in Asia and Africa, are experiencing rapid economic growth with a swelling middle class. By 2025, the consuming class is expected to reach 4.2 billion people, with rising disposable incomes and urbanization driving increased demand for luxury goods like diamonds. In India, the middle-class population is projected to approach 600 million, fueling market expansion as more consumers gain purchasing power and seek high-end products.

- Growth of E-commerce Platforms for Jewelry Sales: The online jewelry market is expanding rapidly, with a 13.8% annual growth rate and expected to nearly triple in value by 2032. In 2023, online sales accounted for about 25-33% of total jewelry sales, driven by consumer preference for convenience, wider selections, and competitive pricing. Innovations like augmented reality (AR) virtual try-ons and influencer marketing are enhancing customer engagement, further accelerating digital jewelry sales and boosting overall diamond market growth.

Market Challenges

- Fluctuating Raw Material Prices: The diamond industry faces significant challenges due to volatile raw material prices, which can impact profit margins. Factors such as supply chain disruptions and geopolitical tensions contribute to this unpredictability. This volatility can deter investment in diamond mining and production, leading to potential shortages and increased costs for consumers, ultimately affecting market stability and growth.

- Environmental Concerns and Ethical Sourcing: The diamond industry is under growing scrutiny for its environmental impact and ethical sourcing practices. Rising consumer awareness has fueled demand for responsibly sourced and lab-grown diamonds, posing a challenge to traditional producers. Companies must adapt to these evolving preferences to sustain market relevance and comply with emerging sustainability regulations.

Global Diamond Market Future Outlook

The diamond market is poised for transformative growth, driven by evolving consumer preferences towards sustainability and ethical sourcing. As lab-grown diamonds gain acceptance, traditional diamond producers are likely to innovate and adapt their offerings. Additionally, the rise of digital retailing will enhance accessibility, allowing consumers to explore diverse options. With increasing disposable incomes in emerging markets, the demand for luxury diamonds is expected to remain robust, creating a dynamic landscape for industry players in the coming years.

Market Opportunities

- Expansion into Untapped Markets: There is significant potential for diamond retailers to expand into untapped markets, particularly in Southeast Asia and Africa. With a growing middle class and increasing disposable incomes, these regions present lucrative opportunities for diamond sales. Companies that strategically enter these markets can capitalize on rising demand for luxury goods, enhancing their market share and profitability.

- Innovations in Diamond Synthesis Technology: Advances in diamond synthesis technology are creating new opportunities for the market. Lab-grown diamonds are becoming more affordable and widely accepted, with production costs decreasing by 20% in recent years. This trend allows companies to offer competitive pricing while meeting consumer demand for ethical products, positioning them favorably in a rapidly evolving market landscape.

Scope of the Report

| By Source |

Natural Diamonds Synthetic Diamonds |

| By Application |

Jewelry Industrial Other Applications |

| By Distribution Channel |

Online Retail Offline Retail Wholesale |

| By Region |

North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range |

Luxury Mid-Range Economy |

| By Carat Weight |

Less than 0.5 Carats 0.5 to 1 Carat 1 to 2 Carats More than 2 Carats |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Federal Trade Commission, Securities and Exchange Commission)

Manufacturers and Producers

Distributors and Retailers

Mining Companies

Jewelry Designers and Brands

Luxury Goods Market Analysts

Financial Institutions

Companies

Players Mentioned in the Report:

De Beers Group

Alrosa

Rio Tinto

Gem Diamonds

Signet Jewelers

Diamond Nexus

Brilliant Earth

Forevermark

Blue Nile

Lucara Diamond Corporation

Table of Contents

1. Global Diamond Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Diamond Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Diamond Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Demand for Luxury Goods

3.1.2. Rising Disposable Incomes in Emerging Markets

3.1.3. Growth of E-commerce Platforms for Jewelry Sales

3.2. Market Challenges

3.2.1. Fluctuating Raw Material Prices

3.2.2. Environmental Concerns and Ethical Sourcing

3.2.3. Competition from Synthetic Diamonds

3.3. Opportunities

3.3.1. Expansion into Untapped Markets

3.3.2. Innovations in Diamond Synthesis Technology

3.3.3. Growing Popularity of Lab-Grown Diamonds

3.4. Trends

3.4.1. Increasing Customization in Jewelry Design

3.4.2. Shift Towards Sustainable and Ethical Practices

3.4.3. Rise of Online Diamond Retailing

3.5. Government Regulation

3.5.1. Compliance with International Trade Laws

3.5.2. Regulations on Conflict Diamonds

3.5.3. Environmental Regulations Impacting Mining Operations

3.5.4. Certification Standards for Ethical Sourcing

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porter’s Five Forces

3.9. Competition Ecosystem

4. Global Diamond Market Segmentation

4.1. By Source

4.1.1. Natural Diamonds

4.1.2. Synthetic Diamonds

4.2. By Application

4.2.1. Jewelry

4.2.2. Industrial

4.2.3. Other Applications

4.3. By Distribution Channel

4.3.1. Online Retail

4.3.2. Offline Retail

4.3.3. Wholesale

4.4. By Region

4.4.1. North America

4.4.2. Europe

4.4.3. Asia-Pacific

4.4.4. Latin America

4.4.5. Middle East & Africa

4.5. By Price Range

4.5.1. Luxury

4.5.2. Mid-Range

4.5.3. Economy

4.6. By Carat Weight

4.6.1. Less than 0.5 Carats

4.6.2. 0.5 to 1 Carat

4.6.3. 1 to 2 Carats

4.6.4. More than 2 Carats

5. Global Diamond Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. De Beers Group

5.1.2. Alrosa

5.1.3. Rio Tinto

5.1.4. Gem Diamonds

5.1.5. Signet Jewelers

5.1.6. Diamond Nexus

5.1.7. Brilliant Earth

5.1.8. Forevermark

5.1.9. Blue Nile

5.1.10. Lucara Diamond Corporation

5.2. Cross Comparison Parameters

5.2.1. Market Share

5.2.2. Revenue Growth Rate

5.2.3. Product Portfolio Diversity

5.2.4. Geographic Presence

5.2.5. Customer Satisfaction Ratings

5.2.6. Innovation Index

5.2.7. Sustainability Practices

5.2.8. Brand Recognition

6. Global Diamond Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. Global Diamond Market Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global Diamond Market Future Market Segmentation

8.1. By Source

8.1.1. Natural Diamonds

8.1.2. Synthetic Diamonds

8.2. By Application

8.2.1. Jewelry

8.2.2. Industrial

8.2.3. Other Applications

8.3. By Distribution Channel

8.3.1. Online Retail

8.3.2. Offline Retail

8.3.3. Wholesale

8.4. By Region

8.4.1. North America

8.4.2. Europe

8.4.3. Asia-Pacific

8.4.4. Latin America

8.4.5. Middle East & Africa

8.5. By Price Range

8.5.1. Luxury

8.5.2. Mid-Range

8.5.3. Economy

8.6. By Carat Weight

8.6.1. Less than 0.5 Carats

8.6.2. 0.5 to 1 Carat

8.6.3. 1 to 2 Carats

8.6.4. More than 2 Carats

9. Global Diamond Market Analysts’ Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping the ecosystem of the Global Diamond Market, identifying all major stakeholders such as producers, retailers, and consumers. This step relies on extensive desk research, utilizing secondary data sources and proprietary databases to gather comprehensive information. The primary goal is to pinpoint and define the critical variables that drive market dynamics.

Step 2: Market Analysis and Construction

In this phase, historical data related to the Global Diamond Market will be compiled and analyzed. This includes evaluating market penetration rates, the balance between marketplaces and service providers, and the resulting revenue generation. Additionally, service quality metrics will be assessed to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be formulated and validated through structured interviews with industry experts from various sectors within the diamond market. These consultations will yield operational and financial insights directly from practitioners, which will be crucial for refining and corroborating the market data collected in earlier steps.

Step 4: Research Synthesis and Final Output

The final phase will involve engaging with multiple manufacturers to gather in-depth insights into product segments, sales performance, and consumer preferences. This direct interaction will help verify and complement the statistics obtained from the bottom-up approach, ensuring a comprehensive and validated analysis of the Global Diamond Market.

Frequently Asked Questions

01. How big is the Global Diamond Market?

The Global Diamond Market is valued at USD 101 billion, driven by factors such as increasing demand, technological advancements, and supportive government initiatives.

02. What are the key challenges in the Global Diamond Market?

Key challenges in the Global Diamond Market include intense competition, regulatory complexities, and infrastructure limitations affecting market dynamics.

03. Who are the major players in the Global Diamond Market?

Major players in the Global Diamond Market include De Beers Group, Alrosa, Rio Tinto, Gem Diamonds, Signet Jewelers, among others.

04. What are the growth drivers for the Global Diamond Market?

The primary growth drivers for the Global Diamond Market are increasing consumer demand, favorable policies, innovation, and substantial investment inflows.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.