Region:Global

Author(s):Shubham

Product Code:KRAC0836

Pages:87

Published On:August 2025

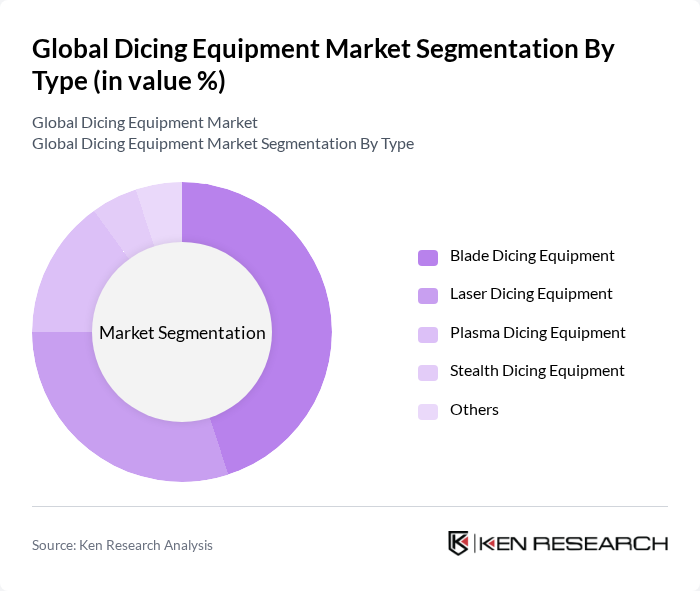

By Type:The dicing equipment market is segmented into Blade Dicing Equipment, Laser Dicing Equipment, Plasma Dicing Equipment, Stealth Dicing Equipment, and Others.Blade Dicing Equipmentremains the most widely used due to its cost-effectiveness and versatility in handling various wafer materials.Laser Dicing Equipmentis gaining traction for its precision and ability to process complex geometries, especially in advanced semiconductor applications.Plasma Dicing Equipmentis preferred for minimizing mechanical damage to sensitive components, supporting higher yields in thin wafer processing.Stealth Dicing Equipmentis increasingly adopted to reduce kerf loss and improve die quality, particularly in high-value electronics and sensor manufacturing .

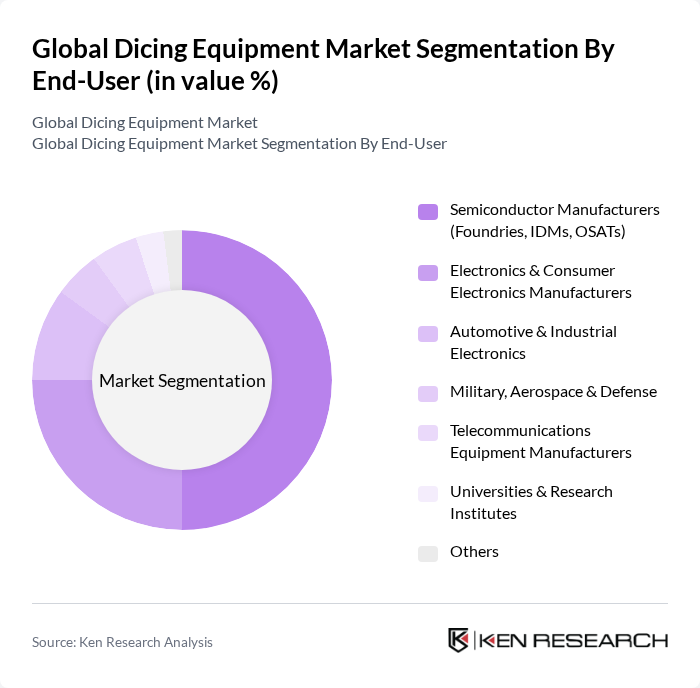

By End-User:The end-user segmentation includes Semiconductor Manufacturers (Foundries, IDMs, OSATs), Electronics & Consumer Electronics Manufacturers, Automotive & Industrial Electronics, Military, Aerospace & Defense, Telecommunications Equipment Manufacturers, Universities & Research Institutes, and Others.Semiconductor Manufacturersare the largest end-users, driven by the continuous demand for chips in consumer electronics, automotive, and industrial applications. The Electronics & Consumer Electronics segment follows closely, supported by the proliferation of smart devices and wearables. The Automotive sector is emerging as a significant user due to the increasing integration of electronics in vehicles, especially for safety, connectivity, and autonomous driving systems .

The Global Dicing Equipment Market is characterized by a dynamic mix of regional and international players. Leading participants such as DISCO Corporation, Tokyo Seimitsu Co., Ltd. (Accretech), Kulicke and Soffa Industries, Inc., SÜSS MicroTec SE, ASM Pacific Technology Ltd., Nidec Sankyo Corporation, Advanced Dicing Technologies Ltd. (ADT), Micro Automation GmbH, KLA Corporation, Applied Materials, Inc., APM Technologies Ltd., Hesse Mechatronics GmbH, SPTS Technologies Ltd. (KLA), EV Group (EVG), Ultratech (a division of Veeco Instruments Inc.) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the dicing equipment market appears promising, driven by technological advancements and increasing demand across various sectors. As manufacturers continue to adopt automation and Industry 4.0 practices, the efficiency of dicing processes is expected to improve significantly. Additionally, the focus on sustainability will likely lead to the development of eco-friendly dicing solutions, further enhancing market growth. The integration of AI in manufacturing processes will also streamline operations, making dicing more precise and cost-effective.

| Segment | Sub-Segments |

|---|---|

| By Type | Blade Dicing Equipment Laser Dicing Equipment Plasma Dicing Equipment Stealth Dicing Equipment Others |

| By End-User | Semiconductor Manufacturers (Foundries, IDMs, OSATs) Electronics & Consumer Electronics Manufacturers Automotive & Industrial Electronics Military, Aerospace & Defense Telecommunications Equipment Manufacturers Universities & Research Institutes Others |

| By Application | Logic & Memory Devices MEMS Devices Power Devices CMOS Image Sensors LED Manufacturing RFID & Passive Components Photovoltaic Cells Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | North America Europe Asia-Pacific (China, Taiwan, South Korea, Japan, Rest of APAC) Latin America Middle East & Africa Rest of the World |

| By Price Range | Low-End Equipment Mid-Range Equipment High-End Equipment |

| By Technology | Conventional Dicing (Blade) Laser Dicing Stealth Dicing Plasma Dicing Hybrid Dicing Solutions |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Semiconductor Manufacturing Facilities | 100 | Process Engineers, Production Managers |

| Electronics Assembly Plants | 60 | Supply Chain Managers, Quality Assurance Leads |

| Research Institutions Focused on Dicing Technology | 40 | Research Scientists, Technical Directors |

| Automotive Electronics Manufacturers | 50 | Product Development Engineers, Procurement Specialists |

| Consumer Electronics Companies | 50 | Operations Managers, R&D Managers |

The Global Dicing Equipment Market is valued at approximately USD 1.5 billion, driven by the increasing demand for semiconductor devices and advanced dicing technologies in various applications, including consumer electronics and automotive sectors.