Global Digital Health Market Outlook to 2030

Region:Global

Author(s):Rohit and Nishika

Product Code:KENGR037

October 2024

89

About the Report

Global Digital Health Market Overview

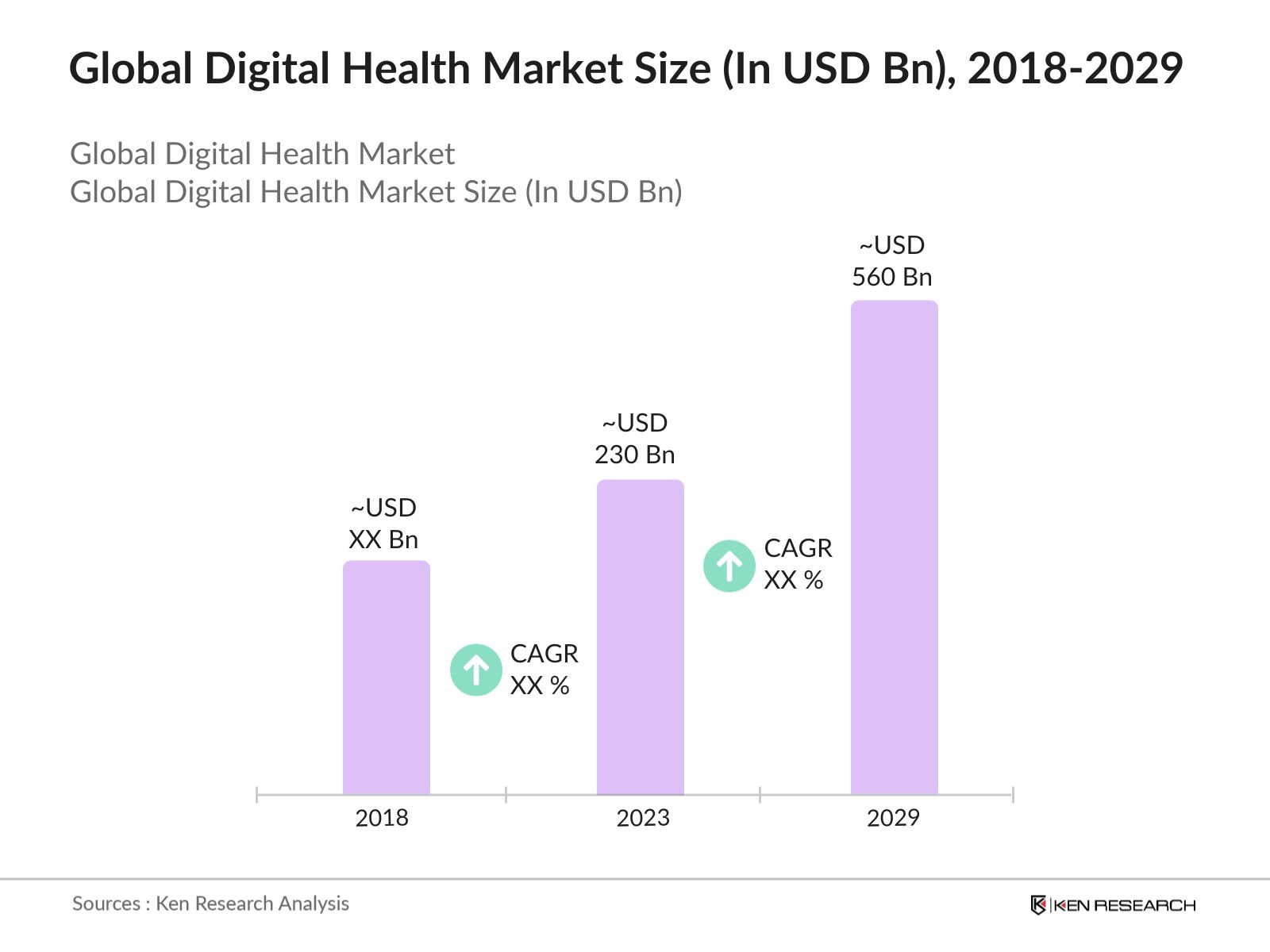

- In 2023, Global Digital Health Market was valued at USD 230 Bn driven by Increased Use of Digital Tools in Healthcare Facilities, Government Support and Policies, Adoption of Wearable Technology, and Integration of Artificial Intelligence. The widespread use of wearable technology, including smartwatches and fitness trackers, has contributed by offering continuous health monitoring and personalized insights.

- Market is highly fragmented with some of the prominent players including United Healthcare (Optum), Oracle Corporation (former Cerner Corporation), Teladoc Health, Veradigm (former Allscripts Healthcare Solutions, Inc.), Babylon Health, Koninklijke Philips N.V., and Omron Healthcare.

- In June 2019, UnitedHealth Group made a strategic move by acquiring the online patient community platform PatientsLikeMe for an undisclosed amount. This acquisition marked a significant expansion of UnitedHealths capabilities in patient engagement and health research.

Global Digital Health Current Market Analysis

- North America as a dominant region: North America leads the global digital health market due to its advanced healthcare infrastructure, robust technological innovation, high healthcare spending, favorable regulatory environment, growing consumer demand for convenient healthcare solutions, and substantial investment and funding in the sector.The United States spent around USD 4.3 trillion on health in 2021, with Canada spending over USD 308 billion in the same year, indicating a strong financial commitment to healthcare and digital health initiatives.The number of smartphone users in the United States is projected to reach 307 million in 2022, significantly contributing to the adoption of digital health solutions in the region.

- Europe as an emerging region: The Asia-Pacific region is the fastest-growing market in digital health due to rapid population growth, a rising middle class, and technological advancements in countries like China, South Korea, and Japan.Increased government investment in healthcare infrastructure and high smartphone and internet usage also drive growth. By 2025, an estimated 1.8 billion people in the region will use mobile services, covering 62% of the population.Chinas Healthy China 2030 plan includes a USD 1.5 trillion investment in healthcare technology, the largest global investment in technology by any country.

- USA as dominant country: The USA dominates the digital health market due to the USA's larger population provides a bigger customer base for digital health products and services.Secondly, the USA attracts more investment and venture capital funding, fueling the growth of digital health startups. Thirdly, the regulatory environment in the USA is conducive to innovation in this sector. In 2016,The U.S. government invested USD 1.3 billion in health IT to develop new mobile healthcare applications, showcasing its commitment to fostering innovation in digital health. In 2021, U.S. digital health startups raised approximately USD 29.1 billion, making up 57% of the total global digital health funding.

Global Digital Health Market Segmentation

The Global Digital Health Market can be segmented based on several factors:

- By Technology: The global digital health market segmentation by technology is divided into Healthcare IT and Telehealth. In 2023, the Healthcare IT sub-segment leads the market, accounting for the largest value share. This is driven by the widespread adoption of electronic health records (EHRs) and other IT solutions that streamline healthcare operations and improve patient management.

- By Healthcare IT: The digital health market segmentation by Healthcare IT is divided into Clinical Healthcare IT and Non-Clinical Healthcare IT. In 2023, the Clinical Healthcare IT leads the market, accounting for the largest value share. This is driven by the increasing deployment of clinical solutions such as EHRs and computerized physician order entry (CPOE) systems, which enhance clinical workflows and patient care.

- By Telehealth: The digital health market segmentation by Telehealth is divided into Virtual Visits, Remote Patient Monitoring, Digital Therapeutics, and Personal Emergency Response System. In 2023, the Virtual Visits sub-segment leads the global digital health market by Telehealth, accounting for the largest value share. This is driven by the rising adoption of telemedicine platforms that facilitate remote consultations and improve access to healthcare services.

Global Digital Health Market Competitive Landscape

|

Company |

Establishment Year |

Geographical Presence |

|

United Healthcare (Optum) |

1977 |

Global |

|

Oracle Corporation (former Cerner Corporation) |

1977 |

Global |

|

Teladoc Health |

2002 |

North America, Europe |

|

Veradigm (formerly Allscripts Healthcare Solutions, Inc.) |

1986 |

North America, Europe, Asia-Pacific, Middle East & Africa |

|

Babylon Health |

2013 |

North America, Asia- Pacafic |

|

Koninklijke Philips N.V. |

1891 |

Global |

- Oracle Corporation (former Cerner Corporation): In June 2022, Oracle completed the acquisition of Cerner Corporation for $95.00 per share, valuing Cerner at approximately $28.3 billion. This strategic move aimed to enhance Oracle's healthcare technology capabilities, integrating Cerner's electronic health record systems into Oracle's extensive portfolio to drive innovation in healthcare IT solutions.

- Veradigm (formerly Allscripts Healthcare Solutions, Inc.): In March 2021, Mercy Iowa City selected the Allscripts Sunrise Platform of Health as its core electronic health record (EHR) system for its community hospitals. This adoption aimed to streamline healthcare delivery, improve patient care, and enhance operational efficiency by leveraging Allscripts' advanced EHR capabilities and integrated solutions.

- Omron Healthcare: In April 2023, OMRON India introduced a Home Heart Monitoring & Management segment in collaboration with Tricog. This initiative aims to enhance remote patient management by providing advanced heart monitoring solutions, allowing patients to manage their cardiovascular health from home while enabling healthcare providers to track and respond to patient data remotely.

Global Digital Health Industry Analysis

Global Digital Health Market Growth Drivers:

- Increased Use of Digital Tools in Healthcare Facilities: There has been a notable rise in the adoption of digital tools and platforms within healthcare facilities. These tools include electronic health records (EHRs), telemedicine systems, and digital diagnostic tools, which have enhanced the efficiency, accuracy, and accessibility of healthcare services. Healthcare providers are increasingly relying on these technologies to streamline operations, improve patient outcomes, and facilitate better data management. In 2023, Over 62 countries, representing more than 2.5 billion people, have adopted the Global Digital Health Monitor (GDHM) to track and improve their digital health investments. As per WHO (world health organization), 32% of patients had a virtual consultation with a medical provider.

- Adoption of Wearable Technology: The proliferation of wearable health technologies, such as smartwatches and fitness trackers, has significantly contributed to the market's expansion. These devices enable continuous health monitoring and data collection, providing users with valuable insights into their health metrics and encouraging proactive health management. The increasing consumer awareness and demand for personalized health monitoring solutions have driven the growth of wearable technology in the digital health sector. Apple has patented a new sensor system that can detect blood glucose levels without drawing blood. This non-invasive technology could be a game-changer for diabetics and is expected to be integrated into future smart Watches.

- Integration of Artificial Intelligence (AI): The integration of artificial intelligence into digital health solutions has revolutionized the industry by enhancing diagnostic accuracy, optimizing treatment plans, and personalizing patient care. AI-powered tools, such as predictive analytics, natural language processing, and machine learning algorithms, are being utilized to analyze vast amounts of health data, identify patterns, and support clinical decision-making processes. This technological advancement has increased the efficacy of digital health solutions and broadened their application across various healthcare domains. AI systems have demonstrated the capability to accurately diagnose diseases in 87% of cases, compared to an 86% accuracy rate for human detection.

Global Digital Health Market Challenges:

- Data Privacy and Security: Data privacy and security are critical challenges in the digital health industry due to the sensitivity of health data, leading to privacy concerns when digitized. With a significant volume of data generated by the healthcare industry, ensuring data protection, encryption, restricted access, and compliance with regulations like HIPAA and GDPR is essential to prevent breaches and protect patient information.

- Data Integration and Standardization Challenge: Interoperability is a significant challenge in the digital health industry, requiring seamless integration of systems across various healthcare entities. Standardizing healthcare data systems and ensuring smooth information exchange between different systems are essential for enhancing the safety and efficiency of digital health solutions. Developers must address interoperability issues and adhere to regulatory standards to facilitate innovation and improve patient care outcomes.

Global Digital Health Market Government Initiatives:

- Health Information Technology for Economic and Clinical Health (HITECH) Act: In the United States, the HITECH Act represents a pivotal legislative effort aimed at accelerating the adoption and meaningful use of health information technology across the healthcare sector. Enacted as part of the American Recovery and Reinvestment Act of 2009, the HITECH Act provides substantial financial incentives to healthcare providers who implement electronic health records (EHRs) and demonstrate their effective utilization.

- European Union Digital Health Strategy: The European Union has launched several strategic initiatives to advance digital health and integrate technology across its member states. A key component of this strategy is the Digital Single Market (DSM) initiative, which seeks to create a unified and seamless digital healthcare ecosystem across the EU. This strategy aims to facilitate the cross-border exchange of health data and ensure that digital health services are accessible to all EU citizens, regardless of their location.

Global Digital Health Future Market Outlook

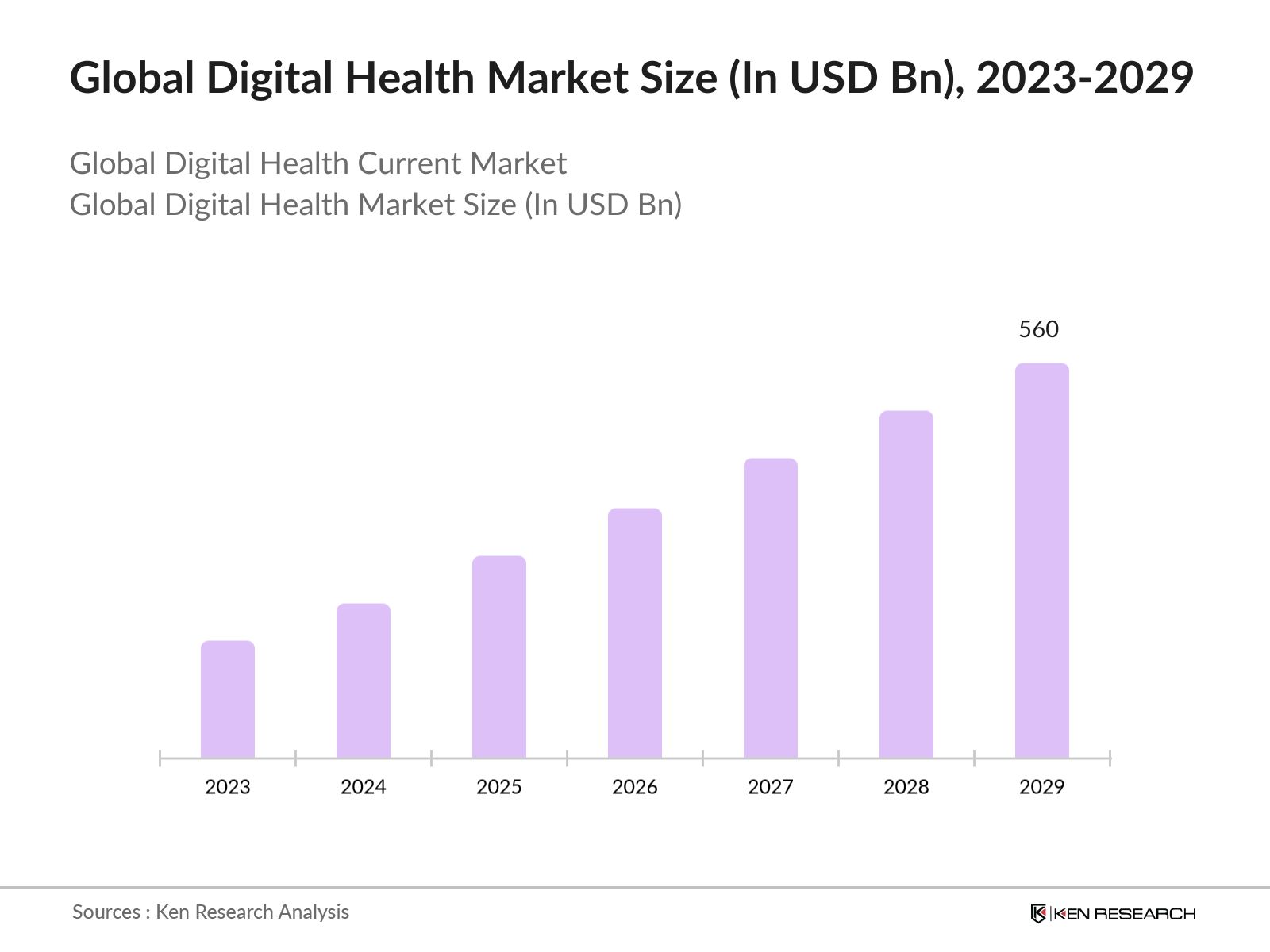

The global digital health market is predicted to grow exceptionally in the forecasted period of 2023-2029 reaching a market size of USD 560 Bn driven by Shifting Focus Towards Home Health, Revisions in Global Digital Health Investment, and Increasing Utilization of AI in Healthcare.

- Shifting Focus Towards Home Health: The future of digital health is increasingly shifting towards home health solutions, driven by advancements in technology and changing patient preferences. This trend reflects a broader movement towards decentralizing healthcare services, allowing patients to manage their health from the comfort of their homes. Key factors contributing to this shift include the rise of wearable health devices, remote monitoring tools, and telehealth platforms that enable real-time health tracking and virtual consultations.

- Revisions in Global Digital Health Investment: As the digital health landscape evolves, there is a notable trend towards revising investment strategies and priorities on a global scale. Investors and stakeholders are increasingly focusing on areas that demonstrate high growth potential and immediate impact, such as artificial intelligence, data interoperability, and cybersecurity within digital health. This shift is driven by the need to address emerging challenges and capitalize on new opportunities in the sector.

Scope of the Report

|

By Region |

North America Europe APAC Latin America MEA |

|

By Technology Type |

Healthcare IT Telehealth |

|

By Healthcare IT Type |

Clinical Healthcare IT Non- Clinical Healthcare IT |

|

By Telehealth Type |

Virtual Visits Remote Patient Monitoring Digital Therapeutics Personal Emergency Response System |

|

By Component Type |

Software Hardware |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Banks and Financial Institutions

Investors and VCs

Government Bodies and Regulatory Bodies (FDA and EMA)

Healthcare Providers and Institutions

Healthcare IT Companies

Pharmaceutical and Biotechnology Companies

Insurance Providers

Medical Device Manufacturers

Telemedicine Service Providers

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2029

Companies

Players Mentioned in the Report:

United Healthcare (Optum)

Oracle Corporation (former Cerner Corporation)

Teladoc Health

Veradigm (formerly Allscripts Healthcare Solutions, Inc.)

Babylon Health

Koninklijke Philips N.V.

Omron Healthcare

NextGen Healthcare, Inc.

Agfa HealthCare

Amwell (American Well Corporation)

Sectra AB

Medical Guardian

Apple Inc

CVS Health

Google

Table of Contents

1. Executive Summary

1.1 Global Health Market

1.2 Global Digital Health Market

2. Global Overview

2.1 Overview of Global Economics

2.2 Overview of Global Digital Health Industry

2.3 Global Health Revenue

2.4 Global Digital Health Infrastructure

3. Global Digital Health Market Overview

3.1 Ecosystem

3.2 Value Chain

3.3 Case Study

4. Global Digital Health Market Size (in USD Bn), 2018-2023

5. Global Digital Health Market Segmentation (in value %), 2018-2023

5.1 By Region (North America, Europe, APAC, Latin America and MEA) in value %, 2018-2023

5.2 By Technology (Healthcare IT and Telehealth) in value%, 2018-2023

5.3 By Healthcare IT (Clinical Healthcare IT and Non- Clinical Healthcare IT) in value %, 2018-2023

5.4 By Telehealth (Virtual Visits, Remote Patient Monitoring, Digital Therapeutics, and Personal Emergency Response System) in value %, 2018-2023

5.5 By Component (Software, Hardware, and Services) in value %, 2018-2023

6. Global Digital Health Market Competition Landscape

6.1 Market Share Analysis

6.2 Market Heat Map Analysis (By Technology)

6.3 Market Heat Map Analysis (By Offerings)

6.4 Market Cross Comparison

6.5 Comparison Matrix

6.6 Investment Landscape

7. Global Digital Health Market Dynamics

7.1 Growth Drivers

7.2 Challenges

7.3 Trends

7.4 Case Studies

7.5 Strategic Initiatives

8. Global Digital Health Future Market Size (in USD Bn), 2023-2029

9. Global Digital Health Future Market Segmentation (in value %), 2023-2029

9.1 By Region (North America, Europe, APAC, Latin America and MEA) in value %, 2023-2029

9.2 By Technology (Healthcare IT and Telehealth) in value%, 2023-2029

9.3 By Healthcare IT (Clinical Healthcare IT and Non- Clinical Healthcare IT) in value %, 2023-2029

9.4 By Telehealth (Virtual Visits, Remote Patient Monitoring, Digital Therapeutics, and Personal Emergency Response System) in value %, 2023-2029

9.5 By Component (Software, Hardware, and Services) in value %, 2023-2029

10. Analyst Recommendations

Research Methodology

Step 1: Stakeholder Identification and Analysis:

Identification of all stakeholders operating with di verse revenue and distribution models to offer the broad range of products and services within this market.

Step 2: Extensive Literature and Industry Review:

Conduction of an extensive review of existing literature, industry reports, and academic publications to gain insights into the global digital health landscape. Gathered secondary data on market trends, challenges, and key players in the sustainable packaging sector.

Step 3: Global Overview and Regional Analysis Collation:

Collation of data from individual regional reports to build a comprehensive global overview of the digital health market. Emphasized the interplay between regional variations and global trends, providing a nuanced understanding of the market dynamics.

Step 4: Data Validation and Statistical Analysis:

Conducted a rigorous validation process to ensure the accuracy and reliability of the obtained data. Employed statistical methods to assess the robustness of the findings and mitigate any potential biases in the research.

Frequently Asked Questions

01 How big is the global digital health market?

In 2023, Global Digital Health Market was valued at USD 230 Bn driven by Increased Use of Digital Tools in Healthcare Facilities, Government Support and Policies, Adoption of Wearable Technology, and Integration of Artificial Intelligence. The widespread use of wearable technology has contributed by offering continuous health monitoring and personalized insights.

02 What are the challenges in the global digital health market?

Challenges in the global digital health market include interoperability issues between different health systems, data privacy concerns, and the high cost of technology implementation. Regulatory compliance and integration of new technologies also pose significant hurdles.

03 Who are the major players in the global digital health market?

Key players in the global digital health market include Teladoc Health, Philips Healthcare, Cerner Corporation, and IBM Watson Health. These companies lead due to their extensive technology portfolios, innovative solutions, and strong market presence.

04 What are the growth drivers of the global digital health market?

Growth drivers in the global digital health market include increased adoption of telehealth services, rising demand for wearable health technologies, and advancements in artificial intelligence. Additionally, government initiatives supporting digital health infrastructure contribute significantly to market expansion.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.