Global Dimethyl Phosphate Market Outlook to 2030

Region:Global

Author(s):Abhinav kumar

Product Code:KROD6850

December 2024

89

About the Report

Global Dimethyl Phosphate Market Overview

- The global dimethyl phosphate market is valued at USD 2.4 billion, driven by its widespread application in flame retardants, agrochemicals, and other industrial uses. The growth in demand is largely attributed to increased agricultural activities and stringent safety regulations concerning flame retardant materials. The agrochemical sector, in particular, has been a significant driver, as dimethyl phosphate is used extensively in the production of pesticides and fertilizers, promoting higher crop yields and ensuring compliance with global agricultural safety standards. This market size is based on a five-year historical analysis, showing a consistent upward trend in demand.

- The market is dominated by key regions, including North America and Europe, with countries such as the United States, Germany, and France leading the way. These countries have well-established industrial sectors, stringent safety regulations, and advanced research and development infrastructures. In North America, the U.S. holds dominance due to its heavy reliance on agrochemicals in large-scale farming and industrial applications. In Europe, strong environmental regulations and advanced chemical manufacturing capabilities give countries like Germany a leading edge. The dominance of these regions is attributed to their technical expertise, regulatory frameworks, and high investment in chemical innovation.

- There is a clear trend toward environmentally friendly alternatives in the chemical industry, driven by stringent environmental policies and increasing consumer awareness. According to the World Bank, in 2023, global investment in renewable energy and eco-friendly manufacturing practices grew by $300 billion, reflecting the widespread adoption of greener technologies. Dimethyl Phosphate is benefiting from this trend, as industries move away from more toxic substances in favor of safer, sustainable alternatives. Many global manufacturers are now focusing on reducing their carbon footprint, which aligns with the growing market preference for eco-friendly chemicals in sectors such as agrochemicals and flame retardants.

Global Dimethyl Phosphate Market Segmentation

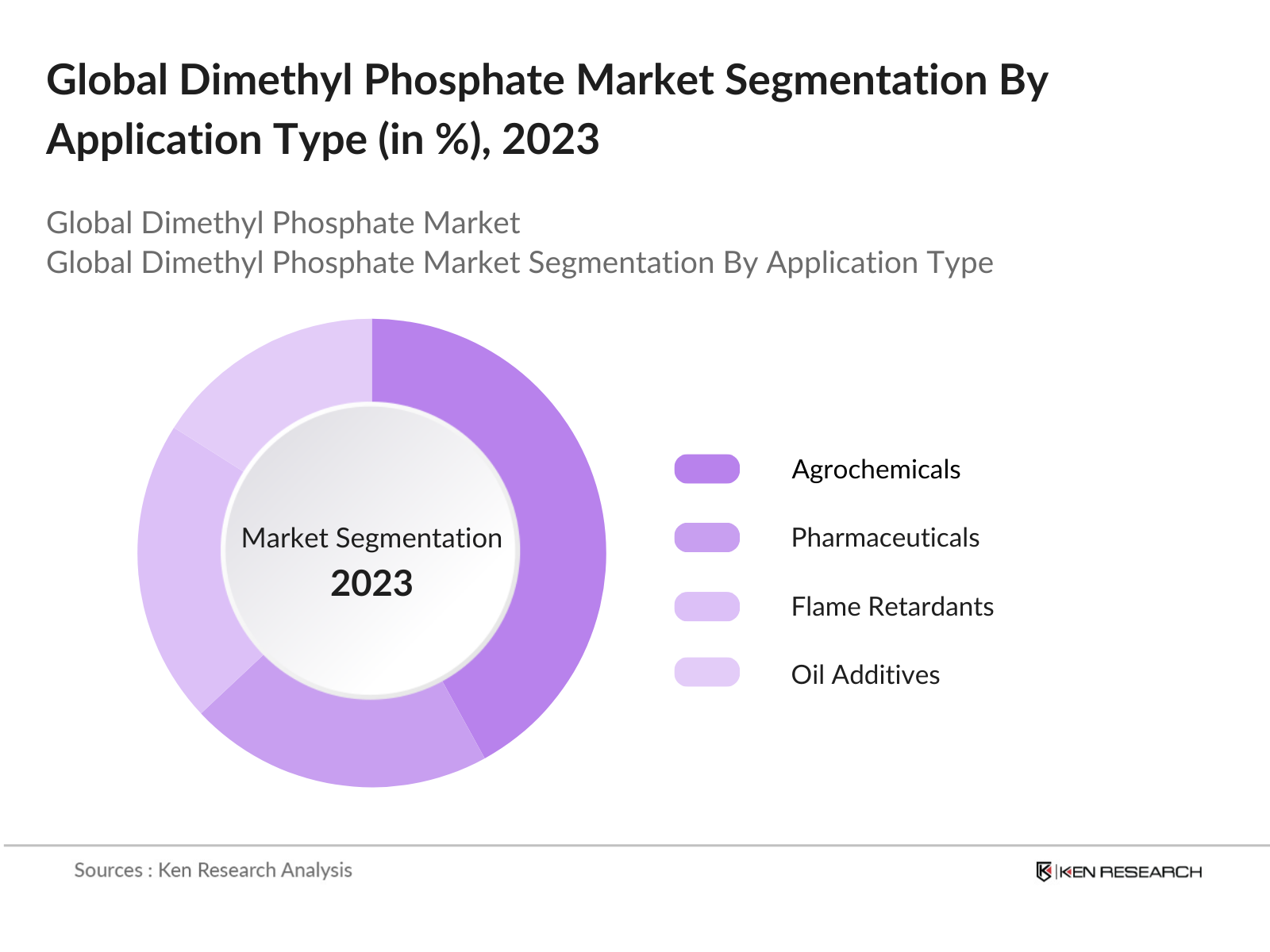

By Application: The global dimethyl phosphate market is segmented by application into agrochemicals, pharmaceuticals, flame retardants, oil additives, and paints & coatings. Among these, the agrochemical application holds the dominant market share. The extensive use of dimethyl phosphate in pesticides and fertilizers has led to its dominance in the market, driven by the increasing need for food security and enhanced agricultural productivity. Countries with significant agricultural output, such as the United States and Brazil, are leading the demand in this segment due to the widespread adoption of advanced agricultural practices and government support for agrochemical innovations.

By Region: The global dimethyl phosphate market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. North America dominates the market, driven by the strong demand for agrochemicals and flame retardants in the U.S. and Canada. The regions emphasis on agricultural output and safety regulations in industrial sectors has resulted in consistent demand for dimethyl phosphate. Asia-Pacific is witnessing the fastest growth, with China and India at the forefront due to the rapid industrialization and expansion of the agricultural sector in these countries.

Global Dimethyl Phosphate Market Competitive Landscape

The global dimethyl phosphate market is dominated by major multinational companies with extensive chemical manufacturing capabilities. These companies have established a strong market presence due to their wide distribution networks, ongoing research and development efforts, and diversified product portfolios. The competitive landscape highlights the consolidation of market share among a few key players, including Lanxess AG, Solvay S.A., and BASF SE. These companies are actively involved in product innovation, mergers, and acquisitions to strengthen their positions in the market.

|

Company |

Establishment Year |

Headquarters |

Product Portfolio |

R&D Investment |

Geographical Reach |

Revenue (2023) |

Sustainability Initiatives |

Employees |

|

Lanxess AG |

2004 |

Germany |

_ |

_ |

_ |

_ |

_ |

_ |

|

Solvay S.A. |

1863 |

Belgium |

_ |

_ |

_ |

_ |

_ |

_ |

|

BASF SE |

1865 |

Germany |

_ |

_ |

_ |

_ |

_ |

_ |

|

Eastman Chemical Company |

1920 |

United States |

_ |

_ |

_ |

_ |

_ |

_ |

|

ICL Group |

1968 |

Israel |

_ |

_ |

_ |

_ |

_ |

_ |

Global Dimethyl Phosphate Industry Analysis

Growth Drivers

- Increasing Demand in Agrochemicals: The agricultural sector's growing dependence on agrochemicals is a significant driver of the Dimethyl Phosphate market. Dimethyl Phosphate is widely used in the formulation of organophosphorus pesticides, which are vital to increasing crop yield. According to the Food and Agriculture Organization (FAO), global pesticide use reached 4.1 million metric tons in 2023. This rise is directly linked to increased global food demand, which the World Bank estimates at 9.7 billion by 2024. Many countries, including Brazil, India, and China, are investing in agriculture to meet these demands, further boosting Dimethyl Phosphate consumption.

- Growing Industrial Applications: The industrial applications of Dimethyl Phosphate, including its use in chemical synthesis and lubricants, are expanding. For example, in 2024, global chemical production grew by 2.7%, supported by government investment in industrial manufacturing sectors, particularly in Asia-Pacific economies. The World Bank reports that the industrial sector in countries like China contributes 33% to the national GDP, promoting the use of chemicals like Dimethyl Phosphate for diverse applications. Additionally, the global demand for lubricant additives is expected to remain steady, driven by infrastructure growth and industrialization, especially in emerging economies like India.

- Regulatory Support for Flame Retardants: Dimethyl Phosphate is increasingly favored in the production of flame retardants due to regulatory support. In 2024, regulatory frameworks from global agencies like the European Chemicals Agency (ECHA) placed restrictions on hazardous substances, boosting demand for non-toxic alternatives like Dimethyl Phosphate. Fire safety regulations have been tightened worldwide. For instance, in 2022, the National Fire Protection Association (NFPA) documented over 1.35 million fire incidents, leading to stricter enforcement of flame retardant regulations. Regulatory actions to limit the use of harmful chemicals in the flame retardant industry are expanding opportunities for safer alternatives such as Dimethyl Phosphate.

Market Challenges

- Stringent Environmental Regulations: Stringent environmental regulations pose challenges to the Dimethyl Phosphate market, especially concerning its use in pesticides and flame retardants. The European Unions REACH regulations and the U.S. Environmental Protection Agency (EPA) have tightened rules surrounding the use of organophosphates, requiring safer alternatives or more expensive reformulations. In 2023, the U.S. EPA enforced penalties on over 120 companies for failing to comply with pesticide regulations, a clear indication of the strict environmental oversight affecting chemical manufacturers. Compliance with these regulations increases operational costs and may limit the market expansion of Dimethyl Phosphate in regions with aggressive environmental policies.

- Volatility in Raw Material Prices: Raw material price volatility, especially in phosphorus derivatives, directly impacts Dimethyl Phosphate production. The global phosphorus supply chain has been affected by geopolitical tensions and export restrictions. In 2023, Morocco, which holds 70% of global phosphorus reserves, implemented export restrictions, causing a spike in raw material costs. According to the International Monetary Fund (IMF), raw material price fluctuations have increased by an average of $50 per metric ton in 2023. Such price instabilities create uncertainties in the production cost of Dimethyl Phosphate, forcing manufacturers to either absorb the cost or pass it on to consumers.

Global Dimethyl Phosphate Market Future Outlook

Over the next five years, the global dimethyl phosphate market is expected to witness robust growth driven by increasing demand in agriculture, expanding industrial applications, and the adoption of sustainable chemical processes. Continuous advancements in chemical manufacturing technologies will enhance production efficiency, reducing costs and environmental impact. Additionally, government regulations promoting the use of flame retardants and safer agrochemicals are likely to bolster the market further.

Opportunities

- Collaborations with Biotech Firms: Collaborations between chemical manufacturers and biotech firms are opening new opportunities for Dimethyl Phosphate in biotechnological applications, including enzyme inhibition and synthesis processes. According to the World Bank, global spending on biotechnology R&D reached $50 billion in 2023, with the U.S. and China leading the investment. These partnerships are driving innovations in bio-based chemical production, creating more sustainable and efficient processes for Dimethyl Phosphate. Government initiatives, such as the U.S. Department of Energys bioenergy program, are providing financial incentives for research in this field, accelerating the development of new applications in pharmaceuticals and agricultural biotechnology.

- Emergence of Bio-Based Phosphates: The shift toward bio-based chemicals offers significant opportunities for Dimethyl Phosphate as industries adopt more sustainable practices. According to the United Nations Environment Programme (UNEP), global investments in green chemistry initiatives, particularly bio-based chemicals, surpassed $100 billion in 2023. Countries like Germany and Japan are actively promoting bio-based production to reduce reliance on fossil-based chemicals, driving demand for Dimethyl Phosphate derived from renewable sources. This transition is being bolstered by stringent environmental regulations and growing consumer demand for environmentally friendly products, making bio-based Dimethyl Phosphate a promising avenue for market expansion.

Scope of the Report

|

Application |

Agrochemicals Pharmaceuticals Flame Retardants Oil Additives Paints & Coatings |

|

End-Use Industry |

Agriculture Industrial Manufacturing Pharmaceuticals Automotive Electronics |

|

Product Type |

Monomethyl Phosphate Dimethyl Phosphate Trimethyl Phosphate |

|

Function |

Flame Retardants Catalysts Solvent Carriers Chemical Intermediates |

|

Region |

North America Europe Asia-Pacific Latin America Middle East & Africa |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing to This Report:

Agrochemical Companies

Flame Retardant Industries

Pharmaceutical Companies

Chemical Industries

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (U.S. Environmental Protection Agency, European Chemicals Agency)

Industrial Safety Regulators

Biotechnology Compoanies

Companies

Players Mentioned in the Report:

Lanxess AG

Solvay S.A.

BASF SE

Eastman Chemical Company

ICL Group

Clariant AG

Aditya Birla Chemicals

Albemarle Corporation

Ashland Global Holdings

Rhodia Operations

Table of Contents

1. Global Dimethyl Phosphate Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Dimethyl Phosphate Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Dimethyl Phosphate Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Demand in Agrochemicals (Agricultural Sector)

3.1.2. Growing Industrial Applications (Industrial Applications)

3.1.3. Regulatory Support for Flame Retardants (Regulatory Policies)

3.1.4. Technological Advancements in Chemical Synthesis (Innovation)

3.2. Market Challenges

3.2.1. Stringent Environmental Regulations (Regulatory Landscape)

3.2.2. Volatility in Raw Material Prices (Pricing Fluctuations)

3.2.3. Limited R&D Investments in Emerging Economies (Investment Landscape)

3.3. Opportunities

3.3.1. Expanding Use in Pharmaceutical Applications (Pharmaceutical Sector)

3.3.2. Collaborations with Biotech Firms (Collaborative Efforts)

3.3.3. Emergence of Bio-Based Phosphates (Sustainable Development)

3.4. Trends

3.4.1. Shift Toward Environmentally Friendly Alternatives (Sustainability)

3.4.2. Increased Adoption in Specialty Chemicals (Specialty Chemicals Demand)

3.4.3. Development of Advanced Manufacturing Processes (Process Innovation)

3.5. Government Regulation

3.5.1. Regulations on Toxic Substance Control (Global Regulatory Compliance)

3.5.2. International Trade Policies and Tariffs (Trade Regulations)

3.5.3. REACH and RoHS Compliance in Europe (Regional Regulations)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Stakeholder Mapping)

3.8. Porters Five Forces

3.9. Competitive Ecosystem

4. Global Dimethyl Phosphate Market Segmentation

4.1. By Application (In Value %)

4.1.1. Agrochemicals

4.1.2. Pharmaceuticals

4.1.3. Flame Retardants

4.1.4. Oil Additives

4.1.5. Paints & Coatings

4.2. By End-Use Industry (In Value %)

4.2.1. Agriculture

4.2.2. Industrial Manufacturing

4.2.3. Pharmaceuticals

4.2.4. Automotive

4.2.5. Electronics

4.3. By Product Type (In Value %)

4.3.1. Monomethyl Phosphate

4.3.2. Dimethyl Phosphate

4.3.3. Trimethyl Phosphate

4.4. By Function (In Value %)

4.4.1. Flame Retardants

4.4.2. Catalysts

4.4.3. Solvent Carriers

4.4.4. Chemical Intermediates

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia-Pacific

4.5.4. Latin America

4.5.5. Middle East & Africa

5. Global Dimethyl Phosphate Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Lanxess AG

5.1.2. Eastman Chemical Company

5.1.3. Solvay S.A.

5.1.4. BASF SE

5.1.5. Dow Inc.

5.1.6. ICL Group

5.1.7. Clariant AG

5.1.8. Aditya Birla Chemicals

5.1.9. Albemarle Corporation

5.1.10. Ashland Global Holdings

5.1.11. Rhodia Operations

5.1.12. Italmatch Chemicals

5.1.13. Perstorp Holding AB

5.1.14. Arkema S.A.

5.1.15. Evonik Industries AG

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue, Product Portfolio, Geographical Reach, R&D Focus, ESG Initiatives)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers And Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Global Dimethyl Phosphate Market Regulatory Framework

6.1. Environmental Standards (Global and Regional)

6.2. Compliance Requirements (Industrial & Chemical)

6.3. Certification Processes (Safety and Environmental)

7. Global Dimethyl Phosphate Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global Dimethyl Phosphate Future Market Segmentation

8.1. By Application (In Value %)

8.2. By End-Use Industry (In Value %)

8.3. By Product Type (In Value %)

8.4. By Function (In Value %)

8.5. By Region (In Value %)

9. Global Dimethyl Phosphate Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The initial phase involved extensive desk research to identify key variables influencing the global dimethyl phosphate market. This included mapping stakeholders such as manufacturers, distributors, and regulatory bodies to understand their roles in market dynamics.

Step 2: Market Analysis and Construction

Historical data on production and consumption patterns were collected and analyzed. Key factors such as market penetration and the ratio of supply to demand were assessed to ensure accuracy in revenue estimations and to identify key trends influencing market growth.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were formulated based on historical data and validated through interviews with industry experts. Consultations provided insights into production challenges, market opportunities, and competitive strategies that were essential for refining market estimates.

Step 4: Research Synthesis and Final Output

The final phase included synthesizing data from industry reports, expert interviews, and financial statements. The final report presents a comprehensive analysis of market dynamics, competitive landscapes, and future growth potential, ensuring accuracy and relevance.

Frequently Asked Questions

01. How big is the Global Dimethyl Phosphate Market?

The global dimethyl phosphate market is valued at USD 2.4 billion, driven by increasing demand in sectors such as agriculture, pharmaceuticals, and industrial manufacturing.

02. What are the key growth drivers for the Global Dimethyl Phosphate Market?

Key growth drivers include rising demand for agrochemicals, advancements in flame retardant technologies, and stringent environmental regulations promoting safer chemical alternatives.

03. Who are the major players in the Global Dimethyl Phosphate Market?

The market is dominated by companies like Lanxess AG, Solvay S.A., BASF SE, Eastman Chemical Company, and ICL Group, owing to their extensive R&D capabilities and broad product portfolios.

04. What challenges does the Global Dimethyl Phosphate Market face?

Challenges include stringent environmental regulations, volatility in raw material prices, and limited research and development investment in emerging economies.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.