Global Draught Beer Market Outlook to 2030

Region:Global

Author(s):Sanjana Verma

Product Code:KROD7093

December 2024

96

About the Report

Global Draught Beer Market Overview

- The global draught beer market is valued at USD 18 billion, driven by the increasing demand for premium and craft beers, particularly in regions with a strong beer culture. Factors such as urbanization and rising disposable income have contributed to the growth of on-premise consumption, especially in bars and restaurants. The growth of this market is also supported by advancements in brewing technology and the rise of microbreweries across major beer-consuming countries.

- Countries such as Germany, Belgium, and the United States dominate the global draught beer market due to their rich brewing traditions and strong beer consumption culture. In Germany, the Reinheitsgebot (beer purity law) and the Oktoberfest event significantly contribute to the markets dominance. The U.S. is leading with its booming craft beer industry, supported by innovative flavors and microbrewery expansions, further fueling the demand for draught beer.

- Taxation policies have a direct impact on the profitability of draught beer producers. In 2023, the average excise tax on beer in the EU was $0.50 per liter, with some countries imposing higher rates. In the U.S., excise taxes vary by state, with rates ranging from $0.10 to $0.40 per liter. These taxes significantly affect the pricing of draught beer, particularly in high-tax regions like Scandinavia and Australia. Breweries must navigate these varying taxation frameworks to remain competitive, while also complying with stringent reporting and accounting requirements.

Global Draught Beer Market Segmentation

By Beer Type: The global draught beer market is segmented by beer type into lager, ale, stout, and pilsner. Lager holds the dominant market share, driven by its widespread acceptance and preference across many countries. Consumers favor lagers due to their light taste and lower bitterness, making them a popular choice in social and casual settings. Brands like Heineken and Budweiser have established strong global recognition, reinforcing the dominance of lagers in the draught beer segment.

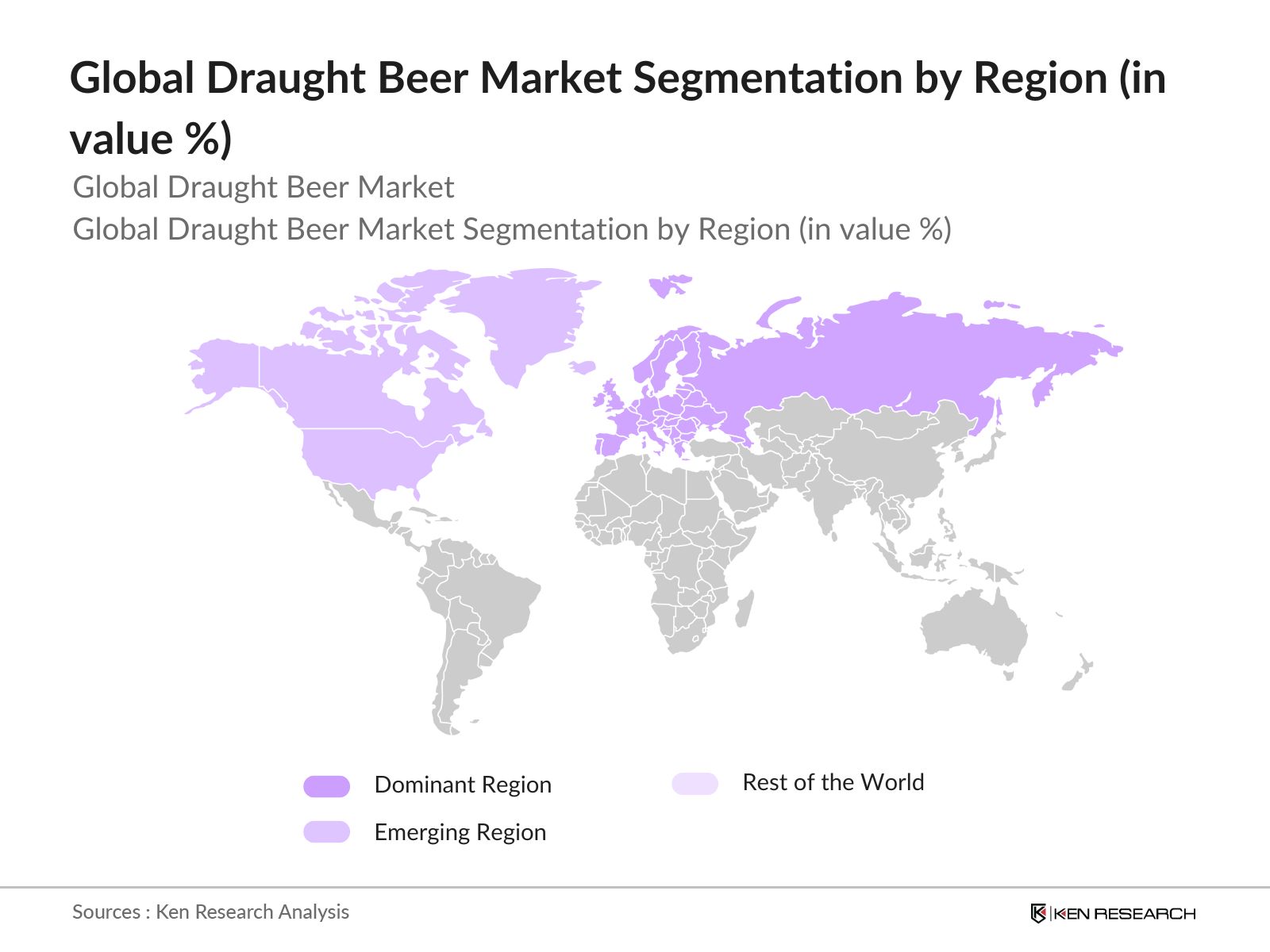

By Region: The global draught beer market is segmented by region into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. Europe holds the dominant market share in the regional segmentation, largely due to its long-standing beer culture and high per capita beer consumption in countries like Germany, Belgium, and the UK. Europes dominance is also driven by the presence of several world-renowned beer festivals, such as Oktoberfest, which significantly boosts draught beer sales. Additionally, the regions extensive network of breweries, ranging from global giants to small craft producers, ensures that Europe remains a stronghold for draught beer consumption.

By Distribution Channel: The draught beer market is segmented by distribution channels into on-premise (bars, restaurants, pubs) and off-premise (retail, supermarkets). The on-premise channel dominates the market due to the growing trend of social drinking and the experience-driven appeal of enjoying freshly poured beer. Bars and restaurants offer a broad selection of premium draught beers, which drives on-premise sales as customers seek out high-quality, freshly brewed beer experiences.

Global Draught Beer Market Competitive Landscape

The global draught beer market is dominated by several major players, including some of the largest brewing companies worldwide. The competitive landscape is marked by a combination of global brewers and regional craft breweries, driving innovation and variety in the market. Major global brands such as Anheuser-Busch InBev and Heineken dominate the market with their extensive distribution networks and strong brand presence. However, regional craft breweries are gaining market share, particularly in North America and Europe, due to growing consumer preference for artisanal and locally brewed beers.

|

Company Name |

Establishment Year |

Headquarters |

Production Volume |

Global Reach |

No. of Breweries |

Revenue (USD Bn) |

Distribution Channels |

Brand Portfolio |

|

Anheuser-Busch InBev |

2008 |

Leuven, Belgium |

- |

- |

- |

- |

- |

- |

|

Heineken N.V. |

1864 |

Amsterdam, NL |

- |

- |

- |

- |

- |

- |

|

Carlsberg Group |

1847 |

Copenhagen, DK |

- |

- |

- |

- |

- |

- |

|

Molson Coors Beverage Co. |

1786 |

Chicago, USA |

- |

- |

- |

- |

- |

- |

|

Boston Beer Company |

1984 |

Boston, USA |

- |

- |

- |

- |

- |

- |

Global Draught Beer Market Analysis

Growth Drivers

- Changing Consumer Preferences: Consumers are increasingly shifting towards draught beer due to its fresh taste and variety of flavors, creating significant demand in the global market. In 2024, the U.S. reported over 7,500 active breweries, reflecting this shift in preferences. In Europe, the number of breweries has grown by 2,500 since 2020, further highlighting changing consumption habits. According to IMF data, the global beer consumption volume in 2022 was 189 million kiloliters, with draught beer accounting for a significant portion due to its premium positioning and freshness appeal.

- Expansion of Craft Breweries: Craft breweries are a critical growth driver in the draught beer market, with their numbers expanding rapidly across regions. In the U.S., craft breweries represented 27% of all beer produced in 2022, generating revenues of $29.3 billion, according to data from the National Beer Wholesalers Association. The rising presence of craft breweries globally is driving the production of high-quality draught beer, particularly in regions with strong consumer demand for artisanal and premium products.

- Technological Advancements in Brewing: Technological innovations are improving the efficiency and quality of draught beer production. Automated brewing systems have reduced production times by up to 30% in leading breweries, while new quality control systems ensure product consistency. In 2023, global investments in brewing technology surpassed $2.5 billion, with significant contributions from European and North American breweries. These innovations are expected to drive further efficiencies in the supply chain, reducing wastage and ensuring higher profitability for producers.

Challenges

- High Production and Distribution Costs: High production and distribution costs continue to challenge the draught beer market. In 2023, the global average cost of brewing a hectoliter of beer reached $87, driven by rising raw material and energy costs. The cost of cold chain logistics, essential for maintaining the quality of draught beer, adds an additional $30 per hectoliter, according to industry data. Rising fuel costs, which saw a 25% increase from 2020 to 2023, are also making transportation more expensive, directly impacting the profitability of breweries that rely on draught beer sales.

- Supply Chain Disruptions: The draught beer market faces significant supply chain disruptions, particularly in cold storage and transportation. In 2022, global supply chain delays increased by 19%, with the beverage sector being heavily impacted. Cold storage shortages in Europe and the U.S. have led to longer transit times and quality deterioration risks. These disruptions have forced breweries to seek alternative distribution channels or invest in costly storage solutions.

Global Draught Beer Market Future Outlook

global draught beer market is expected to witness significant growth driven by an increase in demand for premium and craft beers, particularly in the North American and European markets. The market is also likely to benefit from technological advancements in brewing and distribution, including innovative keg systems and sustainable packaging solutions. As consumers seek unique beer experiences, the growth of microbreweries and brewpubs is expected to shape the markets trajectory.

Future Market Opportunities

- Increasing Demand for Premium Beers: The demand for premium beers continues to rise globally, offering a significant opportunity for the draught beer market. In 2023, premium beer sales in the U.S. surpassed 70 million barrels, showing a marked preference for higher-quality brews among consumers. Similarly, premium beer consumption in Asia saw a sharp increase, with 43 million barrels sold in 2022. This growth is fueled by urbanization and increased consumer spending in emerging markets, where premium beers represent status and quality.

- Global Market Expansion: Global market expansion presents a promising opportunity for draught beer producers. Untapped markets, particularly in Africa and Latin America, have seen a rise in beer consumption, with Africa reporting a 22% increase in imports of premium beer in 2022. Export opportunities are also growing, with Latin America importing over 15 million barrels of beer in 2023, according to trade data. Breweries looking to enter these markets are positioned to benefit from rising demand, particularly for high-quality draught beer in urban areas where Western brands hold appeal.

Scope of the Report

|

By Beer Type |

Lager Ale Stout Pilsner |

|

By Distribution Channel |

On-premise Off-premise |

|

By Packaging Type |

Kegs Bottles Cans |

|

By Alcohol Content |

Low-alcohol Regular, Strong |

|

By Region |

North America Europe Asia Pacific Latin America Middle East & Africa |

Products

Key Target Audience

Breweries and Microbreweries

Beer Distributors and Wholesalers

Hospitality Industry (Hotels, Bars, Restaurants)

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Alcohol and Tobacco Tax and Trade Bureau, European Brewery Convention)

Packaging Suppliers (Sustainable and Innovative Packaging)

Keg System Manufacturers

Companies

Players Mentioned in the Report:

Anheuser-Busch InBev

Heineken N.V.

Carlsberg Group

Molson Coors Beverage Company

Asahi Group Holdings

Kirin Holdings

Diageo Plc

Constellation Brands

Boston Beer Company

SABMiller

Table of Contents

Global Draught Beer Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

Global Draught Beer Market Size (In USD Mn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

Global Draught Beer Market Analysis

3.1 Growth Drivers

3.1.1 Changing Consumer Preferences

3.1.2 Expansion of Craft Breweries

3.1.3 Technological Advancements in Brewing (Equipment Efficiency, Quality Control Systems)

3.1.4 Urbanization & Rising Disposable Income (Global, Regional Trends)

3.2 Market Challenges

3.2.1 High Production and Distribution Costs

3.2.2 Supply Chain Disruptions (Cold Storage, Transport)

3.2.3 Regulatory Compliance (Alcohol Licensing, Health Regulations)

3.3 Opportunities

3.3.1 Increasing Demand for Premium Beers

3.3.2 Global Market Expansion (Untapped Markets, Export Opportunities)

3.3.3 Rise in Sustainability Trends (Eco-friendly Packaging, Sustainable Brewing)

3.4 Trends

3.4.1 Growth of Draught Beer in On-premise Channels (Bars, Restaurants)

3.4.2 Digitization in Beer Distribution (E-commerce Platforms, Digital Marketing)

3.4.3 Introduction of Innovative Flavors

3.5 Government Regulations

3.5.1 Taxation Policies

3.5.2 Restrictions on Alcohol Advertising (Marketing, Promotion Regulations)

3.5.3 Health and Safety Compliance (Alcohol Content Regulations, Health Warnings)

3.6 Competitive Ecosystem (Barriers to Entry, Competitive Landscape)

3.7 SWOT Analysis

3.8 Porters Five Forces Analysis

Global Draught Beer Market Segmentation

4.1 By Beer Type (In Value %)

4.1.1 Lager

4.1.2 Ale

4.1.3 Stout

4.1.4 Pilsner

4.2 By Distribution Channel (In Value %)

4.2.1 On-premise (Bars, Restaurants, Pubs)

4.2.2 Off-premise (Retail, Supermarkets)

4.3 By Packaging Type (In Value %)

4.3.1 Kegs

4.3.2 Bottles

4.3.3 Cans

4.4 By Alcohol Content (In Value %)

4.4.1 Low-alcohol Beers

4.4.2 Regular

4.4.3 Strong

4.5 By Region (In Value %)

4.5.1 North America

4.5.2 Europe

4.5.3 Asia Pacific

4.5.4 Latin America

4.5.5 Middle East & Africa

Global Draught Beer Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Anheuser-Busch InBev

5.1.2 Heineken N.V.

5.1.3 Carlsberg Group

5.1.4 Molson Coors Beverage Company

5.1.5 Asahi Group Holdings

5.1.6 Kirin Holdings

5.1.7 SABMiller

5.1.8 Diageo Plc

5.1.9 Constellation Brands

5.1.10 Boston Beer Company

5.2 Cross Comparison Parameters (Market Share %, Global Reach, Production Capacity, Revenue)

5.3 Market Share Analysis

5.4 Strategic Initiatives (Product Launches, Partnerships)

5.5 Mergers and Acquisitions

5.6 Investment Analysis (Private Equity, Government Investments)

5.7 Venture Capital Funding

5.8 Strategic Alliances

Global Draught Beer Market Regulatory Framework

6.1 Alcohol Taxation and Excise Duties

6.2 Distribution Licensing Requirements

6.3 Certification Processes (ISO Standards, HACCP)

Global Draught Beer Future Market Size (In USD Mn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

Global Draught Beer Future Market Segmentation

8.1 By Beer Type (In Value %)

8.2 By Distribution Channel (In Value %)

8.3 By Packaging Type (In Value %)

8.4 By Alcohol Content (In Value %)

8.5 By Region (In Value %)

Global Draught Beer Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial stage of research involves identifying key stakeholders in the global draught beer market. This step includes secondary research to collect data on beer consumption trends, distribution channels, and consumer preferences. The key variables influencing market growth, such as distribution network efficiency and technological advancements, are identified through these sources.

Step 2: Market Analysis and Construction

Historical data from the beer industry, including sales volumes, production capacities, and distribution reach, is collected. The analysis also includes evaluating consumer preferences for different beer types, which helps construct the market framework. This step involves data analysis from sources like industry reports and government agencies.

Step 3: Hypothesis Validation and Expert Consultation

Industry experts from major beer producers are consulted to validate market assumptions. These consultations help refine the data collected and provide additional insights into trends like the rise of premium craft beers and sustainability in packaging.

Step 4: Research Synthesis and Final Output

The final step involves synthesizing data from various sources, ensuring accuracy and coherence in the findings. This process includes reviewing market reports, consulting industry professionals, and finalizing the analysis of the draught beer market, supported by quantitative and qualitative data.

Frequently Asked Questions

01 How big is the Global Draught Beer Market?

The global draught beer market is valued at USD 18 billion, driven by increasing demand for premium and craft beer in key regions like North America and Europe.

02 What are the challenges in the Global Draught Beer Market?

Challenges in Global Draught Beer Market include high production costs, complex supply chains, and stringent regulatory compliance in major beer-consuming regions. Additionally, the rising demand for sustainable packaging adds pressure on manufacturers.

03 Who are the major players in the Global Draught Beer Market?

Key players in Global Draught Beer Market include Anheuser-Busch InBev, Heineken N.V., Carlsberg Group, Molson Coors Beverage Company, and Boston Beer Company. These companies dominate due to their extensive distribution networks and strong brand portfolios.

04 What are the growth drivers of the Global Draught Beer Market?

Global Draught Beer Market is driven by consumer preference for high-quality, premium beers, the expansion of microbreweries, and the popularity of on-premise consumption. Technological advancements in brewing also support market growth.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.