Global Drip Irrigation Market Outlook to 2030

Region:Global

Author(s):Vijay Kumar

Product Code:KROD738

December 2024

85

About the Report

Global Drip Irrigation Market Overview

- The global drip irrigation market reached a valuation of USD 4 billion in 2023, driven by the increasing demand for water-efficient agricultural practices and the need to enhance crop yields in water-scarce regions. The market's growth is supported by technological advancements in precision agriculture, government subsidies, and the rising importance of sustainable farming methods. These factors have collectively fueled the adoption of drip irrigation systems across various regions.

- Major players in the global drip irrigation market include Netafim, Jain Irrigation Systems Ltd., The Toro Company, Rain Bird Corporation, and Lindsay Corporation. These companies have solidified their market positions through continuous investment in research and development, strategic partnerships, and a focus on expanding their global footprint. Their ability to introduce innovative solutions tailored to diverse agricultural needs has enabled them to maintain a competitive edge.

- In 2024, Jain Irrigation Systems Ltd. expanded its product portfolio by introducing a new range of affordable drip irrigation systems designed specifically for small-scale farmers in emerging markets. This initiative has gained significant traction in Africa and Southeast Asia, where access to water-efficient technology is crucial for improving agricultural productivity. Additionally, The Toro Company launched a new series of solar-powered drip irrigation systems targeting regions with unreliable electricity supply, emphasizing the growing demand for sustainable irrigation solutions.

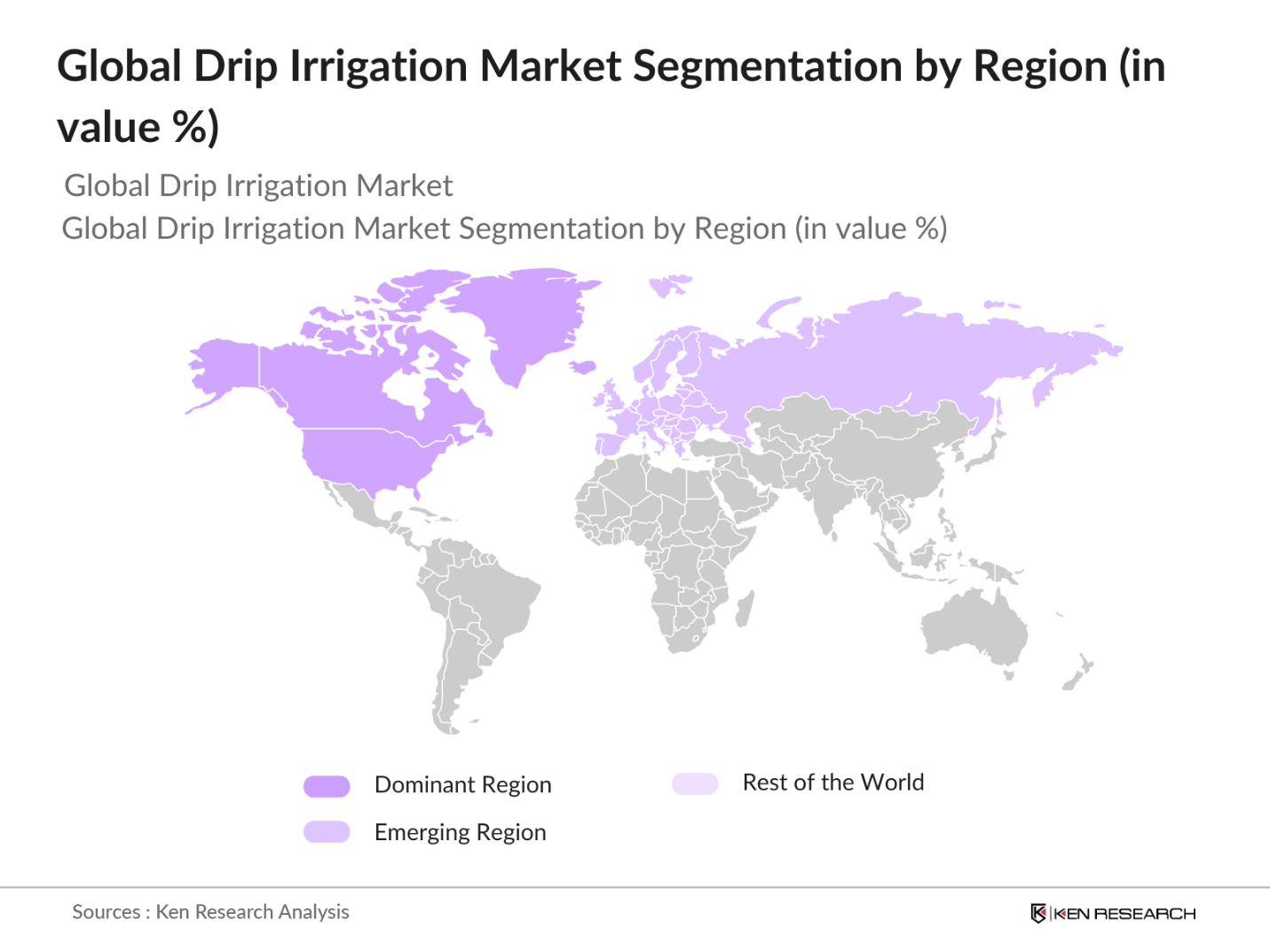

- North America dominates the global drip irrigation market, primarily due to the region's advanced agricultural infrastructure, strong focus on precision farming, and supportive government policies. The presence of major market players and the increasing adoption of water conservation practices contribute to North America's leadership position. Government initiatives like the U.S. Department of Agriculture's Environmental Quality Incentives Program (EQIP) are driving the adoption of drip irrigation systems across various agricultural sectors.

Global Drip Irrigation Market Segmentation

By Crop Type: The global drip irrigation market is segmented by crop type into fruits and vegetables, field crops, and others. In 2023, the fruits and vegetables segment held the dominant market share due to the high profitability and sensitivity of these crops to water stress. Drip irrigation is extensively used in the cultivation of high-value crops like grapes, tomatoes, and citrus fruits, where precise water delivery is critical for maintaining quality and yield.

By Component: The global drip irrigation market is segmented by component into emitters, drip tubes, filters, and others. In 2023, emitters dominated the market share within this segment due to their critical role in ensuring uniform water distribution. Emitters are designed to regulate water flow and pressure, making them essential for achieving efficient irrigation. The popularity of emitters is driven by their adaptability to various crop types and soil conditions, making them a preferred choice among farmers.

By Region: Geographically, the drip irrigation market is segmented into North America, Europe, Asia-Pacific, Latin America, and MEA. In 2023, North America dominated the market, driven by the region's advanced agricultural infrastructure, high adoption of precision farming techniques, and government support for water conservation initiatives.

Global Drip Irrigation Market Competitive Landscape

|

Company Name |

Headquarters |

Establishment Year |

|

Netafim |

Tel Aviv, Israel |

1965 |

|

Jain Irrigation Systems Ltd. |

Jalgaon, India |

1986 |

|

The Toro Company |

Bloomington, Minnesota, USA |

1914 |

|

Rain Bird Corporation |

Azusa, California, USA |

1933 |

|

Lindsay Corporation |

Omaha, Nebraska, USA |

1955 |

- The Toro Company: The Toro Company has introduced a new line of solar-powered drip irrigation systems designed for regions with unreliable electricity. This product line addresses the increasing need for sustainable irrigation solutions, especially in areas where access to conventional power is limited, offering an eco-friendly alternative that ensures consistent water delivery for agricultural practices.

- Lindsay Corporation: Lindsay Corporation expanded its presence in Latin America in 2023 by acquiring a local drip irrigation manufacturer. This strategic move aims to enhance Lindsay's market penetration in the region, where demand for efficient irrigation systems is rising due to increasing agricultural activities. The acquisition is expected to boost Lindsay's sales by 20% in the Latin American market.

Global Drip Irrigation Market Analysis

Market Growth Drivers

- Water Scarcity and Agricultural Demand: The increasing scarcity of water resources is driving the adoption of drip irrigation systems, particularly in regions like the Middle East, Africa, and parts of Asia. Governments are increasingly focusing on water conservation in agriculture, with initiatives such as India's Jal Jeevan Mission promoting micro-irrigation to enhance water efficiency in farming.

- Government Subsidies and Financial Incentives: In 2024, various governments intensified their efforts to promote sustainable agriculture through financial support for drip irrigation systems. The U.S. Department of Agriculture (USDA) allocated $1.2 billion under the Environmental Quality Incentives Program (EQIP) to support farmers in adopting water-efficient technologies, including drip irrigation. Similar programs in other regions are expected to further boost market growth.

- Food Security Concerns: The global population is projected to reach 8.2 billion by 2024, intensifying the demand for food production. This surge in demand has prompted governments and farmers to seek ways to increase crop yields without depleting water resources. Drip irrigation, which can save up to 70% more water compared to traditional methods, is being increasingly adopted in key agricultural economies like the USA, China, and Brazil.

Global Drip Irrigation Market Challenges

- High Initial Costs: The cost of setting up a drip irrigation system remains a significant barrier, particularly for small-scale farmers in developing regions. Despite government subsidies, the initial investment required for installation can be prohibitive, limiting the widespread adoption of this technology.

- Complex Maintenance Requirements: Drip irrigation systems require regular maintenance to prevent clogging and ensure efficient water distribution. This maintenance complexity is particularly problematic in regions with poor infrastructure, where system breakdowns can lead to significant crop losses.

Global Drip Irrigation Market Government Initiatives

- India's Pradhan Mantri Krishi Sinchayee Yojana (PMKSY): In 2024, the Indian government significantly expanded the Pradhan Mantri Krishi Sinchayee Yojana, allocating INR 4,000 crores to enhance the irrigation infrastructure across the country. The initiative focuses on promoting micro-irrigation methods, including drip irrigation, to achieve the goal of "Har Khet Ko Pani" (Water for Every Field).

- U.S. Environmental Quality Incentives Program (EQIP): The USDAs EQIP, which received $1.2 billion in funding for 2024, continues to be a cornerstone of the U.S. government's efforts to promote sustainable agriculture. EQIP provides financial assistance to farmers for adopting environmentally sound agricultural practices, including drip irrigation.

Global Drip Irrigation Market Future Market Outlook

The Global Drip Irrigation Market is poised for significant growth, driven by advancements in precision agriculture technologies, expanding adoption in emerging markets, and a stronger emphasis on sustainable farming practices and water conservation.

Future Market Trends

- Advancements in AI-Driven Irrigation Systems: By 2028, the global drip irrigation market is expected to witness widespread adoption of AI-driven systems that automatically adjust water delivery based on real-time data from soil sensors, weather forecasts, and crop growth patterns. These systems will enable farmers to optimize water use, leading to increased crop yields and reduced water wastage.

- Increased Focus on Sustainable Agriculture Practices: Sustainable agriculture will become a central theme in the global drip irrigation market by 2028, driven by increasing awareness of environmental issues and the need to preserve natural resources. Drip irrigation systems will be integrated with renewable energy sources, such as solar power, to reduce their carbon footprint. The United Nations Sustainable Development Goals (SDGs) will further incentivize the adoption of drip irrigation as a key component of sustainable farming practices, particularly in regions facing severe water scarcity.

Scope of the Report

|

By Crop |

Fruits and Vegetables Field Crops Others |

|

By Product |

Emitters Tubing Valves |

|

By Region |

North America Europe APAC Latin America MEA |

|

By Component |

Emitters Drip Tubes Filters Others |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing to This Report:

Agricultural Equipment Manufacturers

Government and Regulatory Bodies

Water Management Authorities

Farmers and Agricultural Cooperatives

Agricultural Research Institutes

Investments and Venture Capitalist Firms

Drip Irrigation System Distributors

Smart Agriculture Technology Providers

Environmental Conservation Agencies

Irrigation System Installers

Time Period Captured in the Report

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report

Netafim

Jain Irrigation Systems Ltd.

The Toro Company

Rain Bird Corporation

Lindsay Corporation

Rivulis Irrigation

Hunter Industries

DripWorks

Elgo Irrigation Ltd.

Metzer Group

Table of Contents

1. Global Drip Irrigation Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Drip Irrigation Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Drip Irrigation Market Analysis

3.1. Growth Drivers

3.1.1. Water Conservation Needs

3.1.2. Government Subsidies and Initiatives

3.1.3. Technological Advancements in Irrigation

3.1.4. Increasing Agricultural Productivity Demands

3.2. Market Challenges

3.2.1. High Initial Investment Costs

3.2.2. Maintenance and Technical Issues

3.2.3. Lack of Awareness Among Farmers

3.3. Opportunities

3.3.1. Expansion in Emerging Markets

3.3.2. Integration with Smart Farming Solutions

3.3.3. Development of Low-Cost Drip Irrigation Systems

3.4. Trends

3.4.1. Adoption of Precision Agriculture

3.4.2. Use of Solar-Powered Drip Systems

3.4.3. Increasing Use of Recycled Water in Irrigation

3.5. Government Regulations

3.5.1. Water Usage Policies

3.5.2. Agricultural Subsidies

3.5.3. Environmental Protection Standards

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Landscape

4. Global Drip Irrigation Market Segmentation

4.1. By Component (In Value %)

4.1.1. Emitters/Drippers

4.1.2. Drip Tubes/Drip Lines

4.1.3. Filters

4.1.4. Valves

4.1.5. Pressure Pumps

4.1.6. Fittings & Accessories

4.2. By Crop Type (In Value %)

4.2.1. Field Crops

4.2.2. Fruits & Nuts

4.2.3. Vegetable Crops

4.2.4. Other Crops (e.g., Ornamental Plants)

4.3. By Application (In Value %)

4.3.1. Surface Application

4.3.2. Subsurface Application

4.4. By Emitter/Dripper Type (In Value %)

4.4.1. Inline Emitters

4.4.2. Online Emitters

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia-Pacific

4.5.4. Latin America

4.5.5. Middle East & Africa

5. Global Drip Irrigation Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Netafim Limited

5.1.2. Jain Irrigation Systems Ltd.

5.1.3. The Toro Company

5.1.4. Rain Bird Corporation

5.1.5. Lindsay Corporation

5.1.6. Valmont Industries, Inc.

5.1.7. Rivulis Irrigation Ltd.

5.1.8. Hunter Industries Inc.

5.1.9. Eurodrip S.A.

5.1.10. Metzer Group

5.1.11. Irritec S.p.A

5.1.12. Chinadrip Irrigation Equipment Co., Ltd.

5.1.13. Elgo Irrigation Ltd.

5.1.14. Antelco Pty Ltd.

5.1.15. Microjet Irrigation Systems

5.2. Cross Comparison Parameters (Number of Employees, Headquarters, Inception Year, Revenue, Product Portfolio, Market Presence, R&D Investment, Strategic Partnerships)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.6.1. Venture Capital Funding

5.6.2. Government Grants

5.6.3. Private Equity Investments

6. Global Drip Irrigation Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. Global Drip Irrigation Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global Drip Irrigation Future Market Segmentation

8.1. By Component (In Value %)

8.2. By Crop Type (In Value %)

8.3. By Application (In Value %)

8.4. By Emitter/Dripper Type (In Value %)

8.5. By Region (In Value %)

9. Global Drip Irrigation Market Analysts Recommendations

9.1. Total Addressable Market (TAM)/Serviceable Available Market (SAM)/Serviceable Obtainable Market (SOM) Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identifying Key Variables

Creating an ecosystem for all major entities within the Global Drip Irrigation Market and referencing a combination of secondary and proprietary databases to conduct desk research. This step involves gathering industry-level information, identifying market trends, and understanding the competitive landscape to ensure a comprehensive analysis.

Step 2: Market Building

Collating statistics on the Global Drip Irrigation Market over the years, analyzing market penetration across various segments, and evaluating the performance of key market players. This includes reviewing production capacities, market shares, and sales data to accurately compute the revenue generated within the global drip irrigation market. Quality checks are conducted to ensure the accuracy and reliability of the data points shared.

Step 3: Validating and Finalizing

Developing market hypotheses and conducting Computer Assisted Telephone Interviews (CATIs) with industry experts and stakeholders from leading companies in the drip irrigation market. These interviews are crucial for validating the collected data, refining market forecasts, and obtaining operational and financial insights directly from industry representatives.

Step 4: Research Output

Engaging with multiple key players in the drip irrigation industry to understand the dynamics of product segments, customer needs, sales patterns, and market challenges. This step involves using a bottom-up approach to validate the data, ensuring that the final statistics and insights accurately reflect market conditions and support strategic decision-making.

Frequently Asked Questions

1. How big is the Global Drip Irrigation Market?

The global drip irrigation market reached a valuation of USD 4 billion in 2023, driven by the increasing demand for water-efficient agricultural practices and the need to enhance crop yields in water-scarce regions.

2. What are the challenges in the Global Drip Irrigation Market?

Challenges in the global drip irrigation market include high initial costs of system installation, complex maintenance requirements, and limited awareness and training among small-scale farmers, particularly in developing regions.

3. Who are the major players in the Global Drip Irrigation Market?

Key players in the global drip irrigation market include Netafim, Jain Irrigation Systems Ltd., The Toro Company, Rain Bird Corporation, and Lindsay Corporation. These companies lead the market due to their innovative product offerings and strong distribution networks.

4. What are the growth drivers of the Global Drip Irrigation Market?

The market is driven by increasing water scarcity, government subsidies and financial incentives, and rising concerns over food security. The adoption of precision agriculture technologies also plays a significant role in market expansion.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.