Global Drone Battery Market Outlook to 2030

Region:Global

Author(s):Naman Rohilla

Product Code:KROD6872

December 2024

99

About the Report

Global Drone Battery Market Overview

- The global drone battery market is valued at USD 9.6 billion, according to a comprehensive analysis. The market's growth is primarily driven by increased demand for Unmanned Aerial Vehicles (UAVs) across various sectors, including defence, commercial deliveries, and industrial surveillance. In particular, advancements in battery technology, such as lithium-ion and hydrogen fuel cells, are enabling longer flight times, further fueling the adoption of drones globally.

- Key countries dominating the drone battery market include the United States, China, and Israel. The U.S. leads due to its extensive use of drones in defence and logistics, backed by major manufacturers and government investments. Meanwhile, Chinas dominance stems from its vast manufacturing capabilities and innovations in consumer and commercial drones. Israel is a leader in military drones due to its highly advanced defence sector, making it a top market for drone battery technology.

- Drone batteries must comply with strict aviation safety standards to mitigate risks associated with battery failures or malfunctions. In 2023, the International Civil Aviation Organization (ICAO) updated its guidelines for the safe use and transport of lithium-ion batteries in UAVs. These standards ensure that batteries meet rigorous safety requirements for both commercial and defence applications. Compliance with these regulations is mandatory for drone manufacturers, as failure to adhere can result in legal and financial penalties.

Global Drone Battery Market Segmentation

- By Drone Type: The market is segmented by drone type into commercial drones, defence drones, agricultural drones, delivery drones, and surveying and mapping drones. Defence drones lead the market segment due to investments from governments, particularly in the U.S., China, and Israel. Their application in reconnaissance, surveillance, and combat operations requires highly efficient and long-lasting batteries, further pushing demand for advanced battery solutions in the defence sector.

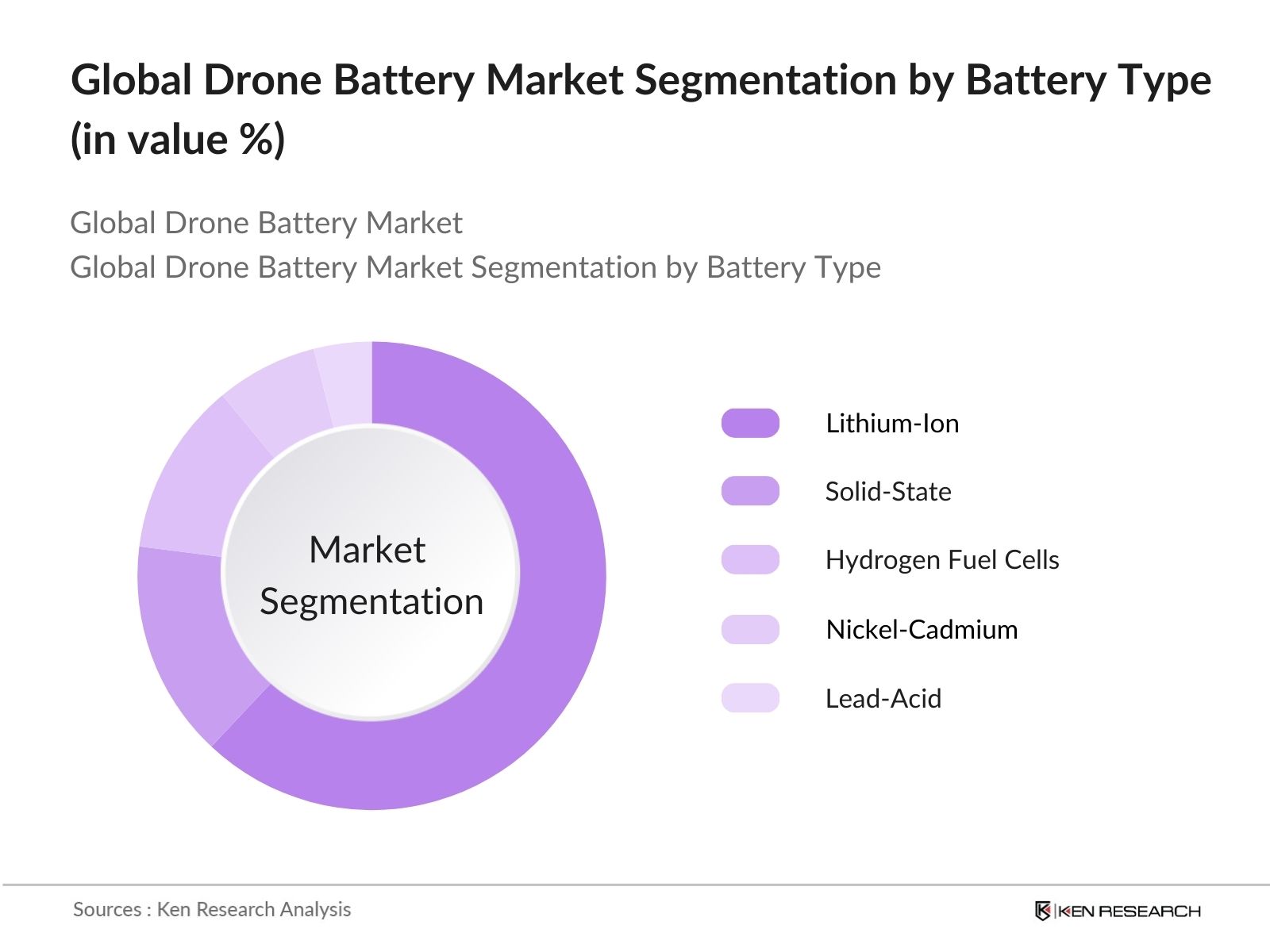

- By Battery Type: The market is segmented by battery type into lithium-ion, solid-state, hydrogen fuel cells, nickel-cadmium, and lead-acid batteries. Lithium-ion batteries hold a dominant share due to their high energy density, longer lifespan, and lightweight characteristics, which make them ideal for drones in various sectors, from delivery services to military applications. Their widespread adoption is also fueled by ongoing improvements in battery technology, which enhance overall drone performance and extend flight duration.

- By Region: The market is regionally segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. North America dominates the market, largely due to the presence of key drone manufacturers and robust government initiatives in the U.S. to develop drone technology for both commercial and defence applications. The regions mature technological landscape, paired with extensive research and development, ensures it maintains a leading position in the global market.

Global Drone Battery Market Competitive Landscape

The global drone battery market is consolidated, with a few key players holding a major share. Companies like DJI and Parrot dominate the commercial sector, while firms like Ballard Power Systems and Doosan Mobility Innovation focus on advanced battery technologies for defence applications. These players' strong brand equity, continuous innovation, and large-scale production capabilities position them as market leaders.

|

Company |

Establishment Year |

Headquarters |

Technology Innovation |

Production Capacity |

Battery Type Specialization |

Strategic Partnerships |

Revenue |

Employee Strength |

|

DJI Technology Co. Ltd. |

2006 |

Shenzhen, China |

- |

- |

- |

- |

- |

- |

|

Parrot Drones |

1994 |

Paris, France |

- |

- |

- |

- |

- |

- |

|

Ballard Power Systems |

1979 |

Burnaby, Canada |

- |

- |

- |

- |

- |

- |

|

Doosan Mobility Innovation |

2014 |

South Korea |

- |

- |

- |

- |

- |

- |

|

LG Chem |

1947 |

Seoul, South Korea |

- |

- |

- |

- |

- |

- |

Global Drone Battery Market Analysis

Global Drone Battery Market Growth Drivers

- Increasing Demand for UAVs in Commercial and Defence Applications: The global increase in the adoption of Unmanned Aerial Vehicles (UAVs) in commercial and defence sectors is one of the primary drivers of the drone battery market. In 2023, there were over 860,000 registered commercial drones in the U.S., reflecting a rise from the 720,000 reported in 2022, as per the Federal Aviation Administration (FAA). Additionally, defence spending on UAVs has risen, with the U.S. Department of Defence allocating $7 billion for drone technologies in 2023. This surge in UAV usage necessitates more advanced and durable battery solutions to support operations.

- Advancements in Battery Technology: The growing advancements in battery technology, including Lithium-Ion and Solid-State batteries, are critical to extending flight durations and improving drone performance. Lithium-ion batteries are currently the most common choice, offering energy densities of up to 260 Wh/kg. Solid-state batteries are under development with potential energy densities of 350 Wh/kg, providing a promising future for longer flight times. In 2023, the global R&D expenditure on battery technologies exceeded $14 billion, largely driven by the need for more efficient power solutions for UAVs.

- Rising Adoption of Drones in Delivery Services: The adoption of drones for delivery services is on the rise, with companies such as Amazon and UPS already testing drone-based delivery systems. In the U.S., the Federal Aviation Administration (FAA) has approved over 2,000 waivers for drone delivery operations as of 2023. The use of drones in delivery services has the potential to cut transportation times by up to 40%, creating a strong demand for advanced batteries that can power longer and more reliable flights. Currently, the average battery range for delivery drones is around 15 miles.

Global Drone Battery Market Challenges

- High Initial Battery Costs: Despite advancements in battery technology, the high initial costs remain a major barrier to wider adoption, especially for smaller drone manufacturers. Lithium-ion batteries, the most commonly used in drones, can cost anywhere between $100 and $500 depending on capacity and size. These costs are considerably higher when compared to traditional internal combustion engines used in ground vehicles. Battery costs are expected to remain high in the near term, with limited availability of raw materials such as lithium and cobalt contributing to these inflated prices.

- Limited Battery Life and Range: The limited battery life and range of current drone batteries present another challenge. On average, drones powered by lithium-ion batteries can fly for 20 to 30 minutes on a single charge. This restricts their use for longer missions, particularly in military and logistics applications. Despite improvements in energy density, battery life continues to be a limiting factor, and the need for high-capacity batteries remains a critical concern. Developing more efficient energy storage solutions is essential for the expansion of UAV operations.

Global Drone Battery Market Future Outlook

Over the next five years, the global drone battery market is expected to experience major growth driven by technological advancements in battery systems, increasing adoption of drones across various sectors, and growing government investments in defence drones. The market will witness new developments in energy-efficient batteries, such as solid-state and hydrogen fuel cell technologies, to meet the demands of extended flight durations and sustainable energy consumption. Moreover, the commercial sector will see increased drone adoption for logistics, delivery, and industrial applications, further boosting demand for advanced battery systems.

Global Drone Battery Market Opportunities

- Development of High-Efficiency Batteries: The development of high-efficiency batteries, such as hydrogen fuel cells, presents growth opportunities for the drone battery market. Hydrogen fuel cells offer energy densities up to 33,000 Wh/kg, far surpassing traditional lithium-ion batteries. This technology could extend drone flight times to several hours, making them more viable for long-distance applications like surveillance and cargo delivery. In 2023, global investments in hydrogen fuel cell technology reached $3 billion, signalling strong potential for future integration into UAVs.

- Expansion in Emerging Markets: Emerging markets, particularly in Southeast Asia and Africa, offer considerable growth opportunities for the drone battery market. These regions are rapidly adopting drones for agricultural, infrastructure, and delivery applications. For example, in 2023, the African Development Bank launched a $150 million initiative to support drone technology in agriculture across the continent. The increased deployment of drones in these regions will drive demand for reliable and efficient battery solutions.

Scope of the Report

|

Battery Type |

Lithium-Ion Solid-State Hydrogen Fuel Cells Nickel-Cadmium Lead-Acid |

|

Drone Type |

Commercial Drones Defence Drones Agricultural Drones Delivery Drones Surveying and Mapping Drones |

|

Capacity |

<5000 mAh 5000-10000 mAh 10000-20000 mAh >20000 mAh |

|

Technology |

Fast-Charging Smart Batteries High Energy Density |

|

Region |

North America Europe Asia-Pacific Latin America Middle East & Africa |

Products

Key Target Audience

Drone Manufacturers

Battery Manufacturers

Defence Contractors

Banks and Financial Institutions

Commercial UAV Operators

Government and Regulatory Bodies (Federal Aviation Administration, European Aviation Safety Agency)

Logistics and Delivery Companies

Investor and Venture Capitalist Firms

Drone-as-a-Service Providers

Companies

Players Mentioned in the Report

DJI Technology Co. Ltd.

Parrot Drones

Ballard Power Systems

Ultratech Power Products

BYD Company Ltd.

Sion Power Corporation

Panasonic Corporation

Toshiba Corporation

Samsung SDI

LG Chem

Table of Contents

1. Global Drone Battery Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Global Drone Battery Market Size (In USD Bn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Global Drone Battery Market Analysis

3.1 Growth Drivers

3.1.1 Increasing Demand for UAVs in Commercial and Defence Applications

3.1.2 Advancements in Battery Technology (Lithium-Ion, Solid-State, etc.)

3.1.3 Rising Adoption of Drones in Delivery Services

3.1.4 Growing Investments in Drone Startups

3.2 Market Challenges

3.2.1 High Initial Battery Costs

3.2.2 Limited Battery Life and Range

3.2.3 Regulatory Restrictions

3.2.4 Lack of Charging Infrastructure

3.3 Opportunities

3.3.1 Development of High-Efficiency Batteries (e.g., Hydrogen Fuel Cells)

3.3.2 Expansion in Emerging Markets

3.3.3 Growing Demand for Drone-Based Logistics and Surveillance

3.4 Trends

3.4.1 Shift Towards Lightweight and Energy-Dense Batteries

3.4.2 Use of Solar-Powered Drone Batteries

3.4.3 Battery Swapping Technologies

3.5 Government Regulations

3.5.1 Drone Battery Compliance with Aviation Safety Standards

3.5.2 Emission Reduction Targets

3.5.3 Battery Recycling Regulations

3.5.4 Certifications for Lithium-Ion and Alternative Batteries

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem (Manufacturers, Suppliers, UAV Producers)

3.8 Porters Five Forces

3.9 Competitive Ecosystem

4. Global Drone Battery Market Segmentation

4.1 By Battery Type (In Value %)

4.1.1 Lithium-Ion

4.1.2 Solid-State

4.1.3 Hydrogen Fuel Cells

4.1.4 Nickel-Cadmium

4.1.5 Lead-Acid

4.2 By Drone Type (In Value %)

4.2.1 Commercial Drones

4.2.2 Defence Drones

4.2.3 Agricultural Drones

4.2.4 Delivery Drones

4.2.5 Surveying and Mapping Drones

4.3 By Capacity (In Value %)

4.3.1 <5000 mAh

4.3.2 5000-10000 mAh

4.3.3 10000-20000 mAh

4.3.4 >20000 mAh

4.4 By Technology (In Value %)

4.4.1 Fast-Charging

4.4.2 Smart Batteries (Battery Management Systems)

4.4.3 High Energy Density Batteries

4.5 By Region (In Value %)

4.5.1 North America

4.5.2 Europe

4.5.3 Asia-Pacific

4.5.4 Latin America

4.5.5 Middle East & Africa

5. Global Drone Battery Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 DJI Technology Co. Ltd.

5.1.2 Parrot Drones

5.1.3 Yuneec International Co. Ltd.

5.1.4 Ballard Power Systems

5.1.5 Ultratech Power Products

5.1.6 BYD Company Ltd.

5.1.7 Sion Power Corporation

5.1.8 Panasonic Corporation

5.1.9 Toshiba Corporation

5.1.10 Samsung SDI

5.1.11 LG Chem

5.1.12 Epsilor Electric Fuel Ltd.

5.1.13 BSLBATT Battery

5.1.14 Doosan Mobility Innovation

5.1.15 Plug Power Inc.

5.2 Cross Comparison Parameters (Technology Innovation, Market Share, Production Capacity, Number of Patents, Employee Strength, Revenue, Headquarters Location, Strategic Partnerships)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers And Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. Global Drone Battery Market Regulatory Framework

6.1 Environmental Standards

6.2 Compliance Requirements for Battery Manufacturing

6.3 Safety Certifications for UAV Batteries

7. Global Drone Battery Future Market Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Global Drone Battery Future Market Segmentation

8.1 By Battery Type (In Value %)

8.2 By Drone Type (In Value %)

8.3 By Capacity (In Value %)

8.4 By Technology (In Value %)

8.5 By Region (In Value %)

9. Global Drone Battery Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The research began by mapping the ecosystem of stakeholders in the drone battery market, focusing on major manufacturers, technology providers, and end-users. Secondary data sources, including industry reports, government publications, and proprietary databases, were utilized to define the key variables influencing the market.

Step 2: Market Analysis and Construction

A detailed analysis of historical market data was conducted, evaluating market penetration, battery efficiency, and adoption rates across drone segments. Revenue trends, market demand, and key technological advancements were assessed to ensure accuracy in future market projections.

Step 3: Hypothesis Validation and Expert Consultation

Industry experts from major battery manufacturers and UAV producers were consulted to validate research findings. These experts provided valuable insights into operational efficiencies, technological challenges, and financial performance in the drone battery sector.

Step 4: Research Synthesis and Final Output

The data from secondary research and expert consultations were synthesized to produce a final report that provides a holistic view of the global drone battery market. This report includes market forecasts, competitor analysis, and key trends shaping the market.

Frequently Asked Questions

01. How big is the Global Drone Battery Market?

The global drone battery market is valued at USD 9.6 billion, driven by technological advancements and increasing demand for UAVs across defence, commercial, and industrial sectors.

02. What are the challenges in the Global Drone Battery Market?

Key challenges in the global drone battery market include the high cost of battery development, limited flight times due to current battery capacities, and regulatory hurdles concerning UAV operations and battery safety.

03. Who are the major players in the Global Drone Battery Market?

Major players in the global drone battery market include DJI Technology, Parrot Drones, Ballard Power Systems, Ultratech Power Products, and BYD Company Ltd., known for their innovation in battery technologies and UAV applications.

04. What are the growth drivers of the Global Drone Battery Market?

The global drone battery market is driven by increased UAV applications in logistics, defence, and surveillance, alongside innovations in lithium-ion and hydrogen fuel cell battery technologies that extend drone flight times.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.