Global Dry Ice Market Outlook 2030

Region:Global

Author(s):Shivani

Product Code:KROD6867

November 2024

90

About the Report

Global Dry Ice Market Overview

- The global dry ice market is valued at USD 1.44 billion, driven by its widespread use across industries such as food and beverage, healthcare, and industrial cleaning. The demand for dry ice is propelled by its unique properties, including the ability to sublimate directly from solid to gas, which makes it ideal for temperature-sensitive applications, particularly in cold chain logistics and medical transport.

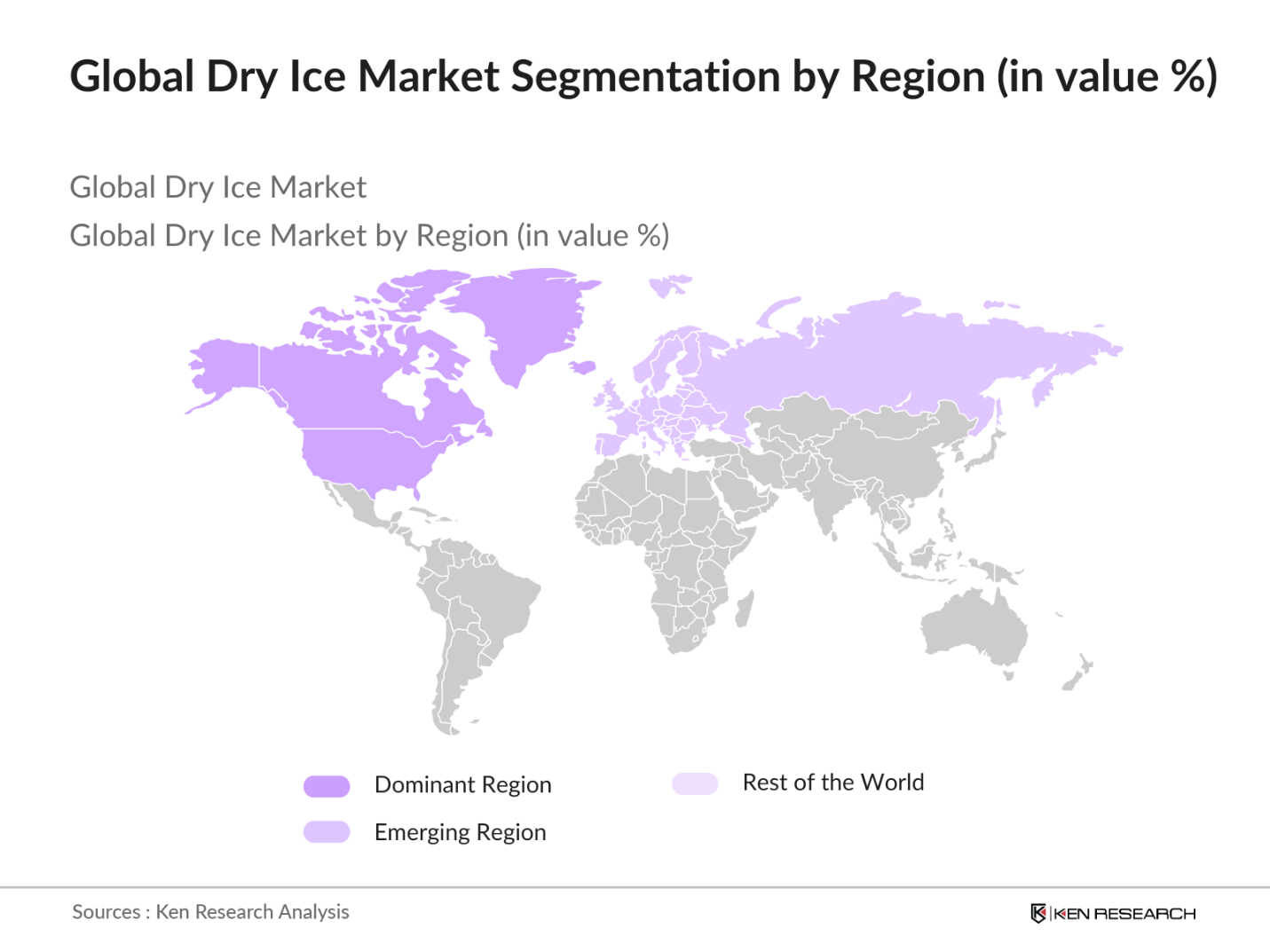

- North America and Europe are dominant regions in the global dry ice market, with key countries like the United States, Germany, and the UK leading in dry ice production and consumption. This dominance is attributed to the high demand for dry ice in the food and beverage industries for storage and transportation, as well as in the healthcare sector for vaccine preservation. Moreover, the well-established infrastructure and technological advancements in these regions enable efficient production and distribution of dry ice, making them key players in the global market.

- The U.S. government has been actively supporting the development of cold chain infrastructure, a key sector driving dry ice demand. In 2022, the U.S. Department of Agriculture announced a $100 million investment into improving cold storage facilities for perishable goods, including pharmaceuticals and food. This initiative is expected to bolster the dry ice market by increasing demand for temperature-controlled logistics across the country. The U.S. continues to promote sustainable cold chain technologies, aiding the dry ice sector in particular for food safety and transportation.

Global Dry Ice Market Segmentation

By Product Type: The global dry ice market is segmented by product type into pellets, blocks, and slices. Pellets hold a dominant market share due to their versatility and widespread use in industrial applications such as cleaning and blasting. The ease of handling and faster sublimation of pellets compared to other forms makes them highly popular in sectors like manufacturing and pharmaceuticals. This form of dry ice is also commonly used in transportation to maintain cold chain integrity, particularly for perishables and medical supplies, further driving its dominance.

By Region: The market is segmented by region into North America, Europe, Asia-Pacific, Middle East & Africa, and Latin America. North America leads the market due to the strong presence of industries such as pharmaceuticals, food processing, and manufacturing, all of which are significant consumers of dry ice. The growing demand for sustainable and eco-friendly cleaning solutions in this region also boosts the adoption of dry ice blasting technologies. Additionally, North America's cold chain logistics sector, particularly in the United States, benefits from the extensive use of dry ice for transporting temperature-sensitive goods.

Global Dry Ice Market Competitive Landscape

The global dry ice market is dominated by several key players, both regional and international, that have established themselves through innovations and technological advancements. Companies in the market leverage economies of scale and extensive distribution networks to maintain their leadership.

|

Company Name |

Establishment Year |

Headquarters |

Product Type Focus |

Revenue (USD Bn) |

Regional Presence |

R&D Investment |

Strategic Partnerships |

Manufacturing Facilities |

|

Air Liquide |

1902 |

Paris, France |

Dry Ice Pellets |

|||||

|

Linde AG |

1879 |

Dublin, Ireland |

Industrial Cleaning |

|||||

|

Continental Carbonic Products |

1978 |

Decatur, Illinois, USA |

Dry Ice Pellets |

|||||

|

Praxair Technology |

1907 |

Danbury, Connecticut, USA |

CO2 Recovery Systems |

|||||

|

Polar Ice |

1980 |

Alberta, Canada |

Dry Ice Blocks |

Global Dry Ice Market Analysis

Market Growth Drivers

- Demand in Food Transportation: The global dry ice market is seeing a substantial rise in demand due to its usage in food transportation. With the increasing trade of perishable goods, there is a significant need for dry ice to maintain low temperatures during transit. In 2023, global food exports grew by 6% compared to the previous year, driven by countries like the USA and China, where cold-chain infrastructure is expanding rapidly. Additionally, the World Bank reports a rise in global trade by over $1 trillion in 2022, further pushing the demand for temperature-controlled logistics, a key factor for dry ice utilization.

- Application in Medical and Healthcare: Dry ice is crucial in medical applications, particularly for transporting vaccines and biological samples. During the COVID-19 pandemic, the demand for dry ice surged, and its use remains vital. In 2022, global healthcare expenditures rose to $9.2 trillion, with countries like the U.S. allocating $1.6 trillion towards pharmaceuticals and biotechnology, further driving dry ice consumption for safe transportation of medical supplies. The growing number of clinical trials and demand for biological specimen preservation in countries like India and Brazil also contributes to this trend.

- Adoption in Entertainment and Special Effects: The entertainment industrys use of dry ice for special effects, particularly in live events and film productions, has increased notably in the last decade. In 2022, global entertainment and media revenues surpassed $2.4 trillion, with a notable portion allocated to film and live events. The U.S. and South Korea lead the global film production industry, where dry ice is widely used for fog and smoke effects in productions. The availability of high-budget productions in these countries continues to support the dry ice market for entertainment purposes.

Market Challenges

- Availability of Substitutes: The growing availability of alternative cooling agents such as gel packs and liquid nitrogen presents a challenge for the dry ice market. These substitutes are often seen as cost-effective and environmentally friendly options in industries like healthcare and logistics. In 2023, the World Health Organization (WHO) reported a 10% increase in the use of alternative cooling technologies for vaccine transportation in developing nations, reducing dependency on dry ice. The logistics sector in particular is witnessing innovations in cold-chain technology, pushing for alternative solutions.

- Environmental Concerns: The environmental impact of carbon emissions associated with dry ice production is a growing concern. In 2023, global CO2 emissions were estimated at 36.8 billion metric tons, according to the International Energy Agency (IEA), making sustainability a major focus in industries that rely on dry ice. Many industries are facing pressure to adopt greener alternatives as international environmental regulations tighten. Companies producing dry ice are being urged to reduce their carbon footprint, further complicating the market landscape.

Global Dry Ice Market Future Outlook

Over the next five years, the global dry ice market is expected to experience steady growth, driven by the increasing adoption of sustainable technologies in cleaning and manufacturing processes. The food and beverage industry will continue to be a major driver due to the growing demand for efficient cold chain logistics. Additionally, advancements in dry ice production techniques, along with the expansion of healthcare infrastructure globally, will further fuel the demand for dry ice. Key innovations in CO2 recovery systems and automation will enhance production efficiency and reduce costs, thereby promoting market expansion.

Market Opportunities:

- Growing Focus on Sustainable Production: As industries become more eco-conscious, there is a growing focus on sustainable dry ice production methods. The European Union has introduced stringent regulations aimed at reducing CO2 emissions, prompting companies to explore cleaner methods for producing dry ice. In 2023, the International Energy Agency reported that sustainability initiatives in manufacturing sectors in Europe increased by 15%, pushing industries to adopt greener technologies. This shift towards eco-friendly practices is expected to shape the future of the dry ice market.

- Use of Dry Ice in 3D Printing: Dry ice has found its application in 3D printing, particularly in metal and plastic additive manufacturing. The global 3D printing market was valued at $15 billion in 2022, and with advancements in material science, dry ice is increasingly used to maintain optimal conditions during printing processes. Countries like the U.S. and Japan are leading this trend, with their robust manufacturing sectors adopting dry ice for industrial 3D printing applications.

Scope of the Report

|

By Product Type |

Dry Ice Pellets Dry Ice Blocks Dry Ice Slices |

|

By Application |

Food and Beverage Healthcare and Pharmaceuticals Industrial Cleaning Others (Entertainment, Laboratory) |

|

By Technology |

Direct CO2 Recovery Indirect CO2 Recovery |

|

By End-User Industry |

Food Industry Industrial Manufacturing Pharmaceuticals and Healthcare Aerospace and Electronics |

|

By Region |

North America Europe Asia-Pacific Middle East & Africa Latin America |

Products

Key Target Audience

Dry Ice Manufacturers

Cold Chain Logistics Companies

Industrial Cleaning Firms

Healthcare and Pharmaceutical Companies

Food and Beverage Producers

CO2 Recovery Technology Providers

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (EPA, European Commission)

Companies

Major Players

Air Liquide

Linde AG

Continental Carbonic Products

Praxair Technology

Polar Ice

Messer Group

Sicgil India Limited

Tripti Dry Ice Co.

CryoCarb

Air Products and Chemicals, Inc.

Dry Ice Corp.

Tomco2 Systems

EcoIce Dry Ice

A-Gas International

CryoFX

Table of Contents

1. Global Dry Ice Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Dry Ice Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Dry Ice Market Analysis

3.1. Growth Drivers

3.1.1. Demand in Food Transportation

3.1.2. Usage in Industrial Cleaning

3.1.3. Application in Medical and Healthcare

3.1.4. Adoption in Entertainment and Special Effects

3.2. Market Challenges

3.2.1. Availability of Substitutes

3.2.2. High Production Costs

3.2.3. Environmental Concerns

3.3. Opportunities

3.3.1. Expansion in Emerging Markets

3.3.2. Technological Advancements

3.3.3. Increasing Demand in Cold Chain Logistics

3.4. Trends

3.4.1. Growing Focus on Sustainable Production

3.4.2. Use of Dry Ice in 3D Printing

3.4.3. Integration with Automated Cleaning Systems

3.5. Government Regulations [Global Environmental Standards, Certifications]

3.6. SWOT Analysis [Global Market Strengths, Weaknesses, Opportunities, Threats]

3.7. Stakeholder Ecosystem [Raw Material Suppliers, End-Users, Manufacturers]

3.8. Porters Five Forces [Supplier Power, Buyer Power, Threat of Substitutes, New Entrants, Industry Rivalry]

3.9. Competitive Landscape [Global Competitors, Market Concentration]

4. Global Dry Ice Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Dry Ice Pellets

4.1.2. Dry Ice Blocks

4.1.3. Dry Ice Slices

4.2. By Application (In Value %)

4.2.1. Food and Beverage

4.2.2. Healthcare and Pharmaceuticals

4.2.3. Industrial Cleaning

4.2.4. Others (Entertainment, Laboratory)

4.3. By Technology (In Value %)

4.3.1. Direct CO2 Recovery

4.3.2. Indirect CO2 Recovery

4.4. By End-User Industry (In Value %)

4.4.1. Food Industry

4.4.2. Industrial Manufacturing

4.4.3. Pharmaceuticals and Healthcare

4.4.4. Aerospace and Electronics

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia-Pacific

4.5.4. Middle East & Africa

4.5.5. Latin America

5. Global Dry Ice Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. Air Liquide

5.1.2. Linde AG

5.1.3. Messer Group

5.1.4. Praxair Technology

5.1.5. Continental Carbonic Products

5.1.6. Polar Ice

5.1.7. Sicgil India Limited

5.1.8. Tripti Dry Ice Co.

5.1.9. CryoCarb

5.1.10. Air Products and Chemicals, Inc.

5.1.11. Dry Ice Corp.

5.1.12. Tomco2 Systems

5.1.13. EcoIce Dry Ice

5.1.14. A-Gas International

5.1.15. CryoFX

5.2 Cross Comparison Parameters [Product Portfolio, Revenue, Regional Presence, R&D Investments, Market Share, Number of Employees, Market Penetration, Strategic Initiatives]

5.3. Market Share Analysis [Global Market, Regional Comparison]

5.4. Strategic Initiatives [Mergers, Acquisitions, Partnerships]

5.5. Investment Analysis [Venture Capital, Private Equity, Government Grants]

6. Global Dry Ice Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. Global Dry Ice Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global Dry Ice Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By Technology (In Value %)

8.4. By End-User Industry (In Value %)

8.5. By Region (In Value %)

9. Global Dry Ice Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The research began by identifying key variables affecting the global dry ice market, including demand drivers, technological innovations, and regulatory changes. This involved comprehensive desk research using both proprietary and public databases to gather relevant industry-level data.

Step 2: Market Analysis and Construction

The second step involved analyzing historical data on dry ice production, distribution, and consumption trends. This was combined with supply chain analysis to estimate market penetration across various industries, with particular focus on regional demand.

Step 3: Hypothesis Validation and Expert Consultation

In this phase, expert consultations were conducted through phone interviews and surveys with key players in the dry ice market. These insights helped validate market assumptions and provided a clearer understanding of industry challenges and opportunities.

Step 4: Research Synthesis and Final Output

Finally, the data was synthesized into a cohesive analysis, combining bottom-up approaches with industry feedback. This final stage ensured the accuracy of market estimates and the identification of future growth opportunities.

Frequently Asked Questions

1. How big is the Global Dry Ice Market?

The global dry ice market is valued at USD 1.44 billion, driven by increasing demand across industries such as food, healthcare, and manufacturing, particularly for cold chain logistics and industrial cleaning.

2. What are the challenges in the Global Dry Ice Market?

Major challenges include high production costs due to the energy-intensive nature of CO2 recovery and environmental concerns regarding the use of CO2 in dry ice production. The availability of substitutes also affects market growth.

3. Who are the major players in the Global Dry Ice Market?

Key players include Air Liquide, Linde AG, Continental Carbonic Products, Praxair Technology, and Polar Ice. These companies dominate due to their extensive production capabilities and global distribution networks.

4. What are the growth drivers of the Global Dry Ice Market?

Growth is driven by the increasing demand for cold chain logistics in the food and beverage industry, the rise in healthcare applications such as vaccine storage, and the adoption of eco-friendly industrial cleaning solutions.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.