Global Dump Trucks Market Outlook 2030

Region:Global

Author(s):Shivani Mehra

Product Code:KROD5691

November 2024

86

About the Report

Global Dump Trucks Market Overview

- The global dump trucks market, driven by strong demand across multiple sectors, is valued at USD 38.55 billion. This market size has been propelled by infrastructure development, growing mining operations, and technological advancements. Governments worldwide are investing in transportation and infrastructure projects, increasing the demand for dump trucks to move materials such as sand, gravel, and waste. In the mining industry, a rise in mineral extraction also continues to drive dump truck sales as companies seek reliable, heavy-duty vehicles for large-scale operations.

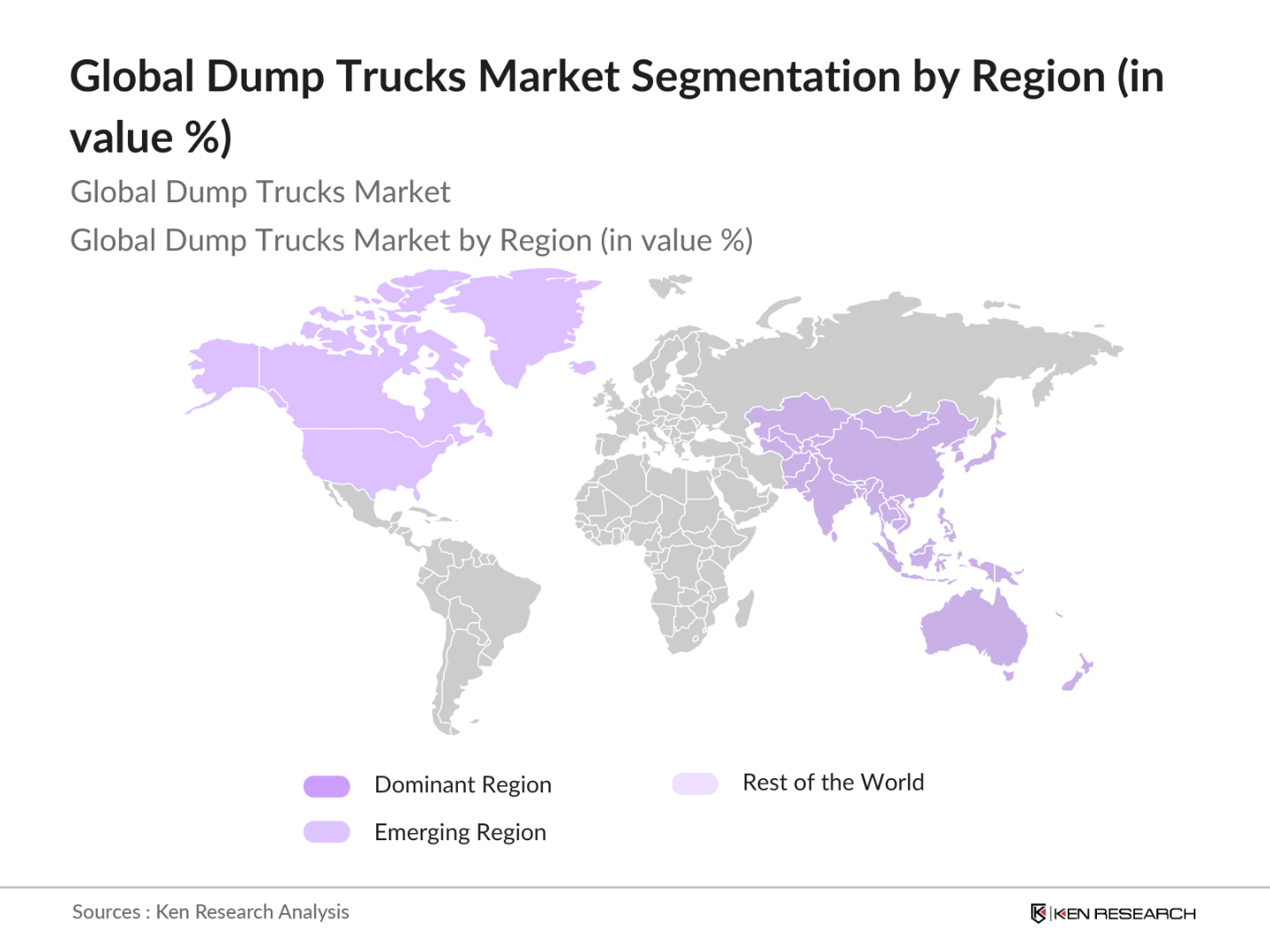

- Asia-Pacific countries, including China, India, and Australia, are key players in the dump truck market due to significant construction and mining projects. China and India have shown robust urbanization and infrastructure development, while Australias mining sector continues to thrive, boosting the need for dump trucks. In North America, the U.S. plays a vital role as large-scale construction projects, coupled with stringent emissions regulations, drive demand for efficient, environmentally-friendly dump trucks.

- Technological advancements, particularly the development of autonomous and electric dump trucks, present significant growth opportunities. In 2023, companies like Komatsu and Caterpillar introduced fully electric and autonomous dump trucks designed to improve efficiency and reduce fuel consumption.EU Green Vehicle Initiative: The European Union has committed significant funding towards green vehicle initiatives, with 80 billion earmarked to support the adoption of electric vehicles, including heavy-duty trucks, through subsidies and infrastructure development. This has spurred investment in electric dump trucks across the region.

Global Dump Trucks Market Segmentation

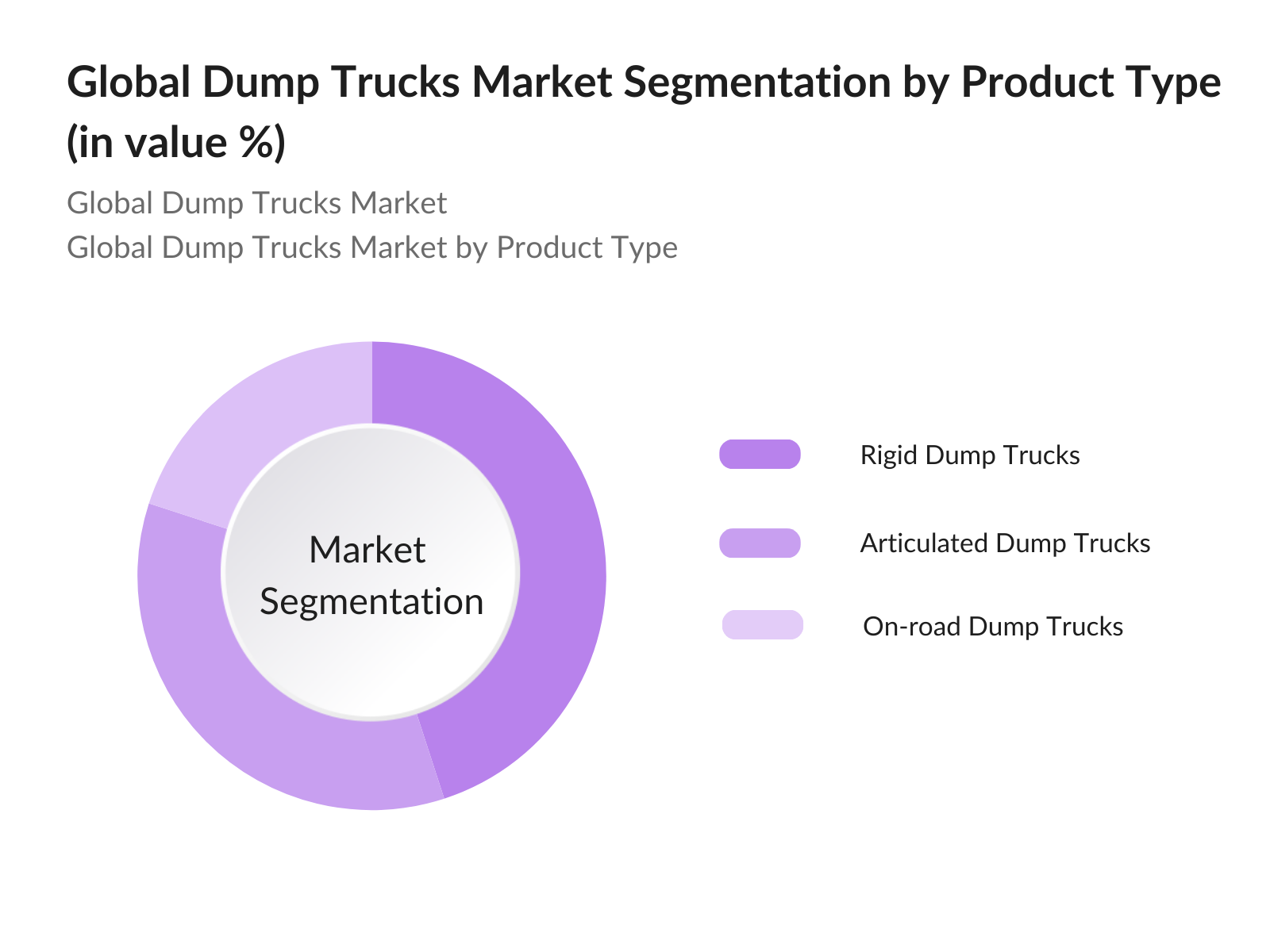

By Product Type: The dump truck market is segmented by product type into articulated dump trucks, rigid dump trucks, and on-road/off-road dump trucks. Rigid dump trucks dominate the market due to their application in large mining and infrastructure projects. These trucks are highly favored in mining due to their ability to transport large payloads over challenging terrains. The on-road dump trucks are gaining traction for urban construction projects, especially in regions with increasing urbanization.

By Region: The market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific dominates the market, particularly due to significant infrastructure projects in China and India. These countries are rapidly urbanizing, creating massive demand for construction vehicles. In addition, Australias robust mining sector supports this regions dominance. North America also holds a strong position, primarily driven by the United States, where fleet modernization and technology adoption are key drivers.

Global Dump Trucks Market Competitive Landscape

The global dump truck market is highly consolidated with key players focusing on product innovation and expanding their product portfolios. Technological advancements, including electric engines and autonomous driving features, are shaping the competitive landscape. Companies are also exploring strategic partnerships and joint ventures to expand their market presence. The major players are.

|

Company Name |

Establishment Year |

Headquarters |

Revenue (2023) |

Market Position |

Product Portfolio |

Fleet Size |

Global Presence |

R&D Investments |

Recent Developments |

|

Caterpillar Inc. |

1925 |

Illinois, USA |

$50 bn |

- |

- |

- |

- |

- |

- |

|

Komatsu Ltd. |

1921 |

Tokyo, Japan |

$40 bn |

- |

- |

- |

- |

- |

- |

|

Volvo Construction Equipment |

1832 |

Gothenburg, Sweden |

$20 bn |

- |

- |

- |

- |

- |

- |

|

Hitachi Construction Machinery |

1970 |

Tokyo, Japan |

$10 bn |

- |

- |

- |

- |

- |

- |

|

Liebherr Group |

1949 |

Bulle, Switzerland |

$15 bn |

- |

- |

- |

- |

- |

- |

Global Dump Trucks Market Analysis

Market Growth Drivers

- Expansion of Construction Industry: The expansion of the construction industry has driven the demand for dump trucks globally. In 2023, construction activities surged in emerging economies, with infrastructure development taking priority. The construction sector contributed $10.9 trillion to global GDP in 2022, according to the World Bank, significantly impacting the demand for heavy machinery like dump trucks. In the US alone, government spending on construction projects, including highways and public infrastructure, reached $1.7 trillion in 2022, fueling the demand for dump trucks for material transport.

- Increasing Government Infrastructure Investments: Governments worldwide have ramped up infrastructure investments to bolster economic recovery post-pandemic. For instance, the US government allocated $1.2 trillion for infrastructure projects under the Infrastructure Investment and Jobs Act in 2021, directly boosting the demand for dump trucks used in road construction, bridge repairs, and urban development. Similarly, Indias National Infrastructure Pipeline (NIP) aims to invest $1.4 trillion by 2025 into various sectors, increasing the need for heavy-duty vehicles like dump trucks.

- Rise in Mining Operations (Ore Extraction and Hauling): Mining operations, particularly for ore extraction and hauling, have been critical drivers of dump truck demand. In 2022, the global mining sector saw significant growth, with countries like China and Australia leading in iron ore production, reaching over 880 million metric tons of output. The expansion of mining projects in Africa, particularly for minerals like cobalt and lithium, essential for renewable energy applications, further spurred demand for dump trucks.

Market Challenges:

- High Manufacturing and Compliance Costs: The manufacturing of dump trucks incurs high costs, exacerbated by stringent safety and environmental regulations. Compliance with emission standards, particularly in the European Union and the US, where regulations are strict, increases operational costs. For example, the Euro VI emission standards, implemented in Europe, have necessitated the use of advanced technologies, significantly increasing production expenses per vehicle. These additional costs arise from the incorporation of advanced emission control systems such as selective catalytic reduction (SCR) and diesel particulate filters (DPF), which are mandatory to meet regulatory requirements.

- Stringent Emission Regulations: Stringent emission regulations pose a challenge for dump truck manufacturers, especially in developed regions. The European Union's Euro VI and the US Environmental Protection Agencys Tier 4 standards require significant reductions in nitrogen oxides and particulate matter emissions from heavy-duty vehicles. Compliance has required manufacturers to invest in cleaner technologies, such as selective catalytic reduction (SCR) and diesel particulate filters (DPF). In 2023, the average cost increase per vehicle due to emission control technologies was estimated to be between $5,000 to $10,000.

Global Dump Trucks Market Future Outlook

Over the next five years, the global dump truck market is expected to see steady growth driven by the adoption of electric and autonomous dump trucks, expanding mining activities, and growing urbanization in developing nations. Technological innovations, such as the integration of AI and machine learning for autonomous driving, will significantly enhance operational efficiency, particularly in mining. Additionally, the push towards greener technologies is expected to drive the adoption of electric dump trucks, especially in regions like North America and Europe, where emission standards are stringent.

Market Opportunities:

- Expanding Rental and Leasing Models: The demand for rental and leasing models for dump trucks has been rising, particularly in emerging markets. In 2022, the construction equipment rental market was valued at over $110 billion globally. With the high upfront costs of purchasing dump trucks, companies increasingly opt for rental or leasing options to reduce capital expenditure. Countries like India, where the infrastructure sector is booming, have seen increasing demand for equipment rentals as companies aim to remain flexible amid fluctuating project volumes. This approach allows businesses to manage cash flow more effectively while maintaining access to the necessary equipment for large-scale projects.

- Technological Advancements in Autonomous and Electric Dump Trucks: Technological advancements, particularly the development of autonomous and electric dump trucks, present significant growth opportunities. In 2023, companies like Komatsu and Caterpillar introduced fully electric and autonomous dump trucks designed to improve efficiency and reduce fuel consumption. The global market for electric vehicles, including heavy-duty trucks, is set to benefit from government incentives in regions like the EU, where significant funding has been allocated for green vehicle initiatives. The shift toward electrification and automation is expected to reduce operational costs, enhance productivity, and increase safety in hazardous environments like mining.

Scope of the Report

|

By Product Type |

Articulated Dump Trucks Rigid Dump Trucks On-road Dump Trucks Off-road Dump Trucks |

|

By Engine Type |

Internal Combustion Engine Electric Engine |

|

By Capacity |

Below 25 Metric Ton 25 to 50 Metric Ton 51 to 150 Metric Ton |

|

By End-User |

Construction Mining Infrastructure Development Agriculture |

|

By Region |

North America Europe Asia Pacific Latin America Middle East & Africa |

Products

Key Target Audience

Construction Companies

Mining Companies

Dump Truck Manufacturers

Fleet Management Companies

Government and Regulatory Bodies (e.g., U.S. Environmental Protection Agency, European Environment Agency)

Electric Vehicle Manufacturers

Investments and Venture Capitalist Firms

Autonomous Vehicle Technology Providers

Companies

Players Mention in the Report

Caterpillar Inc.

Komatsu Ltd.

Volvo Construction Equipment

Hitachi Construction Machinery

Liebherr Group

SANY Heavy Industry Co. Ltd.

Deere & Company

FAW Group Corporation

Bell Equipment Ltd.

Xuzhou Construction Machinery Group Co. Ltd.

CNH Industrial

Daimler AG

BYD Company Limited

Zoomlion Heavy Industry Science and Technology

Mercedes Benz Group AG

Table of Contents

1. Global Dump Trucks Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Drivers (Technological Advancements, Infrastructure Projects, Mining Growth)

1.4. Market Segmentation Overview

2. Global Dump Trucks Market Size (In USD Million)

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Dump Trucks Market Analysis

3.1. Growth Drivers

3.1.1. Expansion of Construction Industry

3.1.2. Increasing Government Infrastructure Investments

3.1.3. Rise in Mining Operations (Ore Extraction and Hauling)

3.2. Market Challenges

3.2.1. High Manufacturing and Compliance Costs

3.2.2. Stringent Emission Regulations

3.2.3. Skilled Workforce Shortages in Operating Heavy Equipment

3.3. Opportunities

3.3.1. Technological Advancements in Autonomous and Electric Dump Trucks

3.3.2. Expanding Rental and Leasing Models

3.3.3. Fleet Modernization Initiatives

3.4. Trends

3.4.1. Adoption of Electric and Hybrid Dump Trucks

3.4.2. Integration of Telematics for Fleet Management

3.4.3. Growing Use of Autonomous Dump Trucks in Mining

4. Global Dump Trucks Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Articulated Dump Trucks

4.1.2. Rigid Dump Trucks

4.1.3. On-road and Off-road Dump Trucks

4.2. By Engine Type (In Value %)

4.2.1. Internal Combustion Engine

4.2.2. Electric Engine

4.3. By Capacity (In Value %)

4.3.1. Below 25 Metric Ton

4.3.2. 25 to 50 Metric Ton

4.3.3. 51 to 150 Metric Ton

4.4. By End-Use (In Value %)

4.4.1. Construction

4.4.2. Mining

4.4.3. Infrastructure Development

4.4.4. Agriculture

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia Pacific

4.5.4. Latin America

4.5.5. Middle East & Africa

5. Global Dump Trucks Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Caterpillar Inc.

5.1.2. Komatsu Ltd.

5.1.3. Hitachi Construction Machinery

5.1.4. Volvo Construction Equipment

5.1.5. Liebherr Group

5.1.6. SANY Heavy Industry Co. Ltd

5.1.7. Deere & Company

5.1.8. FAW Group Corporation

5.1.9. Bell Equipment Ltd.

5.1.10. Xuzhou Construction Machinery Group Co. Ltd

5.1.11. CNH Industrial

5.1.12. Daimler AG

5.1.13. BYD Company Limited

5.1.14. Zoomlion Heavy Industry Science and Technology

5.1.15. Mercedes Benz Group AG

5.2. Cross Comparison Parameters (Product Portfolio, Revenue, Global Presence, R&D Investments, Strategic Initiatives, Fleet Capacity, Technological Innovation, Clientele Base)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

6. Global Dump Trucks Market Regulatory Framework

6.1. Environmental Standards

6.2. Emission Control Regulations

6.3. Compliance and Safety Standards

7. Global Dump Trucks Future Market Size (In USD Million)

7.1. Market Size Projections

7.2. Key Factors Influencing Future Market Growth

8. Global Dump Trucks Market Future Segmentation

8.1. By Product Type (In Value %)

8.2. By Engine Type (In Value %)

8.3. By Capacity (In Value %)

8.4. By End-Use (In Value %)

8.5. By Region (In Value %)

9. Global Dump Trucks Market Analyst's Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Market Entry Strategy

9.3. Product Innovation Opportunities

9.4. Strategic Partnerships and Acquisitions

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The research process begins with the identification of key variables influencing the dump truck market, including technological advancements, government regulations, and economic conditions. A combination of secondary research and proprietary databases was used to gather detailed information on these factors.

Step 2: Market Analysis and Construction

This step involves analyzing historical data and understanding market dynamics across various segments. For the dump truck market, this includes understanding fleet size, payload capacity, and engine type preferences across regions like Asia Pacific and North America.

Step 3: Hypothesis Validation and Expert Consultation

A set of hypotheses were established regarding future market trends, such as the rise of electric dump trucks and autonomous vehicles. These were validated through interviews with industry experts in mining, construction, and fleet management, ensuring accuracy in forecasts.

Step 4: Research Synthesis and Final Output

In the final phase, data gathered from industry stakeholders was synthesized with quantitative research outputs. This step ensures that the findings provide a comprehensive understanding of market dynamics, product performance, and future trends in the dump truck industry.

Frequently Asked Questions

01. How big is the global dump trucks market?

The global dump trucks market is valued at USD 38.55 billion, driven by infrastructure development and growing mining operations globally.

02. What are the challenges in the dump trucks market?

Challenges include high manufacturing costs due to stringent emission regulations, lack of skilled operators, and fluctuating raw material prices which can affect production costs.

03. Who are the major players in the dump trucks market?

Key players in the market include Caterpillar Inc., Komatsu Ltd., Hitachi Construction Machinery, Volvo Construction Equipment, and Liebherr Group. These companies dominate due to their technological advancements and broad product portfolios.

04. What are the growth drivers of the dump trucks market?

Key drivers include rapid urbanization, increasing infrastructure projects, and the rise of autonomous and electric dump trucks as companies seek eco-friendly solutions to meet regulatory requirements.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.