Global E-cigarette And Vape Market Outlook to 2030

Region:Global

Author(s):Mukul

Product Code:KROD10992

December 2024

111

About the Report

Global E-cigarette and Vape Market Overview

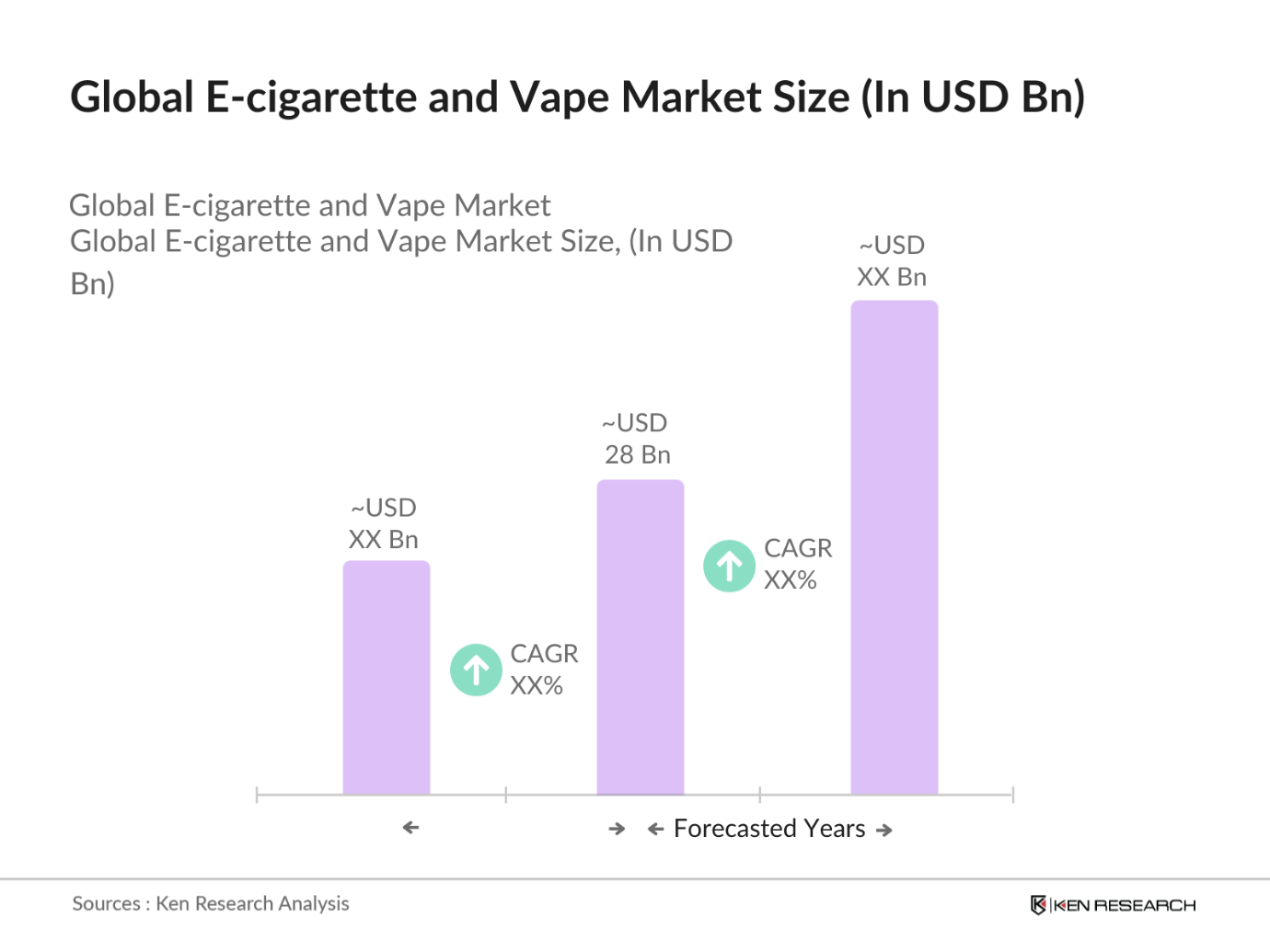

- The global e-cigarette and vape market is valued at USD 28 billion based on a five-year historical analysis. This market is primarily driven by the increasing awareness among consumers regarding the harmful effects of traditional cigarettes, coupled with the rising demand for alternatives like e-cigarettes that offer reduced harm. Moreover, technological advancements such as temperature control, pod-based systems, and rechargeable vaping devices have spurred growth, making e-cigarettes an increasingly preferred choice over conventional tobacco products. This shift is evident in many developed regions, contributing significantly to market expansion.

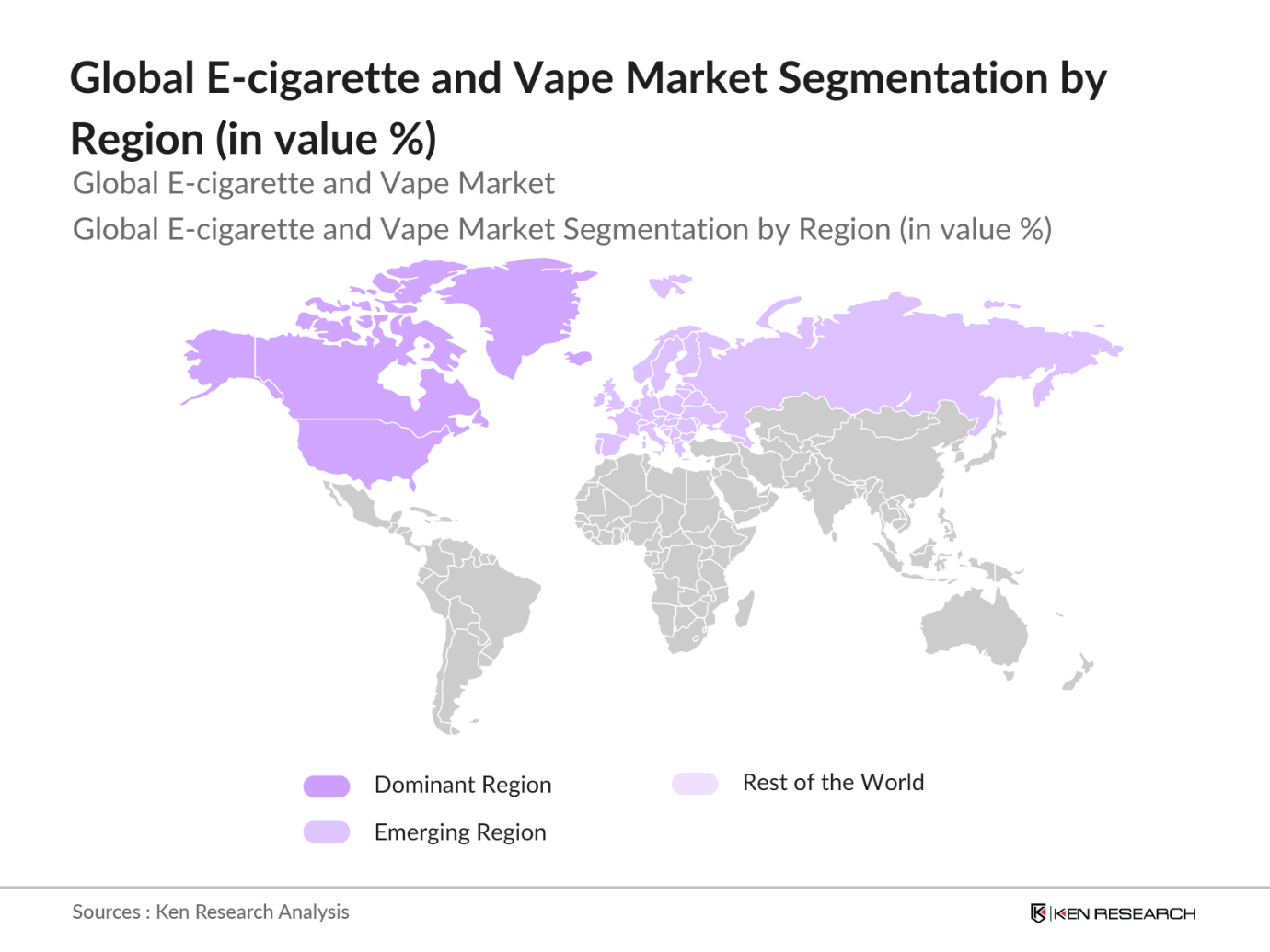

- The market is dominated by North America, particularly the United States, followed by Europe. The dominance of these regions is due to their well-established retail networks, including online channels, and high consumer awareness. The U.S. leads in innovation and regulatory approvals, while European nations such as the U.K. and France have shown rapid adoption due to regulatory frameworks allowing the sale and use of vape products. Asia-Pacific, led by China, is also emerging as a key market due to its robust manufacturing base for vape devices and growing consumer base.

- Governments worldwide are increasingly imposing taxes on e-cigarettes and vaping products, with excise duties and import tariffs contributing to higher product prices. In 2024, the average excise tax on vape products in the European Union increased by 12%, leading to higher retail prices. Similarly, countries like India and South Africa have introduced import tariffs to discourage vaping product imports. These taxation policies have directly influenced consumer pricing and slowed market penetration, particularly in developing countries.

Global E-cigarette and Vape Market Segmentation

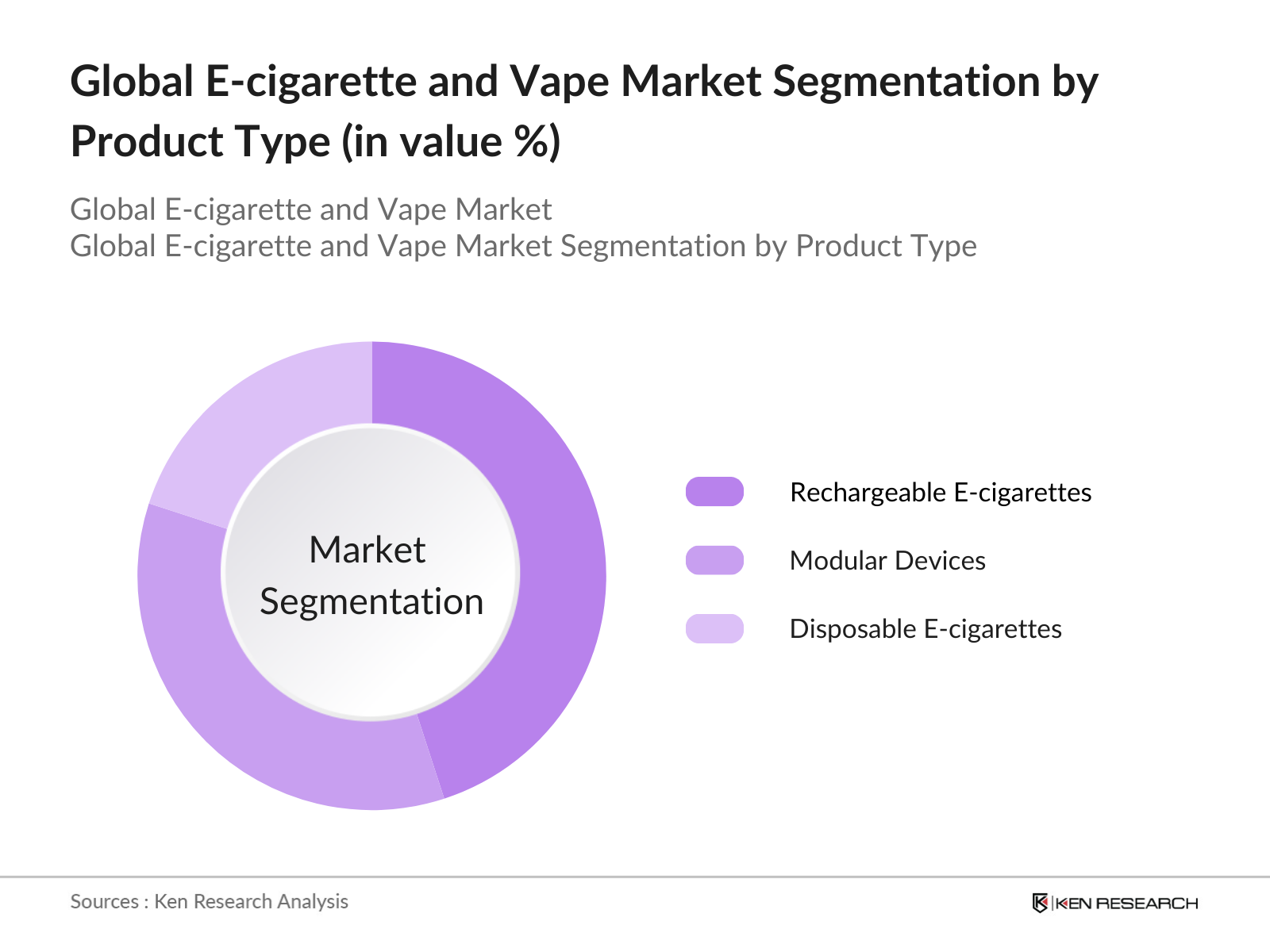

- By Product Type: The e-cigarette and vape market is segmented by product type into disposable e-cigarettes, rechargeable e-cigarettes, and modular devices. Rechargeable e-cigarettes dominate the market due to their cost-effectiveness, longer lifespan, and customizable features. Their ability to offer a variety of flavors, nicotine strengths, and reusable parts appeals to consumers looking for a personalized experience. These devices are particularly favored in North America and Europe, where consumers prefer cost-efficient and sustainable alternatives to disposable vapes.

- By Region: The market is segmented regionally into North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. North America leads the market due to favorable regulatory policies, technological advancements, and higher disposable income. Europe follows, driven by increasing governmental support for reduced-risk products and growing consumer acceptance. Meanwhile, Asia-Pacific is showing rapid growth due to the rising popularity of vaping, particularly in China and Japan.

- By Distribution Channel: The e-cigarette market is segmented by distribution channels into online retail, vape shops, supermarkets/hypermarkets, and convenience stores. Online retail is the dominant channel due to its convenience and the ability for consumers to access a wider variety of products. The rise of e-commerce platforms and direct-to-consumer models has enabled companies to reach a global customer base more effectively, providing product reviews and comparisons that help users make informed decisions.

Global E-cigarette and Vape Market Competitive Landscape

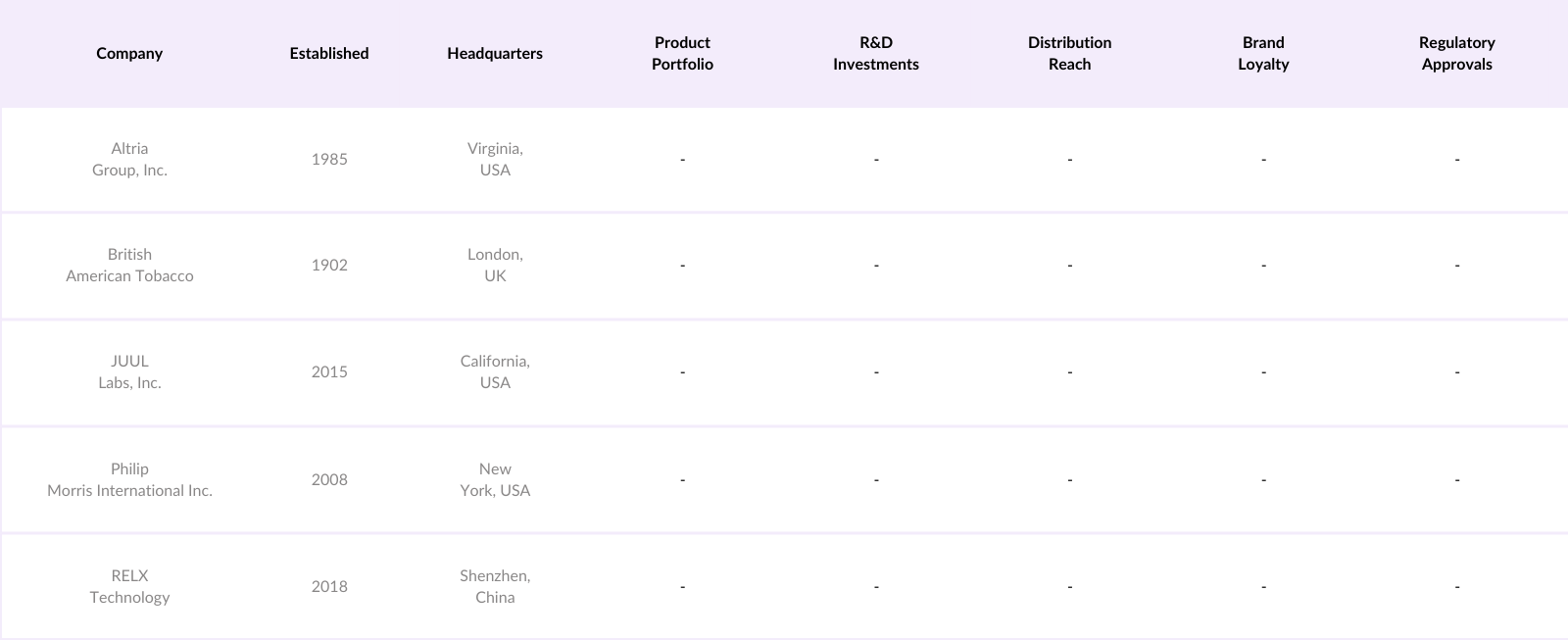

The global e-cigarette and vape market is dominated by key players who focus on product innovations, mergers and acquisitions, and market expansion strategies to strengthen their presence. The competitive landscape is characterized by both established tobacco companies and newer, specialized vape manufacturers. The dominance of these key players is driven by their strong distribution networks, innovation in product offerings, and brand loyalty.

Global E-cigarette and Vape Industry Analysis

Growth Drivers

- Shifting Consumer Preferences: Consumer preferences are shifting from traditional tobacco products to e-cigarettes and vaping devices, driven by factors such as perceived reduced harm and the ability to control nicotine levels. In 2024, global tobacco consumption has seen a sharp decline, with cigarette sales decreasing by over 300 billion sticks annually, particularly in North America and Europe. In the same period, sales of e-cigarette devices have increased significantly, with emerging markets such as India and Southeast Asia contributing to this growth. The World Health Organization (WHO) reports that over 19 million people transitioned from traditional tobacco products to vaping in the last three years.

- Environment (Nicotine Content Regulations, Product Safety Standards): Global regulatory frameworks around e-cigarettes have evolved, with nicotine content regulations being a central focus. For instance, the European Union's Tobacco Products Directive (TPD) limits the nicotine concentration in e-liquids to 20 mg/ml, whereas in the U.S., the FDA mandates pre-market approval of vaping products, enforcing stringent safety standards. As of 2024, more than 75 countries have implemented regulations controlling nicotine content, including the United Kingdom and Australia. The rapid enforcement of these policies has impacted product formulations, with manufacturers shifting toward compliance in key regions.

- Decline in Traditional Cigarette Consumption: Cigarette consumption has steadily declined in recent years due to increased awareness of health risks, government initiatives, and higher excise taxes. According to the World Bank, global cigarette consumption decreased by over 25 billion units annually between 2022 and 2024, particularly in high-income countries. This has fueled the growth of e-cigarettes and vaping devices as alternatives. Countries such as Japan and South Korea have recorded a reduction in smoking prevalence, leading to increased adoption of vape products as substitutes for traditional tobacco.

Market Restraints

- Health-Related Concerns: Despite the growing popularity of e-cigarettes, there are increasing concerns about potential long-term health risks. According to the WHO, as of 2024, over 5 million cases of vaping-related illnesses have been reported globally, particularly affecting younger populations. These concerns have prompted several governments to issue warnings about the health implications of vaping, leading to stricter regulations on advertising and product usage. This has slowed market penetration in some regions, especially in countries like Australia, which recorded a 20% decline in vape sales due to health concerns.

- Stringent Government Policies (Ban on Flavors, Advertising Restrictions): Governments worldwide have introduced stricter policies targeting flavored e-liquids and vaping advertisements. In 2024, over 40 countries, including the United States and India, implemented bans on flavored e-liquids to curb youth adoption. Furthermore, countries like France and Germany have limited vaping advertisements across digital platforms and print media. These measures have led to a noticeable drop in flavored e-liquid sales by 12% in the European Union, stalling growth in certain segments of the vaping market.

Global E-cigarette and Vape Market Future Outlook

Over the next five years, the global e-cigarette and vape market is expected to show significant growth driven by continuous advancements in technology, including Bluetooth-connected devices and temperature control systems, alongside rising consumer demand for reduced-risk tobacco alternatives. The adoption of nicotine-free products and CBD-infused e-liquids is also projected to boost market expansion. In addition, the entry of new manufacturers, coupled with favorable regulatory support in regions such as North America and Europe, will further drive market growth.

Market Opportunities

- Increasing Demand for Nicotine-Free Products: The growing demand for nicotine-free e-cigarette products presents significant opportunities for market expansion. According to the World Health Organization, over 10 million users in 2024 opted for nicotine-free options, driven by health-conscious consumers seeking less addictive alternatives. This trend is particularly strong in countries like the United States and Canada, where nicotine-free products represent 25% of the total vaping market. Manufacturers are responding by diversifying their product portfolios to cater to this growing demand, creating new revenue streams.

- Technological Innovations (Temperature Control, Bluetooth Connectivity): Technological advancements in vaping devices, such as temperature control features and Bluetooth connectivity, are creating new opportunities for growth. In 2024, more than 20% of new vape devices globally were equipped with Bluetooth functionality, allowing users to track usage and control device settings via mobile apps. These innovations are particularly popular in developed markets such as the United States, Japan, and Germany, where consumers are willing to pay a premium for smart devices.

- Expansion into Emerging Markets (Latin America, Asia-Pacific): The expansion of e-cigarettes and vaping products into emerging markets like Latin America and the Asia-Pacific region offers substantial growth potential. In 2024, the Latin American market saw a 30% increase in vaping device imports, particularly in countries like Brazil and Mexico, driven by a combination of rising disposable incomes and shifting consumer preferences. Similarly, Asia-Pacific markets such as India and Indonesia are experiencing a surge in demand as regulatory environments become more favorable, creating opportunities for market entrants.

Scope of the Report

|

Product Type |

Disposable E-cigarettes Rechargeable E-cigarettes Modular Devices |

|

Distribution Channel |

Online Retail Vape Shops Supermarkets/Hypermarkets Convenience Stores |

|

Component |

E-liquids (Nicotine-based, Nicotine-free, CBD) Atomizers Batteries |

|

Device Category |

Closed System Open System Hybrid System |

|

Region |

North America Europe Asia-Pacific Latin America Middle East & Africa |

Products

Key Target Audience

Vape Manufacturers

Nicotine Suppliers

Battery Manufacturers

Online Retailers

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (FDA, European Union TPD)

Retail Distributors

E-liquid Manufacturers

Companies

Players Mentioned in the Report

Altria Group, Inc.

British American Tobacco

Japan Tobacco Inc.

Imperial Brands PLC

JUUL Labs, Inc.

NJOY, LLC

Philip Morris International Inc.

Reynolds American Inc.

Shenzhen IVPS Technology Co., Ltd.

Shenzhen KangerTech Technology Co., Ltd.

RELX Technology

VMR Products LLC

Vuse (R.J. Reynolds Vapor Company)

Eleaf Electronics Co., Ltd.

Geekvape Technology Co., Ltd.

Table of Contents

1. Global E-cigarette and Vape Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Global E-cigarette and Vape Market Size (In USD Mn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Global E-cigarette and Vape Market Analysis

3.1 Growth Drivers

3.1.1 Shifting Consumer Preferences

3.1.2 Regulatory Environment (Nicotine Content Regulations, Product Safety Standards)

3.1.3 Decline in Traditional Cigarette Consumption

3.1.4 Marketing and Celebrity Endorsements

3.2 Market Challenges

3.2.1 Health-Related Concerns

3.2.2 Stringent Government Policies (Ban on Flavors, Advertising Restrictions)

3.2.3 Supply Chain Disruptions

3.3 Opportunities

3.3.1 Increasing Demand for Nicotine-Free Products

3.3.2 Technological Innovations (Temperature Control, Bluetooth Connectivity)

3.3.3 Expansion into Emerging Markets (Latin America, Asia-Pacific)

3.4 Trends

3.4.1 Rise of Pod-Based Systems

3.4.2 Use of CBD in E-liquids

3.4.3 Disposable Vape Devices (Sustainability and Eco-Friendliness)

3.5 Government Regulations

3.5.1 FDA Regulations (Pre-Market Approval, Flavor Restrictions)

3.5.2 Taxation Policies (Excise Duties, Import Tariffs)

3.5.3 Global Regulatory Variations (EU TPD, Chinese Policies)

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem (Manufacturers, Distributors, Retailers, Consumers)

3.8 Porters Five Forces

3.9 Competitive Landscape and Ecosystem

4. Global E-cigarette and Vape Market Segmentation

4.1 By Product Type (In Value %)

4.1.1 Disposable E-cigarettes

4.1.2 Rechargeable E-cigarettes

4.1.3 Modular Devices

4.2 By Distribution Channel (In Value %)

4.2.1 Online Retail

4.2.2 Vape Shops

4.2.3 Supermarkets/Hypermarkets

4.2.4 Convenience Stores

4.3 By Component (In Value %)

4.3.1 E-liquids (Nicotine-based, Nicotine-free, CBD)

4.3.2 Atomizers

4.3.3 Batteries

4.4 By Device Category (In Value %)

4.4.1 Closed System

4.4.2 Open System

4.4.3 Hybrid System

4.5 By Region (In Value %)

4.5.1 North America

4.5.2 Europe

4.5.3 Asia-Pacific

4.5.4 Latin America

4.5.5 Middle East & Africa

5. Global E-cigarette and Vape Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Altria Group, Inc.

5.1.2 British American Tobacco

5.1.3 Japan Tobacco Inc.

5.1.4 Imperial Brands PLC

5.1.5 JUUL Labs, Inc.

5.1.6 NJOY, LLC

5.1.7 Philip Morris International Inc.

5.1.8 Reynolds American Inc.

5.1.9 Shenzhen IVPS Technology Co., Ltd.

5.1.10 Shenzhen KangerTech Technology Co., Ltd.

5.1.11 RELX Technology

5.1.12 VMR Products LLC

5.1.13 Vuse (R.J. Reynolds Vapor Company)

5.1.14 Eleaf Electronics Co., Ltd.

5.1.15 Geekvape Technology Co., Ltd.

5.2 Cross Comparison Parameters (Headquarters, Market Share, Product Portfolio, R&D Spend, Regulatory Approvals, Distribution Reach, Brand Equity, Innovation Index)

5.3 Market Share Analysis

5.4 Strategic Initiatives (Product Launches, Partnerships, Expansions)

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. Global E-cigarette and Vape Market Regulatory Framework

6.1 Compliance Requirements (FDA, CE Mark, ISO Certifications)

6.2 Product Labeling and Health Warnings

6.3 Advertising and Marketing Restrictions

7. Global E-cigarette and Vape Future Market Size (In USD Mn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Global E-cigarette and Vape Future Market Segmentation

8.1 By Product Type (In Value %)

8.2 By Distribution Channel (In Value %)

8.3 By Component (In Value %)

8.4 By Device Category (In Value %)

8.5 By Region (In Value %)

9. Global E-cigarette and Vape Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the global e-cigarette and vape market. This step is underpinned by extensive desk research, utilizing secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the global e-cigarette and vape market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Additionally, an evaluation of service quality statistics is conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations provide valuable operational and financial insights directly from industry practitioners, which are instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple e-cigarette manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction serves to verify and complement the statistics derived from the bottom-up approach, ensuring a comprehensive, accurate, and validated analysis of the e-cigarette and vape market.

Frequently Asked Questions

01. How big is the global e-cigarette and vape market?

The global e-cigarette and vape market is valued at USD 28 billion, driven by increasing consumer demand for alternatives to traditional cigarettes and technological advancements in vaping devices.

02. What are the challenges in the global e-cigarette and vape market?

Challenges include regulatory hurdles, such as FDA pre-market approvals, flavor bans, and taxation policies, alongside public health concerns that could impact consumer adoption.

03. Who are the major players in the global e-cigarette and vape market?

Key players in the market include Altria Group, British American Tobacco, Philip Morris International, JUUL Labs, and RELX Technology. These companies dominate due to their global reach, product innovation, and regulatory approvals.

04. What are the growth drivers of the global e-cigarette and vape market?

The market is propelled by technological innovations, such as pod-based systems, temperature control, and Bluetooth connectivity, alongside growing awareness about the health risks of traditional tobacco products.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.