Global E-Commerce Market Outlook to 2030

Region:Global

Author(s):Mukul

Product Code:KROD10243

December 2024

94

About the Report

Global E-Commerce Market Overview

- The global e-commerce market, valued at USD 25.93 trillion, driven by an increasing number of online shoppers, rapid internet penetration, and the growing importance of mobile commerce. The widespread use of smartphones and advancements in digital payment systems have accelerated the shift from traditional retail to online platforms. Additionally, consumer preferences for convenience, combined with the ease of comparing prices and products online, further boost the growth of the market. Key players such as Amazon and Alibaba have capitalized on these trends to expand their market presence across different regions.

- Countries like China, the United States, and the United Kingdom dominate the global e-commerce market. China leads due to its massive population base and tech-savvy consumers, supported by platforms like Alibaba and JD.com. The U.S. dominates through Amazon, bolstered by strong logistics networks and consumer trust. In the UK, a mature market coupled with strong digital infrastructure and a high demand for online retail has solidified its place as a key market. These countries benefit from strong purchasing power, robust digital ecosystems, and advanced e-commerce platforms.

- Stringent data protection laws like the GDPR in Europe, the California Consumer Privacy Act (CCPA) in the US, and Chinas Cybersecurity Law regulate how e-commerce businesses handle consumer data. By 2023, over 100 countries had implemented comprehensive data protection laws, forcing e-commerce platforms to invest heavily in encryption, secure payment gateways, and user consent management tools. These laws enhance consumer confidence and enable higher e-commerce participation.

Global E-Commerce Market Segmentation

- By Product Type: The global e-commerce market is segmented by product type into consumer electronics, fashion and apparel, health and beauty products, home and kitchen appliances, and groceries and food products. Consumer electronics hold a dominant share due to high demand for smartphones, tablets, and wearables. This dominance is driven by the ongoing technological advancements and a growing trend toward smart devices, with brands like Apple and Samsung leading this segment. Consumers are increasingly turning to e-commerce platforms for electronic purchases due to better prices, reviews, and convenient home delivery options.

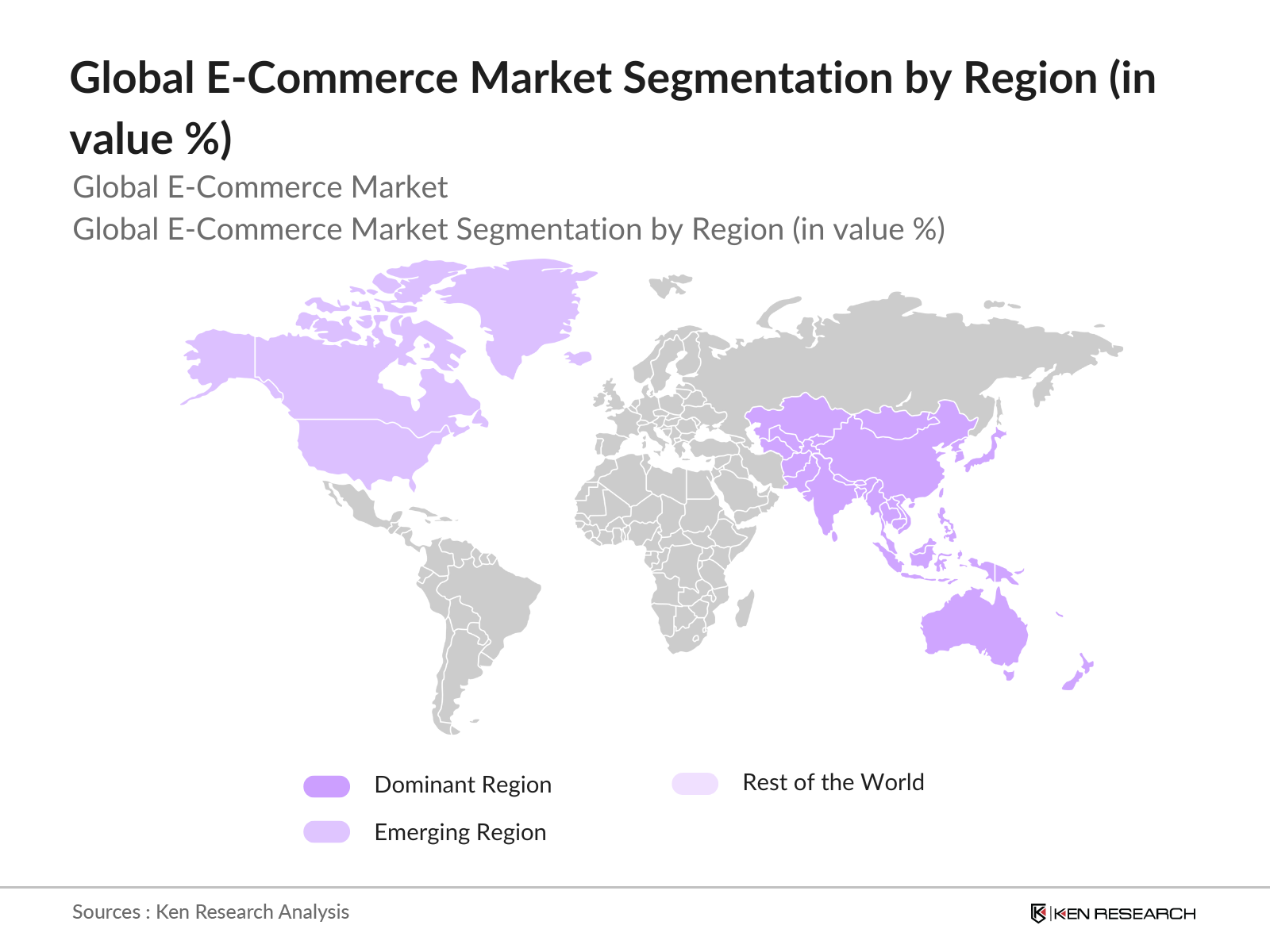

- By Region: The global e-commerce market is segmented by region into North America, Europe, Asia-Pacific, Middle East & Africa, and Latin America. Asia-Pacific dominates the market, driven primarily by Chinas thriving e-commerce ecosystem, which is supported by platforms like Alibaba and JD.com. Rapid urbanization, increasing internet penetration, and the growing middle class in countries like India and Southeast Asia are also propelling growth in this region. North America remains a strong player due to Amazon's dominance and an advanced digital payment system.

- By Application: The e-commerce market is segmented by application into Business to Consumer (B2C), Business to Business (B2B), and Consumer to Consumer (C2C). The B2C segment dominates due to the sheer volume of individual transactions and the increasing trend of direct-to-consumer models. Large platforms like Amazon and eBay have made it easier for individual buyers to purchase a wide variety of goods, contributing to the success of this segment. B2C platforms benefit from streamlined user experiences, multiple payment options, and personalized recommendations.

Global E-Commerce Market Competitive Landscape

The global e-commerce market is highly competitive, with major players operating on a global scale. Key players like Alibaba and Amazon dominate through their advanced logistics networks, vast product offerings, and high levels of consumer trust. The market is also witnessing the emergence of regional players such as Flipkart in India and MercadoLibre in Latin America. This competitive environment is shaped by strategic acquisitions, mergers, and technological innovations aimed at enhancing user experience and expanding market reach.

|

Company Name |

Establishment Year |

Headquarters |

Revenue (USD Bn) |

Number of Employees |

Global Reach |

Key Services |

Major Investments |

Recent Mergers |

|

Alibaba Group |

1999 |

Hangzhou, China |

- |

- |

- |

- |

- |

- |

|

Amazon.com Inc. |

1994 |

Seattle, USA |

- |

- |

- |

- |

- |

- |

|

JD.com |

1998 |

Beijing, China |

- |

- |

- |

- |

- |

- |

|

Shopify Inc. |

2006 |

Ottawa, Canada |

- |

- |

- |

- |

- |

- |

|

Walmart Inc. |

1962 |

Arkansas, USA |

- |

- |

- |

- |

- |

- |

Global E-Commerce Industry Analysis

Growth Drivers

- Internet and Smartphone Penetration: The increase in internet and smartphone usage globally has significantly driven the growth of e-commerce. As of 2024, over 5.4 billion individuals are estimated to be internet users, and nearly 85% of these users access the internet via mobile devices. In India alone, there were 1.2 billion mobile connections by the end of 2023, and the penetration rate is set to grow steadily due to ongoing infrastructure development. This widespread connectivity is essential for the expansion of e-commerce, as it allows for increased access to online retail platforms, especially in developing markets.

- Rising Demand for Online Retail: The demand for online retail is booming due to convenience, time-saving factors, and increased digital literacy. In 2024, online retail is expected to account for 21.4% of total global retail sales, driven largely by the United States, China, and European markets. Government lockdowns during COVID-19 had a substantial effect on accelerating digital adoption, pushing the global number of online shoppers beyond 3 billion by 2023, compared to 1.66 billion in 2022. E-commerce has particularly surged in Latin America, where internet usage reached 78% by 2024.

- Advancements in Digital Payment Infrastructure: Digital payment infrastructure has significantly improved, providing a seamless customer experience and fostering the growth of e-commerce. In 2024, the global digital payments market reached an estimated 90 trillion USD in transaction value, with mobile wallets like Alipay and PayPal driving significant growth. Government initiatives, such as India's Unified Payments Interface (UPI), processed over 100 billion transactions by 2023, highlighting the role of real-time payments in e-commerce growth. These advancements reduce the friction traditionally associated with online payments, thus promoting higher conversion rates in online retail.

Market Restraints

- Logistics and Supply Chain Complexities: Logistics and supply chain inefficiencies pose significant challenges to global e-commerce. As of 2023, 45% of online orders faced delays due to congested shipping routes and port delays, particularly in the Asia-Pacific region. The global shipping industry, responsible for moving approximately 90% of traded goods, faced heightened delays following the COVID-19 pandemic, and the average delivery times have increased from 3 days in 2022 to 5 days in 2024. This has necessitated greater investment in localized supply chains to mitigate disruption risks.

- Data Security and Privacy Concerns: E-commerce faces increasing scrutiny regarding data security and privacy. As of 2023, cyberattacks have surged, with over 25% of global businesses facing breaches, resulting in significant losses. The European Unions General Data Protection Regulation (GDPR), which implemented fines of up to 20 million EUR for non-compliance, has set a benchmark for stringent data protection measures. In 2022, over 1.4 billion data records were exposed globally, necessitating stronger encryption methods and cyber defenses across the e-commerce landscape.

Global E-Commerce Market Future Outlook

The global e-commerce market is poised for significant growth, driven by technological advancements, the expansion of digital payment systems, and increasing consumer demand for online shopping. The rise of AI-based personalization, faster delivery models, and growing penetration of mobile commerce are expected to revolutionize the shopping experience further. Additionally, the market will benefit from the integration of augmented reality (AR) and virtual reality (VR) technologies, enhancing consumer interaction with products online.

Market Opportunities

- Growth in Emerging Markets: Emerging markets offer significant growth opportunities for global e-commerce, with regions like Africa and Southeast Asia experiencing increased internet connectivity and digital payments adoption. In 2024, African internet penetration is expected to surpass 43%, up from 39% in 2022, with approximately 616 million internet users. Countries like Nigeria and Egypt are rapidly becoming e-commerce hotspots. Moreover, Southeast Asias e-commerce market is bolstered by over 450 million internet users as of 2023, providing a growing consumer base for online retailers.

- Integration of AI and Personalization Technologies: Artificial intelligence (AI) and machine learning are transforming the e-commerce experience. In 2024, more than 60% of online consumers report interacting with AI-driven chatbots for customer service. Furthermore, AI-driven personalization has improved recommendation engines, increasing the average order value by up to 15% for major platforms. Companies like Alibaba and Amazon have been at the forefront of deploying AI to analyze customer behavior, resulting in improved user experiences, higher conversion rates, and more efficient supply chains.

Scope of the Report

|

Product Type |

Consumer Electronics Fashion and Apparel Health and Beauty Products Home and Kitchen Appliances Groceries and Food Products |

|

Application |

B2C (Business to Consumer) B2B (Business to Business) C2C (Consumer to Consumer) |

|

Payment Method |

Digital Wallets Credit/Debit Cards Cash-on-Delivery Bank Transfers |

|

Device Type |

Mobile Desktop Tablet |

|

Region |

North America Europe Asia-Pacific Middle East & Africa Latin America |

Products

Key Target Audience

E-commerce Platform Providers

Logistics and Delivery Service Providers

Payment Gateway Providers

Retailers and Merchants

Digital Marketing Agencies

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (WTO, U.S. Federal Trade Commission)

Mobile Network Operators

Companies

Players Mentioned in the Report:

Alibaba Group

Amazon.com Inc.

JD.com

Shopify Inc.

Walmart Inc.

eBay Inc.

Rakuten Inc.

MercadoLibre, Inc.

Zalando SE

Flipkart

The Hut Group

ASOS Plc

Otto Group

Coupang

Wish (ContextLogic Inc.)

Table of Contents

1. Global E-Commerce Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global E-Commerce Market Size (In USD Tn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global E-Commerce Market Analysis

3.1. Growth Drivers

3.1.1. Internet and Smartphone Penetration

3.1.2. Rising Demand for Online Retail

3.1.3. Advancements in Digital Payment Infrastructure

3.1.4. Government Initiatives to Promote Digital Commerce

3.2. Market Challenges

3.2.1. Logistics and Supply Chain Complexities

3.2.2. Data Security and Privacy Concerns

3.2.3. Competition from Local Marketplaces

3.3. Opportunities

3.3.1. Growth in Emerging Markets

3.3.2. Integration of AI and Personalization Technologies

3.3.3. Expansion of Social Commerce

3.4. Trends

3.4.1. Increasing Adoption of Omnichannel Strategies

3.4.2. Rise of Mobile Commerce (M-commerce)

3.4.3. Growth of Subscription-Based E-commerce Models

3.5. Government Regulations

3.5.1. E-commerce Legislation

3.5.2. Cross-Border E-commerce Rules

3.5.3. Data Protection Laws

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. Global E-Commerce Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Consumer Electronics

4.1.2. Fashion and Apparel

4.1.3. Health and Beauty Products

4.1.4. Home and Kitchen Appliances

4.1.5. Groceries and Food Products

4.2. By Application (In Value %)

4.2.1. B2C (Business to Consumer)

4.2.2. B2B (Business to Business)

4.2.3. C2C (Consumer to Consumer)

4.3. By Payment Method (In Value %)

4.3.1. Digital Wallets

4.3.2. Credit/Debit Cards

4.3.3. Cash-on-Delivery

4.3.4. Bank Transfers

4.4. By Device Type (In Value %)

4.4.1. Mobile

4.4.2. Desktop

4.4.3. Tablet

4.5. By Region (In Value %) 4.5.1. North America

4.5.2. Europe

4.5.3. Asia-Pacific

4.5.4. Middle East & Africa

4.5.5. Latin America

5. Global E-Commerce Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. Alibaba Group

5.1.2. Amazon.com Inc.

5.1.3. eBay Inc.

5.1.4. Shopify Inc.

5.1.5. Walmart Inc.

5.1.6. JD.com

5.1.7. Rakuten Inc.

5.1.8. MercadoLibre, Inc.

5.1.9. Zalando SE

5.1.10. Flipkart

5.1.11. The Hut Group

5.1.12. ASOS Plc

5.1.13. Otto Group

5.1.14. Coupang

5.1.15. Wish (ContextLogic Inc.)

5.2 Cross Comparison Parameters

(No. of Employees, Headquarters, Inception Year, Revenue, Global Reach, Market Penetration, Growth Rate, M&A Activity)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. Global E-Commerce Market Regulatory Framework

6.1 E-commerce Guidelines and Compliance

6.2 Taxation Policies

6.3 Cross-border Commerce Rules

6.4 Data Protection and Privacy Laws

7. Global E-Commerce Future Market Size (In USD Tn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Global E-Commerce Future Market Segmentation

8.1 By Product Type (In Value %)

8.2 By Application (In Value %)

8.3 By Payment Method (In Value %)

8.4 By Device Type (In Value %)

8.5 By Region (In Value %)

9. Global E-Commerce Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial step involves mapping the global e-commerce ecosystem, identifying key stakeholders such as platform providers, logistics companies, and regulatory bodies. Extensive desk research is conducted, sourcing data from credible databases to define market influencers.

Step 2: Market Analysis and Construction

In this phase, historical data on the markets growth trajectory is compiled and analyzed, focusing on revenue generation by different product types, applications, and regions. Consumer behavior trends are also studied to assess their impact on market share.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated through interviews with industry experts, encompassing e-commerce platform executives and logistics providers. These consultations provide on-ground insights into market dynamics, enhancing the accuracy of projections.

Step 4: Research Synthesis and Final Output

The final step involves synthesizing the data collected from primary and secondary research into actionable insights. The analysis is cross-verified with key industry players, ensuring reliability before the final market assessment is compiled.

Frequently Asked Questions

01. How big is the Global E-Commerce Market?

The global e-commerce market, valued at USD 25.93 trillion, is driven by increasing internet penetration, rising mobile commerce, and advancements in digital payments.

02. What are the challenges in the Global E-Commerce Market?

Challenges include logistical complexities, data security concerns, and fierce competition among platforms. Consumer expectations for faster delivery times also put pressure on supply chains.

03. Who are the major players in the Global E-Commerce Market?

Key players include Alibaba, Amazon, JD.com, Shopify, and Walmart. Their dominance is supported by their advanced logistics networks, technological innovations, and massive consumer bases.

04. What are the growth drivers of the Global E-Commerce Market?

Key growth drivers include rising demand for online shopping, technological advancements in mobile commerce, and the increasing penetration of internet services in emerging markets.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.