Global Earl Grey Tea Market Outlook to 2030

Region:Global

Author(s):Yogita Sahu

Product Code:KROD5513

November 2024

84

About the Report

Global Earl Grey Tea Market Overview

- The global Earl Grey Tea market is valued at 7.30 million tons, driven by increasing consumer interest in specialty teas with distinct flavors. Earl Grey Tea, known for its unique blend of black tea and bergamot, has seen growing demand due to health-conscious consumers opting for products with natural ingredients. The market is also bolstered by the expanding e-commerce sector, where specialty tea brands have gained significant traction.

- Countries like the United Kingdom and the United States dominate the market due to their strong tea cultures and the presence of established tea brands. The UKs deep-rooted tradition of tea consumption, coupled with a growing preference for premium and organic blends, gives it an edge. Meanwhile, the U.S. has witnessed a rise in tea consumption driven by health trends and specialty tea cafes, further supporting the dominance of these nations in the market.

- Governments in major tea-producing countries such as India, Sri Lanka, and China have launched initiatives to support organic tea farming. In 2024, the Indian government is providing subsidies for farmers converting their tea plantations to organic production. This is likely to encourage greater production of organic Earl Grey tea, contributing to the segments growth. These incentives are expected to increase organic tea output over the next five years, further boosting the supply of organic Earl Grey tea globally.

Global Earl Grey Tea Market Segmentation

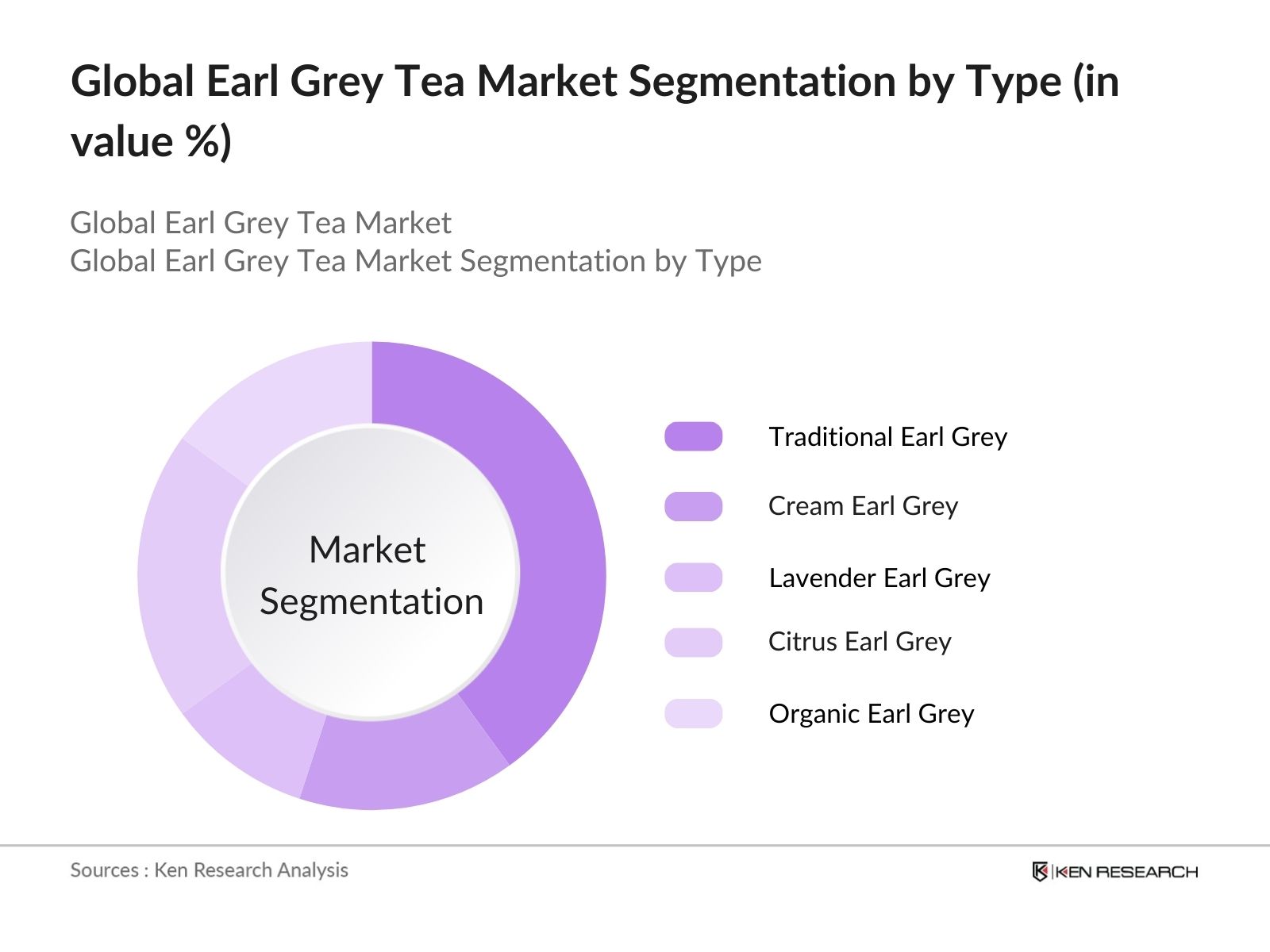

By Type: The market is segmented by type into Traditional Earl Grey, Cream Earl Grey, Lavender Earl Grey, Citrus Earl Grey, and Organic Earl Grey. Traditional Earl Grey dominates the market, accounting for 40% of the share in 2023. This dominance is attributed to its widespread consumer recognition and established presence in both retail and specialty tea outlets. Traditional Earl Grey is often seen as a standard offering, making it a staple in the tea portfolios of many brands, thereby securing its leading position.

By Form: The market is segmented by form into Loose Leaf, Tea Bags, and Powdered Tea. Tea Bags hold the largest market share of 55%, primarily due to their convenience and ease of use. Consumers in regions like North America and Europe prefer the convenience of tea bags, which fit well into their fast-paced lifestyles. Additionally, tea bags are more commonly available across both online and offline retail channels, giving them a significant advantage over other forms.

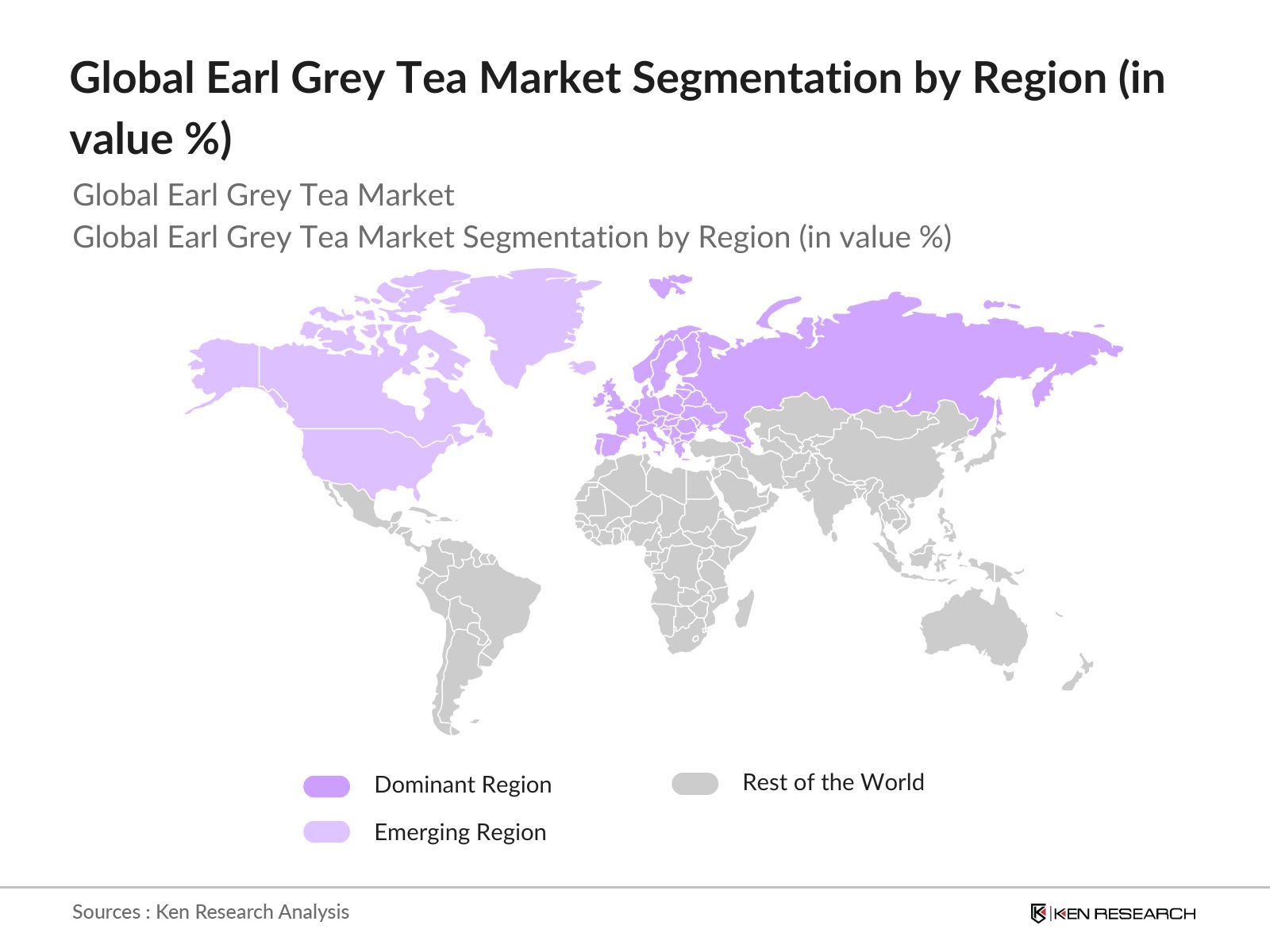

By Region: The market is segmented into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America. Europe leads the market with 35% of the total market share in 2023, driven by the regions strong tea culture, particularly in the UK. The presence of well-established tea brands and growing consumer demand for organic and premium tea blends further supports Europe's dominance. The rise of specialty tea cafes and a preference for natural, health-benefiting products also contribute to the market's strength in this region.

Global Earl Grey Tea Market Competitive Landscape

The market is moderately consolidated, with a mix of global and regional players. Major companies focus on expanding their organic and specialty tea offerings to cater to health-conscious consumers. The market is characterized by strong brand loyalty and a steady influx of new entrants offering niche and artisanal products.

|

Company |

Year Established |

Headquarters |

Product Range |

Sustainability Initiatives |

E-commerce Presence |

Organic Certification |

Global Reach |

|

Twinings |

1706 |

UK |

|||||

|

Harney & Sons |

1983 |

USA |

|||||

|

Bigelow Tea |

1945 |

USA |

|||||

|

Stash Tea |

1972 |

USA |

|||||

|

Ahmad Tea |

1986 |

UK |

Global Earl Grey Tea Market Analysis

Market Growth Drivers

- Rising Demand for Organic Earl Grey Tea: The demand for organic Earl Grey tea is seeing growth due to consumers' increased preference for chemical-free and naturally sourced products. In 2024, it is expected that nearly 15 million consumers globally will shift toward organic variants, as per a health-conscious consumer survey. The demand for organic beverages is driving manufacturers to diversify their product portfolios, offering more organic Earl Grey tea options, which will result in stronger market growth over the next few years.

- Increased Tea Consumption in Emerging Markets: Countries such as China, India, and Brazil have witnessed a rise in tea consumption, including Earl Grey, driven by the growing middle class and changing consumer preferences toward premium beverages. In 2024, it's reported that tea consumption in these emerging economies has surged by nearly 5 billion cups annually, significantly boosting demand for Earl Grey tea. The tea-drinking culture in these regions is expanding beyond traditional variants to include flavored and premium teas like Earl Grey, contributing to the markets expansion.

- Growth in E-commerce and Online Retail: The rise of e-commerce has made it easier for consumers to access a diverse range of Earl Grey tea options, contributing to the markets growth. In 2024, global e-commerce tea sales are expected to reach over 80 million individual purchases, driven by the convenience and variety offered through online channels. This increase in online sales of tea products is primarily in regions like North America and Europe, where e-commerce platforms are well-established.

Market Challenges

- Fluctuations in Raw Material Costs: The price of key raw materials like black tea leaves and bergamot oil, both essential for making Earl Grey tea, has seen considerable volatility in 2024. It is estimated that the cost of black tea leaves has risen by around 200 USD per ton due to unpredictable weather conditions and supply chain disruptions in major producing regions. This rise in production costs is squeezing profit margins for Earl Grey tea producers, making it challenging to maintain competitive pricing in a market where price sensitivity remains high.

- Competition from Other Premium Tea Types: The global tea market is highly competitive, with other premium tea variants like matcha, jasmine, and chamomile competing for market share. In 2024, reports indicate that nearly 35% of premium tea drinkers have shifted their preferences to other types of herbal and specialty teas, affecting the sales of Earl Grey tea. Consumers are exploring different flavors, especially teas known for specific health benefits, such as detox teas, which are gaining popularity.

Global Earl Grey Tea Market Future Outlook

Over the next five years, the global Earl Grey Tea industry is expected to experience growth, driven by increasing consumer preference for natural and premium tea products. The rising trend of organic certification among tea producers and the expansion of specialty tea cafes across Europe and North America will further contribute to this growth.

Future Market Opportunities

- Rise in Demand for Eco-Friendly Packaging: By 2029, the demand for eco-friendly packaging solutions for tea products, including Earl Grey, is expected to surge, driven by increasing consumer awareness of environmental sustainability. The market is likely to see over 100 million units of Earl Grey tea being sold in compostable, biodegradable, or plastic-free packaging annually, as brands align with environmental sustainability goals. T

- Growth in Customization of Earl Grey Tea Products: Customization is expected to be a key trend in the market over the next five years, as consumers seek personalized tea experiences. By 2029, over 2 million tea drinkers globally are expected to purchase customizable Earl Grey tea blends, tailored to their preferences for taste, strength, and added ingredients. This trend will lead to the introduction of personalized subscription boxes and build-your-own blend kits, offering consumers more control over their tea-drinking experience.

Scope of the Report

|

By Type |

Traditional Earl Grey Cream Earl Grey Lavender Earl Grey Citrus Earl Grey Organic Earl Grey |

|

By Form |

Loose Leaf Tea Bags Powdered Tea |

|

By Packaging |

Tin Cans Paper Pouches Eco-friendly Packaging |

|

By Distribution Channel |

E-commerce Supermarkets & Hypermarkets Specialty Stores Convenience Stores |

|

By Region |

North America Europe Asia Pacific Middle East & Africa Latin America |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Tea Manufacturers

Banks and Financial Institution

Investors and Venture Capitalist Firms

Tea Associations and Regulatory Bodies (e.g., World Tea Association)

Government and Regulatory Bodies (e.g., USDA, EU Organic Certification Agencies)

Sustainable Packaging Companies

Health and Wellness Brands

Companies

Players Mentioned in the Report:

Twinings

Harney & Sons

Bigelow Tea

Stash Tea

Ahmad Tea

Tazo Tea

Dilmah Tea

The Republic of Tea

Kusmi Tea

Teabox

Rishi Tea

Numi Organic Tea

Adagio Teas

Mighty Leaf Tea

Whittard of Chelsea

Table of Contents

Global Earl Grey Tea Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

Global Earl Grey Tea Market Size (In Mn Tons)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

Global Earl Grey Tea Market Analysis

3.1. Growth Drivers [Market Expansion in Specialty Tea Products, Rise in Health Awareness, Demand for Premium Teas, Expansion in E-commerce Channels]

3.2. Market Challenges [High Competition, Supply Chain Vulnerabilities, Sourcing of Natural Ingredients, Regulatory Compliance]

3.3. Opportunities [Innovation in Flavor Profiles, Growth in Organic Tea Segment, Emerging Markets in Asia-Pacific, Sustainable Packaging Initiatives]

3.4. Trends [Shift Towards Loose Leaf Teas, Increasing Demand for Organic Earl Grey, Preference for Non-Caffeinated Alternatives, Rise of Home Brewing Kits]

3.5. Government Regulations [Tea Import/Export Laws, Organic Certification, Food Safety Regulations, Environmental Packaging Mandates]

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Ecosystem

Global Earl Grey Tea Market Segmentation

4.1. By Type (In Value %)

4.1.1. Traditional Earl Grey

4.1.2. Cream Earl Grey

4.1.3. Lavender Earl Grey

4.1.4. Citrus Earl Grey

4.1.5. Organic Earl Grey

4.2. By Form (In Value %)

4.2.1. Loose Leaf

4.2.2. Tea Bags

4.2.3. Powdered Tea

4.3. By Packaging (In Value %)

4.3.1. Tin Cans

4.3.2. Paper Pouches

4.3.3. Eco-friendly Packaging

4.4. By Distribution Channel (In Value %)

4.4.1. E-commerce

4.4.2. Supermarkets & Hypermarkets

4.4.3. Specialty Stores

4.4.4. Convenience Stores

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia Pacific

4.5.4. Middle East & Africa

4.5.5. Latin America

Global Earl Grey Tea Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Twinings

5.1.2. Harney & Sons

5.1.3. Bigelow Tea

5.1.4. Stash Tea

5.1.5. Tazo Tea

5.1.6. Dilmah Tea

5.1.7. Ahmad Tea

5.1.8. The Republic of Tea

5.1.9. Kusmi Tea

5.1.10. Teabox

5.1.11. Rishi Tea

5.1.12. Numi Organic Tea

5.1.13. Adagio Teas

5.1.14. Mighty Leaf Tea

5.1.15. Whittard of Chelsea

5.2. Cross Comparison Parameters [Headquarters, Inception Year, Revenue, Market Share, Product Range, Sustainability Initiatives, Organic Certifications, E-commerce Presence]

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Private Equity and Venture Capital Involvement

5.8. Government Grants and Subsidies

Global Earl Grey Tea Market Regulatory Framework

6.1. Tea Product Standards

6.2. Organic Certification Compliance

6.3. Packaging Regulations

6.4. Trade Policies

Global Earl Grey Tea Future Market Size (In Mn Tons)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

Global Earl Grey Tea Future Market Segmentation

8.1. By Type (In Value %)

8.2. By Form (In Value %)

8.3. By Packaging (In Value %)

8.4. By Distribution Channel (In Value %)

8.5. By Region (In Value %)

Global Earl Grey Tea Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Consumer Preference Analysis

9.3. White Space Opportunities

9.4. Strategic Marketing Recommendations

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial stage involves mapping out all major stakeholders within the Global Earl Grey Tea Market. This includes extensive desk research using secondary and proprietary databases to gather comprehensive industry-level information. The goal is to define the critical variables that influence the market, such as consumer preferences, production capacity, and distribution networks.

Step 2: Market Analysis and Construction

This phase involves compiling and analyzing historical data on market penetration, product adoption rates, and revenue generation. A detailed evaluation of the product segmentation, consumer behavior, and market share analysis will also be conducted to ensure the accuracy of revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be validated through structured interviews with industry experts from leading Earl Grey Tea producers and distributors. These insights will provide detailed feedback on market dynamics, operational challenges, and growth opportunities.

Step 4: Research Synthesis and Final Output

In this phase, the data gathered will be synthesized to produce the final report, providing actionable insights. This stage will involve direct consultation with tea manufacturers to ensure the report captures all relevant trends and market drivers accurately.

Frequently Asked Questions

How big is the Global Earl Grey Tea Market?

The global Earl Grey Tea market is valued at 7.30 million tons, driven by increasing demand for specialty tea products and a growing emphasis on health and wellness among consumers.

What are the challenges in the Global Earl Grey Tea Market?

Challenges in the global Earl Grey Tea market include high competition from regional and global brands, supply chain vulnerabilities in sourcing natural ingredients, and strict regulatory compliance, particularly for organic certifications.

Who are the major players in the Global Earl Grey Tea Market?

Major players in the global Earl Grey Tea market include Twinings, Harney & Sons, Bigelow Tea, Stash Tea, and Ahmad Tea. These companies dominate due to their strong brand loyalty, extensive distribution networks, and emphasis on sustainability.

What are the growth drivers of the Global Earl Grey Tea Market?

Growth in the global Earl Grey Tea market is driven by consumer preference for premium, organic, and natural tea products. The expanding e-commerce sector and the rising popularity of specialty tea cafes also contribute to market growth.

Which regions dominate the Global Earl Grey Tea Market?

Europe and North America dominate the global Earl Grey Tea market, with the UK and the US leading due to their strong tea cultures and high demand for premium blends. These regions are home to many established tea brands, giving them a competitive edge.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.