Region:Global

Author(s):Geetanshi

Product Code:KRAB0063

Pages:81

Published On:August 2025

By Type:The eclinical solutions market can be segmented into various types, including Electronic Data Capture (EDC), Clinical Trial Management Systems (CTMS), Randomization and Trial Supply Management (RTSM), Electronic Patient Reported Outcomes (ePRO), Clinical Data Integration Platforms, eCOA (Electronic Clinical Outcome Assessment), and Others. Among these,Electronic Data Capture (EDC)remains the leading sub-segment due to its ability to streamline data collection, enhance data accuracy, and facilitate real-time access to clinical trial data. The adoption of EDC is further supported by increasing regulatory requirements for data transparency and integrity .

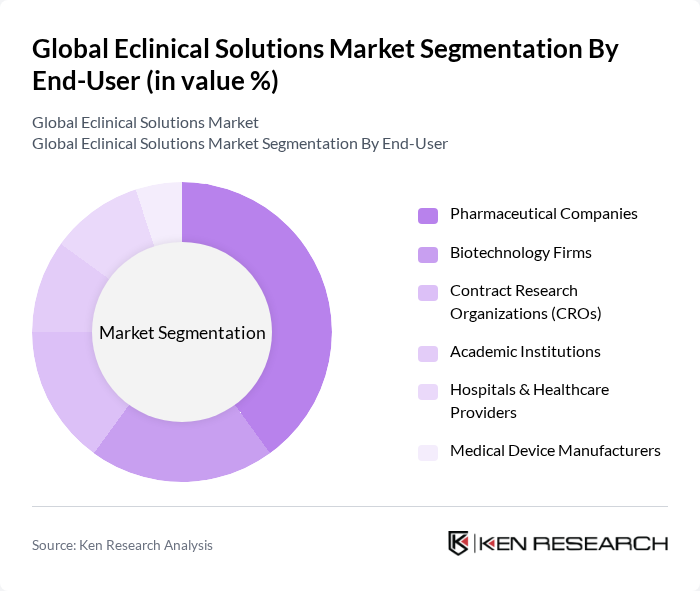

By End-User:The end-user segmentation includes Pharmaceutical Companies, Biotechnology Firms, Contract Research Organizations (CROs), Academic Institutions, Hospitals & Healthcare Providers, and Medical Device Manufacturers.Pharmaceutical Companiesdominate this segment due to their extensive use of eclinical solutions for drug development, regulatory compliance, and the management of large-scale, multi-site clinical trials. CROs and biotechnology firms are also significant adopters, driven by the outsourcing of clinical research and the need for advanced data management platforms .

The Global Eclinical Solutions Market is characterized by a dynamic mix of regional and international players. Leading participants such as Medidata Solutions, Inc., Oracle Corporation, Veeva Systems Inc., Parexel International Corporation, IQVIA Inc., Clario (formerly ERT, Inc.), Signant Health, BioClinica, Inc., ICON plc, Medpace Holdings, Inc., eClinical Solutions LLC, WCG Clinical, Syneos Health, Inc., Celerion, OpenClinica LLC contribute to innovation, geographic expansion, and service delivery in this space.

The future of eclinical solutions is poised for significant transformation, driven by technological innovations and evolving regulatory frameworks. As decentralized clinical trials gain traction, the demand for remote monitoring and data collection tools will increase. Additionally, the integration of artificial intelligence and machine learning will enhance data analytics capabilities, enabling more personalized patient care. These trends will likely lead to improved trial efficiency and patient engagement, ultimately shaping the landscape of clinical research in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Electronic Data Capture (EDC) Clinical Trial Management Systems (CTMS) Randomization and Trial Supply Management (RTSM) Electronic Patient Reported Outcomes (ePRO) Clinical Data Integration Platforms eCOA (Electronic Clinical Outcome Assessment) Others |

| By End-User | Pharmaceutical Companies Biotechnology Firms Contract Research Organizations (CROs) Academic Institutions Hospitals & Healthcare Providers Medical Device Manufacturers |

| By Application | Oncology Cardiovascular Neurology Infectious Diseases Rare Diseases Others |

| By Deployment Mode | Cloud-Based Web-Hosted (On-Demand) On-Premises (Licensed Enterprise) |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Sales Channel | Direct Sales Distributors Online Sales |

| By Pricing Model | Subscription-Based Pay-Per-Use One-Time License Fee |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Clinical Trials | 120 | Clinical Trial Managers, Regulatory Affairs Specialists |

| Biotechnology Research Projects | 90 | Research Scientists, Project Managers |

| eClinical Software Providers | 60 | Product Development Managers, Sales Executives |

| Contract Research Organizations | 50 | Operations Directors, Business Development Managers |

| Regulatory Compliance in Clinical Trials | 70 | Compliance Officers, Quality Assurance Managers |

The Global Eclinical Solutions Market is valued at approximately USD 11.5 billion, reflecting a significant growth driven by the increasing demand for efficient clinical trial management and the adoption of digital technologies in the pharmaceutical and biotechnology sectors.