Global Edible Packaging Market Outlook to 2030

Region:Global

Author(s):Sanjna Verma

Product Code:KROD1071

December 2024

84

About the Report

Global Edible Packaging Market Overview

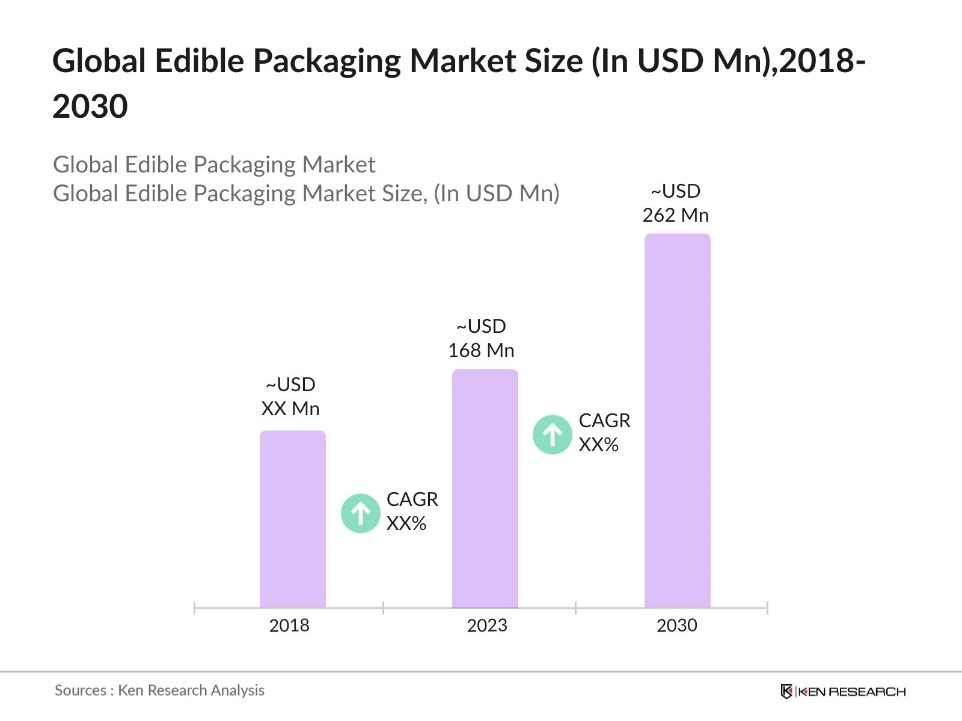

- Global Edible Packaging Market reached a market size of USD 168 million in 2023. This growth is driven by increasing consumer demand for sustainable and eco-friendly packaging solutions. Edible packaging, which includes materials like seaweed, rice, and starch, addresses environmental concerns by reducing plastic waste.

- Major players in the Global Edible Packaging Market include companies like Notpla, Lactips, Evoware, WikiFoods, and Monosol. These companies are at the forefront of developing innovative edible packaging solutions. Notpla, for instance, has gained significant attention with its seaweed-based packaging, which is both biodegradable and edible.

- In 2023, Notpla won the prestigious Earthshot Prize for its innovative seaweed-based packaging, which is entirely edible and compostable. This recognition has increased the company's visibility and market presence, leading to partnerships with major food and beverage companies.

- Cities like New York, London, and Paris dominate the edible packaging market due to their large consumer base, stringent environmental regulations, and high awareness of sustainable practices. New York, for example, has implemented strict bans on single-use plastics, making it a lucrative market for edible packaging companies.

Global Edible Packaging Market Segmentation

The Global Edible Packaging Market can be segmented based on several factors:

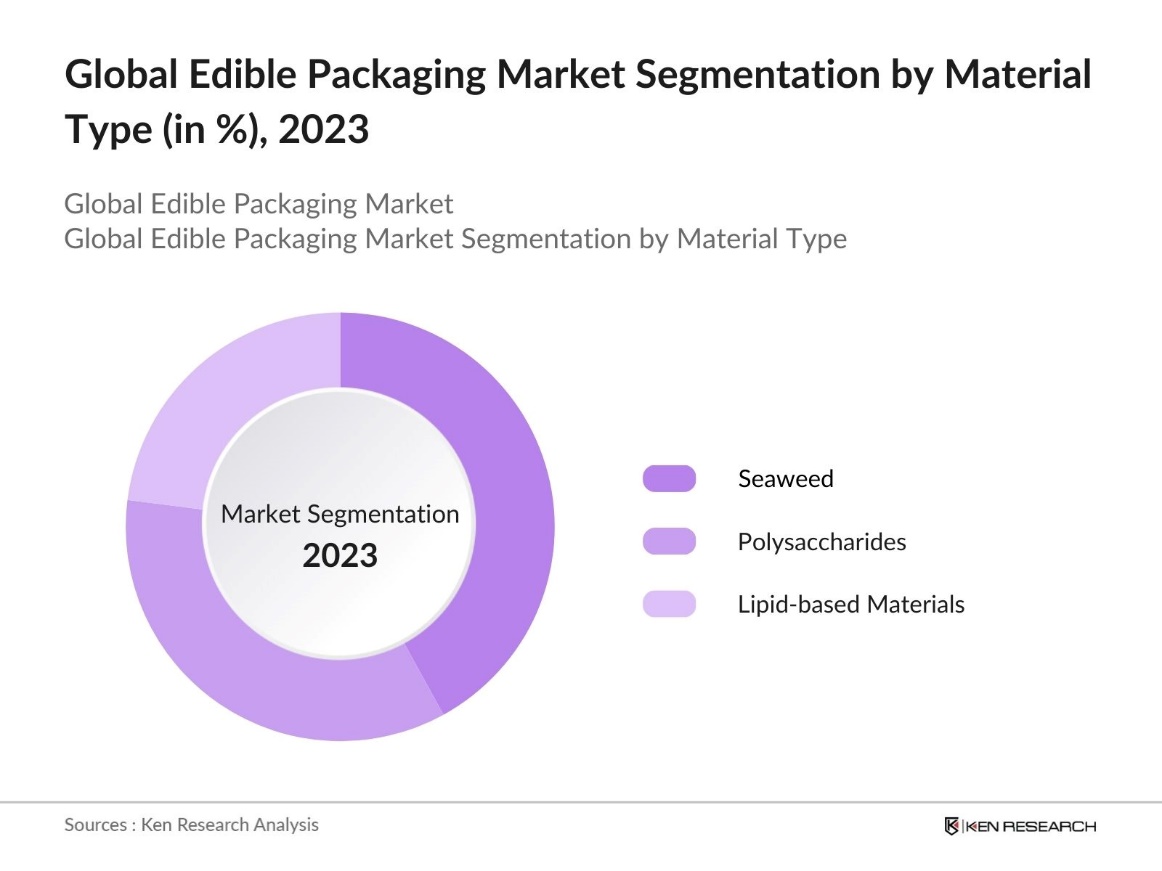

By Material Type: The Global Edible Packaging Market is segmented by material type into seaweed, polysaccharides, and lipid-based materials. In 2023, seaweed-based materials dominate the market share in this segment. The dominance is attributed to seaweed's natural abundance, renewability, and biodegradability. Companies like Notpla are pioneering the use of seaweed in packaging due to its versatility and minimal environmental impact.

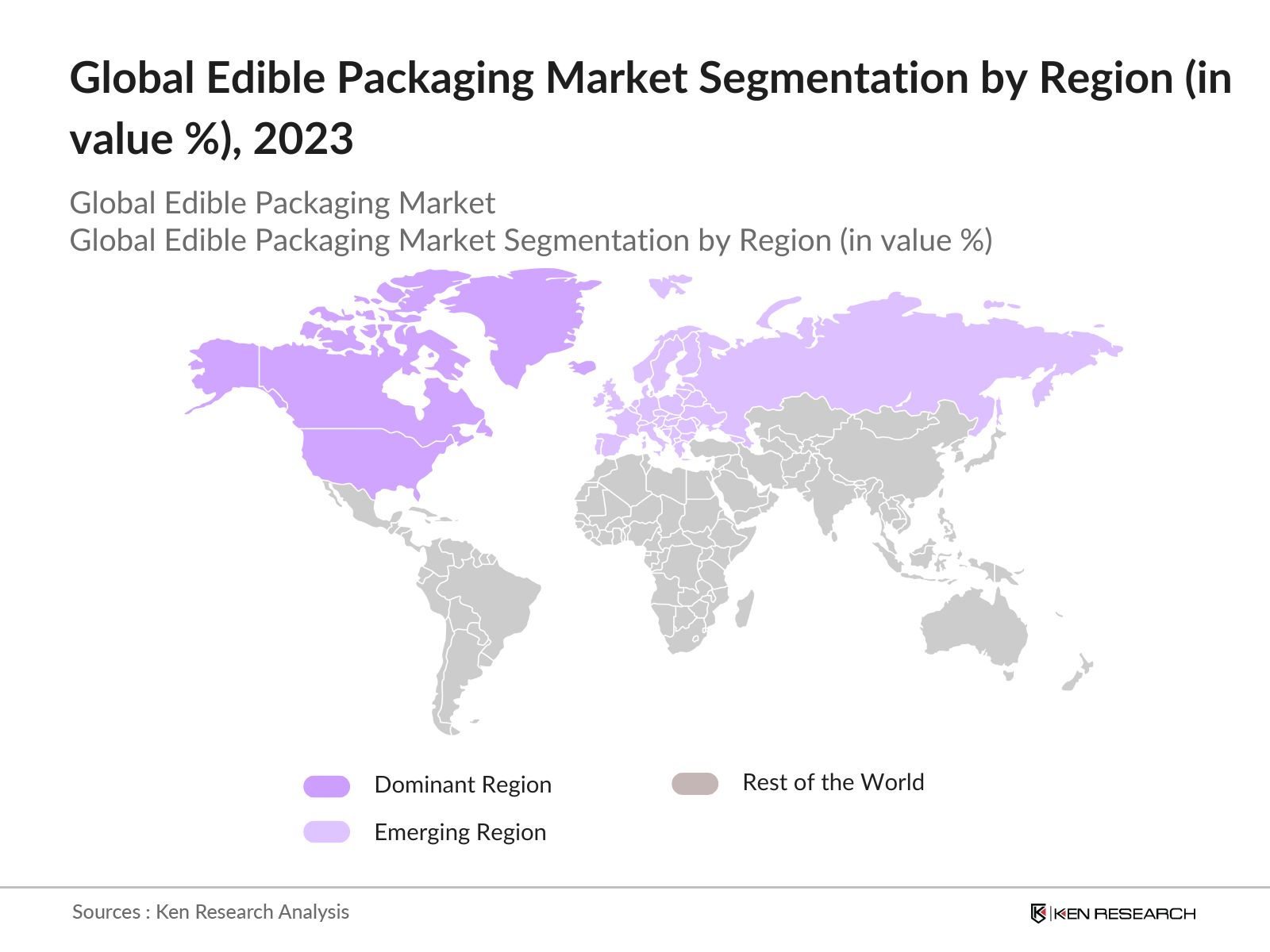

By Region: The Global Edible Packaging Market is segmented by region into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. In 2023, North America held the largest market share in the Global Edible Packaging Market. The region's dominance is attributed to its advanced technological infrastructure and high consumer demand for sustainable packaging solutions.

By Application: Global Edible Packaging Market is segmented by application into food & beverages, pharmaceuticals, and personal care products. In 2023, the food & beverages segment holds a dominant market share due to the widespread use of edible packaging for single-serving products like sauces, coffee, and snacks. The convenience and sustainability offered by edible packaging make it an attractive option for the food industry.

Global Edible Packaging Market Competitive Landscape

|

Company Name |

Establishment Year |

Headquarters |

|

Notepla |

2014 |

London, UK |

|

Lactips |

2014 |

Saint-tienne, France |

|

Evoware |

2016 |

Jakarta, Indonesia |

|

WikiFoods |

2012 |

Cambridge, USA |

|

Monosol |

1953 |

Merrillville, USA |

- Nagase America: In 2024, Nagase America announced its formal integration with Nagase Specialty Materials NA LLC. This strategic move aims to enhance operational efficiency and customer service, which could positively impact their offerings in the edible packaging segment. The integration is expected to leverage their combined expertise in material sciences, potentially leading to innovative solutions in edible packaging.

- Lactips: In 2022, Lactips, the French company specialising in the production of the only 100% biosourced polymer, water-soluble and biodegradable in various environments, inaugurated its first 4,200 m industrial unit in Saint-Paul-en Jarez (42) on 7 September, bringing new life to an old industrial site that has been closed since 2018.

Global Edible Packaging Industry Analysis

Growth Drivers

- Consumer Demand for Sustainable Packaging: The surge in consumer awareness about environmental issues has been a significant growth driver for the Global Edible Packaging Market. The number of food delivery app users in the U.S. increased from 49.5 million in 2022 to 53.9 million in 2023, marking an 8.9% increase. This surge in online food services is driving the demand for innovative and sustainable packaging solutions.

- Government Regulations on Plastic Waste: Stringent government regulations banning single-use plastics are driving the edible packaging market. Single-use plastics contribute to about 50% of plastic waste, with food packaging being the largest user of single-use plastics, consuming up to 35% of global packaging production. This highlights the urgent need for alternatives like edible packaging to mitigate waste.

- Technological Innovations in Edible Packaging: Traditional packaging materials, particularly plastics, contribute to substantial environmental issues, with approximately nine million metric tons of plastic entering the oceans annually. Edible packaging offers a biodegradable alternative, which can help mitigate these challenges by reducing the amount of waste generated from packaging materials.

Market Challenges

- Limited Shelf Life and Durability: Edible packaging materials degrade 40% faster than plastics when exposed to moisture and air. This poses a challenge for manufacturers, especially those dealing with perishable goods that require longer shelf lives. Also, many food manufacturers were hesitant to adopt edible packaging due to these durability concerns.

- Regulatory Hurdles and Safety Concerns: Regulatory approvals for edible packaging materials are stringent, posing a challenge for market growth. The U.S. Food and Drug Administration (FDA) has strict guidelines for materials that come into direct contact with food, requiring extensive testing for safety and compliance. This regulatory bottleneck slows down the introduction of new edible packaging solutions in the market.

Government Initiatives

- European Green Deal: European Green Deal is a comprehensive policy initiative by the European Commission, launched in December 2019, aimed at making the European Union (EU) climate neutral by 2050. The deal includes specific targets, such as reducing emissions by at least 55% by 2030 compared to 1990 levels, which is codified in the European Climate Law.

- U.S. Plastic Waste Reduction Act: In 2021, The Plastic Waste Reduction and Recycling Act aims to establish a comprehensive program to enhance the competitiveness of the U.S. plastics recycling industry while mitigating the environmental impacts of plastic waste. The bill proposes the creation of a Plastic Waste Reduction and Recycling Program, which would coordinate efforts across various federal agencies to support recycling initiatives.

Global Edible Packaging Future Market Outlook

The Global Edible Packaging Market is poised for significant growth over the next five years as the market is expected to reach USD 12 billion in 2030, driven by the increasing adoption of infrared technology across various industries, including defense, automotive, and healthcare.

Future Market Trends

- Expansion of Edible Packaging in Pharmaceuticals: In the coming years, edible packaging will see increased adoption in the pharmaceutical industry. Companies are expected to explore the use of edible materials for drug delivery systems, where the packaging itself can be ingested along with the medication, ensuring zero waste. This innovation could also enhance patient compliance by simplifying the administration process.

- Growth of Customized Edible Packaging Solutions: The trend towards personalized and customized packaging will grow, with companies offering edible packaging tailored to specific dietary needs and preferences. This customization will be particularly popular in the food and beverage sector, where consumers are looking for packaging that aligns with their health goals.

Scope of the Report

Products

Key Target Audience Organizations and Entities who can benefit by Subscribing This Report:

Food & Beverage Manufacturers

Pharmaceutical Companies

Personal Care Product Manufacturers

Food Delivery Platforms

Consumer Goods Companies

Supply Chain and Logistics Providers

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., EPA, EU Commission)

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2030

Table of Contents

1. Global Edible Packaging Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

2. Global Edible Packaging Market Size (in USD Mn), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Edible Packaging Market Analysis

3.1. Growth Drivers

3.1.1. Consumer Demand for Sustainable Packaging

3.1.2. Technological Innovations in Packaging Materials

3.1.3. Supportive Government Regulations

3.2. Restraints

3.2.1. High Production Costs

3.2.2. Limited Shelf Life of Edible Packaging

3.2.3. Regulatory Challenges

3.3. Opportunities

3.3.1. Expansion in Emerging Markets

3.3.2. Collaboration with Food and Beverage Industry

3.3.3. Innovations in Edible Packaging Materials

3.4. Trends

3.4.1. Increased Adoption of Edible Films and Coatings

3.4.2. Growth in Personalized Edible Packaging

3.4.3. Integration of Edible Packaging in Smart Packaging Solutions

3.5. Government Regulation

3.5.1. Food Safety Modernization Act (2024)

3.5.2. European Union Regulations on Edible Packaging (2023)

3.5.3. U.S. FDA Guidelines for Edible Packaging Materials (2023)

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Competition Ecosystem

4. Global Edible Packaging Market Segmentation, 2023

4.1. By Source (in Value %)

4.1.1. Plant Source

4.1.2. Animal Source

4.2. By Application (in Value %)

4.2.1. Food & Beverages

4.2.2. Pharmaceuticals

4.2.3. Personal Care Products

4.3. By Material (in Value %)

4.3.1 Seaweed

4.3.2 Polysaccharides

4.3.3 Lipid-based materials

4.4. By Region (in Value %)

4.4.1. North America

4.4.2. Europe

4.4.3. Asia-Pacific

4.4.4. Latin America

4.4.5. Middle East & Africa

5. Global Edible Packaging Market Cross Comparison

5.1. Detailed Profiles of Major Companies

5.1.1 Note

5.1.2 Lactips

5.1.3 Evoware

5.1.4 WikiFoods

5.1.5 Monosol

5.1.6 Apeel Sciences

5.1.7 Body type.

5.1.8 Nagase America

5.1.9 Skipping Rocks Lab

5.1.10 Evoware

5.1.11 Flavorseal

5.1.12 BluWrap

5.1.13 Coolhaus

5.1.14 Edipeel

5.1.15 LeafLAB

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

6. Global Edible Packaging Market Competitive Landscape

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

6.4. Investment Analysis

6.4.1. Venture Capital Funding

6.4.2. Government Grants

6.4.3. Private Equity Investments

7. Global Edible Packaging Market Regulatory Framework

7.1. Food Safety Standards

7.2. Compliance Requirements

7.3. Certification Processes

8. Global Edible Packaging Market Future Size (in USD Mn), 2023-2030

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

9. Global Edible Packaging Market Future Segmentation, 2030

9.1. By Source (in Value %)

9.2. By Application (in Value %)

9.3. By Material (in Value %)

9.4. By Region (in Value %)

10. Global Edible Packaging Market Analysts Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Marketing Initiatives

10.4. White Space Opportunity Analysis

Disclaimer

Contact UsResearch Methodology

Step 1: Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step 2: Market Building:

Collating statistics on Global Edible Packaging Market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for Edible Packaging Market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step 3: Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step 4: Research output:

Our team will approach multiple edible packaging companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from edible packaging companies.

Frequently Asked Questions

01. How big is Global Edible Packaging Market?

Global Edible Packaging Market reached a market size of USD 168 million in 2023. This growth is driven by increasing consumer demand for sustainable and eco-friendly packaging solutions. Edible packaging, which includes materials like seaweed, rice, and starch, addresses environmental concerns by reducing plastic waste.

02. What are challenges in Global Edible Packaging Market?

Challenges of Global Edible Packaging Market include high production costs, limited shelf life and durability of edible materials, and stringent regulatory approvals. These factors pose significant barriers to the widespread adoption of edible packaging solutions.

03. Who are the major players in Global Edible Packaging Market?

Key players in Global Edible Packaging Market include Notpla, Lactips, Evoware, WikiFoods, and Monosol. These companies lead the market through innovation, strategic partnerships, and a focus on sustainable packaging alternatives.

04 What are the growth drivers of the Global Edible Packaging Market?

Global Edible Packaging Market is driven by increased consumer awareness of environmental issues, stringent government regulations on plastic waste, and technological innovations in the development of biodegradable and edible materials.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.